|

市场调查报告书

商品编码

1635386

中东和非洲的电动式驱动:市场占有率分析、产业趋势和成长预测(2025-2030)Middle East and Africa Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

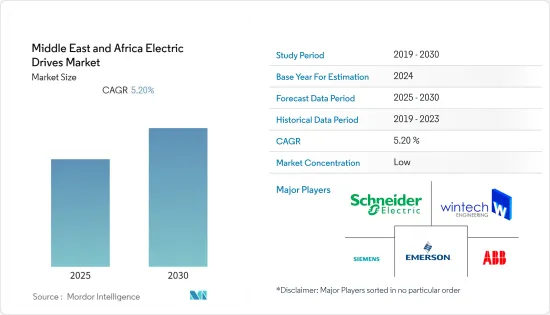

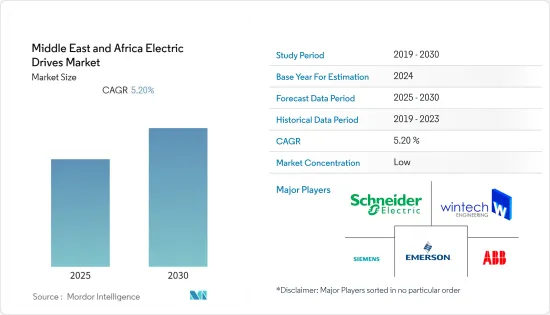

中东和非洲电动式驱动市场预计在预测期内复合年增长率为 5.2%。

主要亮点

- 电动式驱动器能够以低成本实现高效率的生产流程。由于电力消耗是最终用户行业的主要成本因素,预计该地区对电动式驱动器的需求将大幅增加,以获得相对于电力消耗的优势。

- 各种工业製程自动化程度的提高以及交流马达在医疗保健、建筑、汽车和消费品等多种应用中的使用增加预计将推动市场成长。在基础设施开发和建设活动中越来越多地使用交流马达正在加速市场成长,特别是在新兴经济体。

- 例如,在中东开展业务的科技公司 ABB 于 2022 年 6 月建立了测试中心,开发自动化 3D 视觉。该工厂将开发一种支援 3D 视觉的拾放式随机箱拣选解决方案,透过自动选择随机放置的零件来提高Machine Tending和零件供应的速度和生产率。

- 此外,在中东和非洲等开发中地区,由于都市化和工业化,能源需求迅速增加。业界越来越注重采用和部署节能解决方案。此外,马达系统消耗了该部门的大部分电力,从而大大降低了营业成本。直流驱动器是一种透过在负载变化时调节马达转速来最小化马达电力消耗的电气设备。对节能係统不断增长的需求预计将推动直流驱动市场的发展。

- 此外,根据《阿拉伯贸易报》2021年5月报道,预计2030年MEMA地区人口将成长20%,达到5.81亿,2050年将进一步成长24%,达到7.24亿。 15年将以每年3.35%的速度成长。

中东和非洲电动式驱动市场趋势

石油和天然气预计将大幅成长

- 石油和天然气行业成长机会的增加、全球经济成长的稳定以及製造商对成本竞争力的日益重视继续推动产品需求。据英国石油天然气公司 BP 称,2021 年阿拉伯联合大公国的石油产量也将达到约 370 万桶/日。

- 人们对能源效率的认识不断提高,以及严格的环境法规正在增加电动式驱动的采用。电动式驱动具有降低能源消耗并提高石油和天然气装置效率的潜力。

- 例如,2022年4月,GE Digital宣布阿曼领先的勘探和油气生产公司阿曼石油开发公司(PDO)购买了先进的能源管理系统(AEMS)。 PDO 使用 GE Digital 的软体来规划、控制和优化可再生能源发电,以保持石油生产厂的可靠和高效。

- 与其他产业的贡献相比,石油和天然气业务对中东经济的贡献较高。政府和私人公司的进一步投资可能会发展上游勘探和下游原油加工。因此,驱动器製造商的潜在市场可能会扩大,无论是在新计画还是改装需求方面。

