|

市场调查报告书

商品编码

1636527

英国混合电动汽车电池:市场占有率分析、产业趋势与成长预测(2025-2030)United Kingdom Hybrid Electric Vehicle Battery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

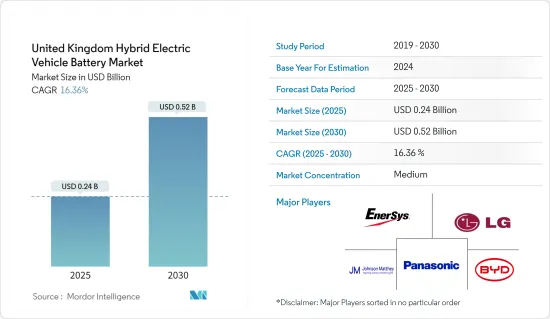

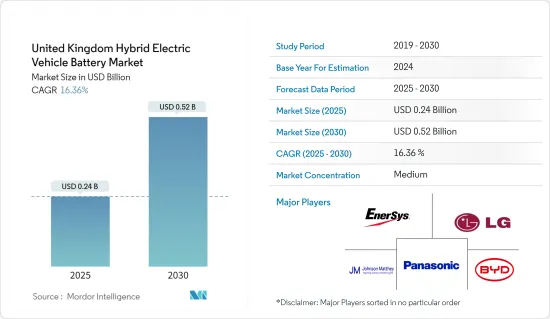

英国混合动力汽车电池市场规模预计2025年为2.4亿美元,2030年将达5.2亿美元,预测期内(2025-2030年)复合年增长率为16.36%。

主要亮点

- 从长远来看,电动车(EV)产量增加和锂离子电池价格下降等因素预计将成为预测期内英国混合动力电动车电池市场的最大驱动因素之一。

- 另一方面,原材料供应有限以及与原材料供应链相关的挑战预计将阻碍预测期内的市场成长。

- 对电池材料技术进步的需求不断增加。预计这一因素将在未来几年在市场上创造一些机会。

英国混合动力汽车电池市场趋势

锂离子电池类型主导市场

- 全球锂离子电动车电池市场是一个充满活力、机会与挑战并存的市场。锂离子二次电池由于其优越的容量重量比而比其他技术更受欢迎。锂离子二次电池的采用因其长寿命、最少维护、更长的保质期和大幅降价等优点而进一步推动。

- 锂离子电池传统上比同类电池更贵,但市场领先公司已投资实现规模经济并加强研发力度。这种日益激烈的竞争不仅提高了电池性能,还降低了锂离子电池的价格。

- 在英国,在日益增长的环境问题和对净零碳排放目标的承诺的推动下,政府推出了一项支持电动车的主导。为了满足对锂离子电池快速增长的需求,世界领导人正在积极开采锂,这对于电动车的储存能力至关重要。

- 2024 年 3 月,电动车占新车註册量的 15.2%,显示其吸引力日益增长。国际能源总署 (IEA) 报告称,2023 年英国电动车销量成长 21.6%,达到 45 万辆。这一发展证实了英国电动车市场的强劲势头。大多数电动车使用锂离子电池,因此电动车的成长可能有利于电池化学材料。

- 2024 年 7 月,这家位于剑桥的电动车製造商宣布推出 35kWh 锂离子电池。该电池不仅可以在短短四分半钟内从 10% 充电到 80%,而且还具有超过 4,000 次快速充电週期的长使用寿命,相当于约 60 万英里。这些进步将刺激锂产量,并与未来几年锂离子电池需求的成长一致。

- 英国政府正在通过一系列奖励,包括补贴、津贴和资金等,提高电动和混合动力汽车的吸引力。

- 2023 年 10 月,英国向 20 个开创性的净零排放技术计划提供了 8,900 万英镑的开创性资金,此举突显了英国在零排放汽车技术方面的领导地位。这些计划包括动力来源越野车、新的锂电池放大工厂和创新的电动车电池系统。这项全面的资助计画包括四个合作研发计划、五个衡量汽车产业成长准备的倡议以及旨在在英国建立大型製造设施的七项可行性研究。

- 在此背景下,预计在预测期内,锂离子电池在混合动力电动车领域的作用将得到加强。

电动车 (EV) 产量的增加预计将推动市场发展

- 在英国,由于电动和混合动力汽车的需求迅速增长,混合动力电动车(HEV)电池的生产正在迅速扩大。为了满足这种不断增长的需求,包括 Nissan 和 Britishvolt 在内的全球领先电池製造商正在英国设立生产设施。

- 由于其优越的位置、强劲的汽车工业和熟练的劳动力,英国被定位为电池生产的主要基地。此外,政府对创新和基础设施发展的支持也提高了我们生产尖端电池技术的能力。这也包括在混合动力车中发挥关键作用的锂离子电池。

