|

市场调查报告书

商品编码

1628744

美国家庭护理包装:市场占有率分析、行业趋势和成长预测(2025-2030)US Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

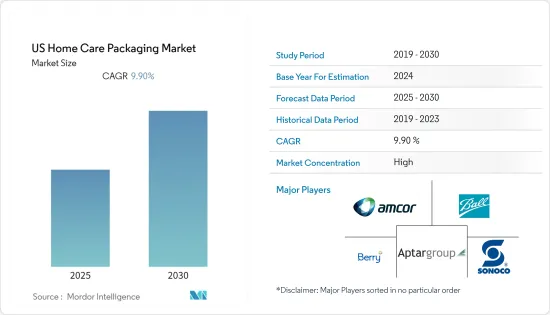

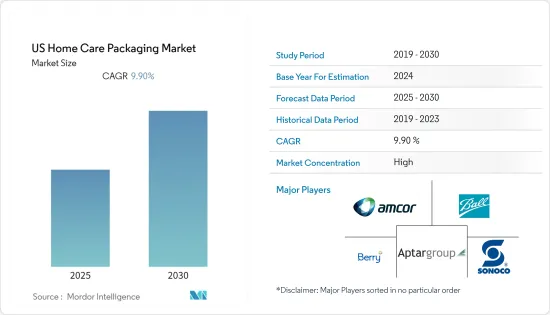

预计美国家庭护理包装市场在预测期间的复合年增长率为 9.9%。

特别是,随着消费者健康意识的增强并倾向于避免高昂的医疗费用,对家庭护理产品的需求正在上升。为了满足这一需求,家庭护理包装行业正在区分多种包装解决方案并增强提案,以在不影响安全标准的情况下传达有用的信息。预计这部分包装市场将在预测期内实现高速成长。

根据经济合作暨发展组织(OECD) 的数据,美国家庭总支出累计14 兆美元。此外,根据经济分析局的估计,截至 2020 年 1 月,个人收入增加了 19,547 亿美元(10.0%)。同样,个人可支配所得(DPI)增至19,632亿美元(11.4%),个人消费支出(PCE)成长2.4%。

儘管景气衰退,但对家庭保健产品的需求从未减少,对包装解决方案的需求成正比增长。在耐用性、成本效益和多功能性等优势的推动下,塑胶已成为企业使用的主要包装材料之一。由于为了提高耐久性和安全性而进行的研究和开发,PLA、生物分解性的PHA(聚羟基烷酯)和生物PTT(聚对苯二甲酸三甲酯)等聚合物对于产业来说是新事物,并逐渐获得认可。然而,高昂的成本为长期永续性带来了挑战。

在家庭护理产品产业,消费者对包装材料永续性的认识不断增强。例如,截至 2021 年 3 月,联合利华正在增加消费后再生塑胶 (PCR) 的使用。该公司塑胶包装总量中约 11% 由再生塑胶製成,该公司的目标是到 2025 年使用至少 25% 的再生塑胶。

美国家庭护理包装市场趋势

疫情影响居家清洗用品需求增加

在美国,消费者越来越多地使用电子商务管道来采购家庭护理产品。线上销售的份额仍然较低,但预计在预测期内将扩大。此外,联合利华正在根据线上通路的产品销售进行新的收购。

随着 2020 年清洁时间变得更长,消费者开始担心传统清洗产品对健康和环境的副作用。因此,在整个 2021 年,以清洗为目的的家庭护理产品的需求预计将需要支持消费者身心健康的倡议。例如,冠状病毒大流行导致卫生纸销售激增,使卫生纸产品成为美国主要的家庭产品类别,价值约104亿美元。

美国清洁协会 (ACI) 于 2020 年 9 月发布了《消费者清洁和卫生调查》,旨在探讨新冠肺炎 (COVID-19) 大流行前后消费者对清洁和消毒做法的看法和行为。调查显示,自流感季节开始以来,美国的清洁工作比以往任何时候都多。

