|

市场调查报告书

商品编码

1766362

烘焙原料市场机会、成长动力、产业趋势分析及 2025 - 2034 年预测Baking Ingredients Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

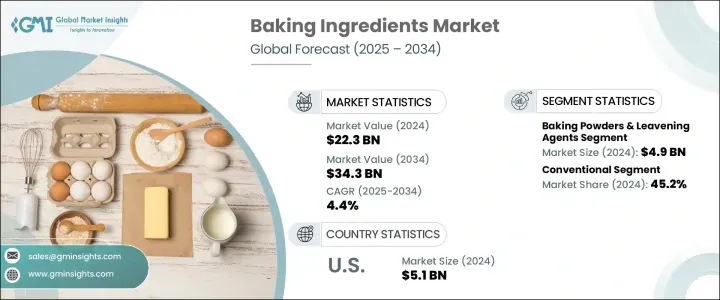

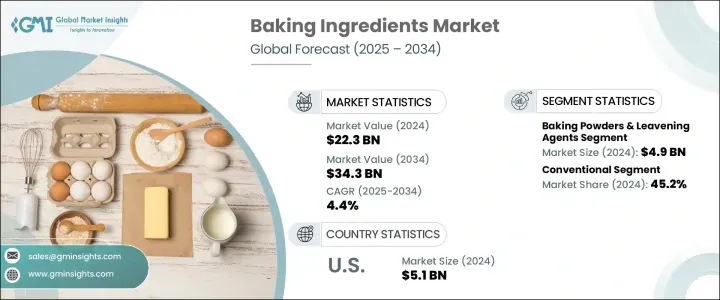

2024年,全球烘焙原料市场规模达223亿美元,预计2034年将以4.4%的复合年增长率成长,达到343亿美元。受全球各类烘焙产品需求不断增长的推动,该市场呈现稳定成长态势。营收和销售均呈现持续成长,反映出全球消费模式的广泛变化。促成这一趋势的关键因素包括饮食习惯的转变、城镇化进程的加速以及人们对即食食品解决方案的日益偏好。包装和便利烘焙食品日益流行,尤其是在新兴地区,加速了对高性能烘焙原料的需求。同时,成熟经济体的需求持续强劲,有助于维持整体市场动能。

不断扩张的餐饮服务网络和有序的零售模式也提升了产品的可及性,从而增加了销量,并提升了烘焙产品在市场上的多样性。随着现代零售店在城市和半城市地区的持续发展,消费者如今可以接触到种类繁多的烘焙食品,从手工麵包到包装方便食品,应有尽有。这种便利性不仅促进了衝动性购买,也鼓励了消费者尝试新的产品类型和口味。此外,零售连锁店和烘焙製造商之间的合作带来了更佳的产品定位、促销活动和店内烘焙专区,进一步提升了消费者的兴趣,并推动了不同人群和消费场合的品类增长。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 223亿美元 |

| 预测值 | 343亿美元 |

| 复合年增长率 | 4.4% |

2024年,泡打粉和膨鬆剂市场规模达49亿美元,预计2025年至2034年期间的复合年增长率将达到4.8%。这些原料在烘焙食品生产中仍然至关重要,因为它们能够确保烘焙食品的透气性、体积和质地的一致性。它们在工业烘焙和家庭烘焙中的广泛应用巩固了其市场主导地位。随着城市人口的增长,尤其是在大城市,对加工和预包装烘焙食品的需求持续增长,从而推动了膨鬆剂消费量的增加。此外,更新的清洁标籤产品和改进的配方在提供可靠效果的同时,也满足了不断变化的消费者需求。其成本效益使其成为小型烘焙店、商业厨房和餐饮服务机构不可或缺的一部分。

2024年,传统配料市场价值达101亿美元,预计到2034年将以4.6%的复合年增长率成长,占据45.2%的市场份额。传统产品的可靠性和价格实惠确保其仍然是满足大量生产需求的首选。同时,人们对清洁标籤和非基因替代品的日益关注正在重塑市场格局,在註重健康的选择和经济高效的解决方案之间寻求平衡。越来越多的消费者出于对食品安全和环境影响的担忧,开始转向有机和可追溯的食品,这表明天然配料形式正日益受到青睐。

