|

市场调查报告书

商品编码

1871276

替代蛋白市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Alternative Protein Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

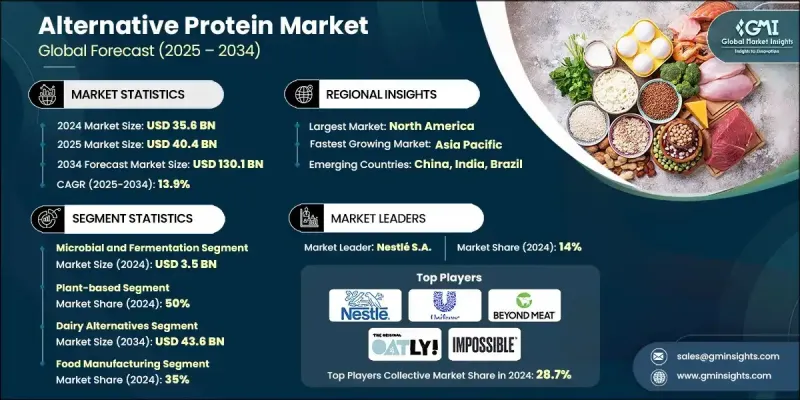

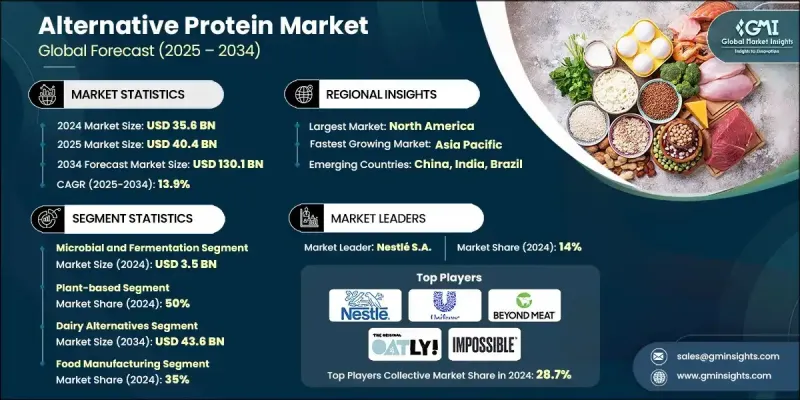

2024 年全球替代蛋白市场价值为 356 亿美元,预计到 2034 年将以 13.9% 的复合年增长率增长至 1301 亿美元。

市场成长的驱动力来自消费者行为的转变、对永续发展的迫切需求以及生物技术的持续进步。替代蛋白正逐渐成为未来食品生态系统的重要组成部分,在保障全球蛋白质安全的同时,也减少了传统肉类和乳製品产业的环境足迹。监管支持的加强、创投的增加以及零售通路的日益完善,都在加速市场的扩张。植物性蛋白质、培育肉类和发酵蛋白合计约占整个市场的85%。融合多种生产平台的混合技术的兴起,正在改善产品的质地、营养品质和价格优势。此外,人工智慧辅助分子农业和3D食品列印等新兴创新技术,正在提升製程效率、可扩展性和客製化程度,为更广泛的商业应用铺路。精准发酵技术透过大规模生产功能性、动物性蛋白,不断重塑蛋白质生产方式,进一步丰富了永续蛋白质替代品的选择,并推动了全球食品供应链的持续转型。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 356亿美元 |

| 预测值 | 1301亿美元 |

| 复合年增长率 | 13.9% |

到2024年,植物蛋白市场占有率预计将达到50%,这主要得益于组织化、萃取和挤压技术的重大进步,这些技术能够模拟肉类的纤维质地。培养蛋白技术利用先进的细胞培养系统和可控的生长环境,无需使用牲畜即可生产逼真的肉类替代品。这些生产方法因其可扩展性和资源效率而日益受到认可,并有助于解决与畜牧业相关的伦理和环境挑战。

