|

市场调查报告书

商品编码

1692130

美国公路货运:市场占有率分析、行业趋势和统计数据、成长预测(2025-2030 年)United States Road Freight Transport - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

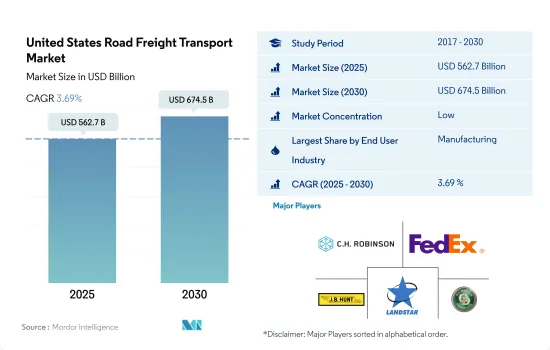

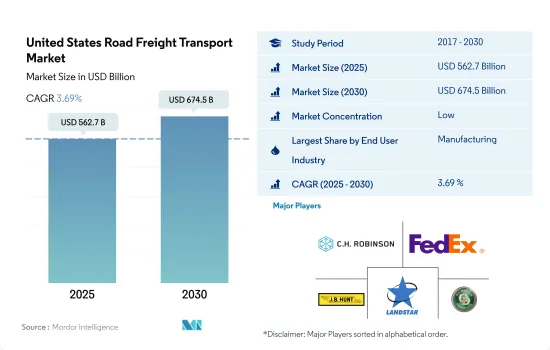

预计 2025 年美国公路货运市场规模为 5,627 亿美元,到 2030 年将达到 6,745 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.69%。

製造业和电子商务产业的成长推动了美国公路货运市场的发展

- 美国製造业是卡车货运的主要驱动力,该产业在 2024 年初转向扩张,标誌着工业活动復苏和运输服务需求增加。此外,2024 年 6 月製成品出口额从 2024 年 5 月的 1,119 亿美元达到 1,130 亿美元。同样,2024 年上半年製成品出口额达到 6,580 亿美元,年增 2.62%。製造业出口的成长是公路货运需求成长的主要原因。

- 公路货运市场的批发和零售部分预计将经历显着增长,这主要归因于美国整体零售业的预期扩张。到2025年,复合年增长率预计将达到3.5%。预计 2023 年至 2027 年期间,美国电子商务收益将以 11.22% 的显着复合年增长率成长。电子商务用户数量的增加也有望在推动这一成长中发挥关键作用,预计到 2029 年用户数量将从 2024 年的 2.73 亿增至 3.33 亿。

美国公路货运市场趋势

美国处于领先地位,在基础设施和供应链投资的推动下,贡献了该地区 GDP 的 86%

- 2024年9月,美国运输部下属的联邦航空管理局向519个计划拨款19亿美元。这些计划遍及 48 个州、关岛、波多黎各和其他地区,都是机场改善计画 (AIP) 的一部分。此外,2023 年还将额外拨款 2.69 亿美元,用于支持美国 56 个机场的 62 个计划。这项竞争倡议将支持机场所有者和营运商加强美国机场系统。第五轮 AIP 资助是迄今为止最大的一轮,将资助一系列计划,包括改善机场安全和永续性以及降低噪音等。美国各地的机场,无论规模大小,都可以获得津贴。

- 在基础设施建设和电子商务繁荣的推动下,运输和仓储行业的就业机会预计将激增。美国劳工统计局 (BLS) 预测 2022 年至 2032 年期间年增率为 0.8%,相当于新增约 57 万个就业机会。值得注意的是,除了仓储和储存之外,宅配和信使服务预计将推动约 80% 的就业成长。

2022年美国仍将是原油净进口国,从80个国家进口约628万桶/天原油。

- 预计到 2024 年 10 月,也就是总统大选前,美国汽油价格将三年多来首次跌破每加仑 3 美元。燃料价格下跌主要是由于需求减弱和原油价格下跌,这为面临高成本加剧通货膨胀的消费者提供了缓解。这也可能有助于副总统卡马拉·哈里斯和其他民主党人反击共和党对高油价的批评。 2024年9月,一般汽油平均价格为每加仑3.25美元,比上月下降19美分,比去年下降58美分。

