|

市场调查报告书

商品编码

1636474

北美电动车电池电解:市场占有率分析、产业趋势与成长预测(2025-2030)North America Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

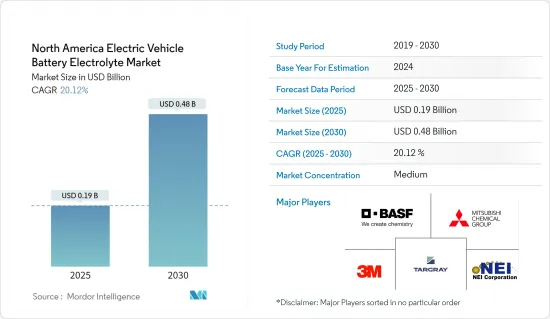

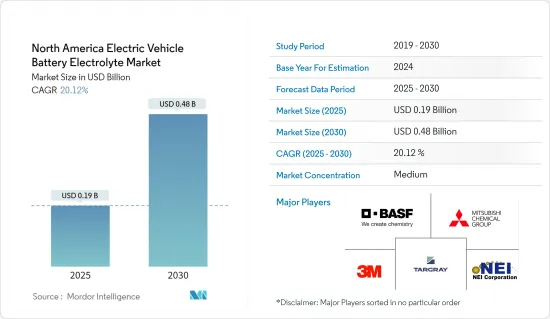

预计2025年北美电动车电池电解市场规模为1.9亿美元,2030年将达4.8亿美元,预测期间(2025-2030年)复合年增长率为20.12%。

主要亮点

- 从中期来看,全部区域电动车渗透率的提高和电池技术的进步预计将在预测期内推动电动车电池电解市场的需求。

- 另一方面,固体电解质的技术挑战可能会严重抑制电动车电池电解质市场的成长。

- 提高电池性能、安全性和寿命的电解配方创新将在不久的将来为电动汽车电池电解市场创造巨大的成长机会,特别是高性能或远距电动车。

- 由于电动车渗透率不断上升,预计美国将在预测期内成为北美电动车电池电解液市场成长最快的国家。

北美电动车电池电解市场趋势

锂离子电池类型大幅成长

- 随着电动车(EV)产业的扩张,北美电动车电池电解市场,特别是锂离子电池电解市场正经历快速成长。这种快速成长背后的关键因素是消费者对电动车的采用增加以及旨在排放温室气体排放的严格政府法规。

- 锂离子电池因其高能量密度、更长的循环寿命和最小的自放电率而对电动车至关重要。锂离子电池定价对电动车的整体成本有重大影响,而电解是这些电池成本的主要决定因素。

- 例如,根据彭博社NEF报道,2023年电池价格将降至139美元/kWh,较上年下降13%。随着技术的不断进步和製造优化,电池组价格预计到2025年将进一步降至113美元/kWh,到2030年将达到80美元/kWh。随着製造效率提高、原料批量采购和供应链合理化导致锂离子电池产量扩大,电池电解液的单位成本将在预测期内下降。

- 此外,锂离子电池的研究和开发正在取得进展,创造出可提高电池性能、安全性和寿命的新电解配方。全国领先的实验室正在为锂离子电动车电池开发先进的电解质解决方案。

- 例如,2023年3月,美国能源局阿贡国家实验室的研究人员推出了一种锂空气电池,可大幅增加电动车的续航里程。这种创新电池使用固体电解质,而不是传统的液体电解质方法。与标准锂离子电池相比,这项进步有可能使能量密度增加四倍,显示在预测期内电动车对这种先进锂离子电池的需求不断增长。

- 此外,主要电池製造商正在北美增加产能,进一步提振电解市场。 2023年9月,瑞典着名锂离子电池製造商Northvolt宣布计画在加拿大魁北克省兴建一座耗资52亿美元的超级工厂。该工厂不仅将生产电池,还将专注于生产正极活性材料。 Northvolt 6 工厂将于今年开始建设,预计将于 2026 年投入营运。这些努力预计将提高锂离子电池的产量,因此未来几年对电动车电解的需求将增加。

- 总之,这些措施和创新预计将扩大北美的锂离子电池产量,并在预测期内大幅增加对电动车电解的需求。

美国正在经历显着成长

- 美国在北美电动车电池电解液市场中发挥着举足轻重的作用,重点是创新、製造和支援措施。电解作为锂离子电池的关键组成部分,促进锂离子在负极和正极之间的传输,对于电动车的能源储存和释放至关重要。

