|

市场调查报告书

商品编码

1413689

全球电子材料气体(含氖、氙)市场分析(2023-2024年)Electronic Gases including Ne & Xe Market Report (a Critical Materials Report) 2023-2024 |

||||||

本报告分析了用于半导体装置製造的电子材料气体的全球市场及其供应链。由于产业低迷,天然气公司面临的挑战之一是大型设备投资的时机和获利能力,例如空气分离装置(ASU)和半导体铸造厂。同时,中国市场上不断出现新的供应商来支持政府支持的 "中国製造" 计画。随着这些供应商能力的增强,他们的影响力可能会在未来三年或更长时间内极大地影响天然气供应链。

有关电子材料气体市场最新资讯和报告亮点的专题新闻稿:

目录

第一章执行摘要

第二章 研究范围、目的与研究方法

第三章 半导体产业市场现况与展望

- 世界经济

- 连结半导体产业与全球经济

- 半导体销售额成长率

- 台湾月度销售趋势

- 2023年高度不确定性-半导体收入成长预计将放缓至负值

- 晶片销售趋势:按电子设备细分市场

- 手机

- PC 出货量

- 伺服器/IT市场

- 半导体製造业的成长与扩张

- 铸造厂扩建公告:概述

- 透过在世界各地扩大铸造厂来加速成长

- 资本支出趋势

- 技术路线图

- 代工投资评估

- 政策和贸易趋势及影响

- 半导体材料概述

- 晶片生产进度可能受到材料产能限制

- 缓解物流问题

- TECHCET:晶圆市场趋势预测(至2027年)

- TECHCET:材料市场预测

第四章 电子材料气体市场趋势

- 推动电子材料气体业务的市场趋势

- 供给能力、需求和投资

- WF6 的需求驱动因素

- WF6的市场需求

- WF6市场需求:MO ALD IP应用

- WF6的市场需求

- 技术驱动/材料变化与转变

- 过去10年整体趋势:从PVD/LPCVD到PECVD/ALD

- 市场趋势:按设备类型/节点 - 高级设备

- 市场趋势:高阶逻辑

- 市场趋势:引入晶圆数量(DRAM)

- 市场趋势:引入晶圆数量(NAND)

- 气相沉积製程:按设备类型/材料划分 - 概述

- 蚀刻製程:依设备类型 - 电子层蚀刻 (ALE)

- 科技趋势与机会:概述

- 按地区划分的趋势

- 区域趋势:林德

- 地区趋势:液化空气集团

- 地区趋势:空气产品公司

- 各地区趋势:太阳日本佐野

- 按地区划分的趋势:韩国

- 地区趋势:日本

- 按地区划分的趋势:日本/韩国

- 地区趋势:中国

- 地区趋势:俄罗斯

- 地区趋势:美国

- 关于规格和纯度的一般评论

- 电子材料气体供应链风险因素

- 地缘政治风险

- 俄罗斯风险

- 供应链风险:原物料价格

- 后勤

- 市场趋势评估

第五章 EHS(环境、健康与安全)与永续发展议题

- EHS 和物流问题 - 半导体製造产生的温室气体

- EHS 和物流问题

- EHS 和物流问题 - 半导体製造产生的温室气体

- EHS 和物流问题 - 空气中的温室气体(氖气)

- 空分单位能源消耗 - 温室气体排放

- 空分单位能源消耗 - 温室气体排放

- 霓虹灯供应从乌克兰转向中国造成的碳排放

- 氖气生产产生的碳足迹

- ISO 气体容器中氖气运输的碳足迹

- 计算运输草案:中国 vs 乌克兰

- 永续半导体製程和製造技术

- 氦气:永续生产 - 绿色氦气

- 氦气:永续生产 - 绿色氦气

- NF3替代品:F2气体

- 氟气法规

- Linde含氟气体安装

- 考虑环境监管风险的公约和协议

第六章 电子材料气体市场统计及预测

- 电子材料气体市场-实际结果与预测(5年)

