|

市场调查报告书

商品编码

1885801

肉类副产品蛋白水解物市场机会、成长驱动因素、产业趋势分析及预测(2025-2034年)Meat by-product Protein Hydrolysates Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034 |

||||||

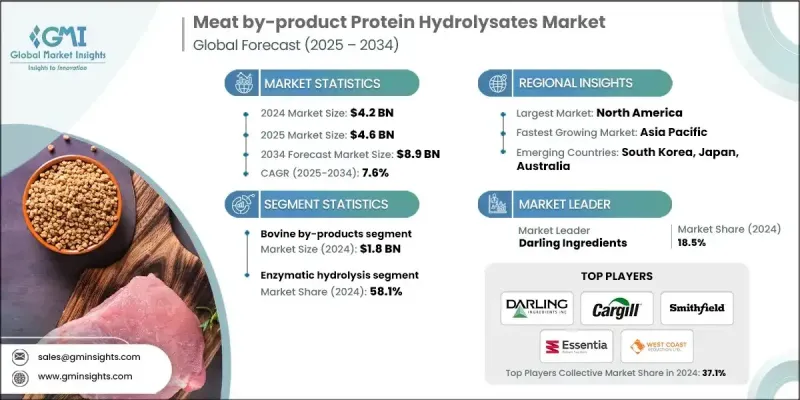

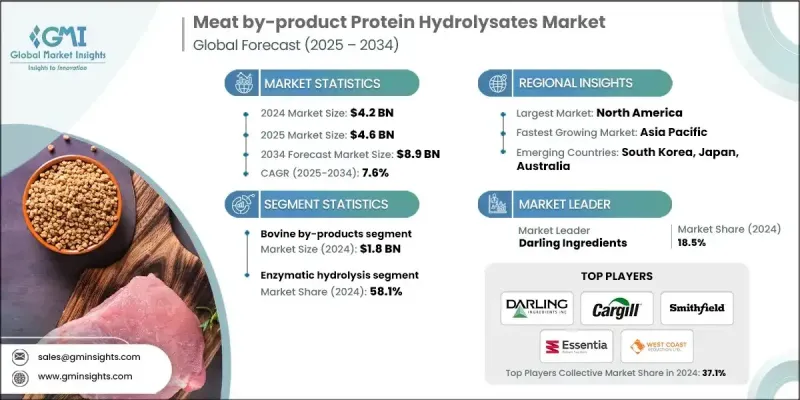

2024 年全球肉类副产品蛋白水解物市场价值为 42 亿美元,预计到 2034 年将以 7.6% 的复合年增长率增长至 89 亿美元。

这些水解物是源自动物副产品(如骨骼、羽毛和内臟)酶解的生物活性胜肽。它们具有优异的消化率、高生物利用度和在动物营养方面的功能优势,正推动其作为传统蛋白质来源的替代品而广泛应用。随着世界各国政府大力倡导减少浪费和提高资源效率,对永续蛋白质解决方案的需求不断增长,进一步推动了市场发展。将肉类副产品转化为蛋白质水解物不仅可以减少浪费,还能提供一种经济高效的优质饲料添加剂,符合全球永续发展目标。监管激励措施,尤其是在欧洲等地区,旨在优化废弃物利用,从而直接支持市场扩张。宠物食品和牲畜饲料产业对动物健康和营养的日益关注,也持续推动市场需求。北美目前凭藉先进的製造基础设施、强有力的监管支持和较高的市场接受度占据主导地位,而亚太地区则是增长最快的市场,这主要得益于肉类消费量的增长、城市化进程的加快以及对可持续动物营养的日益重视。

| 市场范围 | |

|---|---|

| 起始年份 | 2024 |

| 预测年份 | 2025-2034 |

| 起始值 | 42亿美元 |

| 预测值 | 89亿美元 |

| 复合年增长率 | 7.6% |

2024年,牛副产品创造了18亿美元的市场价值,继续保持市场主导地位。这些原料来源丰富且富含蛋白质,是生产肉类副产品蛋白水解物的经济高效且可靠的原料。其营养成分有助于动物生长和免疫健康,因此在动物饲料和水产养殖领域中广泛应用。萃取和水解技术的进步简化了牛副产品的加工流程,进一步巩固了其市场地位。

