|

市场调查报告书

商品编码

1931746

极紫外线(EUV)微影术市场:按组件、系统类型、最终用户、应用和地区分類的全球市场-预测至2032年Extreme Ultraviolet (EUV) Lithography Market by Component (Light Sources, Optics, Masks), System Type (0.33 NA EUV System (NXE), 0.55 NA EUV System (EXE)), Integrated Device Manufacturers, Foundries, Logic Chips, Memory Chips - Global Forecast to 2032 |

||||||

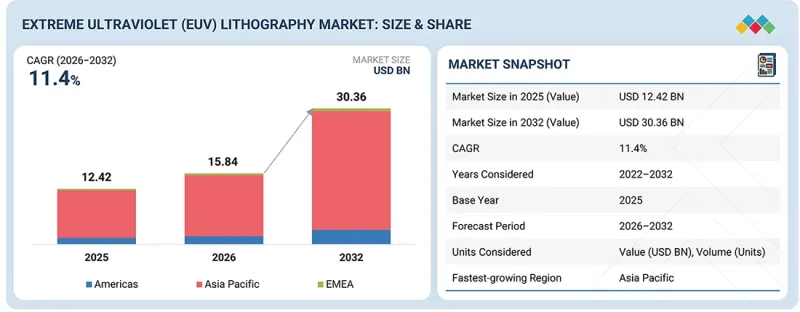

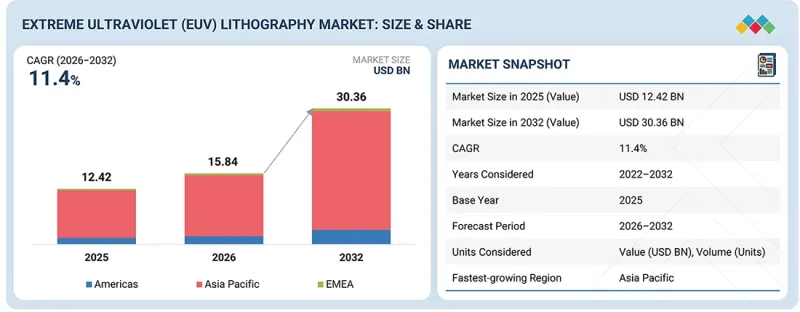

全球极紫外线(EUV)微影术市场预计将从 2026 年的 158.4 亿美元成长到 2032 年的 303.6 亿美元,复合年增长率为 11.4%。

智慧型手机、穿戴式装置、平板电脑和游戏设备等家用电子电器的快速发展,持续推动对先进半导体晶片的需求,这些晶片能够实现更高的性能、更小的尺寸和更高的能源效率。为了实现更快的处理速度、更先进的图形处理能力和更长的电池续航时间,製造商越来越依赖极微影术(EUV),该技术能够製造更小的电晶体并实现更高的电晶体密度。

| 调查范围 | |

|---|---|

| 调查期 | 2021-2032 |

| 基准年 | 2024 |

| 预测期 | 2025-2032 |

| 目标单元 | 金额(十亿美元) |

| 部分 | 按组件、按系统类型、按最终用户、按应用程式、按区域 |

| 目标区域 | 北美、欧洲、亚太地区及其他地区 |

向折迭式显示器、扩增实境(AR) 和虚拟实境 (VR) 等下一代技术的演进,进一步增加了晶片的复杂性,并强化了对基于极紫外光刻 (EUV) 的精密製造流程的需求。随着家用电子电器和自动驾驶应用对效能和小型化的需求不断增长,EUV微影术已成为在先进节点上生产可靠、高性能积体电路的关键技术。

由于光源对先进半导体製程的系统生产率、吞吐量和成本效益有直接影响,预计将在极紫外 (EUV)微影术市场中实现最高的复合年增长率 (CAGR)。对晶圆吞吐量不断增长的需求促使人们需要更强大的 EUV 光源功率、更高的稳定性和更长的正常运作,从而推动现有光源模组的频繁升级和更换。此外,向更先进的製程节点过渡以及逐步向下一代 EUV 平台的转变,也提高了对光源性能的要求,加速了研发投入和应用。与其他 EUV 系统组件相比,光源组件的高技术复杂性、有限的供应商基础以及对提高生产率的高度重视,都支撑着其更快的收入成长。

2025年,逻辑晶片在极紫外线(EUV)微影术应用领域占据最大市场份额,这主要得益于EUV技术在先进製程节点上的早期和广泛应用。诸如7nm、5nm和3nm等尖端逻辑装置需要极精细的图形化、严格的套刻控制和高晶体管密度,而与多重图形化的深紫外线(DUV)技术相比,EUV能够更有效率地实现这些目标。人工智慧、高效能运算、资料中心和先进汽车电子等应用领域的快速成长,推动了对高性能逻辑晶片的强劲需求,并加速了EUV设备利用率和产能的扩张。同时,记忆体製造商正更有选择性地采用EUV技术,专注于特定层,这进一步巩固了逻辑晶片在极紫外线(EUV)微影术整体需求中的主导地位。

亚太地区预计将在预测期内实现最高的复合年增长率,这主要得益于该地区主要半导体晶圆代工厂和集成器件製造商 (IDM) 的集中,以及对先进节点製造的持续投资。该地区的领先地位得益于 5nm、3nm 和 3nm 以下製程的大规模产能扩张,人工智慧、高效能运算和先进消费性电子产品对逻辑晶片日益增长的需求,以及成熟的半导体供应链加速了 EUV 微影技术的应用。此外,持续的资本投资、积极的技术蓝图以及政府主导的加强国内半导体能力的倡议,都在加速 EUV 设备的普及。这些因素共同促成了亚太地区成为全球极紫外线 (EUV)微影术市场的主要需求中心和成长引擎。

