|

市场调查报告书

商品编码

1637829

北美位置分析:市场占有率分析、行业趋势和成长预测(2025-2030)North America Location Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

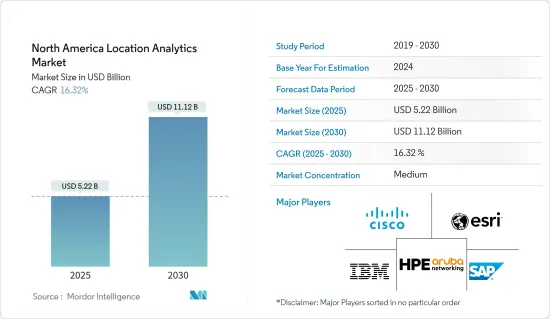

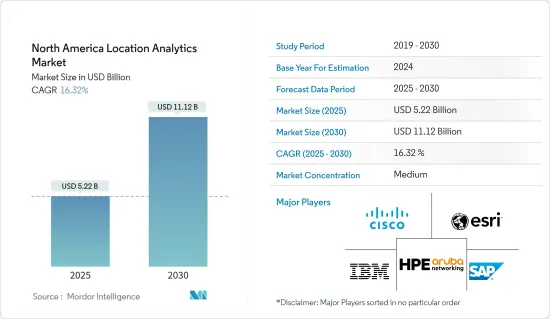

北美位置分析市场规模预计到 2025 年为 52.2 亿美元,预计到 2030 年将达到 111.2 亿美元,预测期内(2025-2030 年)复合年增长率为 16.32%。

近年来,地理空间服务在零售、政府、医疗保健和工业等各个领域越来越受欢迎。云端运算 (IoT)、区块链和人工智慧正在扩大位置分析的应用并推动市场发展。

主要亮点

- 该市场主要是由智慧型手机、汽车和其他行动装置中 GPS(全球定位系统)的实施所推动的。移动定位与卫星GPS结合是发展最快的定位方法。全球小区ID确认CGICTA、扩展观测时差EGOTD等方法,实用精度可达50公尺至1000公尺。由于特定应用的本地化所需的精度,这些技术为最终用户提供了机会。

- 美国拥有卫星等各种GPS基础设施、设备製造商和配套研究经费,再加上政府对提高技术渗透率和准确性的支持,影响了市场的成长。相反,美国联邦通讯委员会放弃了允许该国设备接收伽利略全球导航系统讯号的规定。这影响了该国的 GNSS 晶片製造商纳入此功能,以提高精度。

- 此外,智慧定位可让您远端监控和管理设施内的库存、能源消耗和温度。在室内和室外环境中,它可以提供管理可视性和劳动力监控。智慧定位使公司能够量化房间运转率、评估资产维护週期、管理员工行为以及远端控制人员。

- 消费者不愿意投资可能使他们面临个人资讯或安全风险的技术。这也是阻碍市场成长的因素。因此,製造商和服务供应商必须采取适当的安全措施来确保其客户资料的安全性和机密性。

北美位置分析市场趋势

零售业推动成长

- 地点分析在丰富全通路购物体验方面发挥关键作用。位置分析在零售业的应用是由行动资料的持续使用推动的,因为人们更有可能依赖消费者购物和行动宣传活动,现在可以更轻鬆地在正确的时间显示正确的建议。

- 过去几年,零售业出于各种目的越来越多地使用位置分析,包括提高投资回报率(ROI)、增加销售额、降低成本、提高客户满意度和建立客户忠诚度。

- 位置分析包括,例如,商店销售估计/预测、驾驶时间/距离分析、网路最佳化/情境建模、位置选择规划、专利权/区域评估/重复分析、销售/市场占有率分析、市场规模/需求估计,以及解决产品、区域优化和规划以及客户细分等零售问题。

- 零售商增加销售额的另一种方法是透过地点行销。位置行销直接向附近选定的消费者传递有针对性的讯息。更多观众同时出现在一个地方这一事实也可能允许定向广告转移到此类线上广告平台。零售商还有机会透过智慧定位将客户的网路购物体验与其实体店联繫起来。透过将网站访问和浏览历史记录与商店中实际存在的访客联繫起来,零售商可以更好地了解买家行为并回应他们的需求。

