|

市场调查报告书

商品编码

1683514

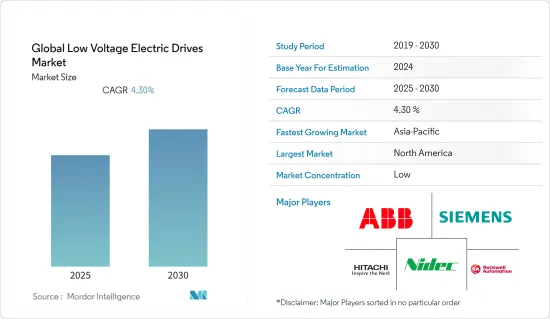

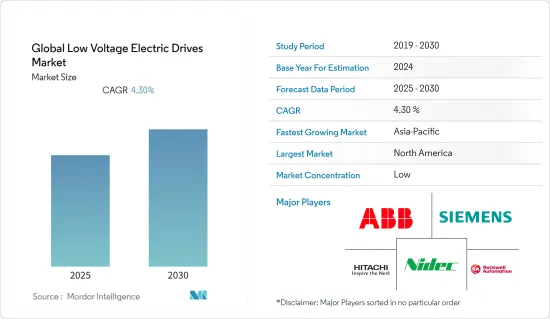

全球低压电力驱动市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Low Voltage Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

预测期内,全球低压电驱动市场预计将实现 4.3% 的复合年增长率

主要亮点

- 低压驱动器用于低功率和高功率应用中,以控制交流马达的扭力和速度。它们的低成本、快速可用性、小型化以及提高整个工业流程的生产效率的能力开闢了新的商业场景。此外,高效率的系统需求和显着的能源节约可能会加速产品前景。

- 由于供应链物流中断和製造工厂暂时关闭,COVID-19 疫情仅对低压驱动器市场产生了轻微影响。地方政府为限制国际贸易和实施国内封锁而采取的严格限制措施对产品需求产生了负面影响。主要竞争对手对医疗设施等关键领域的关注度增加和采用新的作战策略在一定程度上抵消了行业动态。

- 此外,由于商业和工业领域越来越多地采用节能电气设备,微型硬碟领域的低压驱动市场预计也将显着成长。这些系统在输送机、风扇、搅拌机、泵浦和整合/机械应用中的广泛使用及其固有属性(包括一系列无段变速和平稳的速度和扭矩控制能力)将对产品渗透产生积极影响。

- 推动市场扩张的因素包括新兴国家工业化和都市化进程加快、工业自动化程度提高以及对节能马达的需求日益增长。此外,低压驱动器的几个特点,如高安全标准、提高品质和生产力、正能源平衡和降低能耗将极大地促进低压驱动器市场的发展。

- 此外,由于严格的马达可用性标准和法规,以及过时设备的升级和更换,驱动器市场预计将很快扩大。

低压电力驱动市场趋势

汽车产业可望刺激需求

- 汽车生产能力的持续扩大以及新兴经济体新建製造工厂的能源消耗增加将推动汽车低压驱动器市场的发展。最终用户对电动车的接受度模式转移,加上对提高汽车安全性的需求日益增长,促使消费者对采用电动车产生了兴趣。

- 此外,政府专注于扩大电动车的使用,因为电动车能够承受恶劣的环境和高衝击负荷和振动水平,这有助于推动电动车的普及。消费者对电动车的期望越来越高,而增加电压是增加电动装置功率最简单的方法。然而,这只会加剧电气安全问题。

- Volabo 是 ANSYSStart-Ups专案的成员之一,提案了一种低压电动装置运行电压仅为 48 伏特,因此可以安全地触摸。 Volabo 也使用智慧定子笼驱动 (ISCAD) 系统。这种配置以价格低廉且易于製造的铝棒取代了马达中最昂贵的零件铜绕组。

- 此外,nanoFlowcell 还开发出一种技术,无需使用笨重的超级电容即可在自主型系统中实现低压电驱动。这一演变在 Quant 48Volt 变体中展示。 nanoFlowcell 能够从这种低压系统中传输高功率,这有助于提高其设计的固有安全性。

亚太地区可望主导低压驱动器市场

- 由于能源效率法规的实施和对最佳能源解决方案的需求不断增加,亚太地区低压驱动器市场预计将在 2022 年至 2027 年间快速成长。不断增长的工业投资和蓬勃发展的房地产行业可能会提振市场状况。政府为扩大电动车普及率所采取的多项措施预计将增加对电动车配件的需求,从而进一步刺激市场需求。

- 预计到 2027 年,直流低压驱动器将经历显着成长,主要原因是新兴国家消费者可支配收入和都市化的提高。更严格的建筑物排放规定将导致电网的持续维修和维修,从而增加工业需求。该产品具有减少维护、提高效率和易于部署等几个显着的优势,有助于加速市场格局的发展。