主要调查主题细分

我们对在极紫外线 (EUV)微影术市场中营运的主要组织的高阶主管(执行长、市场总监、创新与技术总监等)进行了深入访谈。

极紫外线 (EUV)微影术市场由 ASML(荷兰)主导,ASML 是 EUV微影术产品的唯一製造商。此外,TRUMPF(德国)、Ushio Inc.(日本)、Energetiq(美国)、蔡司集团(德国)、NTT 先进技术公司(日本)、理学控股公司(日本)、Edmund Optics Inc.(美国)、AGC Inc.(日本)、Tekscend Photomasks(日本)、Lasertec Corporation(日本)、HOntec Corporation(日本)、NserService Corporation(日本)、3333 年)。 Corporation(美国)、ADVANTEST CORPORATION(日本)、SUSS MicroTec SE(德国)、Applied Materials, Inc.(美国)、Park Systems(韩国)、Imagine Optic(法国)、MKS Inc.(美国)、台积电(台湾)、英特尔公司(美国)、三星(韩国)、SK 製造商)占据了美光公司(韩国市场)。本研究对极紫外线(EUV)微影术市场的主要企业进行了详细的竞争分析,包括公司简介、近期发展和关键市场策略。

调查范围

本报告对极紫外线 (EUV)微影术市场进行了细分,并按组件、系统类型、最终用户、应用和地区提供了预测。报告也探讨了与该市场相关的驱动因素、限制因素、机会和挑战。报告详细分析了美洲、亚太地区和欧洲、中东及非洲 (EMEA) 三大主要地区的市场情况,并包含了主要参与者的价值链分析和 EUV微影术生态系统分析。

购买本报告的主要优势

- 分析影响极紫外线( 微影术的关键驱动因素(领先代晶圆代工厂微影术快速采用EUV微影术技术)、限制因素(高额初始资本投资)、机会(对先进EUV微影术和半导体元件的投资不断增加)以及挑战(来自其他微影技术的竞争)。

- 产品、解决方案与服务开发与创新:深入了解EUV微影术市场即将推出的组件、技术与研发活动

- 市场发展:关于盈利市场的全面资讯-本报告分析了各个地区的极紫外线(EUV)微影术市场。

- 市场多元化:全面介绍前沿地区新兴的极微影术技术、近期趋势以及极微影术市场的投资情况。

- 竞争评估:对为 EUV微影术提供组件的主要企业(包括 KLA 公司(美国)、蔡司集团(德国)、通快公司(德国)、AGC 公司(日本)和 Lasertec 公司(日本))的市场份额、成长策略和产品供应进行详细评估。

目录

第一章 引言

第二章执行摘要

第三章重要考察

第四章 市场概览

- 市场动态

- 司机

- 抑制因素

- 机会

- 任务

第五章 产业趋势

- 波特五力分析

- 宏观经济展望

- 价值链分析

- 生态系分析

- 定价分析

- 贸易分析

- 2026-2027 年主要会议和活动

- 影响客户业务的趋势/干扰因素

- 投资和资金筹措方案

- 案例研究分析

- 2025年美国关税对极紫外线(EUV)微影术市场的影响

第六章:技术进步、人工智慧的影响、专利与创新

- 技术分析

- 技术/产品蓝图

- 专利分析

- 人工智慧对极微影术的影响

第七章 监理环境

- 监管机构、政府机构和其他组织

- 规则

- 标准

- 政府法规

- 永续性影响和监管政策倡议

- 认证、标籤和环境标准

第八章:顾客状况与购买行为

- 决策流程

- 主要相关人员和采购标准

- 招募障碍和内部挑战

- 各类终端用户的未满足需求

- 市场盈利

第九章 极紫外线(EUV)微影术技术应用节点

- 7NM

- 5NM

- 3NM

- 2NM

- 小于2海里

10. 极紫外线(EUV)微影术市场(依组件划分)

- 光源

- 光学

- 面具

- 其他的

11. 极紫外线 (EUV)微影术市场(依系统类型划分)

- 0.33 NA EUV 系统 (NXE)

- 0.55 NA EUV 系统 (EXE)

第十二章 依最终用户分類的极紫外线(EUV)微影术市场

- 整合装置製造商(IDMS)

- 铸造厂

第十三章 依应用分類的极紫外线(EUV)微影术市场

- 逻辑晶片

- 记忆体晶片

14. 极紫外线(EUV)微影术市场(依地区划分)

- 美洲

- EMEA

- 亚太地区

第十五章 竞争格局

- 概述

- 主要参与企业的竞争策略/优势,2024-2025年

- 2021-2025年收入分析

- 2025年市占率分析

- 估值和财务指标

- 产品对比

- 公司估值矩阵:主要参与企业,2025 年

- 公司估值矩阵:Start-Ups/中小企业,2025 年

- 竞争场景

第十六章:公司简介

- 主要係统製造商

- ASML

- 主要零件製造商

- LIGHT SOURCE MANUFACTURERS

- OPTICS MANUFACTURERS

- MASK MANUFACTURERS

- 其他的

- 最终用户

- TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- INTEL CORPORATION

- SAMSUNG

- SK HYNIX INC.

- MICRON TECHNOLOGY, INC.

第十七章调查方法

第十八章附录

The global extreme ultraviolet (EUV) lithography market is expected to grow from USD 15.84 billion in 2026 to USD 30.36 billion by 2032, at a CAGR of 11.4%. The rapid advancements in consumer electronics, including smartphones, wearables, tablets, and gaming devices, are driving sustained demand for advanced semiconductor chips that offer higher performance, compact designs, and improved energy efficiency. To support faster processing, enhanced graphics, and longer battery life, manufacturers increasingly rely on EUV lithography to enable smaller transistors and higher transistor density.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Billion) |

| Segments | By Component, System Type, End User and Region |

| Regions covered | North America, Europe, APAC, RoW |

The shift toward next-generation technologies, including foldable displays, augmented reality, and virtual reality, is further increasing chip complexity and reinforcing the need for high-precision EUV-based manufacturing. As performance and miniaturization requirements continue to rise across consumer electronics and autonomous applications, EUV lithography is becoming a critical enabler for producing reliable, high-performance integrated circuits at advanced nodes.

