|

市场调查报告书

商品编码

1536845

海上 AUV/ROV:市场占有率分析、产业趋势/统计、成长预测(2024-2029)Offshore AUV And ROV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

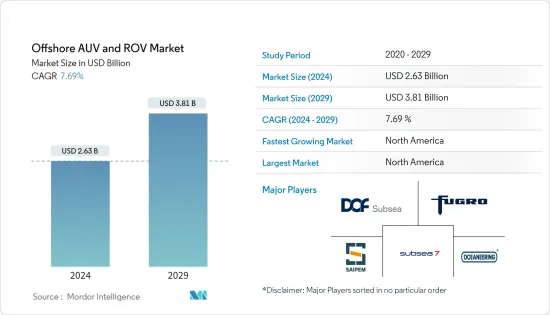

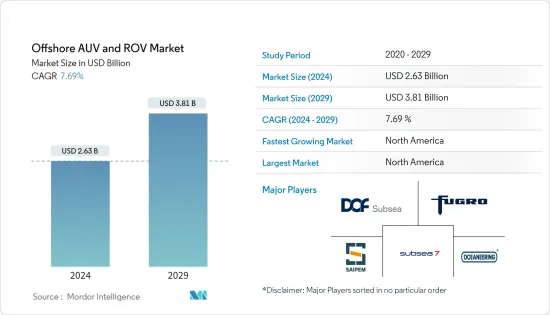

预计2024年全球海上AUV/ROV市场规模将达26.3亿美元,2024年至2029年复合年增长率为7.69%,2029年将达38.1亿美元。

主要亮点

- 从中期来看,海上石油和天然气生产活动的增加、离岸风电行业的成长以及石油和天然气退役活动的增加等因素预计将在预测期内推动海上AUV和ROV市场的发展。

- 另一方面,未来计划加强对气候变迁关注或禁止海洋探勘活动的国家预计将抑制市场成长。

- 然而,技术创新和进步预计将增加 AUV 和 ROV 在石油和天然气、离岸风电和勘探等行业的海上活动中的使用。从长远来看,AUV 和 ROV 的技术进步预计将为公司提供大量机会。

- 北美预计将出现显着成长,大部分需求来自美国和墨西哥等国家。

海上AUV/ROV市场趋势

石油和天然气领域主导市场

- AUV 和 ROV 用于海底基础设施建设、监测和勘探任务的定位和引导。探勘航行器在海上石油油气工程的应用包括引导钻井作业、海底观测、定点采样、导管架安装相关辅助工作、油气管道安装、海上设施维护等。

- 由于世界主要经济体仍然严重依赖石油产品,对石油和天然气的依赖正在增加。石油天然气工业在国际政治、经济上具有巨大影响力。

- 2022年,全球石油产量与前一年同期比较增加4.18%至9,384.8万桶/日。世界人口的增加反映在初级能源消耗的增加上,从2011年的520.90艾焦耳增加到2022年的604.04艾焦耳。

- 世界上许多潜在的碳氢化合物蕴藏量都位于海底。碳氢化合物产业已经开发出适合海底条件的技术,以成功发现和生产石油和天然气。

- 石油和天然气钻机可在深达两英里的水中作业。许多深水井和管道系统都依赖无人水下航行器进行安装、检查、维修和维护。

- 最近,一些国家积极参与海上石油和天然气领域,进行投资以增加海上油田的产量。

- 2022 年 5 月,壳牌和巴西国家石油公司与 Saipem 签订合同,在两个先导计画,包括对两家能源公司运营的巴西近海两个超深水油田进行检查宣传活动。

- 此外,2022年8月,印度石油天然气公司与埃克森美孚公司签署了一份谅解备忘录(HoA),以在该国东海岸和西海岸进行深水探勘。两家公司将专注于探勘东部近海的克里希纳戈达瓦里盆地和高韦里盆地以及西部近海的卡奇-孟买盆地。

- 因此,鑑于上述几点,预计在预测期内,石油和天然气领域对海上AUV和ROV的需求将大幅成长。

北美地区预计将实现显着成长

- 北美地区是全球最发达的海上石油和天然气工业之一,主要重点领域是墨西哥湾和阿拉斯加近海的巨大蕴藏量。随着钻井深度逐年增加,蕴藏量也大幅增加,导致投资增加。

- 由于其高工业化水平和积极的研发投资,预计北美在预测期内将成为海上 AUV 和 ROV 的最大市场之一。

- 由于美国在国防领域和 AUV/ROV 研发方面投入巨资,石油和天然气、航运和可再生能源等其他相关近海领域也将从研究市场的技术进步中受益匪浅。这使得该地区处于 AUV/ROV 技术的前沿。该地区的 AUV 和 ROV 製造商将其产品出口到世界各地。

