|

市场调查报告书

商品编码

1687134

泰国化肥:市场占有率分析、产业趋势与成长预测(2025-2030年)Thailand Fertilizers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

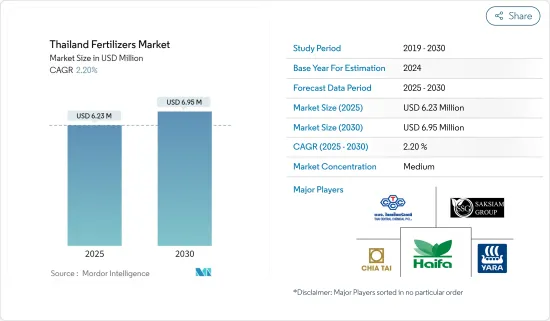

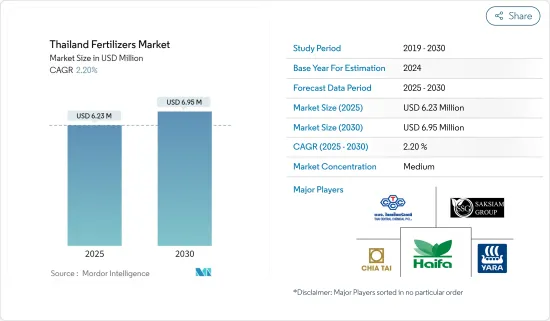

泰国肥料市场规模预计在 2025 年为 623 万美元,预计在 2030 年达到 695 万美元,预测期内(2025-2030 年)的复合年增长率为 2.2%。

由于提高农业生产力以满足日益增长的粮食需求的需求不断增加,泰国的化肥市场正在扩大。玉米、甘蔗和水稻等主要作物需要大量的养分投入,从而推动了化肥需求。氮肥在泰国市场占据主导地位,主要原因是土壤缺氮且水稻种植盛行。尿素是最常用的肥料。儘管有机种植面积增加,但由于生物肥料和有机肥料面临的挑战,农民仍然更喜欢使用合成肥料和化学肥料。

政府透过化肥补贴和软贷款提供的支持对市场动态产生了重大影响。 2024年,新的化肥补贴计划将取代现有的农民津贴计划,提供每莱(最多20莱或3.2公顷)29.7美元的现金援助。上年度,政府为该计画拨款 17 亿美元。预计扩大支持将在未来几年促进化肥消费并提高农业生产力。

泰式肥料市场趋势

需要提高农业生产力

近年来,儘管泰国的耕地面积保持稳定,但农业生产力却有所下降。根据粮农组织统计资料,豆类产量将从 2021 年的每公顷 953.2 公斤下降到 2022 年的每公顷 952.4 公斤。农业产量的下降可能会导致各种农产品和技术(包括化学肥料)的使用增加。

泰国东北部地区是泰国农业用地持有量最大的地区。该地区面临多项农业挑战,包括土壤品质不佳、季节性降雨波动以及地表水稀缺。这些因素使得施肥对于该地区实现更高的生产力至关重要。

为了促进国内农业生产,泰国政府透过提供农业投入补贴来支持农民。例如,政府以化肥补贴的形式为泰国农民提供了新的奖励策略。这是透过国家福利智慧卡实施的,补贴直接支付给持卡人。这些政府措施加上提高农业产量的努力预计将在预测期内推动泰国的化肥需求。

氮肥需求增加

由于可耕地面积减少以及农产品出口在经济中的重要性日益增加,化肥的使用对于泰国的农业部门至关重要。

泰国的土壤缺氮,主要是因为大规模种植水稻。因此,氮肥,尤其是尿素是最常用的。硫酸铵(AS)是泰国继尿素之后使用最广泛的氮肥。 AS 为植物提供必需的氮 (N) 和硫 (S) 营养,具有农业和环境优势,包括与其他氮肥相比毒性较低(NH3 水溶液)且因 NH3 挥发造成的氮损失较少。

