|

市场调查报告书

商品编码

1637872

印度个人护理包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)India Personal Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

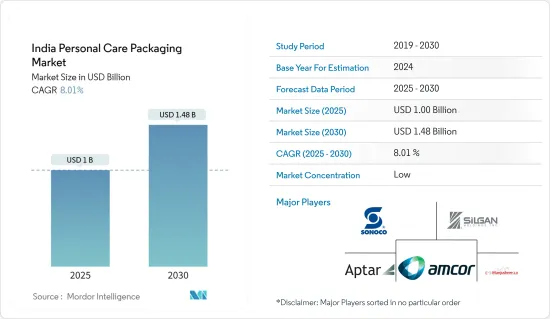

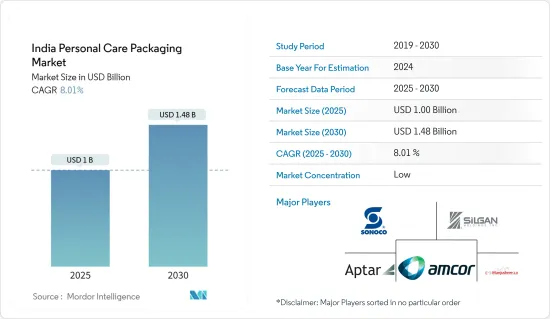

印度个人护理包装市场规模预计在 2025 年为 10 亿美元,预计到 2030 年将达到 14.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.01%。

主要亮点

- 印度不断增长的经济和日益增加的可支配收入正在改变人们的生活方式并增加个人保健产品的消费。这项变化正在推动印度个人护理包装市场的扩张。此外,包装技术的进步和喷雾式、泵式、棒式和滚筒式等创新设计的引入进一步推动了该市场的成长。

- 根据印度品牌股权基金会 (IBEF) 的报告,包装是印度经济第五大产业,凸显了其在推动工业成长和创新方面的关键作用。此外,印度政府的进步政策,特别是允许透过自动途径进行 100% 的外国直接投资,正在鼓励外国对包装行业的投资并丰富印度包装行业的格局。

- 印度领先製造商 Amcor Group 提供多种包装解决方案,包括用于个人护理用途的瓶子、罐子、纸盒和袋子。他们的产品设计具有防碎、可回收和易于使用的特性。此外,创新的结构和图形设计使这些产品不仅脱颖而出,而且吸引了消费者的兴趣。这些产品有效地保护内容物免受污染、变质和损坏,从而增加了对产品的需求。

- 儘管印度个人化包装市场有所成长,但仍面临挑战。障碍包括包装成本高、对可回收性和永续性的担忧,以及根据不断变化的市场趋势和消费者需求设计新包装所需的大量投资。因此,一些供应商坚持使用现有的包装设计,以避免因设计变更和生产转变而增加的成本。

印度个人护理包装市场趋势

塑胶产业预计将占据最大的市场占有率

- 多功能性、成本效益、重量轻、灵活性和耐用性使塑胶成为该市场领先的包装选择。塑胶具有抗碎和有弹性的特性,成为玻璃的首选替代品,大大增加了印度对该产品的需求。

- 塑胶的可塑性使其能够被塑造成各种各样的形状。这种适应性使得塑胶包装被用于从化妆品到洗护用品等无数个人护理用品中。塑胶製成的瓶子、罐子和纸盒可用于多种产品,包括化妆品、洗髮精、护髮素、乳液、保湿霜等。

- 高密度聚苯乙烯(HDPE)瓶是个人护理包装最受欢迎且最经济的选择。 HDPE 强大的耐化学性和有效的防潮阻隔性使其成为各种个人保健产品的理想选择。乳液有多种包装,包括带盖的塑胶瓶、泵分配器和用于少量使用的塑胶管。

- 印度塑胶产业的快速成长得益于塑胶材料出口的增加。根据印度塑胶出口促进委员会(PLEXCONCIL)的资料,印度塑胶出口额从 2024 年 1 月的 9.16 亿美元飙升至 2024 年 3 月的 11.13 亿美元。

预计护肤市场将占较大市场占有率

- 印度是世界第四大美容市场。人们对个人卫生和自我护理的日益重视推动了该国对美容和个人保健产品的需求。天然和有机护肤品正在迅速普及,预计将主导印度化妆品市场,进一步刺激对这些产品的需求。

