|

市场调查报告书

商品编码

1637878

亚太地区酒精饮料包装:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)APAC Alcoholic Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

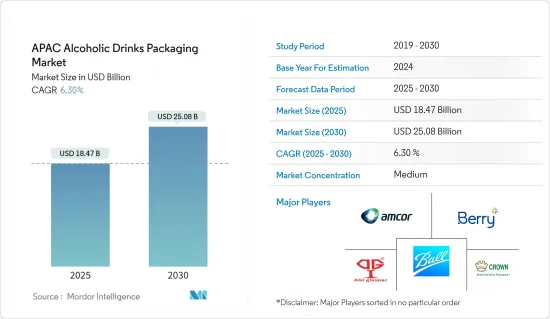

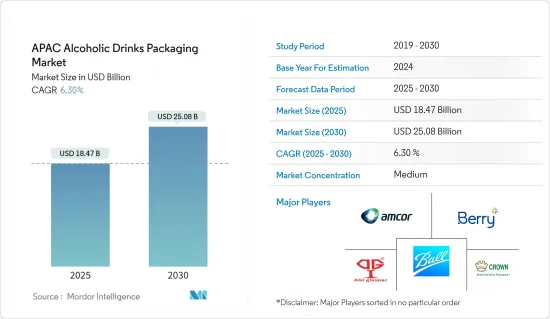

亚太地区酒精饮料包装市场规模预计在 2025 年达到 184.7 亿美元,预计到 2030 年将达到 250.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.3%。

随着该地区酒精饮料消费量的增加,对饮料包装瓶和罐的需求预计将增加。瓶子和罐子很受顾客欢迎,因为它们易于运输和储存。预计这些因素将推动亚太地区酒精饮料包装市场对瓶子的需求增加。

酒精饮料製造商提供各种各样的产品,包装对于扩大其市场范围至关重要。消费者在休閒上的支出增加,加上社会接受度的提高,导致对酒精饮料产品的需求稳定增长,从而对包装行业产生了影响。

玻璃由于其可回收性、再生性和中性反应性,已成为成长最快的酒精饮料包装材料之一。此外,金属罐的日益普及也推动了酒精饮料包装市场的发展。金属罐是用于储存和分配酒精饮料的包装容器。它的强度和刚度使其能够快速轻鬆地填充罐子而不会损失酒精。

此外,该地区的酒精市场受到节庆、都市化、妇女赋权和社会倾向青年人口增加等各种因素的影响,这些因素正在推动市场成长。此外,预测期内,淡啤酒、葡萄酒、低酒精饮料、利口酒和单一麦芽威士忌等新酒精饮料类别的大量成长也将推动该地区包装市场的发展。

亚太地区酒精饮料包装市场趋势

金属包装强劲成长推动市场

- 酒精饮料包装市场根据塑胶、纸张、玻璃和金属等多种材料进行细分。它还涵盖瓶子、罐子、袋子、纸箱和类似容器等产品。此外,市场分析还考虑了永续性、饮料产品的生产力、供需以及疫情对市场的影响等多种因素。

- Ball Corporation、Amcor Group Gmbh 和 Berry Global Inc. 等公司预测其在印度的金属包装业务将大幅成长。由于其永续性,威士忌、葡萄酒和烈酒等新类别正在转向使用铝罐。

- 啤酒爱好者和酿酒师都认识到罐装啤酒在维持饮料品质和新鲜度方面的好处。罐子能更好地抵御光线和氧气,因为光线和氧气会使啤酒随着时间的劣化。此外,金属罐的可回收性很高,回收所需的能源也比玻璃瓶少。随着该地区努力建立更加绿色的未来,啤酒产业转向罐装符合国家永续性目标。

- 此外,该公司正在投资金属包装的未来,因为他们了解选择完全可回收的饮料包装对社区和环境的巨大影响。印度的企业正在积极探索扩大产品类别,以涵盖相当广泛的酒精饮料。各公司也密切关注监管动态,希望创造对罐头更有利的环境。

- 印度工程出口促进会表示,2023年印度铝及相关产品的净出口额将达88亿美元。随着出口价值的增加,铝生产可能实现规模经济和成本效率。这可以使酒精饮料的包装选择更加实惠,并成为製造商更理想的选择。

- 在该地区经营的酒精製造商正专注于推出新的包装酒精饮料。例如,2024 年 3 月,联合啤酒有限公司 (UBL) 宣布推出罐装Queen Fisher 啤酒。女王费雪啤酒 (Queen Fisher Beer) 是一款全女性努力的啤酒,从限量版女王费雪罐装啤酒的配製到由女性酿酒师酿造。

预计啤酒将占据很大的市场。

- 过去几年,啤酒消费量有所增加。印度每年有超过 2000 万达到饮酒年龄的人口,仍然是世界上最大的啤酒市场之一。印度最大的啤酒製造商和着名翠鸟品牌的生产商联合啤酒公司 (United Breweries) 最近推出了最新系列翠鸟即溶啤酒。一盒该产品有两袋。