2024年,酵素水解法占了58.1%的市占率。此方法之所以备受青睐,是因为它能产生高品质、高生物利用度且具有特定功能特性的蛋白质水解物。酵素能选择性地将蛋白质分解成具有更高消化率和生物活性的成分,同时最大限度地减少化学残留,使该製程更安全、更环保。因此,酵素水解法在配製天然和有机动物饲料产品中具有很高的价值。

预计2025年至2034年间,北美肉类副产品蛋白水解物市场将以7.7%的复合年增长率成长。市场对促进环境保护和永续农业实践的饲料原料的需求不断增长。消费者的环保意识日益增强,产业参与者也更重视负责任的畜牧业。天然、可生物降解和可持续的蛋白水解物正日益受到欢迎。包括酵素水解、发酵和生物技术进步在内的技术创新,在提高产品品质和安全性的同时,也降低了生产成本。

全球肉类副产品蛋白水解物市场的主要参与者包括 Titan Biotech、West Coast Reduction Ltd、Cargill、Hormel Foods Corporation、Essentia Protein Solutions、Smithfield Foods Inc、Novonesis、National Beef Packing Company、Sanimax 和 Darling Ingredients。这些企业正透过技术创新、扩大产能和加大研发投入来提升水解物质量,从而巩固其市场地位。策略合作和併购有助于它们拓展分销网络并进入新兴市场。此外,企业也致力于永续发展,例如利用废弃物和开发环保加工方法,以提升品牌信誉。

目录

第一章:方法论与范围

第二章:执行概要

第三章:行业洞察

- 产业生态系分析

- 供应商格局

- 利润率

- 每个阶段的价值增加

- 影响价值链的因素

- 中断

- 产业影响因素

- 成长驱动因素

- 对可持续蛋白质来源的需求不断增长

- 循环经济在食品加工的应用

- 宠物食品和动物饲料产业蓬勃发展

- 产业陷阱与挑战

- 品质标准化挑战

- 供应链中断脆弱性

- 市场机会

- 与替代蛋白质价值链的整合

- 新兴生物活性胜肽的应用

- 成长驱动因素

- 成长潜力分析

- 监管环境

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 波特的分析

- PESTEL 分析

- 技术与创新格局

- 当前技术趋势

- 新兴技术

- 价格趋势

- 按地区

- 来源

- 未来市场趋势

- 专利格局

- 贸易统计(HS编码)(註:仅提供重点国家的贸易统计资料)

- 主要进口国

- 主要出口国

- 永续性和环境方面

- 永续实践

- 减少废弃物策略

- 生产中的能源效率

- 环保倡议

- 碳足迹考量

第四章:竞争格局

- 介绍

- 公司市占率分析

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- MEA

- 按地区

- 公司矩阵分析

- 主要市场参与者的竞争分析

- 竞争定位矩阵

- 关键进展

- 併购

- 合作伙伴关係与合作

- 新产品发布

- 扩张计划

第五章:市场估算与预测:依来源划分,2021-2034年

- 主要趋势

- 牛副产品

- 猪副产品

- 家禽副产品

- 其他的

第六章:市场估算与预测:依製程划分,2021-2034年

- 主要趋势

- 酵素水解

- 化学水解

- 微生物发酵

第七章:市场估计与预测:依应用领域划分,2021-2034年

- 主要趋势

- 餐饮

- 增味剂

- 蛋白质强化剂

- 其他的

- 动物饲料

- 宠物食品

- 牲畜饲料

- 其他的

- 临床营养

- 运动营养

- 婴儿营养

- 膳食补充剂

- 其他的

第八章:市场估算与预测:依地区划分,2021-2034年

- 主要趋势

- 北美洲

- 我们

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 韩国

- 亚太其他地区

- 拉丁美洲

- 巴西

- 墨西哥

- 阿根廷

- 拉丁美洲其他地区

- 中东和非洲

- 沙乌地阿拉伯

- 南非

- 阿联酋

- 中东和非洲其他地区

第九章:公司简介

- Cargill

- Darling Ingredients

- Essentia Protein Solutions

- Hormel Foods Corporation

- National Beef Packing Company

- Novonesis

- Sanimax

- Smithfield Foods Inc

- Titan Biotech

- West Coast Reduction Ltd

The Global Meat by-product Protein Hydrolysates Market was valued at USD 4.2 billion in 2024 and is estimated to grow at a CAGR of 7.6% to reach USD 8.9 billion by 2034.

