|

市场调查报告书

商品编码

1636477

亚太地区电动汽车电池电解:市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia Pacific Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

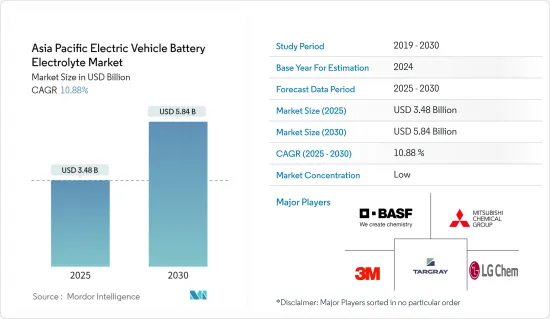

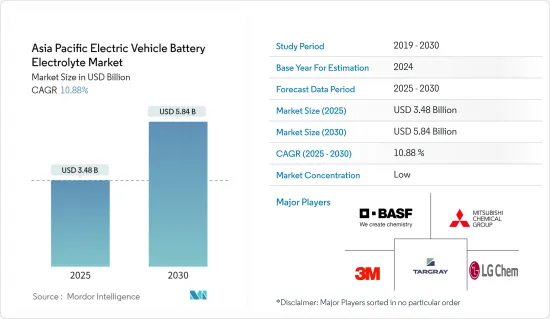

预计 2025 年亚太地区电动车电池电解市场规模为 34.8 亿美元,到 2030 年将达到 58.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.88%。

主要亮点

- 从中期来看,预计预测期内全部区域电动车的普及率不断提高和电池技术的进步将推动电动车电池电解市场的需求。

- 另一方面,固体电解的技术挑战可能会严重抑制电动车电池电解市场的成长。

- 然而,电解配方的技术创新可以提高电池的性能、安全性和寿命,特别是对于高性能或远距电动车,为电动车电池电解市场在不久的将来创造巨大的成长机会。

- 由于电动车的普及,预计预测期内印度将成为亚太地区成长最快的电动车电池电解市场。

亚太地区电动汽车电池电解市场趋势

锂离子电池类型成长强劲

- 亚太地区电动车电池电解市场在电动车 (EV) 供应链中发挥至关重要的作用,并与电动车主要能源储存解决方案锂离子电池的生产直接相关。在严格的排放法规、政府奖励和日益增强的环保意识的推动下,该地区的电动车普及率显着增加。这些因素正在推动对锂离子电池的需求并增加对电池电解的需求。

- 锂离子电池是电动车生态系统的核心,因其高能量密度、长循环寿命和低自放电率而受到重视。锂离子电池的成本在决定电动车整体价格方面起着至关重要的作用,而电解是直接影响这些电池成本的关键部件。

- 例如,彭博新能源财经的报告预测,2023年电池价格将与前一年同期比较减13%至139美元/度。持续的技术进步和製造优化预计将推动电池组价格进一步下降,到 2025 年降至 113 美元/千瓦时,到 2030 年降至 80 美元/千瓦时。由于製造效率的提高、原材料的批量采购和供应链的简化,锂离子电池产量不断扩大,预计预测期内电池电解的单位成本将下降。

- 此外,对锂离子电池的持续研究和开发正在产生新的电解配方,从而提高电池的性能、安全性和使用寿命。最近,全国各地的领先实验室一直在开发用于锂离子电动车电池的先进电解溶液。

- 2024 年 7 月,香港科技大学(HKUST)的研究人员与多所亚洲大学合作,在固态电池技术上取得突破,成为头条新闻。他们展示了专为锂金属电池 (LMB) 定制的最先进的固体电解(SSE),展示了安全性和性能的显着进步。预计这些突破将在预测期内推动电动车高性能锂离子电池的需求。