- 带有皇冠盖的玻璃瓶是该地区传统的啤酒包装。玻璃广泛用于酒精包装,因此预计预测期内其需求将会增加。此外,玻璃价格对酒精产业的利润率有显着影响,并随原油价格的波动而波动。

- 此外,无麸质啤酒在该地区越来越受欢迎。中国、印度和越南的啤酒消费量每年也以超过 6% 的速度成长。这将带来偏好和烹饪方法的创新,刺激对啤酒的需求,并有望带动罐装啤酒的成长。

- 根据中国国家统计局的数据,2023年7月中国啤酒产量接近400万千公升,2022年12月为254千万公升。啤酒产量的增加可能会鼓励包装公司投入资金进行研发,发展出创造性的、环保的包装选择。环保包装、新设计和新材料将提高亚洲酒精饮料包装的品质和吸引力。

- 此外,2024 年 3 月在新加坡成立的 Lion Brewery Co. 正在开闢新局面,并在全球舞台上提升该国精酿啤酒的知名度。该公司是第一家利用线上硝化技术开发罐装硝化烈性黑啤酒的精酿啤酒製造商,也是第一款在杜拜销售的新加坡精酿啤酒。这是新加坡精酿啤酒品牌首次生产烈性黑啤酒黑啤酒。

亚太地区酒精饮料包装产业概况

亚太地区酒精饮料包装市场受主要企业的主导。市场的主要企业包括 Amcor Group GmbH、Crown Holdings, Inc.、Ball Corporation、AGI Glaspac 和 Berry Global Inc.该领域的最新策略倡议包括:

2023 年 8 月 - Crown Holdings Inc. 宣布收购饮料罐和盖製造厂 Helvetia Packaging AG。收购萨尔路易工厂将扩大皇冠饮料罐网络,年产能约 10 亿罐。作为协议的一部分,收购完成后,Crown 将接管 Helvetia 现有的基本客群和相关合约。

2023 年 7 月—Amcor Rigid Packaging (ARP) 为 Ron Rubin Winery 的新 BLUE BIN 葡萄酒系列推出了 100% 再生聚对苯二甲酸乙二醇酯 (rPET) 包装。此系列产品有 750 毫升瓶装。与传统的葡萄酒包装相比,rPET 包装除了减少温室气体排放外,还具有许多环境效益。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 永续包装需求不断成长

- 亚洲酒精消费量上升

- 市场限制

- 政府限制塑胶的使用

第六章 市场细分

- 按材质

- 塑胶

- 纸

- 金属

- 玻璃

- 依产品类型

- 瓶子

- 能

- 小袋

- 纸盒

- 按国家

- 中国

- 印度

- 日本

- 新加坡

- 澳洲和纽西兰

第七章 竞争格局

- 公司简介

- Amcor Group GmbH

- Mondi Group

- Crown Holdings, Inc.

- Gerresheimer AG

- Hualian Glass Bottle

- Ball Corporation

- AGI Glaspac

第八章投资分析

第九章:市场的未来

The APAC Alcoholic Drinks Packaging Market size is estimated at USD 18.47 billion in 2025, and is expected to reach USD 25.08 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

The demand for bottles and cans in beverage packaging is expected to grow as alcoholic beverage consumption rises in the region. Bottles and cans are more convenient to transport and store, making them popular among customers. Due to these factors, the demand for bottles in the Asia-Pacific alcoholic drinks packaging market is expected to increase.

Packaging has been essential in market expansion, with alcoholic beverage makers offering diverse products. Consumer expenditure on recreational activities has increased, as has societal acceptability, resulting in a steady increase in demand for alcoholic drink goods, impacting the packaging industry.

Glass has emerged as one of the fastest-growing alcohol packaging materials due to its recyclability, reusability, and neutral reactivity. Also, the rising popularity of metal cans drives the alcohol packaging market. Metal cans are packaging containers for storing and distributing alcoholic beverages. Its strength and stiffness make filling cans faster and easier without losing alcohol.

Furthermore, various factors influence the alcohol market in the region, including festivities, urbanization, women's empowerment, rising numbers of young people who tend to socialize, etc, push the market growth. Moreover, a lot of growth from new alcoholic drinks categories like light beer, wines, light alcoholic beverages, liqueurs, and single malts also pushed the packaging market in the region over the forecast period.

APAC Alcoholic Drinks Packaging Market Trends

Significant Growth in Metal Packaging to Boost the Market

- The market for alcoholic beverages packaging research market segmentation based on several materials such as plastic, paper, glass, and metal. It also covers products such as bottles, cans, pouches, cartons, and similar containers. Furthermore, the market analysis considers several factors, including sustainability, beverage product production rates, supply and demand, and the influence of pandemics on the market.