此外,86% 的美国人对清洗产品能够保护他们免受冠状病毒感染充满信心。此外,92%的人表示他们有在家中表面使用消毒剂的习惯。超过 50% 的人还计划继续更频繁地擦拭表面并使用消毒剂。

Clorox, Inc.(家庭护理)正在利用 Pine-Sole Original 多表面清洁剂来应对冠状病毒的威胁。该产品声称可以在坚硬、无孔的表面杀死 SARS-CoV-2(导致 COVID-19 的病毒),因此获得了美国环保署 (EPA) 的核准。

人们对产业永续性的兴趣日益浓厚

家庭护理品牌和包装供应商不断努力创新,透过品牌在竞争激烈的市场空间中创造差异化。家庭护理包装领域存在着一个尚未开发的机会,可以透过用更永续性的包装解决方案(如纸瓶和多层瓦楞纸箱)取代塑胶瓶来帮助减少塑胶污染。这种包装是帮助消费者减少塑胶消耗的重要机会,甚至可以省去回收的麻烦。这项措施符合政府的要求。例如,2020年,佛罗里达州记录了约4,710万吨城市废弃物,其中仅塑胶就约占收集总量的7.33%。

从以产品为基础的创新来看,宝洁公司的妙抗保 24 已获得美国环保署 (EPA)核准作为消毒喷雾剂,可有效杀死 SARS-CoV-2。虽然其他多种产品声称可以杀死 99.9% 的 SARS-CoV-2,但妙抗保 24 证明了这一点,它可以全天发挥作用,为您家中的表面提供持久的保护。

O3waterworks LLC 推出了一种臭氧驱动的家用清洗和消毒喷雾。这种喷雾瓶产生低浓度的臭氧水,众所周知,臭氧水可以分解细菌和污染物。它很快就变成水和空气,并且不留任何残留物。该公司的喷雾瓶可用于清洗牙刷、清洗水果和蔬菜、冲洗掉落的奶嘴、清洗婴儿玩具等。

另一位清洁品类领导者 Jelmar 更新了其 CLR 产品线,焕然一新的外观和新的发音(“CLeaR”)。此外,我们还实施了新的创新宣传活动并更改了一些产品名称。这样做是为了反映产品线范围的扩大。

联合利华表示,Love Home & Planet 的「绝大多数」包装是由可回收材料製成的。 「接下来是盖子和袋子。该公司的目标是到 2021 年,Love Home & Planet 的包装采用 100% 回收包装。在美国,Love Home & Planet 拥有30% 的回收包装,用于织物护理、洗碗和清洁。本产品含有浓缩清洁剂,采用永续来源的植物来源清洗剂,即使在冷水中也能发挥作用,从而减少水和能源的使用,透过最大限度地减少洗涤次数来延长衣服的使用寿命。

美国家庭护理包装产业概况

美国家庭护理包装市场适度分散,由于投资增加、新参与企业以及最终用户行业应用的扩大,预计将获得更高的竞争力。下面列出了一些进展。

- 2021 年 8 月 - 联合利华开发了永续的黑色包装,该包装采用以前被视为废弃物的消费后树脂材料层压而成。该公司采用多层消费后树脂设计来实现永续的黑色塑胶包装,适用于个人护理、美容、化妆品、家庭护理和食品。这项创新使黑色塑胶废弃物能够重新用于这些类别的新包装。

- 2021 年 7 月 - Westfall Techniques 收购 Carolina Precision Plastics,使其能够接触欧莱雅、雅诗兰黛和 Clorox(泰铢 Bees 的母公司)等着名化妆品和个人护理公司。

- 2021 年 3 月 - 联合利华北美公司宣布将向闭合迴路 Partners 领导力基金投资 1500 万美元,支持到 2025 年每年回收约 6 万吨美国塑胶包装废弃物。联合利华的投资和每年持续使用约59,000 吨消费后回收(PCR) 塑胶包装的影响将有助于兑现其到2025 年收集和加工比其销售量更多的塑胶包装的承诺。支持。