- 此外,2021年12月,阿布达比国家石油公司报告了2022年至2026年1,270亿美元的资本支出计划,以增加阿联酋的石油和天然气蕴藏量。该国有公司报告称,石油蕴藏量增加了40亿桶,天然气蕴藏量增加了16兆传统立方英尺,使总储量总合达到1,110亿桶和289兆标准立方英尺。此外,阿布达比国家石油公司将阿联酋列为世界石油蕴藏量第六大国家和天然气蕴藏量第七大国家。

预计阿联酋将拥有较大的市场占有率

- 阿拉伯联合大公国 (UAE) 地区商业和住宅建筑自动化的电力消耗量非常高。在该地区采用变频器有可能提高马达驱动设备的效率并最大限度地减少维护。

- 此外,2022 年 4 月,杜拜水电局 (DEWA) 推出了杜拜电动车社区中心网站,透过集中杜拜电动车发展资讯来促进电动车的普及。这是 DEWA 努力促进永续交通途径的使用,同时确保杜拜作为全球绿色经济和永续之都的地位的一部分。

- 此外,由杜拜电力和水务局发起的「绿色充电器」倡议,在杜拜各地提供电动车充电站,旨在减少交通部门的二氧化碳排放,是「杜拜绿色出行战略」的一部分2030」。透过贡献支持酋长国提供创新和环保解决方案的努力。这些发展和倡议将进一步激发研究市场的活力。

- 暖通空调公司开始实现销售和服务流程自动化,使他们能够降低客户获取成本,同时保持有竞争力的价格。智慧技术(例如智慧型手机应用程式)的使用使用户可以集中控制照明、通风和其他系统。这些因素正在推动无刷直流马达和驱动器在 HVAC 应用中的使用增加。

- 此外,2022 年 6 月,阿联酋与「4IR Champions」合作,扩大工业领域的技术采用。该行业现在将受益于支持工业 4.0(阿联酋第四次工业革命 (4IR) 计划)的新伙伴关係和协作。由此,冠军网络大会已成为实现国家产业战略目标的重要机制。

中东和非洲电动式驱动产业概况

由于存在许多全球和区域参与者,该市场竞争激烈。西门子公司、Wintec Engineering、艾默生电气和Schneider Electric公司是中东和非洲电动式驱动市场的主要供应商。这些供应商提供高品质、可靠且技术先进的设备。

- 2021 年 10 月 - 全球水技术公司赛莱默 (Xylem) 透过土耳其泵浦收购了水处理系统领先公司 Anadolu Flygt,致力于透过开发应对世界水挑战的创新解决方案来扩大其区域足迹并加速成长。此次收购使赛莱默能够为该地区更广泛的国家提供服务,扩大其数位水解决方案和经过验证的永续用水系统,以加速中东市场的成长。

- 2021 年 10 月 - 日立能源宣布,它是与沙乌地阿拉伯电力公司和埃及输电公司订单价值数亿美元重大合约的财团中的主要企业。沙乌地阿拉伯王国 (KSA) 和阿拉伯埃及共和国已订单中东和北非首个大规模高压直流互连,可实现高达 3,000 MW 的电力交换。这些发展和努力进一步活跃了研究市场。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买方议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 产业价值链分析

- COVID-19 市场影响评估

第五章市场动态

- 市场驱动因素

- 工业化程度不断提高,对能源效率的需求不断增加

- 汽车工业发展

- 市场挑战

- 实施成本高且缺乏法规结构

- 供应链分布造成零件短缺

第六章 市场细分

- 按类型

- 交流变频器

- 直流驱动

- 伺服驱动器

- 按电压

- 低电压

- 中压

- 按最终用户产业

- 石油和天然气

- 化学/石化

- 饮食

- 用水和污水

- 发电

- 金属/矿业

- 纸浆/造纸製造

- 空调

- 离散製造业

- 其他最终用户产业

- 按国家/地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 卡达

- 南非

- 埃及

- 其他中东和非洲

第七章 竞争格局

- 公司简介

- Wintech Engineering

- Schneider Electric SE

- ABB Ltd.