- 近年来,由于消费者需求、环保意识增强以及税额扣抵和退税等政府激励措施,美国电动车销量大幅成长。电动车采用的激增直接刺激了对锂离子电池以及高品质电池电解的需求。

- 例如,根据国际能源总署(IEA)的报告,2023年电池式电动车销量将达到110万辆,比2022年增长37.5%,比2019年增长惊人的3.58倍。随着政府推出多项措施促进电动车的采用,预计未来几年销量将会增加。

- 此外,美国政府支持向电动车的转变,并强调减少碳排放的措施。这项承诺正在推动尖端电池电解质的进步和部署。

- 例如,2024年3月,拜登政府宣布了美国最全面的气候变迁法规,要求到2032年销售的大部分新车和轻型卡车必须是纯电动的。像这样的大胆倡议不仅会加快电动车的生产,还会增加未来几年对电动车电池电解的需求。

- 为了满足电动车快速成长的需求,许多电池製造商正在美国建立或扩大生产基地。这种国内生产策略不仅减少了对进口产品的依赖,也确保了特定地区电解的稳定供应。

- 例如,2023年3月,LG能源解决方案投资7.2兆韩元(52.2亿美元)在亚利桑那州建立电池製造地,以加强北美EV和ESS电池的生产,成为热门话题。新工厂将生产电动车电池,进一步增加对可靠电解供应的需求。

- 从这些进展中可以清楚看出,此类投资和计划将加强美国的电动车生产,并推动对电动车电池电解的需求。

北美电动汽车电池电解液产业概况

北美电动车电池电解市场温和。主要参与企业(排名不分先后)包括3M公司、BASF、三菱化学集团公司、塔格雷科技国际公司、NEI公司等。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车的扩张

- 电池技术的进步

- 抑制因素

- 固体电解质的技术问题

- 促进因素

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代产品/服务的威胁

- 竞争公司之间的敌对关係

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 电解质类型

- 液体电解质

- 凝胶电解质

- 固体电解质

- 地区

- 美国

- 加拿大

- 其他北美地区

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- 3M Company

- BASF Corporation

- LG Chem Ltd

- Mitsubishi Chemical Group

- Panasonic Holdings Corporation

- Solvay SA

- Asahi Kasei America, Inc.

- Cabot Corporation

- Dongwha Electrolyte Co.,Ltd.

- Samsung SDI

- NEI corporation

- Targray Technology International Inc

- 其他知名公司名单

- 市场排名分析

第七章 市场机会及未来趋势

- 电解液配方的创新

简介目录

Product Code: 50003741

The North America Electric Vehicle Battery Electrolyte Market size is estimated at USD 0.19 billion in 2025, and is expected to reach USD 0.48 billion by 2030, at a CAGR of 20.12% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles and advancements in battery technology across the region are expected to drive the demand for the electric vehicle battery electrolyte market during the forecast period.

- On the other hand, the technological challenges in Solid-State electrolytes can significantly restrain the growth of the electric vehicle battery electrolyte market.

- Nevertheless, the innovation in electrolyte formulations that improve battery performance, safety, and lifespan, particularly for high-performance or long-range EVs creates significant growth opportunities in the electric vehicle battery electrolyte market in the near future.

- The United States is anticipated to be the fastest-growing country in the North American electric vehicle battery electrolyte market during the forecast period due to rising EV adoption.

North America Electric Vehicle Battery Electrolyte Market Trends

Lithium-Ion Batteries Type to Witness Significant Growth

- The North American market for EV battery electrolytes, especially those used in lithium-ion batteries, is experiencing rapid growth, paralleling the broader expansion of the electric vehicle (EV) sector. This surge is largely fueled by increasing consumer adoption of EVs and stringent government regulations aimed at curbing greenhouse gas emissions.

- Lithium-ion batteries are pivotal to the EV landscape, celebrated for their high energy density, extended cycle life, and minimal self-discharge rate. The pricing of lithium-ion batteries significantly influences the overall cost of electric vehicles, with electrolytes being a key determinant of these battery costs.

- For example, a Bloomberg NEF report highlighted that in 2023, battery prices fell to USD 139/kWh, marking a 13% drop from the prior year. With ongoing technological advancements and manufacturing optimizations, projections suggest battery pack prices will further decline to USD 113/kWh by 2025 and reach USD 80/kWh by 2030. As lithium-ion battery production ramps up, driven by enhanced manufacturing efficiencies, bulk raw material procurement, and streamlined supply chains, the cost per unit of battery electrolytes is set to decrease during the forecast period.