- 美国公司正寻求大幅扩张欧洲市场,透过改善供应链来提高自己的地位。例如,2021 年 3 月,Proanpac 透过收购 IG Industries PLC 和 Brayford Plastics Limited 进军英国。此外,2021 年 1 月,Proanpac, LLC 宣布已获得 Pritzker Private Capital (PPC) 的投资,以进一步推进其扩张计划,包括策略性收购和扩大全球影响力。除了现有和新的共同投资者之外,该公司还获得了新加坡主权财富基金 GIC 和 PPC 的投资,以推动其成长。

- 2021 年 2 月 - 汉高宣布增加其厕所清洁凝胶包装中回收聚乙烯 (PEPE) 的含量。例如,「Bif」品牌洁厕剂标准系列达到50%,「ProNature」系列清洁剂达到75%,且公司强调永续性方面以满足消费者的需求。

- 2021 年 1 月 - 总部位于佛罗里达州的 Jabil 公司收购了 Ecologic Brands,使其成为其包装解决方案部门的一部分。此次收购支持公司的永续发展目标。我们签署了艾伦麦克阿瑟基金会的塑胶经济全球承诺,承诺我们的客户从当前解决方案中消除有问题和不必要的塑胶包装。

- 此外,2020 年 12 月,WD-40(家庭和全球贸易专业人士使用的标誌性多用途产品)和 DS Smith 合作提供纸质可回收二次包装解决方案,宣布他们已从废弃物中去除了586,208 件塑胶。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 波特五力分析- 产业吸引力

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间敌对关係的强度

- 价值链/供应链分析

- COVID-19 市场影响

第五章市场动态

- 市场驱动因素

- 产品创新、差异化与品牌化

- 人均所得上升对购买力有正面影响

- 市场限制因素

- 原物料价格波动

第六章 市场细分

- 按材质

- 塑胶

- 纸

- 金属

- 玻璃

- 依产品类型

- 瓶子

- 金属罐

- 纸盒

- 瓶子

- 小袋

- 依居家护理产品分类

- 洗碗

- 杀虫剂

- 衣物洗护

- 洗护用品

- 抛光

- 空气护理

第七章 竞争格局

- 公司简介

- Amcor PLC

- Mondi Group

- Berry Global

- Winpak

- Aptar Group

- Sonoco Products Company

- Silgan Holdings

- Tetra Laval

- DS Smith Plc

- CAN-PACK SA

- Prolamina Packaging

- Ball Corporation

第八章投资分析

第九章 市场机会及未来趋势

The US Home Care Packaging Market is expected to register a CAGR of 9.9% during the forecast period.

Demand for home care products has been on an upward trend, especially as the consumers, with growing health awareness, tend to avoid expensive medical care costs. To keep up with this demand, the home care packaging industry has ramped up its offerings to differentiate between multiple packaging solutions, conveying useful information without compromising on the safety standards. The packaging market for this segment is set to record high growth during the forecast period.

As per OECD, the United States reported USD 14 trillion towards overall household spending in the country. And, allied personal income was recorded to have increased at USD 1,954.7 billion (10.0%) as of January 2020, according to estimates by the Bureau of Economic Analysis. Similarly, the Disposable personal income (DPI) increased to amount to USD 1,963.2 billion (11.4%), along with personal consumption expenditures (PCE) increased by 2.4%.

Despite the economic setbacks, demand for home healthcare products has never declined, and directly proportional to that is the requirement for packaging solutions. Driven by advantages like durability, cost benefits, and versatility, plastic is one of the packaging materials majorly used by companies. Research and development for increased durability and safety found new entrants into the industry, which include polymers like PLA, biodegradable PHA (polyhydroxyalkanoate), bio PTT (polytrimethyl terephthalate), etc., slowly getting acceptance. However, high cost poses a challenge to their sustainability in the long run.