- 此外,透过向零售商提供显示人口资料和人口统计分组的动态地图,位置分析正在商业选址中采用。零售商将能够评估其社区中潜在的分店位置并观察交通模式。

对地理为基础的营销需求不断增长推动市场

- 随着行动装置使用的增加,位置分析在行销中变得越来越重要。来自位置分析的资讯使行销团队可以轻鬆定位消费者,例如该地区即将举办的活动、与商店的距离以及许多其他因素。基于地理/位置的行销允许组织根据消费者的实体位置透过线上或离线通讯传递来针对个人或地理消费者。因此,地球动力学行销可以告诉潜在买家,他们正在考虑的产品在他们的商店中有库存并且可以立即购买。

- 此外,近年来互连设备显着增加,使得地理行销成为可能。从手錶到汽车再到行动电话,一切都可以追溯到网路。连网型设备记录您的活动是很常见的,从而提供有关您的位置和地理位置的大量资讯。行销团队可以利用从这些资料中收集的资讯来更好地了解如何接触消费者并改善整体体验。

- 在每个基于地理的行销计划中强调鼓励客户提供位置分析至关重要。例如,根据微软的研究“消费者资料的价值交换”,消费者非常愿意交换资料以换取折扣、财务奖励或其他感知到的好处。

- 就最终用户而言,近一半的美国零售商使用位置分析。在某些时刻,当需要吸引顾客到商店时,它很有用。跟上总是在移动的消费者的步伐是很困难的。位置分析广告的概念是消费者和零售商之间的连结。消费者可以在正确的时间收到即时推播通知、讯息和警报。

- 例如,沃尔格林使用地理围栏透过推播通知来鼓励客户忠诚度,该通知允许用户在进入地理围栏区域时打开应用程式。用户还可以透过查看其帐户详细资讯来查看促销优惠。此外,零售商在创建个人化体验的用户旅程时意识到了一些重定向机会。您也可以在用户进入您的零售店时投放宣传活动和店内检验。即时触发器可用于定位此类再行销机会。

北美位置分析产业概述

位置分析市场是半静态的,思科系统公司、Esri公司和IBM公司等主要供应商采用併购和策略联盟等策略来扩大市场范围并保持竞争力。该市场竞争激烈,多家供应商为国内和国际市场提供分析解决方案。

2023 年 7 月,Esri 与资料AI 公司 Databricks 合作。此次合作将使 Esri ArcGIS 软体的高阶空间分析功能可在 Databricks 的巨量资料平台 Databricks Lakehouse Platform 上轻鬆使用。与 Databricks Lakehouse 平台整合的 Esri 产品包括 ArcGIS GeoAnalytics Engine 和 Big Data Toolkit,它们是专门为使用户能够对巨量资料集执行空间分析而构建的。

2023 年 5 月,Aruba Networks(HPE 开发的有限合伙人)宣布 Hewlett 将协助企业透过适用于混合多重云端环境的可预测 SaaS 解决方案大规模利用全球资料并使用分析工具,并宣布Packard Enterprise Emerald 软体平台的后续步骤。 Ezmeral 的软体为 HPE GreenLake 的云端资料和分析功能增添了优势,并描述了机器学习计划和人工智慧计划的资料分析基础。

其他好处

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场洞察

- 市场概况

- 生态系分析

- 产业吸引力-波特五力分析

- 买方议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争公司之间的敌对关係

- 主要标准和法规

- 技术简介

- COVID-19 影响评估

第五章市场动态

- 市场驱动因素

- 基于地理的营销需求不断增长

- 零售业中位置分析市场的使用增加

- 物联网的使用不断增加

- 市场问题

- 隐私/安全和监管限制之间的权衡

第六章 市场细分

- 按地点

- 室内的

- 户外

- 按部署模型

- 本地

- 云

- 按行业分类

- 零售

- 银行

- 製造业

- 医疗保健

- 政府机构

- 能源和电力

- 其他的

- 按用途

- 风险管理

- 供应链优化

- 销售和行销优化

- 设施管理

- 远端监控

- 紧急应变管理

- 客户体验管理

- 其他的

- 按国家/地区

- 美国

- 加拿大

第七章 竞争格局

- 公司简介

- Cisco Systems Inc.

