|

市场调查报告书

商品编码

1690962

半导体后端设备:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Semiconductor Back-End Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

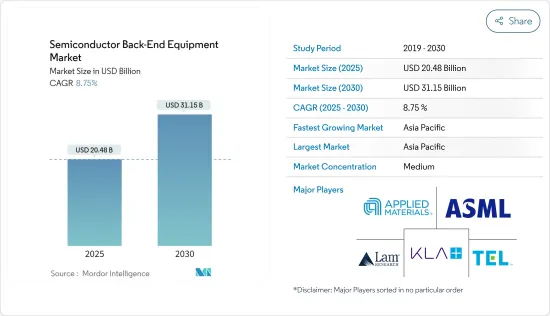

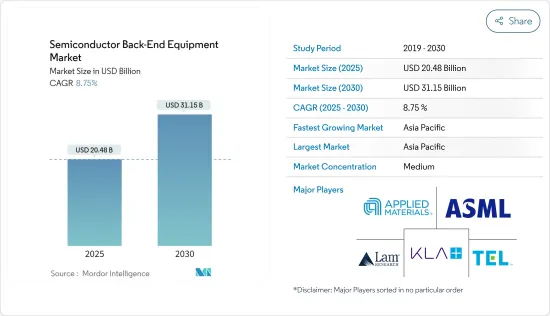

半导体后端设备市场预计在 2025 年达到 204.8 亿美元,在 2030 年达到 311.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 8.75%。

主要亮点

- 能源转型、电气化和人工智慧等技术的采用是再形成全球市场半导体需求的前沿。例如,人工智慧(AI)融入半导体产业预示着创新、效率和机会的新时代的到来。过去,半导体产业主要担任其他高科技产业的推动者。

- 但人工智慧正在使半导体成为改变技术发展和重塑产业经济格局的前沿。例如,人工智慧晶片被用于自动驾驶汽车。这使得它能够根据周围环境做出即时决策。人工智慧晶片也用于医疗保健行业,用于即时监控患者和检测健康问题。这些创新正在改变我们的生活和工作方式,使生活变得更轻鬆、更有效率。

- 此外,世界正日益转向再生能源来源,以减少对不再生燃料的依赖并应对气候变迁。电气化是实现这一转变的关键策略,半导体在改变能源的产生、储存和消耗方式方面发挥核心作用。

- 半导体,尤其是类比产品和嵌入式处理产品,可以透过更智慧、更可靠、更易于存取的太阳能能源储存系统和电动车充电系统实现电气化。因此,透过专注于高压功率、电流和电压感测、边缘处理和连接产品四个关键领域,每家公司都在应对各个终端用户市场中半导体不断变化的动态以及推动后端设备在先进半导体晶圆、封装和组装製程中的作用方面发挥着关键作用。

- 半导体产业正在迅速扩张,对半导体製造设备的需求也随之激增。然而,半导体製造设备的价格对于半导体产业来说是一个非常重要的因素。设备成本对半导体的生产成本有很大影响,进而影响最终产品的价格。预计这将抑制市场成长。

- 预计宏观经济不确定性、消费者支出下降和全球经济波动等因素将阻碍晶片需求。通常,在景气衰退时期,消费支出会下降,从而减少对严重依赖半导体的智慧型手机、平板电脑和笔记型电脑等消费性电子产品的需求。假设全球经济持续恶化,消费需求进一步减弱。如果是这样,预计这些因素将在未来几年对半导体市场产生负面影响。

半导体后端设备市场趋势

组装和包装部门预计将显着成长

- 预计该领域的成长将受到扇出型晶圆级封装(FOWLP)、晶圆级封装(WLP)和系统级封装(SiP)等尖端封装技术日益普及的推动。此外,封装技术的最新进展导致了堆迭 WLCSP 等封装技术的出现,这种技术允许将多个积体电路整合到单一封装中。这些进步包括逻辑和记忆体晶片的结合,以及记忆体晶片的堆迭。因此,预计先进封装的需求将会激增,从而需要购买相应的设备。

- 半导体积体电路在各个领域的应用迅速增加,导致对半导体封装和组装设备的需求增加。电子产业就是一个例子,由于电子设备及其应用的激增,对此类设备的需求正在增长。预计这将大大促进需求的成长。同样,对更小、更快、更有效率的半导体的需求不断增长,推动了对先进封装技术的需求,从而增加了对半导体封装设备的需求。

- 全球各产业对半导体的需求不断成长,导致半导体产能扩大,进而推动半导体后端设备市场的成长。 2023年8月,知名半导体代工厂台积电开始向多家尖端封装设备供应商新订单。与该公司密切合作的供应商包括Gudeng Precision Industrial、Apic Yamada、Disco 和 Scientech。台积电决定与设备供应商合作,体现了该公司不断努力加强其先进封装能力。

