|

市场调查报告书

商品编码

1627140

北美酒精饮料包装:市场占有率分析、行业趋势和成长预测(2025-2030)NA Alcoholic Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

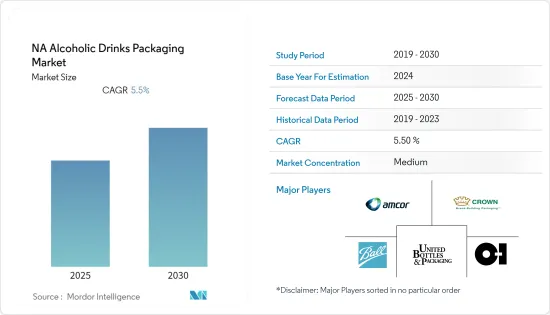

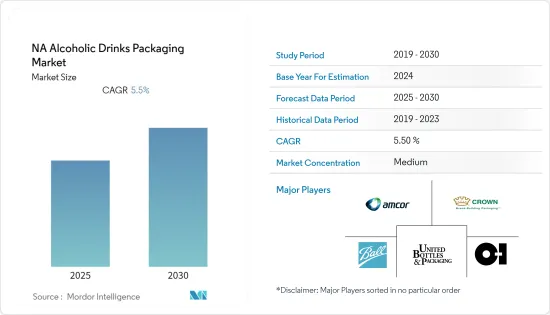

北美酒精饮料包装市场预计在预测期内复合年增长率为 5.5%

主要亮点

- 据克朗斯公司称,2020 年酒精饮料消费量达到 2,440 亿公升,成为全球第二大消费量的包装饮料类型。 Jefferies Group LLC 预计,到 2027 年,美国酒精饮料市场将成为全球最大的酒精饮料市场,预计市场价值约 3,876 亿美元。加拿大排名第十,预计市场规模约481.7亿美元,占美国酒类市场的八分之一。

- 由于 COVID-19,酒精饮料的整体消费量没有重大变化。啤酒和葡萄酒销量增加,但烈性酒销量下降。啤酒和葡萄酒销量增加,但烈性酒销量下降。中低价位白酒需求增加,高阶超高级、超高级白酒需求下降。随着消费者限制社交互动并花更多时间待在家里,对葡萄酒和啤酒的批发需求正在激增。消费者每瓶的花费也比疫情大流行之前更多。

- 疫情期间购物和饮用模式的变化导致人们转向盒中袋等较大包装形式和罐装等较小包装形式。在美国,盒中袋葡萄酒和罐装葡萄酒的销售量正在迅速成长。虽然由于封闭的购物习惯和消费者的囤货慾望,盒中袋形式的扩张被视为暂时的趋势,罐装葡萄酒具有长期的吸引力。

- 近年来,随着罐装等新形式被广泛接受,罐装葡萄酒和啤酒製造商看到了对铝罐包装的巨大需求。这一趋势日益受到重大文化转变的推动,消费者,尤其是千禧世代,越来越多地接受各种方便的葡萄酒形式。

- 着名威士忌品牌 Johnnie Walker 宣布将推出限量版尊尼获加 (Johnnie Walker),瓶身由纸质而非玻璃製成。为了製造这款瓶子,尊尼获加 (Johnnie Walker) 的母公司帝亚吉欧 (Diageo) 与风险管理公司 Pilot Light 合作推出了一家新的永续包装公司 Pulpex Limited。根据帝亚吉欧介绍,这款瓶子是世界上第一个无塑胶、纸质烈酒瓶。纸张将采用永续来源的木浆,威士忌预计将于 2021年终上市。这必须被视为酒类品牌迈向永续包装的重要倡议。

北美酒精饮料包装市场趋势

葡萄酒消费预计将大幅成长

- COVID-19 刺激了酒类电子商务和数位参与度呈指数级增长。因为电子商务可以让消费者比较、探索和发现各种酒精饮料。它特别适合葡萄酒领域,因为它可以让您在喝一口之前就知道葡萄酒的味道和香气。