- 该地区是全球最发达的海上石油和天然气工业之一,主要重点领域是墨西哥湾和阿拉斯加近海的巨大蕴藏量。随着钻探深度逐年增加,技术可采蕴藏量显着增加,投资力道不断增加。

- 随着美国大力投资扩大油气产能,墨西哥湾已成为全球AUV和ROV需求热点。截至 2022 年,墨西哥湾地区的产量分别占美国海上和碳氢化合物总产量的 97% 和 15%。该地区是世界上海上钻井钻机部署最集中的地区之一,包括生产和钻探平臺、海上船舶、管道网路以及其他石油和天然气基础设施。

- 随着 AUV 和 ROV 技术变得越来越便宜,美国石油和天然气生产商越来越多地使用 AUV 和 ROV 来获取海底资产和海面资料并执行日常维护作业。儘管 ROV 和 AUV 的初始成本比潜水作业更高,但它们可以透过完成相同工作量所需的时间更少来降低整体计划营运成本。

- 因此,主要石油和天然气公司通常会在墨西哥湾签订多份 AUV 和 ROV 服务合约。 2022 年 9 月,DOF Subsea USA订单与该地区主要石油和天然气营运商签订了墨西哥湾的多份合约。 DOF Subsea 营运的符合琼斯法案的船舶将每年使用约 180 天,在多个地点执行各种活动,包括检查、维护、修理、轻型工作和试运行支援。

- 墨西哥传统上拥有蓬勃发展的碳氢化合物工业。然而,与美国相比,墨西哥近海领域的平均钻井深度相对较低。因此,墨西哥石油和天然气业者从潜水员辅助服务转向 ROV 和 AUV 等无潜水员服务的经济奖励较少。

- 然而,随着墨西哥政府寻求重振碳氢化合物产业并提高国内碳氢化合物产量,该国的石油和天然气产业预计将获得重大投资,特别是来自国家石油和天然气公司 PEMEX 的投资。 2022年3月,PEMEX的勘探与生产部门PEP宣布已获得浅水Uçukil油田的探勘核准,根据基准和增量情景,投资额为1.07亿美元至4.78亿美元。

- 同样,墨西哥承诺在未来几年投资 12 亿美元开发两个新的海上区块。预计在预测期内,海上领域的大规模投资将推动墨西哥海上 AUV 和 ROV 市场的发展。

- 因此,鑑于上述几点,预计北美地区AUV/ROV市场在预测期内将显着成长。

近海AUV/ROV产业概况

海上 AUV/ROV 市场已减少一半。市场的主要企业(排名不分先后)包括 DOF Subsea AS、Fugro NV、Subsea 7 SA、Saipem SpA 和 Oceaneering International Inc。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章 简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 市场规模与需求预测(美元),~2028

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 美洲、亚太地区和中东/非洲的海上石油和天然气探勘活动增加

- 海上可再生技术的发展

- 抑制因素

- 禁止多地区海上探勘生产活动

- 促进因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 车辆类型

- ROV

- AUV

- 车辆类别

- 作业车辆类别

- 轻型作业车

- 中型作业车

- 重型作业车

- 观察车类

- 作业车辆类别

- 最终用户使用情况

- 石油和天然气

- 防御

- 调查

- 其他用途

- 活动

- 钻井/开发

- 建造

- 检查、维修和保养

- 退休

- 其他活动

- 地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 英国

- 丹麦

- 挪威

- 俄罗斯

- 法国

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 东南亚国协

- 其他亚太地区

- 南美洲

- 巴西

- 委内瑞拉

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

- 中东/非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 奈及利亚

- 其他中东/非洲

- 北美洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- DeepOcean AS

- DOF Subsea AS

- Helix Energy Solutions Group Inc.

- TechnipFMC PLC

- Bourbon

- Fugro NV

- Subsea 7 SA

- Saipem SpA

- Oceaneering International Inc.

