|

市场调查报告书

商品编码

1628724

北美个人护理包装:市场占有率分析、行业趋势和成长预测(2025-2030)NA Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

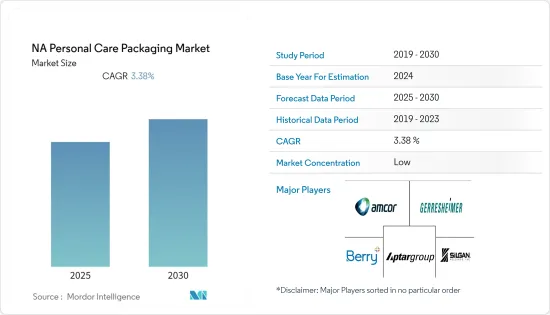

北美个人护理包装市场预计在预测期内复合年增长率为3.38%

主要亮点

- 根据美国劳工统计局的数据,2020年,美国消费者每年将在护髮产品上花费64.7美元。这种护髮产品的支出将推动永续个人护理包装市场的需求。

- 例如,2021年8月,欧莱雅旗下卡尼尔公司在美国推出了全混合洗髮精。此次首次亮相是品牌永续性努力的一部分,其用水量比液体洗髮精少,并且不使用塑胶包装。

- 另外,根据美国着名杂誌《Nail Magazine》的一项调查显示,去美甲沙龙的女性中有超过74%是自己购买用品、工具和设备,而不是使用沙龙用品。

- 为了满足日益增长的管材需求,各供应商正在市场上进行各种合作和创新。例如,2021 年 11 月,化妆品、护肤、个人护理和口腔护理市场塑胶和积层软管的领先供应商之一 Albea Tubes 与 UTCG 和 eXpackUSA 合作开发消费后可回收 (PCR) 管)为美容和个人护理企业提供美国製造的塑胶管。

- 消费者对实用、易于使用的分配器和产品的需求不断增长,促使化妆品公司采用创新的包装解决方案,例如使用可回收、可堆肥和生物分解的塑料,并促进化妆品包装的创新。

北美个人护理包装市场趋势

护髮显着增长

- 护髮品牌在沙龙内外都使用包装。护髮零售领域竞争激烈,护髮品牌依赖包装差异化与消费者建立连结。继护肤之后,护髮产品占据了化妆品市场的最大份额。

- 大多数护髮品牌越来越多地将感官元素融入其包装中,尝试雾面和光泽印刷技术的相互作用。由于使用护理油来保护热诱导造型、增加光泽和减少毛躁,滴管式包装的使用越来越多。

- 自成立以来,总部位于纽约的 Oribe Hair Care 以其棱角分明的线条和大胆色彩的自订包装在货架上占据了独特的地位。该品牌还采用创新的包装,将旧世界的复杂性与时尚、现代设计的优雅融为一体,每个瓶子、直立的管子和时尚的罐子都采用香水瓶的轮廓,结果是一个有凝聚力的展示。

- 专门开发洗髮精和护髮产品的公司也在寻求扩展到零售店,以最大限度地提高收益。例如,Olaplex Holdings 于 2021 年 11 月与 Ulta Beauty Salons 建立了分销合作伙伴关係。从 2022 年 1 月开始,我们的零售产品将在超过 1,250 家 Ulta 商店和 ulta.com 上出售。

- 许多护髮品牌正在伙伴关係提供更好的包装替代方案。公司越来越多地参与补充倡议,鼓励消费者外带并以比单独购买产品更优惠的价格补充。 2020年10月,宝洁美妆宣布在欧洲大规模推出其海飞丝、潘婷、Herbal Essences和Aussie品牌下的首款填充用铝瓶系统。此再填充系统使用新型可重复使用的 100% 铝瓶和可回收填充用袋,将塑胶用量减少 60%(与标准品牌瓶相比,每毫升)。预计它将为改变消费者购买、使用和处置洗髮精瓶的方式铺平道路。

塑胶占据主要市场占有率

- 塑胶因其成本低、重量轻、柔韧、耐用等因素而成为个人保健产品包装的主要材料。在个人保健产品方面,塑胶是製造防碎和「防溢」瓶子、罐子、管子、盖子和封口的首选材料。

