|

市场调查报告书

商品编码

1687911

先进积体电路基板:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Advanced IC Substrates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

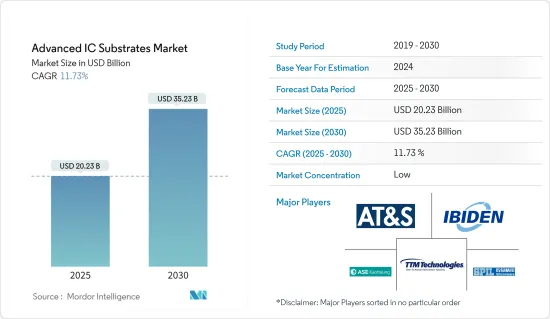

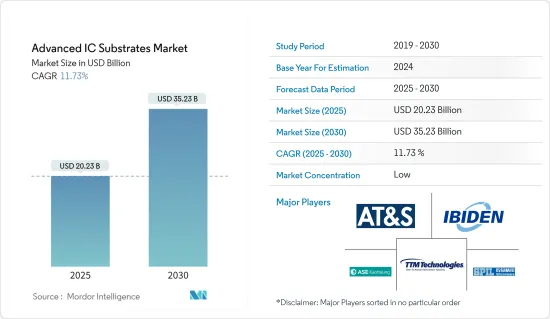

先进IC基板市场规模预计在2025年达到202.3亿美元,预计到2030年将达到352.3亿美元,预测期内(2025-2030年)的复合年增长率为11.73%。

关键亮点

- IC基板在透过导线和孔的导电网路将 IC 晶片连接到 PCB 的过程中发挥着至关重要的作用。它们对于支援各种功能至关重要,包括电路支援、保护、散热以及讯号和电源分配。随着 BGA 和 CSP 等新类型的推出,IC 技术的进步促使 IC基板不断发展,以适应各种封装载体。 5G 智慧型手机需求的成长以及智慧型穿戴装置领域投资的扩大预计将推动市场成长。

- 自从几十年前电子产业采用 IC基板以来,它们已被用于各种应用,从个人电脑和智慧型手机到高效能运算 (HPC) 和其他电子系统。基板技术从早期的导线架、焊线球栅阵列(BGA)和晶片级封装(CSP)发展到覆晶(FC)BGA、FCCSP,甚至还有将晶粒嵌入IC基板上的CoWoS等先进技术。全球对物联网的需求不断增长,这受到消费者和工业领域的推动。随着这些产业的技术应用不断扩大,对IC基板的需求也日益增加。

- 随着人工智慧 (AI)、机器学习 (ML) 和 5G 网路的进步,产生的资料量逐年显着增加。资料的快速扩张将需要改进目前的网路、资料处理和储存系统,从而推动对更快、更高频率设备的需求。因此,小型化、整合密度和性能改进已成为先进基板开发的关键技术重点。为了满足全球市场日益增长的需求,许多公司正在投资先进的基板。

- 先进积体电路基板市场因依赖高阶智慧型手机的持续成长而正在经历显着扩张。随着智慧型手机和消费性电子产品市场达到饱和, 基板製造商正在寻求透过增强技术流程来提高效能和外形尺寸,以扩大其市场范围。因此,SLP技术有望整合到智慧型手錶和平板电脑等高阶家用电子电器中,从而促进先进IC基板的使用。

- 汽车技术的进步正在推动半导体产业及其封装应用的发展。能够实现自动驾驶和各种驾驶辅助功能的智慧汽车的出现正在推动对创新包装解决方案的需求。全球向电动车的转变也促进了先进封装技术的发展,进而推动了先进积体电路基板市场的发展。例如,根据国际能源总署(IEA)的预测,在净零情境下,到2030年,电动车销量预计将占汽车销量的65%左右。此外,全球电动车持有预计将大幅成长,同年达到3.5亿辆。

- 2023年2月,三星电子在专门用于驾驶辅助系统的FC BGA基板上打造出汽车半导体封装,扩大了可用于汽车的晶片产品范围。 ADAS(高级驾驶辅助系统)是汽车半导体中技术难度最高的基板之一,但透过使用该公司的FCBGA(覆晶球栅阵列)可以实现。虽然三星电子的许多FCBGA已经用于个人电脑和智慧型手机,但新的FCBGA将用于高效能自动驾驶。

