|

市场调查报告书

商品编码

1440135

CPaaS(通讯平台即服务):市场占有率分析、产业趋势与统计、成长预测(2024-2029)Communication Platform-as-a-Service (CPaaS) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

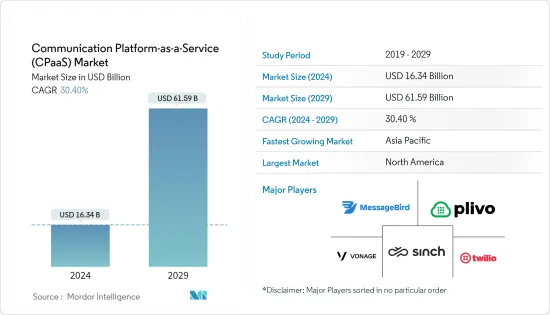

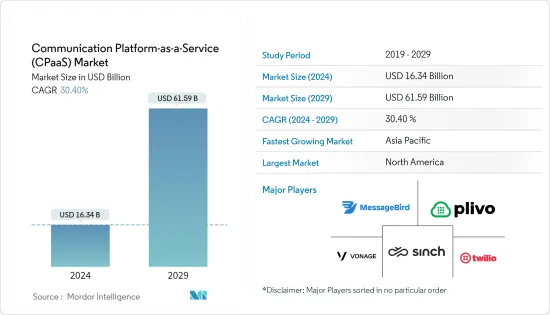

CPaaS(通讯平台即服务)市场规模预计到 2024 年为 163.4 亿美元,预计到 2029 年将达到 615.9 亿美元,预测期间将以 30.40% 的复合年增长率增长(从2029 年至 2029 年)。

人们对易于维护的网路系统的需求日益增长,这些系统能够在医疗保健、零售和製造等众多最终用户行业之间实现高效通讯。此外,通常以 IT 预算最少的医疗保健提供者扩大了对经济高效的云端基础的解决方案的采用。如今,医疗保健客服中心已经建立了 PBX(专用交换机)系统,并藉助基于订阅的联合通讯服务成功处理来自不同站点的多个消费者请求。

主要亮点

- 由于 BYOD 趋势和其他行动解决方案的快速普及,CPaaS 解决方案的采用预计将进一步加速。在这个为世界各地不同公司的员工提供弹性和网路存取的新时代,自带设备 (BYOD) 已发展成为提高办公室效率的关键趋势。据思科称,采用 BYOD 策略的公司平均每名员工每年节省 350 美元。此外,反应性措施和计画可以将每位员工每年节省的费用增加至 1,300 美元。对于中小型企业 (SMB) 来说,这些成本节省会迅速增加,帮助他们更好地保护收益,同时提高员工的工作效率。

- 利用CPaaS不断增长的需求,市场供应商也正在推出与市场相关的新解决方案和服务。例如,Syniverse于2022年2月推出了云端原生超大规模数位参与平台,以增强企业的客户体验并加速数位转型。此外,教育指导和金融投资公司Regum也提高了反应速度。透过实施 Avaya 的 IX云端基础的整合通讯和协作解决方案来增强客户服务。该平台帮助企业在分店之间建立即时、无缝的通信,无论分店位置如何,为世界各地的消费者提供服务,无需额外费用。

- 公司目前正在进行策略併购,以获得在目标市场的竞争优势。 Value First 是印度 CPaaS 供应商之一,于 2021 年 3 月被 Twilio 收购。此次收购将整合CPaaS平台和云端通讯。 Twilio 的决定符合该国在通讯、对话式人工智慧和行销技术方面的快速发展。

- 此外,2022 年 2 月,API/通讯平台即服务 (CPaaS) 产业的云端通讯软体供应商 Kaleyra Inc. 被国际领先的技术和服务供应商博世集团选为值得信赖的供应商。博世行动解决方案将加强其在印度的云端通讯。

- 为因应新冠肺炎 (COVID-19)感染疾病,福布斯全球 2000 大企业被迫加速数位转型。例如,Syniverse 于 2022 年 3 月推出了 Kore,透过为福布斯全球 2000 强公司提供对话式人工智慧 (AI) 和专家服务来支援其通讯平台即服务 (CPaaS) 策略。与人工智慧的合作。 Syniverse 透过由 Syniverse 和 Kore.ai 组成的专业服务团队向企业提供端到端功能,例如网路机器人设计和建置、全通路选择、宣传活动管理和讯息传递以及分析,从而增强了其 CPaaS 产品组合。市场准备好捕获云端基础的软体,包括基本的通讯即服务解决方案,导致疫情后的整体收益成长。