"Light sources to exhibit highest CAGR from 2026 to 2032."

Light sources are expected to witness the highest CAGR in the extreme ultraviolet (EUV) lithography market due to their direct impact on system productivity, throughput, and cost efficiency at advanced semiconductor nodes. Continuous demand for higher wafer throughput is driving the need for increased EUV source power, improved stability, and longer uptime, prompting frequent upgrades and replacements of existing light source modules. In addition, the transition toward more advanced process nodes and the gradual shift to next-generation EUV platforms are increasing performance requirements for light sources, accelerating R&D investments and adoption. The high technical complexity, limited supplier base, and strong focus on productivity-driven enhancements further support faster revenue growth for this component compared to other EUV system elements.

"Logic chips held largest share of extreme ultraviolet (EUV) lithography market in 2025."

Logic chips held the largest market share in the application segment of the extreme ultraviolet (EUV) lithography market in 2025, driven by early and widespread adoption of EUV at advanced process nodes. Leading-edge logic devices at 7 nm, 5 nm, and 3 nm require extremely fine patterning, tight overlay control, and high transistor density, all of which are more efficiently achieved using EUV compared with multi-patterning DUV techniques. The rapid growth of applications such as artificial intelligence, high-performance computing, data centers, and advanced automotive electronics is driving strong demand for high-performance logic chips, accelerating EUV tool utilization and capacity expansion. In contrast, memory manufacturers have adopted EUV more selectively, focusing on specific layers, which further reinforces the dominance of logic chips in overall extreme ultraviolet (EUV) lithography demand.

"Asia Pacific to be fastest-growing regional market for EUV lithography from 2026 to 2032."

Asia Pacific is expected to register the highest CAGR during the forecast period, driven by its strong concentration of leading semiconductor foundries and integrated device manufacturers (IDMs), as well as continuous investments in advanced-node manufacturing. The region's dominance is supported by large-scale capacity expansions at 5 nm, 3 nm, and sub-3 nm nodes, rising demand for logic chips used in AI, high-performance computing, and advanced consumer electronics, and a mature semiconductor supply chain that enables rapid EUV adoption. In addition, sustained capital expenditure, aggressive technology roadmaps, and government-backed initiatives to strengthen domestic semiconductor capabilities are accelerating EUV tool installations. These factors collectively position Asia Pacific as the primary demand center and growth engine for the global extreme ultraviolet (EUV) lithography market.

Breakdown of Primaries

Various executives from key organizations operating in the extreme ultraviolet (EUV) lithography market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-30%, Tier 2-50%, and Tier 3-20%

- By Designation: C-level Executives-25%, Directors-35%, and Others-40%

- By Region: Asia Pacific-40%, Americas-25%, and EMEA- 35%

The extreme ultraviolet (EUV) lithography market is dominated by ASML (Netherlands) as the sole manufacturer of EUV lithography products, as well as by component manufacturers such as TRUMPF (Germany), Ushio Inc. (Japan), Energetiq (US), Zeiss Group (Germany), NTT Advanced Technology Corporation (Japan), Rigaku Holdings Corporation (Japan), Edmund Optics Inc. (US), AGC Inc. (Japan), Tekscend Photomask (Japan), Lasertec Corporation (Japan), HOYA Corporation (Japan), NuFlare Technology, Inc. (Japan), KLA Corporation (US), ADVANTEST CORPORATION (Japan), SUSS MicroTec SE (Germany), Applied Materials, Inc. (US), Park Systems (South Korea), Imagine Optic (France), MKS Inc. (US), Taiwan Semiconductor Manufacturing Company Limited (TSMC) (Taiwan), Intel Corporation (US), Samsung (South Korea), SK HYNIX INC. (South Korea), and Micron Technology (US). The study includes an in-depth competitive analysis of these key players in the extreme ultraviolet (EUV) lithography market, with their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the extreme ultraviolet (EUV) lithography market and forecasts its components, system types, end users, applications, and regions. The report also discusses the drivers, restraints, opportunities, and challenges pertaining to the market. It provides a detailed view of the market across three main regions-Americas, Asia Pacific, and EMEA. The report includes a value chain analysis of the key players and their competitive analysis of the EUV lithography ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (surging deployment of EUV lithography across leading-edge foundry nodes), restraints (high upfront capital investment), opportunities (increasing investments in advanced EUV lithography and semiconductor devices), and challenges (competition from alternative lithography techniques) influencing the growth of the extreme ultraviolet (EUV) lithography market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming components, technologies, research, and development activities in the extreme ultraviolet (EUV) lithography market

- Market Development: Comprehensive information about lucrative markets-the report analyzes the extreme ultraviolet (EUV) lithography market across varied regions

- Market Diversification: Exhaustive information about new EUV lithography in untapped geographies, recent developments, and investments in the extreme ultraviolet (EUV) lithography market

- Competitive Assessment: In-depth assessment of market shares and growth strategies, and offerings of leading players offering components of EUV lithography, such as KLA Corporation (US), ZEISS Group (Germany), TRUMPF (Germany), AGC Inc. (Japan), and Lasertec Corporation (Japan)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 EXECUTIVE SUMMARY

- 2.1 MARKET HIGHLIGHTS AND KEY INSIGHTS

- 2.2 KEY MARKET PARTICIPANTS: MAPPING OF STRATEGIC DEVELOPMENTS

- 2.3 DISRUPTIVE TRENDS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- 2.4 HIGH-GROWTH SEGMENTS

- 2.5 REGIONAL SNAPSHOT: MARKET SIZE, GROWTH RATE, AND FORECAST

3 PREMIUM INSIGHTS

- 3.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- 3.2 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER

- 3.3 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION

- 3.4 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION

4 MARKET OVERVIEW

- 4.1 INTRODUCTION

- 4.2 MARKET DYNAMICS

- 4.2.1 DRIVERS

- 4.2.1.1 Surging deployment of EUV lithography across leading-edge foundry nodes