2024年,美国烘焙原料市场规模达51亿美元,预计2025年至2034年期间的复合年增长率将达到4.2%。强劲的食品製造业基础、消费者对加工烘焙食品日益增长的需求以及完善的供应链基础设施,共同推动了这一稳健成长。原料配方的创新在维持市场成长方面发挥着重要作用,尤其对于满足植物性、无麸质、低糖和纯素食需求的产品而言。零售业的扩张以及全美各地消费者对包装烘焙食品日益增长的偏好,进一步支撑了这一上升趋势。

全球烘焙原料产业的主要参与者,包括焙乐道集团、乐斯福、嘉吉等,正在积极部署创新方法,以加强其全球影响力。这些公司优先考虑研发,推出符合现代饮食偏好的清洁标章、功能性和营养丰富的原料。与餐饮连锁店和零售烘焙店的合作有助于他们扩大客户覆盖范围。他们还投资区域生产中心,以确保供应链效率和对当地需求的回应能力。许多公司在产品开发和分销方面采用数位化策略,以提高敏捷性和客户参与度,巩固其在工业和消费者细分市场的领导地位。

目录

第一章:方法论与范围

第二章:执行摘要

第三章:行业洞察

- 产业生态系统分析

- 供应商格局

- 利润率

- 每个阶段的增值

- 影响价值链的因素

- 中断

- 产业衝击力

- 成长动力

- 方便食品需求不断成长

- 商业烘焙业的成长

- 增加可支配收入

- 改变消费者的生活方式

- 产业陷阱与挑战

- 原物料价格波动

- 与添加剂有关的健康问题

- 市场机会

- 成长动力

- 成长潜力分析

- 监管格局

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- Pestel 分析

- 价格趋势

- 按地区

- 依产品类型

- 未来市场趋势

- 技术和创新格局

- 当前的技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物的策略

- 生产中的能源效率

- 环保倡议

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估计与预测:依成分类型,2021-2034

- 主要趋势

- 泡打粉和膨鬆剂

- 乳化剂

- 酵素

- 油、脂肪和起酥油

- 甜味剂

- 颜色和口味

- 防腐剂

- 麵粉

- 淀粉

- 其他的

第六章:市场估计与预测:依性质,2021-2034

- 主要趋势

- 传统的

- 有机的

- 清洁标籤

- 非基因改造

第七章:市场估计与预测:按应用,2021-2034

- 主要趋势

- 麵包

- 蛋糕和糕点

- 饼干和饼干

- 麵包捲和馅饼

- 披萨饼皮

- 其他的

第八章:市场估计与预测:依最终用途,2021-2034

- 主要趋势

- 商业/工业麵包店

- 零售麵包店

- 手工麵包店

- 餐饮业

- 家庭/零售消费者

第九章:市场估计与预测:按配销通路,2021-2034

- 主要趋势

- B2B

- B2C

- 超市和大卖场

- 专卖店

- 便利商店

- 网路零售

- 其他的

第十章:市场估计与预测:按地区,2021-2034

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 荷兰

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 南非

- 沙乌地阿拉伯

- 阿联酋

- 中东和非洲其他地区

第 11 章:公司简介

- AAK AB

- Archer Daniels Midland Company

- Associated British Foods plc

- Bakels Group

- BASF SE

- Cargill, Incorporated

- Corbion NV

- Dawn Food Products, Inc.

- DuPont de Nemours, Inc.

- DSM-Firmenich AG

- Flowers Foods, Inc.

- General Mills, Inc.

- Grupo Bimbo, SAB de CV

- Ingredion Incorporated

- Kerry Group plc

- Koninklijke DSM NV

- Lesaffre Group

- Mondelez International, Inc.