- 根据硅谷银行发布的《2021年美国葡萄酒产业现况报告》显示,美国葡萄酒市场规模国产葡萄酒成长1.45%,进口葡萄酒成长14.33%。千禧世代接受葡萄酒的速度比其他世代都快。据估计,千禧世代的品牌忠诚度较低。据估计,千禧世代的品牌忠诚度较低。一般来说,他们喜欢尝试不同产地、不同包装、不同风味的葡萄酒,而且很有冒险精神。

- 消费者确信 PET 酒瓶不易破裂且易于运输,因此非常适合小木屋、派对和户外活动。此外,消费者重视环境效益,这进一步推动了包装创新。

- 包装和品牌是葡萄酒的重要且不断发展的方面。例如,美国葡萄酒生产商EandJ Gallo在3公升盒装葡萄酒类别中推出了成功的新品牌「Naked Grape」。其他品牌也在尝试创新包装,以在商店中脱颖而出。例如,「Sofia」品牌销售粉红色罐装葡萄酒,而「Bandit」品牌则采用小型、永续的500毫升和1升纸箱包装葡萄酒。

- 根据联合国精品葡萄酒组织的统计,纯素食主义是成长最快的葡萄酒趋势之一。这也反映在葡萄酒生产中,导致更多素食友善葡萄酒的出现,而这需要玻璃瓶。这些新趋势可能有助于玻璃瓶包装保持在市场上的领先地位。

预计美国将占较大市场占有率

- 美国的葡萄酒消费量最高,2020年达3,300万百公升,是加拿大总消费量的七倍多。便携性和便利性已成为葡萄酒包装创新的关键驱动力,美国新时代葡萄酒零售商 Bota Box 和 Black Box 探索了利乐、盒中袋葡萄酒和纸盒等替代包装。根据硅谷银行发布的《2020年葡萄酒产业状况报告》显示,2019年国内罐装酒虽然只占总量的0.5%,但成长了80%。

- 轻质玻璃是近年来的重大创新,提供与传统玻璃材料相同的耐用性和稳定性,同时减少原料的使用。此外,由于啤酒和威士忌的销售强劲以及对优质饮料的需求也在增加,预计酒精饮料将推动美国的玻璃包装市场。

- 2020年,美国饮料酒精总量经历了20年来最大的成长。成长了2%,是2002年以来的最大增幅。在酒精饮料中,啤酒近年来呈现显着成长。大部分啤酒销售都是玻璃瓶装,这推动了玻璃包装行业提高生产力的需求。对威士忌和兰姆酒等优质酒精饮料的需求不断增长也推动了玻璃瓶的成长。

- 然而,美国之间持续的贸易战可能会影响国内玻璃包装市场。据Ardagh Group称,美国葡萄酒行业70%以上的玻璃瓶是从中国进口的,而对中国进口的关税不断上升,增加了改善玻璃製造基础设施的需求,预计这将导致整体产品成本上升。 。

北美酒精饮料包装产业概况

多家提供酒精饮料包装解决方案的公司的出现加剧了市场竞争。因此,市场适度分散,许多公司正在製定扩大策略。以下是一些最近的趋势:

- 2020 年 2 月 - Garcon Wines 与 Amcor plc 合作,在美国生产由消费后回收 (PCR) PET 塑胶製成的扁平酒瓶。 Amkor 的宝特瓶采用时尚、现代的设计,完美契合当今要求便利和永续性的生活方式。 宝特瓶不易破碎,适用于海滩和泳池,并且具有环境效益,因为它们重量轻、可无限回收,并且比玻璃瓶或铝罐具有更低的碳排放。

- 2020年7月,Can pack Group和位于宾州布兰登的Giorgi Global Holdings, Inc.以及Can pack Group的所有者共同宣布,Can pack已收购宾州奥利芬特的工业产权。这符合我们扩大北美製造工厂的目标。

其他好处:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第一章简介

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章市场动态

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买方议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争公司之间的敌对关係

- 市场驱动因素

- 消费者购买力高

- 酒精饮料消费量增加

- 市场挑战

- 日益增长的环境和永续性问题

- COVID-19 市场影响评估

第五章市场区隔

- 按主要材质分

- 塑胶

- 纸

- 金属

- 玻璃

- 按酒精产品

- 葡萄酒

- 烈酒

- 啤酒

- 即饮 (RTD)

- 其他酒精饮料

- 依产品类型

- 塑胶瓶

- 玻璃瓶

- 金属罐

- 纸盒

- 小袋

- 其他产品类型

- 按国家/地区

- 美国

- 加拿大

第六章 竞争状况

- 公司简介

- Amcor Ltd.