- 4.2.1.2 Elevating use of AI accelerators and deep learning processors in HPC systems

- 4.2.1.3 Increasing complexity of integrated circuits

- 4.2.1.4 Rapid advancements in consumer electronics

- 4.2.2 RESTRAINTS

- 4.2.2.1 High upfront capital investment

- 4.2.2.2 Requirement for advanced infrastructure and skilled workforce

- 4.2.3 OPPORTUNITIES

- 4.2.3.1 Increasing investments in advanced EUV lithography and semiconductor devices

- 4.2.3.2 Emerging applications of EUV lithography

- 4.2.3.3 Advancements in memory modules and chips

- 4.2.3.4 Integration of EUV lithography into advanced display manufacturing

- 4.2.3.5 Application of advanced patterning technologies in photonics and optics production

- 4.2.3.6 Commercialization of High-NA EUV lithography

- 4.2.4 CHALLENGES

- 4.2.4.1 Competition from alternative lithography techniques

- 4.2.4.2 Difficulty in sustaining high source power and productivity

- 4.2.4.3 Detecting and addressing mask defects and yield-related challenges

- 4.2.1 DRIVERS

5 INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 PORTER'S FIVE FORCES ANALYSIS

- 5.2.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.2.2 THREAT OF NEW ENTRANTS

- 5.2.3 THREAT OF SUBSTITUTES

- 5.2.4 BARGAINING POWER OF BUYERS

- 5.2.5 BARGAINING POWER OF SUPPLIERS

- 5.3 MACROECONOMIC OUTLOOK

- 5.3.1 INTRODUCTION

- 5.3.2 GDP TRENDS AND FORECAST

- 5.3.3 TRENDS IN FOUNDRIES

- 5.3.4 TRENDS IN INTEGRATED DEVICE MANUFACTURERS (IDMS)

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 R&D ENGINEERS

- 5.4.2 RAW MATERIAL PROVIDERS AND COMPONENT MANUFACTURERS

- 5.4.3 SYSTEM INTEGRATORS AND MANUFACTURERS

- 5.4.4 MARKETING & SALES SERVICES PROVIDERS

- 5.4.5 END USERS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM TYPES, BY KEY PLAYER, 2021-2025

- 5.6.2 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM, BY REGION, 2021-2025

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT SCENARIO (HS CODE 8442)

- 5.7.2 EXPORT SCENARIO (HS CODE 8442)

- 5.8 KEY CONFERENCES AND EVENTS, 2026-2027

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.10 INVESTMENT AND FUNDING SCENARIO

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 INTEL SECURES EXCLUSIVE HIGH-NA EUV LITHOGRAPHY MACHINES TO RESHAPE SUPPLY CHAIN

- 5.11.2 TSMC DEPLOYS EUV LITHOGRAPHY SYSTEMS TO BOOST PRODUCTION CAPACITY

- 5.11.3 SAMSUNG ELECTRONICS ADVANCES 3 NM GAA PRODUCTION USING EUV LITHOGRAPHY

- 5.12 IMPACT OF 2025 US TARIFF ON EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- 5.12.1 INTRODUCTION

- 5.12.2 KEY TARIFF RATES

- 5.12.3 PRICE IMPACT ANALYSIS

- 5.12.4 IMPACT ON COUNTRY/REGION

- 5.12.4.1 US

- 5.12.4.2 Europe

- 5.12.4.3 Asia Pacific

- 5.12.5 IMPACT ON END USERS

6 TECHNOLOGICAL ADVANCEMENTS, AI-DRIVEN IMPACT, PATENTS, AND INNOVATIONS

- 6.1 TECHNOLOGY ANALYSIS

- 6.1.1 KEY EMERGING TECHNOLOGIES

- 6.1.1.1 High-NA EUV lithography technology

- 6.1.1.2 Advanced EUV resist and patterning materials

- 6.1.2 COMPLEMENTARY TECHNOLOGIES

- 6.1.2.1 Mask pellicles

- 6.1.2.2 Plasma generation

- 6.1.3 ADJACENT TECHNOLOGIES

- 6.1.3.1 Extreme ultraviolet reflectometry (EUVR)

- 6.1.3.2 Atomic layer deposition (ALD)

- 6.1.1 KEY EMERGING TECHNOLOGIES

- 6.2 TECHNOLOGY/PRODUCT ROADMAP

- 6.2.1 SHORT-TERM (2025-2027): PRODUCTIVITY OPTIMIZATION & ADVANCED NODE SCALING

- 6.2.2 MID-TERM (2027-2030): HIGH-NA EUV COMMERCIALIZATION & PROCESS MATURITY

- 6.2.3 LONG-TERM (2030-2035+): FULL HIGH-NA DEPLOYMENT & NEXT-GEN LITHOGRAPHY INTEGRATION

- 6.3 PATENT ANALYSIS

- 6.4 IMPACT OF AI ON EUV LITHOGRAPHY

- 6.4.1 TOP USE CASES AND MARKET POTENTIAL

- 6.4.2 BEST PRACTICES IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- 6.4.3 CASE STUDIES OF AI IMPLEMENTATION IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- 6.4.4 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- 6.4.5 CLIENTS' READINESS TO ADOPT AI IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

7 REGULATORY LANDSCAPE

- 7.1 INTRODUCTION

- 7.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 7.3 REGULATIONS

- 7.4 STANDARDS

- 7.4.1 SEMI STANDARDS

- 7.4.2 ISO & IEC ELECTRICAL, MECHANICAL, AND SAFETY STANDARDS

- 7.4.3 ISO 9001:2015 QUALITY MANAGEMENT SYSTEM STANDARDS

- 7.4.4 ISO 14001 ENVIRONMENTAL MANAGEMENT STANDARDS

- 7.4.5 ROHS & REACH COMPLIANCE STANDARDS

- 7.4.6 CYBERSECURITY & DATA INTEGRITY STANDARDS

- 7.5 GOVERNMENT REGULATIONS

- 7.5.1 US

- 7.5.2 EUROPE

- 7.5.3 CHINA

- 7.5.4 JAPAN

- 7.5.5 INDIA

- 7.6 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

- 7.7 CERTIFICATIONS, LABELING, AND ECO-STANDARDS

8 CUSTOMER LANDSCAPE AND BUYER BEHAVIOR

- 8.1 DECISION-MAKING PROCESS

- 8.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 8.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 8.2.2 BUYING CRITERIA

