|

市场调查报告书

商品编码

1644809

拉丁美洲电力驱动:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Latin America Electric Drives - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

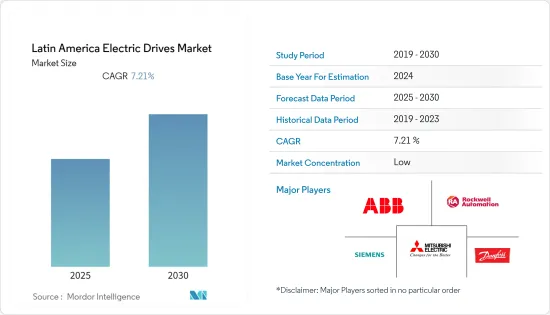

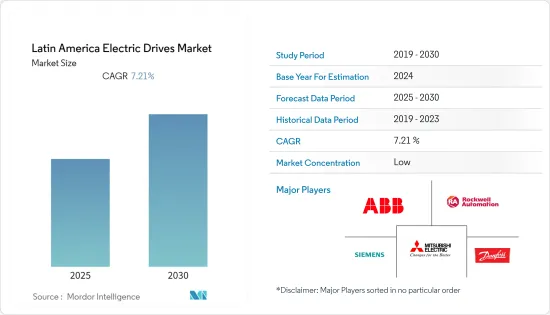

预计预测期内拉丁美洲电动驱动器市场复合年增长率将达到 7.21%。

主要亮点

- 该地区各行业广泛采用电动装置,促进了市场成长率。例如,Fazenda Brasileiro 是一座地下金矿,位于巴西东北部的巴伊亚州,拥有每天 3,500 吨的炭浆设施。该矿已开采 30 多年,每次矿产资源耗尽后都会更新。为了支援此维修计划,VACON 拉丁美洲公司交付了18 台 VACON X 系列交流变频器来管理地下室通风和泵送系统。电力驱动的主要成本很高,这被视为预测期内市场面临的挑战。

- 该地区自动化程度的不断提高对电力驱动市场的需求做出了巨大的贡献。由于贸易紧张和新冠疫情,製造业正在离客户更近。公司正在寻求透过自动化进行近岸外包来解决供应链问题。

- 巴西被认为是拉丁美洲继墨西哥之后领先的製造国之一,也是最大的电气设备(包括医疗设备)和家用电器出口国之一。这推动了该国对工厂自动化的需求。此外,人工智慧模拟可能会提高冶金生产领域的效率,目前该领域的效率落后于已开发国家。

- 电动装置的主要成本很高,这被认为是预测期内市场面临的挑战。新冠疫情对拉丁美洲的电力驱动业务产生了重大影响,为使用电力驱动的各个终端用户产业带来了问题。整个地区实施了封锁,工业陷入停滞。然而,随着新冠疫情过后企业逐步恢復运营,各行各业对节能设备的需求可能会增加,从而导致对电动驱动器的需求相应增加。

拉丁美洲电力驱动市场趋势

交流变频器可望占据市场主要份额

- 由于交流变频器在各个领域的广泛应用,预计将占据较大的份额。交流变频器主要应用于变扭矩应用、暖通空调系统、发电厂、锅炉给水泵等。

- 典型的应用包括发电站给水泵的交流变频器、发电机冷凝水泵的交流变频器以及发电行业的运作。

- 巴西占南美洲三分之二的土地,是南美洲水力发电装置容量最大的国家。巴西的水力发电部门占全国总能源容量的三分之二,占全国电力需求的四分之三以上。巴西的发电严重依赖水力发电,2020年水力发电占巴西电力消耗的66%。虽然亚马逊河流域占巴西水力发电量的大部分,但电力消耗主要集中在东部沿海地区,尤其是南部地区(资料来源:EIA)

- 据监管机构 Aneel 称,巴西 2022 年 3 月新增发电容量 347 兆瓦。热电厂占月新增产能的36%,其次是太阳能光电(29%)、风电(21%)和小型水力水力发电(14%)。

预测期内,HVAC 预计将占据较大份额

- 交流变频器是目前在建筑 HVAC 系统(或变速驱动器)中应用的最有效的能源管理方法之一。采用交流变频器的主要优点是节省能源。透过将系统容量与全年的实际需求相匹配,可以显着节省系统马达的能耗。

- 由于对节能空调和冷冻解决方案的需求不断增长,随着经济继续显示出显着增长的迹像以及住宅和商业建筑部门的扩张,对 HVAC 单元的需求也在增长。已经颁布了许多法规来减少 HVAC 系统的使用,因为 HVAC 系统的能源消耗比传统的供暖方式更大。儘管如此,连网住宅和绿色技术的日益普及预计将为 HVAC 设备供应商带来可观的收入成长。