CPaaS市场趋势

零售和电子商务行业推动市场成长

- 零售业正在经历重大变化,这主要是由于消费者购买偏好的快速变化,从传统的单点互动转向透过网路和社群媒体的全通路互动。不断增长的消费者需求正在所有管道中建立更好的购物和服务体验。因此,它主要透过先进的通讯解决方案来解决,这些解决方案可以自动化客户服务和零售业务流程。

- 根据埃森哲的研究,超过 73% 的客户表示,他们期望客户服务比现在更简单、更快、更方便。此外,许多重要零售商都将全通路视为获得竞争优势的绝佳机会。随着大多数大公司跨多种管道(线上和行动)运营,客户服务已成为选择供应商或商店而不是另一家时最重要的标准。

- CPaaS 是云端基础的框架,可让企业同步即时视讯、音讯和文字通讯。面向开发人员的 API 使零售商能够将这些重要功能整合到他们的社交管道、行动应用程式和网站中。此外,Voxvalley Technologies Pvt Ltd 等主要市场参与者也提供 Vox CPaaS。 Vox CPaaS 让个人可以透过对话式商务、交付追踪、交付警报、废弃购物车简讯提醒和促销讯息来填补空白,从而增强客户服务。所有这些都可以在行动或网路应用程式中轻鬆完成,让您的客户可以轻鬆沟通。

- 此外,一些知名组织已经在利用 CPaaS 透过新的通讯功能来增强其客户旅程。 Booking.com 是全球最大的旅游电子商务公司之一,它使用 CPaaS 将语音通讯整合到其行动应用程式预订和顾客关怀流程中。 Booking.com 在 70 个国家设有 198 个办事处。

- 此外,一些零售商正在将 CPaaS 与 CRM(客户关係管理)介面集成,以改善整个客户参与流程。这有助于解读消费者的问题并将他们引导到正确的区域进行澄清。此外,多家公司已经采用CPaaS视讯解决方案来提供高清品质的视讯和无缝连接,主要是透过视讯通话向客户展示产品功能。另外,由于多数消费者都选择网路购物,为了留住更多消费者,Croma(Infinity Retail Limited)等公司在疫情期间在班加罗尔设立了线上展示店,开设了第一家试点店。

北美地区占比最大

- 由于最近移动性的增加以及智慧型行动装置普及的显着提高,预计北美将主导 CPaaS 市场。此外,随着对用户友好且具有成本效益的基于浏览器的通讯解决方案的需求不断增长,知名市场参与者正计划在该地区推出整合且统一的CPaaS解决方案,这将有助于市场加速扩张。

- 此外,该地区的 CPaaS 市场预计将受益于通讯业物联网的持续部署。美国通讯供应商正在利用基于物联网的技术来加快流程并提高效率。 2020 年,美国每月产生 5,155 万Exabyte的网路流量。根据 Telecom Advisory Services 的预测,到 2023 年,这一数字预计将增加至每月 9,864 万Exabyte。

- 此外,5G部署的高投资率使美国成为5G市场的最大投资者和创新者之一。中国的通讯业正在推动全球 5G 技术消费的很大一部分。美国在投资、部署和应用方面也主导大部分地区5G市场。此外,为了在美国发展5G网路基础设施,Verizon、AT&T和T-Mobile等通讯营运商已与三星、爱立信、诺基亚、华为和中兴通讯等网路设备製造商签署了数十亿美元的协议。总结。

- 2021年11月,爱立信宣布以62亿美元收购Vonage,专注于打造开放创新的全球网路和通讯平台。此次收购将使爱立信更能实现其在全球扩大无线企业客户群的既定目标。 UCaaS 和 CCaaS 皆由 Vonage Communications 平台提供。

- 此外,该领域合作水准的不断提高预计将加速市场扩张。例如,2022 年 3 月,美国知名的通讯业者和数位玩家通讯解决方案供应商 iBASIS 与 Mavenir 合作推出了 CPaaS(通讯平台即服务)产品。我宣称。一家网路软体供应商,透过在任何云端上运作并改变通讯的云端原生软体来塑造网路的未来。这种独特的 CPaaS 方法允许透过应用程式介面将下一代功能无缝整合到当前流程和软体应用程式中。

CPaaS产业概述

CPaaS(通讯平台即服务)市场竞争非常激烈,因为市场上有大大小小的供应商,他们不仅在国内市场运营,而且在国际市场运营。市场似乎呈现零碎化,主要供应商采取併购和产品创新等关键策略来扩大整体产品能力并保持竞争力。

