|

市场调查报告书

商品编码

1628727

欧洲行销自动化软体市场 -市场占有率分析、产业趋势/统计、成长预测(2025-2030)Europe Marketing Automation Software Market - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

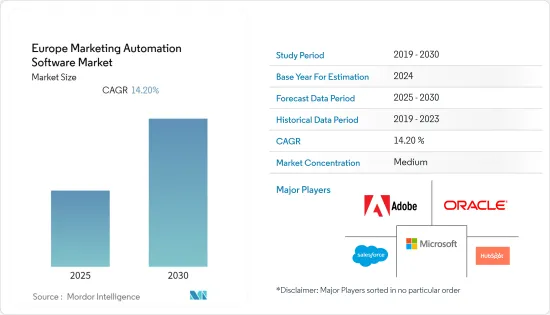

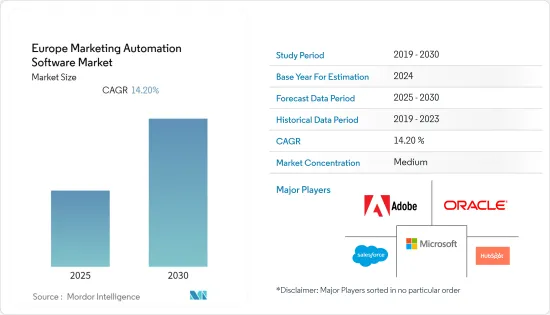

欧洲行销自动化软体市场预计在预测期内复合年增长率为 14.2%

主要亮点

- 行销自动化是旨在自动化行销活动的软体。一个允许经销商处理各种行销传播以改善行销和销售一致性的平台。商家可以透过 HubSpot、Eloqua 和 Marketo 等平台产生合格线索并推动多点触控行销传播。

- 大多数使用自动化行销平台的欧洲 B2B负责人表示,他们需要充分发挥其潜力。供应商专注于他们的软体平台和行销服务,以提供客製化服务,在该地区的商业界中强化 MaaS(行销即服务)概念。不断扩大的市场和越来越多的行销管道也促使公司透过扩大业务范围来探索新市场,从而推动行销成长并引入自动化来简化流程。

- 数位行销的日益普及、SaaS云端服务、资料整合服务的需求不断增加、5G网路覆盖范围的扩大等是该地区受访市场规模巨大的一些关键因素。由于大多数地区最终用户垂直市场的营销投资不断增加以及社交媒体渗透率的不断提高,该市场预计将在预测期内显着增长,从而使该地区成为利润丰厚的研究市场中心。

- 新的行销自动化技术正在帮助 B2C 行销人员管理客户参与。 B2B负责人管理潜在客户,两种类型的负责人管理宣传活动和其他行销流程,例如数位资产管理 (DAM)。许多新的行销自动化计划都是独立实施的,很少与后勤部门系统整合。 Royal Mail Market Reach 最近对来自拥有超过 250 名员工的英国公司的 200 名行销总监和行销主管进行的一项调查显示,80% 的人已经采用了行销自动化解决方案。

- 对整合行销活动(例如意识、客户沟通、内容安排、社群媒体管理、潜在客户培育、定位、支援和客户评级)的需求不断增长,推动了对行销自动化解决方案的需求。自动化旨在提高效率,同时优化组织的资源、时间和成本。人工智慧 (AI) 和机器学习 (ML) 的出现进一步推动了预测个人化的成长,预计将成为预测期内利用行销自动化的最显着优势。

- 该地区的市场成长并非是采用自动化解决方案,而是需要更多熟练的专业人员来教育消费者如何利用分析解决方案并提供有用的资讯和见解,这可能会受到抑制。然而,考虑到数位转型的需要,每个企业都需要软体服务,因此欧洲对软体开发服务有需求。外包服务可以创造对自动化软体服务的需求并克服限制。

- COVID-19 的爆发对市场产生了负面影响。然而,对自动化软体服务的需求略有下降。疫情期间,许多行销公司采取了安全策略:减少行销费用,等待经济状况好转,以减轻对业务的影响。根据 HubSpot 的一项研究,许多公司已经削减了 1% 到 25% 的行销预算。此外,疫情期间,许多实体店被迫关闭,转而进行线上销售和行销,这推动了电子商务的发展,增加了对行销自动化软体服务的需求。即使在大流行之后,由于对线上服务的需求增加和智慧型手机的广泛使用,这种趋势仍在继续增长。

