|

市场调查报告书

商品编码

1637759

进阶通讯服务:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Rich Communication Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

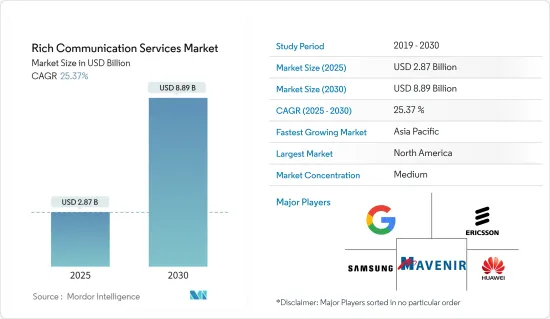

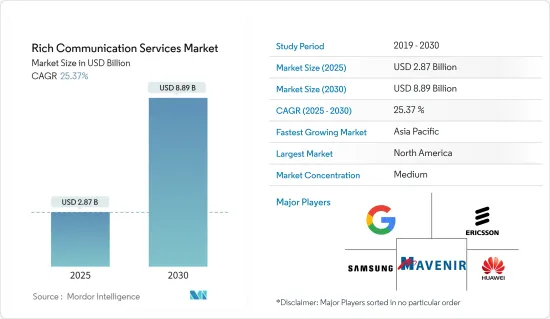

进阶通讯服务市场规模预计在 2025 年为 28.7 亿美元,预计到 2030 年将达到 88.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 25.37%。

主要亮点

- 进阶通讯服务是一组通讯协定和高级通讯标准,用于增强安装在行动电话上的讯息应用程式的效能并提供进阶通讯服务。

- 随着全球行动电话数量的增加,未来几年对优质通讯服务的需求预计将会成长。随着智慧型手机的普及,简讯通讯的需求日益增加。高阶沟通服务提供增强使用者沟通体验的功能,例如已读回执和群组聊天。随着配备此类先进功能的智慧型手机的兴起,RCS通讯服务的采用预计将蓬勃发展。

- SMS 和 MMS 预计将被 RCS 完全取代,包括具有群组聊天、媒体共用、视讯通话、位置共用等高级功能的讯息。因此,预计未来几年行动电话用户的增加将对市场成长产生重大影响。

- 预计通讯服务市场的强劲成长将源自于行动电话用户的不断成长。行动电话服务用户是指订阅使用蜂窝技术并为用户提供交换公共电话网路 (PSTN) 接入的公共行动电话服务的用户。其中包括预付和后付费用户,以及类比和数位行动电话技术。

- 然而,端到端加密存在局限性, Over-The-Top平台的竞争日益激烈,以及由于进阶通讯服务端对端加密而产生的互通性和隐私问题。

进阶通讯服务(RCS) 市场趋势

VO-LTE 技术推动的行动服务发展与普及

- 由于可以同时拨打电话和浏览网页以及发送带有图像的讯息等优点,对进阶通讯服务的需求正在增长,并且 LTE-VO 的普及也在不断推进。

- 智慧型手机和行动服务正在对每个职场产生深远的影响。物联网(IoT)和人工智慧(AI)等最尖端科技的发展正在为此做出贡献。我们把随时随地使用通讯设备称为行动服务。由于行动装置和云端服务的普及,行动服务越来越多地被企业采用。

- 行动解决方案提供优化的网路、更轻鬆的业务资讯存取和更好的客户体验,以提高生产力。进阶通讯服务满足了组织对行动性和通讯多样性日益增长的需求。

- 行动服务中的进阶通讯服务通讯具有诸多优势,例如透过自带装置 (BYOD) 计画携带自带装置时进行檔案共用。因此,VOLTE 和行动服务日益增长的需求推动了在安全的企业环境中使用软体定义网路技术。