到2024年,食品製造业将占据35%的市场。製造商正在采用替代蛋白来改良现有产品,并创造新的、可持续的食品。随着消费者对环保餐饮的关注度不断提高,食品生产商和餐厅正在将植物蛋白和细胞培养蛋白纳入主流菜单,以符合现代饮食偏好和全球永续发展目标。

2024年,北美替代蛋白市场规模达到142亿美元,预计2034年将以10%的复合年增长率成长。该地区受益于强大的研发基础设施、雄厚的投资支持以及消费者对替代蛋白来源的广泛接受。美国在北美市场占据领先地位,这得益于其完善的监管框架、尖端的技术进步以及成熟的食品加工业。政府机构已推出相关指导方针,促进植物蛋白、发酵蛋白和培养蛋白的创新,从而推动该地区替代蛋白的商业化和产品多样化。

全球替代蛋白市场的主要企业包括:Oatly Group AB、Beyond Meat Inc.、Impossible Foods Inc.、Perfect Day Inc.、Tyson Foods Inc.、Eat Just Inc.、雀巢公司、Aleph Farms Ltd.、Mosa Meat BV、联合利华、Quorn Foods、奇华顿公司、Esature.Ir. AG、Roquette Freres SA、达能公司、Upside Foods Inc. 和丰益国际有限公司。这些企业正利用先进的生物技术、合作伙伴关係和产品组合多元化来巩固其市场地位。许多企业正大力投资研发,以提升替代蛋白的口感、质地和营养价值,使其能与动物性产品相提并论。新创企业与大型食品製造商之间的策略合作正在促进创新并加速商业化进程。企业正透过发酵和细胞培养技术扩大生产规模,同时利用混合生产模式优化成本。透过零售通路和速食店拓展到新的区域市场,进一步提高了消费者的购买便利性。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 产业陷阱与挑战

- 市场机会

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲 (MEA)

- 波特的分析

- PESTEL 分析

- 价格趋势

- 按地区

- 按产品类别

- 未来市场趋势

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 专利格局

- 贸易统计(HS编码)

(註:贸易统计仅针对重点国家提供)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依原料划分,2021-2034年

- 主要趋势

- 植物基

- 大豆基

- 豌豆蛋白

- 小麦麸质和谷物蛋白

- 豆类(绿豆、蚕豆、鹰嘴豆)

- 新植物

- 微生物与发酵

- 文化媒体

- 微生物菌株

- 发酵底物

- 细胞培养

- 功能性添加剂和成分

- 乳化剂和稳定剂

- 调味料和调味

- 装订和纹理

- 营养强化

- 其他的

第六章:市场估算与预测:依生产技术划分,2021-2034年

- 主要趋势

- 植物基

- 栽培

- 发酵

- 混合处理

- 新兴技术

- 3D食品列印系统

- 新提取

- 先进生物工艺

第七章:市场估算与预测:依产品类别划分,2021-2034年

- 主要趋势

- 蛋白质原料及中间体

- 蛋白质分离物和浓缩物

- 功能性蛋白质成分

- 特种蛋白

- 肉类替代品

- 碎肉

- 整块肉

- 加工肉类(香肠、鸡块、肉饼)

- 乳製品替代品

- 牛奶

- 起司

- 优格和冰淇淋

- 精准发酵乳蛋白

- 海鲜替代品

- 蛋替代品

- 宠物食品替代品

- 营养补充品和蛋白质粉

第八章:市场估算与预测:依最终用途划分,2021-2034年

- 主要趋势

- 食品製造

- 餐饮服务

- 快速服务

- 全方位服务

- 机构餐饮服务(医院、学校、企业)

- 零售/消费者

- 食品零售

- 电子商务

- 特色/天然食品店

- 其他(化妆品及个人护理用品、药品)

第九章:市场估计与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第十章:公司简介

- Aleph Farms Ltd.

- Beyond Meat Inc.

- Danone SA

- Eat Just Inc.

- Givaudan SA

- Impossible Foods Inc.

- Ingredion Incorporated

- Mosa Meat BV

- Nature's Fynd Inc.

- Nestle SA

- Oatly Group AB

- Perfect Day Inc.

