|

市场调查报告书

商品编码

1850986

金融科技:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Fintech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

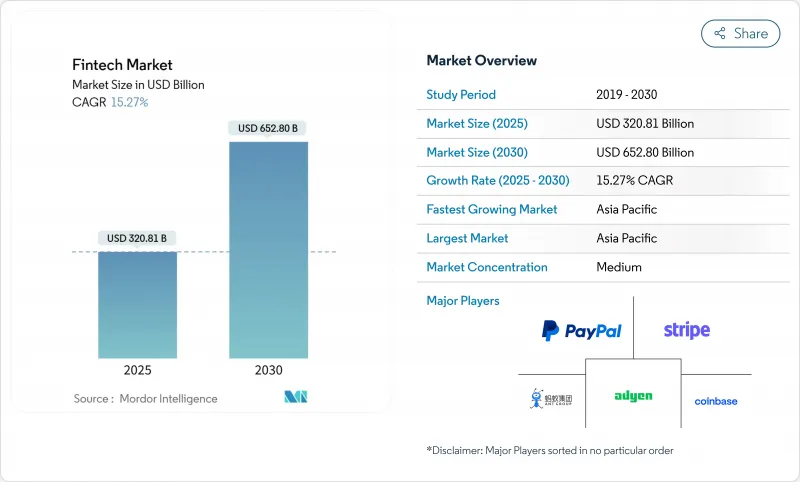

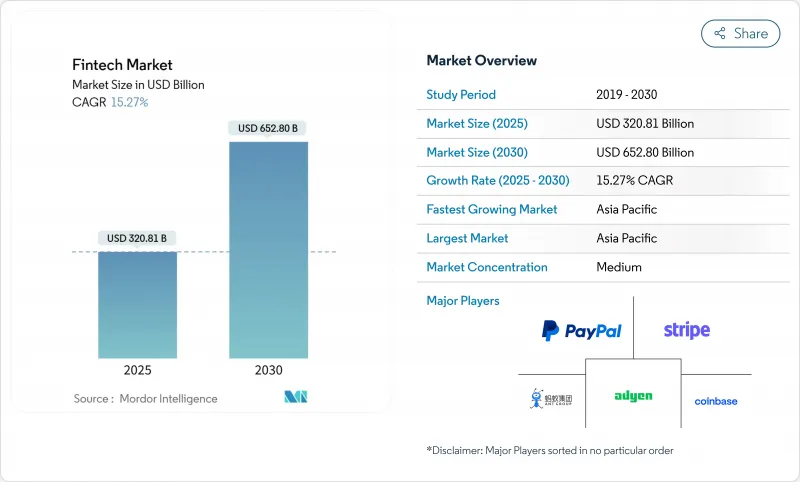

全球金融科技市场预计到 2025 年将达到 3,208.1 亿美元,到 2030 年将达到 6,528 亿美元。

强劲的利多因素包括:监管协调促进跨境扩张、即时支付管道加速交易流程以及开放银行数据的更广泛获取。随着平台巨头将情境化金融融入日常数位体验,商业与金融服务的落差日益缩小,竞争也日益激烈。用于诈欺预防、信用评估和个人化服务的AI工具正从实验性试点阶段走向大规模部署,这使得拥有深厚数据能力的公司更具优势。同时,资本市场也重新向盈利的金融科技业者开放,使它们能够筹集新资金筹措用于产品扩张和策略性收购。

全球金融科技市场趋势与洞察

强制性即时支付将加速金融科技的普及应用。

美国的FedNow和欧洲的SEPA即时信用转帐等央行系统正在将支付预期从数小时缩短至数秒。更快的支付方式为资金管理、小额贷款和现金流分析等领域带来了新的价值提案,帮助金融科技市场拓展先前依赖速度较慢的批量处理的企业客户。预计到2025年,美国的即时交易量将达到74亿笔,中国、英国和香港也将呈现类似的成长动能。整合支付请求、自动对帐和即时贷款等附加服务的供应商可以获得基于相同支付体系的持续收入来源。监管机构设定明确的过渡期限并更新最终结算规则后,快速普及的速度将最快。儘管支付网路互通性仍然是下一个挑战,但连接国内快速支付系统的初步试验已经证明了跨境模式的可行性。