- 工业气体市场

- 电子材料气体市场

- 供应商名单/财务资讯/简介

- 特种气体市场的驱动因素

- 特种气体市场:需求、供给、市占率(5年)

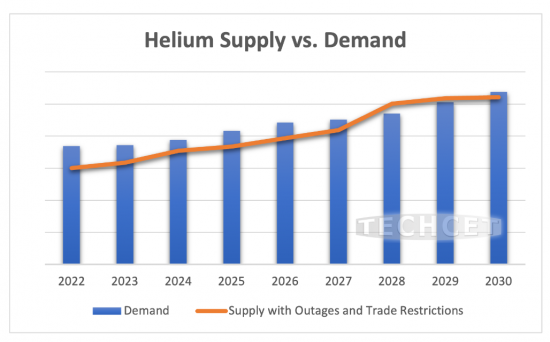

- 氦气 (He):5 年的供需

- 氖气(Ne)5年供需状况

- 氖

- 氙气(XE)5年供需状况

- 三氟化氮(NF3)5年供需状况

- 六氟化钨(WF6)五年供需状况

- 併购 (M&A) 活动

- 新工厂

- 新工厂:LINDE扩建(2023年)

- 新工厂:AIR LIQUIDE扩建(2022/2023)

- NIHON SUO HOLDING CO., LTD.:扩大乙硼烷产能

- 供应商工厂关闭

- 新进入者:K MATERIALS 和 SHOWA DENKO 寻求联合进入美国半导体气体市场

- 新加入者:RESONAC

- 新加入者:NEON(中国)

- 价格趋势

- 供气评估

第七章 下层材料供应链

- 销售渠道

- 物流要求

- 次级供应链:钨的颠覆

- 供应链下游:併购活动

- 下游供应链:EHS 与物流问题

- 下游供应链:价格趋势

- 下游供应链:TECHCET 分析师评估

第八章 供应商简介

- ADEKA CORPORATION

- AIR LIQUIDE

- AZMAX CO., LTD

- DNF CO., LTD

- ENTEGRIS

- 其他20多家企业

第9章附录

This report covers the electronic gas materials market and supply-chain for these materials used in semiconductor device fabrication. One of the challenges that the gas companies encounter is profitability due to the timing of investments and industry downturns for large installations like Air Separation Units (ASUs) and Semiconductor fabs. In the meantime, new suppliers are emerging in the China market to support the "Made in China" program backed by the government. When these suppliers gain in capability and capacity, their influence could dramatically impact the gas supply chain in the next 3+ years.

This report comes with 3 Quarterly Updates featuring updated market information and forecasting from the report analyst.

TABLE OF CONTENTS

1. EXECUTIVE SUMMARY

- 1.1. ELECTRONIC GAS MARKET-HISTORICAL AND 5-YEAR FORECAST

- 1.2. MARKET DRIVERS FOR THE SPECIALTY GAS MARKET

- 1.2.1. SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND

- 1.3. MARKET TRENDS

- 1.4. TECHNOLOGY TRENDS-DEVICE ROADMAP

- 1.4.1. TECHNOLOGY TRENDS-DEVICE SEGMENT OPPORTUNITIES

- 1.5. COMPETITIVE LANDSCAPE-ELECTRONIC GAS MARKET SHARE

- 1.6. SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 1.7. EHS AND LOGISTIC ISSUES-GREEN HOUSE GASES FROM LOGIC PRODUCTION

- 1.8. MARKET ASSESSMENT SUMMARY

2. SCOPE, PURPOSE AND METHODOLOGY

- 2.1. SCOPE

- 2.2. PURPOSE

- 2.3. METHODOLOGY

- 2.4. OVERVIEW OF OTHER TECHCET CMR™ REPORTS

3. SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1. WORLDWIDE ECONOMY

- 3.1.1. SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2. SEMICONDUCTOR SALES GROWTH