- SAP SE

- Esri Inc.

- Aruba Networks(HPE development LP)

- IBM Corporation

- SAS Institute, Inc.

- Pitney Bowes Inc.

- HERE Global BV

- TIBCO Software Inc.

- Ericsson Inc.

第8章 未来展望

第九章投资分析

The North America Location Analytics Market size is estimated at USD 5.22 billion in 2025, and is expected to reach USD 11.12 billion by 2030, at a CAGR of 16.32% during the forecast period (2025-2030).

Geospatial services have been increasingly favored by different sectors, including retail, government, health care, and industry, over the last few years. Cloud computing (IoT), blockchain, and artificial intelligence are expanding the applications of location analytics and, as a result, driving the market.

Key Highlights

- The market is significantly driven by the GPS (Global Positioning System) practices in smartphones, vehicles, and other portable devices. Mobile positioning combined with satellite-based GPS is the most rapidly developing method of positioning. The practical accuracy ranges from 50 to 1000 m for methods such as global cell identity CGICTA and an enhanced observed difference of time, EGOTD. These technologies provide end-users with opportunities based on the accuracy required for specific application location identification.

- The United States boasts various GPS infrastructures, such as satellites, equipment manufacturers, and supportive research funding, combined with government support to boost the technology's penetration and accuracy influences market growth. Instead, the US Federal Communication Commission waived rules to allow devices in the country to receive Galileo Global Navigation System signals; this influenced the GNSS chip makers in the country to incorporate the capability, thus increasing the accuracy.

- Moreover, location intelligence allows for the continuous monitoring and management of inventory, energy consumption, and temperature in a facility by remote control. In its indoor and outdoor environment, it may offer management visibility and monitoring of the workforce. Location intelligence allows companies to quantify room occupancy, assess maintenance cycles for assets, control employees' activities, and operate their personnel remotely.

- Consumers are reluctant to invest in technologies that could result in Personal Information and Safety Risks, as they do not want to take any risks. This factor also hampers the growth of the market. In order to ensure the safety and confidentiality of customers' data, it is therefore necessary that manufacturers and service providers adopt appropriate security measures.

North America Location Analytics Market Trends

Retail Sector to Witness the Growth

- In order to create a more cohesive omnichannel shopping experience, location data plays an essential role. Because of how easily people rely on mobile shopping and mobile location, the application of location analytics for retail has been pushed by the rising use of mobile devices, making it easier for sellers to integrate location data with marketing campaigns to display shoppers with appropriate recommendations at the right time.

- Increasing use of location analytics for different purposes, e.g., to improve Return on Investments (ROI), increase sales, reduce costs, strengthen customer satisfaction, and build loyalty among customers, has been taking place over the past years within the Retail sector.

- Location Analytics solves retail problems, for example, store sales forecasts, driving time and distance profiling, network optimization & scenario modeling, site selection planning, franchise area evaluations& overlap analysis, sales & market share analysis, market size as well and demand estimation through location products, territory optimization & planning, segmentation of the customer.

- Another way for retailers to increase their sales is through location marketing, where targeted messages are delivered directly to the chosen consumers near them. The fact that a wider audience is present in one place simultaneously may also make it possible to shift the targeted advertisement to such an online advertising platform. Retailers also have the opportunity to link their customers' online shopping experience with brick-and-mortar stores through location intelligence. Retailers can improve their understanding of buyer behavior and respond to their needs by connecting site visits and browsing histories with a visitor who is physically present at the store.

- Furthermore, by enabling retailers to use dynamic map maps that show population data and demography groupings, location analysis has also been employed in the selection of commercial sites. Retailers will be able to evaluate potential new sites in nearby areas and watch traffic patterns.

Growing Demand For Geo Based Marketing is Driving the Market

- As more and more mobile devices are being used, location is becoming increasingly important to marketing. Location-based information, such as upcoming events in the area, proximity to a store, or many other factors, may enable marketing teams to target consumers easily. Organizations can target consumers personally or geographically, with online or offline messaging based on their physical location using geobased/location-based marketing. Therefore, Geodynamic marketing can tell prospective buyers that the product they are considering is in stock at another shop, allowing them to buy it immediately.