开放银行和API标准化扩大了资料存取范围

欧洲的PSD2和巴西的开放金融体系表明,统一的API规范如何能够大规模地实现帐户聚合、余额确认和直接银行支付。标准化的授权流程将竞争焦点从资料囤积转向资料利用,从而促进了预测性核保和高度个人化的预算工具的开发。监管机构现在将开放金融视为关键的数位基础设施,其在美洲和亚太部分地区的应用正在加速。将金融科技银行提供的数据与商家、通讯业者和社交讯号结合的平台建构了更丰富的风险模型,从而降低了违约率并扩大了信贷覆盖范围。这种模式正在培育一个可互通的金融科技市场生态系统,在这个生态系统中,规模较小的供应商可以利用第三方分析,并在服务品质而非客户覆盖范围方面与现有企业竞争。

加强对先买后付模式的监管

英国、美国和澳洲的消费者保护机构正在起草相关规则,将「先买后付」(BNPL)产品归类为信贷产品,并强制要求进行支付能力审核、标准化资讯揭露和困难通讯协定。服务提供者必须整合软体查询信用机构,升级争议解决流程,并调整收入模式,减少对滞纳金的依赖。合规成本将会增加,进而推动产业整合,并与已持有贷款执照的受监管金融机构建立合作关係。虽然零售商短期内可能不会迅速采用「先买后付」结帐方式,但透明的条款有望随着时间的推移扩大其潜在客户群。一旦统一的框架建立,那些积极整合符合金融科技监管规定的资料栏位和还款分析技术的公司将占据有利地位。

细分市场分析

新银行虽然在金融科技市场中所占份额较小,但到2030年将以18.7%的复合年增长率快速增长,标誌着银行业正从以分店为中心向以应用程序为中心发生决定性转变。更快的功能、透明的定价和个人化的洞察,使新银行能够吸引更年轻、更依赖行动装置的消费者。传统金融机构将透过加速建立数位子公司和核心银行系统现代化来应对,缩小体验差距,同时增加技术预算。数位支付解决方案仍将是获取客户的重要途径,预计到2024年将占据金融科技市场份额的46.2%。服务提供者正在将诈欺分析、忠诚度整合和营运资金贷款等功能迭加到支付管道中,将低利润的处理环节转化为捆绑式加值提案,从而提高客户终身收入。

除了钱包和银行卡之外,保险科技 (InsurTech)、财富科技 (WealthTech) 和监管科技 (RegTech) 正在开闢独特的道路,资料科学和自动化正在颠覆传统流程。基于使用量的保险和人工智慧驱动的理赔分流正在降低保险公司的赔付率,并吸引保险公司与云端供应商进行合资合作。在财富管理领域,部分所有权和自动再平衡正在使投资更加民主化,而合规自动化工具则正在将新的报告义务货币化。能够在单一体验中编配多种服务的提案将决定未来的赢家,金融科技平台正在朝向模组化架构发展,使用户能够在支付、信贷、储蓄和保障之间自由切换。

区域分析

亚太地区将在2024年占据全球金融科技市场44.86%的份额,并在2030年之前以16.02%的复合年增长率成长。中国的超级应用生态系统和印度的UPI支付系统,以及东南亚降低进入门槛的数位银行牌照项目,都在推动该地区的成长。各国政府正将金融科技视为普惠金融的槓桿,简化电子KYC规范并建立监理沙盒。区域内的现有企业也纷纷设立策略性创投部门,为新兴企业注入资金,利用其创新能力,并对冲颠覆性风险。

儘管用户渗透率日趋成熟,北美仍是创新强劲的地区。人工智慧驱动的个人化服务、加密资产服务和云端原生核心银行系统正在成为差异化服务,监管机构也为稳定币和数位资产託管提供了明确的指南。吸取了重大网路安全事件的教训,资金筹措正转向拥有安全资料交换通讯协定的公司。该地区的金融科技市场持续受益于雄厚的资本市场,这些市场对绩效可靠的收入留存率和交叉销售指标给予奖励。

欧洲的监理领导力正在塑造金融科技的发展轨迹。 PSD2促进了开放银行平台的建设,MiCA使加密资产发行更加透明,DORA则制定了严格的营运弹性规则。这些框架催生了专业的监管科技供应商和合规即服务产品,从而开闢了新的收入来源。欧洲的新兴银行在多币种体系下提供在地化服务,并采用跨币种牌照制度以扩大规模。此外,绿色金融的迫切需求也推动了气候数据平台的发展,这些平台能够衡量交易层面的范围3排放。

南美洲的支付普及率正快速攀升,这主要得益于巴西的PIX即时支付网路。庞大的无银行帐户人口和行动优先的消费习惯,使其成为电子钱包提供商、数位贷款机构和微型保险计划的沃土。监管开放的银行帐户测试环境吸引了国际资本,而本土领导企业则透过提供低成本汇款和与公用事业收费帐单记录挂钩的信用评分,不断扩大该地区的规模。随着基础设施的日趋成熟,该地区正向其他新兴市场输出人才和产品框架。

