|

市场调查报告书

商品编码

1626309

北美居家医疗包装:市场占有率分析、行业趋势和成长预测(2025-2030)North America Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

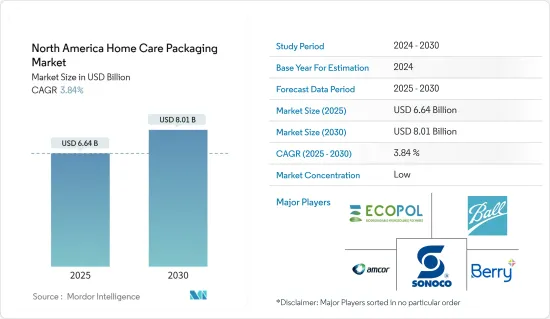

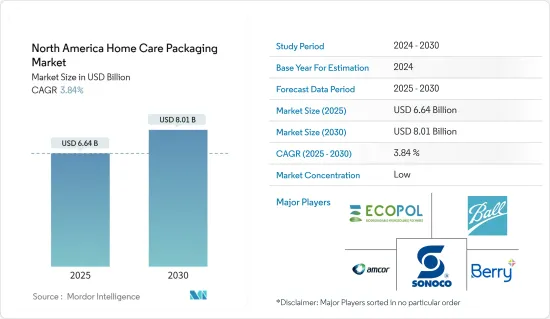

北美居家医疗包装市场规模预计到2025年为66.4亿美元,预计到2030年将达到80.1亿美元,预测期内(2025-2030年)复合年增长率为3.84%。

主要亮点

- 北美家庭护理市场正在经历显着的成长和演变。商店货架上摆满了各种家用清洁产品,从洗衣精到喷雾清洁剂。居家医疗市场涵盖了一系列以清洗和卫生为重点的产品。这包括餐具清洁剂、杀虫剂、衣物洗护产品、盥洗化妆用品、抛光剂、空气清净产品等。这些产品具有创新功能,例如易开盖、可重新密封的封口和符合人体工学的手柄。在包装居家医疗产品时,重点不仅在于吸引人的设计,还在于安全性、功能性和易用性。

- 价格低廉、易于使用和易于储存等包装趋势仍然是居家医疗包装市场的主要消费趋势。较小的包装尺寸为消费者提供了更大的负担能力,正在成为寻求市场竞争的品牌所有者的更首选选择。

- 此外,越来越多的公司正在采用填充用解决方案。肥皂、清洁剂和清洁剂的填充用袋让消费者可以重复使用家中现有的瓶子、喷雾剂和分配器。这些轻质袋子易于运输,并支持在线购买补充装产品的不断增长的趋势。此外,可自订的立式袋不仅提供了直觉的分配系统,而且还提供了额外的保护,以应对电子商务履约的挑战。值得注意的是,Amcor 的填充用居家医疗袋系列符合新的电子商务标准 ISTA6A。

- 在该地区,塑胶和金属是洗护用品和居家医疗产品(例如清洁剂瓶和抛光剂储存器)的主要包装材料。随着该产品类型的不断扩大,对这些材料的需求预计也会增加。在北美,宝洁 73% 的织物护理包装是可回收的,其中包括汰渍、Gain 和 Downy 等品牌。宝洁有着雄心勃勃的目标,旨在到 2023年终将这一数字提高到 99% 以上的可回收率。这些倡议将支持市场成长。

- 然而,由于能源价格空前上涨,油价飙升正在推高整个供应链的塑胶树脂成本。此外,玻璃产业因能源供应问题而面临挑战,因为熔砂、碱灰和石灰石等製程属于能源密集。因此,原物料价格的波动可能会阻碍市场成长。

- 製造商正在开发包装解决方案,最大限度地减少原始材料的使用,并促进消费者回收 (PCR) 和工业回收 (PIR)。除了专注于消费者回收之外,许多供应商还巧妙地关注製造过程中产生的废弃物的回收和循环。此外,该公司正在探索生质塑胶(生物基塑胶树脂)作为进一步减少碳排放的策略。

- 此外,许多北美包装製造商正在采用永续包装解决方案,其中包括专门生产植物来源清洗产品的 Puracy。他们从一次性塑胶开始,转向可再填充的瓶子、袋子,最后选择了 Clean Can 系统,该系统具有可填充的铝罐。包装选择的这种演变将推动该地区对居家医疗包装的需求。