- 根据WEDC(威斯康辛州经济发展公司)统计,墨西哥的HVAC产业由全国约600家公司组成。有 400 家公司生产热交换器。 HVAC 製造商包括 Carrier Corp.、Goodman Manufacturing Co.、Lennox International Inc.、Nortek Global HVAC、Rheem Manufacturing Co.、Trane Inc. 和 York International Corp.预计这将促进该地区对交流变频器的需求。

- 例如,2021年,日本电产旗下为全球住宅和商业电器产品产业提供解决方案的分店Nidec Global Appliances开始大幅扩张其製造能力。额外的容量将为美国 Motors 和 Rescue 品牌的暖气、通风和空调 (HVAC) 系统提供变速马达。该1800万美元的投资将使年产能增加150万台。位于墨西哥蒙特雷的三家 Nidec Global Appliance 製造工厂将获得此生产扩张的投资。

- 2020年9月,智利能源部启动了在智利中南部麦哲伦地区发展区域供热的计画。该计划由全球环境基金 (GEF) 支持,将制定监管、技术、财务和其他要求,以促进该地区的区域供热。

拉丁美洲电力驱动产业概况

由于市场参与者越来越注重新产品开发以克服现有的缺点,预计拉丁美洲电动驱动器市场在整个估计和预测期内将保持竞争力。公司也注重合作和併购,以扩大消费群。市场的主要企业包括罗克韦尔自动化、ABB 有限公司、Schneider电气、西门子股份公司、艾默生电气等。

- 2021 年 1 月 - 罗克韦尔自动化的 Kinetix 5100伺服驱动器配备 Kinetix TLP伺服马达(独立运动解决方案),电压为 480V,适用于包装、转换、印刷、捲筒纸、机械、组装和生命科学OEM应用。 Kinetix 5100伺服系统为多功能、自主型机器提供具有市场竞争力的运动控制,满足了消费者对产品多功能性日益增长的需求。 OEM可以采用 Kinetix 5100伺服驱动器设计电动或自动化系统,以协助加快转换速度。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 提高自动化采用率

- 製造业显着成长

- 市场限制

- 电力驱动成本高

第六章 市场细分

- 按类型

- 交流变频器

- 直流驱动

- 伺服驱动器

- 按电压

- 低电压

- 中压

- 按最终用户产业

- 石油和天然气

- 化工和石化

- 饮食

- 用水和污水

- 发电

- 金属与矿业

- 纸浆和造纸

- HVAC

- 离散製造业

- 其他最终用户产业

- 按国家

- 巴西

- 墨西哥

- 智利

- 其他拉丁美洲国家

第七章 竞争格局

- 公司简介

- Mitsubishi Electric Corporation

- ABB Ltd.

- Danfoss

- Siemens AG

- Rockwell Automation

- Toshiba International Corporation

- Emerson Electric Co.

- Nidec Corporation

- Fuji Electric Co. Ltd.

- Maxon Group

第八章投资分析

第 9 章:未来趋势

The Latin America Electric Drives Market is expected to register a CAGR of 7.21% during the forecast period.

Key Highlights

- The significant adoption of electric drives in various sectors in the region is contributing to the market growth rate. For instance, Fazenda Brasileiro is an underground gold mine with a 3,500-tonne daily capacity carbon-in-pulp facility in Bahia, a state in north-eastern Brazil. The mine has been operating for more than three decades, and it has constantly renewed its mineral reserves as they have been depleted. Vacon Latin America has delivered 18 VACON X-series AC drives to manage ventilation and pumping systems underground to help with this retrofitting project. The primary cost of the electric drives is high, hence is considered a challenge for the market during the forecast period.

- The growing adoption of automation in the region is majorly contributing to the demand for the electric drives market. Manufacturing is moving closer to the customer as a result of trade tensions and COVID-19. Companies are considering nearshoring with automation as a solution to supply-chain concerns.

- After Mexico, Brazil is regarded as one of the top manufacturers in Latin America and one of the largest exporters of electrical equipment (including medical equipment) and appliances. This fuels the country's demand for factory automation. Furthermore, AI-driven simulation is likely to boost the metallurgical production sector's efficiency, which now lags behind that of industrialized nations.

- The primary cost of the electric drives is high, hence is considered a challenge for the market during the forecast period. The COVID-19 pandemic had a huge impact on the Latin American electric drive business, causing problems for various end-user industries that employ electric drives. Lockdowns were imposed across the region, bringing the industry to a halt. However, with the gradual businesses reopening in the post-COVID-19 period, the industry is expected to see an increase in the need for energy-efficient gadgets, resulting in an ancillary demand for electric drives.

Latin America Electric Drives Market Trends

AC drives are Expected to hold Major Share in the Market

- AC drives are expected to hold a major share owing to their widespread applications in various sectors. They are primarily deployed in variable torque applications, HVAC systems, power plants, boiler feeder pumps, and so on.

- The major applications include AC drive in water supply pump in power plant, AC drives on condensing pump of power generator, and so on that include operation in the power generation industry.

