|

市场调查报告书

商品编码

1636526

法国混合动力汽车电池市场:份额分析、产业趋势、成长预测(2025-2030)France Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

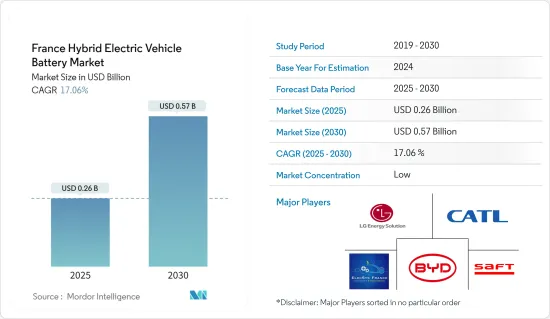

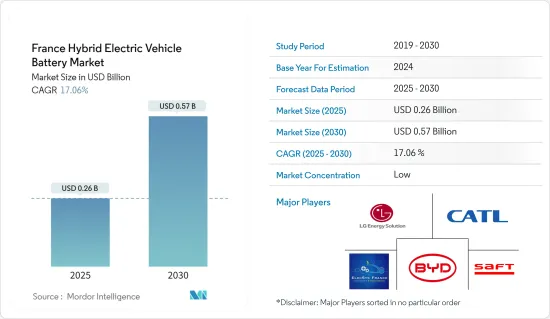

法国混合动力汽车电池市场规模预计到2025年为2.6亿美元,预计到2030年将达到5.7亿美元,预测期内(2025-2030年)复合年增长率为17.06%。

主要亮点

- 从中期来看,混合动力汽车持有增加和锂离子电池成本下降等因素预计将成为预测期内法国混合动力电动车电池市场的最大驱动因素。

- 另一方面,越来越多地采用插电式混合动力电动车等替代电动车技术可能会对市场研究产生负面影响。

- 人们不断努力开发新的电池化学物质,以提供更多的能量和更长的续航里程。预计这一因素将在未来为市场创造一些机会。

法国混合动力汽车电池市场趋势

锂离子电池占市场主导地位

- 随着对高效、环保的交通解决方案的需求不断增加,混合动力汽车製造商越来越青睐锂离子电池。这一趋势主要是由于与其他化学电池相比,锂离子电池具有更高的能量密度、更长的使用寿命和更快的充电速度。

- 过去十年,电池技术和製造流程的显着进步加速了锂离子电池在法国混合动力汽车市场的采用。这些进步不仅降低了成本,还提高了性能和可靠性,使锂离子电池对製造商和消费者都更具吸引力。

- 近年来,锂离子电池和电池组的价格有所下降,增加了对终端用户产业的吸引力。电池价格在2022年短暂上涨后,2023年恢復下跌趋势。特别是锂离子电池组的成本暴跌14%至139美元/kWh的历史低点。

- 这家法国汽车巨头正受益于能源效率的提高和车辆重量的减轻。这一势头是由法国和欧洲的广泛研发工作所推动的,重点是改善电池技术、提高能量密度和延长电池寿命。这些进步显着提高了法国混合动力汽车的国际竞争力。

- 例如,2024年7月,主要企业Stellantis与法国领先的研究机构CEA联手,宣布为期五年的合作。该合资企业的重点是为交通运输业提供下一代锂离子电池的内部设计。此次合作旨在生产尖端电池,可望提高性能、延长使用寿命并减少碳排放,同时保持成本竞争力。

- 此外,政府措施和奖励在促进法国混合动力电动车市场锂离子电池的成长方面发挥关键作用。法国政府推出了消费者补贴、製造商税收减免以及充电基础设施投资等措施。这些倡议不仅刺激了该领域的创新和投资,而且与《流动性导向法案》和《气候计画》等立法一致。这些法律优先考虑减少二氧化碳排放并逐步淘汰传统内燃机汽车,增加了对配备先进锂离子电池的混合动力电动车的需求。

- 鑑于上述情况,锂离子电池产业预计将在预测期内引领市场。

混合动力汽车持有量的增加正在推动市场发展

- 持有混合动力汽车的数量正在增加,预计这将显着推动混合动力电动车(HEV)电池市场的发展。这一趋势反映了消费者偏好和行业向永续交通发展的趋势。随着法国对环境永续性的持续承诺,汽车产业混合动力汽车的采用显着增加,在传统内燃机和全电动汽车之间取得平衡。

- 据Avere-France称,法国混合动力电动车的销量最近激增。 2022年至2023年,法国混合动力汽车持有成长超过10.3%。在过去十年中,该车队规模扩大了近 450 倍,凸显了大众对混合动力电动车日益增长的需求。

