|

市场调查报告书

商品编码

1687074

中国工程塑胶:市场占有率分析、产业趋势与统计、成长预测(2024-2029)China Engineering Plastics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2024 - 2029) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

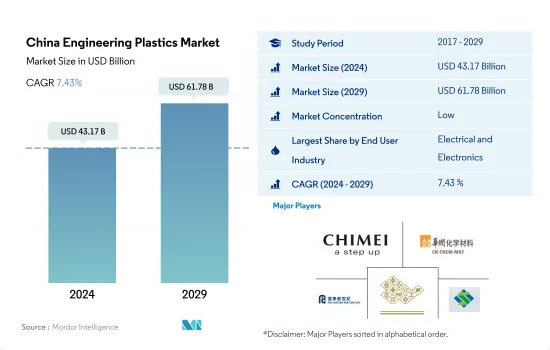

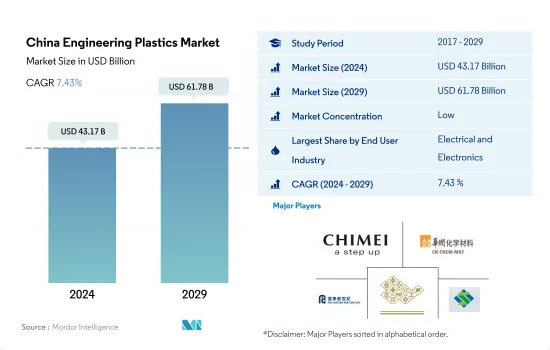

预计 2024 年中国工程塑胶市场规模将达到 431.7 亿美元,预计到 2029 年将达到 617.8 亿美元,预测期内(2024-2029 年)的复合年增长率为 7.43%。

包装体积份额流失至电气和电子产业

- 工程塑胶的应用范围包括航太工业的内墙板和门以及硬质和软质包装。亚太工程塑胶市场受包装、电气电子和汽车产业推动。 2022年工程塑胶市场体积构成比:包装电气电子产业约占39.65%,电子产业约占35.86%。

- 2020年,受全球供应链中断影响,中国工程塑胶消费量较去年与前一年同期比较下降2.88%。然而,消费量在 2021 年有所恢復,并在 2022 年继续稳步增长,数量增长了 2.35%。

- 由于大量生产用于包装饮料、饮用水、个人护理及家居护理产品的塑胶瓶,包装行业是全国最大的工程塑胶消费产业。中国是全球最大的电子商务市场,占全球近50%的市场。预计到 2027 年,该国的电子商务市场销售额将达到约 2.3 兆美元,高于 2023 年的 1.4 兆美元。预计树脂消费量将在 2022 年达到 709 万吨,到 2029 年将达到 960 万吨。所有这些因素都有望推动产业消费,预计在预测期内,产业以金额为准的复合年增长率将达到 6.47%。

- 汽车产业是中国工程塑胶市场成长最快的终端用户产业,预计预测期内以金额为准复合年增长率为 9.40%。这与轻质工程塑胶复合材料(如聚碳酸酯、聚酰胺和氟塑胶)在汽车零件中的应用需求日益增长相吻合,这些复合材料具有耐高温、化学惰性、耐磨、不浸出等优点,可确保性能稳定。

中国工程塑胶市场趋势

中国仍为全球电子製造中心

- 2020年至2021年,中国电气电子产业收益将成长14.5%。其中,1-4月电讯设备製造商产量年增8.6%,行动电话製造商与前一年同期比较10.9%。电脑製造商产量与前一年同期比较增3.9%。

- 受新冠疫情影响,2020年笔记型电脑和平板电脑产量分别下降31.1%和24.5%。

- 然而,在同一时期,由于对电子产品和游戏的需求不断增长,对电气和电子产品的需求也随之增加。 2021年,我国电子製造业利润总额达8,283亿元,与前一年同期比较增38.9%,创历史最高增速。产业利润在经历2018年的下滑之后,2019年至2021年快速成长。

- 中国国防工业电子设备国产化率达85%,国防和高技术设备中关键电子元件国产化率由30%提高到85%。中国仍然是全球消费性电子产品重要製造地,吸引全球主要电子製造商建立製造地和研发中心。这些发展推动了 2022 年的电子产品产量,使该国成为全球产量第一。预计这些因素将在预测期内促进电气和电子行业的生产。

中国工程塑胶产业概况

中国工程塑胶市场较为分散,前五大企业市占率合计为31.57%。市场的主要企业为:奇美电子、华润(集团)、远东新世纪股份有限公司、台塑集团和新丰集团(按字母顺序排列)。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章执行摘要和主要发现

