|

市场调查报告书

商品编码

1637843

中东和非洲的居家医疗包装:市场占有率分析、行业趋势和成长预测(2025-2030)MEA Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

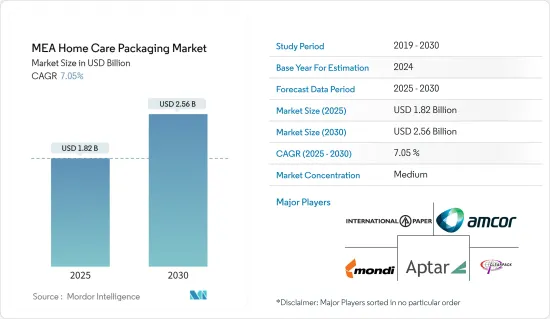

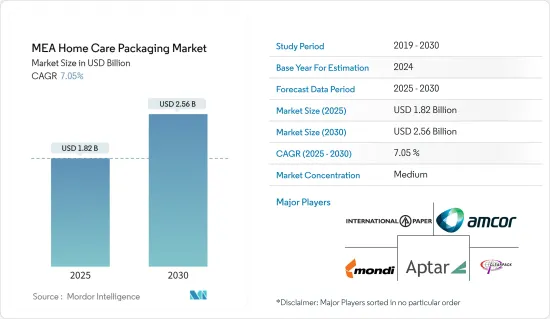

中东和非洲居家医疗包装市场规模预计到 2025 年为 18.2 亿美元,预计到 2030 年将达到 25.6 亿美元,预测期内(2025-2030 年)复合年增长率为 7.05%。

主要亮点

- 居家医疗包装市场包括专为清洗和卫生而设计的产品。低廉的包装、使用的便利性和储存的便利性在整个评估期间保持了主要的消费趋势。对于希望在市场上竞争的品牌所有者来说,较小的包装尺寸正在成为更具吸引力的选择,因为它们对整个客户群来说更实惠。

- 塑胶是包装居家医疗产品最常用的材料之一。儘管产业成长缓慢,但居家医疗包装的创新层出不穷,尤其是衣物洗护领域。虽然已开发国家的销售和收益低迷,但小瓶装推动了销售的成长,这使得洗衣精在新兴市场更便宜。

- 餐具清洁剂、清洁清洁剂、地板清洁剂家居用品均采用宝特瓶包装。公司正在采用新的包装和标籤方法,以保持其产品的可回收性。

- 此外,南非消费者预计需要具有可靠性和可负担性等基本特征的优质产品。该地区的消费者通常会根据当地的生活方式、习俗和承受能力来选择本地或国际品牌。

- 人口成长通常会导致对清洗产品、洗衣精和个人保养用品等居家医疗产品的需求增加。因此,用于容纳和分发这些产品的包装需要相应增长。根据国际货币基金组织(IMF)预测,2023年至2028年阿曼总人口预计将持续成长90万人(增幅17.68%)。

- 中东和非洲居家医疗包装市场面临可能影响其成长和永续性的挑战。关键挑战之一是克服中东和非洲各地不同的监管障碍,这通常会导致包装标准和环境法规的复杂问题。此外,市场面临原物料价格不可预测的波动,这可能会影响生产成本和定价策略。

中东和非洲居家医疗包装市场趋势

瓶装市场预计将显着成长

- 儘管行业增长缓慢,但居家医疗包装的创新仍然很多,特别是在衣物洗护。儘管已开发国家的销售和收益低迷,但新兴市场正在透过将洗衣剂製成更小、更易于每个人使用的瓶子来促进洗衣精的大规模销售。

- 随着卫生意识的增强,尤其是在疫情等事件期间,对消毒剂、消毒剂和清洗产品等居家医疗产品的需求激增。这种增加的需求需要瓶子来容纳和分发这些产品。

- 强调卫生和安全的包装可以增强消费者的信心。在健康和清洁问题驱动的市场中,消费者更有可能信任并购买包装强调卫生特性的产品。

- 保持卫生标准的永续且环保的瓶子包装选择越来越受欢迎。消费者关心他们的个人健康和环境,可生物分解性材料等环保包装选择可以符合这些价值。

- 近年来,该地区的住宅数量有所增加。根据 Sidran Institute 和 Sidra Capital 的数据,沙乌地阿拉伯的住宅拥有率预计将从 2017 年的 49.9% 大幅增加到 2030 年的约 70%。因此,对家居产品的需求预计也会相应增加,从而推动市场成长。

纸包装经历显着成长

- 人们对塑胶包装使用日益增长的环境担忧正在推动产业寻找永续包装。零售商实施的减少塑胶和回收措施,以及有关法律行动的政治辩论,引起了媒体的关注,并提高了消费者对塑胶对野生动物和环境造成的巨大问题的认识。