The home care products industry has been witnessing increased awareness among consumers regarding the sustainability of packaging materials. For instance, as of March 2021, Unilever has stepped up the use of post-consumer recycled plastic (PCR). With around 11% of its total plastic packaging volume consisting of recycled plastic, the company aims to use at least 25% recycled plastic by 2025.

US Home Care Packaging Market Trends

Increased Demand for Household Cleaning Products Owing to the Pandemic

The United States is experiencing an increased use of e-commerce channels to procure home care products by consumers. While the share of online sales remains low, it is expected to grow during the forecast period. Furthermore, Unilever has been making new acquisitions based on selling products through online channels.

With extended periods of cleaning throughout 2020, consumers raised concerns over the side effects of traditional cleaning products on health and the environment. Throughout 2021, it is, thus, expected that the demand for home care products designed to provide cleaning efficacy will require efforts to support consumers' physical and emotional wellbeing as well. For instance, The coronavirus pandemic caused a surge in toilet tissue sales, making toilet tissue products the leading home product category in the United States at about USD 10.4 billion.

A consumer cleaning and hygiene research presented by the American Cleaning Institute (ACI) in September 2020 was designed to tap consumer perceptions and actions regarding cleaning and disinfection practices around the COVID-19 pandemic. The survey suggested that Americans were cleaning more than ever before due to the onset of flu season.

Moreover, 86% of Americans were confident in their cleaning products to help protect themselves against coronavirus. 92% of them suggested that they are habituated to using disinfectants on surfaces in their homes. Over 50% of them plan to continue wiping down surfaces more often and using disinfecting products.

The Clorox Company (in-home care) has taken on the coronavirus threat by using its Pine-Sol Original Multi-Surface Cleaner. The product received approval from the US Environmental Protection Agency (EPA) for claims on killing SARS-CoV-2, the virus that causes COVID-19, on hard non-porous surfaces.

Increasing Awareness Over Sustainability Concerns in the Industry

Home care brands and packaging suppliers have been on a constant spree to innovate and create differentiation in a contested market space through branding. Household care packaging has untapped opportunities to help reduce plastic pollution by replacing plastic bottles with more sustainable packaging solutions like paper bottles and multi-layered cardboard cartons. This packaging represents an important opportunity to help consumers to reduce plastic consumption and might even help make recycling less complicated. The effort has also been consistent with the government; for instance, In 2020, Florida recorded nearly 47.1 million tonnes of municipal waste, of which plastic alone constituted about 7.33% of the total collection.

When looking at product-based innovation, P&G's Microban 24 was approved by the US Environmental Protection Agency (EPA) as a sanitizing spray that is effective in killing SARS-CoV-2. With multiple other products claiming to kill 99.9% of the bacteria, Microban 24 certifies this and continues working throughout the day to provide long-lasting protection for surfaces in homes.

O3waterworks LLC introduced a household cleaning and sanitizing spray-fueled ozone. The spray bottle is known to create low-concentration aqueous ozone to break up germs and contaminants. This quickly becomes water and air, leaving no residue. The company's Spray Bottle can be used to clean toothbrushes, wash fruits and veggies, rinse off dropped pacifiers, clean baby toys, to name a few.

Another cleaning category leader, Jelmar, refreshed its CLR line of products with a new look and a new pronunciation ('CLeaR'). Additionally, it had run a new creative campaign, post several products were renamed. This was done to reflect the breadth of the expanded product line.

According to Unilever, the "majority" of Love Home & Planet's packaging was made from recycled and recyclable materials. "Caps and pouches would be the next. The company is working towards 100% recycled packaging across Love Home & Planet by 2021. In the United States, Love Home & Planet includes more than 30 products for fabric care, dishwashing, and cleaning. It incorporates a concentrated laundry detergent made with sustainably sourced plant-based cleansers that are effective in cold water. A dry-wash spray is designed to prolong the life of clothes by minimizing washing while reducing water and energy use.