- Moreover, ongoing R&D in lithium-ion batteries is birthing new electrolyte formulations that boost battery performance, safety, and lifespan. Leading research labs nationwide are pioneering advanced electrolyte solutions for lithium-ion EV batteries.

- For instance, in March 2023, researchers from Argonne National Laboratory, under the US Department of Energy, unveiled a lithium-air battery poised to significantly extend electric vehicles' driving range. This innovative battery employs a solid electrolyte, diverging from the conventional liquid electrolyte approach. When compared to standard Li-ion batteries, this advancement could potentially quadruple energy density, signaling a heightened demand for such advanced lithium-ion batteries in EVs during the forecast period.

- Additionally, major battery manufacturers are ramping up production capacities in North America, further energizing the electrolyte market. In September 2023, Northvolt, a prominent Swedish lithium-ion battery manufacturer, unveiled plans for a USD 5.2 billion gigafactory in Quebec, Canada. This facility will not only produce batteries but also focus on cathode active material production. Construction of the Northvolt Six factory is set to kick off this year, with operations slated for 2026. Such initiatives are poised to bolster lithium-ion battery production and, consequently, the demand for EV battery electrolytes in the coming years.

- In conclusion, these initiatives and innovations are set to amplify lithium-ion battery production in North America, driving a corresponding surge in demand for EV battery electrolytes during the forecast period.

United States to Witness Significant Growth

- The United States plays a pivotal role in the North American EV battery electrolyte market, emphasizing innovation, manufacturing, and supportive policies. Electrolytes, as vital components of lithium-ion batteries, facilitate the movement of lithium ions between the anode and cathode, crucial for energy storage and release in EVs.

- In recent years, the United States has seen a notable uptick in EV sales, driven by consumer demand, heightened environmental consciousness, and government incentives like tax credits and rebates. This surge in EV adoption has directly spurred demand for lithium-ion batteries and, by extension, high-quality battery electrolytes.

- For instance, the International Energy Agency reported that in 2023, battery electric vehicle sales hit 1.1 million units, marking a 37.5% rise from 2022 and a staggering 3.58-fold increase since 2019. With the government rolling out several pro-EV adoption policies, sales are poised to climb in the coming years.

- Furthermore, the U.S. government is championing the shift to electric mobility, emphasizing policies that curb carbon emissions. This commitment is propelling the advancement and deployment of cutting-edge battery electrolytes.

- For instance, in March 2024, the Biden administration unveiled the nation's most sweeping climate regulations, mandating that by 2032, a significant majority of newly sold passenger cars and light trucks will be all-electric. Such bold moves are set to not only hasten EV production but also amplify the demand for EV battery electrolytes in the coming years.

- In response to the surging EV demand, numerous battery manufacturers are either setting up or expanding their production bases in the U.S. This domestic manufacturing strategy not only curtails dependence on imports but also guarantees a consistent supply of region-specific electrolytes.

- For instance, in March 2023, LG Energy Solution made headlines with a KRW 7.2 trillion (USD 5.22 billion) investment to establish a battery manufacturing hub in Arizona, aiming to bolster EV and ESS battery production in North America. This new facility is set to churn out EV batteries, further amplifying the need for a reliable electrolyte supply.

- Given these developments, it's evident that such investments and projects are set to bolster EV production in the United States, subsequently driving up the demand for EV battery electrolytes.

North America Electric Vehicle Battery Electrolyte Industry Overview

The North America Electric Vehicle Battery Electrolyte market is moderated. Some of the key players (not in particular order) are 3M Company, BASF Corporation, Mitsubishi Chemical Group, Targray Technology International Inc, NEI corporation, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Advancements in Battery Technology

- 4.5.2 Restraints

- 4.5.2.1 Technological Challenges in Solid-State Electrolytes

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 3M Company

- 6.3.2 BASF Corporation

- 6.3.3 LG Chem Ltd

- 6.3.4 Mitsubishi Chemical Group

- 6.3.5 Panasonic Holdings Corporation

- 6.3.6 Solvay SA

- 6.3.7 Asahi Kasei America, Inc.

- 6.3.8 Cabot Corporation

- 6.3.9 Dongwha Electrolyte Co.,Ltd.

- 6.3.10 Samsung SDI

- 6.3.11 NEI corporation

- 6.3.12 Targray Technology International Inc

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Electrolyte Formulations

02-2729-4219

+886-2-2729-4219