- 纸张比塑胶更容易生物分解性,并且可以轻鬆回收。它还可以在不发生化学反应的情况下重新製浆,并且不易受到污染。为此,一些知名品牌正在用纸质包装取代塑胶包装。

- 公司和品牌越来越多地投资于永续包装解决方案,例如可堆肥压缩纸瓶。与相同尺寸的普通塑胶瓶相比,这些纸瓶可节省 60-70% 的塑胶材料,并声称可堆肥和可回收。瓶子由外壳和内袋组成,设计易于拆卸和回收。使用后,外壳会从内袋中弹出,使其可回收性提高 7 倍,甚至堆肥。因此,对纸质和塑胶包装减少的居家医疗的需求不断增加,预计将促进该地区的市场成长。

- 人口成长可能会增加进入居家医疗市场的参与企业数量,导致品牌之间的竞争加剧。为了在这一竞争格局中脱颖而出,公司可以投资创新的包装设计和材料,以使其产品脱颖而出并吸引消费者。根据国际货币基金组织(IMF)的数据,2022年阿联酋人口居住987万,预计2028年将增加至1,100万。

- 双收入家庭的成长趋势预计将推动居家医疗包装市场的成长。混合纸瓶有效地传达了您的品牌对消费者的承诺,并产生了巨大的影响。其独特的纤维外壳在货架上脱颖而出,使其与邻近的包装区分开来,吸引了消费者。

中东和非洲居家医疗包装产业概况

中东和非洲居家医疗包装市场已减少一半。主要参与企业包括 Amcor Group GmbH、Mondi Group、International Paper、ClearPack 和 Aptar Group。

- 2023 年 7 月,包装专家 ALPLA 推出了名为 ALPLARECYCLING 的新品牌。该塑胶包装公司拥有 13 家工厂,其中 4 家是与当地合作伙伴的合资企业。到 2025 年,该公司计划加工至少 25% 的 PCR 材料。包装专家 ALPLA 计划在南非、罗马尼亚和泰国投资数百万美元建造新工厂并扩建波兰工厂后,将其所有业务合併到 ALPLA Recycling 名下。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 当前政治局势对市场的影响

第五章市场动态

- 市场驱动因素

- 可持续包装的需求增加

- 中东和非洲居家医疗产品增加

- 市场限制因素

- 政府对塑胶使用的规定

第六章 市场细分

- 按材质

- 塑胶

- 纸

- 金属

- 玻璃

- 依产品类型

- 瓶子

- 金属罐

- 纸盒

- 瓶子

- 小袋

- 其他的

- 副产品

- 洗碗

- 杀虫剂

- 衣物洗护

- 洗护用品

- 抛光

- 空气护理

- 其他的

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

第七章 竞争格局

- 公司简介

- Amcor Group GmbH

- Mondi Group

- Clearpack Group

- International Paper

- AptarGroup, Inc.

- ALPLA Werke Alwin Lehner GmbH & Co KG

- Ball Corporation

- Sonoco Products Company

- DS Smith PLC

- Tetra Laval Group

第八章投资分析

第9章市场的未来

简介目录

Product Code: 47774

The MEA Home Care Packaging Market size is estimated at USD 1.82 billion in 2025, and is expected to reach USD 2.56 billion by 2030, at a CAGR of 7.05% during the forecast period (2025-2030).

Key Highlights

- The home care packaging market encompasses products designed for cleaning and hygiene. Low-cost packaging, convenience of use, and convenient storage have maintained key consumer trends throughout the assessment. Small pack sizes, which are more affordable to the whole customer base, have emerged as more appealing options for brand owners looking to acquire a competitive edge in the market.

- Plastic is one of the most used materials for home care product packaging. Home care packaging innovations have been numerous, particularly in laundry care, despite the industry's modest growth. While sales and revenues stagnate in developed countries, developing markets are driving volume sales through small bottle sizes that make laundry detergent affordable.

- Household products, such as dishwashing liquids, toilet cleaners, and floor-cleaning acids, are packaged in PET bottles. Companies are taking new packaging and labeling approaches to maintain the recyclability of their products.

- Furthermore, South African consumers are expected to demand high-quality products with essential features like reliability and affordability. Consumers in this region usually opt for local or international brands depending on local lifestyles, customs, and affordability.

- A growing population typically leads to increased demand for home care products such as cleaning agents, laundry detergents, and personal care items. This necessitates corresponding growth in packaging to contain and distribute these products. According to the International Monetary Fund, The total population in Oman is expected to continuously increase between 2023 and 2028 by 0.9 million people (+17.68%).

- The Middle East and African home care packaging market faces challenges that can impact its growth and sustainability. One significant challenge is navigating through regulatory hurdles, which vary across the Middle East and Africa, often posing complexities related to packaging standards and environmental regulations. Additionally, the market contends with the unpredictability of fluctuating raw material prices, which can affect production costs and pricing strategies.