- 此外,旨在促进电子元件本地生产和推动国内製造业的各种政府计划的实施预计将对先进IC基板市场的扩张产生重大影响。此外,韩国于2023年3月推出《K晶片法案》,为晶片和其他战略产业投入4,220亿美元的巨额投资。由于马来西亚、印度和美国等其他国家政府也采取了类似的措施来促进当地製造业的发展,预计未来几年对先进积体电路基板的需求也将增加。

- 市场面临许多障碍,而不仅仅是技术障碍。面对极其严格的技术要求和众多的专利限制,它树立了令人敬畏的标竿。一条IC基板生产线的建立、生产及后续运作需要大量的资金投入,其中资本投入是最大的。

- 新冠疫情导致市场基本面发生重大变化,影响了客户行为、企业收益和公司营运。这场危机促使工厂进一步整合自动化和工业 4.0 技术,刺激了晶片产业的成长并提高了销售额。疫情导致各行业对半导体晶片的需求大幅增加,刺激了对先进积体电路基板的需求。

先进IC基板的市场趋势

行动装置和消费性电子产品预计将占据很大的市场占有率

- 对行动通讯设备和消费性电子产品的需求正在推动行动装置和消费性电子产品製造商开发更小、更便携的产品。微型化趋势日益增强是先进封装需求的主要驱动力。行动和家用电子电器功能的不断扩展,以及智慧型装置和智慧型穿戴装置的普及率激增,预计将在预测时限内对先进 IC基板的采用做出重大贡献。

- 积体电路 (IC) 封装的选择受许多因素影响,包括功率损耗、尺寸、价格和其他考虑因素。全球对 5G 智慧型手机和智慧型穿戴装置的需求不断增长,预计将在未来几年推动对先进 IC基板的需求。此外,人工智慧、HPC等尖端技术的日益普及以及5G等高性能行动装置也推动了对高性能IC基板的需求。

- 由于网路使用量增加、智慧型手机製造宣传活动促销社群媒体平台订阅数量增加等因素,全球对智慧型手机的需求预计将会成长。智慧型手机占据了相当大的市场占有率,预计5G智慧型手机的推出将进一步刺激需求。三星等全球知名公司正大力投资半导体产业,以成为 5G 智慧型手机市场的知名供应商。

- 根据爱立信的报告,预计2022年全球智慧型手机行动网路用户数将达到约64亿,到2028年这一数字预计将超过77亿人。其中,中国、印度和美国的智慧型手机行动网路用户数量最多。 5G技术的推广持续加速,全球已建立16亿个连结。据 GSMA Intelligence 称,预计到 2030 年这一数字将增长到 55 亿。这些因素可能会导致对该产品的需求增加。

- 对智慧型手机等 5G 装置的需求激增,刺激了 5G 的广泛应用。根据 GSMA 预测,到 2025 年,全球三分之一的人口将能够使用 5G 网路。通讯设备和行动用户数量的增加预计最终将推动对 IC基板的需求。物联网应用在各种消费性设备中的普及,带动了智慧设备和半导体微型化的增加,从而推动了对高功能积体电路基板的需求。

- 许多公司生产节能积体电路(IC),特别是针对家用电子电器产业。图形处理单元 (GPU)、个人电脑、游戏笔记型电脑和各种行动装置正在发展成为各种新兴应用的可行解决方案,包括高效能运算、区块链和 AI/ML。神经处理单元 (NPU) 卸载 CPU 和其他系统晶片(SoC) 组件任务的需求不断增长,尤其是在 AI资料处理期间,预计将推动市场需求。

- 预计家用电子电器製造商的投资增加将进一步提升市场潜力。 2023年1月,LG Innotek在新建的龟尾工厂举办了FC-BGA生产活动。覆晶球栅阵列 (FC-BGA) 的生产计划于 2023 年 2 月开始。初始阶段之后,将于 2026 年进入第二阶段。 LG Innotek 的目标是到 2023 年将其 FC-BGA 产能提高到每月 730 万台,到 2026 年进一步提高到每月 1500 万台。