- Siemens AG

- Emerson Electric Co.

- ARPI INDUSTRIAL EQUIPMENT LLC

- Severn Glocon Ltd

- NM TECH TRADING FZE

- STARDOM ENGINEERING SERVICES LLC

- General Tech Services LLC

第八章投资分析

第9章 市场的未来

简介目录

Product Code: 91620

The Middle East and Africa Electric Drives Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- Electric drives deliver a highly-efficient production process at a low cost. As electricity consumption is the major cost component across end-user industries, the demand for electric drives is expected to increase considerably to gain an advantage over electricity consumption in the region.

- The increasing automation of various industrial processes and using electric AC motors in multiple applications such as healthcare, construction, automotive, and consumer goods are expected to drive market growth. The increasing use of alternating electric current (AC) motors in infrastructure development and rising construction activity, particularly in developing economies in the region, accelerates market growth.

- For instance, in June 2022, ABB, a technology company with a presence in the Middle East, established a test center to develop a 3D vision for automation. This facility will create pick-and-place, 3D vision-enabled Random Bin Picking solutions to automate the selection of randomly placed parts, improving machine tending and parts feeding speed and productivity.

- Moreover, urbanization and industrialization are causing a rapid increase in energy demand in developing regions such as the Middle East and Africa. In industries, there has been a growing emphasis on adopting and implementing energy-efficient solutions. Furthermore, motor systems consume a large portion of the power supplied to sectors, significantly reducing the operating cost. DC drives are pieces of electrical equipment that help minimize motor power consumption by regulating the motor speed at variable loads. The growing demand for energy-efficient systems is expected to fuel the DC drive market.

- Furthermore, according to Trade Arabia, in May 2021, the demand for energy in the MEMA region is expected to grow by 3.35 % per year for the next 15 years, as the MEMA region's population is expected to grow by 20% to 581 million in 2030 and another 24% by 2050 to 724 million.

MEA Electric Drives Market Trends

Oil & Gas is Expected a Significant Growth

- Growing opportunities for oil & gas industries, as well as the stabilization of global economic growth and manufacturers' increasing focus on cost-competitiveness, will continue to drive product demand. In addition, According to BP, a British oil and gas company, the United Arab Emirates produced approximately 3.7 million barrels of oil per day in 2021.

- Electric drive adoption has increased due to increased awareness of energy efficiency and stringent environmental regulations. Electric drives are likely to reduce energy consumption and improve efficiency in oil and gas installations.

- For instance, in April 2022, GE Digital announced that Petroleum Development Oman (PDO), the Sultanate of Oman's leading exploration and oil and gas production company, had purchased the Advanced Energy Management System (AEMS). PDO will use the GE Digital software to plan, control, and optimize renewable energy generation to keep its oil production plants running reliably and efficiently.

- The contribution of the oil and gas enterprise to the Middle Eastern economies is relatively high compared with the contribution of other sectors. Further investment by government-owned and private entities will develop upstream exploration and downstream crude oil processing. As a result, the addressable market for drive manufacturers will likely increase, both in terms of new projects and retrofit demands.

- Furthermore, in December 2021, The Abu Dhabi National Oil Company reported a USD 127 billion capital spending plan for 2022-2026, increasing the UAE's oil and natural gas reserves. The state-owned company reported an increase in national reserves of 4 billion stock tank barrels of oil and 16 trillion traditional cubic feet of natural gas, bringing the totals to 111 billion stb and 289 trillion scf, respectively. Furthermore, ADNOC ranks the UAE sixth in the world in terms of oil and seventh in terms of gas reserves.

United Arab Emirates is Expected For a Significant Market Share

- Electricity consumption in the UAE region for commercial and residential building automation is extremely high. Adoption of VFDs in this region may increase the efficiency of motor-driven equipment while requiring minimal maintenance.