- 2022 年 2 月,为欧洲和南非的企业和聚合商提供云端通讯服务的 MR Messaging FZC 签订了最终协议,该协议将被 Route Mobile 的完全子公司Routesms Solutions FZE 收购。此次收购扩大了 Root Mobile 在全球 CPaaS 的影响力,并符合该公司的全球扩张策略。

- 2022 年 1 月,全球领先的客户经验编配云端服务供应商Genesys 和全球领先的企业云端通讯公司 Bandwidth Inc. 公布了未来企业客服中心的重大进展。 Bandwidth 现在整合到 Genesys Cloud CX 平台中,扩展了 DuetSM 解决方案的范围,使公司能够将复杂的语音通信与通讯系统分开,并将其引入客服中心领域。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业生态系统分析

- 纯CPaaS

- 企业级CPaaS

- 通讯业者主导的CPaaS

- 基于服务供应商的CPaaS(支援合作伙伴)

- 混合CPaaS 产品

- 评估 COVID-19 对市场的影响

- 定价策略和经营模式分析

- UCaaS 等邻近市场与传统部署的比较分析

第五章市场动态

- 市场驱动因素

- 公司正在摆脱相邻的传统模式

- 全通路行销需求不断成长

- 市场挑战

- 个人资料法规扩展到医疗保健等最终用户领域

- 市场机会(技术创新,例如基于情境的交易、轻量级部署,以进一步加速采用)

第六章 CPaaS产业主要趋势

- 无伺服器部署

- 机器学习和人工智慧的到来

- 透过机器人进行全通路沟通

- 安全和隐私范式

第七章市场区隔

- 最终用户产业

- 资讯科技和电信

- BFSI

- 零售与电子商务

- 卫生保健

- 其他最终用户产业

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第八章 竞争形势

- 公司简介

- Twilio Inc.

- Vonage Holdings Corp

- MessageBird BV

- Plivo Inc.

- Snich AB

- Voximplant(Zingaya Inc.)

- 8x8 Inc.

- Voxvalley Technologies

- Bandwidth Inc.(Bandwidth.com)

- IntelePeer Cloud Communications

- Wazo Communication Inc.

- Avaya Inc.

- AT&T Inc.

- Mitel Networks Corporation

- Telestax

- Voxbone SA

- Iotum Inc.

- M800 Limited

- Infobip Ltd

- EnableX.io(VCLOUDX PTE. LTD)

第九章投资分析

第10章市场的未来

The Communication Platform-as-a-Service Market size is estimated at USD 16.34 billion in 2024, and is expected to reach USD 61.59 billion by 2029, growing at a CAGR of 30.40% during the forecast period (2024-2029).

There is a rising need for easily maintained network systems allowing efficient communications across numerous end-user industries, including healthcare, retail, and manufacturing. In addition, healthcare providers, frequently characterized as having minimal IT budgets, expanded their adoption of cost-effective cloud-based solutions. Nowadays, healthcare contact centers set up their PBX (Private Branch Exchange) systems and handle several consumer requests from different sites without any problems due to the subscription-based United Communication Services.

Key Highlights

- The adoption of CPaaS solutions is anticipated to be further accelerated by the fast-growing uptake of the BYOD trend and other mobility solutions. In this new era of flexibility and network accessibility for employees globally for various firms, Bring Your Own Device (BYOD) developed as a significant trend, increasing office productivity. As per Cisco, businesses with a BYOD strategy save, on average, USD 350 annually per employee. Additionally, reactive initiatives and programs can increase these savings to USD 1,300 per employee year. These cost savings for Small to Medium Sized Businesses (SMBs) can mount up quickly and help SMBs better safeguard their bottom line while increasing staff productivity.

- Leveraging the rising need for CPaaS, market vendors are also launching new solutions and services related to the market. For instance, Syniverse introduced a cloud-native, hyperscale digital engagement platform to enhance the enterprises' customer experiences and boost their digital transformations in February 2022. Additionally, Regum, a company engaged in educational instruction and financial investing, increased the responsiveness and speed of its customer service by implementing Avaya's IX cloud-based unified communications and collaboration solution. The platform assisted the business in establishing immediate and seamless communication among its branches, regardless of branch location, and it offers service to consumers worldwide at no extra cost.

