|

市场调查报告书

商品编码

1693757

欧洲生物肥料:市场占有率分析、产业趋势与成长预测(2025-2030)Europe Biofertilizer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

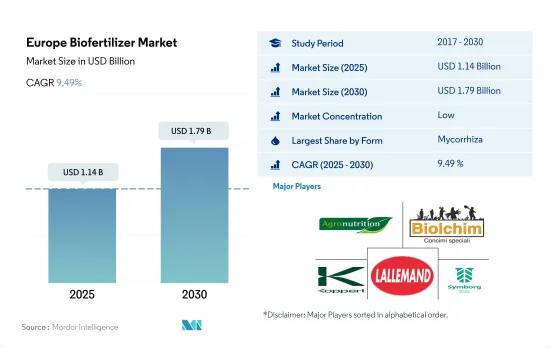

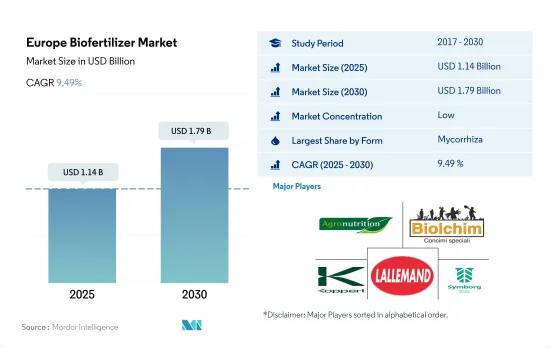

预计 2025 年欧洲生物肥料市场规模将达到 11.4 亿美元,预计到 2030 年将达到 17.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 9.49%。

- 生物肥料是活的微生物,可以透过调动或增加土壤中的养分供应来增强植物营养。农业中用作生物肥料最常见的微生物是菌根真菌、固氮螺菌、固氮菌、根瘤菌和解磷细菌。

- 在这些生物肥料中,菌根真菌在欧洲的应用最为广泛,市场占有率为 62.8%,2022 年价值为 5.495 亿美元。菌根是一种与植物根系形成共生关係的真菌。菌根真菌增加植物根部的表面积,促进养分的吸收。

- 根瘤菌是最重要的固氮菌,与植物共生,寄生于豆科植物的根瘤。根瘤菌将成为该地区第二大消费量生物肥料,到 2022 年将占 13.2%。

- 研究表明,根瘤菌的微生物活性可以在各种豆科作物中每公顷每年固定 40 至 250 公斤的氮。欧盟正计划透过扩大作物种植面积,实现永续植物蛋白生产的转变。此举可能会推动根瘤菌市场的发展。

- 固氮螺菌和固氮菌是自由生活的固氮细菌,可以固定大气中的氮并以非共生的方式提供给植物。生物固氮有助于土壤肥力和作物产量。由于食品生产需求的增加,欧洲对固氮菌的使用预计会扩大。

- 近年来,欧洲生物肥料市场经历了强劲成长,主要受到德国、法国和义大利等国家对有机食品需求不断增长的推动。 2017年至2022年间,该地区的有机种植面积将从490万公顷增加到730万公顷,而生物肥料市场将增加28.1%。

- 为了支持欧洲有机农业的发展,欧盟委员会于 2021 年发布了一项行动计划,旨在到 2030 年将成员国的有机种植面积增加到该地区农业用地面积的 25.0%。作为回应,该地区各国政府正在向有机农民提供补贴,并重新分配农业预算以促进有机农业。

- 例如,2022年,德国政府计画拨款354.6亿美元补贴有机农民,义大利政府则透过国家有机农业促进策略计画投资35.4亿美元。义大利的目标是到2027年将25.0%的农业用地转变为有机农业,比欧盟委员会设定的目标提早三年。