- 3.1.3. TAIWAN MONTHLY SALES TRENDS

- 3.1.4. UNCERTAINTY ABOUNDS ESPECIALLY FOR 2023-SLOWER TO NEGATIVE SEMICONDUCTOR REVENUE GROWTH EXPECTED

- 3.2. CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1. SMARTPHONES

- 3.2.2. PC UNIT SHIPMENTS

- 3.2.3. SERVERS / IT MARKET

- 3.3. SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1. FAB EXPANSION ANNOUNCEMENT SUMMARY

- 3.3.2. WW FAB EXPANSION DRIVING GROWTH

- 3.3.3. EQUIPMENT SPENDING TRENDS

- 3.3.4. TECHNOLOGY ROADMAPS

- 3.3.5. FAB INVESTMENT ASSESSMENT

- 3.4. POLICY & TRADE TRENDS AND IMPACT

- 3.5. SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1. COULD MATERIALS CAPACITY LIMIT CHIP PRODUCTION SCHEDULES?

- 3.5.2. LOGISTICS ISSUES EASED DOWN

- 3.5.3. TECHCET WAFER STARTS FORECAST THROUGH 2027

- 3.5.4. TECHCET'S MATERIAL FORECAST

4. ELECTRONIC GASES MARKET TRENDS

- 4.1. MARKET TRENDS DRIVING THE ELECTRONIC GAS BUSINESS

- 4.2. SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.1. WF6 DEMAND DRIVERS

- 4.2.2. WF6 MARKET DEMAND

- 4.2.3. WF6 MARKET DEMAND-MO ALD IP FILING

- 4.2.4. WF6 MARKET DEMAND

- 4.3. TECHNICAL DRIVERS / MATERIAL CHANGES AND TRANSITIONS

- 4.3.1. GENERAL TREND LAST DECADE GOING FROM PVD & LPCVD TO PECVD

- 4.3.2. MARKET TRENDS BY DEVICE TYPE AND NODE-ADVANCED DEVICES

- 4.3.3. MARKET TRENDS-ADVANCED LOGIC

- 4.3.4. MARKET TRENDS-WAFER STARTS DRAM

- 4.3.5. MARKET TRENDS-WAFER STARTS NAND

- 4.3.6. DEPOSITION PROCESS BY DEVICE TYPE AND MATERIAL-AN OVERVIEW

- 4.3.7. ETCH PROCESS BY DEVICE TYPE-ATOMIC LAYER ETCHING ALE

- 4.3.8. SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES

- 4.4. REGIONAL TRENDS

- 4.4.1. REGIONAL TRENDS-LINDE

- 4.4.2. REGIONAL TRENDS-AIR LIQUIDE

- 4.4.3. REGIONAL TRENDS-AIR PRODUCTS

- 4.4.5. REGIONAL TRENDS-TAIYO NIPPON SANO

- 4.4.6. REGIONAL TRENDS-KOREA

- 4.4.7. REGIONAL TRENDS-JAPAN

- 4.4.8. REGIONAL TRENDS-JAPAN & KOREA

- 4.3.15. REGIONAL TRENDS-CHINA

- 4.4.9. REGIONAL TRENDS-RUSSIA

- 4.4.10. REGIONAL TRENDS-USA

- 4.5. GENERAL COMMENTS ON SPECIFICATIONS AND PURITY

- 4.6. ELECTRONIC GAS SUPPLY CHAIN RISK FACTORS

- 4.6.1. GEOPOLITICAL RISKS

- 4.6.2. RUSSIA RISKS

- 4.6.3. SUPPLY CHAIN RISKS-RAW MATERIAL PRICING

- 4.6.4. LOGISTICS

- 4.7. MARKET TRENDS ASSESSMENT

5. EHS AND SUSTAINABILITY ISSUES

- 5.1. EHS AND LOGISTIC ISSUES-GREEN HOUSE GASES FROM SEMICONDUCTOR PRODUCTION

- 5.2. EHS AND LOGISTICS ISSUES

- 5.3. EHS AND LOGISTIC ISSUE-GREEN HOUSE GASES FROM SEMICONDUCTOR PRODUCTION

- 5.4. EHS AND LOGISTIC ISSUES-GREEN HOUSE GASES FROM AIR GASES (NEON)