- Businesses are now engaging in strategic mergers and acquisitions to obtain a competitive edge in the target market. One of the CPaaS providers in India, Value First, was acquired by Twilio in March 2021. The acquisition unites the CPaaS platform and cloud communication. The decision by Twilio is consistent with the country's rapid advancements in messaging, conversational AI, and mar-tech.

- In addition, in February 2022, Kaleyra Inc., a cloud communications software provider in the API/Communications Platform as a Service (CPaaS) industry, was chosen by Bosch Group, a major international provider of technology and services, as their trusted vendor to power the Bosch Mobility Solutions cloud communications in India.

- Companies in the Forbes Global 2000 have been compelled to quicken their digital transitions in response to the COVID-19 pandemic. For instance, Syniverse announced in March 2022 that it had entered a global partnership with Kore.ai to support its Communications Platform-as-a-Service (CPaaS) strategy by offering conversational artificial intelligence (AI) and expert services to Forbes Global 2000 firms. Syniverse increases its CPaaS portfolio and provides end-to-end capabilities to businesses through a professional services team staffed by Syniverse and Kore.ai, including internet bot design and build, omnichannel selection, campaign management and message delivery, and analytics. The increased market readiness to acquire cloud-based software, including foundational communication platform-as-a-service solutions, resulted in increased overall revenue growth post-pandemic.

CPaaS Market Trends

Retail and E-commerce Industry to Drive the Market Growth

- The retail business has witnessed a significant transformation mainly due to the fast-changing consumer purchasing preferences, moving from the previous single point of interaction to omnichannel interactions via the web or social media. A better shopping and service experience has been well established across all channels due to the rising consumer demand. Hence, it is being catered to by advanced communication solutions that primarily automate customer service and retail business processes.

- More than 73% of customers stated that they had expected customer service to be quite simpler, quicker, and more convenient than it is now, as per a survey by Accenture. Also, a wide range of crucial retail businesses sees omnichannel as a golden chance to acquire a competitive edge. Customer service has emerged as the most vital criterion in choosing one supplier or store over another since most large enterprises now operate across several channels (online and mobile).

- CPaaS is a cloud-based framework that lets businesses synchronize real-time video, audio, and text communication. By utilizing developer-friendly APIs, retailers can integrate these vital features into their social channels, mobile apps, and websites. Further, key market players, like Voxvalley Technologies Pvt Ltd, offer Vox CPaaS, where an individual can augment customer service by filling the gap with conversational commerce, delivery tracking, shipping alerts, abandoned cart SMS reminders, and promotional messages. All of this can be easily achieved within the mobile or web application, and hence the customers can enjoy the ease of communication.

- Additionally, several well-known organizations are already utilizing CPaaS to enhance their client journey with new communication capabilities. One of the biggest travel e-commerce companies in the world, Booking.com, uses CPaaS to assist in integrating voice communication into its mobile apps' booking and customer care processes. Booking.com has 198 offices across 70 different countries.

- Additionally, several retailers are integrating CPaaS with their CRM (Customer Relationship Management) interfaces, improving the overall customer engagement process. It helps in decoding consumer questions and directing them to the appropriate areas for clarification. Additionally, Several businesses employ CPaaS video solutions to provide high HD quality video and seamless connectivity primarily for demonstrating product features and functionality to clients through video calling. Also, to retain more consumers, as most of them chose to shop online, companies like Croma (Infiniti Retail Limited) opened their first pilot store for an online demonstration in Bangalore during the pandemic.

North America Accounts for the Largest Share

- North America is expected to dominate the CPaaS market due to the recent increase in mobility and the massive growth in the penetration of smart mobile devices. Moreover, with the rising demand for user-friendly and cost-effective browser-based communication solutions, prominent market players are planning to launch integrated and unified CPaaS solutions in the region, which is expected to augment the market's expansion.

- Additionally, the region's CPaaS market is anticipated to benefit from the growing deployment of IoT in the telecom industry. American telecom providers are utilizing the ability of IoT-based technologies to expedite processes and boost effectiveness. The United States produced 51.55 million exabytes of internet traffic per month in 2020. It is projected that this number will rise to 98.64 million exabytes per month in 2023, according to projections from Telecom Advisory Services.

- Additionally, due to a high investment rate for 5G deployment, the United States is one of the top investors and innovators in the 5G market. The telecom industry in the nation drives a significant portion of the world's 5G technology consumption. The US also controls most of the regional 5G market in terms of investment, adoption, and applications. Moreover, to develop their 5G network infrastructure in the United States, telecom providers, including Verizon, AT&T, and T-Mobile, have signed billion-dollar contracts with network equipment manufacturers like Samsung, Ericsson, Nokia, Huawei, and ZTE.