- 除此之外,加拿大的 Craft Naturals 还推出了可回收罐装的洗手剂和洗髮水,兼具便利性和永续性。客户可以将罐中的内容物转移到填充用的瓶子中,或者将泵式分配器直接连接到可回收铝罐的顶部。此举突显了家居产品优先考虑永续性的日益增长的趋势。

北美居家医疗包装市场趋势

餐具清洁剂预计将占据较大份额

- 都市化和消费支出的增加是该地区洗碗机产品需求不断增长的关键因素。人们健康和卫生意识的提高,加上消费者支出的增加,推动了对居家医疗产品(尤其是洗碗产品)的强劲需求。联合国人类居住规划署(UN-HABITAT)的资料凸显了这个趋势。 2020年,北美82.6%的人口居住在都市区,预计到2050年这数字将上升至89%。城市人口的快速成长将进一步推动对居家医疗产品的需求。

- 人们对传统餐具清洁剂中有害化学物质的认识不断提高,导致对有机餐具清洁剂和液体清洁剂的需求激增。为此,知名品牌在行销其产品时贴上「100%天然」、「不含化学物质」和「经过皮肤病学测试」等有吸引力的标籤,以吸引有环保意识的消费者。例如,2023 年 1 月,True Earth 增加了新的家居清洗产品系列。洗碗机清洁剂片声称是环保的,旨在最大限度地减少一次性塑胶废物。这款平板电脑设计用途广泛,可有效清洗洗碗机、餐具和烹调器具。每片药片都能对抗油脂和污渍,并具有内置漂洗助剂,让您的餐具保持光亮洁净。

- 此外,该地区的众多品牌以具有竞争力的价格提供优质产品。这些品牌专注于提供具有视觉吸引力的包装形式的餐具清洁剂和餐具液体。多家工业公司正在合作推出完全可回收的单一材料软质塑胶包装。

- 例如,2022 年,Mondi 与 Reckitt Benckiser Group 合作,为 Finish 洗碗机平板电脑 Quantum Ultimate 推出完全可回收的单一材料软质塑胶包装。 Mondi 为 RB 的高阶洗碗机平板电脑「Finish」系列提供 Barrier Pack 回收包装。相比之下,RB 的 Finish 洗碗机锭剂系列传统上使用不可回收的多层、多袋、多材料层压材料。这项采用新的回收包装的措施符合利洁时在 2025 年实现 100% 可回收塑胶包装的承诺。

- 在餐具洗涤产品需求激增的推动下,这些发展支撑了该地区居家医疗包装产业的成长。

塑胶包装引领市场

- 塑胶在瓶子、袋子和罐子等主要包装形式中的广泛使用为这种材料建立了强大的市场。由于其固有的柔韧性、强度和耐用性,塑胶成为包装各种产品的首选,从液体到乳霜再到粉末。与许多其他材料不同,塑胶的延展性使其可以轻鬆模製成各种形式。

- 推动塑胶产品需求的关键因素包括零售业的扩张、双收入家庭的增加以及居家医疗产品对宝特瓶的需求不断增长。除了宝特瓶的优势特性外,防篡改瓶盖和瓶盖等创新也越来越受到关注,并为品牌所有者创造了显着的附加价值。因此,这一趋势正在推动许多居家医疗产品中采用塑胶。

- 此外,在北美,公司正在优先考虑回收工作,作为对抗海洋塑胶污染和解决贫穷的关键策略。该倡议旨在提高回收意识并倡导负责任地使用塑胶。每个回收的瓶子都代表了参与该计划的企业的新收入来源和经济机会。例如,美国庄臣公司推出了世界上第一个Windex品牌的100%回收海洋塑胶瓶,作为其致力于遏制海洋塑胶污染的标誌。

- 此外,汉高也与塑胶银行合作,将社会塑胶纳入其美容护理和消费品的包装中。两家公司都致力于减少海洋中的塑胶废弃物并重建贫困社区。汉高采取了一项引人注目的倡议,与塑胶银行(Plastic Bank)合作,这是一家社会企业,致力于在塑胶废弃物到达海洋和水道之前阻止其进入。透过我们的衣物洗护和美容护理部门,汉高提供完全由再生塑胶製成的产品包装。此外,多达一半的包装是由社会来源的塑胶製成的,这些塑胶是主动采购的,以防止它们进入海洋和水道。