- 根据印度品牌股权基金会(IBEF)的资料,印度个人护理和化妆品市场在过去十年一直持续成长。这一增长归因于全国各地精品店和零售店货架空间的扩大。国际美容产品需求的激增很大程度上归因于电子商务的兴起,尤其是其与实体店的无缝整合。此外,社群媒体正在极大地塑造消费者的偏好,并推动他们走向国际品牌和高端产品类别,从而加强印度的护肤销售。

- 印度包装製造商如 ALPLA Werke Alwin Lehner GmbH &Co KG 专注于化妆品和个人护理用品的创新包装解决方案。例如,2024 年 8 月,在印度开展业务的奥地利公司 Alpla 与 Zerooo 合作推出用于个人护理和化妆品的可重复使用的宝特瓶,加速了对这些产品的需求。

- 印度是美容和化妆品的主要出口国,出口价值稳定成长。根据国际贸易中心 (ITC) 的资料,印度的美容和化妆品出口额预计将从 2021 年的 1.644 亿美元呈指数增长至 2023 年的 7.3795 亿美元。

印度个人护理包装产业概况

市场分散,主要企业包括: Amcor Group、AptarGroup, 市场占有率、Silgan Holdings Inc.、Sonoco Products Company、Manjushree Technopack Ltd 和 Huhtamaki Oyj。这些努力的核心是致力于永续性,满足印度日益增长的消费需求。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 印度包装产业的成长

- 创新且用户友好的包装解决方案不断增加

- 市场限制

- 印度包装成本高且塑胶包装回收问题

第六章 市场细分

- 按材质

- 塑胶

- 纸

- 金属

- 玻璃

- 依产品类型

- 婴儿护理

- 浴缸和淋浴设备

- 口腔护理

- 护肤

- 防晒

- 头髮护理

- 香味

- 其他产品类型

- 按包装类型

- 瓶子

- 金属罐

- 纸盒

- 瓶子

- 小袋

- 其他包装类型

第七章 竞争格局

- 公司简介

- Amcor Group

- Aptar Group, Inc.

- Silgan Holdings Inc.

- Sonoco Products Company

- Manjushree Technopack Ltd

- Skypack India Pvt. Ltd

- Huhtamaki Oyj

- ALPLA Werke Alwin Lehner GmbH & Co. KG

- India Nature Packaging

第八章投资分析

第九章:市场的未来

The India Personal Care Packaging Market size is estimated at USD 1.00 billion in 2025, and is expected to reach USD 1.48 billion by 2030, at a CAGR of 8.01% during the forecast period (2025-2030).

Key Highlights

- India's economic growth and rising disposable incomes have transformed lifestyle patterns, leading to increased consumption of personal care products. This shift has fueled the expansion of the Indian personal care packaging market. Moreover, advancements in packaging technologies and the introduction of innovative designs such as sprays, pumps, sticks, and roller types have further accelerated this market's growth.

- As reported by the Indian Brand Equity Foundation (IBEF), packaging ranks as the fifth largest sector in India's economy, underscoring its crucial role in spurring industrial growth and innovation. Additionally, the Indian government's forward-thinking policies, notably the allowance of 100% FDI through the automatic route, have catalyzed foreign investments in the packaging sector, enriching India's packaging landscape.

- Amcor Group, a leading manufacturer in India, offers a diverse range of packaging solutions, including bottles, jars, cartons, and pouches, tailored for personal care applications. Their products are designed to be shatter-resistant, recyclable, and user-friendly. Furthermore, through innovative structural and graphic designs, these products not only stand out but also engage consumers. They effectively safeguard contents from contamination, spoilage, and damage, thereby boosting product demand.

- Despite its growth, India's personal packaging market grapples with challenges. High packaging costs, concerns over recyclability and sustainability, and the hefty investments needed for new packaging designs aligned with evolving market trends and consumer demands pose hurdles. Consequently, some vendors might stick to existing packaging designs, sidestepping the elevated costs tied to design alterations and production shifts.

India Personal Care Packaging Market Trends

The Plastic Segment is Expected to Hold the Largest Market Share

- Due to its versatility, cost-effectiveness, lightweight nature, flexibility, and durability, plastic is a dominant choice for packaging in the market. Its shatterproof nature and resilience make plastic a preferred alternative to glass, significantly boosting product demand in India.