- 8.3 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- 8.4 UNMET NEEDS OF VARIOUS END USERS

- 8.5 MARKET PROFITABILITY

9 APPLICATION NODES OF EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.2 7 NM

- 9.3 5 NM

- 9.4 3 NM

- 9.5 2 NM

- 9.6 SUB-2 NM

10 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COMPONENT

- 10.1 INTRODUCTION

- 10.2 LIGHT SOURCES

- 10.2.1 RISING FOCUS ON ENHANCING PRECISION AND THROUGHPUT IN SEMICONDUCTORS TO BOOST DEMAND

- 10.3 OPTICS

- 10.3.1 ELEVATING DEMAND FOR HIGHER NUMERICAL APERTURE (HIGH-NA) EUV SYSTEMS TO SUPPORT SEGMENTAL GROWTH

- 10.4 MASKS

- 10.4.1 GREATER EMPHASIS ON PROCESS EFFICIENCY AND SUSTAINABILITY IN EUV MASK PRODUCTION TO CONTRIBUTE TO SEGMENTAL GROWTH

- 10.5 OTHER COMPONENTS

11 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE

- 11.1 INTRODUCTION

- 11.2 0.33 NA EUV SYSTEMS (NXE)

- 11.2.1 COST EFFICIENCY AND RELIABILITY TO STIMULATE DEMAND

- 11.3 0.55 NA EUV SYSTEMS (EXE)

- 11.3.1 ABILITY TO IMPROVE YIELD FOR ADVANCED LOGIC, MEMORY, AND AI CHIPS TO DRIVE MARKET

12 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 INTEGRATED DEVICE MANUFACTURERS (IDMS)

- 12.2.1 INNOVATION IN ADVANCED AND ENERGY-EFFICIENT MICROCHIPS TO FOSTER MARKET GROWTH

- 12.3 FOUNDRIES

- 12.3.1 STRONG FOCUS ON HIGH-VOLUME SEMICONDUCTOR MANUFACTURING TO SUPPORT SEGMENTAL GROWTH

13 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION

- 13.1 INTRODUCTION

- 13.2 LOGIC CHIPS

- 13.2.1 INCREASING COMPLEXITY AND COSTS OF LOGIC DEVICES TO BOOST DEMAND FOR EUV LITHOGRAPHY

- 13.2.2 CPU

- 13.2.3 GPU

- 13.2.4 AI ACCELERATOR

- 13.2.5 SOC

- 13.2.6 ASIC

- 13.3 MEMORY CHIPS

- 13.3.1 GROWING DEMAND FOR ARTIFICIAL INTELLIGENCE, CLOUD COMPUTING, AND HIGH-PERFORMANCE APPLICATIONS TO CREATE OPPORTUNITIES

- 13.3.2 DRAM

- 13.3.3 HBM

14 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION

- 14.1 INTRODUCTION

- 14.2 AMERICAS

- 14.2.1 GROWING DEMAND FOR HIGH-PERFORMANCE, ENERGY-EFFICIENT SEMICONDUCTOR SOLUTIONS TO BOOST MARKET

- 14.3 EMEA

- 14.3.1 EARLY-STAGE COMMERCIALIZATION OF EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY TO CREATE GROWTH OPPORTUNITIES

- 14.4 ASIA PACIFIC

- 14.4.1 CHINA

- 14.4.1.1 Domestic semiconductor capacity building and technology localization to drive market

- 14.4.2 JAPAN

- 14.4.2.1 Presence of leading technology providers to contribute to market growth

- 14.4.3 SOUTH KOREA

- 14.4.3.1 Strong global position in memory and logic semiconductor manufacturing to foster market growth

- 14.4.4 TAIWAN

- 14.4.4.1 Significant investments in eco-friendly EUV system components to propel market