预计美国将出现显着成长

- 打造完整的半导体产业链体系,需要更重视研发,加强自主创新。该地区半导体产业的发展,加上《CHIPS法案》的颁布以加强国内生产,导致对先进IC基板的需求激增。汽车、行动电话等产业对此类基板的需求正在成长,市场可望扩大。

- 连网和消费性电子产品的兴起以及公司对提高品质和提供全面测试解决方案的关注是市场扩张的驱动力。随着需要组装组装和封装解决方案的家用电子电器销售的成长,对高性能、低成本、多功能和高整合度晶片的需求预计也将增长。根据CTA预测,2022年智慧型手錶销售额将达71亿美元,较2021年成长8%。此外,随着5G的普及,家用电子电器市场也将随之成长,预计到2023年5G设备将占智慧型手机出货量的73%。

- 预计汽车行业投资的增加和该地区电动车销量的增加将影响市场的成长。美国电动车市场蓬勃发展,销量令人印象深刻。据 COX Enterprises 称,2023 年第一季,该国电动车销量达到 258,900 辆。与2022年同期的数据相比,这一数字同比大幅增长了约44.9%。 2023 年第一季超过了 2022 年第四季度,成为过去两年 BEV 销售最成功的一个季度。

- 预计市场成长的驱动力将是活性化电动车普及力度。国际能源总署称,加州针对轿车和卡车的零排放法规将于 2022 年和 2023 年生效。这些法规规定了搭乘用乘用车类别中零排放电动车的最低销售要求,目标范围从 2026 年的 35% 到 2035 年的 100%。此外,还为零排放重型汽车 (HDV) 的销售设定了里程碑,目标是在 2035 年至 2042 年期间实现 100% 的普及率,具体取决于具体的车辆细分市场。这些因素促使电动车的普及率不断提高,并增加了对积体电路基板的需求。

- 政府加强推动半导体研发活动将增强该地区的晶片生产能力。这反过来又推动了市场需求。 2024年2月,美国政府就其对半导体相关研发的贡献发表了引人注目的声明。它已宣布打算为此拨款110亿美元。同时宣布成立的国家半导体技术中心(NSTC)是一项由 50 亿美元预算支持的创新计画。这些对半导体产业的策略性投资预计将促进该地区整体市场的扩张。

- 5G 技术的日益普及和通讯业投资的不断增加预计将进一步推动市场成长。物联网的进步将提高IC基板製造商的利润。苹果计划利用台积电的封装天线技术和日月光的 FC AiP 工艺,将毫米波天线整合到其 5G iPhone 和 5G iPad 中。物联网的扩展导致先进半导体封装的使用增加,这可以提高各种应用中积体电路的效能并降低其成本。

先进积体电路基板产业概况

先进IC基板市场竞争适中,由几个主要企业组成。主导市场的参与企业包括日月光集团、TTM Technologies Inc.、京瓷公司、硅品精密工业和IBIDEN。市场现有参与企业正试图透过适应 5G通讯、高性能资料中心和小型电子设备等新技术来保持竞争力。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 产业价值链分析

- 宏观经济趋势对产业的影响

第五章市场动态

- 市场驱动因素

- 扩大先进基板在物联网设备製造的应用

- 半导体元件小型化趋势日益增强

- 市场限制

- 製造流程日益复杂

第六章市场区隔

- 按类型

- FC BGA

- FC CSP

- 按应用

- 行动消费者

- 汽车和运输设备

- 资讯科技和电信

- 其他的

- 按地区

- 美国

- 中国

- 日本

- 韩国

- 台湾

- 其他的

第七章竞争格局

- 公司简介

- ASE Kaohsiung(ASE Inc.)

- AT& S Austria Technologies & Systemtechnik AG

- Siliconware Precision Industries Co. Ltd

- TTM Technologies Inc.

- Ibiden Co. Ltd

- Kyocera Corporation

- Fujitsu Ltd

- JCET Group

- Panasonic Holding Corporation

- Kinsus Interconnect Technology Corp.

