|

市场调查报告书

商品编码

1644808

亚太地区电动驱动:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

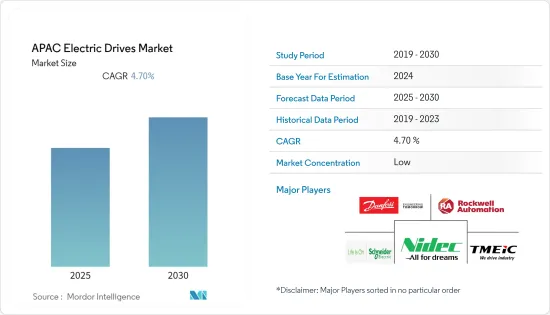

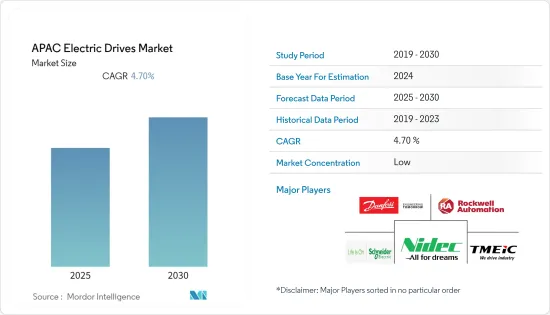

预计预测期内亚太地区电动驱动器市场复合年增长率将达到 4.7%。

主要亮点

- 由于工业 4.0 而导致的製造业的巨大转变以及物联网的采用,利用技术推动生产以实现更大的产能和产量,正在推动电动驱动市场的需求。其他驱动优势(例如最低的维护要求和改进的製程控制)也在推动采用。

- 各行各业的製造流程和自动化中电力驱动装置的使用日益广泛,推动需求的成长。对提高输出能源效率的需求日益增长,进一步增强了电力驱动市场。

- 此外,日本工业自动化和工业4.0发展正在加速。日本已成为工厂自动化产品的製造地,为亚太地区的其他区域市场提供产品,从而降低该地区的工厂自动化成本。

- 印度政府措施,如生产连结奖励(PLI) 计划,该计划与第 65 条计划相结合,将使电子製造和製药业进一步受益。因此,随着技术不断被采用以满足市场需求,製造业也随之成长和扩大。例如,根据高盛的数据,22财年印度製造业的新投资和订单活动成长了210%。

- 此外,「中国製造2025」计画旨在减少中国对外国技术的依赖,从而帮助国内製造商加强营运、扩大业务以服务更大的市场,从而增加对电动装置的需求。

- 工业化进程的加速推动了中国和印度等国家对自动化设备和需要交流变频器的马达驱动设备的需求。然而,初始安装成本、维护和电力驱动的替代选择阻碍了市场的成长。

- 新冠疫情期间,工厂停工对製造设施产生了重大影响,减少了石油和天然气、施工机械和发电等各个工业领域对电力驱动的需求。这次疫情也凸显了工厂自动化取代劳动力的必要性,以解决技术纯熟劳工短缺的问题,并避免因前所未有的情况而导致工作流程中断。

亚太地区电力驱动市场趋势

发电业推动市场成长

- 在发电厂中,各种设备消耗其所生产电力的5-10%。发电过程是由马达驱动的,会消耗大量的电能。这就是为什么变速、变电压电力驱动器越来越多地被使用的原因。这有助于减少电力消耗并提高流程的能源效率。这些驱动器也可用作发电过程的一部分的泵浦和风扇。

- 印度能源署(IEA)预计,受经济活动復苏和中国等主要新兴经济体快速成长的推动,2021年电力需求将成长4.5%。新兴和开发中国家中经济体的需求延续了2020年下半年恢復的成长轨迹。中国和印度经济强劲復苏的预测可能会加速这一轨迹。

- 预计2021年中国GDP成长率为9%,印度为12%,预计两国电力需求较2020年平均成长约8%。东南亚国家预计也将出现强劲的成长復苏,2021年需求将成长5%,总需求将比2019年水准高出3%。

- 因此,该地区主要国家的电力需求不断增长,从而产生了对变速驱动器的需求,随着发电公司对产能扩张和电力基础设施的投资,预计预测期内变速驱动器的需求将进一步推动成长。例如,截至 2021 年,印度有 33 吉瓦(GW)的燃煤发电厂在建,另有 29 吉瓦的计划处于监管部门审批的不同阶段。

预计中国将占很大份额

- 随着亚太地区製造业产量的不断增长,中国正在推动对工业机器人的需求。国内工业机器人和工业控制系统的日益普及正在推动对电力驱动的需求。

- 製造业是中国经济的支柱之一,由于人口老化、人事费用上升和廉价移民劳动力不永续,製造业正经历快速转型。此外,全球70%的电脑、通讯设备和消费性电子产品都是中国製造的。