- 5.4.1. ASU ENERGY CONSUMPTION-GHG EMISSIONS

- 5.4.2. ASU ENERGY CONSUMPTION-GHG EMISSIONS

- 5.4.3. CARBON FOOTPRINT OF SHIFTING NEON SUPPLY FROM UKRAINE TO CHINA

- 5.4.4. CARBON FOOTPRINT OF NEON PRODUCTION

- 5.4.5. CARBON FOOTPRINT OF NEON SHIPPING IN GAS ISO CONTAINER

- 5.4.6. DRAFT CALCULATION TRANSPORT: CHINA VS UKRAINE

- 5.5. SUSTAINABLE SEMICONDUCTOR PROCESSES AND MANUFACTURING TECHNOLOGIES

- 5.6. HELIUM-SUSTAINABLE PRODUCTION-GREEN HELIUM

- 5.7. HELIUM-SUSTAINABLE PRODUCTION-GREEN HELIUM

- 5.8. NF3 REPLACEMENT: F2 GAS

- 5.8.1. FLUORINATED GAS REGULATIONS

- 5.8.3. LINDE F-GAS INSTALLATION

- 5.8.4. ENVIRONMENT REGULATION RISK-IMPLEMENTED TREATIES AND PROTOCOLS

6. ELECTRONIC GASES MARKET STATISTICS & FORECASTS

- 6.1. ELECTRONIC GAS MARKET-HISTORICAL AND 5-YEAR FORECAST

- 6.1.1. INDUSTRIAL GAS MARKET

- 6.1.2. ELECTRONIC GAS MA

- 6.1.3. SUPPLIER LIST, FINANCIALS AND PROFILES

- 6.1.4. MARKET DRIVERS FOR THE SPECIALTY GAS MARKET

- 6.2. SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND RKET SHARE

- 6.2.1. HE 5-YEAR SUPPLY & DEMAND

- 6.2.2. NE 5-YEAR SUPPLY & DEMAND

- 6.2.3. NEON

- 6.2.4. XE 5-YEAR SUPPLY & DEMAND

- 6.2.5. NF3 5-YEAR SUPPLY & DEMAND

- 6.2.6. TUNGSTEN HEXAFLUORIDE 5-YEAR SUPPLY & DEMAND

- 6.3. M&A ACTIVITIES

- 6.4. NEW PLANTS

- 6.4.1. NEW PLANTS, LINDE EXPANSIONS 2023

- 6.4.2. NEW PLANTS, AIR LIQUIDE EXPANSIONS 2022/2023

- 6.4.3. NIHON SUO HOLDING CO., LTD. TO INCREASE DIBORANE CAPACITY

- 6.5. SUPPLIER PLANT CLOSURES

- 6.5.1. NEW ENTRANTS-SK MATERIALS, SHOWA DENKO SEEK JOINT ENTRY INTO US SEMICONDUCTOR GAS MARKET

- 6.5.2. NEW ENTRANTS-RESONAC

- 6.5.3. NEW ENTRANTS-NEON, CHINA

- 6.6. PRICING TRENDS

- 6.7. GAS SUPPLY ASSESSMENT

7. SUB TIER MATERIAL SUPPLY CHAIN

- 7.1. SALES CHANNELS

- 7.2. LOGISTICS REQUIREMENTS

- 7.2.1. SUB-TIER SUPPLY-CHAIN: TUNGSTEN DISRUPTIONS

- 7.3. SUB-TIER SUPPLY-CHAIN M&A ACTIVITY

- 7.4. SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 7.5. SUB-TIER SUPPLY-CHAIN PRICING TRENDS