- 半导体晶片利用率和产量的大幅成长是半导体封装和组装设备产业扩张的主要驱动力。此外,SIA 支持的 WSTS 最近发布的行业预测显示,2023 年全球销售额将下降 9.4%,然后在 2024 年增长 13.1%。该预测预计 2023 年全球销售额将达到 5,200 亿美元,低于 2022 年的 5,741 亿美元。到 2024 年,全球销售额预计将成长到 5,884 亿美元。这些积极的行业趋势可能会使包装设备供应商抓住市场机会。

- 预计市场将受到美光、台积电和日月光等知名供应商对封装技术的投资以及其他供应商利用这些技术的优势的推动。苹果、三星、英特尔等公司使用先进晶片封装 (ACP) 将多个组件整合到单一基板,从而提高设备性能和效率。僱用这样的公司可能会推动 ATP 设备的成长。

亚太地区预计将出现显着的市场成长

- 中国正在推动雄心勃勃的半导体计划,并投入 1500 亿美元的资金。该国的目标是加强国内积体电路产业并提高晶片产量。正在进行的美国贸易战加剧了这一关键尖端製程技术领域的紧张局势,导致许多中国公司投资半导体代工厂。中国已宣布多项倡议以促进其半导体产业发展,包括在代工、氮化镓(GaN)和碳化硅(SiC)市场进行大规模宣传活动。

- 该地区不断增长的半导体业务和不断提高的晶片生产能力预计将推动对后端设备的需求。中国高科技产业正利用其在通讯、可再生能源和电动车领域的强大影响力,力争提升其在全球技术价值链中的地位。

- 除了这些领域之外,该行业现在还将重点放在先进的半导体上。这种转变主要得益于先进节点製造技术的进步、记忆体市场的扩张、积极参与碳化硅 (SiC) 竞赛以及对先进封装和製造设备的策略性投资。预计中国各地代工业务的扩张和晶圆厂的投资将重振市场。

- 近年来,韩国半导体产业成长显着,产量和出货量均大幅增加。这种快速成长标誌着技术进步的復苏,对韩国经济和全球科技产业来说是个好兆头。三星、SK海力士等韩国领先的半导体公司已成为全球半导体产业的主要企业。该地区晶片产能的扩大预计将进一步提振后端设备市场。

- 该地区各个市场晶片需求的激增引起了人们对后端半导体业务的关注。预计专门从事下游加工的公司将在未来几年继续大力投资和技术进步。

半导体后端设备产业概况

半导体后端设备市场半固体,既有全球参与者,也有中小型企业。市场的主要企业包括 ASML Holding NV、应用材料公司 (Applied Materials Inc.)、LAM Research Corporation、东京电子有限公司 (Tokyo Electron Limited) 和 KLA Corporation。市场参与者正在采取伙伴关係、扩张和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 12 月,应用材料公司和 CEA-Leti 扩大了合作,建立了一个联合实验室,专注于为 ICAPS 市场(物联网、通讯、汽车、电力和感测器)提供专用半导体应用的材料工程解决方案。该实验室旨在透过满足物联网、电动车和智慧电网基础设施的需求来加速下一代设备的创新。计划将解决材料工程难题,以提高效能、降低功耗并缩短时间。

- 2023 年 11 月,三星电子与 ASML 控股签署初步协议,将在韩国投资 1 兆韩元(7.6 亿美元)建立联合研发机构。此次合作概述于 ASML 总部签署的谅解备忘录中列出,将专注于使用 ASML 尖端的极紫外线 (EUV) 工具开发记忆体晶片。作为全球唯一的 EUV 扫描仪製造商,ASML 的技术对于复杂的半导体图形化、简化製造流程和提高生产产量比率至关重要。该研发中心是ASML共同设立的首个海外设施,将专注于开发基于下一代EUV技术的超精细半导体製造流程。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- 新冠肺炎疫情的影响、宏观经济趋势与地缘政治情势

第五章 市场动态

- 市场驱动因素

- 电动和混合动力汽车对半导体的需求不断增加

- 新代工厂的需求(国际晶片短缺)

- 市场限制

- 安装成本高

- 产品不断发展影响需求

第六章 市场细分

- 按类型

- 测量与检查

- 切割

- 黏合

- 组装和包装

- 按地区

- 美国

- 欧洲

- 中国

- 韩国

- 台湾

- 日本

- 其他亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- ASML Holding NV

- Applied Materials Inc.

- LAM Research Corporation

- Tokyo Electron Limited

- KLA Corporation

- Advantest Corporation

- Onto Innovation Inc.

- Screen Holdings Co., Ltd.

- Teradyne Inc.