- In addition, recent years have seen a marked increase in interconnected devices; thus, geo-marketing has become feasible. Everything, such as watches, cars, cell phones, and so on, can be traced back to the Internet. It is common for connected devices to record the movements of their users; a wealth of information about location and geography is available. To better understand how consumers are being approached and improve the overall experience, marketing teams may apply the information gathered from these data.

- It is crucial to emphasize encouraging customers to provide location information in all geobased marketing plans. For example, the Microsoft study "The Value Exchange of Consumer Data" shows consumers are very eager to trade data in return for discounts, financial incentives, and other perceived benefits.

- As far as end users are concerned, nearly half of US retailers use location deals. It is useful to them at a given moment when they are drawing customers into their shops. It's hard keeping up with consumers that are always on the move. The concept of location-based advertising acts as a connecting point between consumers and retailers. Real-time push notifications, messages, and alerts may be received at the correct time for consumers.

- For instance, Walgreens uses geofencing to promote customer loyalty by pushing a notification that allows users to open their app every time they enter the geofenced area. The user can further view promotional offers by looking at their account details. Moreover, retailers notice several retargeting opportunities While creating user journeys for a personalized experience. When a user enters a retail store, offers and in-store validations can also be delivered. Real-time triggers might be used to target these remarketing opportunities.

North America Location Analytics Industry Overview

The Location Analytics Market market is semiconsolidated, with significant vendors like Cisco Systems Inc., Esri Inc., IBM Corporation, etc., adopting strategies for mergers and acquisitions and strategic partnerships, among others, to expand their reach and stay competitive in the market. The market is competitive owing to multiple vendors providing analytics solutions to the domestic and international markets.

In July 2023, Esri partnered with Databricks, the data and AI company. The collaboration will provide users with the advanced spatial analytics capabilities of Esri's ArcGIS software, easily accessible in Databricks' big data platform, the Databricks Lakehouse Platform. Esri offerings that integrate with the Databricks Lakehouse Platform include ArcGIS GeoAnalytics Engine and Big Data Toolkit, which are built specifically to enable users to perform spatial analysis on big datasets.

In May 2023, Aruba Networks (HPE development LP) introduced The next step of the Hewlett Packard Enterprise emerald software platform, which enables organizations to leverage data from around the world and use analytical tools at scale via a predictableSaaS solution for hybrid multi-cloud environments. Ezmeral's software adds the edge to the cloud data and Analytics capability of HPE GreenLake, providing a Data Analytics Foundation for Machine Learning ML projects and Artificial Intelligence Projects.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Ecosystem Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Buyers

- 4.3.2 Bargaining Power of Suppliers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Key Standards and Regulations

- 4.5 Technology Snapshot

- 4.6 Assessment of the Impact of COVID-19

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for geo-based marketing

- 5.1.2 Increasing use of location analytics market in the retail sector

- 5.1.3 Increasing Usage of Internet of Things

- 5.2 Market Challenges

- 5.2.1 Trade-offs between privacy/security and regulatory constraints

6 MARKET SEGMENTATION

- 6.1 By Location

- 6.1.1 Indoor

- 6.1.2 Outdoor

- 6.2 By Deployment Model

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By End-User Vertical

- 6.3.1 Retail

- 6.3.2 Banking

- 6.3.3 Manufacturing

- 6.3.4 Healthcare

- 6.3.5 Government

- 6.3.6 Energy and Power

- 6.3.7 Other End-User Applications

- 6.4 By Application

- 6.4.1 Risk Management

- 6.4.2 Supply Chain Optimization

- 6.4.3 Sales and Marketing Optimization

- 6.4.4 Facility Management

- 6.4.5 Remote Monitoring

- 6.4.6 Emergency Response Management

- 6.4.7 Customer Experience Management

- 6.4.8 Others

- 6.5 By Country

- 6.5.1 United States

- 6.5.2 Canada

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Cisco Systems Inc.

- 7.1.2 SAP SE

- 7.1.3 Esri Inc.

- 7.1.4 Aruba Networks (HPE development LP)

- 7.1.5 IBM Corporation

- 7.1.6 SAS Institute, Inc.

- 7.1.7 Pitney Bowes Inc.

- 7.1.8 HERE Global BV

- 7.1.9 TIBCO Software Inc.

- 7.1.10 Ericsson Inc.