|

市场调查报告书

商品编码

1687186

欧洲作物保护化学品-市场占有率分析、产业趋势与统计、成长预测(2025-2030)Europe Crop Protection Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

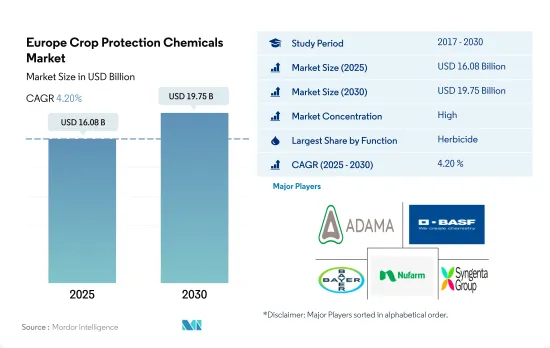

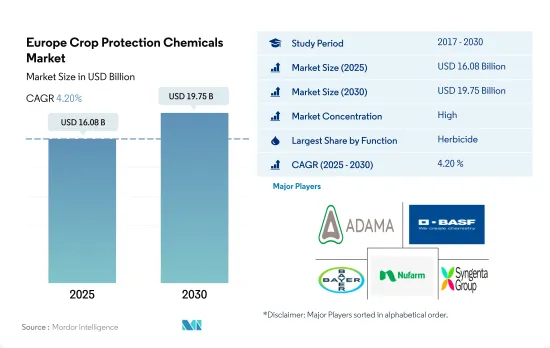

欧洲作物保护化学品市场规模预计在 2025 年达到 160.8 亿美元,预计到 2030 年将达到 197.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.20%。

由于害虫防治用途的增加,除草剂和杀菌剂占据了市场主导地位

- 欧洲农业种类繁多,在许多国家的经济中扮演重要角色。该地区气候多样,以种植小麦、大麦、大豆以及各种水果和蔬菜而闻名。 2022年,欧洲的以金额为准份额为15.7%。

- 该地区不断增长的人口促使人们在农业中使用作物保护化学品,以获得更好的产量并满足日益增长的作物需求。同时,技术进步改变了农业实践,使害虫防治过程变得更加容易。

- 以以金额为准计算,2022 年除草剂占比最大,为 34.7%。杂草对作物、作物和园艺作物的侵袭给该地区的农业生产力带来了重大挑战。水果产业对该地区的经济成长贡献巨大,因此杂草会破坏水果,造成严重的经济损失。反枝苋(红根藜)、稗草(稗草)、加拿大蓬草、马唐(马唐)和莎草(紫边)是该地区最常见的杂草。因此,除草剂的使用量增加,以对抗这些杂草的侵袭并维持农业生产力。

- 杀菌剂的份额位居第二,为 32.7%。作为主要的谷物和豆类产区之一,该地区极易受到真菌疾病的侵害,但可以透过使用杀菌剂来缓解。

- 人们对粮食安全的日益关注以及各种发展促使农民更有效率、更永续地生产粮食,同时尽量减少害虫对作物的影响。这推动了市场的发展,预计在预测期内复合年增长率将达到 4.0%。

主要作物杂草滋生加剧,导致德国占据市场主导地位

- 欧洲农民种植作物作物,包括谷物(如小麦、大麦、燕麦)、油籽(如油菜籽、向日葵)、水果、蔬菜和多种经济作物。地中海地区以橄榄和柑橘生产而闻名,而北欧国家则专注于谷物和根茎类作物生产。

- 其中,德国占据市场主导地位,2022 年的份额为 21.6%。 2022 年杀虫剂总使用量为 78,754 吨,其次是除草剂 48,781 吨和杀菌剂 40,884 吨。根据欧盟统计局的数据,2020 年德国活性物质产量从去年的 45,181 吨增加到 47,974 吨。主要作物杂草侵染的增加以及为保障产量而对作物保护的需求预计将推动市场在预测期内(2023-2029 年)以 3.5% 的复合年增长率增长。

- 谷物和谷类是该地区作物保护化学品消费的主导产品,2022 年占 60.5%。谷物和谷类的主导地位是由于种植面积的增加和病虫害的感染增加。 2022年,这些作物占农业用地的63.0%。