- Nordson Corporation

第八章投资分析

第九章:市场的未来

The Semiconductor Back-End Equipment Market size is estimated at USD 20.48 billion in 2025, and is expected to reach USD 31.15 billion by 2030, at a CAGR of 8.75% during the forecast period (2025-2030).

Key Highlights

- Incorporating technologies such as energy transition, electrification, and AI has been at the forefront of reshaping the demand for semiconductors in the global market. For instance, integrating artificial intelligence (AI) into the semiconductor industry signals a new era of innovation, efficiency, and opportunity. In the past, the industry primarily served as an enabler for other high-tech sectors.

- However, with AI, semiconductors are at the forefront of transforming technology development, reshaping the industry's economic landscape. For instance, AI-powered chips are used in self-driving cars. This enables them to make real-time decisions based on their surroundings. AI-powered chips are also used in the healthcare industry for real-time monitoring of patients and detecting health issues. These innovations can transform the way of living and working, making lives more accessible and efficient.

- Furthermore, the world is increasingly shifting toward renewable energy sources to reduce reliance on non-renewable fuels and combat climate change. Electrification is a key strategy for achieving this transition, and semiconductors are playing a central role in revolutionizing how energy is generated, stored, and consumed.

- Semiconductors, particularly analog and embedded processing products, are well positioned to enable electrification through smarter, more reliable, and accessible solar-energy storage and electric-vehicle charging systems. Thus, companies are playing a significant role in addressing the changing dynamics of semiconductors in various end-user markets by focusing on four critical areas, namely high-voltage power, current and voltage sensing, edge processing, and connectivity products, thus driving the role of back-end equipment for advanced semiconductor wafers, packaging, and assembly process.

- The semiconductor industry has been expanding rapidly, and the demand for semiconductor manufacturing equipment has also surged. However, the price of these machines has turned out to be a crucial factor in the industry. The equipment cost can have a noteworthy impact on the production cost of semiconductors, affecting the final product's price. This is expected to restrain the market's growth.

- Factors such as macroeconomic uncertainty, decreased consumer spending, and fluctuations in the global economy are expected to hamper chip demand. Consumer spending typically decreases during an economic downturn, reducing demand for consumer electronics like smartphones, tablets, and laptops, which rely heavily on semiconductors. Suppose the global economy continues to deteriorate and consumer demand weakens further. In that case, these factors are anticipated to have a detrimental effect on the semiconductor market in the upcoming years.

Semiconductor Back-End Equipment Market Trends

Assembly and Packaging Segment is Expected to Witness Significant Growth

- The segment's growth is expected to be driven by the increasing acceptance of cutting-edge packaging techniques such as fan-out wafer-level packaging (FOWLP), wafer-level packaging (WLP), and system-in-package (SiP). Furthermore, recent advancements have led to the emergence of packaging technologies like stacked WLCSPs, which enable the integration of multiple integrated circuits in a single package. These advancements encompass a combination of logic and memory chips, as well as stacked memory chips. As a result, the demand for advanced packaging is anticipated to surge, necessitating the acquisition of corresponding equipment.

- The surge in the utilization of semiconductor ICs in various sectors has led to a rise in the requirement for semiconductor packaging and assembly equipment. An example is the electronics industry's expanding necessity for such equipment, driven by the widespread use of electronic devices and their applications. This is anticipated to be a significant factor contributing to the increased demand. Likewise, the growing need for smaller, faster, and more efficient semiconductors is propelling the demand for advanced packaging technologies, fueling the demand for semiconductor packaging equipment.

- The increasing global need for semiconductors in different industries has led to an expansion in their production capacity, consequently fueling the growth of the semiconductor back-end equipment market. In August 2023, TSMC, a prominent semiconductor foundry, initiated new orders with multiple suppliers of state-of-the-art packaging equipment. Gudeng Precision Industrial, Apic Yamada, Disco, and Scientech are among the suppliers working closely with the company. TSMC's decision to engage with equipment suppliers reflects its ongoing commitment to enhancing its advanced packaging capabilities.

- The significant growth in the utilization and production of semiconductor chips is a key driver behind the expansion of the semiconductor packaging and assembly equipment sector. Moreover, a recent industry forecast by WSTS, supported by SIA, predicts a 9.4% decline in global sales for 2023, followed by a 13.1% increase in 2024. The forecast anticipates that global sales will amount to USD 520 billion in 2023, a decrease from the USD 574.1 billion recorded in 2022. By 2024, global sales are expected to rise to USD 588.4 billion. These positive industry trends will enable packaging equipment vendors to capitalize on market opportunities.