- 14.4.5 REST OF ASIA PACIFIC

- 14.4.1 CHINA

15 COMPETITIVE LANDSCAPE

- 15.1 OVERVIEW

- 15.2 KEY PLAYER COMPETITIVE STRATEGIES/RIGHT TO WIN, 2024-2025

- 15.3 REVENUE ANALYSIS, 2021-2025

- 15.4 MARKET SHARE ANALYSIS, 2025

- 15.5 COMPANY VALUATION AND FINANCIAL METRICS

- 15.5.1 COMPANY VALUATION

- 15.5.2 FINANCIAL METRICS

- 15.6 PRODUCT COMPARISON

- 15.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2025

- 15.7.1 STARS

- 15.7.2 EMERGING LEADERS

- 15.7.3 PERVASIVE PLAYERS

- 15.7.4 PARTICIPANTS

- 15.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2025

- 15.7.5.1 Company footprint

- 15.7.5.2 Region footprint

- 15.7.5.3 End user footprint

- 15.7.5.4 Component footprint

- 15.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2025

- 15.8.1 PROGRESSIVE COMPANIES

- 15.8.2 RESPONSIVE COMPANIES

- 15.8.3 DYNAMIC COMPANIES

- 15.8.4 STARTING BLOCKS

- 15.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2025

- 15.8.5.1 Detailed list of key startups/SMEs

- 15.8.5.2 Competitive benchmarking of key startups/SMEs

- 15.9 COMPETITIVE SCENARIO

- 15.9.1 PRODUCT LAUNCHES

- 15.9.2 DEALS

16 COMPANY PROFILES

- 16.1 INTRODUCTION

- 16.2 KEY SYSTEM MANUFACTURERS

- 16.2.1 ASML

- 16.2.1.1 Business overview

- 16.2.1.2 Products/Solutions/Services offered

- 16.2.1.3 Recent developments

- 16.2.1.3.1 Deals

- 16.2.1.4 MnM view

- 16.2.1.4.1 Key strengths/Right to win

- 16.2.1.4.2 Strategic choices

- 16.2.1.4.3 Weaknesses/Competitive threats

- 16.2.1 ASML

- 16.3 KEY COMPONENT MANUFACTURERS

- 16.3.1 LIGHT SOURCE MANUFACTURERS

- 16.3.1.1 TRUMPF

- 16.3.1.1.1 Business overview

- 16.3.1.1.2 Products/Solutions/Services offered

- 16.3.1.1.3 MnM view

- 16.3.1.1.3.1 Key strengths/Right to win

- 16.3.1.1.3.2 Strategic choices

- 16.3.1.1.3.3 Weaknesses/Competitive threats

- 16.3.1.2 Ushio Inc.

- 16.3.1.2.1 Business overview

- 16.3.1.2.2 Products/Solutions/Services offered

- 16.3.1.2.3 MnM view

- 16.3.1.2.3.1 Key strengths/Right to win

- 16.3.1.2.3.2 Strategic choices

- 16.3.1.2.3.3 Weaknesses/Competitive threats

- 16.3.1.3 Energetiq

- 16.3.1.3.1 Business overview

- 16.3.1.3.2 Products/Solutions/Services offered

- 16.3.1.3.3 Recent developments

- 16.3.1.3.3.1 Product launches

- 16.3.1.3.4 MnM view

- 16.3.1.3.4.1 Key strengths/Right to win

- 16.3.1.3.4.2 Strategic choices

- 16.3.1.3.4.3 Weaknesses/Competitive threats

- 16.3.1.1 TRUMPF

- 16.3.2 OPTICS MANUFACTURERS

- 16.3.2.1 ZEISS Group

- 16.3.2.1.1 Business overview

- 16.3.2.1.2 Products/Solutions/Services offered

- 16.3.2.1.3 Recent developments

- 16.3.2.1.3.1 Product launches

- 16.3.2.1.3.2 Deals

- 16.3.2.2 NTT ADVANCED TECHNOLOGY CORPORATION

- 16.3.2.2.1 Business overview

- 16.3.2.2.2 Products/Solutions/Services offered

- 16.3.2.3 Rigaku Holdings Corporation

- 16.3.2.3.1 Business overview

- 16.3.2.3.2 Products/Solutions/Services offered

- 16.3.2.4 Edmund Optics Inc.

- 16.3.2.4.1 Business overview

- 16.3.2.4.2 Products/Solutions/Services offered

- 16.3.2.1 ZEISS Group

- 16.3.3 MASK MANUFACTURERS

- 16.3.3.1 AGC Inc.

- 16.3.3.1.1 Business overview

- 16.3.3.1.2 Products/Solutions/Services offered

- 16.3.3.2 Tekscend Photomask

- 16.3.3.2.1 Business overview

- 16.3.3.2.2 Products/Solutions/Services offered

- 16.3.3.3 Lasertec Corporation

- 16.3.3.3.1 Business overview

- 16.3.3.3.2 Products/Solutions/Services offered

- 16.3.3.3.3 Recent developments

- 16.3.3.3.3.1 Product launches

- 16.3.3.4 HOYA Corporation

- 16.3.3.4.1 Business overview

- 16.3.3.4.2 Products/Solutions/Services offered

- 16.3.3.5 NuFlare Technology Inc.

- 16.3.3.5.1 Business overview

- 16.3.3.5.2 Products/Solutions/Services offered

- 16.3.3.1 AGC Inc.

- 16.3.4 OTHER COMPONENT MANUFACTURERS

- 16.3.4.1 KLA Corporation

- 16.3.4.2 ADVANTEST CORPORATION

- 16.3.4.3 SUSS MicroTec SE

- 16.3.4.4 Applied Materials, Inc.

- 16.3.4.5 Park Systems

- 16.3.4.6 Imagine Optic

- 16.3.4.7 MKS Inc.

- 16.3.1 LIGHT SOURCE MANUFACTURERS

- 16.4 END USERS

- 16.4.1 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED

- 16.4.2 INTEL CORPORATION

- 16.4.3 SAMSUNG

- 16.4.4 SK HYNIX INC.

- 16.4.5 MICRON TECHNOLOGY, INC.

17 RESEARCH METHODOLOGY

- 17.1 RESEARCH DATA

- 17.2 SECONDARY AND PRIMARY RESEARCH

- 17.2.1 SECONDARY DATA

- 17.2.1.1 List of key secondary sources

- 17.2.1.2 Key data from secondary sources

- 17.2.2 PRIMARY DATA

- 17.2.2.1 List of primary interview participants

- 17.2.2.2 Breakdown of primaries

- 17.2.2.3 Key data from primary sources

- 17.2.2.4 Key industry insights

- 17.2.1 SECONDARY DATA

- 17.3 MARKET SIZE ESTIMATION

- 17.3.1 BOTTOM-UP APPROACH

- 17.3.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 17.3.2 TOP-DOWN APPROACH

- 17.3.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 17.3.1 BOTTOM-UP APPROACH

- 17.4 MARKET SIZE ESTIMATION FOR BASE YEAR

- 17.5 MARKET FORECAST APPROACH

- 17.5.1 SUPPLY SIDE

- 17.5.2 DEMAND SIDE

- 17.6 DATA TRIANGULATION

- 17.7 RESEARCH ASSUMPTIONS

- 17.8 RESEARCH LIMITATIONS

- 17.9 RISK ANALYSIS

18 APPENDIX

- 18.1 INSIGHTS FROM INDUSTRY EXPERTS

- 18.2 DISCUSSION GUIDE

- 18.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.4 CUSTOMIZATION OPTIONS

- 18.5 RELATED REPORTS

- 18.6 AUTHOR DETAILS

List of Tables

- TABLE 1 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: INCLUSIONS AND EXCLUSIONS