- 根据包装器材工业协会 (PMMI) 的数据,瓶子、罐子、粉盒和管材等塑胶包装的市场占有率为 61%,而化妆品和其他个人保健产品中瓶子是最常用的容器。

- 由 HDPE 生产的个人保健产品瓶是最常见且最便宜的,经济、抗衝击且保持良好的防潮性。乳液瓶有各种形状、尺寸和规格,但有些是带盖的管子。这些管子通常由塑胶製成,具体取决于其尺寸。然而,一些乳液瓶是由塑胶製成的,但有一个泵分配器而不是有盖的顶部。这对于许多不想拧上和拧开顶盖或翻转盖子的人来说非常有用。

- Gerresheimer Plastic Packaging 致力于解决环境问题,提供一系列由各种消费后回收材料製成的 PET 产品。我们可以生产 100% R-PET 製成的化妆品瓶。除了使用回收材料外,Gerresheimer 还热衷于透过使用生医材料来帮助客户减少温室气体排放。生医材料是传统 PE/PET 的可再生替代品。甘蔗是用于生产生医材料的材料之一,从甘蔗工厂提取乙醇并转化为绿色乙烯,然后运送到聚合工厂,在那里转化为绿色PE/PET。

- 此外,为了完全消除原生塑料的使用,该公司正在探索其他材料,例如主要由甘蔗製成的生质塑胶,人们认为在不久的将来可能会成为石油基原生塑料的可行替代品。 。

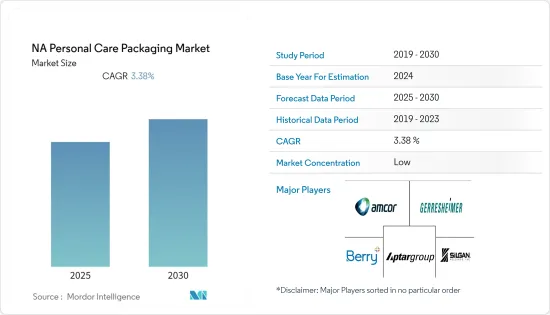

北美个人护理包装产业概况

由于 Amcor、AptarGroup Inc.、Gerresheimer AG、RPC Group Plc(Berry Global Group)和 Silgan Holdings Inc. 等公司的存在,北美个人护理包装市场高度分散。 Amcor、AptarGroup Inc.、Gerresheimer AG、RPC Group Plc (Berry Global Group)、RPC Group Plc (Berry Global Group) 和 Silgan Holdings Inc. 等公司正在进行大量研发投资,以维持北美包装产业的发展。永续性数位化来扩大我们的市场。

- 2021 年 6 月 - Amcor 宣布推出新机器来生产超透明耐热薄膜。 AmPrima 生产线采用机器方向定向技术,能够以我们的竞争对手在可回收解决方案中无法比拟的速度生产薄膜。

- 2021 年 1 月 - Silgan Holdings Inc. 与 Bondi Sands 合作推出新推出的美黑产品 Pure。 Silgan Dispensing 的 EZ'R 发泡剂是 100% 可回收的聚丙烯 (PP) 流,是市场上第一个完全由塑胶组件製成的泡沫应用。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- COVID-19 对市场的影响

第五章市场动态

- 市场驱动因素

- 随着可支配收入的增加,个人保健产品的消费增加

- 越来越注重创新和有吸引力的包装

- 市场限制因素

- 新包装解决方案的研发和製造成本较高

第六章 市场细分

- 依材料类型

- 塑胶

- 玻璃

- 金属

- 纸

- 按包装类型

- 塑胶瓶/容器

- 玻璃瓶/容器

- 金属容器

- 折迭式纸盒

- 瓦楞纸箱

- 管和棒

- 盖子与封口装置

- 泵浦和分配器

- 软塑胶包装

- 其他包装类型

- 依产品类型

- 口腔护理

- 头髮护理

- 彩妆品

- 护肤

- 男士美容

- 除臭剂

- 其他产品类型

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Albea SA

- HCP Packaging Co. Ltd

- RPC Group Plc(Berry Global Group)

- Silgan Holdings Inc.