- Puratos Group

- Tate & Lyle PLC

The Global Baking Ingredients Market was valued at USD 22.3 billion in 2024 and is estimated to grow at a CAGR of 4.4% to reach USD 34.3 billion by 2034. This market demonstrates stable growth, fueled by rising global demand across various categories of baked products. Both revenue and volume have shown consistent increases, reflecting widespread changes in consumption patterns worldwide. Key factors contributing to this trend include shifting dietary habits, growing urbanization, and a rising preference for ready-made food solutions. The growing popularity of packaged and convenience baked items, particularly in emerging regions, is accelerating the need for high-performance baking ingredients. At the same time, mature economies continue to show solid demand, helping to maintain overall market momentum.

Expanding food service networks and organized retail formats have also improved product accessibility, leading to increased sales volumes and broader diversification of baked offerings in the market. As modern retail outlets continue to grow in both urban and semi-urban areas, consumers now have greater exposure to a wide variety of baked goods, ranging from artisanal breads to packaged convenience items. This enhanced availability has not only boosted impulse purchases but has also encouraged experimentation with new product types and flavors. Additionally, partnerships between retail chains and bakery manufacturers have led to better product placement, promotional campaigns, and in-store bakery sections, further elevating consumer interest and driving category growth across multiple demographics and consumption occasions.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $22.3 Billion |

| Forecast Value | $34.3 Billion |

| CAGR | 4.4% |

In 2024, the baking powders and leavening agents segment generated USD 4.9 billion and is forecast to grow at a 4.8% CAGR between 2025 and 2034. These ingredients remain vital in baked goods production due to their role in ensuring consistent aeration, volume, and texture. Their widespread use in both industrial and home baking reinforces their dominant market position. As urban populations grow, particularly in large cities, demand for processed and pre-packaged bakery items continues to rise-driving higher consumption of leavening agents. Additionally, newer clean-label options and improved formulations are catering to evolving consumer demands while delivering reliable results. Their cost-efficiency makes them an essential component across small bakeries, commercial kitchens, and food service operations.

The conventional ingredients segment was valued at USD 10.1 billion in 2024 and is projected to grow at a 4.6% CAGR through 2034, holding a 45.2% share. The reliability and affordability of conventional products ensure they remain a preferred option to meet high-volume production needs. Meanwhile, increased attention toward clean-label and non-GMO alternatives is reshaping market dynamics, offering a balance between health-conscious choices and cost-effective solutions. A growing segment of consumers is turning to organic and traceable options in response to concerns over food safety and environmental impact, signaling rising traction for natural ingredient formats.

United States Baking Ingredients Market was valued at USD 5.1 billion in 2024 and is expected to grow at a 4.2% CAGR from 2025 to 2034. This steady performance is driven by a strong food manufacturing base, rising consumer demand for processed baked items, and a robust supply chain infrastructure. Innovation in ingredient formulations plays a major role in sustaining market growth, especially for products tailored to meet demands for plant-based, gluten-free, sugar-reduced, and vegan options. Retail expansion and increasing preference for packaged baked goods across the country further support this upward trend.

Key players in the Global Baking ingredient industry, including Puratos Group, Lesaffre, Cargill, and others, are actively deploying innovative approaches to strengthen their global footprint. These companies are prioritizing research and development to introduce clean-label, functional, and nutrient-rich ingredients tailored to modern dietary preferences. Collaborations with food service chains and retail bakeries are helping them expand their customer reach. They are also investing in regional production hubs to ensure supply chain efficiency and responsiveness to local demands. Many are adopting digitalization strategies in product development and distribution to improve agility and customer engagement, reinforcing their market leadership across both industrial and consumer-facing segments.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis

- 2.2 Key market trends

- 2.2.1.1 Regional

- 2.2.1.2 Ingredient type

- 2.2.1.3 Nature

- 2.2.1.4 Application

- 2.2.1.5 End use

- 2.2.1.6 Distribution channel

- 2.3 TAM analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.5 Executive decision points