- 欧洲作物保护化学品市场受到提高作物产量和效率的需求的推动。该地区人口成长迅速,但农业用地却在减少。因此,农民面临提高产量的压力。因此,农民正在采用新的农业方法来提高作物产量,为作物保护化学品市场铺平了道路。预计预测期内市场复合年增长率将达到 4.0%。

欧洲作物保护化学品市场趋势

为了提高作物产量并减少虫害,对作物保护化学品的需求正在增加。

- 欧洲由于地理位置和地形不同,气候多样。欧洲不同地区的不同气候条件影响该地区可种植的作物种类和害虫种类。 2022年,该地区每公顷农业用地的作物保护化学品平均消费量为38.8公斤。

- 欧洲使用最广泛的化学作物保护化学品类型是杀菌剂,2022 年该地区每公顷农业用地的平均消费量为 19.4 公斤。真菌病害的感染对所有类型的作物都构成重大风险,因为它会导致严重的产量损失并损害收穫农产品的整体品质。因此,欧洲农民严重依赖杀菌剂来有效控制和管理这些疾病。

- 2022年除草剂施用率为每公顷11.7公斤,每公顷除草剂用量增加。这种增长可以归因于多种因素,包括人们认识到使用除草剂是提高作物产量和品质的一种有价值且经济有效的方法。 2022年除草剂施用率与前一年同期比较增加了4.02%。

- 杀虫剂是 2022 年第三常用化学品,施用率为每公顷 6.9 公斤。在整个欧洲,作物面临蚜虫、科罗拉多马铃薯甲虫和金针虫等害虫的严重威胁,这些害虫对作物造成了严重的破坏和损失。为了应对这些挑战并实现最高的产量,杀虫剂在有效控制和管理害虫方面发挥着至关重要的作用。

对Cypermethrin的需求推高了其活性成分的价格。此次价格上涨是由于主要作物对Cypermethrin的需求增加。

- Cypermethrin是一种主要在欧洲使用的杀虫剂。由于其能有效治疗多种昆虫,包括蚜虫、介壳虫、斑甲虫、棉红铃虫、早期斑螟和毛虫,因此被广泛应用于农业。在德国、英国和法国等国家,Cypermethrin主要用于多种作物的害虫防治。截至 2022 年,该活性成分的成本为每吨 21.2 美元。

- Emamectin benzoate是一种杀虫剂,对危害农作物果实和叶子的有害鳞翅目昆虫有很强的效果。甲氨基阿维菌素苯甲酸盐的快速作用和作用方式使其在幼虫各个阶段以较低的施用率就能发挥高效作用。它最初是为核果、葡萄和各种蔬菜等作物设计的。 2022 年的价格为每吨 17,400 美元。

- Azoxystrobin是一种广泛应用于农业的杀菌剂,是抗菌谱最广的杀菌剂。它是一种强效活性成分,广泛应用于多种作物。有效防治叶斑病、銹病、白粉病、霜霉病、网斑病、晚疫病等病害。 2022年Azoxystrobin的市场估价为每吨4,400美元。

- Tebuconazole是一种以系统性特性而闻名的活性成分,既可以治疗也可以预防植物疾病。Tebuconazole可抑制影响葡萄、樱桃、杏仁、谷物和菜籽等作物的孢子形成和有害真菌的生长。 2020年,其价值为每吨8,700美元。

欧洲作物保护化学品产业概况

欧洲作物保护化学品市场相当集中,前五大公司占了73.24%的市场。该市场的主要企业是 ADAMA Agricultural Solutions Ltd.、 BASF SE、Bayer AG、Nufarm Ltd 和 Syngenta Group。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 每公顷作物保护化学品消费量

- 活性成分价格分析

- 法律规范

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 价值炼和通路分析

第五章市场区隔

- 功能

- 杀菌剂

- 除草剂

- 杀虫剂

- 杀软体动物剂

- 杀线虫剂

- 执行模式

- 化学喷涂

- 叶面喷布

- 熏蒸

- 种子处理

- 土壤处理

- 作物类型

- 经济作物

- 水果和蔬菜

- 粮食

- 豆类和油籽

- 草坪和观赏植物

- 原产地

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 乌克兰

- 英国

- 其他欧洲国家

第六章 竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- ADAMA Agricultural Solutions Ltd.

