|

市场调查报告书

商品编码

1431042

世界半导体装置:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Global Semiconductor Device - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

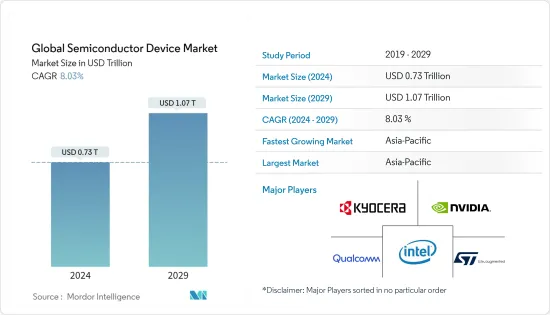

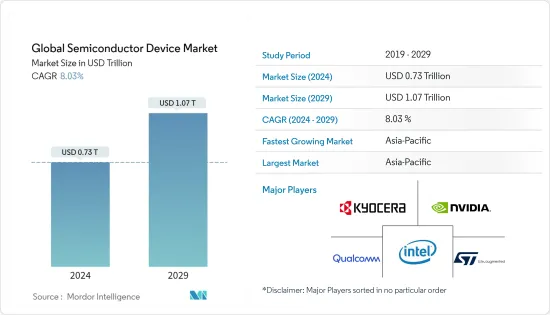

预计2024年全球半导体装置市场规模将达7,300亿美元,预计2029年将达到1.07兆美元,在预测期内(2024-2029年)复合年增长率为8.03%。

半导体产业正在经历快速成长,半导体已成为所有现代技术的基本组成部分。该领域的进步和创新对所有下游技术产生直接影响。

主要亮点

- 半导体产业预计将应对人工智慧(AI)、自动驾驶、物联网和5G等新兴技术对半导体材料日益增长的需求,以及主要企业之间的竞争和持续的研发支出。预计在预测期内将继续强劲增长。

- 这项研究涵盖了供应商提供的各种半导体以及使用它们的行业。最终用户行业的估计是基于半导体在该行业中服务的应用类型。

- 2020 年初,COVID-19 在全球范围内的爆发严重扰乱了研究市场的供应链和生产。对于电路和晶片製造商来说,影响更为严重。由于人手不足,亚太地区许多包装和检验工厂已经减少或关闭营运。这也造成了依赖半导体的最终产品公司瓶颈。

- 不过,根据半导体产业协会的数据,半导体产业自2020年第一季开始开始復苏。儘管面临与冠状病毒相关的物流挑战,位于亚太地区的半导体工厂仍继续以高产能正常运作。此外,2020年2月韩国等国家的晶片出口成长了9.4%,大多数半导体业务持续不间断。 COVID-19 大流行增加了消费性电子和汽车行业的半导体需求,这主要是由于大流行后电动车的采用增加。

半导体装置市场趋势

积体电路占据很大份额

- 智慧型手机、功能手机和平板电脑设备的普及正在推动市场发展。类比IC具有广泛的应用,包括第三代和第四代 (3G/4G) 无线基地台和行动装置电池。 RFIC(射频 IC)是一种类比电路,通常工作在 3kHz 至 2.4GHz(3,000 赫兹至 24 亿赫兹)以及大约 1 THz(1 兆赫兹)频宽。广泛应用于行动电话和无线设备。由于持续发展,该领域的类比IC市场预计将成长。

- 在整个IC市场中,逻辑IC是广泛采用的组件,预计在预测期内将显着成长。逻辑晶片广泛应用于几乎所有数位产品,从智慧型手机到算术逻辑单元(ALU)。近年来,汽车和智慧型手机产业的成长主要推动了逻辑半导体元件的成长。然而,由于 HPC 和 AI 等应用的成长,逻辑组件的范围目前正在扩大。

