|

市场调查报告书

商品编码

1548889

全球ITSM(IT服务管理)市场:市场占有率分析、产业趋势/统计、成长预测(2024-2029)ITSM - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

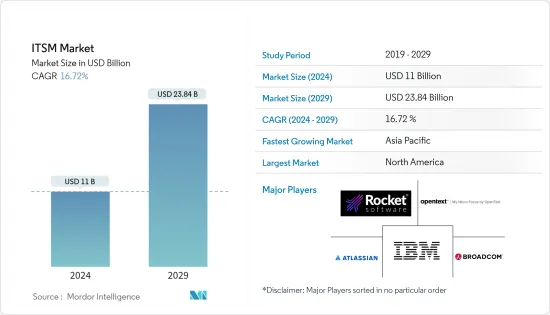

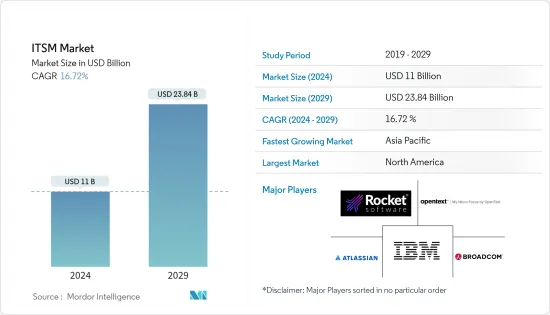

全球ITSM(IT服务管理)市场规模预估2024年为110亿美元,2029年达到238.4亿美元,预估在预测期间(2024-2029年)复合年增长率为16.72%。

资讯科技服务管理 (ITSM) 定义了所有与 IT 相关的活动,包括为实现 IT 组织的业务目标而执行的客製化解决方案的建立、交付、支援和管理。

主要亮点

- IT 服务管理 (ITSM) 的现状在不断变化的资讯科技领域至关重要。它反映了在技术突破和不断变化的业务动态的推动下,公司交付和管理 IT 支援和服务的方式发生了转变。 ITSM 现在是一项策略要求,可推动卓越营运、改善员工支援和体验,并直接为整体组织绩效做出贡献,而不仅仅是一个支援角色。

- 2023 年对 IT 服务台来说是非常重要的一年,凸显了以前未被注意到、现在需要关注的某些需求。 2024 年,ITSM 场景正在迅速变化。 IT 服务管理的新趋势正在引起人们的关注,预示着员工 IT 支援和技术援助的革命。因此,IT 服务台经理必须随时了解最新的 ITSM 趋势及其潜在影响。

- AITSM 趋势代表了生成式人工智慧和现代自动化带来的重大转变。在 GenAI 的支援下,这种创新方法可以主动、有效率地自动化 IT 服务台内的 IT 请求、营运和任务。主要组织现在正在采用 GenAI,这对 ITSM 产生了重大影响。当先进的生成式人工智慧整合到 IT 服务管理业务中时,公司可以从提高的生产力和解决各种 IT 相关问题的最佳实践中受益。

- AITSM 提高了 IT 支援的效率和准确性,并为更具回应性和主动性的服务环境奠定了基础。结合智慧工单路由和预测性问题解决等进阶功能,可显着提高 IT 服务管理的品质。利用 AITSM 的公司的成功将取决于他们利用生成式 AI 认知能力的能力,开创以创新、回应能力和效率为特征的 IT 服务管理新时代。

- COVID-19 大流行对科技业产生了重大影响,扰乱了供应链价值链并造成了商品通膨的威胁。疫情也导致远距工作激增,人们更加关注评估和降低端到端价值链中的风险,从而刺激了对 IT 服务管理的需求。

IT服务管理市场趋势

IT/通讯领域预计将占据较大市场占有率

- IT 和通讯领域的 IT 服务管理现代化是一种不断发展的方法。这弥合了传统本地 IT 系统和基于云端的 IT 系统之间的差距。这提高了业务效率和有效性。这种在整个企业内捕获、分析和共用资料方式的统一性改善了内部 IT 员工和外部相关人员的体验。