北美占有最大市场占有率

- 该地区 5G 网路普及率较高,且人工智慧和其他智慧连网设备的使用日益广泛。此外,对下一代通讯服务的需求激增、将客户服务趋势从对话互动中转移的聊天机器人以及进阶通讯服务正在推动行动网路营运商 (MNO) 接受为本地通讯管道开发的最新进展。技术进步配置服务的机会。

- 预计该地区高端通讯服务市场的成长将受到越来越多的公司(例如 Subway IP LLC 和 Express)采用 RCS 平台进行广告宣传的推动。与简讯宣传活动相比,这些企业透过使用进阶通讯服务A2P 来提高客户参与。

- 北美是世界上简讯应用和智慧型手机普及率最高的地区之一。根据CTIA的报告,2019年,99.7%的美国人口居住在4G LTE覆盖的地区。此外,据爱立信称,到2025年,行动用户数量预计将达到3.2亿。

- 此外,预计到 2025 年,北美 74% 的行动用户将由 5G 组成。 2019年,全部区域的LTE安装率为91%。鑑于这一普及率,该地区对各种智慧型手机通讯应用程式的需求可能会很大。

- 这一增长是由于该地区行动银行服务的接受度不断提高。进阶通讯服务平台旨在为银行提供行动付款、新开户、信用卡和签帐金融卡申请、分店和 ATM搜寻以及客户支援等功能。

进阶通讯服务(RCS) 产业概览

市场竞争格局依然温和,各公司正积极探索进阶通讯服务领域所提供的众多机会。该公司正在与科技公司和网路营运商建立策略伙伴关係,以利用先进的技术力并推动创新。

2023 年 2 月,沃达丰宣布了雄心勃勃的计划,将与Google的合作扩展到欧洲市场,涵盖行动通讯服务、Pixel 设备和沃达丰的电视平台。此次加强的伙伴关係将使沃达丰客户能够透过利用 Google Jibe Cloud 享受更丰富的通讯体验,并将加强沃达丰对进阶通讯服务(RCS) 的实施。

2022 年 10 月,Sinch AB(发布)宣布将把 KakaoTalk 频道整合到其对话 API 中。这项新增功能大大扩展了企业与全球消费者进行全通路对话的可用沟通管道范围。扩充的管道包括 SMS、RCS、WhatsApp、Viber、Business、Facebook Messenger 以及现在的 KakaoTalk。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 市场覆盖

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 产业相关人员分析

- COVID-19 对 RCS 市场的影响评估

第五章 市场动态

- 市场驱动因素

- 投资广告和行销

- Android 手机支援 RCS通讯的最新进展及其快速普及

- 与服务提供者直接合作

- 持续监管 OTT通讯创造新机会

- 采用 VO-LTE 技术的行动服务不断发展和普及,将推动成长

- 市场限制

- 缺乏端对端加密引发互通性和隐私问题

第 6 章 RCS通讯- 时间轴与实施

- RCS 的演变

- 目前使用案例和实施研究

- 巴克莱银行和 HDFC 银行专注于转向 RCS 以提高客户参与

- Virgin Trains 和 JR 为旅游业客户支援引入 RCS

- 谷歌在欧洲主要国家推出 RCS,绕过当地营运商支持

- 主要应用

7. RCS引入对原生简讯的影响分析

- 2016 年至 2021 年 A2P SMS 与 OTT通讯细分

- A2P 在总数位广告收入中所占的份额

- P2P 格局的预测变化

第 8 章市场细分

- 按最终用户

- BFSI

- 媒体与娱乐

- 旅游与饭店

- 零售

- 卫生保健

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 拉丁美洲

- 中东和非洲

第九章 竞争格局

- 公司简介

- Telefonaktiebolaget LM Ericsson

- Google LLC

- Huawei Technologies Co Ltd

- Mavenir Systems

- Samsung Electronics Co Ltd

- ZTE Corporation

- Global Message Services

- Sinch AB

- Juphoon System Software Co Ltd

- Summit Tech

- AT&T Inc

- T-Mobile USA Inc

- Verizon Wireless

- SK Telecom Co Ltd

- Telstra Corporation Limited

- Vodafone Group PLC

第 10 章 主要 MNO 的 RCS蓝图

第十一章 市场展望

The Rich Communication Services Market size is estimated at USD 2.87 billion in 2025, and is expected to reach USD 8.89 billion by 2030, at a CAGR of 25.37% during the forecast period (2025-2030).

