|

市场调查报告书

商品编码

1632070

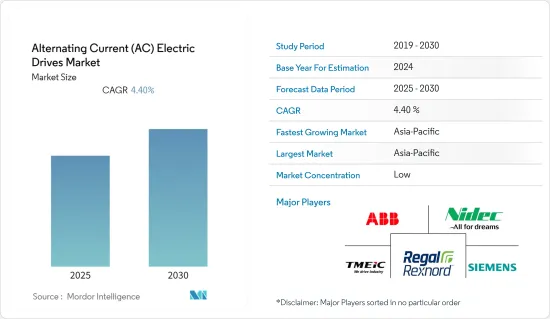

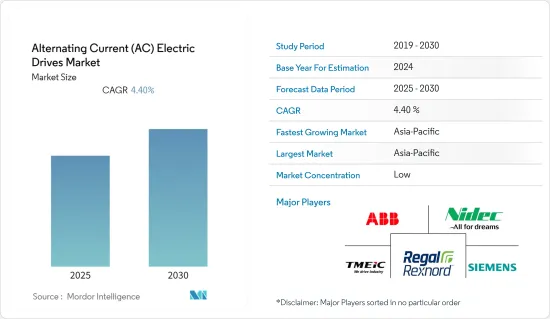

交流 (AC) 电力驱动器:市场占有率分析、行业趋势和成长预测(2025-2030 年)Alternating Current (AC) Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

交流 (AC) 电力驱动市场预计在预测期内复合年增长率为 4.4%

主要亮点

- 国内消费率的上升、天然气产业的成长和製造业前景的改善预计将增加对交流电驱动器的需求。例如,根据 IEA 的数据,由于供暖需求增加和经济强劲復苏,2021 年 1 月中国天然气需求与前一年同期比较增 23%。

- 食品业的製造商越来越多地采用自动化来保持其提供的产品品质并满足行业机构制定的准则和法规。例如,食品药物管理局的食品安全现代化法案 (FSMA) 引入了法规,要求大型食品製造商满足预防控制和现行良好生产规范 (CGMPS) 的要求。

- 政府对环境问题的严格法规减少了能源使用和碳排放,导致了低功率交流变频器的采用,因为监控能源使用有助于实现能源效率并降低营运成本并调节需求。

- 此外,都市化和工业化正在增加对需要交流变频器的自动化和马达驱动设备的需求。然而,初始设置成本、维护以及电力驱动替代方案的存在是阻碍市场成长的因素。

- 产业大流行导致的工厂关闭影响了製造设施,并减少了各行业对电力驱动的需求。这次疫情也凸显了工厂自动化取代劳动力的必要性,以解决技术纯熟劳工短缺问题,并避免因前所未有的情况而导致工作流程中断。

交流 (AC) 电力驱动市场趋势

离散製造业大幅成长

- 交流电驱动器在处理汽车、飞机、国防设备、电子产品、半导体和纺织产品大批量生产的离散製造业产业中有着广泛的应用。

- 美国是目前对航太製造最具吸引力的国家,SpaceX、蓝色起源和美国军方等私人企业对此表现出浓厚的兴趣。该国的航太和国防(A&D)产业增加了研发资金。自2010年以来,研发支出不断增加,年投资额成长14%,达到170亿美元。汽车和航空与国防产业製造业务的成长预计将推动交流变频器的需求。

- 电子产品生产过程消耗大量能源。随着客户需求的增加和产量的飙升,製造商正在采用节能设备的自动化。因此,许多最终用户,尤其是离散製造业的最终用户,越来越多地采用带有交流电驱动的客製化马达。

- 此外,电子製造公司正在全球扩大其製造能力。例如,2022年3月,英特尔计画斥资超过330亿欧元提高整个欧盟的製造能力,将半导体价值链的不同部分引入欧洲,并增强其供应链的弹性。

亚太地区预计将占据较大份额

- 该地区的组织正在取得进展,并在其工厂中看到更可靠、高效和可预测的流程,并转向工业物联网 (业务) 连接机器和自动化流程。 。

- 例如,日本工程公司三菱电机公司于2022年6月宣布,将向其子公司三菱电机印度私人有限公司投资约22亿美元,建造一座新工厂,生产逆变器和FA(工厂自动化)控制系统产品。

