|

市场调查报告书

商品编码

1636460

中东和非洲电动车电池分离器市场占有率分析、产业趋势、统计和成长预测(2025-2030)Middle East And Africa Electric Vehicle Battery Separator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

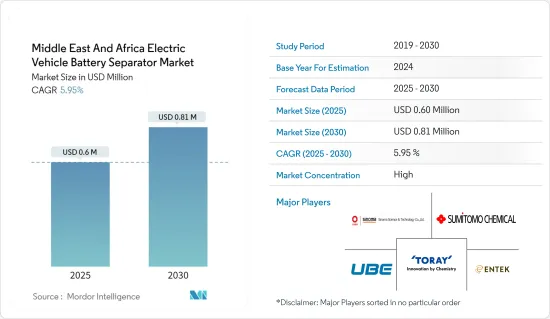

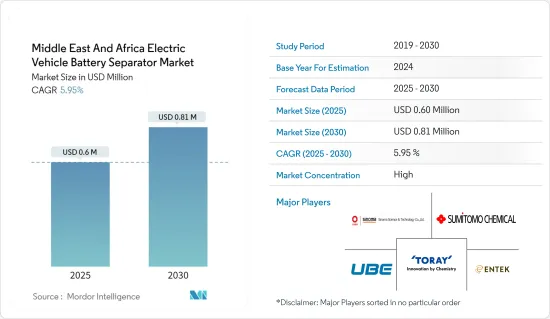

中东和非洲电动车电池隔膜市场规模预计到2025年为60万美元,预计到2030年将达到81万美元,预测期内(2025-2030年)复合年增长率为5.95%。

主要亮点

- 从中期来看,电动车的普及和锂离子电池价格的下降预计将在预测期内推动市场发展。

- 另一方面,该地区原材料供需缺口预计将抑制未来市场成长。

- 新兴电池技术的不断进步预计将为中东和非洲电动车电池隔膜市场创造机会。

- 在该地区所有国家中,由于电动车的普及,预计阿拉伯联合大公国将显着成长。

中东和非洲电动车电池隔膜市场趋势

锂离子电池领域成长迅速

- 在锂离子电池(LIB)领域的带动下,中东和非洲的电动车(EV)电池隔离膜市场预计将显着成长。锂离子电池因其优越的容量重量比、改进的性能、延长的保质期和持续下降的价格而变得越来越受欢迎。

- 与铅酸电池相比,锂离子(Li-ion)电池具有显着的技术优势。锂离子电池的平均寿命超过 5,000 次循环,而典型铅酸电池的平均寿命为 400 至 500 次循环。此外,锂离子电池需要较少的维护和更换,并且在整个放电週期中保持恆定电压。

- 行业主要企业正在大力投资研发和扩张,以进一步提高绩效。竞争的加剧,加上技术的进步和原材料成本的降低,大大降低了锂离子电池的体积加权平均价格。价格从 2013 年的 780 美元/千瓦时暴跌至 2023 年的 139 美元/千瓦时。雄心勃勃的预测称,2025 年将降至 113 美元/千瓦时,2030 年将降至 80 美元/千瓦时。这些成本降低增加了锂离子电池在电动车市场的吸引力,并刺激了对电动车电池隔膜的需求。

- 锂离子电池历来与家用电子电器产品联繫在一起,但它们在电动车上的应用正在发生巨大变化。中东和非洲仍处于锂离子电池製造能力发展的早期阶段,落后于中国、美国和欧洲等全球领跑者,但投资领先阿联酋和沙乌地阿拉伯等国家。这些战略投资不仅旨在实现经济多元化,还满足了对电动车快速增长的需求,为电池材料(包括电动车电池隔膜)的蓬勃发展铺平了道路。

- 例如,Titan Lithium 与阿布达比哈利法经济区 (KEZAD) 集团合作,在阿布达比建立了最先进的锂加工设施,这是一项具有里程碑意义的倡议。这家耗资 50 亿澳元的合资企业将在 KEZAD Al Mamorah 建立一座占地 290,000平方公尺的大型工厂,为电动车行业生产关键的电池级碳酸锂和氢氧化锂。这些措施将加强该地区的电动车电池供应链,并为隔板等电池组件提供利润丰厚的机会。