Key Highlights

- Rich communication services is a set of protocols and advanced messaging standards to enhance the performance of message applications that are installed in mobile phones, which provide rich communication services.

- The demand for premium communication services is expected to grow in the coming years as the number of mobile phones increases worldwide. Demand for SMS communication is increasing due to the rising use of smartphones. High communications services offer features to enhance the user's experience of communicating, such as read receipt and group chat. The adoption of RCS messaging services is expected to be strengthened by the increasing number of smartphones with such advanced features.

- SMS and MMS are supposed to be completely replaced by RCS. Messages with advanced features such as group chat, media sharing, video call, or location sharing. Therefore, a significant influence on market growth in the coming years is expected to be the increased uptake of mobile phone subscribers.

- The strong growth in the telecommunications services market is likely to be driven by increased subscribers, who are increasingly adopting cell phones. A mobile service subscriber is an agreement for a public mobile phone service using cellular technologies to provide users with access to the switched Public Telephone Network PSTN. Both prepaid and postpaid subscribers are covered by this provision, as well as Analog and Digital mobile technologies.

- However, limited end-to-end encryption and increasing competition by over-the-top platforms, along with Interoperability and Privacy concerns due to lack of end-to-end encryption, hinder the rich communication services market growth.

Rich Communication Services (RCS) Market Trends

Increasing Development and Adoption of Mobility Service Along with (VO-LTE) Technology to Witness the Growth

- The growing demand for rich communication services due to its benefits, such as the simultaneous use of calls and web surfing while sending messages with images, is a result of an increasing uptake of voice over long-term evolution (LTEVO).

- Smartphones and mobility services are having a profound effect in every workplace. The development of cutting-edge technologies such as the Internet of Things (IoT) and artificial intelligence (AI) has contributed to this. The use of communication devices at any location and time shall be referred to as mobility services. Mobility services are becoming more and more widely adopted by enterprises, thanks to their widespread use of mobility devices and cloud services.

- Mobility solutions offer an optimized network, easy access to business information, and better customer experiences in order to improve productivity. Rich communication services meet the growing need for mobility and diversity of communication in organizations.

- The benefits of rich communication service messaging in mobility services, e.g., file sharing when you bring your own device through the bring-your-own-device (BYOD) program, are many. Consequently, the use of software-defined networking technologies in secured enterprise environments is driven by a growing demand for VOLTE along with mobility services.

North America to Hold the Largest Market Share

- In this region, owing to the high network penetration of 5G and the growing use of artificial intelligence & other smart connected devices. Moreover, the surge in need for next-generation messaging service, chatbots shifting the inclination of customer service from conversational interactions, and rich communication service provide opportunities for mobile network operators (MNOs) to set up service on the latest technical advances being developed for the native messaging channel.

- The growth of the market for high communication services in this region is expected to be driven by an increase in the number of businesses adopting RCS platforms, like Subway IP LLC and Express, which are running their advertising campaigns. These companies have seen an increase in their customer engagement through the use of rich communication services, A2P, as opposed to SMS campaigns.

- North American region to one of the highest penetration of SMS applications and smartphones and users in the world. CTIA reported that 99.7% of the American population lived in areas with fourth-generation LTE coverage in 2019; also, the number of mobile subscriptions was estimated to reach 320 million by 2025, according to Ericsson.

- Furthermore, in 2025, 74% of North America's mobile subscriptions are projected to be made up of 5G. In 2019, there were 91% LTE installations across the region. In view of this adoption rate, a considerable demand for various smartphone communication applications will be generated in the region.