- 製造业是中国经济的支柱之一,随着中国人口老化、人事费用飙升以及廉价农民工不再可持续,製造业正在经历快速转型。此外,全球70%的家用电子电器产品是中国製造的。

- 随着发电、石油天然气、纺织、采矿等各行业对製造流程自动化的重视,最终用户正在不断提高生产过程中的工业自动化程度,并加强交流电力驱动的应用。

- 此外,该地区不断变化的环境正在推动商业、机构和房地产等领域对暖通空调系统的需求。此外,基础设施计划和建筑物的增加也增加了对节能暖通空调系统的需求。因此,暖通空调製造商正在进行扩张投资以满足需求。例如,据印度商工部称,根据 PLI 计划,26 家公司已在印度空调空调零件製造领域投资 389.8 亿卢比。

交流 (AC) 电力驱动产业概述

随着全球製造业的发展,对交流电驱动器的需求不断增加,全球交流变频器市场高度分散。丹佛斯、ABB、西门子等市场主要企业不断创新新产品,活性化併购、产能扩张等活动,进一步加剧竞争。

- 2022 年 5 月 - 专注于工业自动化和数位转型的最大公司之一罗克韦尔自动化宣布推出用于工业电机控制的新型 Allen-Bradley Armor PowerFlex 交流变频驱动器。这些机载驱动器可实现快速安装、轻鬆试运行和预测性维护。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 製造业自动化的进步

- 政府法规的收紧和对节能设备的需求不断增加

- 市场问题

- 安装和维护高成本

第 6 章 细分

- 按电压

- 低电压

- 中压

- 按最终用户产业

- 石油和天然气

- 化工/石化

- 饮食

- 用水和污水

- 发电

- 金属/矿业

- 纸浆/造纸製造

- 空调

- 离散製造业

- 其他的

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲/纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲

- 中东/非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东/非洲

- 北美洲

第七章供应商市场占有率分析

第八章 竞争格局

- 公司简介

- ABB Ltd

- Danfoss

- Rockwell Automation Inc.

- Schneider Electric SE

- Siemens AG

- WEG SA

- Yaskawa Electric Corporation

- Toshiba International Corporation

- Parker Hannifin Corporation

- Fuji Electric Co. Ltd.

第九章投资分析

第十章投资分析市场的未来

简介目录

Product Code: 91172

The Alternating Current Electric Drives Market is expected to register a CAGR of 4.4% during the forecast period.

Key Highlights

- Due to the rising domestic consumption rate, the growing gas industry and improving manufacturing outlook are anticipated to augment the demand for AC electric drives. For instance, according to IEA, in China, the increasing heating demand, combined with a strong economic recovery, pushed y-o-y gas demand growth to 23% in January 2021.

- Manufacturers in the food industry are increasingly adopting automation to meet the guidelines and regulations set by the industry associations to maintain the quality of products offered. For instance, Food & Drug Administration's Food Safety Modernization Act (FSMA) introduced regulations that necessitate giant food manufacturers to meet preventive controls and Current Good Manufacturing Practice (CGMPS) requirements.

- The stringent government regulations regarding environmental concerns to cut down energy usage and carbon emission regulate the demand for low-power AC drive as it helps achieve energy efficiency and reduce operating costs by monitoring energy usage.

- Moreover, urbanization and industrialization have raised the demand for automated and motor-driven equipment that needs AC drives. However, the initial setup cost, maintenance, and presence of alternative options to Electric drives are the factors hindering the market's growth.

- The Covid-19 pandemic shutdown of factories has impacted manufacturing facilities and decreased the demand for electric drives across different industry verticals. The pandemic has also highlighted the need for factory automation to replace labor to deal with a skilled labor shortage and avoid workflow disruption due to the situation's unprecedented nature.

Alternating Current (AC) Electric Drives Market Trends

Discrete Industries to Grow Significantly

- AC electric drives find robust applications across the discrete manufacturing industry, which deals with the mass production of automobiles, aircraft, defense equipment, electronic products, semiconductors, and textiles.