- DS Smith PLC

- Graham Packaging Company

- Libo Cosmetics Company Ltd

- AptarGroup Inc.

- Amcor PLC

- Cosmopak Ltd

- Quadpack Industries SA

- Rieke Packaging Systems Ltd

- Gerresheimer AG

- Raepak Ltd

第八章投资分析

第九章 市场机会及未来趋势

The NA Personal Care Packaging Market is expected to register a CAGR of 3.38% during the forecast period.

Key Highlights

- According to the Bureau of Labor Statistics, in 2020, American consumers spent between 64.7 U.S. dollars in a year on hair care products. Such spending on hair products will drive the demand for the sustainable personal care packaging market.

- For Instance, in August 2021, Garnier, a subsidiary of L'Oreal, introduced Whole Blends Shampoo Bars in the United States. The debut is part of the brand's greater sustainability effort, as they are made with less water than their liquid counterparts and have no plastic packaging.

- Further, according to a survey conducted by the Nail Magazine, a prominent magazine based in California, the United States, more than 74% of the women who visit nail salons buy their own supplies, tools, and equipment rather than using salon supplies.

- In order to cater to the increasing demand for tubes, various suppliers have come up with different collaborations and innovations in the market. For Instance, in November 2021, Albea Tubes, one of the major providers of plastic and laminate tubes for the cosmetic, skincare, personal care, and oral care markets, partnered with U.T.C.G and eXpackUSA to offer Made in America tubes made from post-consumer recycled (PCR) plastics to beauty and personal care businesses.

- The increasing demand from consumers for practical and user-friendly dispensing solutions and products is prompting cosmetic companies to adopt innovative packaging solutions such as the use of recyclable plastic and compostable and biodegradable plastics, thereby driving the innovations in cosmetic packaging.

North America Personal Care Packaging Market Trends

Haircare Will Observe a Significant Growth

- Haircare brands use packaging to their advantage, both in the salon and beyond. Haircare for the retail segment is highly competitive, and hair care brands are relying on packaging differentiation to forge a connection with consumers. After skincare, hair care commands a significant share of the cosmetic market.

- Most hair care brands experiment with the interplay of matte and gloss printing techniques and are increasingly incorporating sensory elements into their packaging. The use of treatment oils for added heat styling protection, imparting shine, or decreasing frizz has led to the increased use of dropper packaging as a dosing and precision application method.

- Oribe Hair Care, based in New York, recently cultivated a distinctive shelf presence with its angularly lined, boldly-hued, custom packaging since its inception. The brand also has innovative packaging, which blends old-world intricacy with sleekly modern engineered elegance, and all the bottles, upright tubes, and sophisticated jars deliver a cohesive display suggestive of perfume bottle silhouettes.

- Companies dedicated to the development of shampoos and hair care products have also been looking to expand into retail stores to maximize any possible revenue. For instance, in November 2021, Olaplex Holdings, Inc. formed a distribution partnership with Ulta Beauty Salons, designed around increasing retail channels for their products by using the salons as stores. The Company's retail products will be available in more than 1,250 Ulta stores and on ulta.com from January 2022.

- Many hair care brands are entering into partnerships to provide better packaging alternatives. Companies are increasingly engaging in refilling initiatives that encourage consumers to bring back their bottles and refill them at a subsidized price, compared to if they would have purchased the product independently. In October 2020, P&G Beauty announced its first-ever refillable aluminum bottle system to launch at-scale, with its Head & Shoulders, Pantene, Herbal Essences, and Aussie brands in Europe. The refill system uses a new reusable 100% aluminum bottle and recyclable refill pouch, made using 60% less plastic (per mL versus standard brand bottle). It is expected to pave the way in changing the way consumers buy, use and dispose of their shampoo bottles.

Plastic to Hold Major Market Share

- Plastic is a prominent material in personal care product packaging due to its low cost, lightweight, flexibility, durability, and other factors. For personal care products, plastics are a material of choice for manufacturing shatterproof and 'no-spill' bottles, jars, tubes, caps, and closures.

- According to the Packaging Machinery Manufacturers Institute (PMMI), at 61% market share, plastic packaging, such as bottles, jars, compacts, and tubes, dominate in beauty and other personal care products, where bottles are the most commonly used containers, accounting for 30% of the market.