- BASF SE

- Bayer AG

- Corteva Agriscience

- FMC Corporation

- Nufarm Ltd

- Sumitomo Chemical Co. Ltd

- Syngenta Group

- Upl Limited

- Wynca Group(Wynca Chemicals)

第七章:CEO面临的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 资料包

- 词彙表

简介目录

Product Code: 56167

The Europe Crop Protection Chemicals Market size is estimated at 16.08 billion USD in 2025, and is expected to reach 19.75 billion USD by 2030, growing at a CAGR of 4.20% during the forecast period (2025-2030).

Herbicides and fungicides dominate the market owing to their increased use in pest control

- Agriculture in Europe is diverse and plays a significant role in the economies of many countries. The region encompasses a wide range of climates and is known for cultivating wheat, barley, soybean, and various fruits and vegetables. In 2022, Europe occupied a share of 15.7% by value.

- The population growth in the region has encouraged the use of pesticides in agriculture to achieve better yields and meet the increasing demand for food crops. At the same time, technological advancements have changed the way of farming and eased the pest control process.

- Herbicides occupied the largest share of 34.7% by value in 2022. Weed attacks in staple, commercial, and horticultural crops pose a significant challenge to the region's agricultural productivity. As there is a significant contribution by the fruit sector to the region's economic growth, weeds cause substantial economic damage by attacking fruits. Amaranthus retroflexus (redroot pigweed), Echinochloa crus-galli (Barnyard grass), Conyza canadensis (Canadian fleabane), Digitaria sanguinalis (large crabgrass), Cyperus rotundus (purple nutsedge) are the most common weeds in the region. Therefore, herbicide use has increased to combat these weed attacks and maintain agricultural productivity.

- Fungicides occupied the second-highest share of 32.7%. Being one of the top regions for grains and pulses production, it is highly susceptible to fungal diseases, which are mitigated using fungicides.

- Increased concerns for food security and various developments have facilitated the efficient and sustainable production of food by farmers while minimizing the impact of pests on their crops. This has driven the market, which is anticipated to register a CAGR of 4.0% over the forecast period.

Germany dominated the market due to increasing weed infestation in major crops

- European farmers cultivate various crops, including grains (wheat, barley, oats, etc.), oilseeds (rapeseed, sunflower, etc.), fruits, vegetables, and various industrial crops. The Mediterranean region is known for olive and citrus production, while northern European countries focus on cereals and root crops.

- Among the countries, Germany dominated the market and accounted for a share of 21.6% in 2022. The total agricultural usage for insecticides accounted for 78,754 metric tons, followed by herbicides with 48,781 metric tons, and fungicides with 40,884 metric tons in 2022. According to Eurostat, Germany produced 47,974 metric tons of active ingredients in 2020, higher than 45,181 metric tons from the previous year. Increasing weed infestation in major crops and the need for crop protection to protect the yields are estimated to drive the market at a CAGR of 3.5% during the forecast period (2023-2029).

- Grains and cereal crops dominated the consumption of crop protection chemicals in the region, which accounted for 60.5% in 2022. The dominance of grains and cereals is attributed to the higher cultivation area and increased pest infestations. In 2022, these crops accounted for 63.0% of the agricultural land.

- The European crop protection chemicals market is driven by the need to increase crop yield and efficiency. The region's population is drastically growing, but the farmlands are diminishing. As a result, farmers are being pushed to increase their yield. Therefore, new farming practices are being adopted by farmers to increase crop yield, which is paving the way for the crop protection chemicals market. The market is anticipated to record a CAGR of 4.0% during the forecast period.

Europe Crop Protection Chemicals Market Trends

To increase the yield of crops and reduce pest infestation, the demand for pesticides is rising

- Europe has a diverse climate due to its geographical position and varying topography. Different parts of Europe have different climatic conditions, which influence the types of crops that can be grown and the pests that can thrive in those areas. In 2022, the average consumption of crop protection chemicals in this region was 38.8 kg per hectare of agricultural land.

- Fungicides were the most widely used type of chemical pesticide in Europe, with an average consumption of 19.4 kg per hectare of agricultural land in the region in 2022. The prevalence of fungal diseases presents a significant risk to all crop types, as they can lead to substantial yield reductions and compromise the overall quality of harvested produce. Consequently, European farmers heavily rely on fungicides to effectively control and manage these diseases.