- 从市场消费来看,法国是欧洲最大的市场,2022年植物生物肥料的份额为21.1%,其次是义大利,占15.8%,西班牙占10.5%。

- 由于有机农业日益普及以及政府不断推出倡议推动农业向更永续的农业实践转变,欧洲生物肥料市场预计将持续成长。

欧洲生物肥料市场的趋势

欧洲绿色交易对有机农业的成长做出了巨大贡献,义大利是有机种植面积最大的国家。

- 欧洲国家在推广有机农业方面正在取得进展,过去十年被归类为有机农业的土地面积大幅增加。 2021年3月,欧盟委员会启动了“有机行动计画”,旨在实现《欧洲绿色交易》中到2030年25%的农业用地实现有机化的目标。奥地利、义大利、西班牙和德国是欧洲领先的有机农业国家。义大利有机耕种占其农业用地面积的 15.0%,高于欧盟 7.5% 的平均水准。

- 2021年,欧盟有机土地面积达1,470万公顷。农业生产区分为三大利用类型:作物(主要为谷物、根茎类作物和新鲜蔬菜)、永久性草地和永久性作物。 2021年,有机耕地面积为650万公顷,占欧盟有机农业总面积的46%。

- 2017年至2021年间,欧盟有机种植谷物、油籽、蛋白质作物和豆类的面积增加了32.6%,达到1,60万公顷以上。 2020年,种植多年生作物将达到130万公顷,占有机土地面积的15%。橄榄、葡萄、杏仁和柑橘类水果就是属于这一类作物的几个例子。西班牙、义大利和希腊是重要的有机橄榄种植国,近年来其种植面积分别为19.7万公顷、17.9万公顷和4.7万公顷。橄榄和葡萄对欧洲农业都至关重要,因为它们可以加工成国内外都需要的特色产品。该地区有机种植面积的增加可望增强欧洲有机农业产业。

该地区对有机产品的需求不断增加,人均支出不断增加

- 欧洲消费者越来越多地购买采用天然材料和工艺製成的产品。有机食品不再是小众产业,因为它在欧盟农业总产量中所占的份额仍然很小。欧盟是国际第二大有机产品单一市场,人均年支出为74.8美元。过去十年,欧洲人均有机食品支出翻了一番。 2020 年,瑞士和丹麦消费者在有机食品上的支出最高(人均分别为 494.09 美元和 453.90 美元)。

- 根据全球有机贸易数据,德国是欧洲最大的有机食品市场,也是仅次于美国的全球第二大有机食品市场,2021年市场规模达63亿美元,人均消费量达75.6美元。中国将占全球有机食品需求的 10.0%,预计 2021 年至 2026 年的复合年增长率为 2.7%。

- 法国有机食品市场成长强劲,2021年零售额成长12.6%。根据全球有机贸易数据,2021年法国人均有机食品支出为88.8美元。 2018年,根据法国生物技术署/精神洞察晴雨表的记录,88%的法国人表示他们曾经食用过有机产品。保护健康、环境和动物福利是法国消费有机食品的主要原因。西班牙、荷兰和瑞典等其他几个国家的有机市场也开始成长,纷纷开设有机商店。在新冠疫情期间和之后,有机食品的销量增加。这是因为消费者越来越关注健康问题,并且了解传统种植食品的负面影响。

欧洲生物肥料产业概况

欧洲生物肥料市场细分化,前五大公司占1.29%。该市场的主要企业有 Agronutrition、Biolchim SPA、Koppert Biological Systems Inc.、Lallemand Inc.、Symborg, Inc. 等。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3个月的分析师支持

目录

第一章执行摘要和主要发现

第二章 报告要约

第三章 引言

- 研究假设和市场定义

- 研究范围

- 调查方法

第四章 产业主要趋势

- 有机种植区

- 有机产品人均支出

- 法律规范

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 土耳其

- 英国

- 价值炼和通路分析

第五章市场区隔

- 形式

- 固氮螺菌

- 固氮菌

- 菌根真菌

- 解磷细菌

- 根瘤菌

- 其他生物肥料

- 作物类型

- 经济作物

- 园艺作物

- 田间作物

- 原产地

- 法国

- 德国

- 义大利

- 荷兰

- 俄罗斯

- 西班牙

- 土耳其

- 英国

- 其他欧洲国家

第六章竞争格局

- 关键策略趋势

- 市场占有率分析

- 商业状况

- 公司简介

- Agronutrition

- Andermatt Group AG

- Atlantica Agricola

- Biolchim SPA

- Bionema

- Ficosterra

- Koppert Biological Systems Inc.

- Lallemand Inc.

