|

市场调查报告书

商品编码

1636489

中国电动汽车电池电解:市场占有率分析、产业趋势/统计、成长预测(2025-2030)China Electric Vehicle Battery Electrolyte - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

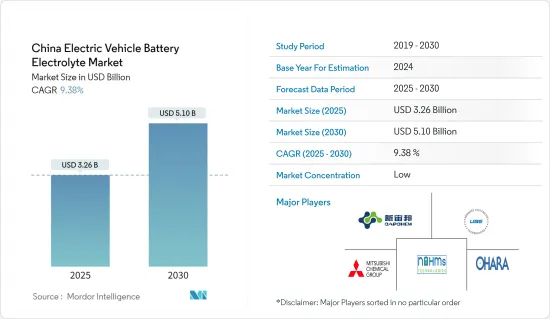

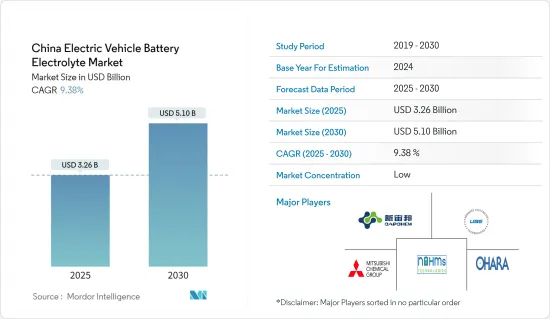

预计2025年中国电动车电池电解市场规模为32.6亿美元,2030年将达51亿美元,预测期间(2025-2030年)复合年增长率为9.38%。

主要亮点

- 从长远来看,中国电动车(包括纯电动车、插电式混合动力车、混合动力车)的使用量不断增加,以及促进电动车使用的政府优惠补贴(IE免税政策)预计将推动市场成长。

- 相反,电池製造原材料蕴藏量的短缺预计将对电动车电池电解液市场产生负面影响。

- 儘管如此,中国电池检测机构(即中国汽车电池研究院、SGS中国)在电解质材料方面正在进行的研究和进步可能会提供市场成长的机会。

中国电动车电池电解市场趋势

锂离子电池可望主导市场

- 锂离子电池由于使用寿命长而被用于为电动车(EV)提供动力,从而减少了电池更换的频率。与其他电池不同,锂离子电池不含铅、镉等有害物质,环保、干净、安全。此外,这些电池还提供强大的动力输出,这对于需要快速加速和高速行驶的电动车来说至关重要。

- 2023 年 6 月,中国电池製造商 Gothion Hitech 推出了一款用于电动车的锂锰铁电池 (LMFP),单次充电可行驶 621 英里。传统上,这个范围主要是透过昂贵的镍钴电池来实现的。 Gothion预计其LMFP电池的功率将达到240Wh/kg,并且以每千瓦时美元计算,价格比标准LFP电池低5%。

- 截至2023年,中国在纯电动车(BEV)领域占据主导地位,销量达到约540万辆。在正负极之间传输正锂离子的电解起着极其重要的作用,因此随着锂离子电池越来越多地用于电动车,对渗透电解的需求预计将会增加。

- 2024年7月,中国研究团队开发出具有低密度和负极相容性的高性价比硫化物固体电解质,实现了固态电池技术的突破。这些固态电池有望解决锂离子电池目前面临的容量和安全挑战。

- 据预测,到2025年,中国电池製造商的电池产量将达到惊人的4,800吉瓦时(GWh)。鑑于电池电解在充放电过程中的关键作用,电池产量的激增将放大全国对电池电解材料的需求。

- 因此,随着锂离子电池在电动车中的采用增加以及价格暴跌,预计未来几年锂离子电池产业将大幅成长。

电动车的普及预计将推动市场发展

- 中国是插电式混合动力电动车(EV)的主要市场,并因生产大量用于各种应用的电池而受到全球认可。随着政府大力推动无排放交通,中国可能在未来几年保持其主导地位。

- 插电式混合动力汽车预计将在未来十年变得更加普遍,促使外国汽车製造商向中国品牌寻求专业知识。特别是,中国主要汽车製造商比亚迪在2008年推出了全球首款插电式混合动力车型F3DM轿车,成为热门话题。