- The market is anticipated to be driven by the investments made by prominent vendors such as Micron, TSMC, and ASE in packaging technologies, along with other vendors capitalizing on the advantages offered by these technologies. Apple, Samsung, and Intel are among the companies that utilize advanced chip packaging (ACP) to enhance device performance and efficiency by consolidating multiple components onto a single substrate. Such adoption by the companies will enhance the growth of ATP equipment.

Asia-Pacific Expected to Witness Significant Growth in the Market

- China is pursuing an ambitious semiconductor agenda with the support of USD 150 billion in funding. The country aims to enhance its domestic IC industry and increase its chip production. The ongoing US-China trade war has intensified tensions in this crucial sector, where the most advanced process technology is concentrated, leading many Chinese companies to invest in semiconductor foundries. China has unveiled various initiatives to strengthen its semiconductor sector, such as a substantial expansion campaign in the foundry, gallium-nitride (GaN), and silicon carbide (SiC) markets.

- The growing semiconductor business and increasing chip production capabilities in the region are expected to drive the demand for back-end equipment. China's tech industry aims to ascend the global technology value chain by capitalizing on its strong presence in telecommunications, renewables, and electric vehicles (EVs).

- In addition to these sectors, the industry is now focusing on advanced semiconductors. This transition is primarily driven by advancements in advanced node manufacturing, the expansion of the memory market, active involvement in the silicon carbide (SiC) race, and strategic investments in advanced packaging and manufacturing equipment. The growing foundry business and investments in fabs throughout China are anticipated to stimulate the market.

- South Korea has seen notable growth in its semiconductor industry over the past few years, with a substantial increase in both production and shipments. This surge indicates a resurgence in technological advancement, which bodes well for the country's economy and the global tech sector. Leading South Korean semiconductor companies like Samsung and SK Hynix have established themselves as key players in the global semiconductor industry. The expanding chip production capabilities in the region will further boost the market for back-end equipment.

- The surge in chip demand across various markets in the region has brought attention to the back-end semiconductor business. Companies specializing in back-end processes are anticipated to persist in making aggressive investments and technological advancements in the upcoming years.

Semiconductor Back-End Equipment Industry Overview

The semiconductor back-end equipment market is semi-consolidated due to the presence of both global players and small and medium-sized enterprises. Some of the major players in the market are ASML Holding NV, Applied Materials Inc., LAM Research Corporation, Tokyo Electron Limited, and KLA Corporation. Players in the market are adopting strategies such as partnerships, expansions, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- December 2023: Applied Materials and CEA-Leti have expanded their collaboration with a joint lab focusing on materials engineering solutions for specialty semiconductor applications, catering to ICAPS markets (IoT, communications, automotive, power, and sensors). The lab aims to accelerate innovation for next-gen devices by addressing demands from IoT, electric vehicles, and smart grid infrastructure. Projects will tackle materials engineering challenges to enhance ICAPS device performance, reduce power consumption, and achieve faster time to market.

- November 2023: Samsung Electronics and ASML Holding have inked a preliminary agreement to invest 1 trillion WON (USD 760 million) in a joint research and development facility in South Korea. The collaboration, outlined in a memorandum of understanding signed at ASML's headquarters, focuses on advancing memory chips using ASML's cutting-edge extreme ultraviolet (EUV) equipment. As the exclusive EUV scanner manufacturer globally, ASML's technology is pivotal for intricate semiconductor patterning, streamlining manufacturing, and enhancing production yields. The R&D center, the first overseas facility jointly established by ASML, will concentrate on developing ultra-fine semiconductor manufacturing processes based on next-generation EUV technology.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Impact of COVID-19, Macro Economic Trends, and Geopolitical Scenarios

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Semiconductors in Electric and Hybrid Vehicles

- 5.1.2 Demand for Setting Up New Foundries (International Chip Shortage)

- 5.2 Market Restraints

- 5.2.1 High Setup Costs

- 5.2.2 Constant Evolution of Products Influencing Demand

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Metrology and Inspection

- 6.1.2 Dicing

- 6.1.3 Bonding

- 6.1.4 Assembly and Packaging

- 6.2 By Geography

- 6.2.1 United States

- 6.2.2 Europe

- 6.2.3 China

- 6.2.4 South Korea

- 6.2.5 Taiwan

- 6.2.6 Japan

- 6.2.7 Rest of the Asia-Pacific

- 6.2.8 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ASML Holding N.V

- 7.1.2 Applied Materials Inc.

- 7.1.3 LAM Research Corporation

- 7.1.4 Tokyo Electron Limited

- 7.1.5 KLA Corporation

- 7.1.6 Advantest Corporation

- 7.1.7 Onto Innovation Inc.

- 7.1.8 Screen Holdings Co., Ltd.

- 7.1.9 Teradyne Inc.

- 7.1.10 Nordson Corporation