- Unimicron Corporation

第八章投资分析

第九章 市场机会与未来趋势

The Advanced IC Substrates Market size is estimated at USD 20.23 billion in 2025, and is expected to reach USD 35.23 billion by 2030, at a CAGR of 11.73% during the forecast period (2025-2030).

Key Highlights

- IC substrates play a crucial role in connecting IC chips to the PCB by utilizing a conductive network of traces and holes. They are essential for supporting various functions like circuit support, protection, heat dissipation, and signal and power distribution. The advancement in IC technology, with the introduction of new types like BGA and CSP, has led to the evolution of IC substrates to accommodate different package carriers. The increasing demand for 5G-enabled smartphones and growing investments in the field of smart wearables are expected to drive the market's growth.

- Ever since the electronics industry embraced IC substrates a few decades ago, they have been utilized in various applications, ranging from personal computers and smartphones to high-performance computing (HPC) and other electronic systems. The substrate technology has progressed from early lead frame, wire-bonding ball grade array (BGA), and chip scale packaging (CSP) to flip chip (FC) BGA, FCCSP, and even more advanced technologies like CoWoS, embedded die in IC substrate. The increasing demand for global IoT is driven by both consumer and industrial industries. In these industries, the demand for IC substrates is also rising due to the expanding applications of the technology.

- As artificial intelligence (AI), machine learning (ML), and 5G networks continue to advance, the volume of data being generated increases substantially each year. This rapid expansion of data will necessitate the enhancement of current networking, data processing, and storage systems, leading to a greater need for high-speed and high-frequency devices. Consequently, miniaturization, increased integration, and improved performance have emerged as crucial technological priorities for the development of advanced substrates. Numerous companies have made investments in advanced substrates to cater to the growing global market demand.

- The advanced IC substrates market has experienced notable expansion, given its reliance on the continued growth of high-end smartphones. With the market for smartphones and consumer electronics reaching a saturation point, manufacturers of substrates are striving to broaden their market reach by enhancing technology processing to improve performance and form factor. Consequently, the integration of SLP technology in high-end consumer electronics like smartwatches and tablets is expected to propel the use of advanced IC substrates.

- Advancements in automotive technology are propelling the semiconductor industry and its packaging applications. With the emergence of smart vehicles that enable autonomous driving and various driver-assisted functionalities, the demand for innovative packaging solutions is on the rise. The shift toward electric vehicles on a global scale is also contributing to the growth of advanced packaging technologies, consequently boosting the market for advanced IC substrates. For instance, As per the International Energy Agency (IEA), in the Net Zero Scenario, electric vehicle sales are projected to account for approximately 65% of the total car sales by 2030. Furthermore, the global electric vehicle fleet is expected to grow significantly, reaching a staggering 350 million vehicles by the same year.

- In February 2023, Samsung Electro-Mechanics created an automotive semiconductor package on an FC BGA substrate specifically for driving assistance systems, expanding the range of chip products that can be used in automobiles. Advanced driver assistance systems (ADAS), one of the most technically difficult automotive semiconductor substrates to develop, can be used with its flip-chip ball grid array (FCBGA). Although many of Samsung Electro-Mechanics' FCBGAs were used in PCs and smartphones, the new FCBGA will be used for high-performance autonomous driving.

- Furthermore, the implementation of different government programs aimed at boosting the local production of electronic components and fostering domestic manufacturing is projected to significantly influence the expansion of the advanced IC substrates market. Additionally, South Korea introduced the K-Chips Act in March 2023, allocating a substantial investment of USD 422 billion toward chips and other strategic industries. Such government initiatives in boosting local production across other countries like Malaysia, India, and the United States are expected to increase the demand for advanced IC substrates in the coming years.

- The market encounters various obstacles, extending beyond technical hurdles. It is confronted with exceptionally rigorous technical demands and numerous patent limitations, which have established a formidable benchmark. The establishment, production, and subsequent functioning of the IC substrate production line all demand substantial financial investment, with equipment capital investment being the most substantial aspect.