- Teledyne Technologies Incorporated

第七章 市场机会及未来趋势

- AUV/ROV 市场的技术进步

简介目录

Product Code: 52273

The Offshore AUV And ROV Market size is estimated at USD 2.63 billion in 2024, and is expected to reach USD 3.81 billion by 2029, growing at a CAGR of 7.69% during the forecast period (2024-2029).

Key Highlights

- Over the medium term, factors such as rising offshore oil and gas production activities, growing offshore wind power industry, and increasing oil and gas decommissioning activities are expected to drive the offshore AUV and ROV market during the forecast period.

- On the other hand, countries planning to increase their focus on climate change and banning offshore exploration activities in the future are expected to restrain market growth.

- Nevertheless, innovation and technological advancement are expected to increase the utilization of AUVs and ROVs in offshore activities in industries such as oil and gas, offshore wind, research, etc. The technological advancements in AUVs and ROVs are expected to offer a considerable opportunity for companies in the long term.

- North America is expected to witness significant growth, with the majority of the demand coming from countries such as the United States and Mexico.

Offshore AUV And ROV Market Trends

Oil and Gas Segment to Dominate the Market

- AUVs and ROVs are used for positioning and guidance for sub-sea infrastructure construction, monitoring, and survey missions. The applications of underwater vehicles in offshore oil and gas engineering include guide drilling work, undersea observation, fixed-point sampling, auxiliary work involved in jacket installation, laying of oil and gas pipelines, and maintenance of offshore facilities.

- The dependence on oil and gas increases as major economies globally still rely heavily on petroleum-based products. The oil and gas industry displays immense influence in international politics and economics.

- In 2022, global oil production recorded 93,848 thousand barrels per day, with an increase of 4.18% over the previous year. The increase in the global population was reflected in an increase in primary energy consumption, which stood at 604.04 exajoules in 2022, up from 520.90 exajoules in 2011.

- Many of the potential global reserves of hydrocarbons lie beneath the sea. The hydrocarbon industry developed techniques suited to conditions found in offshore sites, both to find oil and gas and produce it successfully.

- Oil and gas drilling rigs may operate in water depths of two miles. Many of these deepwater wells and pipeline systems rely on unmanned underwater vehicles to help perform installations, inspections, repairs, and maintenance.

- Several countries have recently been active in the oil and gas offshore sector and have been witnessing investments in increasing production from offshore fields, hence creating an opportunity for AUVs and ROVs.

- In May 2022, Shell and Petrobras contracted Saipem to use its FlatFish subsea drone for two pilot projects involving the inspection campaigns of two ultra-deepwater fields offshore Brazil operated by the two energy companies.

- Furthermore, in August 2022, Oil and Natural Gas Corp., an Indian oil explorer and producer, entered into a Heads of Agreement (HoA) with ExxonMobil Corp. for deepwater exploration on both the east and west coasts of the country. In the eastern offshore, both oil explorers plan to focus on the Krishna Godavari and Cauvery basins, and in the western offshore, they will focus on the Kutch-Mumbai region.

- Therefore, owing to the above points, the demand for offshore AUVs and ROVs is expected to grow significantly in the oil and gas sector during the forecast period.

North America is Expected to Witness Significant Growth

- The North American region has one of the most well-developed offshore oil and gas industries globally, with the primary areas of focus being the vast reserves in the Gulf of Mexico and offshore Alaska regions. As drilling depths have increased over the years, the volume of technically recoverable reserves has increased significantly, which attracted growing investments.

- Due to the high level of industrialization and investments in research and development, North America is expected to be one of the largest markets for offshore AUVs and ROVs during the forecast period.

- As the United States has invested heavily in the defense sector and the R&D of AUVs and ROVs, other related offshore sectors, like oil and gas, shipping, and renewable energy, have profited immensely from the technological advancements in the market studied. Due to this, the region is at the forefront of AUV and ROV technology. AUV and ROV manufacturers in the region export their products globally.

- The region has one of the most well-developed offshore oil and gas industries globally, with the primary areas of focus being the vast reserves in the Gulf of Mexico and the offshore Alaska region. As drilling depths have increased over the years, the volume of technically recoverable reserves has increased significantly, which attracted growing investments.

- As the United States invested heavily in expanding its oil and gas production capacity, the Gulf of Mexico has become a global hotspot for AUV and ROV demand. As of 2022, the Gulf of Mexico region was responsible for 97% and 15% of the US offshore and total hydrocarbon production, respectively. The region has one of the highest global densities of offshore rig deployment and consists of other oil and gas infrastructure, like production and drilling platforms, marine vessels, and pipeline networks.