- 英国政府正在推出多项倡议,鼓励混合动力汽车和电动车的生产和使用。值得注意的措施包括「零之路」策略,该策略旨在到 2030 年结束汽油和柴油汽车的新销售,以及对电池生产和电动车基础设施的大量投资。

- 截至 2023 年 1 月,英国有 17 个计划专注于开发电动车电池技术。这些倡议得到了英国研究与创新 (UKRI) 透过 Innovate UK 提供的 2,760 万欧元(2,980 万美元)的支持,旨在提高英国在电池价值链中的竞争力。此外,20个净零技术突破性计划已获得8,900万欧元(9,612万美元)的资金,巩固了英国作为零排放汽车技术全球领导者的地位。

- 2024年3月,英国先进推进中心宣布投资约7,720万美元,以加强电动车产业。 Nissan、YASA、EMPEL Systems 和 JLR 等知名公司已准备好在该国联合研发电动车生产。

- 根据机动车辆工业协会 (SMMT) 的资料,到 2023 年,混合动力电动车 (HEV) 将占车辆註册量的约 12.6%。这比 2022 年登记量达到 238,942 辆增加了 27.1%。考虑到该领域的优势,例如减少碳排放,预计未来几年将进一步成长。

- 因此,混合动力电动车在英国迅速增长,预计在不久的将来对电池的需求将会增加。

英国混合动力汽车电池产业概况

英国混合动力电动车电池市场温和。该市场的一些主要企业包括比亚迪有限公司、EnerSys、松下控股公司、Energizer Holding Inc.和LG Energy Solution。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 调查范围

- 市场定义

- 研究场所

第 2 章执行摘要

第三章调查方法

第四章市场概况

- 介绍

- 2029年之前的市场规模与需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和措施

- 市场动态

- 促进因素

- 电动车 (EV) 产量增加

- 锂离子电池价格下降

- 抑制因素

- 原料蕴藏量不足

- 促进因素

- 供应链分析

- PESTLE分析

- 投资分析

第五章市场区隔

- 电池类型

- 锂离子电池

- 铅酸电池

- 钠离子电池

- 其他的

- 车型

- 客车

- 商用车

第六章 竞争状况

- 併购、合资、联盟、协议

- 主要企业策略

- 公司简介

- BYD Company Ltd

- EnerSys

- Panasonic Holdings Corporation

- Energizer Holding Inc.

- LG Energy Solution

- Britishvolt

- Johnson Matthey

- Oxis Energy

- Faradion

- Nexeon Ltd.

- 其他知名公司名单

- 市场排名/份额分析

第七章 市场机会及未来趋势

- 电池材料技术进步

简介目录

Product Code: 50003896

The United Kingdom Hybrid Electric Vehicle Battery Market size is estimated at USD 0.24 billion in 2025, and is expected to reach USD 0.52 billion by 2030, at a CAGR of 16.36% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors such as increasing electric vehicle (EV) production and declining lithium-ion battery prices are expected to be among the most significant drivers for the United Kingdom's hybrid electric vehicle battery market during the forecast period.

- On the other hand, limited availability of raw materials and challenges associated with the raw material supply chain are expected to hinder market growth in the forecast period.

- Nevertheless, there has been a growing demand for technological advancements in battery materials. This factor is expected to create several opportunities for the market in the future.

United Kingdom Hybrid Electric Vehicle Battery Market Trends

Lithium-ion Battery Type to Dominate the Market

- The global lithium-ion electric vehicle battery market is a dynamic arena, teeming with both opportunities and challenges. Lithium-ion rechargeable batteries are outpacing other technologies in popularity, thanks to their superior capacity-to-weight ratio. Their adoption is further fueled by advantages like extended lifespan, minimal maintenance, enhanced shelf life, and a notable drop in prices.

- While lithium-ion batteries traditionally commanded a premium over their counterparts, leading market players have been channeling investments into achieving economies of scale and ramping up R&D. This intensified competition has not only bolstered battery performance but also driven down lithium-ion battery prices.

- In the United Kingdom, government initiatives are championing electric vehicles, spurred by mounting environmental concerns and a commitment to net-zero carbon emission targets. Lithium, a crucial component for EV storage capacity, is being aggressively extracted by global leaders to meet the surging demand for lithium-ion batteries.

- March 2024 saw electric cars making up 15.2% of new registrations, a testament to their growing allure. The International Energy Agency reported a 21.6% sales uptick in 2023, with the United Kingdom moving 450,000 electric vehicles. This trend underscores a robust momentum in the United Kingdom's electric car market. As the majority of EVs utilize lithium-ion batteries for added advantages, hence growth in EVs is likely to favor the battery chemistry.