- Sustane Natural Fertilizer Inc.

- Symborg, Inc.

第七章 CEO 的关键策略问题

第 8 章 附录

- 世界概况

- 概述

- 五力分析框架

- 全球价值链分析

- 市场动态(DRO)

- 资讯来源及延伸阅读

- 图片列表

- 关键见解

- 数据包

- 词彙表

简介目录

Product Code: 500017

The Europe Biofertilizer Market size is estimated at 1.14 billion USD in 2025, and is expected to reach 1.79 billion USD by 2030, growing at a CAGR of 9.49% during the forecast period (2025-2030).

- Biofertilizers are living microorganisms that can enhance plant nutrition by either mobilizing or increasing nutrient availability in soils. The most common microorganisms used as biofertilizers in agriculture include mycorrhiza, Azospirillum, Azotobacter, Rhizobium, and phosphate-solubilizing bacteria.

- Among these biofertilizers, mycorrhiza is most predominantly used in Europe and accounted for a market share of 62.8% in 2022, with a value of USD 549.5 million. Mycorrhiza is a fungus that establishes a symbiotic relationship with the plant root system. It increases the root surface area of plants, enhancing their nutrient uptake.

- Rhizobium is the most important nitrogen-fixing bacterium that exists in a symbiotic relationship with plants and lives in the root nodules of leguminous plants. Rhizobium is the second most consumed biofertilizer in the region, accounting for a share of 13.2% in 2022.

- It has been found that 40-250 kg of nitrogen per hectare per year is fixed in different legume crops by the microbial activities of Rhizobium. The European Union is planning to transition toward sustainable plant protein production by expanding the area under leguminous crop cultivation. This move may potentially drive the Rhizobium segment of the market.

- Azospirillum and Azotobacter are free-living, nitrogen-fixing bacteria that can fix atmospheric nitrogen and make it available to plants in a non-symbiotic manner. Biological nitrogen fixation contributes to soil fertility and crop productivity. Due to the increasing demand for food production, the use of Azotobacter in the European region is anticipated to grow.

- The European biofertilizer market has experienced significant growth in recent years, primarily driven by the increasing demand for organically grown food in countries like Germany, France, and Italy. From 2017 to 2022, the region's organically cultivated area grew from 4.9 million hectares to 7.3 million hectares, resulting in a 28.1% increase in the biofertilizer market.

- To support the growth of organic farming practices in Europe, in 2021, the European Commission unveiled an action plan to increase the organic area in member countries to occupy 25.0% of the region's agricultural land area by 2030. In response, governments across the region are providing subsidies to organic farmers and diverting agricultural budgets toward promoting organic farming practices.

- For example, in 2022, the German government planned to subsidize organic farmers with a budget of USD 35.46 billion, while the Italian government invested USD 3.54 billion through the National Strategic Plan to promote organic agriculture. Italy aims to convert 25.0% of its agricultural land to organic farming by 2027, three years ahead of the target set by the European Commission.

- In terms of market consumption, France was the largest market in Europe for plant biofertilizers, accounting for a 21.1% share in 2022, followed by Italy and Spain accounting for 15.8% and 10.5%, respectively.

- The growth of the European biofertilizer market is expected to continue due to the increasing popularity of organic farming practices and rising government initiatives driving the transition toward more sustainable agricultural practices.

Europe Biofertilizer Market Trends

European Green Deal is majorly contributing for increasing organic cultivation, Italy majorly holding largest area under organic

- European countries are increasingly promoting organic farming, and the amount of land categorized as organic has significantly increased over the last 10 years. In March 2021, the European Commission launched an organic action plan to achieve the European Green Deal target of ensuring that 25% of agricultural land is under organic farming by 2030. Austria, Italy, Spain, and Germany are among the leading countries for organic cultivation in the European region. Italy has 15.0% of its agricultural area under organic farming, which is higher than the EU average of 7.5%.

- In 2021, organic land in the European Union was recorded at 14.7 million hectares. The agricultural production area is divided into three main types of use: arable land crops (mainly cereals, root crops, and fresh vegetables), permanent grassland, and permanent crops. The area of organic arable land was 6.5 million hectares in 2021, the equivalent of 46% of the European Union's total organic agricultural area.

