|

市场调查报告书

商品编码

1645087

全球气动废弃物管理系统市场 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Pneumatic Waste Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

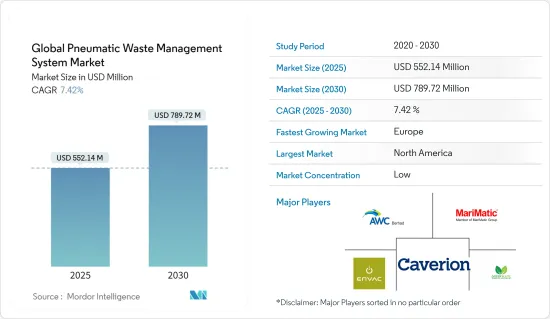

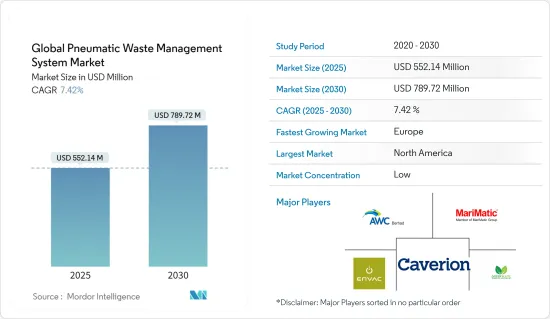

2025 年全球气动废弃物管理系统市场规模估计为 5.5214 亿美元,预计到 2030 年将达到 7.8972 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.42%。

关键亮点

- 考虑到对智慧城市解决方案的需求不断增长、政府促进永续发展的倡议以及城市固态废弃物产生量的不断增加,气动废弃物管理系统预计将在未来几年实现显着增长。与传统的废弃物收集方法相比,此类系统具有许多好处,包括减少噪音和交通拥堵、改善公共卫生和安全、减少温室气体排放。

- 这种符合永续性目标且可能受益于公共奖励的系统,随着环境法规愈发严格,正变得越来越有吸引力。预计到2050年全球固态废弃物产量将会增加,这也是一个主要驱动因素。透过促进高效的废弃物管理和减少对垃圾掩埋场的依赖,气动废弃物收集系统提供了一种切实可行的解决方案。

- 2023 年 7 月,大金奈城市发展局 (GCC) 访问了罗马、巴黎和巴塞隆纳,探讨如何改善这些城市实施的固态废弃物管理 (SWM) 系统。

- 为了方便处理废弃物并避免溢出和直接接触,GCC 将安装带有盖子孔的垃圾箱,并用彩色带指示废弃物类型。这些将安装在海滩等人流量大的区域。此外,还将在海滩上放置专门用于盛放玻璃瓶的容器,为期两到三个月。此外,GCC提案定期在垃圾收集车上安装称重机,以测量各类用户排放重量,并识别大件垃圾排放。

全球气动废弃物管理系统市场趋势

预计未来几年欧洲市场将显着成长

- 几十年来,气动废弃物管理系统已在欧洲各地安装,并被认为是先进的技术。这些系统在斯堪地那维亚广泛存在,其中瑞典和芬兰最为集中。随着对更永续环境的需求不断增长,废弃物管理策略也日益全球化。在需要减少交通和污染的都市区,气动废弃物收集提供了传统公路运输的替代方案。

- 据欧洲资讯来源称,固定式真空废弃物收集系统的投资成本在 230 万欧元(250 万美元)至 1,360 万欧元(1,476 万美元)之间,不包括建筑工程和可行性研究和检查。根据系统的大小,这些成本可能会大不相同。垃圾收集口的数量、管网的长度、收集的废弃物的数量以及一个真空废弃物收集系统的规模都根据所连接的人口数进行调整。

- 每米管道的平均成本在 1,000 欧元至 3,000 欧元之间,每个入口的平均成本在 20,000 欧元至 70,000 欧元之间(21,706 美元至 75,974 美元)。平均住宅投资 2,400 欧元(2,604 美元),或每位居民投资 835 欧元(906 美元)。

- 2023 年 8 月,Embac 发明了一种气动垃圾收集系统,该系统将程式转移到地下,取代了从单一垃圾槽中手动收集垃圾,大大减少了与垃圾相关的拥塞和碳排放。在中国,许多智慧城市和医院正在采用这项技术。

医院对气动废弃物管理系统的需求正在上升

- 从医疗保健和食品服务的角度来看,气动废弃物系统用于运输医疗废弃物、厨余垃圾和其他潜在危险物质。促进健康和安全有助于利用气动系统处理某些类型的废弃物。

- 2023 年 10 月,Envac France 负责在巴黎巴蒂尼奥勒区的伊西勒穆利诺和罗曼维尔市安装气动废弃物收集系统。这项先进技术大幅减少了传统废弃物收集车的收集路线,并减少了80%的NO2和CO2排放。