- 7.6. SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

8. SUPPLIER PROFILES

- ADEKA CORPORATION

- AIR LIQUIDE

- AZMAX CO., LTD

- DNF CO., LTD

- ENTEGRIS

- ...and 20+ more

9. APPENDIX

- 9.1. GASES USED BY MULTIPLE INDUSTRIES

- 9.1.1. SPECIALTY GAS INDUSTRY MATRIX

- 9.1.2. GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING

- 9.1.3. GASES USED IN THE DISPLAY INDUSTRY

- 9.2. SUPPLIER LISTING BY GAS TYPE

- 9.2.1. HYDRIDES

- 9.2.2. SILICON PRECURSORS (SILANES)

- 9.2.3. ETCHANTS/CHAMBER CLEAN

- 9.2.4. DEPOSITION/MISC

- 9.2.5. BULK GASES

- 9.3. ETCH GAS ROADMAPS

- 9.3.1. ETCH ROADMAPS 1 OF 3

- 9.3.2. ETCH ROADMAPS 2 OF 3

- 9.3.3. ETCH ROADMAPS 3 OF 3

LIST OF FIGURES

- FIGURE 1: ELECTRONIC GAS MARKET

- FIGURE 2: ELECTRONIC GAS MARKET SEGMENTATION

- FIGURE 3: TECHCET WAFER START FORECAST BY NODE

- FIGURE 4: TECHNOLOGY ROADMAP DEVICES

- FIGURE 5: TOTAL ELECTRONIC GAS MARKET SHARE 2021, US$6,3 BILLION

- FIGURE 6: AIR GAS BOILING POINT

- FIGURE 7: COMPARISON OF CO2 EMISSIONS FROM VARIOUS TRANSPORTATION MODES

- FIGURE 8: OCEAN CONTAINER PRICE INDEX-JULY '20 TO MARCH '23

- FIGURE 9: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2022)

- FIGURE 10: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 11: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)*

- FIGURE 12: 2023 SEMICONDUCTOR INDUSTRY REVENUE GROWTH FORECASTS

- FIGURE 13: 2022 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 14: MOBILE PHONE SHIPMENTS WW ESTIMATES

- FIGURE 15: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 16: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 17: SEMICONDUCTOR AUTOMOTIVE PRODUCTION

- FIGURE 18: TSMC PHOENIX INVESTMENT ESTIMATED WILL BE US $40 B

- FIGURE 19: CHIP EXPANSIONS 2022-2027 US$366 B

- FIGURE 20: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 21: GLOBAL TOTAL EQUIPMENT SPENDING BY SEGMENT (US$ B)

- FIGURE 22: OVERVIEW OF ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP

- FIGURE 23: INTEL OHIO PLANT SITE FEB. 2023 AND ARTIST RENDERING (ON BOTTOM)

- FIGURE 24: EUROPE CHIP EXPANSION UPSIDE

- FIGURE 25: PORT OF LA

- FIGURE 26: TECHCET WAFER START FORECAST BY NODE SEGMENTS**

- FIGURE 27: GLOBAL SEMICONDUCTOR MATERIALS OUTLOOK

- FIGURE 28: 2D PHASE OF BORON AS POSSIBLE FUTURE TRANSISTOR CHANNEL

- FIGURE 29: 3DNAND MARKET SHARE 2022

- FIGURE 30: 3DNAND STRUCTURE

- FIGURE 31: MO PRECURSORS

- FIGURE 32: PATENT FAMILIES FILED FOR MOLYBDENUM ALD IN THE MEMORY SPACE

- FIGURE 33: WAFER START FORECAST SHOWING TWO TIMING SCENARIOS WHERE MO COULD BE INTRODUCED (MILLIONS OF 200 MM EQUIVALENT / YEAR)