- 根据《Happi》杂誌报道,2023年,全能清洁剂和消毒水位居美国家庭清洗产品榜首,销售额超过17亿美元。其次是马桶清洁剂,销售额接近 6.6944 亿美元。销售额的激增预计将推动预测期内的市场成长。

- 然而,对塑胶对环境影响的担忧,加上容易获得纸张、金属和玻璃等环保替代品,导致过去十年市场成长放缓。随着生物分解性塑胶的出现和回收工作的改进,塑胶有望继续在居家医疗包装中占有一席之地。

北美居家医疗包装产业概况

北美居家医疗包装市场竞争激烈,有多个主要参与者。从市场占有率来看,目前少数大公司占据市场主导地位。这些拥有重要市场占有率的领先公司也在扩大海外基本客群。这些公司利用策略合作计划来增加市场占有率和盈利。居家医疗包装製造商拥有多种解决方案来帮助品牌实现零售包装。无论品牌需要运输包装还是促销捆绑包,这些製造商都会优先考虑每个品牌的特定需求。

此外,居家医疗产品製造商确保瓶子具有引人注目、有吸引力、可持续和功能性的设计。我们的包装专家专注于永续性,提供自订的多层选项,帮助您的产品在货架上大放异彩。例如,总部位于美国的 Graham Packaging 专门从事居家医疗包装,并采用 AccuStrength 等技术。这使我们能够生产出轻质容器,不仅能保持性能,还能减少塑胶消耗和货运成本。此外,这些可回收包装可以含有消费后树脂 (PCR),帮助品牌实现永续性目标。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- 市场驱动因素

- 对轻量填充用袋的需求迅速增加

- 对植物来源清洗产品的需求不断增长

- 市场限制因素

- 油价上涨阻碍市场成长

第五章市场区隔

- 依材料类型

- 塑胶

- 纸

- 金属

- 玻璃

- 依产品类型

- 瓶子

- 能

- 纸盒

- 小袋

- 其他的

- 按居家医疗产品

- 清洁剂

- 杀虫剂

- 衣物洗护

- 洗护用品

- 抛光

- 空气护理

- 其他居家医疗产品

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- Amcor PLC

- Berry Global Inc.

- Ball Corporation

- AptarGroup Inc

- Sonoco Products Company

- Silgan Holdings

- Constantia Flexibles Group GmbH

- DS Smith Plc

- Can-Pack SA

- Ecopol America Inc.

第七章 投资分析

第八章 市场机会及未来趋势

The North America Home Care Packaging Market size is estimated at USD 6.64 billion in 2025, and is expected to reach USD 8.01 billion by 2030, at a CAGR of 3.84% during the forecast period (2025-2030).

Key Highlights

- The North American homecare market is experiencing significant growth and evolution. Store shelves are filled with a diverse range of household cleaning products, from laundry detergents to spray cleaners. The homecare market covers a broad spectrum of products focused on cleaning and hygiene. This includes dishwashing agents, insecticides, laundry care items, toiletries, polishes, air care products, and others. These products frequently feature innovations such as easy-to-open caps, resealable closures, and ergonomic handles. When packaging home care products, key considerations extend beyond just appealing design to include safety, functionality, and user-friendliness.

- Packaging trends, such as low cost, ease of use, and easy storage, have remained the major consumer trends in the home care packaging market. Small pack sizes, offering affordability to the entire consumer base, have emerged as more favorable alternatives among brand owners seeking a competitive edge in the market.

- Additionally, companies are increasingly adopting refill solutions. Refill pouches for soaps, cleaners, and detergents enable consumers to reuse their existing bottles, sprayers, and dispensers at home. These lightweight pouches, which are easy to ship, cater to the growing trend of purchasing refill products online. Furthermore, customizable stand-up pouches not only provide an intuitive dispensing system but also offer enhanced protection, ensuring they endure the challenges of e-commerce fulfillment. Notably, Amcor's range of refill-ready home care pouches aligns with the new e-commerce standard, ISTA6A.