- Ball Corporation, Amcor Group Gmbh, Berry Global Inc., and other companies foresee a significant increase in their metal packaging business in India. Because of their sustainability, new categories like whiskey, wine, and hard spirits have moved to aluminum cans.

- Beer enthusiasts and brewers have also recognized the benefits of cans in maintaining the quality and freshness of the beverage. Cans offer superior protection against light and oxygen, which can degrade beer over time. Additionally, metal cans are highly recyclable, requiring less energy than glass bottle recycling. As the region strives to build a greener future, the beer industry's shift toward cans aligns with the nation's sustainability goals.

- Furthermore, businesses are investing in the future of metal packaging because they understand the significant impact of choosing endlessly recyclable beverage packaging on communities and the environment. Companies actively seek expanded categories in India, encompassing a considerably broader range of alcoholic beverages. The companies also closely examine the regulatory developments and expect a favorable environment for cans.

- Engineering Exports Promotion Council India stated India's net export value for aluminum and related products in 2023 was USD 8.8 billion. Aluminum production will experience economies of scale and cost-effectiveness as its export value rises. This might lead to more affordable packaging options for alcoholic beverages, making it a more desirable choice for manufacturers.

- Alcohol producers operating across the region are focused on launching alcoholic beverages in new packages. For instance, in March 2024, United Breweries Limited (UBL) announced the launch of Queenfisher beer in cans. Queenfisher Beer is an all-women initiative, from formulating the limited-edition Queenfisher can brewing it by women brewers.

Beer is expected to take a significant share of the market.

- Beer consumption has risen in the last few years. With over 20 million people reaching the legal drinking age yearly, India remains one of the world's foremost beer markets. United Breweries, India's largest beer manufacturer and maker of the well-known Kingfisher brand, has recently released their latest Kingfisher Instant Beer. The product is packaged in a box with two sachets.

- The glass bottle with a crown closure is the traditional beer packaging in the region. Because glass is widely utilized in alcohol packaging, demand is likely to rise throughout the forecast period. Furthermore, glass prices substantially influence the margin profile of alcohol industries, which swings in response to crude oil price fluctuations.

- Furthermore, gluten-free beers are becoming increasingly popular in this region. Beer consumption is also increasing at over 6% per year in China, India, and Vietnam. As a result, rising innovation in tastes and preparations is anticipated to stimulate beer demand, resulting in beer cans' growth.

- According to the National Bureau of Statistics of China, close to 4 million kiloliters of beer was produced in China in July 2023 which was 2.54 million kiloliters in December 2022. Due to the increase in beer production, packaging businesses may spend money on R&D to develop creative and environmentally friendly packaging options. The quality and appeal of alcoholic beverage packaging in Asia will be improved through eco-friendly packaging, new designs, and materials.

- Moreover, in March 2024, Singapore-founded Lion Brewery Co. is elevating the country's craft beer presence on the global stage by breaking new ground. They are the first craft brewery to pioneer a canned nitro stout with in-line nitro technology and the first Singaporean craft beer to be distributed in Dubai. This marks the first time a Singaporean craft beer brand has produced a canned Nitro Stout beer.

APAC Alcoholic Drinks Packaging Industry Overview

The Asia-Pacific alcoholic drinks packaging market is moderate with the presence of major players. Some of the major players in the market are Amcor Group GmbH, Crown Holdings, Inc., Ball Corporation, AGI Glaspac, Berry Global Inc., and others. Some recent strategic initiatives made in this sector are:

August 2023 - Crown Holdings Inc. announced the acquisition of Helvetia Packaging AG, a beverage can and end manufacturing facility. The acquisition of the Saarlouis plant will expand Crown's beverage can network, with an annual capacity of around 1 billion units. As part of the agreement, Crown will take over the existing Helvetia customer base and associated contracts at closing.

July 2023 - Amcor Rigid Packaging (ARP) launched 100% recycled polyethylene terephthalate (rPET) packaging for Ron Rubin Winery's new BLUE BIN wine range. The range is 750 ml in a bottle. In addition to reducing greenhouse gas emissions compared to conventional wine packaging, rPET packaging offers many environmental advantages.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Sustainable Packaging

- 5.1.2 Increasing Consumption of Alcoholic Drinks in Asia

- 5.2 Market Restraints

- 5.2.1 Government Regulation for Plastic Usage

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Cans

- 6.2.3 Pouches

- 6.2.4 Carton

- 6.3 By Country

- 6.3.1 China

- 6.3.2 India

- 6.3.3 Japan

- 6.3.4 Singapore

- 6.3.5 Australia and New Zealand

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor Group GmbH

- 7.1.2 Mondi Group

- 7.1.3 Crown Holdings, Inc.

- 7.1.4 Gerresheimer AG

- 7.1.5 Hualian Glass Bottle

- 7.1.6 Ball Corporation

- 7.1.7 AGI Glaspac