|

市场调查报告书

商品编码

1692484

东南亚户外数位广告 (DooH):市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)South East Asia Digital Out-of-Home (DooH) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

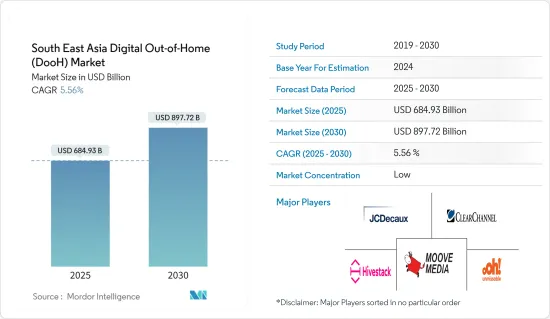

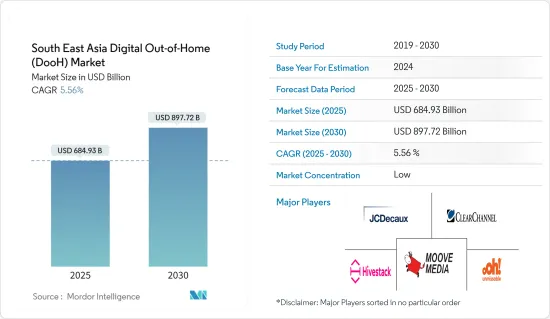

东南亚数位户外广告 (DooH) 市场规模预计在 2025 年达到 6,849.3 亿美元,预计到 2030 年将达到 8977.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.56%。

数位户外广告是利用数位电子看板技术的户外广告。这些技术使用人工智慧和分析技术来帮助负责人在正确的时间向正确的人传递正确的讯息。

主要亮点

- 线下广告业务正在逐步采用地理围栏和信标等新技术,以实现以前不可能的追踪和客製化。这导致了显着的市场成长。

- 数位户外广告之所以能占有一席之地,有许多原因,包括易于管理、变化迅速、价格低廉和针对市场。数位户外广告允许广告商和负责人将多个讯息发送到设备网络,并远端连接到这些设备来更新内容。由于新冠疫情,政府对线下购物的限制导致数位户外广告业务损失惨重。

- DooH 使该地区的卖家能够更快地改变其展示和沟通方式,从而以更低的成本更有效的接触潜在买家。此外,它比传统广告更易于管理。数位看板提供产品和可访问性更新、互动式资讯以及视觉上吸引人的图像和影片。

- 智慧城市计划使用各种数位显示器来保持城市的平稳运行,任何数位显示器都可以用来产生广告收入。数位电子看板技术可以帮助您利用这些线索。从小型互动式资讯亭萤幕到大型数位广告牌,我们的系统提供显示关键资讯和留下印象所需的运算效能、高品质图形、连接性和分析能力。

- 此外,该地区正经历全球公司的扩张,为解决方案供应商提供有利可图的发展和成长机会。例如,在 InfoComm Asia 2023 活动期间,三星与当地企业合作,向重返办公室的企业和寻求与企业互动的客户展示其最新的专业 AV 技术。

- 由于无法计算出准确的 DooH广告曝光率,因此很难量化使用者对 DooH 的参与度。虽然供应商可以使用智慧型手机位置资料来预测特定户外广告附近的客流量,但这些统计数据并不总是准确的,并且不包括脸部辨识整合来识别已经看过广告的人的性别和年龄,这使得实施更加复杂并阻碍了市场增长。

- 儘管疫情增加了新闻出版商的流量并使数位库存更有价值,但对新冠疫情内容品牌安全的担忧导致程序化每千次展示费用下降。

东南亚户外数位广告 (DooH) 市场趋势

Billboard 正在变得越来越大

- 新加坡的广告看板高度集中,获得数位户外广告的企业将有很大机会提高品牌知名度和认知度。该行业还在衡量 DooH 所驱动的互动取得了长足进步(例如,互动式展示和带有二维码选择的广告),鑑于该国在数位户外广告方面的大量投资,这为企业提供了评估其宣传活动有效性的资料。