- 2024 年 5 月,中国政府宣布计划投资约 8.45 亿美元开发下一代电动车 (EV) 电池技术,这是一项重大倡议。包括CATL(全球最大电池製造商)、比亚迪和吉利汽车等主要汽车製造商在内的六家公司将获得政府支持开发全固态电池(ASSB)。

- 根据中国工业协会(CAAM)2023年8月的报告,中国乘用电动车销量为905万辆,其中纯电动车(BEV)626万辆,插电式混合动力汽车(PHEV)626万辆。占279万台。到2023年,插电式电动车(包括纯电动车和插电式混合动力车)将占中国汽车总销量的37%,其中纯电动车的市场占有率为25%,插电式混合动力车的市占率为12%。

- 2024年6月,中国工业与资讯化部公布了电池产业新指南。该指南旨在提高电动车用锂离子电池的品质和创新,鼓励企业从单纯扩大产能转向加强创新,特别是在电池电解液解决方案方面。

- 2030年,预计中国电动车保有量将达到5,000万辆,电动车充电年用电量需求将达到200太瓦时。这种快速增长的需求凸显了中国电动车电池电解的发展潜力。

- 鑑于电动车的快速普及和持续的技术进步,中国有望在可预见的未来保持市场主导地位。

中国电动汽车电池电解产业概况

中国电动车电池电解市场呈现半瓜分状态。参与市场的主要企业(排名不分先后)包括Advanced Electrolyte Technologies LLC、三菱化学控股公司、深圳新宙邦科技有限公司、Nohms Technologies Inc.和Ohara Iron Works。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第二章调查方法

第三章执行摘要

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规政策

- 市场动态

- 促进因素

- 电动车(包括 BEV、PHEV 和 HEV)的使用增加

- 政府优惠政策促进电动车使用

- 抑制因素

- 电池材料供应链差异

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 其他电池类型

- 电解型

- 液体电解

- 凝胶电解

- 固体电解

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- Advanced Electrolyte Technologies LLC

- Mitsubishi Chemical Holdings

- Shenzhen Capchem Technology Co., Ltd

- Nohms Technologies Inc

- Ohara Corporation

- BASF SE

- LG Chem Ltd

- Targray Industries Inc.

- SGS China

- Ningbo Shanshan Co., LTD

- 市场排名/份额(%)分析

- 其他主要参与者名单

第七章 市场机会及未来趋势

- 先进电解材料的研发

The China Electric Vehicle Battery Electrolyte Market size is estimated at USD 3.26 billion in 2025, and is expected to reach USD 5.10 billion by 2030, at a CAGR of 9.38% during the forecast period (2025-2030).

Key Highlights

- Over the long term, the increasing usage of electric vehicles, including BEVs, PHEVs, and HEVs, and favorable government subsidies (i.e. tax exemption policy) to promote the usage of electric vehicles in the China are expected to drive the market's growth.

- Conversely, the lack of raw material reserves for battery manufacturing is expected to negatively impact the electric vehicle battery electrolyte market.

- Nevertheless, the ongoing research and advancement in electrolyte material in Chinese battery testing labs i.e, China Automotive Battery Research Institute Co., Ltd., SGS China may offer opportunities for market growth.

China Electric Vehicle Battery Electrolyte Market Trends

Lithium-ion Battery is Expected to Dominate the Market

- Lithium-ion batteries, favored for their extended lifespan, are the go-to power source for electric vehicles (EVs), leading to less frequent battery replacements. Unlike some other battery types, lithium-ion variants are deemed environmentally friendly, as they steer clear of toxic materials such as lead or cadmium, making them a cleaner and safer option. Furthermore, these batteries deliver a robust power output, essential for EVs that demand swift acceleration and high speeds.

- In June 2023, Gotion High-Tech, a Chinese battery manufacturer, introduced a lithium-manganese-iron-phosphate (LMFP) battery, boasting an impressive range of 621 miles per charge for electric vehicles. Previously, this range was predominantly achieved by pricier nickel-cobalt batteries. Gotion anticipates its LMFP battery will reach 240 Wh/kg and be priced 5% lower than the standard LFP battery on a USD per kilowatt-hour basis.

- As of 2023, China stands as a dominant player in the battery electric vehicle (BEV) arena, with sales hitting approximately 5.4 million units. The rising adoption of lithium-ion batteries in EVs is set to boost the demand for penetration electrolyte solutions, given the electrolyte's pivotal role in ferrying positive lithium ions between the cathode and anode.