- 根据美国能源资讯署 (EIA) 的数据,2024 年原油价格将与 2023 年持平,2025 年则将下降。美国将在 2023 年安装新的精製能力,从而运作并减少 2024 年和 2025 年石油产品价格的扭曲。此外,中东,特别是科威特,正在增加新的国际精製能力,这将有助于缓解全球汽油和柴油的价格压力。此外,预计 2024 年裂解价差缩小将导致 2024 年和 2025 年美国平均零售燃料价格下降。预计 2024 年汽油价格将达到每加仑 3.36 美元,2025 年将达到每加仑 3.24 美元。

美国公路货运业概况

美国公路货运市场较为分散,市场前五大参与者(按字母顺序排列)为 C.H.罗宾逊、联邦快递、J.B. Hunt Transport, Inc.、Landstar System Inc. 和 Old Dominion Freight Line。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 按经济活动分類的GDP分布

- 经济活动GDP成长

- 经济表现及概况

- 电子商务产业趋势

- 製造业趋势

- 交通运输仓储业GDP

- 物流绩效

- 道路长度

- 出口趋势

- 进口趋势

- 燃油价格趋势

- 卡车运输成本

- 卡车持有量(按类型)

- 主要卡车供应商

- 公路货运吨位趋势

- 公路货运价格趋势

- 模态共享

- 通货膨胀率

- 法律规范

- 价值炼和通路分析

第五章市场区隔

- 最终用户产业

- 农业、渔业和林业

- 建设业

- 製造业

- 石油和天然气、采矿和采石

- 批发和零售

- 其他的

- 汇出目的地

- 国内的

- 国际货运

- 卡车负载容量

- 整车装载 (FTL)

- 零担运输 (LTL)

- 货柜运输

- 货柜运输

- 没有容器

- 距离

- 远距

- 短途运输

- 产品成分

- 流体产品

- 固体货物

- 温度控制

- 非温控

- 温度控制

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- AP Moller-Maersk

- ArcBest

- CH Robinson

- DHL Group

- FedEx

- JB Hunt Transport, Inc.

- Knight-Swift Transportation Holdings Inc.

- Landstar System Inc.

- Old Dominion Freight Line

- Ryder System, Inc.

- Schneider National, Inc.

- United Parcel Service of America, Inc.(UPS)

- Werner Enterprises Inc.

- XPO, Inc.

第七章:CEO面临的关键策略问题

第 8 章 附录

- 全球物流市场概览

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(市场驱动因素、限制因素、机会)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

- 外汇

简介目录

Product Code: 90811

The United States Road Freight Transport Market size is estimated at 562.7 billion USD in 2025, and is expected to reach 674.5 billion USD by 2030, growing at a CAGR of 3.69% during the forecast period (2025-2030).

Growth of the manufacturing and e-commerce industry boosting the road freight market in the United States

- The United States manufacturing sector, a major driver of truck freight, returned to expansion in early 2024, signaling a recovery in industrial activity and increased demand for transportation services. Moreover, manufactured goods exports reached USD 113 billion in June 2024, up from USD 111.9 billion in May 2024. Similarly, in the first six months of 2024, manufactured goods exports reached USD 658 billion, up 2.62% compared to the same period last year. The upturn in manufacturing exports is significantly contributing to increased road freight demand.

- The wholesale and retail trade segment of the road freight transportation market is expected to have significant growth, primarily due to the projected expansion of the overall retail industry in the United States. It is expected to register a commendable CAGR of 3.5% by 2025. E-commerce revenue in the United States is predicted to experience a substantial CAGR of 11.22% during the period spanning 2023 to 2027. The increasing number of e-commerce users is also expected to play a pivotal role in driving this growth, with the user base projected to reach 333 million by 2029, up from 273 million in 2024.

United States Road Freight Transport Market Trends

United States leads regional GDP with 86% contribution, driven by infrastructure and supply chain investments

- In September 2024, the FAA, under the US Department of Transportation, allocated USD 1.9 billion in grants for 519 projects. These projects span 48 states, Guam, Puerto Rico, and other territories, all part of the Airport Improvement Program (AIP). Additionally, USD 269 million in Supplemental Discretionary Grants for 2023 will back 62 projects at 56 U.S. airports. This competitive initiative aids airport owners and operators in enhancing the U.S. airport system. Marking its largest round yet, this fifth AIP grant cycle funds diverse projects, from airport safety and sustainability upgrades to noise reduction. The grants cater to airports nationwide, regardless of size.