- 在新加坡,DooH 广告看板可以在以下任何地方展示或安装:购物中心、杂货店、加油站、酒吧、餐厅、提供免费 Wi-Fi 的 LCD公共广播亭、医院、诊所、医生办公室、公寓、住宅、办公大楼、电影院、体育场、娱乐场所、主要干道、人流量大的地方等等。

- DooH 广告看板广告是第一种也是最有效的户外广告媒体形式,因为它作为广告平台可以覆盖最大的受众。泰国由两个主要城市组成,为该国的市场成长创造了巨大的机会,因为安装在路边电线杆的数位广告看板可以吸引观众的注意。

- 此外,3D 和行动广告看板的发展等最新创新也有望影响所研究市场的成长,因为它们显着扩展了使用案例并支援更新的广告方法,并帮助企业以创新方式提升客户体验。

- 印尼的 DooH 产业正在经历快速的数位化转型。数位户外广告在印尼国内外已经广泛传播。结合最新的广告技术,这些动态显示器具有与传统广告看板相同的高覆盖率,但还具有提供更深入的分析能力的额外优势。

- Billboard 在菲律宾 DooH 市场占有很大的份额。广告看板是一种有效的广告形式,可以让品牌最大限度地向各个地方的大量人群展示其产品和服务。

- 越南各个城市都有许多传统广告看板。据知名广告公司Shojiki Advertising JSC称,越南共有17,135块大型户外广告牌,其中大部分安装在四大城:胡志明市、河内、岘港和芹苴。

- 2023 年 12 月,Location Media Xchange (LMX) 和 DOmedia伙伴关係,透过全球使用最广泛的本地户外广告市场 BillboardsIn.com 在线提供超过 15,000 个户外(OOH) 广告资产供购买。广告主目前可以在新加坡、马来西亚、印尼、泰国、菲律宾、越南和印度策划和购买本地广告宣传。

马来西亚经济强劲成长

- 马来西亚户外广告市场预计将在未来几年大幅增长,这得益于广告商和负责人的兴趣日益浓厚,以及户外广告的众多优势,例如,户外广告仍然是广告商最具成本效益的媒体管道之一,同时其规模庞大且与现实环境形成鲜明对比,对消费者产生了更大的影响。

- 此外,全国各地的广告商和品牌所有者对更具创新性的广告媒介的需求正在增长,这对户外广告市场的成长产生了积极影响。此外,在当今竞争激烈的市场中,由于国内各组织越来越注重开展有影响力的户外宣传活动来提高知名度和推动业务成长,因此对户外广告解决方案的需求也日益增加。

- 例如,2023 年 12 月,Vistar Media 和 BigTree 宣布建立伙伴关係,为马来西亚各地的广告商提供一系列优质数位萤幕。 Vistar Media 是一家全球数位户外广告 (DooH) 程式化技术提供商,而 BigTree 是一家马来西亚户外 (OOH) 广告解决方案提供商。两家公司的合作将使 Vistar 能够轻鬆地将世界各地的广告商与 BigTree 的 30 个地点的数位广告网路连接起来,包括户外广告看板、购物中心和火车站。

- 同样,2022 年 1 月,HiveStack 宣布在马来西亚全面运作。马来西亚的多家代理商、品牌和全通路需求端平台 (DSP) 现在可以存取 Hivestack 平台,透过私人市场 (PMP) 和公开交易来规划、启动和衡量他们的程式化 DooH宣传活动。

- 此外,数位显示的成长为马来西亚户外广告市场带来了光明的未来。这就是为什么在过去几年里,数位户外广告领域与该国的静态户外广告领域相比出现了显着增长。然而,随着技术的进步,静态户外广告领域预计将在未来几年占据市场主导地位。

- 马来西亚的 DooH 在过去两年中经历了显着增长,预计在预测期内将继续以显着的速度增长,这得益于数位化和自动化趋势、全国广告看板和显示器数位化的提高以及房地产、零售和汽车等商业领域需求的不断增长。

- 该国的广告需求受到 DooH宣传活动的许多优势的推动,包括与许多其他类型的广告相比更高的召回率和更低的成本。 DooH 市场供应商提出的改进和新想法正在带来更好的个人化、更好的定位和更精确的测量,从而支持该国市场的快速成长。