- 随着技术的快速进步,通讯业者不断注重创新。因此,我们专注于升级基础设施,同时开发尖端的解决方案来服务我们的客户,包括创新、客户服务、基础设施配置和人力资源。

- 此外,实施 ITSM 解决方案还为通讯业者提供了通讯、云端和软体许可组合中的申请、费用、使用情况和资产的统一可见性。因此,它提供了一套细粒度的流程来管理您现有的IT基础设施,同时主要透过提高可见度来降低整体成本并提高生产力。此外,随着对云端基础的模型的需求不断增加,IT 公司正在专注于实施 ITSM。随着云端基础的生态系统的普及,公司正在跨云端平台提供新服务并扩大合作伙伴关係。

- 此外,IT 企业的内容成长与新管道的新增和流程变化同步。由于社群媒体和智慧型装置的出现,ITSM 解决方案的激增预计将增加处理交易、业务和社交内容的需求,并实现跨各种数位管道的内容流化。

- 据 5G Americas 称,在可预见的未来,5G 用户数量预计将持续成长,两年内将达到 30 亿用户。其中包括未来两年的 6 亿份合约。

预计北美将占据很大的市场份额

- 该地区越来越多地采用 IT 服务解决方案来帮助组织提高效率并保持生产力。

- 数位绩效管理提供绩效洞察并实现即时、闭合迴路问题解决。数位绩效管理提供了一个通用的绩效视图,以易于理解的业务指标:时间来表达。此指标对于第一线员工、经理和高阶主管来说很容易理解,并且是企业范围解决方案的基础。

- 此外,加拿大政府制定了「云端优先」策略,该策略在启动资讯技术投资、措施、策略和计划时将云端服务确定为主要交付选项并对其进行评估。云端运算还有望使加拿大政府能够利用私人提供者的创新,并使资讯技术更加敏捷。

- 最近的技术趋势,例如增强的云端基础设施、支援物联网的生态系统以及认知运算应用的不断增加,为整个美国IT 产业创造新的业务需求提供了机会。

- 由于旨在提高生产力、员工满意度和成本效益的 BYOD 政策的迅速采用,云端基础的ITSM 市场正在不断增长。此类策略需要远端存取讯息,而云端基础的ITSM 解决方案可促进这一点。

- 由于 COVID-19 爆发期间需要远端工作,大多数组织也在采取预防措施来保护其向员工提供的行动装置和设备。加拿大网路安全中心鼓励加拿大网路安全界,特别是关键基础设施网路维护者,提高对俄罗斯国家支持的网路威胁的认识和保护。网路中心与美国和英国的合作伙伴一起建议采取主动的网路监控和缓解措施。

IT服务管理产业概述

IT 服务管理市场高度分散,主要参与者包括 IBM Corporation、ASG Technologies Group Inc. (Rocket Software)、Atlassian Corporation PLC、Micro Focus International PLC (Open Text Corporation) 和 Broadcom Inc. Masu。市场上的公司正在采取联盟和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 10 月 安永和 IBM 联合发布了 EY.ai Workforce,这是一种创新的人力资源解决方案,使组织能够将人工智慧 (AI) 整合到关键业务流程中。两家公司之间的合作标誌着人工智慧在提高人力资源部门生产力方面的重要里程碑。

- 2023 年 11 月 Jira、Confluence 和 Bitbucket 等流行工具背后的 Atlassian Corporation 收购了主要企业的IT资料品管技术公司 AirTrack。此次收购是 Atlassian 持续努力帮助企业采用全面的资产和配置管理方法的一部分。透过结合 AirTrack 和 Jira Service Management 的功能,企业可以更有效地追踪其所有关键资产,从而降低营运风险、成本和攻击面。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 大流行的市场影响评估

第五章市场动态

- 市场驱动因素

- 最终用户产业更采用IT基础设施更新

- 对管理和监控IT基础设施效能的整合平台的需求不断增长

- 市场限制因素

- ITSM 实施中的挑战以及服务等级协定中缺乏品质标准

第六章 市场细分

- 按发展

- 云

- 本地

- 按用途

- 配置管理

- 绩效管理

- 网管

- 资料库管理系统

- 其他用途

- 按最终用户产业

- BFSI

- 製造业

- 政府/教育

- 资讯科技/通讯

- 零售

- 旅游/酒店业

- 卫生保健

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东/非洲

第七章 竞争格局

- 公司简介

- IBM Corporation

- ASG Technologies Group Inc.