- 这种成长不仅受到监管要求的推动,还受到消费者对将环境效益与实用性相结合的车辆的偏好的推动。随着混合动力汽车销售的增加,对电池的需求也在增加,这对于优化燃油效率和排放气体至关重要。随着道路上混合动力汽车数量的增加,对高性能、可靠电池的需求不断增加,促使製造商提高产量并投资研发。

- 政府旨在减少碳排放和支持清洁能源的激励措施和措施进一步推动了混合动力汽车的兴起。法国政府减少温室气体排放的承诺与欧盟 (EU) 的更广泛目标相呼应,并正在加速向混合动力汽车的转变。补贴、税收减免和回扣等经济奖励使混合动力汽车变得混合动力汽车容易获得併增加了其市场占有率。

- 2023年,法国政府推出新的生态奖金,以进一步促进电动车的采用。对于新乘用车,该补贴涵盖购买成本的27%(含税)。如果您租赁电池,则该费用也包含在内。个人最高奖金金额为 5,000 欧元,公司最高奖金金额为 3,000 欧元。对于新货车,补助为含税购买成本的 40%,同样包括租赁电池的成本。不过,个人最高补贴金额为6,000欧元,企业最高补助金额为4,000欧元。

- 随着混合动力汽车越来越普及,对电池的需求也增加。这种需求既涉及质量,也涉及数量,重点是更长的生命週期、更快的充电和更高的能量密度。因此,电池市场的竞争日益激烈,供应商不断创新,以在这个不断扩大的市场中获得更大的份额。

- 总之,在政府积极措施的鼓励下,混合动力电动车的激增可能成为预测期内市场的驱动力。

法国混合动力汽车电池产业概况

法国的混合动力电动车电池市场已被削减一半。该市场的主要企业(排名不分先后)包括 LG Energy Solution、Contemporary Amperex Technology、比亚迪公司、Saft Groupe SA 和 Elecsys France。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 混合动力汽车持有量增加

- 锂离子电池价格下降

- 抑制因素

- 供应链限制

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他的

- 车型

- 客车

- 商用车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- LG Energy Solution

- Contemporary Amperex Technology Co Ltd.

- BYD Company

- Panasonic Holdings Corporation

- SK Innovation Co Ltd

- Enersys Sarl

- Exide Industries Ltd

- Saft Groupe SA

- Elecsys France

- Clarios, LLC

- 其他知名公司名单

- 市场排名/份额(%)分析

第七章 市场机会及未来趋势

- 电池材料技术进步

简介目录

Product Code: 50003895

The France Hybrid Electric Vehicle Battery Market size is estimated at USD 0.26 billion in 2025, and is expected to reach USD 0.57 billion by 2030, at a CAGR of 17.06% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as rising growth in hybrid vehicle fleets and the declining cost of lithium-ion batteries are expected to be among the most significant drivers for the France hybrid Electric Vehicle Battery Market during the forecast period.

- On the other hand, increasing adoption of alternate electric vehicle technology like plug-in hybrid electric vehicles is likely to have a negative impact on the market studied.

- Nevertheless, continued efforts are being made to develop new battery chemistries that provide more energy and an extended drive range. This factor is expected to create several opportunities for the market in the future.

France Hybrid Electric Vehicle Battery Market Trends

Lithium-ion Battery to Dominate the Market

- As the demand for efficient and eco-friendly transportation solutions rises, hybrid vehicle manufacturers increasingly favor lithium-ion batteries. This trend is primarily attributed to lithium-ion batteries' superior energy density, extended lifespan, and quicker charging capabilities compared to alternative battery chemistries.

- Over the past decade, significant advancements in battery technology and manufacturing processes have accelerated the adoption of lithium-ion batteries in France's hybrid electric vehicle market. These advancements have not only reduced costs but also enhanced performance and reliability, making lithium-ion batteries more appealing to both manufacturers and consumers.

- In recent years, the prices of lithium-ion batteries and cell packs have been declining, enhancing their appeal to end-user industries. After a brief uptick in 2022, battery prices resumed their downward trend in 2023. Notably, the cost of lithium-ion battery packs plummeted by 14%, hitting a historic low of USD 139/kWh.

- French automotive leaders are reaping the rewards of heightened energy efficiency and lighter vehicle weights. This momentum is bolstered by extensive R&D efforts in France and Europe, focusing on battery technology enhancements, energy density improvements, and battery lifespan extensions. These advancements significantly elevate the global competitiveness of French-made hybrid vehicles.