US Home Care Packaging Industry Overview

The market for Home Care Packaging in the United States is moderately fragmented and is expected to attain a higher degree of competitiveness owing to the increasing investments, new players, and growing applications in end-user industries. Some of the developments are as follows -

- August 2021 - Unilever developed a sustainable black packaging made from layered post-consumer resin materials, which was previously treated as waste. The company had used a multilayer post-consumer resin design to achieve sustainable black plastic packaging suitable for personal care, beauty, cosmetics, home care, and food products. This innovation enables black plastic waste to be re-used in new packaging across these categories.

- July 2021 - Westfall Technik acquired Carolina Precision Plastics, giving Westfall access to prominent cosmetics and personal care companies, including L'Oreal, Estee Lauder, and Clorox (which owns Burt's Bees).

- March 2021 - Unilever North America announced a USD 15 million investment in Closed Loop Partners' Leadership Fund to help recycle an estimated 60,000 metric tons of USlastic packaging waste annually by 2025, an amount equivalent to more than half of UnUnilever'slastics footprint in North America. The impact of UnUnilever'sew investment and its continued use of post-consumer recycled (PCR) plastic packaging, which is approximately 59,000 metric tons per year, will underpin the delivery of its commitment to collect and process more plastic packaging than it sells by 2025.

- American companies have been significantly looking to expand into the European market to improve their position through improved supply chains. For instance, In March 2021, Proampac acquired IG Industries PLC and Brayford Plastics Limited to mark their expansion into the UK. Furthermore, in Jan 2021, ProAmpac LLC announced that it had received investment from Pritzker Private Capital (PPC) to further its expansion plans, including strategic acquisitions and increasing the global footprint. The company received investment from GIC, Singapore's sovereign wealth fund in addition to existing and new co-investors, and PPC to promote its growth.

- February 2021 - Henkel announced the amount of recycled polyethylene (PEPEin the packaging of its toilet cleaner gels increased. By reaching 50% for toilet cleaners in the standard range, for example, from the Biff brand, and, in the case of cleaners from the Pro Nature range, as much as 75%, the company has banked on sustainability aspects to speak to consumers needs.

- January 2021 - Jabil, the company in Florida, acquired Ecologic Brands, which would become part of its Packaging Solutions division. This acquisition would support the cocompany'swn sustainability goals. It is a signatory of the Ellen MacArthur FoFoundation'sew Plastics Economy Global Commitment and pledged to engage its customers "t" eliminate problematic and unnecessary plastic packaging from their current solutions.

- Moreover, In December 2020, WD-40, the iconic multi-use product used in households and by trade professionals worldwide, and DS Smith announced that it worked together to provide a paper-based, recyclable secondary packaging solution that has led to the removal of 586,208 individual pieces of plastic from the waste stream.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis - Industry Attractiveness

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Impact of COVID-19 Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Product Innovation, Differentiation, and Branding

- 5.1.2 Rising Per Capita Income Positively Impacting Purchase Power

- 5.2 Market Restraints

- 5.2.1 Fluctuating Raw Material Prices

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Metal Cans

- 6.2.3 Cartons

- 6.2.4 Jars

- 6.2.5 Pouches

- 6.3 By Homecare Products

- 6.3.1 Dishwashing

- 6.3.2 Insecticides

- 6.3.3 Laundry Care

- 6.3.4 Toiletries

- 6.3.5 Polishes

- 6.3.6 Air Care

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Mondi Group

- 7.1.3 Berry Global

- 7.1.4 Winpak

- 7.1.5 Aptar Group

- 7.1.6 Sonoco Products Company

- 7.1.7 Silgan Holdings

- 7.1.8 Tetra Laval

- 7.1.9 DS Smith Plc

- 7.1.10 CAN-PACK S.A.

- 7.1.11 Prolamina Packaging

- 7.1.12 Ball Corporation