欧洲行销自动化软体市场趋势

对数位行销的需求不断增长推动市场成长

- 负责人正在策略性地投资于行销自动化解决方案和工具,以掌握最新的数位行销趋势,并使他们的业务与最新的技术颠覆保持一致。从社群媒体行销到搜寻引擎优化和内容行销,行销经理投入大量资金来支持和促进销售。

- 社群媒体行销是娱乐和行销供应商保持自动化粉丝群参与的首要任务,而对能够同时管理多个社群媒体平台的软体的需求也推动了市场需求。根据 Sortlist 的数据,去年欧洲投资最多的行销领域是数位策略和线上广告(19.3%)、社群媒体(14.5%)、网站创建和电子商务(13.9%)以及传统广告(13.3%)。

- 例如,7Mind 在所有社群媒体管道上提供每日即时冥想,帮助用户一起冥想。我们也透过活跃的 Facebook 群组与社群互动,用户经常在群组中寻求建议。该品牌的 CRM宣传活动得到了用户的热烈回应,他们分享了各种缓解压力的技巧和应对这种情况的方法。

- 7Mind 确保其内容资产(即文案和创新)专注于缓解压力,而不是关注用户厌倦听到的 COVID-19 情况。我们注意到 CPI/CPS 显着下降,并且根据通路的不同,用户获取成本也更低。

- 此外,电子邮件行销预计将广受认可。根据 Royal Mail Market Reach 的数据,49% 的英国消费者更愿意接收邮件而不是电子邮件。根据广告从业者协会 (IPA) 的最新研究,在 12 个月的时间里,38% 的消费者在收到电子邮件后购买或订购产品或服务。预计这将推动该地区电子邮件行销对行销自动化的需求。

- 欧洲行销电子邮件的开启率高于北美。根据 GetResponse Benchmarking 的数据,北美的平均开启率为 18.13%,而欧洲为 21.75%。此外,点击率为 2.64%,而北美为 2.41%。电子邮件开启率表明电子邮件行销是该地区的主要管道之一。

义大利占有很大份额

- 加上各行业自动化的进步,行销对于销售和客户维繫的重要性越来越大,对自动化行销服务的需求也越来越大。透过采用工业4.0,企业可以更了解客户需求,提高本地製造能力,并开发整合客户和偏好的新方法。

- 电子邮件行销是义大利企业最常使用的吸引现有客户和开发潜在客户的工具。随着企业数位化,他们对电子邮件行销的依赖正在迅速增加。义大利公司的 B2B 和 B2C 电子邮件收讯率合计为 98.5%。根据专门从事数位服务和产品开发的数位代理商 AKQA 进行的一项研究,义大利跨国公司去年在持续宣传活动上平均花费了 12 万美元,在一次性活动和影响力行销上花费了 6 万美元。同时,中小企业平均在持续宣传活动上花费 61,000 美元,在一次性行销活动上花费 30,000 欧元(32,000 美元)。

- 电子商务领域预计将显着促进该国的零售额。该国的公司已经在部署使用人工语言 (AI) 和机器语言 (ML) 的建议引擎来创建超个人化的客户体验。根据Trading Economics的数据,今年10月零售额年与前一年同期比较1.3%。电子商务和零售业的成长增加了该国对行销自动化软体的需求。

- 预测个人化的发展正在为未来铺平道路,透过大规模客製化策略为特定客户群带来更多个人化的内容提案。此外,社交媒体行销自动化允许社交媒体经理提前安排帖子,并允许团队重新安排常青内容以吸引新读者。

欧洲行销自动化软体产业概述

欧洲行销自动化软体市场与国内外许多参与企业竞争激烈。市场参与企业正在采取多种策略性倡议,例如合作、合资和併购,以实现成长和竞争。许多公司相信升级现有的产品组合才能吸引客户。最近的市场趋势包括:

2022 年 12 月,云端 CRM 供应商 Very Simple Systems 推出了新的工作流程自动化,让公司可以透过建立工作流程并删除 CRM 中的重复任务来简化流程并提高生产力。

2022 年 6 月,Campaigner 将在英国纽卡斯尔开设新办事处,为英国企业利用简讯行销、客户旅程自动化、转换追踪和声誉维护工具创造重要机会,并从当地团队的支援中受益。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争公司之间的敌对关係

- 替代品的威胁

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 数位行销需求不断增长

- 对整合行销工作的需求不断增长

- 市场限制因素

- 全行业缺乏熟练的专业人才

第六章 市场细分

- 按发展

- 云端基础

- 本地

- 按用途

- 宣传活动管理

- 电子邮件行销

- 集客式行销

- 行动行销

- 社群媒体行销

- 其他的

- 按行业分类

- 娱乐和媒体

- 金融服务

- 政府机构

- 医疗保健

- 製造业

- 零售

- 其他行业

- 按国家/地区

- 英国

- 德国

- 法国

- 义大利

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- Salesforce Inc.

