|

市场调查报告书

商品编码

1745093

防机器人拨号及品牌呼叫市场:2025年~2030年Robocall Mitigation & Branded Calling Market: 2025-2030 |

||||||

自动拨号诈骗:2025 年全球消费者损失将超过 800 亿美元,但预计 2026 年将下降

| 主要统计 | |

|---|---|

| 2025年的语音自动电话诈欺造成的受害总额: | 800亿美元 |

| 由于2030年的品牌呼叫的总收益: | 23亿美元 |

| 品牌呼叫市场成长率: | 1,720% |

| 预测期间: | 2025-2030年 |

本研究资料包对快速发展的反自动呼叫和品牌呼叫市场进行了详细分析。包括行动营运商、监管机构以及自动拨号保护和品牌呼叫供应商在内的利害关係人可以了解未来的成长、关键趋势和竞争格局。我们也分析了不断变化的监管环境和新兴框架。

研究套件包含多个可单独购买的选项,例如存取自动拨号保护和品牌呼叫的采用情况和未来成长情况的数据,以及重点介绍最新市场机会的深入研究。此外,该套件还包含对自动拨号保护和品牌呼叫领域 19 家市场领导者的广泛分析。

总而言之,这是了解这个快速发展的市场的关键工具,自动拨号保护供应商和行动营运商可以用它来规划未来策略。其无与伦比的全面性使该研究套件成为预测这样一个充满不确定性且快速增长的市场未来的宝贵资源。

主要特点

- 市场动态:洞察反自动拨号和品牌呼叫市场课题所带来的关键趋势及其对市场的影响。本研究涵盖了不法分子利用人工智慧进行非法自动拨号所带来的课题,尤其是利用人工智慧产生的语音进行非法呼叫,以及非法自动拨号在OTT平台和Wangiri 2.0上造成的破坏。本研究评估了政府针对非法自动拨号的干预措施、北美联邦通讯委员会等监管机构实施的监管措施,以及品牌呼叫等其他自动拨号缓解措施。研究也包含61个主要国家/地区当前发展和未来成长的区域市场成长分析。

- 关键要点和策略建议本文详细分析了反自动拨号和品牌呼叫市场的关键发展机会和发现,并为利害关係人提供了策略建议。

- 产业基准预测:提供合法呼叫、非法自动拨号流量和品牌认证 API 通话的五年市场成长预测资料库。

- Juniper Research 竞争排行榜:Juniper Research 的竞争排行榜评估了 19 家领先的自动拨号保护和品牌认证呼叫供应商的能力,并根据市场表现、收入和未来业务前景等标准对其进行评分。

样品view

市场资料·预测报告

样品

市场趋势·策略报告

市场资料&预测报告

本调查套件中包含以下指标:

- 自动拨号总数

- 诈欺性自动拨号总数

- 成功自动拨号总数

- 自动拨号诈欺损失总额

- 品牌呼叫身分验证 API 呼叫总数

- 品牌呼叫身分验证 API 呼叫产生的平台总

Juniper Research 互动式预测 (Excel) 包含以下功能:

- 统计分析:使用者可以搜寻资料期间所有地区和国家显示的特定指标。图表可以轻鬆修改并汇出到剪贴簿。

- 国家/地区资料工具:此工具可让您查看预测期间内所有地区和国家的指标。搜寻栏可让您优化显示的指标。

- 国家比较工具:您可以选择特定的国家进行比较。图表也可以汇出。

- 假设分析:透过五个互动式场景比较预测假设。

目录

市场趋势·策略

第1章 重要点·策略性建议

- 重要点·策略性建议

第2章 防机器人拨号:未来市场展望

- 自动拨号电话应对措施:简介

- 人工智慧与机器学习的进步

- 人工智慧在诈欺中的应用

- 人工智慧在自动拨号电话应对措施中的应用

- 政府和监管机构的干预

- 向 VoIP 网路过渡

- 讯号级自动拨号电话应对措施

- 全通路攻击

- 成功的自动拨号电话应对措施

- 增强网路安全的要求

- 利害关係人教育与认知

- 向 5G 网路过渡

第3章 品牌呼叫:未来市场展望

- 品牌呼叫:简介

- 品牌呼叫的限制

- BCID

- 语音通路价值

- 行动用户认知与教育

- 营运商提升语音通路价值的策略

第4章 各国准备指数

- 各国准备指数:简介

- 焦点市场

- 成长市场

- 饱和市场

- 新兴国家市场

竞争排行榜

第1章 竞争排行榜

第2章 业者简介

- 自动拨号保护与品牌呼叫市场:供应商概况

- BICS (Proximus Global)