- With two-thirds of the continent's total capacity, Brazil has the most installed hydroelectric capacity in South America. The hydropower sector in Brazil accounts for two-thirds of total energy capacity and more than three-quarters of electricity demand. Brazil's electricity generation is heavily reliant on hydropower; in 2020, hydropower accounted for 66% of the country's electrical consumption. The Amazon River Basin has the majority of Brazil's hydropower capacity, although electrical consumption centers are primarily found along the eastern coast, particularly in the south (source: EIA)

- According to regulator Aneel, Brazil raised its electricity generation capacity by 347MW in March 2022, with new plants coming online. Thermoelectric plants accounted for 36% of the monthly capacity increase, followed by solar with 29%, wind with 21%, and small hydropower plants with 14%.

HVAC is Expected to Hold Significant Share During the Forecast Period

- The AC drive is among the most effective energy management methods currently applied to building HVAC systems (or variable speed drive). The primary advantage of employing an AC drive is that it saves energy. Major savings in system motor energy use are gained by matching system capacity to actual demand throughout the year.

- Due to the growing demand for energy-efficient air-conditioning and refrigeration solutions, demand for HVAC units is expanding as the economy continues to show signs of significant growth and the housing and commercial building sectors expand. Many regulations have been enacted to reduce the usage of HVAC systems, which are more energy-intensive than traditional heating alternatives. Nonetheless, with the growing trend of linked homes and the adoption of greener technologies, HVAC equipment vendors are likely to see a significant increase in income.

- According to the WEDC (Wisconsin Economic Development Corporation), Mexico's HVAC industry consists of around 600 enterprises across the country. Heat exchangers are manufactured by 400 different firms. Carrier Corp., Goodman Manufacturing Co., Lennox International Inc., Nortek Global HVAC, Rheem Manufacturing Co., Trane Inc., and York International Corp. are among the HVAC manufacturers. This is analyzed to boost the demand for AC drives in the region.

- For instance, in 2021, Nidec Global Appliance, a branch of Nidec Corporation committed to providing solutions for the global residential and commercial appliance industries, has begun a significant expansion of its manufacturing capacity. The extra capacity will enable variable speed motors for heating, ventilation, and air conditioning (HVAC) systems from the US Motors and Rescue brands. The estimated USD 18 million investment will expand annual production capacity by 1.5 million units. Three Nidec Global Appliance manufacturing factories in Monterrey, Mexico, will receive the investment for this production expansion.

- In September 2020, Chile's ministry of energy launched a program to develop district heating in the south-central Magallanes region of Chile. The Global Environment Facility (GEF) supported project will develop the regulatory, technology, finance, and other requirements to advance district heating in the region.

Latin America Electric Drives Industry Overview

The market for Latin America electric drives is estimated to be highly competitive over the forecast period, as the players in the market are increasingly working on new product development with a sharp focus on overcoming the shortcomings of the prosecutor. The players are also focusing on partnerships and mergers and acquisitions in order to expand their consumer base. Major players in the market include Rockwell Automation, ABB Ltd., Schneider Electric, Siemens AG, and Emerson Electric, among others.

- January 2021 - The Kinetix 5100 servo drive with Kinetix TLP servo motor standalone motion solution from Rockwell Automation is launched in 480V for applications in packaging, converting, print, and web, machine and assembly, and life sciences OEM applications. By providing a market-competitive motion-control capability for versatile, freestanding machines, the Kinetix 5100 servo system addresses growing consumer demand for more product variety. OEMs can design a motorized or automated system with the Kinetix 5100 servo drive to assist speed up changeovers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Automation

- 5.1.2 Signficant Growth in Manufacturing Sector

- 5.2 Market Restraints

- 5.2.1 High Costs of Electric Drive

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 AC Drives

- 6.1.2 DC Drives

- 6.1.3 Servo Drives

- 6.2 By Voltage

- 6.2.1 Low

- 6.2.2 Medium

- 6.3 By End-user Industry

- 6.3.1 Oil & Gas

- 6.3.2 Chemical & Petrochemical

- 6.3.3 Food & Beverage

- 6.3.4 Water & Wastewater

- 6.3.5 Power Generation

- 6.3.6 Metal & Mining

- 6.3.7 Pulp & Paper

- 6.3.8 HVAC

- 6.3.9 Discrete Industries

- 6.3.10 Other End-user Industries

- 6.4 By Country

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Chile

- 6.4.4 Rest of Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mitsubishi Electric Corporation

- 7.1.2 ABB Ltd.

- 7.1.3 Danfoss

- 7.1.4 Siemens AG

- 7.1.5 Rockwell Automation

- 7.1.6 Toshiba International Corporation

- 7.1.7 Emerson Electric Co.

- 7.1.8 Nidec Corporation

- 7.1.9 Fuji Electric Co. Ltd.

- 7.1.10 Maxon Group