- FIGURE 34: 3D DEVICE ARCHITECTURES

- FIGURE 35: FORECASTS--WAFER STARTS 2021 TO 2027

- FIGURE 36: FORECASTS--WAFER STARTS LOGIC 300 MM

- FIGURE 37: SAMSUNG START 3 NM PILOT RAMP USING GAA-FET TECHNOLOGY JUNE 2022

- FIGURE 38: IMEC 2022 LOGIC ROADMAP

- FIGURE 39: APPLIED MATERIALS CENTURA PATTERN SHAPING CLUSTER

- FIGURE 40: FORECASTS--WAFER STARTS DRAM 300 MM

- FIGURE 41: IP FILING IN THE FIELD OF 3DRAM IS ACCELERATING

- FIGURE 42: FORECASTS--WAFER STARTS NAND 300 MM

- FIGURE 43: PATHWAYS FOR CONTINUED 3D NAND SCALING

- FIGURE 44: 3DNAND SCALING FROM 1 STACK TO 4 STACKS

- FIGURE 45: SELECTIVE W LOWERS RESISTANCE

- FIGURE 46: FINFET/GAA TRANSITION

- FIGURE 47: SELECTIVITY IMPROVEMENT WITH ALE

- FIGURE 48: ALD AND ALE ROADMAPS OF INTEL, TSMC AND SAMSUNG

- FIGURE 49: DEP-ALE STI FILL AND RECESS ETCH

- FIGURE 50: PLASMA AND THERMAL ALE PROCESSES

- FIGURE 51: AIR LIQUIDE FINANCIALS (ANNUAL REPORT 2022 PENDING)

- FIGURE 52: KOREA 2021 NEON IMPORTS

- FIGURE 53: RESONAC BUSINESS SEGMENT REVENUE 2022

- FIGURE 54: TOTAL HELIUM PRODUCTION 160 MILLION M3

- FIGURE 55: FLUORSPAR PRICE IN US 2014-2022

- FIGURE 56: OCEAN CONTAINER PRICE INDEX-JULY '20 TO MARCH '23

- FIGURE 57: CO2 EMISSIONS CONTRIBUTIONS WITHIN A CHIP FAB

- FIGURE 58: GLOBAL WARMING IMPACT FROM VARIOUS PROCESS GASES

- FIGURE 59: TOTAL EMISSIONS AND ENERGY USE PROJECTION PER LOGIC NODE

- FIGURE 60: CO2EQ OUTPUT FROM ETCH GASES

- FIGURE 61: AIR SEPARATION UNIT FLOW CHART

- FIGURE 62: AIR GAS BOILING POINT

- FIGURE 63: CARBON GENERATION FROM AIR SEPARATION PROCESSES

- FIGURE 64: COMPARISON OF CO2 EMISSIONS FROM VARIOUS TRANSPORTATION MODES

- FIGURE 65: F2 AND NF3 ACTIVATION

- FIGURE 66: ELECTRONIC GAS MARKET

- FIGURE 67: TOTAL INDUSTRIAL GAS MARKET 2021, US$97 BILLION

- FIGURE 68: TOTAL ELECTRONIC GAS MARKET 2021, US$6,3 BILLION

- FIGURE 69: ELECTRONIC GAS MARKET SEGMENTATION

- FIGURE 70: HE WW SUPPLY AND DEMAND

- FIGURE 71: 2027 HELIUM SUPPLY

- FIGURE 72: TOTAL NEON DEMAND VS. SUPPLY

- FIGURE 73: KOREA 2021 NEON IMPORTS

- FIGURE 74: TOTAL XENON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 75: TOTAL KRYPTON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 76: NF3 SUPPLY/DEMAND