- Moreover, in April 2022, The Dubai Electricity and Water Authority (DEWA) launched the 'Dubai EV Community Hub' website to increase EV adoption by centralizing information about EV developments in Dubai. This is part of DEWA's efforts to promote the use of sustainable transportation while also securing Dubai's position as a global capital for a green economy and sustainable development.

- Also, the Green Charger initiative launched by the Dubai Electricity and Water Authority to provide charging stations for electric vehicles in various parts of Dubai supports the emirate's efforts to provide innovative and environmentally friendly solutions through its contribution to reducing carbon emissions from the transportation sector and supporting the Dubai Green Mobility Strategy 2030. These developments and initiatives further boost the studied market.

- HVAC companies have begun to automate their sales and service processes, allowing them to reduce customer acquisition costs while maintaining competitive pricing. The use of smart technologies, such as smartphone apps will enable users to control lighting, ventilation, and other systems from a single point of control. These factors contribute to the increased use of brushless DC motors and drives in HVAC applications.

- Further, in June 2022, UAE collaborated with '4IR champions' to increase tech adoption in the industrial sector. Due to this, the sector will benefit from new partnerships and collaborations that support the UAE's Fourth Industrial Revolution (4IR) Programme, Industry 4.0. As a result, the Champions Network Assembly is a critical mechanism for achieving the objectives of the national industrial strategy.

MEA Electric Drives Industry Overview

The market is highly competitive due to the presence of numerous global and regional players. Siemens AG, Wintech Engineering, Emerson Electric, and Schneider Electric SE are the major vendors in the Middle East and Africa Electric Drives Market. These vendors offer high-quality, dependable, and technologically advanced devices.

- October 2021 - Xylem, a global water technology company committed to expanding its regional footprint and accelerating growth by developing innovative solutions to the world's water challenges, has acquired Turkey's top pumping and water treatment systems company Anadolu Flygt. The acquisition will enable the company to serve a broader range of countries in the region and accelerate Xylem's growth in the Middle East market with an expanded suite of digital water solutions and proven systems for sustainable water use.

- October 2021 - Hitachi Energy announced that it is the lead in a consortium that has been awarded a major contract worth several hundreds of millions of USD from the Saudi Electricity Company and the Egyptian Electricity Transmission Company. The award is for the first-ever large-scale HVDC interconnection in the Middle East and North Africa, enabling the Kingdom of Saudi Arabia (KSA) and the Arab Republic of Egypt to exchange up to 3,000 MW of electricity - much of which is expected to be generated from renewable energy sources in the future. These developments and initiatives further boost the studied market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Industrialisation and Growing Demand for Energy Efficiency

- 5.1.2 Flourishing Automotive Sector

- 5.2 Market Challenges

- 5.2.1 High implementation costs and a lack of a regulatory framework

- 5.2.2 Shortage of components and parts due to supply chain distribution

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 AC Drives

- 6.1.2 DC Drives

- 6.1.3 Servo Drives

- 6.2 By Voltage

- 6.2.1 Low

- 6.2.2 Medium

- 6.3 By End-user Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemical & Petrochemical

- 6.3.3 Food & Beverage

- 6.3.4 Water & Wastewater

- 6.3.5 Power Generation

- 6.3.6 Metal & Mining

- 6.3.7 Pulp & Paper

- 6.3.8 HVAC

- 6.3.9 Discrete Industries

- 6.3.10 Other End-user Industries

- 6.4 By Country

- 6.4.1 United Arab Emirates

- 6.4.2 Saudi Arabia

- 6.4.3 Qatar

- 6.4.4 South Africa

- 6.4.5 Egypt

- 6.4.6 Rest of the Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Wintech Engineering

- 7.1.2 Schneider Electric SE

- 7.1.3 ABB Ltd.

- 7.1.4 Siemens AG

- 7.1.5 Emerson Electric Co.

- 7.1.6 ARPI INDUSTRIAL EQUIPMENT LLC

- 7.1.7 Severn Glocon Ltd

- 7.1.8 NM TECH TRADING FZE

- 7.1.9 STARDOM ENGINEERING SERVICES LLC

- 7.1.10 General Tech Services LLC

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219