第二章 报告要约

第 3 章 简介

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 最终用户趋势

- 航太

- 车

- 建筑和施工

- 电气和电子

- 包装

- 进出口趋势

- 价格趋势

- 回收概述

- 聚酰胺 (PA) 回收趋势

- 聚碳酸酯 (PC) 回收趋势

- 聚对苯二甲酸乙二醇酯 (PET) 的回收趋势

- 苯乙烯共聚物(ABS、SAN)的回收趋势

- 法律规范

- 中国

- 价值链与通路分析

第五章 市场区隔

- 最终用户产业

- 航太

- 车

- 建筑和施工

- 电气和电子

- 工业/机械

- 包装

- 其他最终用户产业

- 树脂类型

- 氟树脂

- 依亚型

- 乙烯-四氟乙烯(ETFE)

- 氟化乙丙烯 (FEP)

- 聚四氟乙烯(PTFE)

- 聚氟乙烯 (PVF)

- 聚二氟亚乙烯(PVDF)

- 其他子树脂类型

- 液晶聚合物(LCP)

- 聚酰胺(PA)

- 副树脂类型

- 芳香聚酰胺

- 聚酰胺(PA)6

- 聚酰胺(PA)66

- 聚邻苯二甲酰胺

- 聚丁烯对苯二甲酸酯(PBT)

- 聚碳酸酯(PC)

- 聚醚醚酮 (PEEK)

- 聚对苯二甲酸乙二醇酯(PET)

- 聚酰亚胺(PI)

- 聚甲基丙烯酸甲酯 (PMMA)

- 聚甲醛(POM)

- 苯乙烯共聚物(ABS 和 SAN)

- 氟树脂

第六章 竞争格局

- 主要策略趋势

- 市场占有率分析

- 业务状况

- 公司简介.

- Chang Chun Group

- CHIMEI

- China Petroleum & Chemical Corporation

- China Resources(Holdings)Co.,Ltd.

- Covestro AG

- Dongyue Group

- Far Eastern New Century Corporation

- Formosa Plastics Group

- Henan Energy Group Co., Ltd.

- Highsun Holding Group

- Jilin Joinature Polymer Co., Ltd.

- PetroChina Company Limited

- Sanfame Group

- Shenzhen Wote Advanced Materials Co.,Ltd.

- Zhejiang Hengyi Group Co., Ltd.

第七章:执行长的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架(产业吸引力分析)

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源和进一步阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 54601

The China Engineering Plastics Market size is estimated at 43.17 billion USD in 2024, and is expected to reach 61.78 billion USD by 2029, growing at a CAGR of 7.43% during the forecast period (2024-2029).

Packaging to lose its market share by volume to the electrical and electronics industry

- Engineering plastics have applications ranging from interior wall panels and doors in the aerospace industry to rigid and flexible packaging. The Asia-Pacific engineering plastics market is led by the packaging, electrical and electronics, and automotive industries. The packaging electrical and electronics industries accounted for around 39.65% and 35.86%, respectively, of the engineering plastics market by volume in 2022.

- In 2020, China's engineering plastics consumption fell by 2.88% by volume over the previous year due to disruptions in the global supply chain. However, consumption recovered in 2021 and continued to grow steadily, increasing by 2.35% in volume in 2022.

- The packaging industry consumes the highest amounts of engineering plastics in the country due to the large-scale production of plastic bottles used in the packaging of beverages, drinking water, personal care, and household care products, among others. China is the largest e-commerce market globally, with its share amounting to almost 50%. The country's e-commerce market is projected to reach a revenue of around USD 2.3 trillion in 2027 from USD 1.4 trillion in 2023. In 2022, the industry consumed 7.09 million tons of resin, which is expected to reach 9.6 million tons by 2029. All these factors boost the industry's consumption, which is expected to record a CAGR of 6.47%, by value, during the forecast period.

- Automotive is the fastest-growing end-user industry of the Chinese engineering plastics market, expected to record a CAGR of 9.40% by revenue during the forecast period. This is in line with the industry's increasing demand for lightweight engineering plastic composites, such as polycarbonate, polyamide, and fluoropolymer, for use in vehicle components due to their benefits such as high-temperature use, chemical inertness, resistance to abrasion, and non-leaching capabilities that ensure consistent performance.

China Engineering Plastics Market Trends

China to remain a global electronics manufacturing hub

- China witnessed a 14.5% increase in the revenue of its electrical and electronics industry from 2020 to 2021. Of these, the output of telecom equipment manufacturers registered a Y-o-Y gain of 8.6% in the first four months, while mobile phone output shrank by 10.9% from the previous year. The output of computer manufacturers registered a 3.9% growth in 2020 from the previous year.