- As ROV and AUV technology has become increasingly affordable, oil and gas producers in the United States have been investing in ROV and AUV services to obtain data and carry out routine maintenance work on subsea assets and surfaces. Despite the higher upfront cost compared to diving crews, ROVs and AUVs need less time to complete the same amount of work, which reduces overall project OPEX.

- Due to this, major oil and gas companies routinely deal out multiple contracts for ROVs and AUV services in the Gulf of Mexico. In September 2022, DOF Subsea USA announced that the company had been awarded multiple contracts in the Gulf of Mexico by leading regional oil and gas operators. The Jones Act Compliant vessel(s) operated by DOF Subsea will be utilized for around 180 days over a one-year term, performing a range of activities, including inspection, maintenance, repair, light construction, and commissioning support at multiple field locations.

- Traditionally, Mexico had a strong hydrocarbon industry. However, the average drilling depths in Mexico's offshore sector have been relatively lower than that of the United States. Due to this, Mexican oil and gas operators have fewer financial incentives to switch from diver-assisted to diverless services, such as ROVs and AUVs.

- However, as the Mexican government looks to revitalize the hydrocarbon sector and boost domestic hydrocarbon production, the country's oil and gas industry is expected to see large investments, especially from state oil and gas utility PEMEX. In March 2022, PEP, the E&P wing of the PEMEX, announced that it received approval for the exploration of the Uchukil block in shallow waters with an investment of USD 107-478 million based on the baseline and incremental scenarios.

- Similarly, Mexico also committed to investing USD 1.2 billion in the development of two new offshore fields in forthcoming years. Such large investments in the offshore sector are expected to drive the offshore AUV and ROV market in Mexico during the forecast period.

- Therefore, owing to the above points, the North American region is expected to witness significant growth in the AUV and ROV markets during the forecast period.

Offshore AUV And ROV Industry Overview

The offshore AUV and ROV market is semi-fragmented. Some of the key players in this market (in no particular order) include DOF Subsea AS, Fugro NV, Subsea 7 SA, Saipem SpA, and Oceaneering International Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Offshore Oil and Gas Exploration Activities in the American, Asia-Pacific, and Middle-East and African Regions

- 4.5.1.2 Growing Offshore Renewable Technologies

- 4.5.2 Restraints

- 4.5.2.1 Ban on Offshore Exploration and Production Activities in Multiple Regions

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Vehicle Type

- 5.1.1 ROV

- 5.1.2 AUV

- 5.2 Vehicle Class

- 5.2.1 Work-class Vehicle

- 5.2.1.1 Light Work-class Vehicle

- 5.2.1.2 Medium Work-class Vehicle

- 5.2.1.3 Heavy Work-class Vehicle

- 5.2.2 Observatory-class Vehicles

- 5.2.1 Work-class Vehicle

- 5.3 End-user Application

- 5.3.1 Oil and Gas

- 5.3.2 Defense

- 5.3.3 Research

- 5.3.4 Other End-user Applications

- 5.4 Activity

- 5.4.1 Drilling and Development

- 5.4.2 Construction

- 5.4.3 Inspection, Repair, and Maintenance

- 5.4.4 Decommissioning

- 5.4.5 Other Activities

- 5.5 Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 Denmark

- 5.5.2.4 Norway

- 5.5.2.5 Russia

- 5.5.2.6 France

- 5.5.2.7 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 ASEAN Countries

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Venezuela

- 5.5.4.3 Argentina

- 5.5.4.4 Colombia

- 5.5.4.5 Rest of South America

- 5.5.5 Middle-East and Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 United Arab Emirates

- 5.5.5.3 Qatar

- 5.5.5.4 Nigeria

- 5.5.5.5 Rest of Middle-East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 DeepOcean AS

- 6.3.2 DOF Subsea AS

- 6.3.3 Helix Energy Solutions Group Inc.

- 6.3.4 TechnipFMC PLC

- 6.3.5 Bourbon

- 6.3.6 Fugro NV

- 6.3.7 Subsea 7 SA

- 6.3.8 Saipem SpA

- 6.3.9 Oceaneering International Inc.

- 6.3.10 Teledyne Technologies Incorporated

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in the AUV and ROV Market

02-2729-4219

+886-2-2729-4219