中东和非洲蕴藏着多元化的商业机会。波湾合作理事会成员国正在发放数位银行牌照,扶持政府支持的金融科技加速器,并将国家财富投资于以人工智慧为中心的金融计画。非洲的行动支付网路在交易量方面保持全球领先地位,汇款通道也正在与侨民电子钱包进行整合。区域金融科技主题包括符合伊斯兰教法的嵌入式金融、低手续费的跨境汇款以及利用卫星农业数据促进的农业投入融资。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 透过即时支付授权(FedNow、SEPA即时信用转帐)加速金融科技的普及

- 开放银行和API标准化(PSD2、巴西开放金融)扩大资料访问

- 中国和印度的央行数位货币试点计画推动基础设施升级

- 亚洲电子商务平台嵌入式金融的兴起

- 中东、北非和拉丁美洲中小企业信贷缺口推动了数位借贷平台的发展

- 与ESG相关的金融科技解决方案吸引了欧洲绿色投资基金。

- 市场限制

- 加强对先买后付模式的监管

- 复杂的诈骗和深度造假会带来身分风险。

- 云浓度过高可能导致单点故障风险

- 冬季资金筹措和估值调整抑制了规模扩张

- 价值/供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 买方/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 投资和资金筹措趋势分析

第五章 市场规模与成长预测

- 按服务方案

- 数位支付

- 数位借贷和金融

- 数位投资

- 保险科技

- 新银行

- 最终用户

- 零售

- 公司

- 透过使用者介面

- 行动应用

- 网页/浏览器

- POS/物联网设备

- 按地区

- 北美洲

- 美国

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥伦比亚

- 其他南美洲

- 欧洲

- 英国

- 德国

- 法国

- 西班牙

- 义大利

- 比荷卢经济联盟(比利时、荷兰、卢森堡)

- 北欧国家(瑞典、挪威、丹麦、芬兰、冰岛)

- 其他欧洲地区

- 亚太地区

- 中国

- 印度

- 日本

- 韩国

- 澳洲

- 东南亚(新加坡、印尼、马来西亚、泰国、越南、菲律宾)

- 亚太其他地区

- 中东和非洲

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

- 其他中东和非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- PayPal Holdings Inc.

- Ant Group Co. Ltd.

- Stripe Inc.

- Block Inc.(Square, Cash App)

- Adyen NV

- Coinbase Global Inc.

- Robinhood Markets Inc.

- Revolut Ltd.

- Klarna Bank AB

- N26 GmbH

- SoFi Technologies Inc.

- Nubank(Nu Holdings)

- Wise plc

- Afterpay Ltd.

- FIS Global

- Fiserv Inc.

- Intuit Inc.

- M-PESA(Vodafone/Safaricom)

- Paytm Digital Payments Ltd.

- Razorpay Software Pvt Ltd.

第七章 市场机会与未来展望

The global fintech market reached USD 320.81 billion in 2025 and is forecasted to climb to USD 652.80 billion by 2030, reflecting a sturdy 15.27% CAGR over the period.

Strong tailwinds include harmonizing regulations that ease cross-border expansion, real-time payment rails that accelerate transaction flows, and widening access to open-banking data. Competitive intensity is heightening as platform giants embed contextual finance into everyday digital journeys, shrinking the gap between commerce and financial services. Artificial-intelligence tools for fraud prevention, credit decisioning, and personalized offers are moving from experimental pilots to scale deployments, tilting the advantage toward firms with deep data capabilities. Simultaneously, capital markets are reopening for profitable fintech operators, enabling fresh funding for product expansion and strategic acquisitions.

Global Fintech Market Trends and Insights

Real-time payments mandates accelerating fintech adoption

Central-bank systems such as FedNow in the United States and SEPA Instant Credit Transfer in Europe are transforming settlement expectations from hours to seconds. Faster clearing underpins new value propositions in treasury management, micro-lending, and cash-flow analytics, helping the fintech market reach enterprise customers that once relied on slower batch processes. In 2025, U.S. real-time transactions are expected to hit 7.4 billion, and similar momentum is visible in China, the United Kingdom, and Hong Kong. Providers that integrate overlay services-request to pay, automated reconciliation, and just-in-time financing-gain sticky revenue streams grounded in the same rails. Adoption is most rapid where regulators set explicit migration deadlines and update settlement finality rules. Payment-network interoperability remains the next hurdle, but pilots linking domestic faster-payment systems already demonstrate viable cross-border models.