- Plastic and metal dominate as the preferred packaging materials for toiletries and home care products, including detergent bottles and polish storage items in the region. As this product category continues to expand, the demand for these materials is projected to rise in tandem. In North America, 73% of P&G's fabric care packaging, encompassing brands like Tide, Gain, and Downy, is recyclable. P&G has set an ambitious target, aiming to elevate this figure to over 99% recyclability by the close of 2023. These initiatives are poised to bolster market growth.

- However, rising oil prices are inflating the cost of plastic resins throughout the supply chain, driven by unprecedented surges in energy prices. Additionally, the glass industry faces challenges due to energy supply concerns, as processes like melting sand, soda ash, and limestone are energy-intensive. Consequently, fluctuations in raw material prices are poised to impede market growth.

- Nevertheless, manufacturers are developing packaging solutions that minimize the use of virgin materials and enhance the rates of post-consumer (PCR) and post-industrial (PIR) recycling. Beyond the emphasis on consumer recycling, numerous vendors have adeptly focused on collecting and recycling waste generated during the manufacturing process. Additionally, companies are exploring bioplastics (bio-based plastic resins) as a strategy to further diminish their carbon footprint.

- Furthermore, many North American packaging manufacturers, including Puracy, a company specializing in plant-based cleaning products, are increasingly adopting sustainable packaging solutions. Puracy has transitioned through several packaging stages: starting from disposable plastic, moving to a refillable bottle, then a pouch, and finally settling on the Clean Can system, which features a refillable aluminum can. This evolution in packaging choices is poised to drive up the demand for home care packaging in the region.

- In addition to this, Craft Naturals, a Canadian company, is introducing hand soaps and shampoos packaged in recyclable cans, merging convenience with sustainability. Customers can either transfer the contents of the can into a refillable bottle or directly attach a pump dispenser to the top of the recyclable aluminum can. This move underscores the rising trend of prioritizing sustainability in household products.

North America Home Care Packaging Market Trends

Dishwashing is expected to Hold a Significant Share

- Urbanization and rising consumer spending are key drivers behind the growing demand for dishwashing products in the region. Heightened awareness of health and hygiene, coupled with increased consumer spending, has spurred a robust demand for home care products, particularly dishwashing items. Data from the United Nations Human Settlements Programme (UN-HABITAT) highlights this trend: In 2020, 82.6% of North America's population resided in urban areas, with projections suggesting this figure will climb to 89% by 2050. This urban population surge is poised to boost the demand for home care products further.

- Growing awareness of the harmful chemicals in conventional dishwashing products is driving a surge in demand for organic dishwashing detergents and liquids. In response, leading brands are promoting their offerings with appealing labels like "100% Natural," "Chemical-Free Formulations," and "Dermatologically Tested," aiming to attract eco-conscious consumers. For example, in January 2023, Tru Earth unveiled a new addition to its household cleaning lineup. Their dishwasher detergent tablets, touted as eco-friendly, aim to minimize single-use plastic waste. Designed for versatility, these tablets effectively clean dishwashers, flatware, and cookware. Each tablet tackles grease and stains and features an integrated rinse aid, ensuring dishes come out sparkling clean-all while being gentle on the environment.

- Moreover, numerous brands in the region are offering high-quality products at competitive prices. These brands focus on delivering dishwashing soaps and liquids in visually appealing packaging formats. Several industry players collaborate to launch fully recyclable, mono-material flexible plastic packaging.

- For instance, in 2022, Mondi partnered with Reckitt Benckiser Group to unveil a fully recyclable, mono-flexible plastic packaging for their Finish Dishwasher Tablet Quantum Ultimate. Mondi supplied the BarrierPack recycled packaging for RB's premium Finish dishwasher tablet line. In contrast, RB's Finish dishwasher tablet range previously utilized a non-recyclable, multi-layered, multi-pouch, multi-material laminate. This shift to new recycled packaging aligns with RB's commitment to achieving 100% recyclable plastic packaging by 2025.

- These developments underscore the growth of the home care packaging industry, driven by the surging demand for dishwashing products in the region.

Plastic Packaging is Driving the Market

- Plastic's prevalent use in key packaging forms, including bottles, pouches, and jars, has established a robust market for the material. Its inherent flexibility, strength, and durability make plastic the preferred choice for packaging a diverse range of products, from liquids to creams and powders. Unlike many other materials, plastic's malleability allows it to be easily molded into various shapes.