- 在目前已运作两座废弃物收集设施的伊西勒魁北克市和巴蒂尼奥勒市、穆兰市和罗曼维尔市,Embac 与一家永续城市发展供应商合作安装了气动废弃物管理系统。此外,蒙彼利埃和斯特拉斯堡医院的两个手术室总共可容纳 1,500 多张床位。

- 总合而言,巴黎带的城市设施为 11,000 个家庭提供了自动化废弃物收集服务,这意味着超过 36,000 名居民受益于创新的废弃物管理服务,这些服务除了方便之外,还有助于改善城市环境。

全球气动废弃物管理系统产业概况

气动废弃物管理系统市场由全球参与企业整合和主导。参与企业正致力于扩大其地理影响力,以抢占大部分市场份额。市场的主要企业包括 Envac Group、Stream、MariMatic Oy、Aerbin ApS 和 Logiwaste AB。这些公司不断采用併购、策略联盟、合资和伙伴关係等策略来抢占更多的市场占有率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 市场技术进步

- 政府的市场法规和倡议

- 交通费用亮点

- 价值链/供应链分析

- COVID-19 市场影响

第五章 市场动态

- 市场驱动因素

- 都市化和人口成长

- 政府法规和倡议

- 投资技术进步

- 市场限制

- 社会认知与接受

- 维护和营运成本

- 市场机会

- 发展新兴市场

- 采用循环经济模式

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/购买者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 按最终用户

- 住宅

- 商业(办公室)

- 医院

- 饭店业

- 其他的

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 欧洲

- 德国

- 法国

- 西班牙

- 义大利

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 日本

- 澳洲

- 新加坡

- 马来西亚

- 泰国

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 卡达

- 阿拉伯聯合大公国

- 埃及

- 其他中东和北非地区

- 拉丁美洲

- 巴西

- 阿根廷

- 其他拉丁美洲国家

- 北美洲

第七章 竞争格局

- Market Concentration

- 公司简介

- ENVAC

- MARIMATIC OY

- AWC BERHAD

- Stream

- ATREO

- Ecosir Group OY

- GreenWave Solutions

- CAVERION Corporation

- Air-Log International GmbH

- LOGIWASTE AB

- AERBIN APS

- Peakway Environmental Sci & Tech Co. Ltd*

- 其他公司

第 8 章:市场的未来

第 9 章 附录

The Global Pneumatic Waste Management System Market size is estimated at USD 552.14 million in 2025, and is expected to reach USD 789.72 million by 2030, at a CAGR of 7.42% during the forecast period (2025-2030).

Key Highlights

- In view of the growing demand for smart city solutions, government initiatives promoting sustainable development, and increasing municipal solid waste generation, pneumatic waste management systems are expected to grow significantly over the next few years. Such systems offer a number of advantages, such as reducing noise and traffic congestion, improving public health and safety, and lowering greenhouse gas emissions compared to conventional waste collection methods.

- These systems, aligned with sustainability objectives and the potential to benefit from public incentives, are becoming increasingly attractive as environmental regulations become more stringent. The global municipal solid waste production is expected to increase by 2050, and this is another major growth driver. By facilitating efficient waste management and reducing reliance on landfills, pneumatic waste collection systems provide a practical solution.

- In July 2023, following a trip to Rome, Paris, and Barcelona, the Greater Chennai Corporation (GCC) mulled over the introduction of measures practiced by these cities to improve the solid waste management (SWM) system.

- In order to allow easy disposal of waste and avoid spilling and direct contact with it, GCC intends to install dustbins with holes in the lids and colored bands to indicate the category of waste to be disposed of. These are expected to be introduced in high-traffic areas such as beaches. For a period of 2 to 3 months, separate containers for glass bottles will also be placed on the beach. Additionally, the GCC proposed installing a weighing machine in garbage collection vehicles on a pilot basis to determine the weight generated by different users and identify bulk waste generators.

Global Pneumatic Waste Management System Market Trends

Europe is Expected to Witness Significant Market Growth in the Coming Years

- For decades, pneumatic waste management systems have been in place throughout Europe and are considered to be an advanced technology. These systems are widespread in Scandinavia, with Sweden and Finland having the highest concentration. Waste management strategies are becoming increasingly global as the need for a more sustainable environment grows. In urban areas where there is a need to reduce traffic and pollution, pneumatic waste collection provides an alternative to traditional road haulage.