- Ball Corporation

- United Bottles & Packaging

- Ardagh Group SA

- WestRock LLC

- Crown Holdings Incorporated

- Owens-Illinois(OI), Inc.

- Encore Glass

- Brick Packaging, LLC

- Berry Global, Inc.

- IntraPac International LLC

第七章 投资分析

第八章市场的未来

简介目录

Product Code: 50018

The NA Alcoholic Drinks Packaging Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- According to Krones AG, alcoholic beverage consumption reached 244 billion liters in 2020, making it the second most consumed packed beverage type in the world. The United States alcoholic beverage market is expected to be the largest alcohol market worldwide, with a projected market value of about 387.6 billion USD by 2027, according to Jefferies Group LLC. Canada ranked 10th with a market value projected at around USD 48.17 billion, amounting to one-eight of the United States alcohol market.

- Due to COVID-19, overall consumption of alcoholic beverages didn't change much: beer and wine sales rose, whereas hard liquor sales declined. Demand for budget and mid-priced spirits increased, while demand for high-end super-premium and ultra-premium spirits decreased. As consumers limit interactions and spend more time at home, there have been huge spikes in demand for wholesale wine and beer. Consumers are also spending more per bottle than before the pandemic.

- Changes in shopping and drinking patterns during the pandemic have led to a shift towards large packaging formats, such as bag-in-a-box, and small packaging formats, such as cans. Bag-in-box wine sales are booming along with canned wine in the United States. While the expansion of the bag-in-box format is largely seen as a temporary trend driven by lockdown shopping habits and consumers' desire to stock up, but canned wine has long-term appeal.

- Manufacturers of canned wine and beer witnessed a huge demand for aluminum can packaging, and this is due to new formats such as cans gaining wider acceptance in recent years. This trend has been increasingly driven by a significant cultural shift, as consumers, with millennials particularly standing out as keen adopters of different wine formats that offer convenience.

- A prominent whisky brand Johnnie Walker announced that it would release a limited edition of Johnnie Walker whisky using bottles made of paper rather than glass. To create the bottle, Diageo, the parent company of Johnnie Walker, partnered with venture management company Pilot Lite to launch Pulpex Limited, a new sustainable packaging technology company. According to Diageo, it is the world's first plastic-free paper-based spirit bottle. The paper will be supplied from sustainably-sourced wood pulp, and the whisky will be launched by the end of 2021. This must be seen as a significant effort made by any alcohol brand towards sustainable packaging.

North America Alcoholic Drinks Packaging Market Trends

Wine Consumption is expected to Grow Significantly

- Covid-19 has spurred an exponential increase in alcohol e-commerce and digital engagement. Since e-commerce allows consumers to compare, review, and discover between different alcoholic beverages. It is particularly well suited to the wine segment since people get a fair idea about the taste and smell of wine even before taking a single sip.

- According to the State of the US Wine Industry 2021 Report by Silicon Valley Bank, the domestic and imported US wine market volume increased by 1.45% and 14.33%, respectively. Millennials are adopting wine at a faster rate than any other generation. They are estimated to have low brand loyalty. In general, they like to experiment with distinct-tasting wines from various regions in different packaging, which greatly appeals to their sense of adventure.

- Consumers are receiving PET wine bottles positively, as the bottles are unbreakable and easier to carry, making them exceptional for cottages, parties, and outdoor events. Moreover, consumers appreciate the environmental benefits, which are further favoring innovations in the packaging.

- For wine, packaging and branding is an important aspect, which is evolving, and many suppliers are extending and launching their current/new brands in this space. For instance, United States-based wine producer EandJ Gallo launched a new brand, "Naked Grape," in the 3-liter box category of wine and got successful. Other brands are also experimenting with innovative packaging solutions to stand out on the store shelf. For instance, the Sofia brand sells wine in pink cans, and the Bandit brand packages its wine in small, sustainable 500 ml and one-liter cartons.