- The COVID-19 pandemic led to significant shifts in the market foundations, impacting customer behavior, business revenues, and corporate operations. This crisis expedited the integration of automation and Industry 4.0 technologies in factories, driving growth in the chip industry and boosting sales. Due to the pandemic, there was a notable increase in the demand for semiconductor chips across various industries, fueling the necessity for advanced IC substrates.

Advanced IC Substrates Market Trends

Mobile Devices and Consumer Electronics Are Expected to Hold Major Market Shares

- The need for mobile communication devices and consumer electronics is compelling mobile and consumer electronics manufacturers to develop smaller and more portable products. The rising inclination toward miniaturization is the main driver behind the demand for advanced packaging. The expanding capabilities of mobile devices and consumer electronics, along with the surging popularity of smart devices and smart wearables, are expected to significantly contribute to the adoption of advanced IC substrates in the projected timeframe.

- The selection of the package for an integrated circuit (IC) is influenced by various factors such as power dissipation, size, price, and other considerations. With the increasing demand for 5G-enabled smartphones and smart wearables worldwide in the coming years, the requirement for advanced IC substrates is expected to increase. Additionally, the growing adoption of state-of-the-art technologies like AI and HPC, along with high-performance mobile devices, including 5G, is fueling the demand for sophisticated IC substrates.

- The global demand for smartphones is projected to witness growth as a result of factors such as the increasing usage of the Internet, the intense promotional campaigns by smartphone manufacturers, and the rising number of subscriptions to social media platforms. Smartphones hold a substantial market share, and the introduction of 5G smartphones is expected to further drive the demand. Renowned global companies like Samsung are investing significantly in the semiconductor industry to establish themselves as prominent vendors in the 5G smartphone market.

- Ericsson reported that the global count of smartphone mobile network subscriptions reached nearly 6.4 billion in 2022; the figure is expected to surpass 7.7 billion by 2028. Notably, China, India, and the United States have the highest number of smartphone mobile network subscriptions. The widespread adoption of 5G technology continues to accelerate, with 1.6 billion connections already established worldwide. According to GSMA Intelligence, this figure is expected to rise to 5.5 billion by 2030. These factors are likely to lead to increased product demand.

- The surge in demand for 5G-capable devices like smartphones is fueling the growth of 5G penetration. According to GSMA, one-third of the global population is expected to have access to 5G networks by 2025. These escalating numbers of communication devices and mobile subscriptions would consequently boost the demand for IC substrates. The proliferation of IoT applications in a wide range of consumer devices led to a rise in smart devices and compact semiconductors, thereby boosting the need for sophisticated IC substrates.

- Numerous companies are producing energy-efficient integrated circuits (ICs), particularly for the consumer electronics industry. Graphics processing units (GPUs), PCs, gaming laptops, and various portable devices have evolved to become viable solutions for a range of emerging applications such as high-performance computing, blockchain, and AI/ML. The increasing need for neural processing units (NPU) to offload tasks from CPUs and other system-on-chip (SoC) components, particularly during AI data processing, is projected to drive up the market demand.

- Increasing investments by the manufacturers of consumer electronics are further expected to increase the potential of the market. In January 2023, LG Innotek organized an event at its newly established Gumi facility, where it was expected to produce FC-BGA. The manufacturing of the flip-chip ball grid array (FC-BGA) is scheduled to commence in February 2023. Following this initial phase, the second phase will commence in 2026. LG Innotek aimed to enhance its FC-BGA production capacity to 7.3 million units per month in 2023; it expects to further increase it to 15 million units per month in 2026.

The United States is Expected to Witness Significant Growth

- The United States is poised for significant expansion in the market over the coming years, necessitating a greater focus on research and development and enhancing independent innovation to build a comprehensive semiconductor industry chain system. The advancement in the region's semiconductor industry, coupled with the enactment of the CHIPS Act to enhance domestic production, led to a surge in demand for advanced IC substrates. The increasing need for these substrates in industries such as automotive and mobile is anticipated to propel the market forward.