- In November 2021, to concentrate on creating a global network and communication platform for open innovation, Ericsson announced the acquisition of Vonage for USD 6.2 billion. With the acquisition, Ericsson can better fulfill its stated goal of growing its wireless enterprise clientele globally. Unified Communications as a Service (UCaaS) and Contact Center as a Service (CCaaS) are both offered by the Vonage Communications Platform.

- Additionally, the increasing level of collaboration in the area is expected to accelerate market expansion. In March 2022, for instance, iBASIS, a well-known US-based provider of communications solutions for operators and digital players, declared the launch of its Carrier Communications Platform-as-a-Service (CPaaS) offering in collaboration with Mavenir, the Network Software Provider shaping the future of networks with cloud-native software that operates on any cloud and transforms the communication. This unique CPaaS approach allows the frictionless integration of next-generation capabilities into the current processes and software applications through application programming interfaces.

CPaaS Industry Overview

The Communications Platform-as-a-Service (CPaaS) Market is extremely competitive, mainly due to the existence of various small and large vendors in the market conducting business in domestic as well as international markets. The market appears to be fragmented, with key vendors adopting major strategies like mergers, and acquisitions, product innovation to widen their overall product functionality and stay competitive.

- In February 2022, A provider of cloud communications services to businesses and aggregators in Europe and South Africa, M. R. Messaging FZC, has signed definitive agreements to be acquired by Route Mobile's wholly owned subsidiary, Routesms Solutions FZE. The acquisition expands Route Mobile's global presence in CPaaS and is consistent with its global expansion strategy.

- In January 2022, With Genesys, a worldwide cloud service provider in customer experience orchestration, Bandwidth Inc., a major global corporate cloud communications company, disclosed a significant advancement in the future of the enterprise contact center. With its inclusion in the Genesys Cloud CX platform, Bandwidth is expanding its range of DuetSM solutions, which enable businesses to decouple complicated telephony from their communications systems, into the contact center sector.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.2.1 Pure-play CPaaS

- 4.2.2 Enterprise-grade CPaaS

- 4.2.3 Telco-driven CPaaS

- 4.2.4 Service Provider-based CPaaS (enablement partners)

- 4.2.5 Hybrid CPaaS Offerings

- 4.3 Assessment of COVID-19 Impact on the Market

- 4.4 Pricing strategies and Business Model Analysis

- 4.5 Comparative Analysis of Adjacent Markets, such as UCaaS and Traditional Deployments

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Shift of Companies from Adjacent and Traditional Models

- 5.1.2 Growing Demand for Omnichannel Marketing

- 5.2 Market Challenges

- 5.2.1 Growing Personal Data Regulations across End-user Verticals, such as Healthcare

- 5.3 Market Opportunities (Technological Innovations, such as Context-based Transactions, Lightweight Deployments to further Drive Adoption)

6 KEY TRENDS IN CPAAS INDUSTRY

- 6.1 Serverless Deployments

- 6.2 Advent of Machine Learning and Artificial Intelligence

- 6.3 Omnichannel Communication Through Bots

- 6.4 Security and Privacy Paradigm

7 MARKET SEGMENTATION

- 7.1 End-User Vertical

- 7.1.1 IT and Telecom

- 7.1.2 BFSI

- 7.1.3 Retail and E-commerce

- 7.1.4 Healthcare

- 7.1.5 Other End-User Verticals

- 7.2 Geography

- 7.2.1 North America

- 7.2.2 Europe

- 7.2.3 Asia Pacific

- 7.2.4 Rest of the World

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Twilio Inc.

- 8.1.2 Vonage Holdings Corp

- 8.1.3 MessageBird B.V.

- 8.1.4 Plivo Inc.

- 8.1.5 Snich AB

- 8.1.6 Voximplant (Zingaya Inc.)

- 8.1.7 8x8 Inc.

- 8.1.8 Voxvalley Technologies

- 8.1.9 Bandwidth Inc. (Bandwidth.com)

- 8.1.10 IntelePeer Cloud Communications

- 8.1.11 Wazo Communication Inc.

- 8.1.12 Avaya Inc.

- 8.1.13 AT&T Inc.

- 8.1.14 Mitel Networks Corporation

- 8.1.15 Telestax

- 8.1.16 Voxbone SA

- 8.1.17 Iotum Inc.

- 8.1.18 M800 Limited

- 8.1.19 Infobip Ltd

- 8.1.20 EnableX.io (VCLOUDX PTE. LTD)