These hydrolysates are bioactive peptides derived from the enzymatic breakdown of animal by-products such as bones, feathers, and offal. Their exceptional digestibility, high bioavailability, and functional benefits in animal nutrition are driving their adoption as an alternative to traditional protein sources. Rising demand for sustainable protein solutions is further boosting the market, as governments worldwide promote waste reduction and resource efficiency. Transforming meat by-products into protein hydrolysates not only reduces waste but also offers a cost-effective, high-quality feed additive, aligning with global sustainability goals. Regulatory incentives, particularly in regions like Europe, are focused on optimizing waste usage, directly supporting market expansion. Increasing attention to animal health and nutrition in the growing pet food and livestock feed sectors continues to fuel demand. North America currently dominates the market due to advanced manufacturing infrastructure, robust regulatory support, and high adoption rates, while the Asia-Pacific region is the fastest-growing market, driven by rising meat consumption, urbanization, and a growing focus on sustainable animal nutrition.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $4.2 Billion |

| Forecast Value | $8.9 Billion |

| CAGR | 7.6% |

In 2024, the bovine by-products generated USD 1.8 billion, maintaining a dominant position in the market. These sources are abundant and protein-rich, offering a cost-effective and reliable raw material for producing meat by-product protein hydrolysates. Their nutritional profile supports growth and immune health, making them popular in animal feed and aquaculture applications. Advances in extraction and hydrolysis techniques have simplified processing from bovine sources, further strengthening their market position.

The enzymatic hydrolysis segment accounted for a 58.1% share in 2024. This method is preferred because it produces high-quality, bioavailable protein hydrolysates with targeted functional properties. Enzymes selectively break down proteins into fractions with enhanced digestibility and bioactivity while minimizing chemical residues, making the process safer and more environmentally friendly. As a result, enzymatic hydrolysis is highly valued in formulating natural and organic animal feed products.

North America Meat by-product Protein Hydrolysates Market is expected to grow at a CAGR of 7.7% between 2025 and 2034. Demand is rising for feed ingredients that promote environmental conservation and sustainable farming practices. Awareness among consumers is increasing, and industry players are emphasizing responsible animal husbandry. Natural, biodegradable, and sustainable protein hydrolysates are gaining popularity. Technological innovations, including enzymatic hydrolysis, fermentation, and biotechnology advancements, are enhancing product quality and safety while reducing production costs.

Key players in the Global Meat by-product Protein Hydrolysates Market include Titan Biotech, West Coast Reduction Ltd, Cargill, Hormel Foods Corporation, Essentia Protein Solutions, Smithfield Foods Inc, Novonesis, National Beef Packing Company, Sanimax, and Darling Ingredients. Companies in the Meat by-product Protein Hydrolysates Market are adopting strategies to strengthen their market presence through technological innovation, expanding production capacities, and investing in R&D to improve hydrolysate quality. Strategic partnerships and mergers allow them to extend distribution networks and reach emerging markets. Focused efforts on sustainability, such as utilizing waste products and developing environmentally friendly processing methods, enhance brand credibility.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Market scope and definition

- 1.2 Research design

- 1.2.1 Research approach

- 1.2.2 Data collection methods

- 1.3 Data mining sources

- 1.3.1 Global

- 1.3.2 Regional/Country

- 1.4 Base estimates and calculations

- 1.4.1 Base year calculation

- 1.4.2 Key trends for market estimation

- 1.5 Primary research and validation

- 1.5.1 Primary sources

- 1.6 Forecast model

- 1.7 Research assumptions and limitations

Chapter 2 Executive Summary

- 2.1 Industry 360° synopsis

- 2.2 Key market trends

- 2.2.1 Source trends

- 2.2.2 Process trends

- 2.2.3 Application trends

- 2.2.4 Regional trends

- 2.3 TAM Analysis, 2025-2034

- 2.4 CXO perspectives: strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin

- 3.1.3 Value addition at each stage

- 3.1.4 Factor affecting the value chain

- 3.1.5 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Rising demand for sustainable protein sources

- 3.2.1.2 Circular economy implementation in food processing

- 3.2.1.3 Growing pet food & animal feed industries

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Quality standardization challenges

- 3.2.2.2 Supply chain disruption vulnerabilities

- 3.2.3 Market opportunities

- 3.2.3.1 Integration with alternative protein value chains

- 3.2.3.2 Emerging bioactive peptide applications

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.2 Europe

- 3.4.3 Asia Pacific

- 3.4.4 Latin America

- 3.4.5 Middle East & Africa

- 3.5 Porter's analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Price trends

- 3.8.1 By region

- 3.8.2 By source

- 3.9 Future market trends

- 3.10 Patent landscape

- 3.11 Trade statistics (HS code) ( Note: the trade statistics will be provided for key countries only)

- 3.11.1 Major importing countries

- 3.11.2 Major exporting countries

- 3.12 Sustainability and environmental aspects

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.13 Carbon footprint consideration

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 By region

- 4.2.1.1 North America

- 4.2.1.2 Europe

- 4.2.1.3 Asia Pacific

- 4.2.1.4 LATAM

- 4.2.1.5 MEA

- 4.2.1 By region

- 4.3 Company matrix analysis

- 4.4 Competitive analysis of major market players

- 4.5 Competitive positioning matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New product launches

- 4.6.4 Expansion plans

Chapter 5 Market Estimates and Forecast, By Source, 2021-2034 (USD Billion) (Kilo Tons)

- 5.1 Key trends

- 5.2 Bovine by-products

- 5.3 Porcine by-products

- 5.4 Poultry by-products

- 5.5 Others

Chapter 6 Market Estimates and Forecast, By Process, 2021-2034 (USD Billion) (Kilo Tons)

- 6.1 Key trends

- 6.2 Enzymatic hydrolysis

- 6.3 Chemical hydrolysis

- 6.4 Microbial fermentation

Chapter 7 Market Estimates and Forecast, By Application, 2021-2034 (USD Billion) (Kilo Tons)

- 7.1 Key trends

- 7.2 Food & beverage

- 7.2.1 Flavor enhancers

- 7.2.2 Protein fortifiers

- 7.2.3 Others

- 7.3 Animal feed

- 7.3.1 Pet food

- 7.3.2 Livestock feed

- 7.3.3 Others

- 7.4 Clinical nutrition

- 7.5 Sports nutrition

- 7.6 Infant nutrition

- 7.7 Dietary supplements

- 7.8 Others

Chapter 8 Market Estimates and Forecast, By Region, 2021-2034 (USD Billion) (Kilo Tons)

- 8.1 Key trends

- 8.2 North America

- 8.2.1 U.S.

- 8.2.2 Canada

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 France

- 8.3.4 Spain

- 8.3.5 Italy

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 China

- 8.4.2 India

- 8.4.3 Japan

- 8.4.4 Australia

- 8.4.5 South Korea

- 8.4.6 Rest of Asia Pacific

- 8.5 Latin America

- 8.5.1 Brazil

- 8.5.2 Mexico

- 8.5.3 Argentina

- 8.5.4 Rest of Latin America

- 8.6 Middle East and Africa

- 8.6.1 Saudi Arabia

- 8.6.2 South Africa

- 8.6.3 UAE

- 8.6.4 Rest of Middle East and Africa

Chapter 9 Company Profiles

- 9.1 Cargill

- 9.2 Darling Ingredients

- 9.3 Essentia Protein Solutions

- 9.4 Hormel Foods Corporation

- 9.5 National Beef Packing Company

- 9.6 Novonesis

- 9.7 Sanimax

- 9.8 Smithfield Foods Inc

- 9.9 Titan Biotech

- 9.10 West Coast Reduction Ltd