- FIGURE 77: AWF6 FORECAST

- FIGURE 78: HARDMASK SCHEMATIC

- FIGURE 79: LATEST SITUATION MAP IN UKRAINE, SHOWING TAKEN MAURIUPOL BUT ODESSA STILL FREE

- FIGURE 80: RESONAC BUSINESS SEGMENT REVENUE 2022

- FIGURE 81: RARE GAS PRICE ESCALATION

- FIGURE 65: F2 AND NF3 ACTIVATION

- FIGURE 66: ELECTRONIC GAS MARKET

- FIGURE 67: TOTAL INDUSTRIAL GAS MARKET 2021, US$97 BILLION

- FIGURE 68: TOTAL ELECTRONIC GAS MARKET 2021, US$6,3 BILLION

- FIGURE 69: ELECTRONIC GAS MARKET SEGMENTATION

- FIGURE 70: HE WW SUPPLY AND DEMAND

- FIGURE 71: 2027 HELIUM SUPPLY

- FIGURE 72: TOTAL NEON DEMAND VS. SUPPLY

- FIGURE 73: KOREA 2021 NEON IMPORTS

- FIGURE 74: TOTAL XENON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 75: TOTAL KRYPTON DEMAND VS. SUPPLY (MILLION LITERS/YR)

- FIGURE 76: NF3 SUPPLY/DEMAND

- FIGURE 77: AWF6 FORECAST

- FIGURE 78: HARDMASK SCHEMATIC

- FIGURE 79: LATEST SITUATION MAP IN UKRAINE, SHOWING TAKEN MAURIUPOL BUT ODESSA STILL FREE

- FIGURE 80: RESONAC BUSINESS SEGMENT REVENUE 2022

- FIGURE 81: RARE GAS PRICE ESCALATION

- FIGURE 82: HE MATERIALS SUPPLIER TIER STRUCTURE

- FIGURE 83: TUNGSTEN USE BY INDUSTRY (TECHCET ESTIMATE)

- FIGURE 84: ELECTRONIC SPECIALTY GASES

- FIGURE 85: BULK GASES 177

LIST OF TABLES

- TABLE 1: SPECIALTY AND BULK GAS REVENUE 2022, 2027

- TABLE 2: ELECTRONIC GAS MARKET GROWTH RATES BY END MARKET

- TABLE 3: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 4: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE & PROCESS TECHNOLOGY

- TABLE 5: GLOBAL GDP AND SEMICONDUCTOR REVENUES*

- TABLE 6: IMF ECONOMIC OUTLOOK*

- TABLE 7: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2022

- TABLE 8: OVERVIEW OF DEPOSITION PROCESSES BY DEVICE TYPE AND MATERIAL

- TABLE 9: ETCH GASES SUMMARY TABLE

- TABLE 10: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE

- TABLE 11: LINDE FINANCIALS AND REGIONAL SALES

- TABLE 12: AIR PRODUCTS REGIONAL FINANCIALS

- TABLE 13: TAIYO NIPPON SANSO REGIONAL FINANCIALS

- TABLE 14: ESTIMATED SUPPLY CHAIN SUPPLIER RANKING

- TABLE 15: REGIONAL SUMMARY OF GAS MARKET

- TABLE 16: CO2 EMISSIONS PER TONS SHIPPED BY OCEAN, TRUCK OR RAIL

- TABLE 17: GAS GWP AND ATMOSPHERIC LIFETIME

- TABLE 18: ELECTRONIC GAS MARKET SIZE AND GROWTH

- TABLE 19: TOTAL REVENUE 2022 COMPARED TO 2021 OF MAJOR GAS COMPANIES AND GAS SUPPLIERS

- TABLE 20: ELECTRONIC GAS MARKET GROWTH RATES BY END MARKET

- TABLE 21: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 22: M&A ACTIVITIES

- TABLE 23: SPECIALTY GAS INDUSTRY MATRIX

- TABLE 24: GASES USED IN FPD MANUFACTURING

- TABLE 25: HYDRIDE GAS SUPPLIERS

- TABLE 26: SILICON PRECURSOR SUPPLIERS

- TABLE 27: ETCHANT GAS SUPPLIERS

- TABLE 28: DEPOSITION/MISC. GAS SUPPLIERS

- TABLE 29: BULK GAS SUPPLIERS

- TABLE 30: ETCH ROADMAPS

- TABLE 31: ETCH ROADMAPS

- TABLE 32: ETCH ROADMAPS