- 此次扩张是由于政府为建设永续交通途径和其他工业活动提供了诱人的奖励。电力基础设施的持续产品创新和持续技术改进将推动市场成长。这也是因为该地区对石油和天然气、电力和食品加工的需求不断增长。

- 例如,ABB 于 2022 年 1 月在印度推出了其防火(FLP) 低压马达。 FLP 即使在爆炸性条件下也能安全可靠地运行,并且具有 IE2 和 IE3 效率等级。该产品还包含远端监控功能,扩大了该国的产品阵容。

低压电力驱动产业概况

全球低压电驱动市场高度分散,有多家全球和区域参与者。市场趋势受无机成长计划、併购和持续的技术改进所塑造。 ABB、西门子、倍福自动化、艾默生电气公司、伊顿和日立是该领域的一些主要参与者。

- 2021 年 11 月 - 创新轴发电机采用由永磁技术组成的新型驱动系统和动力输出 (PTO) 解决方案,将成为 ABB 为 Himilayan Shipping 超大型散装货船提供的设备包的一部分。低压电力驱动器和变压器、工程、计划管理和试运行服务都将成为 ABB 为喜马拉雅航运船舶提供的全面供货范围的一部分。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者和消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 更加关注能源效率和能源标准

- 汽车产业加速成长

- 市场挑战

- 实施成本高

第六章 市场细分

- 类型

- 交流变频器

- 直流驱动

- 伺服驱动

- 最终用户产业

- 车

- 石油和天然气

- 化工和石化

- 食品和饮料

- 用水和污水

- 发电

- 金属与矿业

- 纸浆和造纸

- 空调

- 离散製造业

- 其他最终用户产业

- 地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 英国

- 德国

- 义大利

- 法国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲国家

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 土耳其

- 其他中东和非洲地区

- 北美洲

第 7 章 供应商市场占有率

第八章 竞争格局

- 公司简介

- ABB Ltd.

- Siemens AG

- Hitachi, Ltd.

- Nidec Corporation

- Rockwell Automation

- Beckhoff Automation

- Johnson Controls

- Yaskawa America, Inc.

- Schneider Electric

- Hiconics Eco-energy Technology Co., Ltd.

- Schneider Electric, Fuji Electric Co., Ltd.,

- CG Power & Industrial Solutions Ltd.

第九章投资分析

第十章 投资分析 未来市场展望

简介目录

Product Code: 91192

The Global Low Voltage Electric Drives Market is expected to register a CAGR of 4.3% during the forecast period.

Key Highlights

- Low voltage drives are used in low and high-power applications to control the torque and speed of alternating current motors. Because of the low cost, quick availability, and reduced size, as well as the ability to boost process productivity throughout industrial processes, the business scenario will spread. Furthermore, high-efficiency system requirements and large energy savings will accelerate the product landscape.

- Due to the interruptions in supply chain logistics and the temporary shutdown of manufacturing facilities, the COVID-19 pandemic has only had a marginal impact on the low voltage drive market. The strict restrictions taken by regional governments to restrict international trade and enforce national lockdowns have had a negative impact on product demand. The dynamics of the industry have been somewhat counterbalanced by the increased attention paid to emergency sectors like healthcare facilities and the adoption of new combat strategies by the major competitors.

- Furthermore, with the growing adoption of energy-efficient electrical equipment in the commercial and industrial sectors, the low voltage drive market for the microdrives segment is also predicted to experience significant growth. Product penetration will be positively impacted by the expanding use of these systems for conveyors, fans, mixers, pumps, and integrated/machinery applications, as well as their essential characteristics, which include a variety of stepless and smooth speed and torque control features.

- The factors fueling the market's expansion include the rise in industrialization and urbanization in emerging nations, the rise in industrial automation, and the expanding need for energy-efficient motors. Additionally, several characteristics of low voltage drives, including high safety standards, improved quality and productivity, positive energy balance, and reduced energy consumption, significantly boost the market for low voltage drives.

- The drive market is also predicted to increase shortly due to stringent motor efficacy standards and regulations and the upgrading and replacement of outdated equipment.

Low Voltage Electric Drives Market Trends

Automotive Industry is Expected to Boost the Demand

- The automotive low-voltage drive market will be boosted by the continuing expansion of automotive production capacity and rising energy consumption in new manufacturing facilities in emerging nations. The consumer focus has switched toward adopting these drives due to the paradigm shift toward acceptance of electric autos among end-users, in conjunction with the growing demand to increase vehicle safety.

- Furthermore, increased government emphasis on expanding e-mobility cars by their uses in tough areas and their capacity to withstand high shock loads and vibration levels have boosted product penetration. Consumers expect more from electric vehicles, and increasing the voltage is the simplest way to improve electric drives' power. This merely exacerbates the problem of electrical safety.