- 市面上有不同类型的记忆体,包括 DRAM、SRAM、Nor Flash、NAND Flash、ROM 和 EPROM。半导体记忆体的应用包括电脑记忆体(个人电脑、笔记型电脑)、消费性设备(相机、行动电话)、商业 IT 应用(电信、资料中心)、传统工业应用以及新兴的物频谱应用。发现电子资料储存设备。汽车电子中越来越多地采用记忆体IC以及电子设备中记忆体记忆体晶片的不断扩大使用是推动DRAM产品需求的主要因素。

- 对资料中心的需求增加也推高了对记忆体组件的需求。目前,北美地区的大型资料中心计划正在推动对DRAM等记忆体的强劲需求。然而,根据衡量每个用户资料中心空间的指标,中国网路资料中心的规模预计将成长至少美国的22倍,至少是日本目前规模的10倍。因此,DRAM拥有巨大的成长机会,正在影响半导体产业。

汽车产业占较大市场占有率份额

- 半导体晶片已成为现代汽车的重要组成部分,因为它们广泛用于汽车的各种功能。汽车中使用的晶片可以采取型态,从包含单一电晶体的单一组件到控制复杂系统的复杂积体电路。例如,晶片安装在汽车的 LED 灯元件中。 LED灯单元中的每个二极体都是一个发光的晶片。现代汽车中仅 LED 车头灯就使用了大量晶片。车头灯还需要一个控制单元才能发挥作用。

- 车辆安全性的提高以及对 ADAS(高级驾驶辅助系统)需求的不断增长正在加速对半导体的需求。倒车相机、主动式车距维持定速系统、盲点侦测、变换车道辅助、安全气囊部署和紧急煞车系统等智慧功能均由半导体技术实现。此外,ADAS 还包括用于基于视觉的功能的图像和摄影机感测器、用于停车辅助等短距离功能的超音波感测器,以及用于在黑暗或雾中检测物体的雷达和雷射雷达感测器,涵盖了广泛的感应器.

- 先进半导体解决方案供应商瑞萨电子于2022年3月宣布,将扩大与本田在ADAS领域的合作。迄今为止,本田在Legend搭载的「Honda SENSING Elite」中采用了瑞萨电子的汽车SoC(系统单晶片)「R-Car」和汽车MCU「RH850」。作为扩大合作伙伴关係的一部分,本田将在其全方位安全驾驶支援系统「Honda SENSING 360」中使用 R-Car 和 RH850。

- 电动车需求的成长预计将为所研究的市场带来新的成长机会。电动车中使用的电子设备和感测器数量不断增加,推动了对半导体晶片的需求。例如,根据国际能源总署 (IEA) 的数据,全球使用的纯电动车 (BEV) 数量将从 2016 年的 120 万辆增加到 2021 年的 1,130 万辆。

- 此外,中国将在2021年成为电动车的主要生产国(资料来源:IEA)。欧洲地区的销量在2020年的繁荣之后也继续呈现强劲增长(增长65%至230万辆),美国的销量在经历了两年的下滑后也出现了增长。在预测期内,汽车产业预计将对所研究市场的成长产生重大影响,因为电动车销量预计将遵循类似的成长模式。

半导体装置产业概况

由于整合度的提高、技术进步和地缘政治局势,全球半导体装置市场正在波动。此外,只有在创新具有显着的永续竞争优势的市场中,竞争才会加剧。在此背景下,考虑到最终用户对半导体製造公司品质的期望的重要性,品牌形象发挥着重要作用。由于市场上现有巨头如英特尔公司、英伟达公司、京瓷公司、高通技术公司和意法半导体公司的存在,市场渗透率也很高。

创新水平、上市时间和性能是参与者在市场上脱颖而出的关键条件。整体而言,在预测期内,竞争公司之间的敌对行动正在缓慢成长。

- 2022 年 7 月 爱立信、高通科技公司和法国航太公司泰雷兹计画将 5G 引入地球轨道卫星网路。在进行了包括多项研究和模拟在内的详细研究后,该公司将开始测试和检验5G 非地面网路 (5G NTN),并专注于智慧型手机用例。