- According to the United Nations of Fine Wines, Veganism is one of the fastest-growing wine trends. It is also reflected in wine production, leading to more vegan-friendly wines, which would require the glass bottles because of zero rates of chemical reactions ensuring that the wine inside the glass bottle has its aroma and flavor intact. This new trend will help the glass packaging segment to retain its top position in the given market.

United States is Expected to Hold Significant Market Share

- The United States consumes the largest volume of wine of any country, at 33 million hectoliters in 2020, which is more than seven times Canada's total wine consumption. Portability and convenience became significant drivers in wine packaging innovation, which led to United States-based new-age wine sellers Bota Box and Black Box to explore alternative packagings, such as tetra packs and bag-in-box wine and cartons. According to the State Of Wine Industry Report 2020 by Silicon Valley Bank, canned wine in the country has recorded an 80% growth in 2019, despite the 0.5% as an overall share.

- Lightweight glass has been the major innovation in recent times, offering the same resistance as the older glass materials and higher stability while reducing the volume of the raw materials used. Also, alcoholic drinks are expected to lead the way for the glass packaging market, owing to the decent sales of beer and whiskey in the United States, with an increasing demand for premium variants.

- In 2020, the United States witnessed the biggest volume gain in total beverage alcohol volume in nearly twenty years. It was up by 2%, the most significant increase since 2002. Among alcoholic beverages, beer witnessed substantial growth in the past few years. The majority of beer volume is sold in glass bottles and is driving the need for increased production rates in the glass packaging industry. The increasing demand for premium variants in alcoholic drinks like whiskey, rum, etc., is also driving the growth of glass bottles.

- However, the ongoing trade war between the United States and China may impact the glass packaging market in the country. Ardagh Group stated that over 70% of the US wine industry glass bottles are imported from China; and due to increase in the tariff rate imposed on China imports, the need for improving glass manufacturing infrastructure is expected to rise, leading to an increase in the overall cost of the product in coming years.

North America Alcoholic Drinks Packaging Industry Overview

The availability of several players providing packaging solutions for alcoholic beverages has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies. Some of the recent developments are:

- February 2020 - Garcon Wines collaborated with Amcor plc to produce flat wine bottles made with post-consumer recycled (PCR) PET plastic in the United States. Amcor's PET Bottles are sleek, modern, and perfectly match with today's lifestyle requirements for convenience and sustainability. PET bottles are unbreakable, beach- and pool-friendly, and also have environmental benefits since they are lightweight, infinitely recyclable, and have a lower carbon footprint than glass bottles or aluminum cans.

- July 2020, The Can pack Group and Giorgi Global Holdings, Inc., situated in Blandon, Pennsylvania, and the owner of the Canpack Group jointly announcedCanpack'ss acquisition of industrial property in Olyphant, Pennsylvania. This is in line with a goal to expand manufacturing facilities in North America.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 High Purchasing Power of Consumers

- 4.4.2 Increasing Consumption of Alcoholic Drinks

- 4.5 Market Challenges

- 4.5.1 Increasing Environmental and Sustainability Concerns

- 4.6 Assessment of the Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Primary Material

- 5.1.1 Plastic

- 5.1.2 Paper

- 5.1.3 Metal

- 5.1.4 Glass

- 5.2 By Alcoholic Products

- 5.2.1 Wine

- 5.2.2 Spirits

- 5.2.3 Beer

- 5.2.4 Ready to Drink (RTD)

- 5.2.5 Other Types of Alcoholic Beverages

- 5.3 By Product Type

- 5.3.1 Plastic Bottles

- 5.3.2 Glass Bottles

- 5.3.3 Metal Cans

- 5.3.4 Cartons

- 5.3.5 Pouches

- 5.3.6 Other Product Types

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Amcor Ltd.

- 6.1.2 Ball Corporation

- 6.1.3 United Bottles & Packaging

- 6.1.4 Ardagh Group SA

- 6.1.5 WestRock LLC

- 6.1.6 Crown Holdings Incorporated

- 6.1.7 Owens-Illinois (O-I), Inc.

- 6.1.8 Encore Glass

- 6.1.9 Brick Packaging, LLC

- 6.1.10 Berry Global, Inc.

- 6.1.11 IntraPac International LLC

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219