|

市场调查报告书

商品编码

1640531

美国酒精饮料包装:市场占有率分析、行业趋势和成长预测(2025-2030 年)US Alcoholic Drinks Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

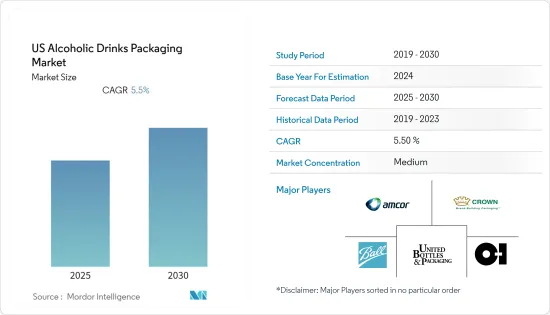

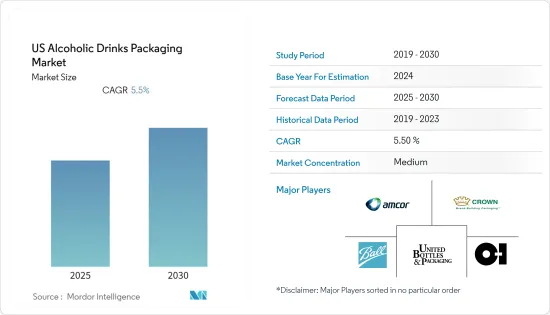

预计预测期内美国酒精饮料包装市场复合年增长率将达到 5.5%。

主要亮点

- 市场的成长受到多种因素的推动,例如酒精消费量的增加、精酿啤酒行业对金属罐的需求不断增长以及酒精饮料行业对 PET 包装的使用不断增加。

- 酒精饮料的包装在设计、坚固性和外带潜力方面都有了显着的进步。酒精饮料公司正在寻找创新方式来表达他们的品牌,减少他们的碳排放并提供适合外带的包装。

- 此外,酒精饮料生产商定期推出新产品和口味添加物,增加使用量并促进酒精饮料包装市场的发展。

- 该地区酒精饮料包装市场的成长受到能源和原材料成本上升的严重阻碍,这增加了包装的製造成本。

- 在COVID-19疫情爆发期间,所研究的市场受到各国实施的封锁措施的影响,封锁扰乱了供应链流程,并关闭了多个国家的生产工厂以抑制病毒的影响,面临缓慢增长。

美国酒精饮料包装市场趋势

塑胶推动成长

- 越来越多的酒精饮料开始采用塑胶包装解决方案。各种饮料包装对立式袋和带嘴袋的需求日益增加。然而,饮料的品质受pH值、储存温度、压力和污染物的影响。改变水平可以改变饮料的成分。为了消除氧化的可能性,越来越多的公司转向具有阻隔性(耐热、耐湿、耐菌)等特性的软包装产品。

- 随着包装材料轻质化的快速普及,以及降低生产、运输和物料输送成本的动力,饮料软质塑胶包装正得到广泛的应用。

- 饮料玻璃包装物流成本高,且不方便捷,运输过程中破损现象较多。塑胶包装所提供的成本效益和物流便利性正在鼓励许多饮料製造商选择塑胶包装。预计这种潜在的采用将对所研究的市场产生积极影响。

- 带有喷口的立式袋通常用于饮料包装,预计在整个预测期内,自立袋在液体包装中的使用将会增加,因为它们更容易在商店竖立起来,从而实现更有效、更高效的展示。带有喷口的立式袋已经变得很受欢迎,因为它们比饮料包装使用的标准玻璃或硬塑胶便宜。

玻璃瓶可望占较大市场占有率

- 玻璃也常用于包装酒精饮料,因为它可回收,并且可以无限期重复使用而不会影响品质或纯度。玻璃的防水性有助于避免玻璃包装中的酒精味道受到污染。

- 除了推动啤酒瓶需求的因素外,由于罐头短缺,尤其是在 COVID-19 疫情导致订单暂停之后,全部区域对玻璃瓶(如酒瓶)的需求也在增加。

- 玻璃瓶携带和储存也极为方便,成为消费者的首选。预计这些因素将推动对酒精饮料玻璃瓶包装的需求。

- 越来越多的酒类製造商有意识地在包装中使用再生材料,并增加酒瓶中再生玻璃的比例。例如,Absolut 致力于透过推出使用 41% 再生玻璃的限量版设计来最大限度地减少包装浪费。

- 回收玻璃的化学反应为 0%,因此对酒精的浓度、香气或味道没有影响。因此,预计玻璃瓶在该地区市场占有率将会增加。

美国酒精饮料包装产业概况

有多家公司提供酒精饮料包装解决方案,这使得市场竞争激烈。因此,市场适度分散,许多公司正在实施扩大策略。

- 2022 年 5 月-可口可乐 UNITED Partners 与 Oi Glass 合作,增加回收玻璃来製造新的玻璃瓶。可口可乐装瓶公司联合致力于创造一个“没有废弃物的世界”,并设定了到2030年其瓶子中使用50%再生材料的目标。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场动态

- 市场驱动因素

- 消费者购买力强

- 酒精饮料消费量增加

- 市场挑战

- 包装对环境和永续性的担忧日益增加

- COVID-19 市场影响评估

第六章 市场细分

- 按主要材质

- 玻璃

- 金属

- 塑胶

- 纸

- 按酒类分类

- 葡萄酒

- 烈酒

- 啤酒

- 即饮(RTD)

- 其他酒类

- 依产品类型

- 玻璃瓶

- 金属罐

- 塑胶瓶

- 纸盒

- 小袋

- 其他产品类型

第七章 竞争格局

- 公司简介

- Ball Corporation

- Crown Holdings Inc.

