|

市场调查报告书

商品编码

1686582

杀菌剂:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Fungicide - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

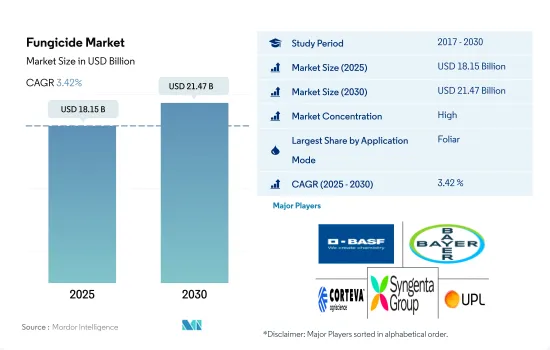

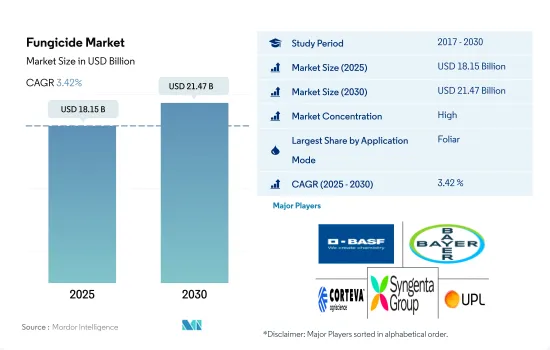

杀菌剂市场规模预计在 2025 年达到 181.5 亿美元,预计到 2030 年将达到 214.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.42%。

真菌疾病的增加推动了透过各种施用方法使用杀菌剂的需求。

- 根据具体要求和疾病,杀菌剂的使用方法多种多样。多样化的施用方法对于在各种农业条件下有效施用杀菌剂起着重要作用。

- 2022 年,叶面喷布在杀菌剂领域占据最大的市场占有率,为 60.1%。这种方法之所以受到人们的青睐,是因为它能够直接针对叶子上的病原体,从而有效地防治叶面真菌疾病。叶面喷布可促进杀菌剂快速渗透和吸收到植物组织中,确保有效对抗真菌病原体。

- 杀菌剂种子处理在植物生长早期对抗真菌感染方面发挥重要作用。这些处理方法在种子周围形成一层保护膜,有效地防止种子腐烂、猝倒病、涝渍病和根腐病等多种疾病。特别是杀菌剂种子处理剂将在2022年全球杀菌剂市场中占据14.1%的显着市场占有率。这表明杀菌剂在保护植物健康和促进作物生长方面做出了重大贡献。

- 施用方法的选择受多种因素影响,包括所针对的特定疾病、作物类型、疾病发展阶段以及设备的可用性。杀菌剂市场预计将扩大,在 2023-2029 年预测期内预计复合年增长率为 3.8%。这种增长反映了对抗植物疾病和提高农业生产力的策略的不断发展。

作物受真菌病原体侵染的日益严重导致了杀菌剂的使用量不断增加。

- 由于真菌疾病导致的作物损失不断增加以及对全球粮食安全的日益担忧,推动了杀菌剂等作物保护化学品的使用。在全球范围内,农民因真菌病害损失了 10% 至 23% 的作物。采用集约化农业实践、单一栽培以及干旱、热浪等不断变化的气候条件导致各种真菌疾病的增加,从而造成农业生产中杀菌剂的大量使用。 2022 年全球杀菌剂市场价值为 163.7 亿美元,消费量为 190 万吨,占全球作物保护化学品市场市场占有率的 18.1%。

- 南美洲占据杀菌剂市场占有率的30.3%,市价为49.6亿美元。市场占有率较高的原因是干旱和热浪对农作物的影响,引发真菌病害蔓延和作物损失,导致该地区杀菌剂的使用量增加。同年,巴西占了南美杀菌剂市场的59.4%,因为其主要作物水稻、小麦和大豆极易受到真菌病害的侵害。

- 2022年,欧洲杀菌剂市场价值占全球杀菌剂市场价值的28.4%。葡萄晚疫病、葡萄早疫病、白粉病、霜霉病、枯萎病、叶枯病和细菌性枯萎病是影响该地区主要作物的常见病害。西班牙、俄罗斯、法国和义大利是主要的杀菌剂消费国,分别占市场占有率的18.1%、15.0%、14.3%和12.5%。在欧洲,气温升高有利于各种真菌病原体的繁殖。

全球杀菌剂市场趋势

每年不断增加的经济损失迫使农民使用更多的杀菌剂。

- 真菌病害对作物生产构成重大威胁,影响多种作物,包括谷物、水果、蔬菜和观赏植物。杀菌剂年平均消费量将从2017年的每公顷1.4公斤增加到2022年的每公顷1.6公斤,这是由于需要有效管理和控制疾病、最大限度地减少作物损害并确保最佳产量。