- 2022 年 3 月,英特尔宣布第一阶段计划,未来 10 年在欧盟投资约 800 亿欧元,涵盖整个半导体价值链,包括研发 (R&D)、製造和封装技术。这项投资将包括约170亿欧元,用于在德国建立大型半导体晶圆厂,在法国开发新的研发和设计设施,以及在义大利、爱尔兰、波兰和西班牙提供研发、製造和代工服务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 科技趋势

- 产业价值链分析

- 评估 COVID-19 对产业的影响

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

第五章市场动态

- 市场驱动因素

- 扩大物联网和人工智慧等技术的采用

- 5G的普及和5G智慧型手机需求的增加

- 市场挑战

- 供应链中断导致半导体晶片短缺

第六章市场区隔

- 依设备类型

- 离散半导体

- 光电子学

- 感应器

- 积体电路

- 模拟

- 逻辑

- 记忆

- 微

- 微处理器 (MPU)

- 微控制器(MCU)

- 数位讯号处理器

- 按行业分类

- 汽车

- 通讯(有线和无线)

- 消费者

- 工业的

- 计算/资料存储

- 按地区

- 美国

- 欧洲

- 日本

- 中国

- 韩国

- 台湾

- 世界其他地区

第七章 半导体代工现状

- 按铸造厂分類的铸造业务销售额和市场占有率

- 半导体销售 - IDM 与无晶圆厂

- 截至 2021 年 12 月年底,基于晶圆厂地点的晶圆产能

- 前五名半导体公司晶圆产能及依节点技术分類的晶圆产能趋势

第八章 竞争形势

- 公司简介

- Intel Corporation

- Nvidia Corporation

- Kyocera Corporation

- Qualcomm Incorporated

- STMicroelectronics NV

- Micron Technology Inc.

- Xilinx Inc.

- NXP Semiconductors NV

- Toshiba Corporation

- Texas Instruments Inc.

- Taiwan Semiconductor Manufacturing Company(TSMC)Limited

- SK Hynix Inc.

- Samsung Electronics Co. Ltd

- Fujitsu Semiconductor Ltd

- Rohm Co. Ltd

- Infineon Technologies AG

- Renesas Electronics Corporation

- Advanced Semiconductor Engineering Inc.

- Broadcom Inc.

- ON Semiconductor Corporation

第九章 市场未来展望

The Global Semiconductor Device Market size is estimated at USD 0.73 trillion in 2024, and is expected to reach USD 1.07 trillion by 2029, growing at a CAGR of 8.03% during the forecast period (2024-2029).

The semiconductor industry is witnessing rapid growth, with semiconductors emerging as the basic building blocks of all modern technology. The advancements and innovations in this field are resulting in a direct impact on all downstream technologies.

Key Highlights

- The semiconductor industry is estimated to continue its robust growth during the forecast period to accommodate the increasing demand for semiconductor materials in emerging technologies, such as artificial intelligence (AI), autonomous driving, Internet of Things, and 5G, coupled with competition among key players and consistent spending on R&D.

- The study covers various semiconductors offered by the vendors and the industries utilizing them. The estimates for the end-user industries are derived based on the type of application the semiconductors provide in that industry.

- The outbreak of COVID-19 across the globe has significantly disrupted the supply chain and production of the studied market in the initial phase of 2020. For circuit and chipmakers, the impact was more severe. Due to labor shortages, many of the package and testing plants in the Asia-Pacific region reduced or even suspended operations. This also created a bottleneck for end-product companies that depend on semiconductors.

- However, according to the Semiconductor Industry Association, after Q1 of 2020, the semiconductor industry started the recovery. Despite logistical challenges related to the coronavirus, semiconductor facilities located in Asia-Pacific continued to function normally with high-capacity rates. Moreover, in various countries, such as South Korea, most semiconductor operations continued uninterrupted, and chip exports grew by 9.4% in February 2020. The COVID-19 pandemic has increased the demand for semiconductors across the consumer electronics and automotive sectors, mainly due to the growing adoption of EVs post-pandemic.

