|

市场调查报告书

商品编码

1640352

欧洲家庭护理包装:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Home Care Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

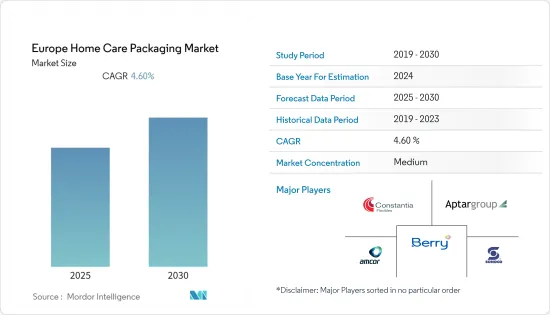

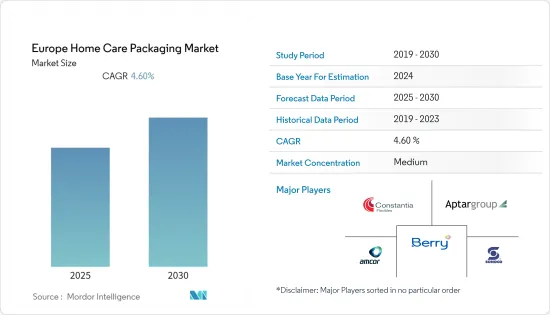

预计预测期内欧洲家庭护理包装市场复合年增长率将达到 4.6%。

主要亮点

- 由于 COVID-19 因素(如在家工作场景和家庭隔离)导致人们在家中度过的时间增加,增加了杀死细菌的需要,同时也降低了感染的机会,尤其是在高接触区域。约有 84% 的消费者改变了家居清洁方式,各大公司也纷纷推出适合自己产品以应对疫情衝击的新产品。

- 随着新冠疫情爆发,消费者对个人和家庭卫生的意识增强,个人和商务用对洗衣护理、外观保养和厕所清洁产品的需求均增加,预计将呈现稳定成长。

- 近期,消费者网路支出大幅增加,带动了家用清洁剂的线上销售。宝洁公司、汉高公司、联合利华、Church & Dwight 和利洁时集团是全球领先的家庭护理产品供应商。

- 网路平台让消费者更了解并专注于个人和环境健康。根据多项调查,超过20%的全球消费者更喜欢采用永续包装或由再生材料製成的包装的产品,这将在中期内导致对无添加产品的需求增加。

欧洲家庭护理包装市场趋势

塑胶材料有望占据较大的市场占有率

- 塑料在所有主要包装类型中的广泛使用为塑料作为一种材料创造了市场。这种材料的柔韧性、强度和耐用性使其成为业界许多液体、乳霜和粉末产品包装的理想选择。

- 与市场上其他材料相比,塑胶具有高度的柔韧性,可以模製成任何形状。零售业的需求不断增长、双收入家庭的增加以及对塑胶瓶的需求不断增加是塑胶製品的主要驱动力。

- 除了其优越的特性之外,防篡改瓶盖和封口等创新技术也越来越受欢迎,这为品牌所有者带来了显着的附加价值。这就是为什么塑胶被广泛应用于各种产品的原因。

- 此外,由于便利性和永续性问题,消费者的偏好逐渐转向软质塑胶包装而非硬质塑胶包装。软质塑胶包装比同类的硬质塑胶包装轻 80%,而且价格便宜。

- 然而,由于对塑胶相关环境问题的担忧,过去十年市场成长放缓。

- 然而,随着生物分解性塑胶和回收过程的出现,塑胶有望在包装领域继续使用。

英国可望占较大市场占有率

- 在欧洲地区,英国预计将占据家庭护理包装市场的最大份额,其次是德国。消费者对包装家庭护理产品的安全性和益处的认识不断提高,预计将推动市场成长。此外,根据 RetailX 冠状病毒消费者追踪报告,人们对 COVID-19 的日益担忧正在推动消费者行为发生重大变化。

- 欧洲家庭护理产品包装市场受到严格监管,确保家庭护理产品使用起来最安全。严格且不断变化的法规也造成了市场扭曲。创新的包装和特殊成分的加入为产品带来了额外的好处,这也推动了市场的发展。