东南亚数位户外广告 (DooH) 产业概览

东南亚数位户外广告 (DooH) 市场较为分散,只有少数几家大型企业。公司不断投资于策略联盟和产品开发,以扩大市场占有率。

2024 年 4 月,在泰国等东南亚市场提供户外 (OOH) 媒体服务的 Plan B Media 与领先的程序化解决方案提供商 Vistar Media 合作,以增强其在泰国和新加坡的数位户外 (DooH) 广告。此次合作旨在为该地区的 DooH 广告产业带来无缝的程式化解决方案。

2023 年 10 月,全球领先的独立程式化 DooH广告科技公司 Hivestack 与专门从事电梯萤幕的当地媒体所有者 UpMedia 合作,扩大其在泰国的业务。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概览

- 市场驱动因素

- 智慧城市计划支出增加推动数位广告转型

- 商业领域需求旺盛

- 市场挑战

- 广告衡量、成本和市场区隔的营运挑战

- 世界有望进入东南亚 DooH 市场的关键线索

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 生态系分析

- COVID-19 对 DooH 市场的影响

第五章 东南亚数位户外广告(DooH)市场现状

- 马来西亚DooH市场状况

- 马来西亚户外广告市场

- 马来西亚 DooH 市场

- 按应用细分

- 新加坡 DooH 市场现状

- 新加坡的户外广告市场

- 新加坡 DooH 市场

- 按应用细分

- 泰国 DooH 市场现状

- 泰国的户外广告市场

- 泰国的 DooH 市场

- 按应用细分

- 印尼DooH市场状况

- 印尼的户外广告市场

- 印尼 DooH 市场

- 应用领域

- 菲律宾 DooH 市场现状

- 菲律宾户外广告市场

- 菲律宾的 DooH 市场

- 按应用细分

- 越南 DooH 市场现状

- 越南的户外广告市场

- 越南的 DooH 市场

- 按应用细分

第六章竞争格局

- 公司简介

- JCDecaux Singapore Pte Ltd

- Clear Channel Singapore Pte Ltd

- Ooh!Media Digital PTY Limited

- Hivestack Inc.

- Moove Media Pte Ltd

- SPHMBO(Singapore Press Holding Ltd)

- Vistar Media

- Talon outdoor limited

- Mediatech Services Pte Ltd

- Daktronics Inc.

- Neosys Documail(S)Pte Ltd

- TAC Media Sdb Bhd

- Moving Walls

- Pi Interactive(Brandlah)

第七章 DooH 市场未来展望

The South East Asia Digital Out-of-Home Market size is estimated at USD 684.93 billion in 2025, and is expected to reach USD 897.72 billion by 2030, at a CAGR of 5.56% during the forecast period (2025-2030).

DooH advertising is out-of-home advertising that is powered by digital signage technologies. These technologies use AI and analytics to help marketers get the right message to the right people at the right time.

Key Highlights

- The offline advertising business is slowly adopting new technologies, like geofencing and beacons, which make tracking and customization possible in ways that weren't possible before. This is helping the market grow significantly.

- DooH is being used in the right places for many reasons, such as how easy it is to manage, how quickly it can be changed, how cheap it is, how well it can target a market, and more. Advertisers and marketers can use DooH to send multiple pieces of information to a network of devices and connect to these devices remotely to update their content. Government restrictions on offline shopping due to the COVID-19 pandemic caused a big loss for the DooH advertising business.

- DooH allows sellers in the region to modify the displays and communications more rapidly and allows the information to reach potential buyers at a lower cost and with better effectiveness. Additionally, it is simpler to manage than conventional advertisements. Digital signs provide up-to-the-minute details on products and accessibility, interactive information, and visually appealing images and videos.

- Smart city projects use different kinds of digital displays to make sure the city runs smoothly, and every digital display can be used to make money from ads. Digital signage technology assists in capitalizing on these prospects. From small interactive kiosk screens to large-format digital billboards, systems deliver the computing performance, high-quality graphics, and connectivity needed to make an impression and the analytics needed to disclose critical information.

- Furthermore, the region has been witnessing expansions from global companies, as they offer lucrative opportunities to the solution providers for development and growth. For instance, during the InfoComm Asia 2023 event, Samsung partnered with regional companies to showcase the latest professional audio-visual technology for businesses returning to the office, as well as customers seeking engaging interactions with companies.