- Oracle Corporation

- Microsoft Corporation

- Hubspot Inc.

- Marketo Inc.

- Salesfusion Inc.

- SAS Institute

- Act-on Software Inc.

- Dotmailer Ltd

- Force24

- Adobe Systems Inc.

第八章投资分析

第九章 市场机会及未来趋势

The Europe Marketing Automation Software Market is expected to register a CAGR of 14.2% during the forecast period.

Key Highlights

- Marketing automation is software that exists intending to automate marketing actions. To increase the alignment between marketing and sales, it is a platform where dealers may handle a variety of marketing communications. Dealers can generate qualified leads and drive multi-touch marketing communications through platforms like HubSpot, Eloqua, and Marketo.

- Most European B2B marketers using automated marketing platforms stated they must use them to their full potential. The vendors are focusing on a couple of their software platform offerings with marketing services to provide customized services, strengthening the Marketing as a Service (MaaS) concept among the region's business circles. The growing marketplace and the increasing number of marketing channels are also boosting companies to explore new markets by increasing their businesses' reach, which drives the growth in marketing and pushes companies to deploy automation to streamline the process.

- The growing adoption of digital marketing, SaaS cloud services, increasing demand for data integration services, and expanding 5G network coverage are some of the significant factors that the market studied is estimated to have a massive scope in the region. The market is expected to grow significantly over the forecast period due to increased marketing investment by most regional end-user verticals and an ever-growing social media penetration making the region a lucrative hub for the studied market.

- New marketing automation technologies have emerged to help B2C marketers manage customer engagement. B2B marketers manage leads, and marketers of both types manage other marketing processes, such as campaigns and digital asset management (DAM). Many new marketing automation projects were standalone implementations with little integration into back-office systems. A recent survey by the Royal Mail Market Reach of 200 CMOs in the United Kingdom's Marketing Directors and Heads of Marketing of companies having more than 250 employees revealed that 80% had already installed a marketing automation solution.

- The rise in demand to integrate marketing efforts that include building awareness, customer communication, content scheduling, social media management, lead nurturing, positioning, supporting, and customer evaluation drives the need for Marketing Automation solutions. Automation aims to increase efficiency while optimizing the organization's resources, time, and cost. The advent of artificial intelligence (AI) and machine learning (ML) has further propelled the growth of predictive personalization, which is expected to be the most prolific advantage of utilizing marketing automation over the forecast period.

- The need for more skilled professionals to instruct consumers on how to make the most of analytics solutions and use them for helpful information and insights in the region due to the introduction of automation solutions could restrain the market growth. However, considering the need for digital transformation, there is a demand for software development services in Europe, as every company needs a software service. Outsourcing the service creates a demand for Automation software services and could overcome the restraining factor.

- The COVID-19 outbreak negatively impacted the market. However, there was a slight decrease in demand for Automation software services. During the pandemic, many marketing companies adopted a play-it-safe approach by reducing their marketing expenses so that the impact was less on their businesses, and they had to wait for the economic scenario to improve. According to a Hubspot survey, many enterprises reduced their marketing budgets by between 1% and 25%. Additionally, many physical stores were forced to close during the pandemic and switch to online sales and marketing, which boosted e-commerce and increased the need for Marketing Automation Software services. This trend continues to grow post-pandemic owing to the increasing demand for online services and smartphone penetration.

Europe Marketing Automation Software Market Trends

Increasing Demand for Digital Marketing is Driving the Market Growth

- Marketing managers are strategically spending on marketing automation solutions and tools to adopt the latest digital marketing trends to keep businesses updated with the recent technological disruptions. From social media marketing to SEO or content marketing, marketing managers make significant investments to support and boost their sales.

- With social media marketing, a high priority for entertainment and marketing vendors to maintain automated fan-base engagement, the need for software that can manage multiple social media platforms simultaneously is also driving the demand for the market. According to Sortlist, digital strategy and online advertising (19.3%), social edia (14.5%), website creation and e-commerce (13.9%), and traditional advertising (13.3%) are the most invested areas of marketing in the Europe region last year.

- For instance, 7Mind offers daily live meditation across all social media channels, helping users meditate together. It is also engaging with its community on the active Facebook group, where it gets a lot of requests from users asking for advice. The CRM campaigns run by the brand about different tips on releasing stress and how to deal with the situation saw an overwhelmingly positive response from users.