- First Orion

- Hiya

- iconectiv

- LANCK Telecom

- Metaswitch

- Mobileum

- Neural Technologies

- Numeracle

- NUSO

- Ribbon Communications

- SecurityGen

- Sinch

- Subex

- TNS

- TransNexus

- TransUnion

- Twilio

- XConnect

- 调查手法

- 限制与解释

- 相关调查

资料·预测

第1章 市场预测·重要点

第2章 防机器人拨号及品牌呼叫的预测

- 自动拨号电话:预测方法

- 行动用户接到的自动拨号电话总数

- 行动用户接到的诈骗自动拨号电话总数

- 成功自动拨号电话总数

- 自动拨号电话造成的诈欺损失总额

第3章 品牌呼叫的预测

- 预测方法与假设

- 品牌呼叫认证呼叫总数

- 品牌呼叫认证呼叫带来的平台总收入

'Robocalling Fraud: Global Consumer Losses to Exceed $80bn in 2025, But Will Start Declining in 2026'

| KEY STATISTICS | |

|---|---|

| Total losses to robocalling fraud in 2025: | $80bn |

| Total branded calling revenue in 2030: | $2.3bn |

| Branded calling market growth: | 1,720% |

| Forecast period: | 2025-2030 |

Overview

Our "Robocall Mitigation & Branded Calling" research suite provides a detailed analysis of this rapidly evolving market. It enables stakeholders, from mobile operators, regulators, robocall mitigation and branded calling vendors, to understand future growth, key trends, and the competitive environment. The suite also analyses changing regulatory environments and emerging frameworks.

The research suite includes several options that can be purchased separately, including access to data mapping the adoption and future growth of robocall mitigation and branded calling, and a thorough study uncovering the latest market opportunities. Additionally, it includes a document containing an extensive analysis of the 19 market leaders in the robocall mitigation and branded calling space. The coverage can also be purchased as a Full Research Suite, containing all these elements and a substantial discount.

Collectively, they provide a critical tool for understanding this rapidly evolving market; allowing robocall mitigation vendors and mobile operators to shape their future strategy. Its unparalleled coverage makes this research suite an incredibly useful resource for projecting the future of such an uncertain and fast-growing market.

All report content is delivered in the English language.

Key Features

- Market Dynamics: Insights into key trends and market impacts resulting from challenges within the robocall mitigation and branded calling market. This research addresses challenges posed by bad actors utilising AI within illegal robocalling; specifically using AI-generated voices for illegal calls, and disruption caused by unlawful robocalls on over-the-top platforms and Wangiri 2.0. The research then assesses government interventions in illegal robocalls and regulations imposed by regulators, such as the Federal Communications Commission in North America, alongside alternative robocall mitigation efforts, such as branded calling. This robocall mitigation and branded calling research also includes a regional market growth analysis on the current development and future growth of robocall mitigation and branded calling across 61 key countries.

- Key Takeaways & Strategic Recommendations: In-depth analysis of key development opportunities and findings within the robocall mitigation and branded calling market, accompanied by strategic recommendations for stakeholders.

- Benchmark Industry Forecasts: 5-year forecast databases are provided for the market growth in legitimate calls, illegal robocall traffic, and branded authentication API calls.

- Juniper Research Competitor Leaderboard: Key player capability and capacity assessment for 19 leading robocall mitigation and branded calling vendors via the Juniper Research Competitor Leaderboard; scoring these vendors on criteria such as market performance, revenue and future business prospects.

SAMPLE VIEW

Market Data & Forecasts Report

The numbers tell you what's happening, but our written report details why, alongside the methodologies.

SAMPLE VIEW

Market Trends & Strategies Report

A comprehensive analysis of the current market landscape, alongside strategic recommendations.

Market Data & Forecasts Report

The market-leading research suite for the "Robocall Mitigation & Branded Calling" market includes access to comprehensive 5-year forecast datasets of 14 tables and over 6,380 datapoints.

Metrics in the research suite include:

- Total Number of Robocalls

- Total Number of Fraudulent Robocalls

- Total Number of Successful Robocalls

- Total Fraudulent Losses to Robocalling

- Total Number of Branded Calling Authentication API Calls

- Total Platform Revenue from Branded Calling Authentication API Calls

Juniper Research Interactive Forecast Excel contains the following functionality:

- Statistics Analysis: Users can search for specific metrics displayed for all regions and countries across the data period. Graphs are easily modified and can be exported to the clipboard.