- User engagement with DooH is difficult to quantify because counting exact DooH impressions is impossible. While vendors can predict traffic near a specific outdoor ad using smartphone location data, it may not be an exact count, and it does not include the integration of face recognition to establish people's gender and age who have already seen the advertisements, which makes the implementation more complex and hinders the market's growth.

- Even though the pandemic helped news publishers get more traffic and increase the value of their digital inventory, programmatic CPM fell because of concerns about brand safety in COVID-19 content.

South East Asia Digital Out-of-Home (DooH) Market Trends

Billboards to Witness Significant Growth

- Due to Singapore's sizable billboard concentration, companies that acquire DooH advertising would have considerable opportunities to increase their brand awareness and visibility. The industry has also made strides in measuring the interactions brought about by DooH (for instance, through interactive displays and ads that allow opt-ins through QR codes), so the businesses will have data to back their assessments of the efficacy of their campaigns through significant investments in the digital billboard advertising in the country.

- In Singapore, DooH billboards can be displayed or mounted on any of the following: shopping centers, grocers, petrol stations, pubs, and restaurants; LCD public announcement kiosks with free Wi-Fi; hospitals, clinics, and doctor's offices; condominiums, housing developments, and office towers; movie theaters, sports stadiums, and entertainment venues; major thoroughfares; and areas where there is a lot of foot activity.

- Billboard advertising in DooH is the first and most effective form of outdoor advertising medium because of its unique offerings as an advertising platform to reach the maximum number of audiences. Thailand consists of two major cities, which creates a significant opportunity for market growth in the country because digital billboards can be mounted on roadside poles to drive audiences' attention.

- Furthermore, recent innovations such as the evolution of 3D and mobile billboards are also expected to influence the growth of the market studied, as they significantly expand the use cases and support the new way of advertising, as well as help businesses enhance the customer experience in an innovative way.

- The DooH industry in Indonesia is witnessing a rapid transition toward digitalization. Digital billboards have become much more widespread in and outside of Indonesia. Combined with modern advertising technology, these dynamic displays have the same high reach as traditional billboards but with the added benefit of providing deeper analytics capabilities.

- Billboards hold a significant share of the DooH market in the Philippines. A billboard is an effective form of advertising, giving maximum exposure to the brand's products and services to a high volume of people at various locations.

- Vietnam has significant traditional billboards installed across various cities. According to Shojiki Advertising JSC, a well-known advertising firm, there are 17,135 large-sized outdoor billboards in Vietnam, most of which are located in the four major cities of Ho Chi Minh, Hanoi, Da Nang, and Can Tho.

- In December 2023, Location Media Xchange (LMX) and DOmedia formed a partnership to provide more than 15,000 OOH (out-of-home) advertising assets for purchase online through BillboardsIn.com, the most widely used local OOH ad marketplace in the world. Advertisers can now plan and purchase local ad campaigns across Singapore, Malaysia, Indonesia, Thailand, the Philippines, Vietnam, and India.

Malaysia to Witness Major Growth

- The Malaysian ooH market is expected to grow significantly in the coming years due to increased interest from advertisers and marketers, as well as the numerous benefits, such as the fact that ooH advertising remains one of the most cost-effective media channels for advertisers while also having a significant impact on consumers due to their contrast and size to the real-world environment.

- Additionally, demand for more innovative media in advertising is increasing among advertisers and brand owners around the country, thus positively impacting the ooH market's growth. Furthermore, in today's competitive market, the increasing focus of organizations in the country drives the demand for ooH solutions to create impactful ooH campaigns to increase their visibility and drive business growth.

- For instance, in December 2023, Vistar Media and Big Tree announced a partnership to bring a variety of premium digital screens to advertisers throughout Malaysia. Vistar Media is a global provider of programmatic technology for digital out-of-home (DooH), while Big Tree is a Malaysian out-of-home (ooH) advertising solutions provider. Through their collaboration, Vistar can effortlessly connect advertisers from around the world to Big Tree's network of 30 digital venues, which include outdoor billboards, retail shopping malls, and transit train stations.