- For example, in July 2024, Stellantis, a key player in automotive research, joined forces with CEA, a top-tier French research institution, to announce a collaborative venture spanning five years. Their joint endeavor centers on the in-house design of next-gen lithium-ion battery cells, tailored for the transportation industry. The collaboration aims to produce state-of-the-art cells that promise enhanced performance, longevity, and a smaller carbon footprint, all while keeping costs competitive.

- Moreover, government policies and incentives play a crucial role in propelling the growth of lithium-ion batteries in France's hybrid electric vehicle market. The French government has introduced measures such as consumer subsidies, tax incentives for manufacturers, and investments in charging infrastructure. These initiatives not only stimulate innovation and investment in the sector but also align with laws like the "Mobility Orientation Law" and the "Climate Plan." These laws prioritize reducing CO2 emissions and phasing out traditional combustion engine vehicles, thereby amplifying the demand for hybrid electric vehicles powered by advanced lithium-ion batteries.

- Given the aforementioned factors, the lithium-ion battery segment is poised to lead the market during the forecast period.

Rising Hybrid Vehicle Fleet to Drive the Market

- France's expanding fleet of hybrid vehicles is poised to significantly boost the hybrid electric vehicle (HEV) battery market. This trend mirrors both consumer preferences and industry movements towards sustainable transportation. With France's ongoing commitment to environmental sustainability, the automotive sector has seen a notable uptick in hybrid vehicle adoption, striking a balance between traditional internal combustion engines and fully electric vehicles.

- According to Avere-France, hybrid electric vehicle sales in France have surged recently. Between 2022 and 2023, the French hybrid fleet grew by over 10.3%. Over the last decade, this fleet has expanded nearly 450-fold, highlighting the nation's burgeoning appetite for hybrid electric vehicles.

- This growth is fueled not just by regulatory mandates but also by consumer preferences for vehicles that blend environmental advantages with practicality. As hybrid vehicle sales rise, so does the demand for their batteries, essential for optimizing fuel efficiency and curbing emissions. With an increasing number of hybrids on the roads, the demand for high-performance, reliable batteries intensifies, leading manufacturers to boost production and channel investments into research and development.

- Government incentives and policies aimed at curbing carbon emissions and championing cleaner energy are further fueling the hybrid vehicle fleet's growth. The French government's dedication to slashing greenhouse gas emissions resonates with broader European Union goals, hastening the shift towards hybrids. Financial incentives like subsidies, tax breaks, and rebates are making hybrid vehicles more accessible, carving out a larger market share for them.

- In 2023, the French government rolled out new ecological bonuses to further encourage electric vehicle adoption. For new passenger cars, the aid covers 27% of the total acquisition cost, taxes included. If the battery is leased, its expense is also included. The bonus caps at EUR 5,000 for individuals and EUR 3,000 for businesses. For new vans, the aid is set at 40% of the purchase cost, including taxes, and again encompasses leased battery costs. However, the maximum aid is limited to EUR 6,000 for individuals and EUR 4,000 for businesses.

- As hybrid vehicles proliferate, so does the demand for their batteries. This demand emphasizes not just quantity but also quality, with a focus on longer life cycles, quicker charging, and enhanced energy density. As a result, the battery market is becoming increasingly competitive, with suppliers innovating to secure a larger slice of this expanding market.

- In conclusion, the burgeoning fleet of hybrid electric vehicles, bolstered by proactive government policies, is set to propel the market forward during the forecast period.

France Hybrid Electric Vehicle Battery Industry Overview

The France Hybrid Electric Vehicle Battery Market is semi-fragmented. Some of the key players in this market (in no particular order) are LG Energy Solution, Contemporary Amperex Technology Co Ltd., BYD Company, Saft Groupe SA, and Elecsys France

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Rising Hybrid Vehicle Fleet

- 4.5.1.2 Decreasing Lithium-ion Battery Price

- 4.5.2 Restraints

- 4.5.2.1 Supply Chain Constraints

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 LG Energy Solution

- 6.3.2 Contemporary Amperex Technology Co Ltd.

- 6.3.3 BYD Company

- 6.3.4 Panasonic Holdings Corporation

- 6.3.5 SK Innovation Co Ltd

- 6.3.6 Enersys Sarl

- 6.3.7 Exide Industries Ltd

- 6.3.8 Saft Groupe SA

- 6.3.9 Elecsys France

- 6.3.10 Clarios, LLC

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/Share (%) Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

02-2729-4219

+886-2-2729-4219