- The organic cultivation area of cereals, oilseeds, protein crops, and pulses in the European Union increased by 32.6% between 2017 and 2021, amounting to more than 1.6 million hectares. With 1.3 million hectares in production, perennial crops accounted for 15% of the organic land in 2020. Olives, grapes, almonds, and citrus fruits are a few examples of crops in this group. Spain, Italy, and Greece are significant growers of organic olive trees, with 197,000, 179,000, and 47,000 hectares, respectively, in recent years. Both olives and grapes are crucial for the European agricultural industry because they can be turned into specialty products that are in demand locally and globally. The increasing organic acreage in the region is expected to strengthen the organic agricultural industry in Europe.

Growing demand and rising the per capita spending on organic products in the region

- European consumers are increasingly purchasing goods made using natural materials and methods. Even though organic food still only makes up a fraction of the European Union's overall agricultural production, it is no longer a niche industry. The European Union represents the second-largest single market for organic goods internationally, with an average per capita spending of USD 74.8 annually. The per capita spending on organic food in Europe has doubled in the last decade. In 2020, Swiss and Danish consumers spent the most on organic food (USD 494.09 and USD 453.90 per capita, respectively.

- Germany is the largest organic food market in Europe and the second largest market in the world after the United States, with a market size of USD 6.3 billion in 2021 and a per capita consumption of USD 75.6, as per Global Organic Trade data. The country accounted for 10.0% of the global organic food demand and is estimated to record a CAGR of 2.7% between 2021 and 2026.

- The organic food market in France witnessed strong growth, with a 12.6% rise in retail sales in 2021. The country's per capita spending on organic food was recorded at USD 88.8 in 2021, as per Global Organic Trade data. In 2018, as recorded by the Agence BIO/Spirit Insight Barometer, 88% of French people declared having consumed organic products. The preservation of health, environment, and animal welfare are the primary justifications for consuming organic foods in France. The organic market has begun to grow in several other nations, including Spain, the Netherlands, and Sweden, with the opening of organic stores. Organic food sales grew during and post the COVID-19 pandemic as consumers began paying more attention to health issues and learned the adverse effects of conventionally grown food.

Europe Biofertilizer Industry Overview

The Europe Biofertilizer Market is fragmented, with the top five companies occupying 1.29%. The major players in this market are Agronutrition, Biolchim SPA, Koppert Biological Systems Inc., Lallemand Inc. and Symborg, Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Area Under Organic Cultivation

- 4.2 Per Capita Spending On Organic Products

- 4.3 Regulatory Framework

- 4.3.1 France

- 4.3.2 Germany

- 4.3.3 Italy

- 4.3.4 Netherlands

- 4.3.5 Russia

- 4.3.6 Spain

- 4.3.7 Turkey

- 4.3.8 United Kingdom

- 4.4 Value Chain & Distribution Channel Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD and Volume, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Form

- 5.1.1 Azospirillum

- 5.1.2 Azotobacter

- 5.1.3 Mycorrhiza

- 5.1.4 Phosphate Solubilizing Bacteria

- 5.1.5 Rhizobium

- 5.1.6 Other Biofertilizers

- 5.2 Crop Type

- 5.2.1 Cash Crops

- 5.2.2 Horticultural Crops

- 5.2.3 Row Crops

- 5.3 Country

- 5.3.1 France

- 5.3.2 Germany

- 5.3.3 Italy

- 5.3.4 Netherlands

- 5.3.5 Russia

- 5.3.6 Spain

- 5.3.7 Turkey

- 5.3.8 United Kingdom

- 5.3.9 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 Agronutrition

- 6.4.2 Andermatt Group AG

- 6.4.3 Atlantica Agricola

- 6.4.4 Biolchim SPA

- 6.4.5 Bionema

- 6.4.6 Ficosterra

- 6.4.7 Koppert Biological Systems Inc.

- 6.4.8 Lallemand Inc.

- 6.4.9 Sustane Natural Fertilizer Inc.

- 6.4.10 Symborg, Inc.

7 KEY STRATEGIC QUESTIONS FOR AGRICULTURAL BIOLOGICALS CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

02-2729-4219

+886-2-2729-4219