- 此外,领先的电池製造商正在提高其在亚太地区的生产能力,以满足对电动车不断增长的需求,从而促进电解市场的发展。例如,BMW于2024年2月宣布计画在泰国罗勇府建立新的电池工厂。 BMW计画将泰国打造为亚太地区电动车电池的战略出口基地,进一步加强其电动车锂离子电池的供应。这些措施将在未来几年促进锂离子电池的生产,从而在预测期内增加对电动车电池电解的需求。

- 总而言之,这些努力和技术创新不仅有望增加该地区的锂离子电池产量,而且还将在未来几年推动电动车电池电解的需求。

印度可望主导市场

- 印度正迅速崛起成为亚太电动车(EV)市场的主要企业。尤其是政府在「加快混合动力汽车和电动车的普及和生产」(FAME)计划下制定的雄心勃勃的电动车普及目标,为包括电解在内的电动车电池市场的成长创造了肥沃的环境。培育了以下内容。

- 近年来,由于消费者需求不断增长、环保意识不断增强以及税额扣抵和退税等政府激励措施,印度的电动车销量大幅增加。电动车普及率的激增刺激了对锂离子电池和高端电池电解的需求增加。

- 例如,根据国际能源总署(IEA)的报告,2023年电动车销量将达到8.2万辆,较2022年增长70.8%,较2019年增长惊人的119倍。在一系列政府支持政策的推动下,未来几年电动车销售量预计将进一步成长。

- 随着业界将重点转向据称具有更高能量密度和安全性的固态电池,预计对新型电解的需求将会增加。最近,多家公司签署协议,以满足汽车领域对固态电池日益增长的需求。

- 例如,2023年10月,出光兴产株式会社(出光)和丰田汽车公司宣布建立合作关係,旨在开拓固体电解的量产技术。两家公司的合作旨在提高生产力并为电池电动车(BEV)建立有弹性的供应链。展望未来,两家公司的宏伟目标是在 2027-28 年实现这些电池的商业化部署,为此后的大规模量产铺平道路。这些努力将在预测期内提振对固态电池的需求,并确保电动车电池生产的电解稳定供应。

- 此外,印度政府正在积极支持电动车(EV)运动并推动国内电池製造。该策略包括为电动车购买者提供补贴、为生产商减税以及增加对充电基础设施的投资。

- 例如,印度政府在2023年设定了雄心勃勃的目标,即到2030年,个人汽车销售的30%、商用汽车的70%以及两轮车和三轮车的80%都是电动车。为了进一步奖励这种转变,政府提供每千瓦时 10,000 印度卢比(120 美元)至 15,000 印度卢比(180 美元)的补贴。这些倡议不仅将推动对先进电动车电池的需求,还将在预测期内增加该地区对先进电动车电池电解的需求。

- 鑑于这些发展,很明显,未来几年电动车生产的势头和对电动车电池电解的相应需求将会激增。

亚太地区电动汽车电池电解产业概况

亚太地区电动车电池电解市场规模减少一半。主要参与者(不分先后顺序)包括 3M 公司、BASF株式会社、三菱化学集团、特锐技术国际公司和 LG 化学有限公司。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2029 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电动车日益普及

- 电池技术的进步

- 限制因素

- 固体电解的技术问题

- 驱动程式

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

- 投资分析

第五章 市场区隔

- 依电池类型

- 锂离子电池

- 铅酸电池

- 其他的

- 按电解类型

- 液态电解

- 固体电解

- 凝胶电解

- 按地区

- 中国

- 印度

- 澳洲

- 马来西亚

- 泰国

- 印尼

- 越南

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- 3M Company

- BASF Corporation

- LG Chem Ltd

- Mitsubishi Chemical Group

- Panasonic Holdings Corporation

- UBE Industries, Ltd.

- Asahi Kasei America, Inc.

- Soulbrain Co., Ltd.

- Dongwha Electrolyte Co.,Ltd.