- The expansion is driven by the rise in connected and consumer electronics, along with companies' focus on improving quality and offering comprehensive testing solutions. The demand for high-performance, affordable, versatile, and highly integrated chips is expected to grow alongside the increasing sales of consumer electronics, requiring advanced assembly and packaging solutions. As per CTA, smartwatch sales reached USD 7.1 billion in 2022, marking an 8% increase compared to 2021. Moreover, the consumer electronics market experienced growth due to the expansion of 5G, with 5G devices estimated to make up 73% of smartphone shipments in 2023.

- Increasing investments and EV sales in the region's automotive industry are expected to influence the market's growth. The EV market in the United States is thriving, with impressive sales figures. According to COX Enterprise, the sales of battery electric vehicles in the country reached a remarkable 258,900 units in the first quarter of 2023. This represented a substantial year-over-year growth of around 44.9% compared to the figures from the same period in 2022. The first quarter of 2023 surpassed the fourth quarter of 2022, making it the most successful quarter for BEV sales in the country over the previous two years.

- The market's growth is expected to be driven by the increasing efforts to promote the adoption of EVs. According to the IEA, California enforced new ZEV mandates for cars and trucks in 2022 and 2023. These mandates established a minimum sales requirement for ZEVs in the passenger LDV category, with the goal ranging from 35% in 2026 to 100% in 2035. Furthermore, milestones have been set for the sale of zero-emission heavy-duty vehicles (HDVs), with the aim of achieving 100% adoption between 2035 and 2042, depending on the specific vehicle segment. These factors contribute to the rise in EV adoption and will generate more demand for IC substrates.

- The region's chip production capabilities will be enhanced as a result of the growing government efforts to promote semiconductor R&D activities. This, in turn, will drive the market demand. In February 2024, the US government made a noteworthy announcement regarding the dedication to semiconductor-related research and development. It disclosed its intention to allocate a significant sum of USD 11 billion toward this endeavor. It also introduced the National Semiconductor Technology Center (NSTC), an innovative initiative backed by a budget of USD 5 billion. These strategic investments in the semiconductor industry will contribute to the overall expansion of the market in the region.

- The increasing adoption of 5G technology and growing investments in the communications industry are further expected to boost the market's growth. The profits of IC substrate manufacturers are boosted by the advancements in IoT. Apple planned to incorporate mmWave antenna into its 5G iPhones and 5G iPads by utilizing TSMC's antenna in package technology and ASE's FC AiP process. The expansion of IoT led to increased utilization of the latest semiconductor packages, which can improve the performance of ICs and reduce costs in various applications.

Advanced IC Substrates Industry Overview

The advanced IC substrates market is moderately competitive and consists of a few major players. The players dominating the market include ASE Group, TTM Technologies Inc., Kyocera Corporation, Siliconware Precision Industries Co. Ltd, and Ibiden Co. Ltd. The existing players in the market are striving to maintain a competitive edge by catering to newer technologies such as 5G telecommunication, high-performance data centers, and compact electronic devices.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Macro Economic trends on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Application of Advanced Substrate in Manufacturing of IoT Equipment

- 5.1.2 Increasing Trend of Miniaturization in Semiconductor Devices

- 5.2 Market Restraints

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 FC BGA

- 6.1.2 FC CSP

- 6.2 By Application

- 6.2.1 Mobile and Consumer

- 6.2.2 Automotive and Transportation

- 6.2.3 IT and Telecom

- 6.2.4 Other Applications

- 6.3 By Geography

- 6.3.1 United States

- 6.3.2 China

- 6.3.3 Japan

- 6.3.4 South Korea

- 6.3.5 Taiwan

- 6.3.6 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASE Kaohsiung (ASE Inc.)

- 7.1.2 AT&S Austria Technologies & Systemtechnik AG

- 7.1.3 Siliconware Precision Industries Co. Ltd

- 7.1.4 TTM Technologies Inc.

- 7.1.5 Ibiden Co. Ltd

- 7.1.6 Kyocera Corporation

- 7.1.7 Fujitsu Ltd

- 7.1.8 JCET Group

- 7.1.9 Panasonic Holding Corporation

- 7.1.10 Kinsus Interconnect Technology Corp.

- 7.1.11 Unimicron Corporation