- 英国市场的成长主要得益于软包装产业。全球包装供应商正在该地区建立业务,并收购当地公司,凸显了英国市场的潜力。例如,2020 年 1 月,麦克法兰集团收购了保护性包装解决方案供应商 Armagrip。

- 英国是欧洲地区领先的经济体之一。欧洲国家可支配收入的增加,使得家庭护理产品的价格更加实惠,从而使得疫情期间家庭护理用品的品质得到提高。越来越多的移民为了就业而定居于该国,这也推动了家庭护理市场的成长。

- 疫情期间,消费者关心健康卫生。消费者关心安全和清洁。消毒剂和消毒剂的常规使用量呈指数级增长,对家庭护理产品包装市场产生了积极影响。

欧洲家庭护理包装产业概况

家庭护理产品包装市场相当分散,有几个主要参与者。从市场占有率来看,目前少数几家大公司占据着市场主导地位。这些拥有高市场占有率的大公司正专注于扩大海外基本客群。市场的主要参与者包括 Amcor、Berry Global Inc. 和 Constantia Flexibles。这些公司正在利用策略合作措施来扩大市场占有率并提高盈利。

- 2021 年 6 月-Amcor 推出新机器,生产超透明耐热薄膜。 AmPrima 生产线采用机器方向取向技术,以竞争对手无法比拟的速度生产薄膜,为包装应用提供可回收解决方案。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 产品创新、差异化与品牌

- 人均所得的提高对购买力有正面影响

- 市场限制

- 原物料价格波动

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 COVID-19 的市场影响

第六章 市场细分

- 按材质

- 塑胶

- 纸

- 金属

- 玻璃

- 按类型

- 瓶子和容器

- 金属罐

- 纸盒

- 小袋

- 其他类型

- 按产品

- 洗碗

- 杀虫剂

- 衣物洗护

- 洗护用品

- 抛光

- 空气清净

- 其他产品

- 按国家

- 英国

- 法国

- 德国

- 义大利

- 西班牙

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- Amcor PLC

- Ball Corporation

- RPC Group

- Winpak Ltd

- AptarGroup Inc.

- Sonoco Products Company

- Silgan Holdings

- Constantia Flexibles Group GmbH

- DS Smith PLC

- Can-Pack SA

- ProAmpac

第八章投资分析

第九章 市场机会与未来趋势

The Europe Home Care Packaging Market is expected to register a CAGR of 4.6% during the forecast period.

Key Highlights

- More time at home due to COVID 19 factors, like lockdown measures, the work-from-home scenario, and home quarantine, created the need for killing germs with the added benefit of reducing the chance of infection, particularly in the frequent contact areas. With around 84% of the consumer changing the way they clean their homes, players positioned their products to cope with the pandemic surge.

- As consumers have become more conscious about personal and home hygiene after the COVID-19 pandemic, the demand for laundry care, surface care, and toilet care-related products, both personal and commercial, is expected to witness escalating growth.

- In the recent past, online spending by consumers increased significantly, which boosted the online sales of household cleaners. Procter & Gamble, Henkel AG, Unilever, Church & Dwight, and Reckitt Benckiser Group are the leading players offering home care products globally.

- Consumers are more informed and concerned about personal and environmental health with connected platforms. According to several studies, more than 20% of consumers globally prefer products with packaging that is sustainable and/or made from recycled materials, which is leading to the demand for products with free-from claims over the medium term.

Europe Home Care Packaging Market Trends

Plastic Material is Expected to Hold a Significant Market Share

- The wide usage of plastic through all major packaging types is creating a market for plastic as a material. The flexibility, strength, and durability of the material make it ideal for the packaging of many liquids, cream, and powder products in the industry.

- Compared to other materials available in the market, plastic remains highly flexible and can be molded into any shape. Growth in demand from the retail industry, increasing dual-income households, and rising demand for plastic bottles are the major drivers for plastic products.

- Apart from its favorable properties, innovations, such as tamper-evidence caps and closures, are gaining popularity, which can lead to a crucial value add for the brand owners. This has driven the use of plastics across a variety of products.