- Plastic's malleability allows it to be shaped into diverse forms. This adaptability sees plastic packaging being employed in a myriad of personal care items, from cosmetics to toiletries. Bottles, jars, and cartons crafted from plastic cater to an extensive array of products, including makeup, shampoos, conditioners, lotions, and moisturizers.

- High-density polyethylene (HDPE) bottles are the most prevalent and economical choice for personal care packaging. With its robust chemical resistance and effective moisture barrier, HDPE is ideal for a range of personal care formulations. Packaging for lotions varies, featuring plastic bottles with either capped tops or pump dispensers and plastic tubes, which are designed for smaller quantities.

- India's burgeoning plastic industry is fueled by the rising exports of plastic materials, which are transformed into packaging products, consumer goods, films, sheets, and medical items. According to data from the Plastics Export Promotion Council of India (PLEXCONCIL), the value of Indian plastic exports surged from USD 916 million in January 2024 to USD 1,113 million in March 2024.

The Skincare Segment Expected to Hold a Significant Market Share

- India is the world's fourth-largest beauty market. A heightened emphasis on personal hygiene and self-care drives the country's demand for beauty and personal care products. The surging popularity of natural and organic skincare products is set to dominate India's cosmetics landscape, further boosting product demand.

- Data from the Indian Brand Equity Foundation (IBEF) highlighted a decade-long consistent growth in India's personal care and cosmetics market. This growth can be attributed to the expanding shelf space in boutiques and retail outlets nationwide. The surge in demand for international beauty products is largely attributed to the rise of e-commerce, especially its seamless integration with brick-and-mortar stores. Moreover, social media significantly shapes consumer preferences, steering them toward international brands and premium categories, thereby bolstering skincare product sales in India.

- Packaging manufacturers in India, such as ALPLA Werke Alwin Lehner GmbH & Co KG, emphasize innovative packaging solutions for cosmetic and personal care items. For instance, in August 2024, Alpla, an Austrian firm with Indian operations, collaborated with Zerooo to unveil reusable PET bottles tailored for personal care and cosmetic products, thus accelerating product demand.

- India is a prominent exporter of beauty and makeup products, witnessing steady growth in its export figures. Data from the International Trade Center (ITC) revealed a leap in India's beauty and makeup product exports, from a valuation of USD 164.40 million in 2021 to an impressive USD 737.95 million in 2023.

India Personal Care Packaging Industry Overview

The market is fragmented, featuring key players such as Amcor Group, AptarGroup, Inc., Silgan Holdings Inc., Sonoco Products Company, Manjushree Technopack Ltd, and Huhtamaki Oyj. To bolster their market share, these vendors are broadening their product lines, engaging in mergers and acquisitions, and actively seeking collaborations and expansions. Central to these initiatives is a commitment to sustainability, aligning with the surging consumer demand in India.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growth in the Packaging Sector In India

- 5.1.2 Rise in Availability of Innovative and User-Friendly Packaging Solutions

- 5.2 Market Restraints

- 5.2.1 High Packaging Cost and Concerns Over Plastic Packaging Recycling in India

6 MARKET SEGMENTATION

- 6.1 Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 Product Type

- 6.2.1 Baby Care

- 6.2.2 Bath and Shower

- 6.2.3 Oral Care

- 6.2.4 Skin Care

- 6.2.5 Sun Care

- 6.2.6 Hair Care

- 6.2.7 Fragrances

- 6.2.8 Other Product Types

- 6.3 Packaging Type

- 6.3.1 Bottles

- 6.3.2 Metal Cans

- 6.3.3 Cartons

- 6.3.4 Jars

- 6.3.5 Pouches

- 6.3.6 Other Packaging Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group

- 7.1.2 Aptar Group, Inc.

- 7.1.3 Silgan Holdings Inc.

- 7.1.4 Sonoco Products Company

- 7.1.5 Manjushree Technopack Ltd

- 7.1.6 Skypack India Pvt. Ltd

- 7.1.7 Huhtamaki Oyj

- 7.1.8 ALPLA Werke Alwin Lehner GmbH & Co. KG

- 7.1.9 India Nature Packaging