- Atlassian Corporation PLC

- Micro Focus International PLC

- Broadcom Inc.

- Axios Systems

- BMC Software Inc.(Kohlberg Kravis Roberts & Co. LP)

- Freshworks Inc.

- Ivanti Inc.

- ServiceNow Inc.

第 8 章 供应商竞争力

- 供应商市场收益(2023 年)

- 供应商比较分析

第九章投资分析

第十章 市场未来性

The ITSM Market size is estimated at USD 11 billion in 2024, and is expected to reach USD 23.84 billion by 2029, growing at a CAGR of 16.72% during the forecast period (2024-2029).

Information technology service management (ITSM) defines all IT-related activities that include creating, delivering, supporting, and managing the customized solutions executed to achieve the business goal of the IT organizations.

Key Highlights

- The current state of IT service management (ITSM) is highly significant in the ever-changing field of information technology. It reflects a turning point in how businesses deliver and manage their IT support and services, owing to technological breakthroughs and shifting business dynamics. ITSM is now a strategic requirement that promotes operational excellence, improves employee support and experience, and directly contributes to overall organizational performance rather than just being a support role.

- The year 2023 was crucial for the IT service desk as it highlighted specific needs that were previously unnoticed but now require attention. In 2024, the ITSM (information technology) scene is rapidly changing. Emerging trends in IT service management are gaining prominence and heralding a revolution in employee IT support and technical assistance. Therefore, it is essential for IT service desk managers to stay updated with the latest ITSM trends and their potential impacts.

- The trend of AITSM represents a significant change brought about by Generative AI and modern automation. By utilizing GenAI, this innovative method can proactively and efficiently automate IT requests, actions, and tasks within the IT service desk. Nowadays, leading organizations are adopting GenAI, which has a significant impact on ITSM. When advanced Generative AI is integrated into IT service management operations, businesses can benefit from increased productivity and best practices for resolving various IT-related issues.

- AITSM enhances the efficiency and accuracy of IT support and establishes a foundation for a more responsive and proactive service environment. It incorporates advanced features such as intelligent ticket routing and predictive issue resolution, significantly improving IT service management quality. The success of companies that utilize AITSM will be determined by their ability to leverage the cognitive powers of Generative AI, enabling them to usher in a new era of IT service management characterized by innovation, responsiveness, and efficiency.

- The COVID-19 pandemic significantly impacted the technology industry, caused disruptions in the supply chain value chain, and created threats of commodity inflation. The pandemic also led to a surge in remote work and a heightened focus on evaluating and reducing risks in the end-to-end value chain, which, in turn, fueled the demand for IT service management.

Information Technology Service Management Market Trends

The IT and Telecommunication Segment is Expected to Hold a Significant Market Share

- Modernizing IT service management for IT and telecom sectors is an evolved approach. This bridges the gap between traditional, on-premise, and cloud-based IT systems. It increases operational efficiency and effectiveness. Thus, consolidating how data is captured, analyzed, and shared across enterprises provides an improved experience for internal IT employees and external constituents.

- With rapid technological advancements, telecom businesses are continually focusing on innovation. Thus, they focus on upgrading their infrastructure while developing state-of-the-art solutions to serve their customers, including innovation, customer service, infrastructure setup, and human resources.

- Moreover, the implementation of ITSM solutions helps telecom enterprises gain unified visibility into invoices, expenses, usage, and assets across their entire communications, cloud, and software license portfolio. Thus, it reduces overall costs and enhances productivity, mainly by improving visibility, while providing a finely tuned set of processes to manage existing IT infrastructure. Moreover, IT companies are focusing on adopting ITSM with the increasing demand across the cloud-based models. With the growing adoption of cloud-based ecosystems, companies have expanded their partnership through new offerings across the cloud platform.

- Furthermore, the increase in content across IT enterprises is synced with adding new channels and changing processes. The proliferation of ITSM solutions due to the emergence of social media and smart devices is expected to increase the need to handle transactional and business content and social content to enable content mobilization across different digital channels.