- 7Mind ensures that the content assets, i.e., the copy and creatives, are focusing on stress reduction without concentrating on the COVID-19 situation, which the users are tired of hearing about. It noticed that CPI/CPS dropped considerably, making user acquisition cheaper, depending on channels.

- Moreover, email marketing is anticipated to gain significant recognition. According to Royal Mail Market Reach, 49% more consumers in the United Kingdom are willing to receive a piece of mail than they do an email. The latest Institute of Practitioners in Advertising (IPA) study shows that over 12 months, 38% of consumers bought or ordered products or services after receiving mail. This is anticipated to drive demand for marketing automation in email marketing in the region.

- The marketing email open rates in Europe are better than in North America. According to GetResponse Benchmarking, the region has an average open rate of 21.75% compared to 18.13% in North America. Also, the click-through rate is 2.64% compared to 2.41% in North America. The open email rates suggest that email marketing is one of the main channels in the region.

Italy Holds Significant Market Share

- The growing significance of marketing in generating sales and customer retention, coupled with increased automation in various industries, is increasing the need for automated marketing services. Adopting Industry 4.0 would enable companies to understand their customers' needs better, improve their manufacturing capabilities locally, and develop new ways to integrate their customers and preferences.

- Email marketing is the most used tool by companies to engage existing clients or to acquire potential customers in Italy. With companies going digital, the dependence on email marketing has grown drastically. The combined receiving rate of B2B and B2C emails is 98.5% among Italian companies. According to a survey conducted by AKQA, a digital agency specializing in creating digital services and products, multinational companies in the country spent, on average, USD 120 thousand on ongoing campaigns and USD 61 thousand on one-shot initiatives and influencer marketing last year. At the same time, small- and medium-sized companies spent an average of USD 61000 for ongoing campaigns and EUR 30000 (USDE 32000) for single marketing actions.

- The e-commerce sector is expected to boost retail sales in the country significantly. Enterprises in the country are already running with recommendation engines that use artificial language (AI) and machine language (ML) to create hyper-personalized customer experiences. Trading Economics said retail sales rose by 1.3% in October this year compared to the previous year. Such an increase in the e-commerce and retail sector drives the need for marketing automation software in the country.

- The growth of predictive personalization is paving the way to the future, resulting in more personalized content suggestions through mass customization strategies for specific strata of clientele. Furthermore, automated social media marketing enables social media managers to schedule posts in advance, allowing teams to reschedule evergreen content to attract new readers and a platform for understanding social media analytics, like mentions and replies.

Europe Marketing Automation Software Industry Overview

The Europe marketing automation software market is competitive due to various domestic and international players. Players in the market adopt multiple strategic initiatives such as collaboration, joint ventures, and mergers and acquisitions to grow and compete. Many organizations believe in upgrading their current portfolio to attract their customers. Some of the recent developments in the market are:

In December 2022, Really Simple Systems, a cloud CRM vendor, launched its new workflow automation feature, which allows users to create workflows in the CRM, remove repetitive tasks, allowing businesses to streamline processes and improve productivity.

In June 2022, Campaigner launched its new office in Newcastle, UK, and created a huge opportunity for UK businesses to take advantage of SMS marketing, customer-journey automation, conversion tracking, and reputation defender tools and benefit from the support of local teams.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digital Marketing

- 5.1.2 Rising Demand to Integrate Marketing Efforts

- 5.2 Market Restraints

- 5.2.1 Lack of Skilled Professionals Across the Industry

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 Cloud-based

- 6.1.2 On-premise

- 6.2 By Application

- 6.2.1 Campaign Management

- 6.2.2 E-mail Marketing

- 6.2.3 In-bound Marketing

- 6.2.4 Mobile Marketing

- 6.2.5 Social Media Marketing

- 6.2.6 Other Applications

- 6.3 By End-User Verticals

- 6.3.1 Entertainment and Media

- 6.3.2 Financial Services

- 6.3.3 Government

- 6.3.4 Healthcare

- 6.3.5 Manufacturing

- 6.3.6 Retail

- 6.3.7 Other End-User Verticals

- 6.4 By Country

- 6.4.1 United Kingdom

- 6.4.2 Germany

- 6.4.3 France

- 6.4.4 Italy

- 6.4.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Salesforce Inc.

- 7.1.2 Oracle Corporation

- 7.1.3 Microsoft Corporation

- 7.1.4 Hubspot Inc.

- 7.1.5 Marketo Inc.

- 7.1.6 Salesfusion Inc.

- 7.1.7 SAS Institute

- 7.1.8 Act-on Software Inc.

- 7.1.9 Dotmailer Ltd

- 7.1.10 Force24

- 7.1.11 Adobe Systems Inc.