- 由于重点关注製造流程、建筑、发电和采矿最终用户的自动化,生产过程中工业自动化的不断扩展正在推动电力驱动的应用。

- 製造商正致力于透过在业务中使用机器人来实现生产流程的现代化和数数位化,以应对疫情造成的干扰。例如,根据工业和资讯化部的数据,预计2021年至2025年中国机器人产业营业利润将以每年20%的速度成长。受汽车、航太、物流和采矿业需求不断增长的推动,中国还计划在2025年将製造业机器人密度提高一倍。

- 公司正在其製造业务中实施流程自动化和机器人技术,以加快生产速度。例如,2021年11月,荣耀在中国深圳开设了一个高度自动化的製造工业,目前该工业园区能够以每小时约126台的产出率生产该品牌的核心产品。

亚太地区电驱动产业概况

亚太地区电力驱动市场较为分散,有多家地区和国际企业,其中包括:丹佛斯、ABB、日本电产、TMEIC 等公司在市场上提供高品质、可靠且技术先进的设备。

- 2021 年 7 月-东芝三菱电机工业系统株式会社为中国河北省唐山首钢京唐钢铁有限公司最先进的热轧设备交付了马达驱动系统和自动化系统。最终交付于 2021 年 5 月完成。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 製造业越来越多地采用自动化

- 对节能驱动器的需求不断增加

- 市场挑战

- 高成本

第六章 市场细分

- 按类型

- 交流变频器

- 直流驱动

- 伺服驱动器

- 按电压

- 低电压

- 中压

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 饮食

- 用水和污水

- 发电

- 金属与矿业

- 纸浆和造纸

- HVAC

- 离散製造业

- 其他最终用户产业

- 按国家

- 中国

- 印度

- 日本

- 韩国

- 澳洲和纽西兰

- 其他亚太地区

第 7 章 供应商市场占有率

第八章 竞争格局

- 公司简介

- Danfoss

- Rockwell Automation

- Schneider Electric

- Nidec Corporation

- TMEIC

- Toshiba International Corporation

- Fuji Electric Co. Ltd.

- Wolong Electric Group

- WEG

- CG Power & Industrial Solutions Ltd.

- ElectroCraft, Inc.

第九章投资分析

第十章:市场的未来

简介目录

Product Code: 91124

The APAC Electric Drives Market is expected to register a CAGR of 4.7% during the forecast period.

Key Highlights

- The massive shifts in manufacturing due to Industry 4.0 and the acceptance of IoT to advance production, with technologies to achieve greater production capacity and output, have propelled the demand for the electric drives market. Also, the additional drive benefits such as minimized maintenance requirements and improved process control are the factors fueling adoption.

- The increasing usage of electric drives in the manufacturing processes and their automation across different industry verticals is boosting the demand. The growing need for greater output energy efficiency further strengthens the electric drive market.

- Furthermore, the automation in the industries of Japan and the development of Industrial version 4.0 is speeding up faster. Japan has emerged to become a manufacturing hub for factory automation products, supplying them to other regional markets in the Asia-Pacific region, making factory automation more affordable in the area.

- Several government initiatives in India, such as the Production Linked Incentive (PLI) schemes, announced that the electronics manufacturing and pharmaceuticals sectors could be usefully combined with the Section 65 scheme for added benefits. This resulted in the growth and expansion of manufacturing industries with the adoption of technology to cater to the market's demand. For instance, according to Goldman Sachs, new investment and order activities in the manufacturing industry in India have witnessed a 210% increase in FY 2022.

- Moreover, the made-in-China 2025 initiative to reduce China's dependence on foreign technology is helping the domestic manufacturing industry to strengthen their businesses and cater to a large market by expanding their businesses, adding up the demand for electric drives.

- The growth in industrialization has raised the demand for automated and motor-driven equipment that needs AC drives in the countries such as China, India, etc. However, the initial setup cost, maintenance, and presence of alternative options to Electric drives are the factors impeding the market's growth.

- The shutdown of factories and plants during the Covid-19 pandemic significantly impacted manufacturing facilities and decreased the demand for electric drives across different industry verticals such as oil & gas, construction machinery, and power generation. The pandemic has also highlighted the need for factory automation to replace labor to deal with a skilled labor shortage and avoid disruption in the workflow due to the unprecedented nature of the situation.