- Country Data Tool: This tool lets users look at metrics for all regions and countries in the forecast period. Users can refine the metrics displayed via a search bar.

- Country Comparison Tool: Users can select and compare specific countries. This tool also allows users to export graphs.

- What-if Analysis: Here, users can compare forecast metrics against their assumptions, via 5 interactive scenarios.

Market Trends & Strategies Report

This report examines the "Robocall Mitigation & Branded Calling" market landscape in detail; assessing market trends and factors shaping the evolution of this rapidly changing market. The report delivers a comprehensive analysis of the strategic opportunities for robocall mitigation and branded calling providers; addressing key verticals and developing challenges, and how stakeholders must navigate these. It also includes evaluation of key country-level opportunities for growth in the robocall mitigation and branded calling market.

Competitor Leaderboard Report

The Competitor Leaderboard report provides a detailed evaluation and market positioning for 19 leading Robocall Mitigation & Branded Calling vendors. The vendors are positioned as established leaders, leading challengers, or disruptors and challengers based on capacity and capability assessments:

|

|

This document is centred around the Juniper Research Competitor Leaderboard; a vendor positioning tool backed by a robust methodology that provides an at-a-glance view of a market's competitive landscape.

Table of Contents

Market Trends & Strategies

1. Key Takeaways & Strategic Recommendations

- 1.1. Key Takeaways and Strategic Recommendations

- 1.2. Key Takeaways

- 1.3. Strategic Recommendations

2. Robocall Mitigation: Future Market Outlook

- 2.1. Introduction to Robocall Mitigation

- Table 2.1: Current Robocall Mitigation Solutions

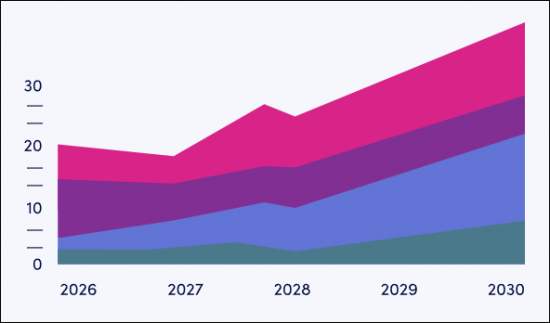

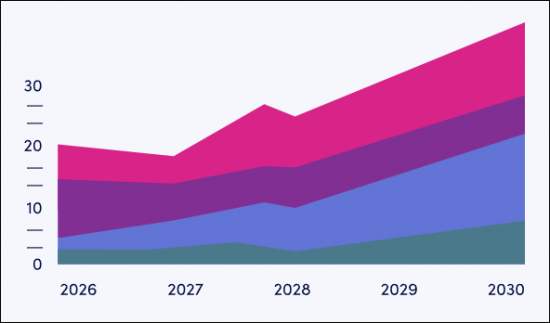

- Figure 2.2: Total Fraudulent Losses to Robocalling ($82.5 billion), Split by 8 Key Regions, 2025

- 2.2. Advancements in AI and ML

- 2.2.1. AI in Fraudulent Activity

- Figure 2.3: Average Loss to Fraudulent Robocalling per Mobile Subscriber ($), Split by 8 Key Regions, 2025-2030

- 2.2.2. AI in Robocall Mitigation

- 2.2.1. AI in Fraudulent Activity

- 2.3. Government and Regulatory Intervention

- 2.4. Shift to VoIP Networks

- 2.5. Robocall Mitigation at the Signalling Level

- 2.6. Omnichannel Attacks

- 2.7. Success in Robocall Mitigation

- Figure 2.4: Total Fraudulent Losses to Robocalling ($m), Split by 8 Key Regions, 2025-2030

- 2.8. Requirement for Enhanced Network Security

- 2.9. Stakeholder Education and Awareness

- 2.10. Shift to 5G Networks

3. Branded Calling: Future Market Outlook

- 3.1. Introduction to Branded Calling

- Figure 3.1: Total Number of Branded Calling Authentication Calls, Split by 8 Key Regions, 2025