- TABLE 2 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: SUMMARY OF CHANGES

- TABLE 3 PORTER'S FIVE FORCES ANALYSIS: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- TABLE 4 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021-2029

- TABLE 5 ROLE OF COMPANIES IN EUV LITHOGRAPHY ECOSYSTEM

- TABLE 6 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM TYPES OFFERED BY ASML, 2021-2025 (USD)

- TABLE 7 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM, BY REGION, 2021-2025 (USD MILLION)

- TABLE 8 IMPORT DATA FOR HS CODE 8442-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 9 EXPORT DATA FOR HS CODE 8442-COMPLIANT PRODUCTS, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 10 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: KEY CONFERENCES AND EVENTS, 2026-2027

- TABLE 11 US-ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 12 LIST OF MAJOR PATENTS, 2023-2024

- TABLE 13 TOP USE CASES AND MARKET POTENTIAL

- TABLE 14 BEST PRACTICES FOLLOWED BY COMPANIES

- TABLE 15 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: CASE STUDIES RELATED TO AI IMPLEMENTATION

- TABLE 16 INTERCONNECTED/ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 17 AMERICAS: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 EUV LITHOGRAPHY: REGULATIONS

- TABLE 21 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS (%)

- TABLE 22 KEY BUYING CRITERIA FOR END USERS

- TABLE 23 UNMET NEEDS OF END USERS OF EUV LITHOGRAPHY TECHNOLOGY

- TABLE 24 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COMPONENT, 2022-2025 (USD MILLION)

- TABLE 25 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COMPONENT, 2026-2032 (USD MILLION)

- TABLE 26 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE, IN TERMS OF VALUE AND VOLUME, 2022-2025

- TABLE 27 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE, IN TERMS OF VALUE AND VOLUME, 2026-2032

- TABLE 28 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE, 2022-2025 (USD MILLION)

- TABLE 29 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY SYSTEM TYPE, 2026-2032 (USD MILLION)

- TABLE 30 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 31 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 32 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 33 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 34 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 35 INTEGRATED DEVICE MANUFACTURERS (IDMS): EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 36 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 37 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 38 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN ASIA PACIFIC, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 39 FOUNDRIES: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN ASIA PACIFIC, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 40 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION, 2022-2025 (USD MILLION)

- TABLE 41 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY APPLICATION, 2026-2032 (USD MILLION)

- TABLE 42 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2022-2025 (USD MILLION)

- TABLE 43 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY REGION, 2026-2032 (USD MILLION)

- TABLE 44 AMERICAS: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 45 AMERICAS: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 46 EMEA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 47 EMEA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 48 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COUNTRY, 2022-2025 (USD MILLION)

- TABLE 49 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY COUNTRY, 2026-2032 (USD MILLION)

- TABLE 50 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 51 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 52 CHINA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 53 CHINA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 54 JAPAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 55 JAPAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 56 SOUTH KOREA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 57 SOUTH KOREA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 58 TAIWAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 59 TAIWAN: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2022-2025 (USD MILLION)

- TABLE 61 REST OF ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, BY END USER, 2026-2032 (USD MILLION)

- TABLE 62 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: KEY PLAYER STRATEGIES/ RIGHT TO WIN, 2024-2025

- TABLE 63 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DEGREE OF COMPETITION

- TABLE 64 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: REGION FOOTPRINT, 2025

- TABLE 65 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: END USER FOOTPRINT, 2025

- TABLE 66 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: COMPONENT FOOTPRINT, 2025

- TABLE 67 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: LIST OF KEY STARTUPS/SMES, 2025

- TABLE 68 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2025

- TABLE 69 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: PRODUCT LAUNCHES, OCTOBER 2024 TO DECEMBER 2025

- TABLE 70 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DEALS, OCTOBER 2024 TO DECEMBER 2025

- TABLE 71 ASML: COMPANY OVERVIEW

- TABLE 72 ASML: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 73 ASML: DEALS

- TABLE 74 TRUMPF: COMPANY OVERVIEW

- TABLE 75 TRUMPF: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 76 USHIO INC.: COMPANY OVERVIEW

- TABLE 77 USHIO INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 78 ENERGETIQ: COMPANY OVERVIEW

- TABLE 79 ENERGETIQ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 80 ENERGETIQ: PRODUCT LAUNCHES

- TABLE 81 ZEISS GROUP: COMPANY OVERVIEW

- TABLE 82 ZEISS GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 83 ZEISS GROUP: PRODUCT LAUNCHES

- TABLE 84 ZEISS GROUP: DEALS

- TABLE 85 NTT ADVANCED TECHNOLOGY CORPORATION: COMPANY OVERVIEW

- TABLE 86 NTT ADVANCED TECHNOLOGY CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 87 RIGAKU HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 88 RIGAKU HOLDINGS CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 89 EDMUND OPTICS INC.: COMPANY OVERVIEW

- TABLE 90 EDMUND OPTICS INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 91 AGC INC.: COMPANY OVERVIEW

- TABLE 92 AGC INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 93 TEKSCEND PHOTOMASK: COMPANY OVERVIEW

- TABLE 94 TEKSCEND PHOTOMASK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 95 LASERTEC CORPORATION: COMPANY OVERVIEW

- TABLE 96 LASERTEC CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 97 LASERTEC CORPORATION: PRODUCT LAUNCHES

- TABLE 98 HOYA CORPORATION: COMPANY OVERVIEW

- TABLE 99 HOYA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 100 NUFLARE TECHNOLOGY INC.: COMPANY OVERVIEW

- TABLE 101 NUFLARE TECHNOLOGY INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 102 KLA CORPORATION: COMPANY OVERVIEW