- This growth is a result of the increasing acceptance of mobile banking services within the region. Rich communication service platforms are designed to provide banks with functionalities such as mobile payments, opening new accounts, applying for credit or debit cards, searching branches and ATMs, and customer support.

Rich Communication Services (RCS) Industry Overview

The competitive landscape within the market remains moderate, with companies actively exploring the numerous opportunities presented by the rich communication services sector. Organizations are forging strategic partnerships with technology firms and network operators to harness advanced technological capabilities and foster innovation.

In February 2023, Vodafone unveiled its ambitious plans to extend its collaboration with Google across the European market, encompassing mobile messaging services, Pixel devices, and Vodafone's TV platform. This enhanced partnership will enable Vodafone customers to relish enriched messaging experiences through the utilization of Google Jibe Cloud, which will empower Vodafone's implementation of Rich Communications Services (RCS).

In October 2022, Sinch AB (publ) announced the integration of the KakaoTalk channel into its Conversation API. This addition significantly broadens the array of communication channels available for enterprises seeking to engage in omnichannel conversations with their global consumer base. The extended channels now encompass SMS, RCS, WhatsApp, Viber, Business, Facebook Messenger, and the latest inclusion, KakaoTalk.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the market

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Assessment of the Impact of COVID-19 on the RCS Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Investments in the field of advertising and marketing

- 5.1.2 Recent developments associated with Android phones enabling RCS messaging to rapidly drive adoption

- 5.1.3 Direct Association of the Service Providers

- 5.1.4 Ongoing efforts to regulate OTT messaging to also open up new opportunities

- 5.1.5 Increasing Development and Adoption of Mobility Service Along with (VO-LTE) Technology to Witness the Growth

- 5.2 Market Restraints

- 5.2.1 Interoperability and Privacy concerns due to lack of end-to-end encryption

6 RCS MESSAGING - TIMELINE and IMPLEMENTATION

- 6.1 Evolution of RCS

- 6.2 Current use-cases and implementation studies

- 6.2.1 Barclays & HDFC Banks focus on switching to RCS to drive customer engagement

- 6.2.2 Virgin Trains and Japan Railway company launch RCS to provide customer support in the travel industry

- 6.2.3 Google bypasses local operator support to launch RCS in major European countries

- 6.3 Major Applications

7 ANALYSIS ON THE IMPACT OF RCS ADOPTION ON NATIVE SMS

- 7.1 Breakdown of A2P SMS and OTT Messaging for 2016-2021

- 7.2 Share of A2P of the overall Digital Advertising revenue

- 7.3 Anticipated changes in the P2P landscape

8 MARKET SEGMENTATION

- 8.1 End-User

- 8.1.1 BFSI

- 8.1.2 Media and Entertainment

- 8.1.3 Travel and Hospitality

- 8.1.4 Retail

- 8.1.5 Healthcare

- 8.1.6 Other End-User verticals

- 8.2 Geography

- 8.2.1 North America

- 8.2.2 Europe

- 8.2.3 Asia

- 8.2.4 Latin America

- 8.2.5 Middle East and Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Company Profiles

- 9.1.1 Telefonaktiebolaget LM Ericsson

- 9.1.2 Google LLC

- 9.1.3 Huawei Technologies Co Ltd

- 9.1.4 Mavenir Systems

- 9.1.5 Samsung Electronics Co Ltd

- 9.1.6 ZTE Corporation

- 9.1.7 Global Message Services

- 9.1.8 Sinch AB

- 9.1.9 Juphoon System Software Co Ltd

- 9.1.10 Summit Tech

- 9.1.11 AT&T Inc

- 9.1.12 T-Mobile USA Inc

- 9.1.13 Verizon Wireless

- 9.1.14 SK Telecom Co Ltd

- 9.1.15 Telstra Corporation Limited

- 9.1.16 Vodafone Group PLC