MEA Home Care Packaging Market Trends

The Bottles Segment is Anticipated to Witness Significant Growth

- Home care packaging innovations have been numerous, particularly in laundry care, despite the industry's modest growth. While sales and revenues are stagnating in developed countries, developing markets are driving volume sales through small bottle sizes that make laundry detergent affordable to all.

- Heightened hygiene awareness, especially during events such as a pandemic, results in a surge in demand for home care products like disinfectants, sanitizers, and cleaning agents. This increased demand requires bottles to contain and distribute these products.

- Packaging that emphasizes hygiene and safety features can enhance consumer confidence. In a market driven by health and cleanliness concerns, consumers are more likely to trust and purchase products with packaging that highlights their hygienic properties.

- Sustainable and eco-friendly bottle packaging options that maintain hygiene standards are becoming increasingly popular. Consumers are concerned about personal health and the environment, and eco-friendly packaging options, like biodegradable materials, can align with these values.

- In the past few years, the number of homeowners in the region has been rising. According to the Sidran Institute and Sidra Capital, the share of home ownership in Saudi Arabia is expected to increase significantly from 49.9% in 2017 to around 70% in 2030. Consequently, the demand for home products is also expected to increase proportionally, bolstering market growth.

Paper Packaging is Observing Notable Growth

- Increasing environmental concerns over the use of plastic packaging are driving industries to look for sustainable packaging. Retailers' implementation of plastic-reducing and recycling measures and political discussions of legal measures have created media attention, raising consumer awareness of the enormous problem plastics can pose to wildlife and the environment.

- Paper is far more biodegradable than plastic and can be easily recycled. It can also be re-pulped without chemical reactions and is less sensitive to contamination. This has led to some established brands replacing plastic packaging with paper.

- Companies and brands are increasing their investment in sustainable packaging solutions, like compostable compressed paper bottles. These paper bottles claim to save 60-70% of plastic material compared to regular plastic bottles of the same size and are both compostable and recyclable. Comprised of an outer shell and an inner pouch, this bottle is made to disassemble for recycling easily. The outer shell pops away from the internal bag after use and can be recycled up to seven times more or composted. Therefore, increasing demand for paper-based packaging and less plastic packaging in-home care is expected to augment market growth in this region.

- The growing population can attract more players into the home care market, leading to increased competition among brands. To stand out in this competitive landscape, companies may invest in innovative packaging designs and materials to differentiate their products and attract consumers. According to the International Monetary Fund, in 2022, approximately 9.87 million inhabitants lived in the United Arab Emirates, and this figure is estimated to grow to 11 million by 2028.

- The rising trend of dual-income households is expected to drive growth in the home care packaging market. Hybrid paper bottles effectively communicate a brand's commitment to consumers, making a significant impact. Their unique fiber shell stands out on shelves, setting them apart from neighboring packaging and captivating consumers.

MEA Home Care Packaging Industry Overview

The Middle East and African home care packaging market is semi-fragmented. Some of the major players in the market are Amcor Group GmbH, Mondi Group, International Paper, ClearPack, and Aptar Group.

- July 2023: ALPLA, a packaging expert, introduced a new brand called ALPLARECYCLING. There were 13 facilities owned by the plastic packaging company, including four joint ventures with local partners. By 2025, the company plans to process at least 25% PCR material. Packaging expert ALPLA is expected to unify all its operations under the name ALPLArecycling after investing millions into new facilities in South Africa, Romania, Thailand, and a site extension in Poland.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Value Chain/Supply Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of the Current Geo-Political Scenario on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Sustainable Packaging

- 5.1.2 Augmenting Home Care Products In MEA Region

- 5.2 Market Restraints

- 5.2.1 Government Regulation for Plastic Usage

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Products Type

- 6.2.1 Bottles

- 6.2.2 Metal Cans

- 6.2.3 Cartons

- 6.2.4 Jars

- 6.2.5 Pouches

- 6.2.6 Others

- 6.3 By Products

- 6.3.1 Dishwashing

- 6.3.2 Insecticides

- 6.3.3 Laundry Care

- 6.3.4 Toiletries

- 6.3.5 Polishes

- 6.3.6 Air Care

- 6.3.7 Others

- 6.4 By Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 South Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Mondi Group

- 7.1.3 Clearpack Group

- 7.1.4 International Paper

- 7.1.5 AptarGroup, Inc.

- 7.1.6 ALPLA Werke Alwin Lehner GmbH & Co KG

- 7.1.7 Ball Corporation

- 7.1.8 Sonoco Products Company

- 7.1.9 DS Smith PLC

- 7.1.10 Tetra Laval Group

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219