- In 2022, the herbicide application rate was 11.7 kg per hectare, representing increased herbicide usage per hectare. This rise can be attributed to several factors, including the recognition of herbicide usage as a valuable and economically efficient approach to improve both the quantity and quality of crop yields. The herbicide application rate experienced a growth of 4.02% in 2022 compared to the previous year.

- In 2022, insecticides were the third most commonly used pesticide, with an application rate of 6.9 kg per hectare. Throughout Europe, crops face significant challenges due to pests such as aphids, Colorado beetles, wireworms, and other insects, which cause substantial crop damage and loss. To address these challenges and achieve the best possible yields, insecticides play a vital role in effectively controlling and managing pests.

Demand for cypermethrin increased the active ingredient price. This surge in price is attributed to the growing demand for cypermethrin use in major crops

- Cypermethrin is a primary insecticide employed in Europe. Its widespread adoption in agriculture is attributed to its effectiveness in handling a variety of insect species, including aphids, beetles, spotted ball worms, pink ball worms, early spot borers, and hairy caterpillars. Countries like Germany, the United Kingdom, and France predominantly utilize cypermethrin to manage pests across different crops. As of 2022, the cost of this active ingredient stood at USD 21.2 per metric ton.

- Emamectin benzoate is an insecticide that has potent efficacy against harmful Lepidoptera species that impact the fruits and leaves of agricultural crops. The swift action and mode of operation of emamectin benzoate result in high effectiveness even at low application rates throughout all larval growth stages. It was originally designed for use in crops like stone fruits, grapes, and a wide variety of vegetables. In 2022, its price was USD 17.4 thousand per metric ton.

- Azoxystrobin, a fungicide extensively employed in agriculture, possesses the widest range of activity among antifungal agents. It functions as a potent active component and finds widespread application across different crops. It effectively addresses diseases like leaf spots, rusts, powdery mildew, downy mildew, net blotch, and blight. The market valuation of azoxystrobin in 2022 was recorded at USD 4.4 thousand per metric ton.

- Tebuconazole is an active ingredient known for its systemic nature, providing both curative and preventive control over plant diseases. Tebuconazole hinders spore formation, inhibiting the growth of harmful fungi, which affect crops like grapes, cherries, almonds, cereals, and canola. In 2020, its value was USD 8.7 thousand per metric ton.

Europe Crop Protection Chemicals Industry Overview

The Europe Crop Protection Chemicals Market is fairly consolidated, with the top five companies occupying 73.24%. The major players in this market are ADAMA Agricultural Solutions Ltd., BASF SE, Bayer AG, Nufarm Ltd and Syngenta Group (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Consumption Of Pesticide Per Hectare

- 4.2 Pricing Analysis For Active Ingredients

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Ukraine

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Function

- 5.1.1 Fungicide

- 5.1.2 Herbicide

- 5.1.3 Insecticide

- 5.1.4 Molluscicide

- 5.1.5 Nematicide

- 5.2 Application Mode

- 5.2.1 Chemigation

- 5.2.2 Foliar

- 5.2.3 Fumigation

- 5.2.4 Seed Treatment

- 5.2.5 Soil Treatment

- 5.3 Crop Type

- 5.3.1 Commercial Crops

- 5.3.2 Fruits & Vegetables

- 5.3.3 Grains & Cereals

- 5.3.4 Pulses & Oilseeds

- 5.3.5 Turf & Ornamental

- 5.4 Country

- 5.4.1 France

- 5.4.2 Germany

- 5.4.3 Italy

- 5.4.4 Netherlands

- 5.4.5 Russia

- 5.4.6 Spain

- 5.4.7 Ukraine

- 5.4.8 United Kingdom

- 5.4.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and analysis of Recent Developments)

- 6.4.1 ADAMA Agricultural Solutions Ltd.

- 6.4.2 BASF SE

- 6.4.3 Bayer AG

- 6.4.4 Corteva Agriscience

- 6.4.5 FMC Corporation

- 6.4.6 Nufarm Ltd

- 6.4.7 Sumitomo Chemical Co. Ltd

- 6.4.8 Syngenta Group

- 6.4.9 Upl Limited

- 6.4.10 Wynca Group (Wynca Chemicals)

7 KEY STRATEGIC QUESTIONS FOR CROP PROTECTION CHEMICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219