- In July 2024, a team of Chinese researchers made strides in solid-state battery technology by crafting a cost-effective sulfide solid electrolyte, characterized by its low density and stellar anode compatibility. These all-solid-state batteries are poised to address the capacity and safety challenges currently faced by lithium-ion batteries.

- Forecasts suggest that by 2025, Chinese battery manufacturers will churn out a staggering 4,800 giga-watt hours (GWh) of batteries. Given the critical role of battery electrolytes in the charging and discharging process, this surge in battery production is set to amplify the demand for battery electrolyte materials throughout the nation.

- Consequently, with the rising adoption of lithium-ion batteries in electric vehicles and their plummeting prices, the lithium-ion battery segment is poised for substantial growth in the coming years.

Increasing Adoption of Electric Vehicles is expected to Drive the Market

- China stands as the leading market for plug-in hybrid electric vehicles (EVs) in the region and is globally recognized for its mass production of batteries across various applications. With the government's strong push towards emission-free transportation, China is set to uphold its dominant position in the coming years.

- Plug-in hybrid vehicles are poised to gain traction in the next decade, leading foreign carmakers to seek expertise from Chinese brands. Notably, BYD, a prominent Chinese player, made headlines in 2008 by launching the world's inaugural plug-in hybrid model, the F3DM sedan.

- In a significant move, the Chinese government, in May 2024, unveiled plans to invest approximately USD 845 million into pioneering next-generation battery technologies for electric vehicles (EVs). Six companies, including CATL (the globe's largest battery manufacturer) and major automakers like BYD and Geely, have been greenlit for government backing to advance all-solid-state batteries (ASSBs).

- As reported by the China Association of Automobile Manufacturers (CAAM) in August 2023, China has seen sales of 9.05 million passenger electric vehicles, breaking down to 6.26 million battery-only EVs (BEVs) and 2.79 million plug-in hybrid electric vehicles (PHEVs). In 2023, plug-in electric vehicles (both BEVs and PHEVs) accounted for 37% of China's total automotive sales, with market shares of 25% for BEVs and 12% for PHEVs.

- In June 2024, China's Ministry of Industry and Information Technology rolled out fresh directives for the battery sector. These guidelines aim to elevate the quality and innovation of lithium-ion batteries for electric vehicles, urging firms to pivot from merely expanding production capacity to enhancing technological innovations, especially in battery electrolyte solutions.

- Looking ahead, by 2030, China anticipates hosting 50 million electric vehicles, translating to a staggering annual electricity demand of 200 TWh for EV charging. This burgeoning demand underscores the potential for advancements in electric vehicle battery electrolytes within the nation.

- Given the surging adoption of EVs and ongoing technological strides, China is poised to retain its market dominance in the foreseeable future.

China Electric Vehicle Battery Electrolyte Industry Overview

The China Electric Vehicle Battery Electrolyte Market is semi-fragmented. Some of the major companies operating in the market (in no particular order) include Advanced Electrolyte Technologies LLC, Mitsubishi Chemical Holdings, Shenzhen Capchem Technology Co., Ltd, Nohms Technologies Inc., and Ohara Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Usage of Electric Vehicles, including BEVs, PHEVs, and HEVs

- 4.5.1.2 Favorable government policies to promote the usage of electric vehicles

- 4.5.2 Restraints

- 4.5.2.1 The Supply chain gap in battery materials

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-Ion Batteries

- 5.1.2 Lead-Acid Batteries

- 5.1.3 Other type of Batteries

- 5.2 Electrolyte Type

- 5.2.1 Liquid Electrolyte

- 5.2.2 Gel Electrolyte

- 5.2.3 Solid Electrolyte

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Advanced Electrolyte Technologies LLC

- 6.3.2 Mitsubishi Chemical Holdings

- 6.3.3 Shenzhen Capchem Technology Co., Ltd

- 6.3.4 Nohms Technologies Inc

- 6.3.5 Ohara Corporation

- 6.3.6 BASF SE

- 6.3.7 LG Chem Ltd

- 6.3.8 Targray Industries Inc.

- 6.3.9 SGS China

- 6.3.10 Ningbo Shanshan Co., LTD

- 6.4 Market Ranking/Share (%) Analysis

- 6.5 List of Other Prominent Players

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 R&D for advanced electrolyte material