Semiconductor Device Market Trends

Integrated Circuit to Hold Significant Share

- The rising proliferation of smartphones, feature phones, and tablets is driving the market. Analog ICs are used in a wide range of applications, including third and fourth-generation (3G/4G) radio base stations and portable device batteries. RFICs (radio frequency ICs) are analog circuits that usually run in the frequency range of 3 kHz to 2.4 GHz (3,000 hertz to 2.4 billion hertz) circuits that would work at about 1 THz (1 trillion hertz). They are widely used in cell phones and wireless devices. As they are under development, the analog IC market in this segment is expected to grow.

- In the overall IC market, logic ICs are the widely adopted component and are expected to witness significant growth over the forecast period. Logic chips have a wide range of applications in almost every digital product ranging from smartphones to arithmetic-logic units (ALU). In recent years, the growth in the automotive and smartphone industry has mainly driven the growth of the logic semiconductor component. However, the growth in applications like HPC and AI is now expanding the scope of logic components.

- The market has different types of memory, such as DRAM, SRAM, Nor Flash, NAND Flash, ROM, and EPROM, among others. Semiconductor memory refers to various electronic data storage devices that find applications as computer memory in computers (PCs, laptops), consumer devices (cameras, phones), commercial IT applications (telecom, datacenters), traditional industrial applications, and the emerging spectrum of IoT applications. The increasing adoption of memory ICs in automobile electronics and the growing application of memory storage chips in electronic devices are the major factors driving the demand for DRAM products.

- The increasing demand for data centers is also boosting the demand for memory components. Currently, large data center projects in North America have contributed to the strong demand for memory, such as DRAM. However, according to the measure of data center space per user, China's internet data centers are poised to grow to at least 22 times that of the United States, or at least ten times the current space of Japan. Hence, DRAM has a significant opportunity for growth and thus is impacting the semiconductor industry.

Automotive Sector to hold a Significant Market Share

- Semiconductor chips have become an integral part of modern-day vehicles, owing to their widespread use in various functions of vehicles. Chips used in cars can take many forms ranging from single components containing a single transistor to intricate integrated circuits controlling a complex system. For instance, chips are found in the LED light elements of vehicles. Every single diode inside an LED light unit is a chip that emits light. LED headlights alone account for a vast number of chips in modern-day cars. The headlights also need control units to make them function.

- The growing need for better safety and advanced driver assistance systems (ADAS) in cars has accelerated the demand for semiconductors. Intelligent functions, like backup cameras, adaptive cruise control, blind-spot detection, lane change assist, airbag deployment, and emergency braking systems, are made possible through semiconductor technologies. Further, ADAS covers a broad array of sensors, including image and camera sensors for vision-based features, ultrasonic sensors for short-range features like parking assist, and radar and lidar sensors for object detection under dark or foggy conditions.

- In March 2022, Renesas Electronics Corporation, a supplier of advanced semiconductor solutions, announced the expansion of its collaboration with Honda in the field of ADAS. Previously, Honda adopted Renesas' R-Car automotive system on a chip (SoC) and RH850 automotive MCU for its Honda SENSING Elite system featured in the Legend. With the expansion of the partnership, Honda will use R-Car and RH850 in the Honda SENSING 360 omnidirectional safety and driver assistance system.

- The increasing demand for electric vehicles is expected to open new growth opportunities for the studied market. An increased number of electronic devices and sensors are used in electric vehicles, driving the demand for semiconductor chips. For instance, according to the International Energy Agency (IEA), the number of battery electric vehicles (BEV) in use has increased from 1.2 million in 2016 to 11.3 million in 2021 globally.

- Furthermore, China was the leading producer of electric vehicles in 2021 (Source: IEA). Sales in the European region also showed continued robust growth (up 65% to 2.3 million) after the 2020 boom, which also increased in the United States after two years of decline. With EV sales expected to follow a similar growth pattern, the automotive industry is expected to significantly impact the growth of the studied market during the forecast period.