- Planted Foods AG

- Quorn Foods

- Roquette Freres SA

- The EVERY Company

- Tyson Foods Inc.

- Unilever PLC

- Upside Foods Inc.

- Wilmar International Limited

The Global Alternative Protein Market was valued at USD 35.6 billion in 2024 and is estimated to grow at a CAGR of 13.9% to reach USD 130.1 billion by 2034.

Market growth is driven by shifting consumer behavior, sustainability imperatives, and continuous biotechnological advancements. Alternative proteins are emerging as a crucial component of the future food ecosystem, addressing global protein security while reducing the environmental footprint of traditional meat and dairy industries. Increasing regulatory support, growing venture capital investments, and stronger retail distribution are accelerating the market's expansion. Together, plant-based proteins, cultivated meat, and fermentation-derived proteins represent approximately 85% of the overall market. The rise of hybrid technologies that combine multiple production platforms is improving product texture, nutritional quality, and affordability. In addition, emerging innovations such as AI-assisted molecular farming and 3D food printing are enhancing process efficiency, scalability, and customization, paving the way for wider commercial adoption. Precision fermentation continues to redefine protein manufacturing by producing functional, animal-identical proteins at scale, further diversifying options for sustainable protein alternatives and contributing to the ongoing transformation of the global food supply chain.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $35.6 Billion |

| Forecast Value | $130.1 Billion |

| CAGR | 13.9% |

The plant-based proteins segment held a 50% share in 2024, supported by major progress in texturization, extraction, and extrusion technologies that mimic the fibrous texture of meat. Cultivated protein technologies utilize advanced cell culture systems and controlled growth environments to produce authentic meat analogues without the use of livestock. These production methods are increasingly recognized as scalable and resource-efficient, addressing ethical and environmental challenges associated with animal agriculture.

The food manufacturing segment held 35% share in 2024. Manufacturers are adopting alternative proteins to reformulate existing products and create new, sustainable food offerings. As consumer interest in environmentally responsible dining continues to grow, food producers and restaurants are incorporating plant and cell-based proteins into mainstream menus to align with modern dietary preferences and global sustainability goals.

North America Alternative Protein Market generated USD 14.2 billion in 2024 and will grow at a CAGR of 10% through 2034. The region benefits from robust research infrastructure, strong investment backing, and widespread consumer acceptance of alternative protein sources. The U.S. leads the North American market, driven by supportive regulatory frameworks, cutting-edge technological advancements, and a mature food processing industry. Governmental agencies have introduced guidelines that promote innovation in plant-based, fermentation, and cultivated proteins, encouraging broader commercialization and product diversity in the region.

Key companies operating in the Global Alternative Protein Market include Oatly Group AB, Beyond Meat Inc., Impossible Foods Inc., Perfect Day Inc., Tyson Foods Inc., Eat Just Inc., Nestle S.A., Aleph Farms Ltd., Mosa Meat B.V., Unilever PLC, Quorn Foods, Givaudan S.A., The EVERY Company, Ingredion Incorporated, Nature's Fynd Inc., Planted Foods AG, Roquette Freres S.A., Danone S.A., Upside Foods Inc., and Wilmar International Limited. Companies in the Alternative Protein Market are leveraging advanced biotechnology, partnerships, and portfolio diversification to strengthen their market position. Many are investing heavily in R&D to enhance the taste, texture, and nutritional profiles of protein alternatives, making them competitive with animal-derived options. Strategic collaborations between startups and large food manufacturers are fostering innovation and accelerating commercialization. Firms are scaling production through fermentation and cell-based technologies while optimizing costs with hybrid manufacturing models. Expansion into new regional markets through retail channels and quick-service restaurants is further increasing consumer accessibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Raw Material

- 2.2.3 Production Technology

- 2.2.4 Product Category

- 2.2.5 End use

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future Outlook and Strategic Recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.2 Industry pitfalls and challenges

- 3.2.3 Market opportunities

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa (MEA)

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Price trends

- 3.7.1 By region

- 3.7.2 By product category

- 3.8 Future market trends

- 3.9 Technology and Innovation landscape

- 3.9.1 Current technological trends

- 3.9.2 Emerging technologies

- 3.10 Patent Landscape

- 3.11 Trade statistics (HS code)

( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans

Chapter 5 Market Estimates and Forecast, By Raw Material, 2021-2034 (USD Billion & Tons)

- 5.1 Key trends

- 5.2 Plant based

- 5.2.1 Soy based

- 5.2.2 Pea protein

- 5.2.3 Wheat gluten & cereal protein

- 5.2.4 Legume (mung, fava, chickpea)

- 5.2.5 Novel plant

- 5.3 Microbial & fermentation

- 5.3.1 Culture media

- 5.3.2 Microorganisms strains

- 5.3.3 Fermentation substrates

- 5.4 Cell culture

- 5.5 Functional additives & ingredients

- 5.5.1 Emulsifiers & stabilizers

- 5.5.2 Flavoring & seasoning

- 5.5.3 Binding & texturing

- 5.5.4 Nutritional fortification

- 5.6 Others

Chapter 6 Market Estimates and Forecast, By Production Technology, 2021-2034 (USD Billion & Tons)

- 6.1 Key trends

- 6.2 Plant based

- 6.3 Cultivated

- 6.4 Fermentation

- 6.5 Hybrid processing

- 6.6 Emerging technologies

- 6.6.1 3D food printing systems

- 6.6.2 Novel extraction

- 6.6.3 Advanced bioprocessing

Chapter 7 Market Estimates and Forecast, By Product Category, 2021-2034 (USD Billion & Tons)

- 7.1 Key trends

- 7.2 Protein ingredients & intermediates

- 7.2.1 Protein isolates & concentrates

- 7.2.2 Functional protein ingredients

- 7.2.3 Specialty protein

- 7.3 Meat alternatives

- 7.3.1 Ground meat

- 7.3.2 Whole cut meat

- 7.3.3 Processed meat (sausages, nuggets, patties)

- 7.4 Dairy alternatives

- 7.4.1 Milk

- 7.4.2 Cheese

- 7.4.3 Yogurt & ice cream

- 7.4.4 Precision fermentation dairy proteins

- 7.5 Seafood alternatives

- 7.6 Egg alternatives

- 7.7 Pet food alternatives

- 7.8 Nutritional supplement & protein powders

Chapter 8 Market Estimates and Forecast, By End Use, 2021-2034 (USD Billion & Tons)

- 8.1 Key trends

- 8.2 Food manufacturing

- 8.3 Food service

- 8.3.1 Quick service

- 8.3.2 Full service

- 8.3.3 Institutional food service (hospitals, schools, corporate)

- 8.4 Retail/consumer

- 8.4.1 Grocery retail

- 8.4.2 E-commerce

- 8.4.3 Specialty/natural food stores

- 8.5 Others (cosmetics & personal care, pharmaceuticals)

Chapter 9 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion & Tons)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 France

- 9.3.4 Spain

- 9.3.5 Italy

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Rest of Asia Pacific

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.5.4 Rest of Latin America

- 9.6 Middle East and Africa

- 9.6.1 Saudi Arabia

- 9.6.2 South Africa

- 9.6.3 UAE

- 9.6.4 Rest of Middle East and Africa

Chapter 10 Company Profiles

- 10.1 Aleph Farms Ltd.

- 10.2 Beyond Meat Inc.

- 10.3 Danone S.A.

- 10.4 Eat Just Inc.

- 10.5 Givaudan S.A.

- 10.6 Impossible Foods Inc.

- 10.7 Ingredion Incorporated

- 10.8 Mosa Meat B.V.

- 10.9 Nature's Fynd Inc.

- 10.10 Nestle S.A.

- 10.11 Oatly Group AB

- 10.12 Perfect Day Inc.

- 10.13 Planted Foods AG

- 10.14 Quorn Foods

- 10.15 Roquette Freres S.A.

- 10.16 The EVERY Company

- 10.17 Tyson Foods Inc.

- 10.18 Unilever PLC

- 10.19 Upside Foods Inc.

- 10.20 Wilmar International Limited