- Samsung SDI

- Fujifilm Wako Pure Chemical Corporation

- 其他着名公司名单

- 市场排名分析

第七章 市场机会与未来趋势

- 电解配方创新

简介目录

Product Code: 50003744

The Asia Pacific Electric Vehicle Battery Electrolyte Market size is estimated at USD 3.48 billion in 2025, and is expected to reach USD 5.84 billion by 2030, at a CAGR of 10.88% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing adoption of electric vehicles and advancements in battery technology across the region are expected to drive the demand for the electric vehicle battery electrolyte market during the forecast period.

- On the other hand, the technological challenges in Solid-State electrolytes can significantly restrain the growth of the electric vehicle battery electrolyte market.

- Nevertheless, the innovation in electrolyte formulations that improve battery performance, safety, and lifespan, particularly for high-performance or long-range EVs creates significant growth opportunities in the electric vehicle battery electrolyte market in the near future.

- India is anticipated to be the fastest-growing country in the Asia Pacific electric vehicle battery electrolyte market during the forecast period due to rising EV adoption.

Asia Pacific Electric Vehicle Battery Electrolyte Market Trends

Lithium-Ion Batteries Type to Witness Significant Growth

- The Asia Pacific EV battery electrolyte market plays a crucial role in the electric vehicle (EV) supply chain, being directly tied to the production of lithium-ion batteries, the primary energy storage solution for EVs. The region has witnessed a significant uptick in electric vehicle adoption, driven by stringent emissions regulations, government incentives, and a growing environmental consciousness. These factors are fueling the demand for lithium-ion batteries, subsequently boosting the need for battery electrolytes.

- Lithium-ion batteries are central to the EV ecosystem, valued for their high energy density, long cycle life, and low self-discharge rate. The cost of lithium-ion batteries plays a pivotal role in determining the overall price of electric vehicles, with electrolytes being a crucial component that directly influences these battery expenses.

- For example, a Bloomberg NEF report highlighted that in 2023, battery prices dropped to USD 139 /kWh, marking a 13% decline from the previous year. With ongoing technological advancements and manufacturing optimizations, battery pack prices are projected to dip further, forecasting USD 113/kWh in 2025 and an ambitious USD 80/kWh by 2030. As lithium-ion battery production ramps up, thanks to enhanced manufacturing efficiencies, bulk raw material procurement, and streamlined supply chains, the cost per unit of battery electrolytes is set to decrease during the forecast period.

- Moreover, ongoing research and development in lithium-ion batteries are birthing new electrolyte formulations that boost battery performance, safety, and lifespan. Recently, top research labs nationwide have been pioneering advanced electrolyte solutions for lithium-ion EV batteries.

- In July 2024, researchers from the Hong Kong University of Science and Technology (HKUST), in collaboration with several Asian universities, made headlines with a breakthrough in solid-state battery technology. They introduced a cutting-edge solid-state electrolyte (SSE) tailored for lithium-metal batteries (LMBs), showcasing significant advancements in safety and performance. Such breakthroughs are poised to amplify the demand for sophisticated lithium-ion batteries in EVs during the forecast period.

- Furthermore, leading battery manufacturers are ramping up production capacities in the Asia Pacific, responding to the surging EV demand, which in turn is propelling the electrolyte market. For instance, in February 2024, BMW unveiled plans for a new battery factory in Rayong, Thailand, aiming to bolster the nation's battery supply chains. The automaker envisions Thailand as a strategic export hub for EV batteries throughout the Asia Pacific, further strengthening the lithium-ion battery supply for EVs. Such initiatives are set to boost lithium-ion battery production in the coming years, subsequently elevating the demand for EV battery electrolytes during the forecast period.

- In conclusion, these initiatives and innovations are poised to not only amplify lithium-ion battery production in the region but also escalate the demand for EV battery electrolytes in the coming years.