- The United States is currently the most attractive country for aerospace manufacturing due to excessive interest from private firms like SpaceX, Blue Origin, and the US military. The country's aerospace and defense (A&D) industry increased its funding for R&D. Since 2010; its R&D spending has increased, with the annual investments increasing by 14%, to reach a value of USD 17 billion. The growth in the manufacturing operations of the automotive and A&D industries is expected to propel the demand for AC drives.

- The production process of electronics consumes a huge amount of energy. With the increasing customer demand and the ever-surging production volumes, the manufacturers are adopting automation with energy-efficient devices. Hence, many end-users, especially in the discrete industries, are increasingly adopting customized motors with AC electric drives.

- Furthermore, electronics manufacturing companies are expanding their manufacturing capacities across the globe. For instance, in March 2022, Intel plans to spend more than EUR 33 billion to increase its manufacturing capacities across the EU to bring various parts of the semiconductor value chain and increase supply chain resiliency in Europe.

Asia Pacific is Expected to Hold Major Share

- The regional organizations are making progress and seeing results from more reliable, efficient, and predictive processes at the plant and expect further increase in operational efficiency from investments in the industrial Internet of Things (IIoT) that connect machines and automate processes.

- For instance, in June 2022, Japanese engineering company Mitsubishi Electric Corporation said that it would spend approximately USD 2200 million on its subsidiary Mitsubishi Electric India Pvt. Ltd. to set up a new factory in the country to manufacture inverters and factory automation (FA) control system products.

- Manufacturing is one of the pillars of China's economy and is undergoing a rapid transformation as the population ages, rising labor costs, and inexpensive migrant workers are no longer sustainable. Moreover, 70% of the world's consumer electronics are made in China.

- With the emphasis on automating manufacturing processes in different industry verticals such as power generation, oil & gas, textile, and mining, end-users are increasing continuous industrial automation in production processes, enhancing the application of AC electric drives.

- Moreover, the changing environment in the region has been driving the demand for HVAC systems in commercial, institutional, real estate, etc. sectors. Also, the growing number of infrastructure projects and buildings creates demand for energy-efficient HVAC systems. Hence, HVAC manufacturers are investing in expansion to cater to the demand. For instance, according to the Ministry of Commerce & Industry India, 26 companies are investing 3898 Crore in AC conditioner components manufacturing in India under PLI Scheme.

Alternating Current (AC) Electric Drives Industry Overview

The global AC drives market is highly fragmented as the demand for AC electric drives is increasing with the growing manufacturing industry across the globe. The key players in the market, like Danfoss, ABB, Siemens AG, and others, are continuously innovating new products and rising activities such as mergers and acquisitions and capacity expansion, further increasing the competition.

- May 2022 - Rockwell Automation, one of the largest companies dedicated to industrial automation and digital transformation, announced the release of its new Allen-Bradley Armor PowerFlex AC variable frequency drives for industrial motor control applications. These on-machine drives provide quicker installation, simple commissioning, and predictive maintenance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Automation in Manufacturing Industry

- 5.1.2 Rising Government Regulations and Demand of Energy Efficient Devices

- 5.2 Market Challenges

- 5.2.1 High Cost of Installation and Maintenance

6 SEGMENTATION

- 6.1 By Voltage

- 6.1.1 Low

- 6.1.2 Medium

- 6.2 By End-user Industry

- 6.2.1 Oil & Gas

- 6.2.2 Chemical & Petrochemical

- 6.2.3 Food & Beverage

- 6.2.4 Water & Wastewater

- 6.2.5 Power Generation

- 6.2.6 Metal & Mining

- 6.2.7 Pulp & Paper

- 6.2.8 HVAC

- 6.2.9 Discrete Industries

- 6.2.10 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Russia

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia & New Zealand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Chile

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle-East & Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Turkey

- 6.3.5.4 Rest of Middle-East & Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB Ltd

- 8.1.2 Danfoss

- 8.1.3 Rockwell Automation Inc.

- 8.1.4 Schneider Electric SE

- 8.1.5 Siemens AG

- 8.1.6 WEG SA

- 8.1.7 Yaskawa Electric Corporation

- 8.1.8 Toshiba International Corporation

- 8.1.9 Parker Hannifin Corporation

- 8.1.10 Fuji Electric Co. Ltd.

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219