- 2.6 Critical success factors

- 2.7 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for convenience foods

- 3.2.1.2 Growth in commercial bakery sector

- 3.2.1.3 Increasing disposable income

- 3.2.1.4 Changing consumer lifestyles

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Fluctuating raw material prices

- 3.2.2.2 Health concerns related to additives

- 3.2.3 Market opportunities

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia pacific

- 3.4.4 Latin America

- 3.4.5 Middle east & Africa

- 3.5 Porter's analysis

- 3.6 Pestel analysis

- 3.6.1 Technology and innovation landscape

- 3.6.2 Current technological trends

- 3.6.3 Emerging technologies

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product type

- 3.8 Future market trends

- 3.9 Technology and innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) (Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates & Forecast, By Ingredient Type, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Baking powders & leavening agents

- 5.3 Emulsifiers

- 5.4 Enzymes

- 5.5 Oils, fats & shortenings

- 5.6 Sweeteners

- 5.7 Colors & flavors

- 5.8 Preservatives

- 5.9 Flour

- 5.10 Starches

- 5.11 Others

Chapter 6 Market Estimates & Forecast, By Nature, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Conventional

- 6.3 Organic

- 6.4 Clean label

- 6.5 Non-GMO

Chapter 7 Market Estimates & Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Bread

- 7.3 Cakes & pastries

- 7.4 Cookies & biscuits

- 7.5 Rolls & pies

- 7.6 Pizza crusts

- 7.7 Others

Chapter 8 Market Estimates & Forecast, By End Use, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 Commercial/industrial bakeries

- 8.3 Retail bakeries

- 8.4 Artisanal bakeries

- 8.5 Foodservice industry

- 8.6 Household/retail consumers

Chapter 9 Market Estimates & Forecast, By Distribution Channel, 2021-2034 (USD Billion) (Kilo Tons)

- 9.1 Key trends

- 9.2 B2B

- 9.3 B2C

- 9.3.1 Supermarkets & hypermarkets

- 9.3.2 Specialty stores

- 9.3.3 Convenience stores

- 9.3.4 Online retail

- 9.3.5 Others

Chapter 10 Market Estimates & Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 10.1 Key trends

- 10.2 North America

- 10.2.1 U.S.

- 10.2.2 Canada

- 10.3 Europe

- 10.3.1 UK

- 10.3.2 Germany

- 10.3.3 France

- 10.3.4 Italy

- 10.3.5 Spain

- 10.3.6 Netherlands

- 10.3.7 Rest of Europe

- 10.4 Asia Pacific

- 10.4.1 China

- 10.4.2 India

- 10.4.3 Japan

- 10.4.4 South Korea

- 10.4.5 Australia

- 10.4.6 Rest of Asia Pacific

- 10.5 Latin America

- 10.5.1 Brazil

- 10.5.2 Mexico

- 10.5.3 Argentina

- 10.5.4 Rest of Latin America

- 10.6 Middle East and Africa

- 10.6.1 South Africa

- 10.6.2 Saudi Arabia

- 10.6.3 UAE

- 10.6.4 Rest of Middle East and Africa

Chapter 11 Company Profiles

- 11.1 AAK AB

- 11.2 Archer Daniels Midland Company

- 11.3 Associated British Foods plc

- 11.4 Bakels Group

- 11.5 BASF SE

- 11.6 Cargill, Incorporated

- 11.7 Corbion N.V.

- 11.8 Dawn Food Products, Inc.

- 11.9 DuPont de Nemours, Inc.

- 11.10 DSM-Firmenich AG

- 11.11 Flowers Foods, Inc.

- 11.12 General Mills, Inc.

- 11.13 Grupo Bimbo, S.A.B. de C.V.

- 11.14 Ingredion Incorporated

- 11.15 Kerry Group plc

- 11.16 Koninklijke DSM N.V.

- 11.17 Lesaffre Group

- 11.18 Mondelez International, Inc.

- 11.19 Puratos Group

- 11.20 Tate & Lyle PLC