- 3.2. Branded Calling Limitations

- 3.2.1. BCID

- 3.3. Value of the Voice Channel

- Figure 3.2: Total Voice Calls (m), Split by 8 Key Regions, 2025-2029

- 3.4. Mobile Subscriber Awareness and Education

- 3.4.1. Operator Strategies to Increase the Value of the Voice Channel

4. Country Readiness Index

- 4.1. Introduction to Country Readiness Index

- Figure 4.1: Robocall Mitigation & Branded Calling Country Readiness Index: Regional Definitions

- Table 4.2: Juniper Research's Country Readiness Index Scoring Criteria: Robocall Mitigation & Branded Calling

- Figure 4.3: Juniper Research's Country Readiness Index: Robocall Mitigation & Branded Calling

- Table 4.4: Robocall Mitigation & Branded Calling Country Readiness Index: Market Segments

- 4.2. Focus Markets

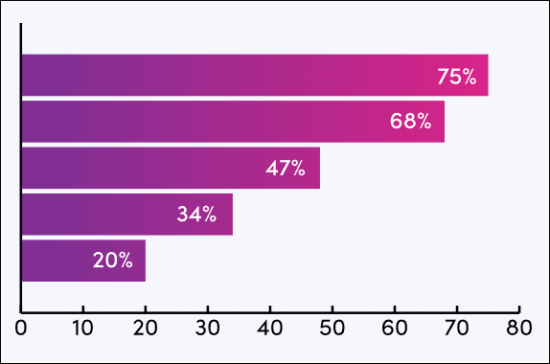

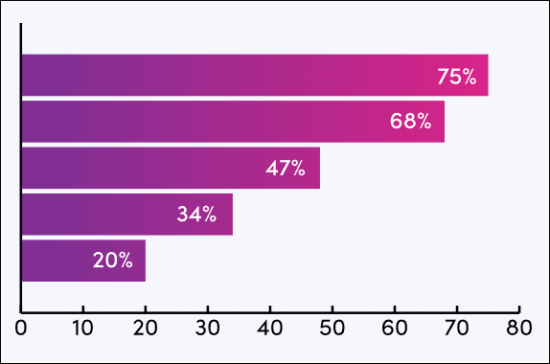

- Figure 4.5: Average Number of Branded Calls per Subscriber in 2030, Split by Focus Markets

- 4.2.1. These Countries Rank as High-income Areas

- 4.2.2. There Is Strong Historic Investment in Technological Innovation

- 4.3. Growth Markets

- 4.3.1. Inadequate Existing Robocall Mitigation

- 4.3.2. Widening Scope of Robocall Fraud

- 4.4. Saturated Markets

- Figure 4.6: Total Number of Fraudulent Robocalls Received (m), Split by 8 Key Saturated Markets, 2025-2030

- 4.5. Developing Markets

- 4.5.1. Digital Revolutions

- 4.5.2. Expanding Scope of Robocall Fraud

- Table 4.7: Juniper Research's Country Readiness Index Heatmap: North America

- Table 4.8: Juniper Research's Country Readiness Index Heatmap: Latin America

- Table 4.9: Juniper Research's Country Readiness Index Heatmap: West Europe

- Table 4.10: Juniper Research's Country Readiness Index Heatmap: Central & East Europe

- Table 4.11: Juniper Research's Country Readiness Index Heatmap: Far East & China

- Table 4.12: Juniper Research's Country Readiness Index Heatmap: Indian Subcontinent

- Table 4.13: Juniper Research's Country Readiness Index Heatmap: Rest of Asia Pacific

- Table 4.14: Juniper Research's Country Readiness Index Heatmap: Africa & Middle East

Competitor Leaderboard

1. Competitor Leaderboard

- 1.1. Why Read This Report

- Table 1.1: Juniper Research Competitor Leaderboard: Robocall Mitigation & Branded Calling Vendors & Product Portfolio

- Figure 1.2: Juniper Research Competitor Leaderboard: Robocall Mitigation & Branded Calling Vendors

- Table 1.3: Juniper Research Competitor Leaderboard: Vendors

- Table 1.4: Juniper Research Competitor Leaderboard Heatmap: Robocall Mitigation & Branded Calling Vendors (1 of 2)

- Table 1.5: Juniper Research Competitor Leaderboard Heatmap: Robocall Mitigation & Branded Calling Vendors (2 of 2)

2. Vendor Profiles

- 2.1. Robocall Mitigation & Branded Calling Market: Vendor Profiles

- 2.1.1. BICS (Proximus Global)