- 沙乌地阿拉伯在全球二次电池领域取得了长足的进步。 2023年6月,奥贝坎投资集团与澳洲新兴企业European Lithium合作,在沙乌地阿拉伯建立氢氧化锂精製。此外,国营矿业巨头 Maaden 正在与美国艾芬豪电气公司合作,在阿拉伯地盾广阔的未勘探地区寻找锂和其他稀有金属。随着该地区锂离子电池供应链和製造能力的扩大,这些策略措施将增加对电动车电池隔膜的需求。

- 2023 年 9 月,沙乌地阿拉伯宣布当地投资公司 Energy Capital Group 已与美国科技新兴企业Pure Lithium 合作。两家公司的合资企业将专注于开发来自油田卤水的锂电池,初始投资为5,000万美元。该倡议旨在应对锂离子电池金属快速增长的需求,并进一步激活电动车电池隔膜市场。此外,该地区致力于建立可持续的锂离子电池供应链,其成为全球电池联盟的成员凸显了这一点,这表明电动车电池隔膜的强劲成长轨迹。

- 为了加强非洲的锂离子电池供应链,金属提炼和回收公司 ReElement Technologies 于 2024 年 2 月与 Afrivolt 签署了谅解备忘录。该伙伴关係将在非洲创建闭合迴路锂电池和电动车製造生态系统,重点是由 ReElement Technologies Africa 及其子公司精製的在地采购的关键矿物。在可预见的未来,这样的生态系统有望加强锂离子电池组件(包括隔膜)的成长。

- Afrivolt(原名 Aqora)正在该生态系统内主导创建锂离子电池超级工厂。与 ReElement Technologies 的谅解备忘录预计将转化为强而有力的承购协议,可持续支持非洲超级工厂的营运。这些倡议,加上发展当地人才库的努力,将推动该地区的锂离子电池产业的发展。

- 鑑于这些动态发展,锂离子电池产业正在中东和非洲的电动车电池製造中确立主导地位,而电动车电池隔离膜市场预计在未来几年将大幅成长。

阿联酋经历了显着的成长

- 阿联酋准备实现电动车 (EV) 电池产业的显着成长,包括隔膜等重要材料。快速的工业化、电动车采用的快速成长以及阿联酋的战略经济定位正在为强劲的电池采用和创新奠定基础。

- 近年来,电动车在阿联酋的普及率迅速提高。根据国际能源总署(IEA)的报告,2023年电动车销量约28,900辆,较2022年的约18,900辆大幅成长。这种上升趋势,加上阿联酋雄心勃勃的目标,即到 2050 年使电动和混合动力汽车占其保有量的 50%,正在推动电动车电池的需求,特别是关键的隔膜材料刺激了需求。

- 根据其永续性目标,阿联酋正在大力投资电动车基础设施,以推动电动车的采用。这些努力旨在应对气候变迁并减少对石化燃料的依赖。因此,对高容量、耐用的电动车电池的需求不断增加,对高效能电池隔膜的需求也在增加。

- 此外,电池技术的进步,特别是固体电池的出现,正在提高电动车电池的效率、安全性和整体性能。 2024年4月,美国Statevolt宣布计画在哈伊马角兴建一座耗资32亿美元的超级工厂。这项策略性倡议旨在满足中东/非洲和印度快速成长的电池储存和电动车市场的需求,并为电动车电池隔膜製造商开闢新的途径。

- 2022 年初 M Glory Holding Group 宣布成立,进一步凸显了阿联酋对电动车製造的承诺。他们计划在杜拜工业城开设一家大型电动车製造工厂。这座占地 93,000平方公尺的工厂投资 15 亿迪拉姆,目标是每年生产 55,000 辆电动车,增加了对电动车电池及其隔膜的需求。

- 这些战略倡议使阿联酋在中东和非洲快速成长的电动车电池製造业中发挥至关重要的作用,凸显了电动车电池隔膜的关键作用。

中东和非洲电动汽车电池隔膜产业概况

中东和非洲的电动车电池隔膜市场正在变得半固体。市场主要企业包括(排名不分先后)Entek International LLC、Toray International Inc.、中材科技、UBE Corporation 和住友化学。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 锂离子电池价格下降

- 抑制因素

- 原料供需缺口

- 促进因素

- 供应链分析

- 产业吸引力-五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 材料类型

- 聚丙烯

- 聚乙烯

- 其他材料类型

- 地区

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 埃及

- 奈及利亚

- 其他中东/非洲

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Entek International LLC

- Toray International Inc.

- Sinoma Science & Technology Co., Ltd.