- According to 5G Americas, growth in 5G subscriptions is expected to continue into the foreseeable future, reaching 3 billion subscriptions in two years. That includes 600 million subscriptions over the next two years.

North America is Expected to Hold a Significant Share in the Market

- The region is witnessing an influx in the adoption of IT service solutions to increase efficiency and maintain the productivity of organizations.

- Digital performance management provides performance insights and enables real-time, closed-loop problem-solving. It delivers one universal view of performance, communicated in understandable business metrics: hours. The metrics are easily understandable for frontline workers, managers, and executives and provide a foundation for an enterprise-scale solution.

- Furthermore, the government of Canada has a 'cloud-first' strategy, where cloud services are identified and evaluated as the principal delivery option while initiating information technology investments, initiatives, strategies, and projects. The cloud is also expected to allow the government of Canada to harness the innovation of private-sector providers to make its information technology more agile.

- The recent technological trends, such as enhanced cloud infrastructure, IoT-enabled ecosystem, and the rising application of cognitive computing, provided opportunities to create new business imperatives across the US IT sector.

- The market is witnessing the growth of cloud-based ITSM, owing to the rapid adoption of BYOD policies for improved productivity, employee satisfaction, and cost-effectiveness. These policies require remote accessibility of information, which is facilitated by cloud-based ITSM solutions.

- Owing to remote working practices during the COVID-19 pandemic, most organizations are also taking preventive measures to secure their mobile devices and equipment provided to the employees. The Canadian Centre for Cyber Security encourages the Canadian cybersecurity community, especially critical infrastructure network defenders, to bolster their awareness of and protection against Russian state-sponsored cyber threats. The Cyber Centre joins US and UK partners in recommending proactive network monitoring and mitigations.

Information Technology Service Management Industry Overview

The information technology service management market is highly fragmented, with the presence of major players like IBM Corporation, ASG Technologies Group Inc. (Rocket Software), Atlassian Corporation PLC, Micro Focus International PLC (Open Text Corporation), and Broadcom Inc. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023: EY and IBM jointly launched EY.ai Workforce, an innovative HR solution enabling organizations to integrate artificial intelligence (AI) into their key HR business processes. This collaboration between the companies is a significant milestone in the role of AI, which is aimed at increasing productivity within the HR function.

- November 2023: Atlassian Corporation, the company behind popular tools like Jira, Confluence, and Bitbucket, acquired AirTrack, a leading IT data quality management technology provider. This acquisition is part of Atlassian's ongoing efforts to help businesses adopt a comprehensive asset and configuration management approach. By combining the capabilities of AirTrack and Jira Service Management, enterprises can keep track of all their critical assets more effectively, thereby reducing operational risks, costs, and attack surfaces.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Adoption of Updated IT Infrastructure Across End-user Industries

- 5.1.2 Increasing Demand for a Unified Platform to Manage and Monitor IT Infrastructure Performance

- 5.2 Market Restraints

- 5.2.1 Issues in ITSM Implementation and Lack of Quality Standards in Service-level Agreement

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud

- 6.1.2 On-premise

- 6.2 By Application

- 6.2.1 Configuration Management

- 6.2.2 Performance Management

- 6.2.3 Network Management

- 6.2.4 Database Management Systems

- 6.2.5 Other Applications

- 6.3 By End-user Industry

- 6.3.1 BFSI

- 6.3.2 Manufacturing

- 6.3.3 Government and Education

- 6.3.4 IT and Telecommunication

- 6.3.5 Retail

- 6.3.6 Travel and Hospitality

- 6.3.7 Healthcare

- 6.3.8 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 ASG Technologies Group Inc.

- 7.1.3 Atlassian Corporation PLC

- 7.1.4 Micro Focus International PLC

- 7.1.5 Broadcom Inc.

- 7.1.6 Axios Systems

- 7.1.7 BMC Software Inc. (Kohlberg Kravis Roberts & Co. LP )

- 7.1.8 Freshworks Inc.

- 7.1.9 Ivanti Inc.

- 7.1.10 ServiceNow Inc.

8 VENDOR COMPETITIVENESS

- 8.1 Vendor Market Revenue, 2023

- 8.2 Vendor Comparative Analysis