APAC Electric Drives Market Trends

Power Generation Industry to Drive Market Growth

- The power generation plants consume 5-10% of the power they produce due to various devices. The power generation processes are driven by electric motors that consume large amounts of electricity. This has resulted in the growth in the use of variable speed and voltage electric drives as it helps reduce electricity consumption and make the processes energy efficient. Also, these drives are being used as pumps and fans that are part of the power generation process.

- According to Indian Energy Agency (IEA), electricity demand is expected to increase by 4.5% in 2021, supported by rebounding economic activity and rapid growth in major emerging economies such as China. Demand in emerging and developing economies remains on the growth trajectory that resumed in the second half of 2020. This trajectory will be accelerated by China and India's projected strong economic recovery.

- With a projected 2021 GDP growth of 9% in China and 12% in India, electricity demand is expected to grow by around 8% in both countries compared with 2020. Southeast Asian countries are also expected to see a strong return to growth, with demand increasing 5% in 2021, putting total demand 3% above 2019 levels.

- Thus, the growth in the demand for electricity in the major countries of the region is creating the demand for variable speed drive and is further expected to propel the growth during the forecast period as power generation companies are investing in capacity expansion and power infrastructure. For instance, as of 2021, there were 33 gigawatts (GW) of coal-fired power plants under construction, and another 29 GW of proposed projects are under various stages of regulatory approval in India.

China is Expected to Hold Significant Share

- China has led the industrial robot demand, owing to the rising production by manufacturing industries in the Asia Pacific region. The increase in the adoption of industrial robots in the country and the Industrial Control System in the country facilitate the demand for electric drives.

- Manufacturing is one of the pillars of China's economy and is undergoing a rapid transformation as the population ages, rising labor costs, and inexpensive migrant workers are no longer sustainable. Moreover, 70% of the world's computers, communication equipment, and consumer electronics are made in China.

- Continuous industrial automation in production processes is growing owing to the emphasis on automating manufacturing processes, construction, power generation, and mining end-users, boosting the application of electric drives.

- The manufacturers are focusing on modernization and digitization of production processes to combat the pandemic hindrance by adopting robots in their operations. For instance, according to The Ministry of Industry and Information Technology, the operating income of China's robotics industry is expected to grow at an annual rate of 20 % from 2021 to 2025. And China aims to double its manufacturing robot density by 2025 owing to increased demand from automobile, aerospace, logistics, and mining industries.

- The companies are deploying process automation and robotics in their manufacturing process to increase production speed. For instance, in November 2021, Honor opened its highly automated Manufacturing Industrial Park in Shenzhen, China, and is now able to produce the brand's major products with a production speed of about 126 units every hour.

APAC Electric Drives Industry Overview

The Asia Pacific electric drives market is fragmented owing to the presence of regional and international players such as Danfoss, ABB, Nidec Corporation, TMEIC, etc., in the market that offers high-quality, reliable devices with technological advancement. The competition will likely intensify due to rising activities such as mergers and acquisitions and product launches by vendors to enhance their presence in the market.

- July 2021 - Toshiba Mitsubishi-Electric Industrial Systems Corporation has delivered a motor drive system and an automation system for a cutting-edge hot strip mill facility set up by Shougang Jingtang Iron & Steel Co., Ltd. in Tangshan City, Hebei Province, China. The final delivery was completed in May 2021.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Automation in Manufacturing Industry

- 5.1.2 Inceasing Demand of Energy Efficient Drives

- 5.2 Market Challenges

- 5.2.1 High Cost of Installation and Maintenance

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 AC Drives

- 6.1.2 DC Drives

- 6.1.3 Servo Drives

- 6.2 By Voltage

- 6.2.1 Low

- 6.2.2 Medium

- 6.3 By End-user Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemical & Petrochemical

- 6.3.3 Food & Beverage

- 6.3.4 Water & Wastewater

- 6.3.5 Power Generation

- 6.3.6 Metal & Mining

- 6.3.7 Pulp & Paper

- 6.3.8 HVAC

- 6.3.9 Discrete Industries

- 6.3.10 Other End-user Industries

- 6.4 By Country

- 6.4.1 China

- 6.4.2 India

- 6.4.3 Japan

- 6.4.4 South Korea

- 6.4.5 Australia and New Zealand

- 6.4.6 Rest of Asia-Pacific

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Danfoss

- 8.1.2 Rockwell Automation

- 8.1.3 Schneider Electric

- 8.1.4 Nidec Corporation

- 8.1.5 TMEIC

- 8.1.6 Toshiba International Corporation

- 8.1.7 Fuji Electric Co. Ltd.

- 8.1.8 Wolong Electric Group

- 8.1.9 WEG

- 8.1.10 CG Power & Industrial Solutions Ltd.

- 8.1.11 ElectroCraft, Inc.

9 INVESTMENT ANALYSIS

10 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219