- Similarly, in January 2022, Hivestack announced the launch of full operations in Malaysia. Several agencies, brands, and omnichannel demand-side platforms (DSPs) in Malaysia can access the Hivestack platform to plan, activate, and measure programmatic DOOH campaigns via private marketplace (PMP) and open exchange deals.

- Further, the growth in digital displays offers a promising future for the ooH market in the country. This has resulted in significant growth in the digital ooH segment in the past few years compared to the static ooH segment in the country. However, with technological advances, the static ooH segment is expected to hold a significant share in the coming years.

- The Malaysian DooH has been witnessing significant growth in the past two years and is expected to grow at a significant rate over the forecast period due to factors such as the digitization and automation trend, the increasing digitization of ooH billboards and displays across the country, and growth in demand from commercial sectors such as real estate, retail, and automotive.

- The demand for advertising in the country is driven by the many benefits of DooH campaigns, such as their high rate of recall and low cost compared to many other types of advertising. The improvements and new ideas that DooH market vendors have come up with have led to better personalization, better targeting, and more accurate measurement, which has helped the market grow quickly in the country.

South East Asia Digital Out-of-Home (DooH) Industry Overview

The Southeast Asian digital out-of-home (DooH) market is fragmented, with the presence of a few major companies. The companies continuously invest in strategic partnerships and product developments to gain market share.

April 2024: Plan B Media, a prominent provider of out-of-home (OOH) media services in Thailand and other Southeast Asian markets, partnered with Vistar Media, a leading programmatic solutions provider, to enhance the digital out-of-home (DOOH) advertising landscape in Thailand and Singapore. The collaboration aims to bring seamless programmatic solutions to the region's DooH advertising industry.

October 2023: Hivestack, the world's leading independent programmatic DooH ad tech company, expanded its presence in Thailand by partnering with UpMedia, a local media owner that specializes in elevator screens.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Ongoing Shift Toward Digital Advertising Aided by Increased Spending on Smart City Projects

- 4.2.2 High Demand from Commercial Segment

- 4.3 Market Challenges

- 4.3.1 Operational Challenges Related to Measurement of Advertising Effectiveness, Cost and Market Fragmentation

- 4.4 Key Global Cues Expected to Find their Way into the SEA DooH Market

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Industry Ecosystem Analysis

- 4.7 Impact of COVID-19 on the DooH Market

5 SOUTH EAST ASIA DooH MARKET LANDSCAPE

- 5.1 Malaysia DooH Market Landscape

- 5.1.1 Malaysia OoH Market

- 5.1.2 Malaysia DooH Market

- 5.1.3 Segmentation by Application

- 5.2 Singapore DooH Market Landscape

- 5.2.1 Singapore OoH Market

- 5.2.2 Singapore DooH Market

- 5.2.3 Segmentation by Application

- 5.3 Thailand DooH Market Landscape

- 5.3.1 Thailand OoH Market

- 5.3.2 Thailand DooH Market

- 5.3.3 Segmentation by Application

- 5.4 Indonesia DooH Market Landscape

- 5.4.1 Indonesia OoH Market

- 5.4.2 Indonesia DooH Market

- 5.4.3 Segmentation by Application

- 5.5 Philippines DooH Market Landscape

- 5.5.1 Philippines OoH Market

- 5.5.2 Philippines DooH Market

- 5.5.3 Segmentation by Application

- 5.6 Vietnam DooH Market Landscape

- 5.6.1 Vietnam OoH Market

- 5.6.2 Vietnam DooH Market

- 5.6.3 Segmentation by Application

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 JCDecaux Singapore Pte Ltd

- 6.1.2 Clear Channel Singapore Pte Ltd

- 6.1.3 Ooh!Media Digital PTY Limited

- 6.1.4 Hivestack Inc.

- 6.1.5 Moove Media Pte Ltd

- 6.1.6 SPHMBO (Singapore Press Holding Ltd)

- 6.1.7 Vistar Media

- 6.1.8 Talon outdoor limited

- 6.1.9 Mediatech Services Pte Ltd

- 6.1.10 Daktronics Inc.

- 6.1.11 Neosys Documail (S) Pte Ltd

- 6.1.12 TAC Media Sdb Bhd

- 6.1.13 Moving Walls

- 6.1.14 Pi Interactive (Brandlah)