- UBE Corporation

- Celgard LLC.

- Sumitomo Chemical Co., Ltd.

- Abu Dhabi Polymers Co Ltd(Borouge)

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 新兴电池技术的进步

The Middle East And Africa Electric Vehicle Battery Separator Market size is estimated at USD 0.60 million in 2025, and is expected to reach USD 0.81 million by 2030, at a CAGR of 5.95% during the forecast period (2025-2030).

Key Highlights

- Over the medium period, the growing adoption of electric vehicles and the decreasing price of lithium-ion batteries is expected to drive the market in the forecast period.

- On the other hand, the demand-supply gap of raw materials in the region is expected to restrain market growth in the future.

- Nevertheless, the growing progress in emerging battery technologies is likely to create opportunities for the Middle East and Africa electric vehicle battery separator market.

- Among all the countries in the region, the United Arab Emirates is expected to have significant growth due to the increasing adoption of electric vehicles.

Middle East And Africa Electric Vehicle Battery Separator Market Trends

Lithium-ion Battery Segment to Witness Fastest Growth

- The electric vehicle (EV) battery separator market in the Middle East & Africa is poised for notable growth, spearheaded by the lithium-ion battery (LIB) segment. The rising popularity of lithium-ion batteries can be attributed to their superior capacity-to-weight ratio, enhanced performance, extended shelf life, and a consistent trend of decreasing prices.

- When compared to lead-acid batteries, lithium-ion (Li-ion) batteries present significant technical advantages. They boast a lifespan averaging over 5,000 cycles, a stark contrast to the 400-500 cycles typical of lead-acid batteries. Furthermore, Li-ion batteries demand less frequent maintenance and replacements, and they maintain a consistent voltage throughout their discharge cycle-an essential feature for the efficient operation of electrical components.

- Key industry players are channeling substantial investments into R&D and operational expansions to further enhance performance. This surge in competition, combined with technological advancements and declining raw material costs, has driven a notable decrease in the volume-weighted average price of lithium-ion batteries. From USD 780/kWh in 2013, the price plummeted to USD 139/kWh in 2023. Projections suggest a further dip to around USD 113/kWh by 2025 and an ambitious USD 80/kWh by 2030. Such cost reductions bolster the appeal of lithium-ion batteries in the EV market, subsequently fueling the demand for EV battery separators.

- Historically linked to consumer electronics, lithium-ion batteries have seen a significant shift in application towards electric vehicles. While the Middle East and Africa are still in the nascent stages of developing their lithium-ion battery manufacturing capabilities-trailing behind global frontrunners like China, the United States, and Europe-nations like the United Arab Emirates and Saudi Arabia are making hefty investments in this domain. These strategic investments not only aim to diversify their economies but also seek to cater to the surging demand for electric vehicles, paving the way for a thriving market for battery materials, including EV battery separators.

- For instance, in a landmark move, Titan Lithium has teamed up with the Khalifa Economic Zones Abu Dhabi (KEZAD) Group to set up a cutting-edge lithium processing facility in Abu Dhabi. This AED 5 billion venture will see the establishment of a sprawling 290,000 square meter plant in KEZAD Al Mamourah, dedicated to producing vital battery-grade lithium carbonate and hydroxide for the EV sector. Such initiatives are poised to bolster the EV battery supply chain in the region, presenting lucrative opportunities for battery components like separators.

- Saudi Arabia is making strides in the global rechargeable battery arena. In June 2023, Obeikan Investment Group joined forces with Australian startup European Lithium to set up a lithium hydroxide refinery in the kingdom. Furthermore, Ma'aden, the state mining giant, has collaborated with US's Ivanhoe Electric to scout vast, under-explored territories in the Arabian Shield for lithium and other rare metals. These strategic moves are set to amplify the demand for EV battery separators as the region's Li-ion battery supply chain and manufacturing capabilities expand.

- Demonstrating its commitment, Saudi Arabia, in September 2023, saw Energy Capital Group, a local investment firm, partner with US tech startup Pure Lithium. Their joint venture focuses on developing batteries from lithium sourced from oilfield brines, backed by an initial USD 50 million investment. This initiative aims to cater to the surging demand for lithium-ion battery metals, further energizing the EV battery separator market. Moreover, the region's dedication to building a sustainable lithium-ion battery supply chain is underscored by its membership in the Global Battery Alliance, signaling a robust growth trajectory for EV battery separators.