- In a groundbreaking achievement, a Cambridge-based EV manufacturer unveiled a 35kWh lithium-ion battery in July 2024, boasting a charging time of under five minutes-comparable to traditional gas refueling. This battery not only charges from 10% to 80% in just over four and a half minutes but also promises longevity with over 4,000 fast charge cycles, translating to approximately 600,000 miles. Such advancements are poised to spur lithium production, aligning with the escalating demand for lithium-ion batteries in the coming years.

- The United Kingdom government is bolstering the appeal of electric and hybrid vehicles through a suite of incentives, including grants, subsidies, and financial assistance.

- In a move underscoring the United Kingdom's leadership in zero-emission vehicle technology, October 2023 saw a landmark funding of 89 million pounds distributed among 20 pioneering net-zero tech projects. These spanned hydrogen-powered off-road vehicles, a new lithium scale-up plant, and innovative EV battery systems. The comprehensive funding package encompassed four collaborative R&D projects, five scale-up initiatives to gauge automotive sector growth readiness, and seven feasibility studies aimed at establishing large-scale manufacturing facilities in the United Kingdom.

- Given this backdrop, the forecast period anticipates a bolstered role for lithium-ion batteries in the hybrid electric vehicle sector.

The Increasing Electric Vehicle (EV) Production is Expected to Drive the Market

- The United Kingdom is witnessing a rapid expansion in hybrid electric vehicle (HEV) battery production, driven by surging demand for electric and hybrid vehicles. To cater to this escalating demand, global battery giants, including Nissan and Britishvolt, have set up production facilities in the United Kingdom.

- The United Kingdom's advantageous location, combined with its robust automotive sector and a skilled workforce, positions it as a prime hub for battery production. Additionally, the government's backing for innovation and infrastructure development amplifies the nation's ability to produce cutting-edge battery technologies. This includes lithium-ion batteries, which play a pivotal role in hybrid vehicles.

- The United Kingdom government has rolled out multiple initiatives to further the production and adoption of hybrid and electric vehicles. Notable policies encompass the "Road to Zero" strategy, which targets the cessation of new petrol and diesel car sales by 2030, alongside significant investments in battery production and electric vehicle infrastructure.

- As of January 2023, the United Kingdom is home to 17 projects focused on advancing EV battery technologies. These initiatives, backed by EUR 27.6 million (USD 29.8 million) from UK Research and Innovation (UKRI) via Innovate UK, aim to enhance the United Kingdom's competitiveness in the battery value chain. Additionally, 20 groundbreaking projects in net-zero technology have secured EUR 89 million (USD 96.12 million) in funding, reinforcing the United Kingdom's stature as a global leader in zero-emission vehicle technology.

- In March 2024, the Advanced Propulsion Centre UK unveiled an investment of approximately USD 77.2 million to bolster the electric vehicle industry. Notable companies, including Nissan, YASA, EMPEL Systems, and JLR, are poised for collaborative research and development endeavors in the nation's electric vehicle production.

- Data from the Society of Motor Manufacturers and Traders (SMMT) indicates that in 2023, hybrid Electric Vehicles (HEVs) constituted about 12.6% of total vehicle registrations. This marks a 27.1% surge from 2022, with registrations hitting 238,942. Given the segment's advantages, such as reduced carbon emissions, it's poised for further growth in the coming years.

- Consequently, the burgeoning hybrid electric vehicle landscape in the United Kingdom is set to drive an increased demand for batteries in the foreseeable future.

United Kingdom Hybrid Electric Vehicle Battery Industry Overview

The United Kingdom Hybrid Electric Vehicle Battery Market is moderate. Some of the key players in this market are BYD Company Ltd., EnerSys, Panasonic Holdings Corporation, Energizer Holding Inc., and LG Energy Solution.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Electric Vehicle (EV) Production

- 4.5.1.2 Declining Lithium-ion Battery Prices

- 4.5.2 Restraints

- 4.5.2.1 Lack of Raw Material Reserves

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

- 4.8 Investment Analysis

5 MARKET SEGMENTATION

- 5.1 Battery Type

- 5.1.1 Lithium-ion Battery

- 5.1.2 Lead-Acid Battery

- 5.1.3 Sodium-ion Battery

- 5.1.4 Others

- 5.2 Vehicle Type

- 5.2.1 Passenger Cars

- 5.2.2 Commercial Vehicles

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 BYD Company Ltd

- 6.3.2 EnerSys

- 6.3.3 Panasonic Holdings Corporation

- 6.3.4 Energizer Holding Inc.

- 6.3.5 LG Energy Solution

- 6.3.6 Britishvolt

- 6.3.7 Johnson Matthey

- 6.3.8 Oxis Energy

- 6.3.9 Faradion

- 6.3.10 Nexeon Ltd.

- 6.4 List of Other Prominent Companies

- 6.5 Market Ranking/ Share Analysis

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Battery Materials

02-2729-4219

+886-2-2729-4219