- 在受调查的地区中,欧洲在2022年每公顷农业用地的化学杀菌剂年施用量最高,为2.5公斤/公顷。这是由于集约化耕作方法和单一栽培,注重高价值作物。集约农业通常涉及在同一块土地上将作物种植得太密集,从而吸引更多的病原体,消耗土壤养分并使植物更容易受到病原体的侵害。这导致大量使用化学杀菌剂来保护作物和维持产量。

- 继欧洲之后,南美洲的杀菌剂使用量位居第二,2022 年的平均施用率为每公顷 1.7 公斤。 2022 年,智利的杀菌剂使用量位居该地区之首,为每公顷 4.1 公斤。之所以使用率这么高,是因为智利某些地区的气候条件有利于真菌疾病的发生,因为湿度高、降雨量大、气温波动大。亚太地区、北美和中东等其他地区的杀菌剂使用量也较高。

- 根据联合国粮食及农业组织提供的资料,儘管广泛使用杀菌剂,真菌病害仍造成平均约2,200亿美元的经济损失。气候条件变化和疾病发生率增加等情况可能会加剧这种情况,甚至导致喷洒率增加。

Mancozeb的杀菌作用频谱比其他杀菌剂更广。

- Tebuconazole是一种三唑类杀菌剂。它被广泛用于防治各种作物的真菌病害。Tebuconazole透过抑制真菌细胞膜的重要组成部分麦角固醇的生物合成发挥作用。 2022 年的价格为 8,700 美元。

- Mancozeb是一种属于Dithiocarbamate盐类化学杀菌剂。它常用于防治马铃薯、番茄、葡萄、香蕉等作物的晚疫病、白粉病、早疫病、炭疽病等霉菌病害。代森锰锌比其他杀菌剂具有更广泛的活性频谱,可作用于真菌细胞内的多个部位,因此更有效。代森锰锌2022年的价格为7800美元。

- Azoxystrobin是一种甲氧基丙烯酸酯类杀菌剂,售价为每吨 4,600 美元。Azoxystrobin被广泛用于防治多种作物的真菌疾病。Azoxystrobin透过抑制真菌细胞的粒线体呼吸作用,抑制真菌的生长和繁殖,最终导致真菌死亡。

- Metalaxyl广泛用于防治晚疫病、霜霉病和根腐病等真菌病害,价格为每吨 4,400 美元。Metalaxyl透过抑制真菌细胞中 RNA 的形成发挥作用。这种抑制会阻止必需蛋白质的合成并抑制真菌的生长和繁殖。

- 丙森锌和福美锌属于Dithiocarbamate。 2022 年的价格分别为每吨 3,500 美元和 3,300 美元。过去一段时间价格略有上涨,是由于这些产品的需求不断增长,以及生产所用原材料成本上升。

杀菌剂产业概况

杀菌剂市场格局较为集中,前五大企业占81.72%的市占率。市场的主要企业是BASF公司、拜耳公司、科迪华农业科技、先正达集团和联合磷化有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告发布

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷农药消费量

- 活性成分价格分析

- 法律规范

- 阿根廷

- 澳洲

- 巴西

- 加拿大

- 智利

- 中国

- 法国

- 德国

- 印度

- 印尼

- 义大利

- 日本

- 墨西哥

- 缅甸

- 荷兰

- 巴基斯坦

- 菲律宾

- 俄罗斯

- 南非

- 西班牙

- 泰国

- 乌克兰

- 英国

- 美国

- 越南

- 价值炼和通路分析

第五章市场区隔

- 按应用

- 化学灌溉

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 按作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 按地区

- 非洲

- 按国家

- 南非

- 其他非洲国家

- 亚太地区

- 按国家

- 澳洲

- 中国

- 印度

- 印尼

- 日本

- 缅甸

- 巴基斯坦

- 菲律宾

- 泰国

- 越南

- 其他亚太地区

- 欧洲

- 按国家

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 其他欧洲国家

- 北美洲

- 按国家

- 加拿大

- 墨西哥

- 美国

- 北美其他地区

- 南美洲

- 按国家

- 阿根廷

- 巴西

- 智利

- 其他南美国家

- 非洲

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Jiangsu Yangnong Chemical Co. Ltd

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- UPL Limited

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 52906

The Fungicide Market size is estimated at 18.15 billion USD in 2025, and is expected to reach 21.47 billion USD by 2030, growing at a CAGR of 3.42% during the forecast period (2025-2030).