- TABLE 103 ADVANTEST CORPORATION: COMPANY OVERVIEW

- TABLE 104 SUSS MICROTEC SE: COMPANY OVERVIEW

- TABLE 105 APPLIED MATERIALS, INC.: COMPANY OVERVIEW

- TABLE 106 PARK SYSTEMS: COMPANY OVERVIEW

- TABLE 107 IMAGINE OPTIC: COMPANY OVERVIEW

- TABLE 108 MKS INC.: COMPANY OVERVIEW

- TABLE 109 TAIWAN SEMICONDUCTOR MANUFACTURING COMPANY LIMITED: COMPANY OVERVIEW

- TABLE 110 INTEL CORPORATION: COMPANY OVERVIEW

- TABLE 111 SAMSUNG: COMPANY OVERVIEW

- TABLE 112 SK HYNIX INC.: COMPANY OVERVIEW

- TABLE 113 MICRON TECHNOLOGY, INC.: COMPANY OVERVIEW

- TABLE 114 MAJOR SECONDARY SOURCES

- TABLE 115 PRIMARY INTERVIEW PARTICIPANTS

- TABLE 116 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RISK ANALYSIS

List of Figures

- FIGURE 1 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SEGMENTATION AND REGIONAL SCOPE

- FIGURE 2 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DURATION COVERED

- FIGURE 3 MARKET SCENARIO

- FIGURE 4 GLOBAL EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SIZE, 2022-2032

- FIGURE 5 MAJOR STRATEGIES ADOPTED BY KEY PLAYERS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, 2024-2025

- FIGURE 6 DISRUPTIVE TRENDS IMPACTING GROWTH OF EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- FIGURE 7 HIGH-GROWTH SEGMENTS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET, 2026-2032

- FIGURE 8 ASIA PACIFIC TO DOMINATE EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2026

- FIGURE 9 RISING DEMAND FOR ADVANCED SEMICONDUCTOR NOTES TO CREATE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 10 FOUNDRIES TO COMMAND EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2032

- FIGURE 11 LOGIC CHIPS SEGMENT TO DOMINATE EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2032

- FIGURE 12 ASIA PACIFIC TO CAPTURE LARGEST SHARE OF EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET IN 2032

- FIGURE 13 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 IMPACT ANALYSIS: DRIVERS

- FIGURE 15 IMPACT ANALYSIS: RESTRAINTS

- FIGURE 16 IMPACT ANALYSIS: OPPORTUNITIES

- FIGURE 17 IMPACT ANALYSIS: CHALLENGES

- FIGURE 18 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 19 EUV LITHOGRAPHY VALUE CHAIN ANALYSIS

- FIGURE 20 EUV LITHOGRAPHY ECOSYSTEM ANALYSIS

- FIGURE 21 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM TYPES OFFERED BY KEY PLAYERS, 2021-2025

- FIGURE 22 AVERAGE SELLING PRICE TREND OF EUV LITHOGRAPHY SYSTEM, BY REGION, 2021-2025

- FIGURE 23 IMPORT SCENARIO FOR HS CODE 8442-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 24 EXPORT SCENARIO FOR HS CODE 8442-COMPLIANT PRODUCTS IN TOP 5 COUNTRIES, 2020-2024

- FIGURE 25 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2020-2025

- FIGURE 27 PATENTS APPLIED AND GRANTED, 2015-2024

- FIGURE 28 DECISION-MAKING FACTORS IN EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END USERS

- FIGURE 30 KEY BUYING CRITERIA FOR END USERS

- FIGURE 31 ADOPTION BARRIERS AND INTERNAL CHALLENGES

- FIGURE 32 LIGHT SOURCES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 33 0.55 NA EUV SYSTEMS (EXE) TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 34 FOUNDRIES TO ACCOUNT FOR LARGER MARKET SHARE IN 2026

- FIGURE 35 MEMORY CHIPS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 36 ASIA PACIFIC TO DOMINATE EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET THROUGHOUT FORECAST PERIOD

- FIGURE 37 AMERICAS: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SNAPSHOT

- FIGURE 38 EMEA: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SNAPSHOT

- FIGURE 39 ASIA PACIFIC: EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SNAPSHOT

- FIGURE 40 REVENUE ANALYSIS OF KEY PLAYERS, 2021-2025

- FIGURE 41 MARKET SHARE ANALYSIS OF COMPANIES OFFERING EUV LITHOGRAPHY SOLUTIONS, 2025

- FIGURE 42 COMPANY VALUATION, 2025

- FIGURE 43 FINANCIAL METRICS, 2025

- FIGURE 44 PRODUCT COMPARISON

- FIGURE 45 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2025

- FIGURE 46 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: COMPANY FOOTPRINT, 2025

- FIGURE 47 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2025

- FIGURE 48 ASML: COMPANY SNAPSHOT

- FIGURE 49 TRUMPF: COMPANY SNAPSHOT

- FIGURE 50 USHIO INC.: COMPANY SNAPSHOT

- FIGURE 51 ZEISS GROUP: COMPANY SNAPSHOT

- FIGURE 52 RIGAKU HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 53 AGC INC.: COMPANY SNAPSHOT

- FIGURE 54 TEKSCEND PHOTOMASK: COMPANY SNAPSHOT

- FIGURE 55 LASERTEC CORPORATION: COMPANY SNAPSHOT

- FIGURE 56 HOYA CORPORATION: COMPANY SNAPSHOT

- FIGURE 57 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH DESIGN

- FIGURE 58 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH APPROACH

- FIGURE 59 DATA CAPTURED FROM SECONDARY SOURCES

- FIGURE 60 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 61 DATA CAPTURED FROM PRIMARY SOURCES

- FIGURE 62 CORE FINDINGS FROM INDUSTRY EXPERTS

- FIGURE 63 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH FLOW

- FIGURE 64 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: BOTTOM-UP APPROACH

- FIGURE 65 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: TOP-DOWN APPROACH

- FIGURE 66 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET SIZE ESTIMATION METHODOLOGY (SUPPLY SIDE)

- FIGURE 67 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: DATA TRIANGULATION

- FIGURE 68 EXTREME ULTRAVIOLET (EUV) LITHOGRAPHY MARKET: RESEARCH ASSUMPTIONS