氮肥广泛应用于泰国的主要作物,包括玉米、木薯和甘蔗。由于用途广泛,尿素仍是进口量最大的肥料。正大在单一肥料尿素市场占有重要地位,并受益于俄罗斯的高品质尿素供应。根据国际肥料协会(IFA)的数据,2022年泰国的尿素消费量将达到926,000吨。由于对促进更快生长和更高产量的肥料的需求不断增长,预计该国对氮肥的需求在预测期内将会增加。

泰国肥料产业概况

泰国化肥市场较为集中,参与企业包括雅苒(泰国)有限公司、海法集团、Chai Thai、泰国中央化工公共有限公司及Saksiam集团。併购、合作、业务扩张和新产品推出是这些积极的市场参与企业采用的一些最常见的商业策略。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概览

- 市场驱动因素

- 政府措施和支持

- 农业生产力下降和区域问题

- 食品需求不断成长

- 市场限制

- 气候变迁与自然灾害

- 向有机农业的转变

- 波特五力分析

- 买家的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章市场区隔

- 产品

- 氮肥

- 尿素

- 硝酸铵钙(CAN)

- 硝酸铵

- 硫酸铵

- 无水氨

- 其他氮肥

- 磷肥

- 磷酸一铵(MAP)

- 磷酸二铵(DAP)

- 重过磷酸钙(TSP)

- 其他磷肥

- 钾肥

- 微量元素肥料

- 其他的

- 氮肥

- 应用

- 谷物和谷类

- 豆类和油籽

- 经济作物

- 水果和蔬菜

- 其他的

第六章 竞争格局

- 最受欢迎的策略

- 市场占有率分析

- 公司简介

- Yara International ASA

- NFC Public Company Limited

- Chai Thai Co. Ltd

- Thai Central Chemical Public Company Limited

- Haifa Group

- SAKSIAM GROUP

- ICL Group Ltd

- Rayong Fertilizer Trading Company Limited(UBE Group)

- Grupa Azoty SA(Compo Expert)

- ICP FERTILIZER COMPANY

第七章 市场机会与未来趋势

The Thailand Fertilizers Market size is estimated at USD 6.23 million in 2025, and is expected to reach USD 6.95 million by 2030, at a CAGR of 2.2% during the forecast period (2025-2030).

The Thailand fertilizer market is growing due to the growing need to improve agricultural productivity to meet the growing food demand. Major crops such as corn, maize, sugarcane, and rice require substantial nutrient inputs, driving fertilizer demand. Nitrogenous fertilizers dominate the Thai market, primarily due to nitrogen-deficient soils and widespread rice cultivation. Urea is the most commonly used fertilizer. Despite an expanding area under organic cultivation, farmers prefer synthetic or chemical fertilizers due to challenges associated with biofertilizers and organic alternatives.

Government support through fertilizer subsidies and soft loans has significantly influenced market dynamics. In 2024, a new fertilizer subsidy scheme replaced the previous farmers' allowance program, which provided cash support of USD 29.7 per rai (up to 20 rai or 3.2 hectares). The government allocated USD 1.7 billion to this program in the previous year. This increased support is expected to drive fertilizer consumption and enhance farm productivity in the coming years.

Thailand Fertilizers Market Trends

Need for Increasing Agricultural Productivity

Thailand's agricultural productivity has declined in recent years, despite stable agricultural land area. FAOSTAT data indicates a decrease in pulses yield from 953.2 kg/ha in 2021 to 952.4 kg/ha in 2022. This reduction in agricultural yield is likely to increase the adoption of various agricultural products and technologies, including fertilizers.

The Northeastern region of Thailand has the largest number of farm holdings. This area faces several agricultural challenges, including poor-quality soil, seasonal rainfall variability, and scarcity of surface water. These factors have made fertilizer application essential for achieving higher productivity gains in the region.