- i. Corporate Information

- Table 2.1: BICS' Select Financial Information (Euro-m), 2022 & 2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.2. First Orion

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.2: First Orion's SENTRY Solution Process

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.3. Hiya

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.4. iconectiv

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.5. LANCK Telecom

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.3: LANCK Telecom's FMS Control Centre Dashboard

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.6. Metaswitch

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.7. Mobileum

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.4: Mobileum's RAID Solution

- Figure 2.5: Mobileum's CLI Spoofing Prevention in Action

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.8. Neural Technologies

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.9. Numeracle

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.6: Numeracle's Smart Branding

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.10. NUSO

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.11. Ribbon Communications

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.12. SecurityGen

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.13. Sinch

- i. Corporate Information

- Table 2.7: Sinch's Acquisitions, 2020-2021

- Table 2.8: Sinch's Select Financial Information ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.14. Subex

- i. Corporate Information

- Table 2.9: Subex's Financial Information ($m), 2022 and 2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.15. TNS

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.10: TNS Call Guardian Authentication

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.16. TransNexus

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- Figure 2.11: TransNexus STIR/SHAKEN Solution

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.17. TransUnion

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.18. Twilio

- i. Corporate Information

- Table 2.12: Twilio's Acquisitions, November 2019-present

- Table 2.13: Twilio's Revenue ($m), 2021-2023

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- i. Corporate Information

- 2.1.19. XConnect

- i. Corporate Information

- ii. Geographical Spread

- iii. Key Clients & Strategic Partnerships

- iv. High-level View of Offerings

- v. Juniper Research's View: Key Strengths & Strategic Development Opportunities

- 2.1.1. BICS (Proximus Global)

- 2.2. Juniper Research Leaderboard Methodology

- 2.3. Limitations & Interpretations

- Table 2.14: Juniper Research Competitor Leaderboard Scoring Criteria: Robocall Mitigation and Branded Calling Vendors

- 2.4. Related Research

Data & Forecasting

1. Market Forecasts & Key Takeaways

- 1.1. Introduction to Robocall Mitigation & Branded Calling Market Forecasts

- Figure 1.1: Total Number of Fraudulent Robocalls Received by Mobile Subscribers (m), Split by 8 Key Regions, 2025 and 2030

- Figure 1.2: Total Number of Branded Calling Authentication Calls (m), Split by 8 Key Regions, 2025 and 2030

2. Robocalling and Fraudulent Robocalling Forecast

- 2.1. Introduction to Robocall Forecasts

- Figure 2.1: Total Number of Successful Robocalls (66 million), Split by 8 Key Regions, 2025

- 2.1.1. Robocall Forecast Methodology

- Figure 2.2: Robocall Mitigation & Branded Calling Market: Forecast Methodology

- 2.1.2. Total Number of Robocalls Received by Mobile Subscribers

- Figure & Table 2.3: Total Number of Robocalls Received by Mobile Subscribers (m), Split by 8 Key Regions, 2025-2030

- 2.1.3. Total Number of Fraudulent Robocalls Received by Mobile Subscribers

- Figure & Table 2.4: Total Number of Fraudulent Robocalls Received by Mobile Subscribers (m), Split by 8 Key Regions, 2025-2030

- 2.1.4. Total Number of Successful Robocalls

- Figure & Table 2.5: Total Number of Successful Robocalls (m), Split by 8 Key Regions, 2025-2030

- 2.1.5. Total Fraudulent Losses to Robocalling

- Figure & Table 2.6: Total Fraudulent Losses to Robocalling ($m), Split by 8 Key Regions, 2025-2030

- Table 2.7: Average Loss to Fraudulent Robocalling ($), Split by 8 Key Regions, 2025-2030

3. Branded Calling Forecast

- 3.1. Branded Calling Forecast Methodology

- Figure 3.1: Total Number of Branded Calling Authentication Calls (9.6 billion), Split by 8 Key Regions, 2025

- 3.1.1. Forecast Methodology & Assumptions

- Figure 3.2: Branded Calling Forecast Methodology

- 3.1.2. Total Number of Branded Calling Authentication Calls

- Figure & Table 3.3: Total Number of Branded Calling Authentication Calls (m), Split by 8 Key Regions, 2025-2030

- 3.1.3. Total Platform Revenue From Branded Calling Authentication Calls

- Figure & Table 3.4: Total Platform Revenue From Branded Calling Authentication Calls ($m), Split by 8 Key Regions, 2025-2030