Rising fungal diseases are driving the demand for fungicides in various application methods

- Fungicides may be applied using a variety of methods, depending on the specific requirements and diseases. Diverse application methods play a crucial role in effectively applying fungicides across various agricultural conditions.

- In 2022, foliar application dominated the fungicide segment, holding the largest market share of 60.1%. This method is highly preferred as it provides efficient protection against foliar fungal diseases by directly targeting the pathogens on the leaves. The foliar application facilitates swift penetration and absorption of fungicides into the plant tissues, ensuring their effective action against fungal pathogens.

- Fungicide seed treatments play a crucial role in addressing fungal infections during the initial phases of plant growth. These treatments create a protective shield around seeds, effectively preventing various diseases like seed rots, seedling blights, damping off, and root rots. Notably, within the global fungicide market, fungicide seed treatments accounted for a significant market share of 14.1% in 2022. This highlights their substantial contribution to safeguarding plant health and promoting successful crop establishment.

- The selection of the application mode is influenced by multiple factors, encompassing the particular disease being targeted, the type of crop, the stage of disease development, and the availability of equipment. The fungicide market is anticipated to expand, projecting an estimated CAGR of 3.8% during the forecast period spanning from 2023 to 2029. This growth reflects the ongoing evolution of strategies to combat plant diseases and enhance agricultural productivity.

Growth in the crop infestations by the fungal pathogens raise the fungicides adoption

- Increasing crop losses due to fungal diseases and growing concerns over global food security raise the adoption of crop protection chemicals like fungicides. At the Global level, the farmers are losing 10-23% of their crops to fungal diseases. Adoption of intensive agricultural practices, monocultural practices, and changing climatic conditions like drought and heatwaves lead to the growth of various fungal diseases, which resulted in higher utilization of fungicides in agricultural production. The Global fungicide market accounted for 18.1% market share in the overall Global crop protection chemical market value with USD 16.37 billion in 2022 with a consumption volume of 1.9 million metric tons.

- South American fungicide market value accounted for 30.3%, with a market value of USD 4.96 billion. The higher market share is attributed to the drought and heatwave effect on the crops, which led to the proliferation of fungal diseases and crop losses, resulting in higher utilization of fungicides in the region. In the same year, Brazil accounted for 59.4% of the South American fungicide market, with rice, wheat, and soybeans being the major crops grown and are highly susceptible to fungal diseases.

- Europe's fungicide market value accounted for 28.4% of the Global fungicide market value in 2022. Grape late blight, early blight, powdery mildew, downy mildew, Fusarium wilting, Septoria, and bacterial blight are the common diseases attacking the major crops grown in the region. Spain, Russia, France, and Italy are the major fungicide-consuming countries with a market value share of 18.1%, 15.0%, 14.3%, and 12.5%, respectively. In Europe, temperature increases favor the various fungal pathogens' growth.

Global Fungicide Market Trends

Increasing average annual economic losses are driving farmers to use a higher amount of fungicides

- Fungal diseases pose a significant threat to crop production, affecting a wide range of crops, including cereals, fruits, vegetables, and ornamentals. The rise in the average per-hectare fungicide consumption over the years from 1.4 kg per ha in 2017 to 1.6 kg per ha in 2022 was driven by the need to manage and control diseases effectively, minimizing crop damage and ensuring optimum yields.

- Among the regions studied, in 2022, Europe had the highest per-hectare application of chemical fungicides annually, with 2.5 kg per ha of agricultural land. This was due to its intensified farming practices and monocultures with a focus on high-value crops. Intensive farming usually attracts more pathogens due to overcrowding of crops on a piece of land, depleting soil nutrients and making the plants more susceptible to pathogens. This leads to the overuse of chemical fungicides to protect crops and maintain crop yields.

- Europe is followed by South America in fungicide usage, with an average per-hectare application of 1.7 kg/ha in 2022. Chile had the highest per-hectare consumption of fungicides at 4.1 kg/ha in the region in 2022. This high usage was due to certain regions in Chile having climatic conditions that are conducive to fungal disease development due to high humidity, rainfall, and temperature fluctuations. Other regions like Asia-Pacific, North America, and the Middle East also have a significant amount of fungicidal application.

- According to the data provided by the Food and Agriculture Organization, fungal diseases cause an average economic loss of around USD 220.0 billion despite abundant usage of fungicides. Circumstances like changing climatic conditions and frequent disease outbreaks may even worsen the situation, increasing the application rates.

Mancozeb has a broad spectrum of activity compared to other fungicides

- Tebuconazole is a fungicide belonging to the chemical class of triazoles. It is widely used to control fungal diseases in various crops. Tebuconazole works by inhibiting the biosynthesis of ergosterol, a critical component of fungal cell membranes. This was priced at USD 8.7 thousand in 2022.