India is Expected to Dominate the Market

- India is swiftly emerging as a key player in the Asia-Pacific electric vehicle (EV) market, spurred by a commitment to curbing carbon emissions and reducing reliance on fossil fuels. The government's ambitious EV adoption targets, notably through the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, have fostered a thriving environment for the growth of the EV battery market, including its electrolytes.

- In recent years, India has seen a notable uptick in EV sales, driven by heightened consumer demand, growing environmental consciousness, and government incentives like tax credits and rebates. This surge in EV adoption has, in turn, spurred a heightened demand for lithium-ion batteries and premium battery electrolytes.

- For instance, the International Energy Agency (IEA) reported that in 2023, electric vehicle sales reached 82,000 units, marking a 70.8% increase from 2022 and a staggering 119-fold jump from 2019. With the government rolling out a series of supportive policies, EV sales are poised for further growth in the coming years.

- As the industry pivots towards solid-state batteries, heralded for their superior energy density and safety, there's an anticipated demand for novel electrolytes. Recently, several companies have inked agreements to cater to the burgeoning need for solid-state batteries in the automotive realm.

- For instance, in October 2023, Idemitsu Kosan Co (Idemitsu) and Toyota Motor Corporation unveiled their partnership aimed at pioneering mass-production technology for solid electrolytes. Their collaboration seeks to bolster productivity and forge a resilient supply chain for battery electric vehicles (BEVs). With an eye on the future, both firms are ambitiously targeting the commercial rollout of these batteries by 2027-28, paving the way for expansive mass production thereafter. Such initiatives are set to amplify the demand for solid-state batteries and ensure a consistent supply of electrolytes for EV battery production during the forecast period.

- Additionally, the Indian government is actively championing the electric vehicle (EV) movement and promoting domestic battery manufacturing. Their strategy encompasses subsidies for EV purchasers, tax breaks for producers, and bolstered investments in charging infrastructure.

- For instance, in 2023, the Indian government set ambitious targets: by 2030, they aim for EVs to constitute 30% of private car sales, 70% of commercial vehicles, and 80% of two and three-wheelers. To further incentivize this shift, the government is offering subsidies ranging from INR 10,000 per kWh (USD 120) to INR 15,000 per kWh (USD 180). Such measures are poised to not only boost the demand for advanced EV batteries but also elevate the need for sophisticated EV battery electrolytes in the region during the forecast period.

- Given these developments, it's evident that the momentum in EV production and the corresponding demand for EV battery electrolytes is set to surge in the coming years.

Asia Pacific Electric Vehicle Battery Electrolyte Industry Overview

The Asia Pacific Electric Vehicle Battery Electrolyte market is semi-fragmented. Some of the key players (not in particular order) are 3M Company, BASF Corporation, Mitsubishi Chemical Group, Targray Technology International Inc, LG Chem Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Adoption of Electric Vehicles

- 4.5.1.2 Advancements in Battery Technology

- 4.5.2 Restraints

- 4.5.2.1 Technological Challenges in Solid-State Electrolytes

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Others

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Solid Electrolyte

- 5.2.3 Gel Electrolyte

- 5.3 Geography

- 5.3.1 China

- 5.3.2 India

- 5.3.3 Australia

- 5.3.4 Malaysia

- 5.3.5 Thailand

- 5.3.6 Indonesia

- 5.3.7 Vietnam

- 5.3.8 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 3M Company

- 6.3.2 BASF Corporation

- 6.3.3 LG Chem Ltd

- 6.3.4 Mitsubishi Chemical Group

- 6.3.5 Panasonic Holdings Corporation

- 6.3.6 UBE Industries, Ltd.

- 6.3.7 Asahi Kasei America, Inc.

- 6.3.8 Soulbrain Co., Ltd.

- 6.3.9 Dongwha Electrolyte Co.,Ltd.

- 6.3.10 Samsung SDI

- 6.3.11 Fujifilm Wako Pure Chemical Corporation

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Innovation in Electrolyte Formulations

02-2729-4219

+886-2-2729-4219