The Thai government has supported farmers by providing subsidies on farm inputs to boost agricultural production in the country. For example, the government introduced new stimulus measures for Thai farmers in the form of subsidized fertilizers. This measure was implemented through the state welfare smartcard, providing the subsidy directly to cardholders. These government initiatives, combined with efforts to increase agricultural production, are expected to drive the demand for fertilizers in Thailand during the forecast period.

Growing Demand for Nitrogenous Fertilizers

Fertilizer usage is essential for Thailand's agricultural sector, driven by decreasing arable land and the increasing significance of agricultural exports to the economy.

Thailand's soil is predominantly nitrogen-deficient, largely due to extensive rice cultivation. As a result, nitrogenous fertilizers, particularly urea, are the most commonly used. Ammonium sulfate (AS) ranks as the second most widely used nitrogenous fertilizer in Thailand after urea. AS provides essential nitrogen (N) and sulfur (S) nutrients for plants, offering agronomic and environmental advantages such as reduced toxicity (aqueous NH3) and decreased N loss through NH3 volatilization compared to other N fertilizers.

Nitrogen fertilizers are extensively applied to major crops in Thailand, including corn, cassava, and sugarcane. Urea remains the most imported fertilizer due to its widespread use. Chia Tai has a strong presence in the single-nutrient urea market, benefiting from access to high-quality urea from Russia. According to the International Fertilizer Association (IFA), urea consumption in Thailand reached 926 thousand metric tons in 2022. The demand for nitrogen fertilizers in the country is projected to increase during the forecast period due to increasing the need for fertilizers that promote faster growth and higher yields.

Thailand Fertilizers Industry Overview

Thailand Fertilizer market is consolidated, with players such as Yara (Thailand) Company Limited, Haifa, Chai Thai Co. Ltd, Thai Central Chemical Public Company Limited, and Saksiam Group. being some of the active players in the market. Mergers and acquisitions, partnerships, expansion, and product launches are some of the most adopted business strategies by these active players.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Government Initiatives and Support

- 4.2.2 Declining Agricultural Productivity and Regional Challenges

- 4.2.3 Rising Food Demand

- 4.3 Market Restraints

- 4.3.1 Climate Change and Natural Disasters

- 4.3.2 Shift Towards Organic Farming

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Buyers

- 4.4.2 Bargaining Power of Suppliers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product

- 5.1.1 Nitrogenous Fertilizers

- 5.1.1.1 Urea

- 5.1.1.2 Calcium Ammonium Nitrate (CAN)

- 5.1.1.3 Ammonium Nitrate

- 5.1.1.4 Ammonium Sulfate

- 5.1.1.5 Anhydrous Ammonia

- 5.1.1.6 Other Nitrogenous Fertilizers

- 5.1.2 Phosphatic Fertilizers

- 5.1.2.1 Mono-Ammonium Phosphate (MAP)

- 5.1.2.2 Di-Ammonium Phosphate (DAP)

- 5.1.2.3 Triple Superphosphate (TSP)

- 5.1.2.4 Other Phosphatic Fertilizers

- 5.1.3 Potash Fertilizers

- 5.1.4 Micronutrient Fertilizers

- 5.1.5 Other Products

- 5.1.1 Nitrogenous Fertilizers

- 5.2 Application

- 5.2.1 Grains and Cereals

- 5.2.2 Pulses and Oilseeds

- 5.2.3 Commerical Crops

- 5.2.4 Fruits and Vegetables

- 5.2.5 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Share Analysis

- 6.3 Company Profiles

- 6.3.1 Yara International ASA

- 6.3.2 NFC Public Company Limited

- 6.3.3 Chai Thai Co. Ltd

- 6.3.4 Thai Central Chemical Public Company Limited

- 6.3.5 Haifa Group

- 6.3.6 SAKSIAM GROUP

- 6.3.7 ICL Group Ltd

- 6.3.8 Rayong Fertilizer Trading Company Limited (UBE Group)

- 6.3.9 Grupa Azoty S.A. (Compo Expert)

- 6.3.10 ICP FERTILIZER COMPANY