- Mancozeb is a fungicide belonging to the chemical class of dithiocarbamates. It is commonly used to control fungal diseases like late blight, downy mildew, early blight, and anthracnose in crops like potatoes, tomatoes, grapes, and bananas. Mancozeb has a broad spectrum of activity compared to other fungicides and acts on multiple sites within the fungal cell, making it more effective. Mancozeb was priced at USD 7.8 thousand in 2022.

- Azoxystrobin is a fungicide belonging to the chemical class of strobilurins and was priced at USD 4.6 thousand per metric ton. It is widely used to control fungal diseases in various crops. Azoxystrobin works by inhibiting the mitochondrial respiration in fungal cells, resulting in their inability to grow and reproduce and eventually causing their death.

- Metalaxyl is widely used to control fungal diseases such as late blight, downy mildew, and root rot and was priced at USD 4.4 thousand per metric ton. Metalaxyl works by inhibiting the formation of RNA in fungal cells. This disruption prevents the synthesis of essential proteins, leading to the inhibition of fungal growth and reproduction.

- Propineb and Ziram belong to the chemical class of dithiocarbamates. They were priced at USD 3.5 thousand and 3.3 thousand per metric ton, respectively, in 2022. These slight increases in the prices during the historical period were due to the growing demand for these products and the escalating costs of raw materials used in their production.

Fungicide Industry Overview

The Fungicide Market is fairly consolidated, with the top five companies occupying 81.72%. The major players in this market are BASF SE, Bayer AG, Corteva Agriscience, Syngenta Group and UPL Limited (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 Argentina

- 4.3.2 Australia

- 4.3.3 Brazil

- 4.3.4 Canada

- 4.3.5 Chile

- 4.3.6 China

- 4.3.7 France

- 4.3.8 Germany

- 4.3.9 India

- 4.3.10 Indonesia

- 4.3.11 Italy

- 4.3.12 Japan

- 4.3.13 Mexico

- 4.3.14 Myanmar

- 4.3.15 Netherlands

- 4.3.16 Pakistan

- 4.3.17 Philippines

- 4.3.18 Russia

- 4.3.19 South Africa

- 4.3.20 Spain

- 4.3.21 Thailand

- 4.3.22 Ukraine

- 4.3.23 United Kingdom

- 4.3.24 United States

- 4.3.25 Vietnam

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Application Mode

- 5.1.1 Chemigation

- 5.1.2 Foliar

- 5.1.3 Fumigation

- 5.1.4 Seed Treatment

- 5.1.5 Soil Treatment

- 5.2 Crop Type

- 5.2.1 Commercial Crops

- 5.2.2 Fruits & Vegetables

- 5.2.3 Grains & Cereals

- 5.2.4 Pulses & Oilseeds

- 5.2.5 Turf & Ornamental

- 5.3 Region

- 5.3.1 Africa

- 5.3.1.1 By Country

- 5.3.1.1.1 South Africa

- 5.3.1.1.2 Rest of Africa

- 5.3.2 Asia-Pacific

- 5.3.2.1 By Country

- 5.3.2.1.1 Australia

- 5.3.2.1.2 China

- 5.3.2.1.3 India

- 5.3.2.1.4 Indonesia

- 5.3.2.1.5 Japan

- 5.3.2.1.6 Myanmar

- 5.3.2.1.7 Pakistan

- 5.3.2.1.8 Philippines

- 5.3.2.1.9 Thailand

- 5.3.2.1.10 Vietnam

- 5.3.2.1.11 Rest of Asia-Pacific

- 5.3.3 Europe

- 5.3.3.1 By Country

- 5.3.3.1.1 France

- 5.3.3.1.2 Germany

- 5.3.3.1.3 Italy

- 5.3.3.1.4 Netherlands

- 5.3.3.1.5 Russia

- 5.3.3.1.6 Spain

- 5.3.3.1.7 Ukraine

- 5.3.3.1.8 United Kingdom

- 5.3.3.1.9 Rest of Europe

- 5.3.4 North America

- 5.3.4.1 By Country

- 5.3.4.1.1 Canada

- 5.3.4.1.2 Mexico

- 5.3.4.1.3 United States

- 5.3.4.1.4 Rest of North America

- 5.3.5 South America

- 5.3.5.1 By Country

- 5.3.5.1.1 Argentina

- 5.3.5.1.2 Brazil

- 5.3.5.1.3 Chile

- 5.3.5.1.4 Rest of South America

- 5.3.1 Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Jiangsu Yangnong Chemical Co. Ltd

- 6.4.7 Nufarm Ltd

- 6.4.8 Sumitomo Chemical Co. Ltd

- 6.4.9 Syngenta Group

- 6.4.10 UPL Limited

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219