Semiconductor Device Industry Overview

The Global Semiconductor Device Market is witnessing fluctuation with growing consolidation, technological advancement, and geopolitical scenarios. Further, in a market where the sustainable competitive advantage through innovation is considerably high, the competition will only increase. In such a situation, the brand identity plays a major role, considering the importance of quality that the end-users expect from a semiconductor manufacturing player. With the presence of large market incumbents, such as Intel Corporation, Nvidia Corporation, Kyocera Corporation, Qualcomm Technologies Inc., and STMicroelectronics NV, the market penetration levels are also high.

The level of innovation, time-to-market, and performance are the key terms by which the players differentiate themselves in the market. Overall, the intensity of competitive rivalry is moderately growing over the forecast period.

- July 2022 - Ericsson, Qualcomm Technologies Inc., and French aerospace company Thales are planning to take 5G out of this world and across a network of Earth-orbiting satellites. After having conducted detailed research, which includes multiple studies and simulations, the parties plan to enter smartphone-use-case-focused testing and validation of 5G non-terrestrial networks (5G NTN).

- March 2022 - Intel issued the first phase of its investment plans of approximately EUR 80 billion in the European Union over the next decade across the entire semiconductor value chain, including research and development (R&D), manufacturing, and packaging technologies. In this investment, the company plans to invest approximately EUR 17 billion in establishing a semiconductor fab mega-site in Germany, along with the development of a new R&D and design facility in France, and to invest in R&D, manufacturing, and foundry services in Italy, Ireland, Poland, and Spain.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID-19 on the Industry

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Technologies like IoT and AI

- 5.1.2 Increased Deployment of 5G and Rising Demand for 5G Smartphones

- 5.2 Market Challenges

- 5.2.1 Supply Chain Disruptions Resulting in Semiconductor Chip Shortage

6 MARKET SEGMENTATION

- 6.1 By Device Type

- 6.1.1 Discrete Semiconductors

- 6.1.2 Optoelectronics

- 6.1.3 Sensors

- 6.1.4 Integrated Circuits

- 6.1.4.1 Analog

- 6.1.4.2 Logic

- 6.1.4.3 Memory

- 6.1.4.4 Micro

- 6.1.4.4.1 Microprocessors (MPU)

- 6.1.4.4.2 Microcontrollers (MCU)

- 6.1.4.4.3 Digital Signal Processors

- 6.2 By End-user Vertical

- 6.2.1 Automotive

- 6.2.2 Communication (Wired and Wireless)

- 6.2.3 Consumer

- 6.2.4 Industrial

- 6.2.5 Computing/Data Storage

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 Europe

- 6.3.3 Japan

- 6.3.4 China

- 6.3.5 Korea

- 6.3.6 Taiwan

- 6.3.7 Rest of the World

7 SEMICONDUCTOR FOUNDRY LANDSCAPE

- 7.1 Foundry Business Revenue and Market Shares by Foundries

- 7.2 Semiconductor Sales - IDM vs Fabless

- 7.3 Wafer Capacity by end of December 2021 based on Fab Location

- 7.4 Wafer Capacity by the Top Five Semiconductor Companies and an Indication Of Wafer Capacity By Node Technology

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Intel Corporation

- 8.1.2 Nvidia Corporation

- 8.1.3 Kyocera Corporation

- 8.1.4 Qualcomm Incorporated

- 8.1.5 STMicroelectronics NV

- 8.1.6 Micron Technology Inc.

- 8.1.7 Xilinx Inc.

- 8.1.8 NXP Semiconductors NV

- 8.1.9 Toshiba Corporation

- 8.1.10 Texas Instruments Inc.

- 8.1.11 Taiwan Semiconductor Manufacturing Company (TSMC) Limited

- 8.1.12 SK Hynix Inc.

- 8.1.13 Samsung Electronics Co. Ltd

- 8.1.14 Fujitsu Semiconductor Ltd

- 8.1.15 Rohm Co. Ltd

- 8.1.16 Infineon Technologies AG

- 8.1.17 Renesas Electronics Corporation

- 8.1.18 Advanced Semiconductor Engineering Inc.

- 8.1.19 Broadcom Inc.

- 8.1.20 ON Semiconductor Corporation