- Volabo, an Ansys Startup Program member, proposes a low-voltage electric drive that runs on only 48 volts, a safe-to-touch voltage. Volabo also employs an intelligent stator cage drives (ISCAD) system. The configuration replaces the most expensive component of an electric motor, copper winding, with inexpensive and simple-to-manufacture aluminum bars.

- Furthermore, nanoFlowcell has developed technology that enables low-voltage electric drive in a freestanding system without the use of huge supercapacitors. This advancement will be exhibited in the Quant 48Volt variant. The nanoFlowcell's capacity to deliver so much power from such a low-voltage system contributes to the design's inherent safety.

Asia-Pacific is Expected to Dominate the Low Voltage Drives

- The Asia-Pacific Low Voltage Drives market is expected to grow rapidly between 2022 and 2027 due to the implementation of energy efficiency rules and the rising demand for optimum energy solutions. The market landscape would be augmented by growing industrialization investments and a thriving real estate sector. Several government initiatives to expand EV coverage will increase EV accessory demand, further increasing market demand.

- DC low voltage drives are expected to expand significantly through 2027, owing to rising consumer disposable income and urbanization rates, mainly in emerging countries. Due to stringent building emissions regulations, the continuing repair and retrofitting of electrical networks will increase industrial demand. The product has several major advantages, including reduced maintenance, increased efficiency, and ease of implementation, which help to accelerate the market landscape.

- This expansion is due to attractive government incentives for creating sustainable transportation and other industry activities. Continuous product innovation and continued technical expansion across the electrical infrastructure will drive market growth. Also, this can be due to the rise in demand for oil & gas, power, and food processing in the region.

- ABB, for instance, introduced flameproof (FLP) low voltage motors in India in January 2022. It operates safely and reliably in explosive situations and is available in IE2 and IE3 efficiency classes. The offering includes remote monitoring, which expands the company's product line in the country.

Low Voltage Electric Drives Industry Overview

The global low voltage electric drives market is highly fragmented due to several global and regional players. The market trends will be shaped by inorganic growth initiatives, mergers and acquisitions, and ongoing technical improvements. ABB, Siemens, Beckhoff Automation, Emerson Electric Co., Eaton, and Hitachi, Ltd. are some of the significant players in the field.

- November 2021 - Innovative shaft generators with a Power-Take-Off (PTO) solution, consisting of novel drive systems and permanent magnet technology, will be part of ABB's equipment package for Himilaya Shipping's ultra-large bulk carriers. Low-voltage electric drives and transformers, as well as engineering, project management, and commissioning services, are all included in ABB's comprehensive scope of supply for the Himalaya Shipping vessels.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study assumptions and market definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness -Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing focus toward energy efficiency and energy levels

- 5.1.2 Accelerating the Automotive Industry's Growth

- 5.2 Market Challenges

- 5.2.1 High Implementation Cost

6 MARKET SEGMENTATION

- 6.1 Type

- 6.1.1 AC Drives

- 6.1.2 DC Drives

- 6.1.3 Servo Drives

- 6.2 End-User Industry

- 6.2.1 Automotive

- 6.2.2 Oil & Gas

- 6.2.3 Chemical & Petrochemical

- 6.2.4 F&B

- 6.2.5 Water & Wastewater

- 6.2.6 Power Generation

- 6.2.7 Metal & Mining

- 6.2.8 Pulp & Paper

- 6.2.9 HVAC

- 6.2.10 Discrete Industries

- 6.2.11 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 Italy

- 6.3.2.4 France

- 6.3.2.5 Russia

- 6.3.2.6 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 India

- 6.3.3.3 Japan

- 6.3.3.4 South Korea

- 6.3.3.5 Australia & New Zealand

- 6.3.3.6 Rest of Asia-Pacific

- 6.3.4 Latin America

- 6.3.4.1 Brazil

- 6.3.4.2 Mexico

- 6.3.4.3 Chile

- 6.3.4.4 Rest of Latin America

- 6.3.5 Middle-East and Africa

- 6.3.5.1 United Arab Emirates

- 6.3.5.2 Saudi Arabia

- 6.3.5.3 Turkey

- 6.3.5.4 Rest of Middle-East and Africa

- 6.3.1 North America

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 ABB Ltd.

- 8.1.2 Siemens AG

- 8.1.3 Hitachi, Ltd.

- 8.1.4 Nidec Corporation

- 8.1.5 Rockwell Automation

- 8.1.6 Beckhoff Automation

- 8.1.7 Johnson Controls

- 8.1.8 Yaskawa America, Inc.

- 8.1.9 Schneider Electric

- 8.1.10 Hiconics Eco-energy Technology Co., Ltd.

- 8.1.11 Schneider Electric, Fuji Electric Co., Ltd.,

- 8.1.12 CG Power & Industrial Solutions Ltd.

9 INVESTMENT ANALYSIS

10 FUTURE MARKET OUTLOOK

02-2729-4219

+886-2-2729-4219