- Key drivers fueling the demand for plastic products include the expansion of the retail sector, the rise of dual-income households, and a growing appetite for PET bottles in home care products. Beyond its advantageous properties, innovations such as tamper-evident caps and closures are gaining traction, adding significant value for brand owners. Consequently, this trend has bolstered the adoption of plastics in many home care products.

- Additionally, companies are prioritizing recycling initiatives in North America as a key strategy to combat ocean-borne plastic pollution and tackle poverty. The initiative seeks to enhance recycling awareness and advocate for responsible plastic usage. Each recycled bottle symbolizes a fresh revenue stream or economic chance for those involved in the program. For instance, SC Johnson, a US-based firm, has unveiled the globe's inaugural 100% recycled ocean plastic bottle under its Windex brand, a testament to its commitment to curbing oceanic plastic pollution.

- Moreover, Henkel has partnered with Plastic Bank to integrate social plastic into the packaging of its beauty care products and those from its consumer business units. Both companies are committed to reducing plastic waste in oceans and uplifting impoverished communities. In a notable move, Henkel has joined forces with Plastic Bank, a social enterprise focused on intercepting plastic waste before it reaches oceans and waterways. Through its laundry and beauty care divisions, Henkel has rolled out product packaging made entirely from recycled plastic. Additionally, up to half of this packaging will feature social plastic, sourced proactively to prevent it from entering oceans or waterways.

- As reported by Happi Magazine, in 2023, all-purpose cleaners and disinfectants topped the list of household cleaning products in the U.S., achieving sales surpassing USD 1.70 billion. Toilet bowl cleaners followed, with sales nearing USD 669.44 million. This surge in sales is expected to drive market growth during the forecast period.

- However, concerns regarding the environmental impact of plastics, combined with the easy access to eco-friendly alternatives such as paper, metal, and glass, have slowed market growth over the last decade. Nevertheless, with the emergence of biodegradable plastics and improved recycling initiatives, plastics are poised to retain their presence in home care packaging.

North America Home Care Packaging Industry Overview

The North American home care packaging market is competitive and has several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent market share are expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase market share and profitability. Home care packaging manufacturers are equipped with diverse solutions, assisting brands in achieving retail-ready packaging. Whether brands need transit packaging or promotional bundles, these manufacturers prioritize each brand's specific needs.

Furthermore, home care product makers ensure their bottles grab attention and boast attractive, sustainable, and functional designs. With an emphasis on sustainability, packaging experts offer custom multi-layer options to help products shine on the shelf. For instance, U.S.-based Graham Packaging, a manufacturer specializing in home care packaging, utilizes technologies such as AccuStrength. This enables them to produce lightweight containers that not only maintain performance but also reduce plastic consumption and freight expenses. Furthermore, these recyclable packages have the capability to include post-consumer resin (PCR), supporting brands in meeting their ambitious sustainability goals.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Market Drivers

- 4.4.1 Surging Demand Of Refillable Light Weight Pouches

- 4.4.2 Growing Demand for Plant-based Cleaning Products

- 4.5 Market Restraints

- 4.5.1 Growing Oil Prices to Hinder Market Growth

5 MARKET SEGMENTATION

- 5.1 By Material Type

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Product Type

- 5.2.1 Bottles

- 5.2.2 Cans

- 5.2.3 Cartons

- 5.2.4 Pouches

- 5.2.5 Other Products Types

- 5.3 By Home Care Products

- 5.3.1 Dishwashing

- 5.3.2 Insecticides

- 5.3.3 Laundry Care

- 5.3.4 Toiletories

- 5.3.5 Polishes

- 5.3.6 Air Care

- 5.3.7 Other Home Care Products

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor PLC

- 6.1.2 Berry Global Inc.

- 6.1.3 Ball Corporation

- 6.1.4 AptarGroup Inc

- 6.1.5 Sonoco Products Company

- 6.1.6 Silgan Holdings

- 6.1.7 Constantia Flexibles Group GmbH

- 6.1.8 DS Smith Plc

- 6.1.9 Can-Pack SA

- 6.1.10 Ecopol America Inc.