- According to European sources, the cost of investing in stationary vacuum waste collection systems, excluding construction works and preliminary studies or tests, is between EUR 2.3 million (USD 2.50 million) and EUR 13.6 million (USD 14.76 million). Due to the size of the systems, these costs differ significantly. The number of inlets, the length of the network, the number of waste fractions collected, and the size of one vacuum waste collection system are adjusted according to the connected population.

- The average cost per meter of pipe was EUR 1,000-3,000, and the average cost per inlet was EUR 20,000-70,000 (USD 21,706-75,974). The average investment was EUR 2,400 (USD 2,604) per dwelling and EUR 835 (USD 906) per inhabitant.

- In August 2023, Envac invented a pneumatic waste collection system that moves the procedure underground and replaces manual waste collection from individual refuse chutes, dramatically reducing waste-related heavy traffic and carbon emissions. In China, a number of smart cities and hospitals have adopted this technology.

The Demand for Pneumatic Waste Management Systems for Hospitals is Increasing

- In terms of healthcare and food services, pneumatic waste systems are used to transport medical waste, food scraps, and other potentially hazardous materials. Promoting hygiene and safety contributes to the specific types of garbage managed through pneumatic systems.

- In October 2023, Envac France was responsible for installing pneumatic waste collection systems in the municipalities of Issy-le-Moulineaux and Romainville, as well as in the Batignolles district of Paris. This advanced technology significantly reduces the number of conventional waste truck collection routes, resulting in an 80% reduction in NO2 and CO2 emissions.

- In the municipalities of Issy le Quebec, which currently have two waste collection facilities in operation, Moulin and Romainville, as well as Batignolles, Envac joined forces with suppliers for sustainable urban development to install pneumatic waste management systems. In addition, a combination of over 1,500 beds is available in two operating units at Montpellier Hospital and Strasbourg Hospital.

- In total, the urban facilities in the Paris Belt cover the automated waste collection service of 11,000 households, which means that more than 36,000 inhabitants benefit from an innovative waste management service that, in addition to being convenient, contributes to improving the environment in cities.

Global Pneumatic Waste Management System Industry Overview

The pneumatic waste system market is consolidated and dominated by global players. The players are focusing on expanding their geographical presence to capture a major share of the market. Some of the key players in the market include Envac Group, Stream, MariMatic Oy, Aerbin ApS, and Logiwaste AB. They are continuously adopting strategies like mergers and acquisitions, strategic alliances, joint ventures, and partnerships to gain more market shares.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technology Advancements in the Market

- 4.3 Government Regulations and Initiatives in the Market

- 4.4 Spotlight on Transport Rates

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Impact on COVID-19 on the Market

5 Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Urbanization and Population

- 5.1.2 Government Regulations and Initiatives

- 5.1.3 Investments in Technology Advancements

- 5.2 Market Restraints

- 5.2.1 Public Awareness and Acceptance

- 5.2.2 Maintenance and Operational Costs

- 5.3 Market Opportunities

- 5.3.1 Market Expansions in Developing Regions

- 5.3.2 Adoption of Circular Economy Models

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By End User

- 6.1.1 Residential

- 6.1.2 Commercial (Offices)

- 6.1.3 Hospitals

- 6.1.4 Hospitality

- 6.1.5 Others

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.1.3 Mexico

- 6.2.2 Europe

- 6.2.2.1 Germany

- 6.2.2.2 France

- 6.2.2.3 Spain

- 6.2.2.4 Italy

- 6.2.2.5 Rest of Europe

- 6.2.3 Asia-Pacific

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.3.4 Australia

- 6.2.3.5 Singapore

- 6.2.3.6 Malaysia

- 6.2.3.7 Thailand

- 6.2.3.8 Rest of Asia-Pacific

- 6.2.4 Middle East and Africa

- 6.2.4.1 Saudi Arabia

- 6.2.4.2 Qatar

- 6.2.4.3 United Arab Emirates

- 6.2.4.4 Egypt

- 6.2.4.5 Rest of MENA

- 6.2.5 Latin America

- 6.2.5.1 Brazil

- 6.2.5.2 Argentina

- 6.2.5.3 Rest of Latin America

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Company Profiles

- 7.2.1 ENVAC

- 7.2.2 MARIMATIC OY

- 7.2.3 AWC BERHAD

- 7.2.4 Stream

- 7.2.5 ATREO

- 7.2.6 Ecosir Group OY

- 7.2.7 GreenWave Solutions

- 7.2.8 CAVERION Corporation

- 7.2.9 Air-Log International GmbH

- 7.2.10 LOGIWASTE AB

- 7.2.11 AERBIN APS

- 7.2.12 Peakway Environmental Sci & Tech Co. Ltd*

- 7.3 Other Companies