- Personal care product bottles produced from HDPE are the most common and least expensive, which are economical, impact-resistant, and maintain a good moisture barrier. Lotion bottles come in all different shapes, sizes, and forms, whereas some lotions are kept in capped tubes. These tubes are usually made from plastic, depending on their size. However, there are lotion bottles that are also made of plastic, but instead of the capped tops, they have pump dispensers. This is helpful for many people who do not want to have to screw a top on and off or not want to flip up a cap.

- Gerresheimer Plastic Packaging, which is committed to environmental concerns, offers PET ranges with different mixtures of post-consumer recycled materials. It can produce cosmetic bottles made of up to 100% R-PET. Besides using recycled materials, Gerresheimer is also motivated to help its customers reduce greenhouse gas emissions by using biomaterials. Biomaterials are renewable alternatives to conventional PE/PET. Sugarcane is one of the substances used to make biomaterials, where ethanol is taken from the sugarcane plant, and after converting into green ethylene, it goes to the polymerization plants, where it is converted into green PE/PET.

- Moreover, to fully eliminate the use of virgin plastic, companies are exploring other materials, including bioplastic made primarily from sugarcane, which will very soon provide viable alternatives to virgin petro-based plastics.

North America Personal Care Packaging Industry Overview

The North America Personal Care Packaging Market is highly fragmented due to the presence of players, like Amcor, AptarGroup Inc., Gerresheimer AG, RPC Group Plc (Berry Global Group) Silgan Holdings Inc. are up-scaling the market with substantial R&D investments, drive towards the sustainability and digitization of the packaging industry in North America.

- June 2021- Amcor launched new machines that will produce ultra-clear and heat resistance films. The AmPrima line uses machine-direction orientation technology to produce films that can run at speeds that competitors are unable to match in a recycle-ready solution.

- Jan 2021- Silgan Holdings Inc. partnered with Bondi Sands on the brand's newly launched self-tanning range, Pure. It makes use of Silgan Dispensing's EZ'R foamer, which features a first-to-market foam application that is 100% recyclable in polypropylene (PP) streams and made entirely from plastic components.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyer

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Consumption of Personal Care Products With Growing Disposable Income

- 5.1.2 Growing Focus on Innovative and Attractive Packaging

- 5.2 Market Restraints

- 5.2.1 High Costs of R&D and Manufacturing of New Packaging Solution

6 MARKET SEGMENTATION

- 6.1 By Material Type

- 6.1.1 Plastic

- 6.1.2 Glass

- 6.1.3 Metal

- 6.1.4 Paper

- 6.2 By Packaging Type

- 6.2.1 Plastic Bottles and Container

- 6.2.2 Glass Bottles and Containers

- 6.2.3 Metal Containers

- 6.2.4 Folding Cartons

- 6.2.5 Corrugated Boxes

- 6.2.6 Tube and Stick

- 6.2.7 Caps and Closures

- 6.2.8 Pump and Dispenser

- 6.2.9 Flexible Plastic Packaging

- 6.2.10 Other Packaging Types

- 6.3 By Product Type

- 6.3.1 Oral Care

- 6.3.2 Hair Care

- 6.3.3 Color Cosmetics

- 6.3.4 Skin Care

- 6.3.5 Men's Grooming

- 6.3.6 Deodorants

- 6.3.7 Other Products Types

- 6.4 By Country

- 6.4.1 United States

- 6.4.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Albea SA

- 7.1.2 HCP Packaging Co. Ltd

- 7.1.3 RPC Group Plc (Berry Global Group)

- 7.1.4 Silgan Holdings Inc.

- 7.1.5 DS Smith PLC

- 7.1.6 Graham Packaging Company

- 7.1.7 Libo Cosmetics Company Ltd

- 7.1.8 AptarGroup Inc.

- 7.1.9 Amcor PLC

- 7.1.10 Cosmopak Ltd

- 7.1.11 Quadpack Industries SA

- 7.1.12 Rieke Packaging Systems Ltd

- 7.1.13 Gerresheimer AG

- 7.1.14 Raepak Ltd