- The output of laptops and tablet computers dropped by 31.1% and 24.5%, respectively, in 2020 due to the COVID-19 pandemic-related disruptions.

- However, during the same period, the demand for electrical and electronic products increased owing to the rising demand for electronics and gaming. In 2021, the total profit of Chinese electronic manufacturing enterprises grew by 38.9% over the previous year, reaching CNY 828.3 billion, recording the highest growth rate in the given period. After experiencing a decrease in 2018, the industry's profits rose quickly from 2019 to 2021.

- China domestically manufactures 85% of the electronics used in its defense industry, and the ratio of domestically manufactured essential electronic parts in defense and high-tech equipment rose from 30% to 85%. China remains an important global manufacturing base for consumer electronics, attracting the world's major electronic producers to establish manufacturing bases and research and development centers. Such developments boosted electronics production in 2022, ranking the country first in terms of global production. Such factors are expected to drive production in the electrical and electronics industry during the forecast period.

China Engineering Plastics Industry Overview

The China Engineering Plastics Market is fragmented, with the top five companies occupying 31.57%. The major players in this market are CHIMEI, China Resources (Holdings) Co.,Ltd., Far Eastern New Century Corporation, Formosa Plastics Group and Sanfame Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 End User Trends

- 4.1.1 Aerospace

- 4.1.2 Automotive

- 4.1.3 Building and Construction

- 4.1.4 Electrical and Electronics

- 4.1.5 Packaging

- 4.2 Import And Export Trends

- 4.3 Price Trends

- 4.4 Recycling Overview

- 4.4.1 Polyamide (PA) Recycling Trends

- 4.4.2 Polycarbonate (PC) Recycling Trends

- 4.4.3 Polyethylene Terephthalate (PET) Recycling Trends

- 4.4.4 Styrene Copolymers (ABS and SAN) Recycling Trends

- 4.5 Regulatory Framework

- 4.5.1 China

- 4.6 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2029 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Aerospace

- 5.1.2 Automotive

- 5.1.3 Building and Construction

- 5.1.4 Electrical and Electronics

- 5.1.5 Industrial and Machinery

- 5.1.6 Packaging

- 5.1.7 Other End-user Industries

- 5.2 Resin Type

- 5.2.1 Fluoropolymer

- 5.2.1.1 By Sub Resin Type

- 5.2.1.1.1 Ethylenetetrafluoroethylene (ETFE)

- 5.2.1.1.2 Fluorinated Ethylene-propylene (FEP)

- 5.2.1.1.3 Polytetrafluoroethylene (PTFE)

- 5.2.1.1.4 Polyvinylfluoride (PVF)

- 5.2.1.1.5 Polyvinylidene Fluoride (PVDF)

- 5.2.1.1.6 Other Sub Resin Types

- 5.2.2 Liquid Crystal Polymer (LCP)

- 5.2.3 Polyamide (PA)

- 5.2.3.1 By Sub Resin Type

- 5.2.3.1.1 Aramid

- 5.2.3.1.2 Polyamide (PA) 6

- 5.2.3.1.3 Polyamide (PA) 66

- 5.2.3.1.4 Polyphthalamide

- 5.2.4 Polybutylene Terephthalate (PBT)

- 5.2.5 Polycarbonate (PC)

- 5.2.6 Polyether Ether Ketone (PEEK)

- 5.2.7 Polyethylene Terephthalate (PET)

- 5.2.8 Polyimide (PI)

- 5.2.9 Polymethyl Methacrylate (PMMA)

- 5.2.10 Polyoxymethylene (POM)

- 5.2.11 Styrene Copolymers (ABS and SAN)

- 5.2.1 Fluoropolymer

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Chang Chun Group

- 6.4.2 CHIMEI

- 6.4.3 China Petroleum & Chemical Corporation

- 6.4.4 China Resources (Holdings) Co.,Ltd.

- 6.4.5 Covestro AG

- 6.4.6 Dongyue Group

- 6.4.7 Far Eastern New Century Corporation

- 6.4.8 Formosa Plastics Group

- 6.4.9 Henan Energy Group Co., Ltd.

- 6.4.10 Highsun Holding Group

- 6.4.11 Jilin Joinature Polymer Co., Ltd.

- 6.4.12 PetroChina Company Limited

- 6.4.13 Sanfame Group

- 6.4.14 Shenzhen Wote Advanced Materials Co.,Ltd.

- 6.4.15 Zhejiang Hengyi Group Co., Ltd.

7 KEY STRATEGIC QUESTIONS FOR ENGINEERING PLASTICS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework (Industry Attractiveness Analysis)

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219