- Amcor PLC

- Owens-Illinois Inc.

- United Bottles & Packaging

- Brick Packaging LLC

- Berry Global Inc.

- IntraPac International LLC

- Encore Glass

- WestRock LLC

- Ardagh Group SA

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 54348

The US Alcoholic Drinks Packaging Market is expected to register a CAGR of 5.5% during the forecast period.

Key Highlights

- The growth of the market depends on serval factors, including the rising consumption of alcohol, the growing demand for metal cans from the craft beer industry, and the increasing use of PET packaging in the alcoholic beverage industry.

- Alcoholic beverage packaging is evolving significantly in terms of design, robustness, and to-go possibilities. Alcohol producers are seeking for innovative ways to represent their brand, reduce carbon emissions, and offer suitable take-out containers.

- Additionally, producers of alcoholic beverages regularly release new products and flavor additions, increasing usage and propelling the market for alcoholic beverage packaging.

- The region's alcoholic beverage packaging market growth is being severely hampered by the growing cost of energy and raw materials, which raises the cost of manufacturing packaging.

- During the outbreak of COVID-19, the market studied faced slow growth due to lockdowns imposed by various countries that have disrupted the supply chain process and the closure of production plants in some countries to curb the effect of the virus.

US Alcoholic Drinks Packaging Market Trends

Plastic to Witness the Growth

- Alcoholic beverages are increasingly embracing plastic packaging solutions. There is an increasing demand for stand-up and spouted pouches for various beverage packaging. However, the quality of beverages is affected by pH, storage temperature, pressure, and the presence of contaminants. Changes in the levels can alter the composition of the beverage. Companies are increasingly employing flexible packaging products with properties such as high barrier resistance (heat, moisture, and bacteria) to eliminate possible oxidation.

- The rapidly adopted tendency of lightweight packaging material, alongside the inclination towards reducing production, shipment, and handling costs, is driving the flexible plastic packaging of beverages.

- Logistics of glass packaging for beverages is expensive and inconvenient due to the large generation of breakage during transportation. Driven cost-effectiveness and ease of logistics offered by plastic packaging have encouraged multiple beverage companies to opt for it. Such likely implementation is expected to impact the studied market positively.

- Spouted stand-up pouches, a product commonly used for beverage packaging, are anticipated to witness an increase in their use for liquid packaging throughout the projection period because they are simple to stand up on store shelves for more effective and efficient display. The market under study is predicted to choose a low-cost option for liquid and beverage packaging, leading to the widespread use of spouted stand-up pouches since they are less expensive than the standard glass and stiff plastic used for beverage packaging.

Glass Bottles Expected to Hold Significant Market Share

- Glass is also often used in alcohol packaging since it is recyclable and may be reused endlessly without losing quality or purity. The water-resistant ability of glass helps avoid contamination of the flavor of alcohol in glass packaging.

- Increased demand for glass, such as liquor bottles, across the region, along with the factor driving the demand for beer bottles, is the shortage of cans, especially after shutdown orders due to the COVID-19 pandemic.

- Glass Bottles also offer great convenience in carrying and storage, making them a preferable choice by consumers. These factors are expected to promote the demand for glass bottle packaging for alcoholic drinks.

- More and more liquor manufacturers are becoming aware of using recycled materials in their packaging and raising the percentage of recycled glass used in their bottles. For instance, Absolut has vowed to minimize packaging waste by launching a limited-edition design made from 41% recycled glass.

- It does not influence the strength, smell, or flavor of the alcohol because it has a 0% rate of chemical interaction. As a result, the glass category is predicted to increase its region's alcohol drinks packaging market share.

US Alcoholic Drinks Packaging Industry Overview

The availability of several players providing packaging solutions for alcoholic beverages has intensified the competition in the market. Therefore, the market is moderately fragmented, with many companies developing expansion strategies.

- May 2022 - Coca-Cola UNITED Partners is partnering with O-I Glass to capture more recycled glass to be created into new glass bottles. Coca-Cola Bottling Company UNITED is committed to building a World Without Waste and has a goal of using 50% recycled material in their bottles by 2030.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 High Purchasing Power of Consumers

- 5.1.2 Increasing Consumption of Alcoholic Drinks

- 5.2 Market Challenges

- 5.2.1 Increasing Environmental and Sustainability Concerns over Packaging

- 5.3 Assessment of the Impact of COVID-19 on the Market

6 MARKET SEGMENTATION

- 6.1 By Primary Material

- 6.1.1 Glass

- 6.1.2 Metal

- 6.1.3 Plastic

- 6.1.4 Paper

- 6.2 By Alcohol Type

- 6.2.1 Wine

- 6.2.2 Spirits

- 6.2.3 Beer

- 6.2.4 Ready to Drink (RTD)

- 6.2.5 Other Alcohol Types

- 6.3 By Product Type

- 6.3.1 Glass Bottles

- 6.3.2 Metal Cans

- 6.3.3 Plastic Bottles

- 6.3.4 Cartons

- 6.3.5 Pouches

- 6.3.6 Other Product Types

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Crown Holdings Inc.

- 7.1.3 Amcor PLC

- 7.1.4 Owens-Illinois Inc.

- 7.1.5 United Bottles & Packaging

- 7.1.6 Brick Packaging LLC

- 7.1.7 Berry Global Inc.

- 7.1.8 IntraPac International LLC

- 7.1.9 Encore Glass

- 7.1.10 WestRock LLC

- 7.1.11 Ardagh Group SA

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219