- In a bid to fortify Africa's lithium-ion battery supply chains, METALS refining and recycling firm ReElement Technologies inked an MoU with Afrivolt in February 2024. This partnership seeks to craft a closed-loop lithium battery and electric vehicle manufacturing ecosystem in Africa, emphasizing locally sourced critical minerals refined by ReElement Technologies Africa and its subsidiaries. Such an ecosystem is poised to bolster the growth of lithium-ion battery components, including separators, in the foreseeable future.

- Afrivolt, previously known as Aqora, is spearheading the establishment of a lithium-ion cell gigafactory within this ecosystem. The MoU with ReElement Technologies is anticipated to transition into a robust offtake agreement, ensuring sustained support for the operations of African gigafactories. These initiatives, coupled with efforts to nurture a local talent pool, are set to propel the lithium-ion battery industry in the region.

- Given these dynamic developments, the lithium-ion battery segment is on track to emerge as the dominant player in the Middle East and Africa's EV battery manufacturing landscape, heralding a thriving market for EV battery separators in the years to come.

United Arab Emirates to Witness Significant Growth

- The United Arab Emirates (UAE) is on track for significant growth in its electric vehicle (EV) battery industry, encompassing essential materials like separators. Rapid industrialization, a surge in EV adoption, and the UAE's strategic economic positioning are setting the stage for robust battery adoption and innovation.

- EV adoption in the UAE has seen a sharp uptick in recent years. In 2023, the country recorded around 28,900 electric vehicle sales, a notable rise from approximately 18,900 in 2022, as reported by the International Energy Agency (IEA). This upward trend, combined with the UAE's ambitious target of having electric and hybrid vehicles make up 50% of its total vehicles by 2050, is set to fuel the demand for EV batteries, especially critical separator materials.

- In line with its sustainability goals, the UAE is making substantial investments in EV infrastructure and championing EV adoption. These efforts aim to combat climate change and lessen dependence on fossil fuels. Consequently, there's a rising demand for high-capacity, durable EV batteries, which subsequently boosts the need for efficient battery separators.

- Moreover, technological advancements in batteries, especially the emergence of solid-state batteries, are elevating the efficiency, safety, and overall performance of EV batteries. A case in point: In April 2024, US-based Statevolt unveiled plans for a USD 3.2 billion gigafactory in Ras Al Khaimah, targeting an annual output of up to 40 gigawatt-hours. This strategic move is designed to serve the burgeoning battery storage and electric mobility markets spanning the Middle East, Africa, and India, thereby opening new avenues for EV battery separator manufacturers.

- The UAE's commitment to EV manufacturing is further underscored by M Glory Holding Group's announcement in early 2022. They plan to inaugurate a sizable EV manufacturing facility in Dubai Industrial City. With a hefty investment of AED 1.5 billion, this 93,000 square meter plant aims for an annual output of 55,000 EVs, amplifying the demand for both EV batteries and their separators.

- These strategic moves position the UAE as a pivotal player in the burgeoning EV battery manufacturing landscape of the Middle East and Africa, highlighting the crucial role of EV battery separators.

Middle East And Africa Electric Vehicle Battery Separator Industry Overview

The Middle East And Africa electric vehicle battery separator market is semi-consolidated. Some of the key players in the market (not in any particular order) include Entek International LLC, Toray International Inc., Sinoma Science & Technology Co., Ltd., UBE Corporation, and Sumitomo Chemical Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Decreasing Price of Lithium-ion Batteries

- 4.5.2 Restraints

- 4.5.2.1 Demand-Supply Gap of Raw Materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Force

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Other Battery Types

- 5.2 Material Type

- 5.2.1 Polypropylene

- 5.2.2 Polyethylene

- 5.2.3 Other Material Types

- 5.3 Geography

- 5.3.1 United Arab Emirates

- 5.3.2 Saudi Arabia

- 5.3.3 South Africa

- 5.3.4 Egypt

- 5.3.5 Nigeria

- 5.3.6 Rest of Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Entek International LLC

- 6.3.2 Toray International Inc.

- 6.3.3 Sinoma Science & Technology Co., Ltd.

- 6.3.4 UBE Corporation

- 6.3.5 Celgard LLC.

- 6.3.6 Sumitomo Chemical Co., Ltd.

- 6.3.7 Abu Dhabi Polymers Co Ltd (Borouge)

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Growing Progress in Emerging Battery Technologies