- With infrastructure development and the e-commerce boom, the transportation and storage sector is set for a job surge. The Bureau of Labor Statistics (BLS) projects a 0.8% annual growth rate from 2022 to 2032, translating to nearly 570,000 new jobs. Notably, the couriers and messengers industry, alongside warehousing and storage, is expected to drive about 80% of this job growth.

The United States remained a net crude oil importer in 2022, importing about 6.28 million bpd of crude oil from 80 countries

- Gasoline prices in the US are expected to drop below USD 3 a gallon for the first time in over three years by October 2024, just before the presidential election. Lower fuel prices are mainly due to weaker demand and falling oil prices, providing relief to consumers who have faced high costs that fueled inflation. This could also help Vice President Kamala Harris and other Democrats counter Republican criticism over high gas prices. In September 2024, the average price for regular gas was USD 3.25 a gallon, down 19 cents from last month and 58 cents from last year.

- According to US Energy Information Administration (EIA), crude oil prices will stay steady in 2024 compared to 2023, then decrease in 2025. The US' introduction of new refining capacities in 2023 will boost its operable capacity, alleviating price strain on oil products in 2024 and 2025. Furthermore, the Middle East, particularly Kuwait, will add new international refining capacities, which will help ease global price pressure on gasoline and diesel. Also, it is expected, narrowing crack spreads in 2024 are likely to lead to lower average US retail fuel prices in both 2024 and 2025. Gasoline prices are projected to USD 3.36/gal in 2024 and USD 3.24/gal in 2025.

United States Road Freight Transport Industry Overview

The United States Road Freight Transport Market is fragmented, with the major five players in this market being C.H. Robinson, FedEx, J.B. Hunt Transport, Inc., Landstar System Inc. and Old Dominion Freight Line (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 GDP Distribution By Economic Activity

- 4.2 GDP Growth By Economic Activity

- 4.3 Economic Performance And Profile

- 4.3.1 Trends in E-Commerce Industry

- 4.3.2 Trends in Manufacturing Industry

- 4.4 Transport And Storage Sector GDP

- 4.5 Logistics Performance

- 4.6 Length Of Roads

- 4.7 Export Trends

- 4.8 Import Trends

- 4.9 Fuel Pricing Trends

- 4.10 Trucking Operational Costs

- 4.11 Trucking Fleet Size By Type

- 4.12 Major Truck Suppliers

- 4.13 Road Freight Tonnage Trends

- 4.14 Road Freight Pricing Trends

- 4.15 Modal Share

- 4.16 Inflation

- 4.17 Regulatory Framework

- 4.18 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Destination

- 5.2.1 Domestic

- 5.2.2 International

- 5.3 Truckload Specification

- 5.3.1 Full-Truck-Load (FTL)

- 5.3.2 Less than-Truck-Load (LTL)

- 5.4 Containerization

- 5.4.1 Containerized

- 5.4.2 Non-Containerized

- 5.5 Distance

- 5.5.1 Long Haul

- 5.5.2 Short Haul

- 5.6 Goods Configuration

- 5.6.1 Fluid Goods

- 5.6.2 Solid Goods

- 5.7 Temperature Control

- 5.7.1 Non-Temperature Controlled

- 5.7.2 Temperature Controlled

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 ArcBest

- 6.4.3 C.H. Robinson

- 6.4.4 DHL Group

- 6.4.5 FedEx

- 6.4.6 J.B. Hunt Transport, Inc.

- 6.4.7 Knight-Swift Transportation Holdings Inc.

- 6.4.8 Landstar System Inc.

- 6.4.9 Old Dominion Freight Line

- 6.4.10 Ryder System, Inc.

- 6.4.11 Schneider National, Inc.

- 6.4.12 United Parcel Service of America, Inc. (UPS)

- 6.4.13 Werner Enterprises Inc.

- 6.4.14 XPO, Inc.

7 KEY STRATEGIC QUESTIONS FOR ROAD FREIGHT CEOS

8 APPENDIX

- 8.1 Global Logistics Market Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (Market Drivers, Restraints & Opportunities)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

- 8.7 Currency Exchange Rate

02-2729-4219

+886-2-2729-4219