- Furthermore, there is a gradual shift in customer preference towards the adoption of flexible plastic packaging over its rigid counterpart because of convenience and sustainability issues. Flexible plastic packaging materials are 80% lighter in weight than their equivalent rigid plastic materials, in addition to being cheaper.

- However, environmental concerns associated with plastics have resulted in a slowdown of market growth in the last decade.

- Nevertheless, with the advent of biodegradable plastics and the process of recycling, plastics are expected to sustain their usage in the packaging world.

United Kingdom to Anticipated to Hold Significant Market Share

- In the European region, the United Kingdom is expected to occupy the highest share in the home care packaging market, followed by Germany. The increasing awareness of consumers regarding the safety and benefits of packaged home care products is expected to drive the growth of the market. Also, as per the RetailXCoronavirus Consumer Tracker, there have been significant changes in customer behavior due to the growing COVID-19 concerns.

- The European home care packaging market is highly regulated, which makes home care safest to use. Stringent and changing regulations have also caused distortions in the market. The innovative packaging and incorporation of special ingredients that have given an additional benefit to the product are also driving factors of the market.

- The market in the United Kingdom is mainly growing due to the flexible packaging sector. The global packaging vendors are expanding in the region, and local companies are being acquired, which is indicative of the market potential in the United Kingdom. For instance, in January 2020, Macfarlane Group acquired protective packaging solutions provider Armagrip.

- The United Kingdom is one of the major economies in the European Region. Growing disposable income in European countries has led to rising in the affordability of home care products, which has resulted in improved quality home care items in the pandemic situation. The growth of the home care market is also being driven by the increasing number of migrants settling for employment purposes.

- During the pandemic situation, consumers have been worried about their health and hygiene. They are taking care of safety and cleanliness. Regular usage of sanitizers and disinfectants has grown exponentially, positively impacting the home care packaging market.

Europe Home Care Packaging Industry Overview

The home care packaging market is competitive moderately fragmented, with the presence of several major players. In terms of market share, few of the major players currently dominate the market. These major players with a prominent share in the market are focusing on expanding their customer base across foreign countries. Some of the major players in the market are Amcor, Berry Global Inc., Constantia Flexibles, among others. These companies are leveraging on strategic collaborative initiatives to increase their market share and increase their profitability.

- June 2021- Amcor launched new machines that will produce ultra-clear and heat resistance films. The AmPrima line uses machine-direction orientation technology to produce films that can run at speeds that competitors are unable to match in a recycle-ready solution for the packaging purpose.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Product Innovation, Differentiation, and Branding

- 4.2.2 Rising Per Capita Income Positively Impacting the Purchase Power

- 4.3 Market Restraints

- 4.3.1 Fluctuations in Raw Material Prices

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 IMPACT OF COVID-19 ON THE MARKET

6 MARKET SEGMENTATION

- 6.1 Material

- 6.1.1 Plastic

- 6.1.2 Paper

- 6.1.3 Metal

- 6.1.4 Glass

- 6.2 Type

- 6.2.1 Bottles and Containers

- 6.2.2 Metal Cans

- 6.2.3 Cartons

- 6.2.4 Pouches

- 6.2.5 Other Types

- 6.3 Products

- 6.3.1 Dishwashing

- 6.3.2 Insecticides

- 6.3.3 Laundry Care

- 6.3.4 Toiletries

- 6.3.5 Polishes

- 6.3.6 Air Care

- 6.3.7 Other Products

- 6.4 Country

- 6.4.1 United Kingdom

- 6.4.2 France

- 6.4.3 Germany

- 6.4.4 Italy

- 6.4.5 Spain

- 6.4.6 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Amcor PLC

- 7.1.2 Ball Corporation

- 7.1.3 RPC Group

- 7.1.4 Winpak Ltd

- 7.1.5 AptarGroup Inc.

- 7.1.6 Sonoco Products Company

- 7.1.7 Silgan Holdings

- 7.1.8 Constantia Flexibles Group GmbH

- 7.1.9 DS Smith PLC

- 7.1.10 Can-Pack SA

- 7.1.11 ProAmpac