Open-banking & API standardization broadening data access

PSD2 in Europe and Brazil's Open Finance regime prove that uniform API specifications can unlock account aggregation, balance verification, and direct-from-bank payments at scale. Standardized consent flows shift competition away from data hoarding toward data utilization, encouraging predictive underwriting and hyper-personalized budgeting tools. Regulators now treat open finance as critical digital infrastructure, prompting adoption across the Americas and parts of Asia-Pacific. Fintech platforms that pair bank-sourced data with merchant, telecom, or social signals create richer risk models, lowering default rates and broadening credit access. The pattern is fostering interoperable fintech market ecosystems where smaller providers tap third-party analytics to compete against incumbents on service quality rather than raw customer reach.

Regulatory clamp-down on BNPL models

Consumer-protection agencies in the United Kingdom, the United States, and Australia are drafting rules that classify BNPL products as credit, mandating affordability checks, standardized disclosures, and hardship protocols. Providers must integrate soft-pull credit bureaus, upgrade dispute-resolution workflows, and adjust revenue models away from late-fee dependency. Compliance costs rise, encouraging consolidation and alliances with regulated lenders that already hold lending licenses. Retailers may experience slower BNPL checkout adoption in the near term, but transparent terms could expand the addressable base over time. Fintech firms that pre-emptively embed regulation-ready data fields and repayment analytics create defensible positions once uniform frameworks crystallize.

Other drivers and restraints analyzed in the detailed report include:

- CBDC pilots in China & India driving infrastructure upgrades

- Rise of embedded finance among Asian e-commerce platforms

- Sophisticated fraud & deepfake-based identity risks

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Neobanking accounts for a modest slice of the fintech market size yet posts the fastest 18.7% CAGR to 2030, signaling a decisive shift from branch-centric to app-centric banking. Feature velocity, transparent pricing, and personalized insights allow neobanks to capture young, mobile-first consumers. Established lenders react with digital subsidiaries and accelerated core-bank modernization, narrowing the experiential gap but raising technology budgets. Digital-payments solutions hold 46.2% of the fintech market share in 2024 and remain vital gateways for customer acquisition. Providers layer fraud-analytics, loyalty integrations, and working-capital loans onto payment rails, turning low-margin processing into bundled value propositions that lift customer lifetime revenue.

Expanding beyond wallets and cards, insurtech, wealth-tech, and reg-tech carve specialized lanes where data science and automation can upend legacy processes. Usage-based insurance and AI-driven claims triage cut carrier loss ratios, attracting joint ventures between insurers and cloud vendors. In wealth management, fractional ownership and automated rebalancing democratize investing, while compliance-automation tools monetize new reporting mandates. The ability to orchestrate multiple service propositions within a single experience defines future winners, pushing fintech platforms toward modular architectures that let users toggle between payments, credit, savings, and protection.

The Fintech Market is Segmented by Service Proposition (Digital Payments, Digital Lending and Financing, Digital Investments, Insurtech, and Neobanking), by End-User (Retail and Businesses), by User Interface (Mobile Applications, Web / Browser, and POS / IoT Devices), and by Region (North America, South America, Europe, Asia-Pacific, & Middle East and Africa). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific commanded 44.86% of the fintech market in 2024 and is on track for a 16.02% CAGR through 2030. China's super-app ecosystem and India's UPI rails anchor regional growth, joined by Southeast Asian digital-bank license programs that lower entry barriers. Governments treat fintech as a lever for economic inclusion, streamlining e-KYC norms and nurturing sandboxes. Regional incumbents respond with strategic venture arms that inject capital into start-ups, hedging disruption risk while tapping novel capabilities.

North America remains an innovative powerhouse despite maturing user penetration. AI-driven personalization, crypto-asset services, and cloud-native core banking differentiate offerings as regulators provide clearer guidance on stablecoins and digital-asset custody. Venture funding gravitates toward firms with secure data-exchange protocols, reflecting lessons from high-profile cyber incidents. The fintech market in the region continues to benefit from deep capital markets that reward proven revenue retention and cross-selling metrics.

Europe's regulatory leadership shapes its fintech trajectory. PSD2 catalyzed open-banking platforms, MiCA brings clarity to crypto-asset issuance, and DORA sets stringent operational-resilience rules. These frameworks spawn specialized reg-tech vendors and compliance-as-a-service products, adding new revenue layers. Continental neobanks localize services across multi-currency regimes while passporting licenses to scale. Additionally, green-finance imperatives stimulate climate-data fintech platforms that measure scope-3 emissions at the transaction level.

South America showcases rising adoption curves anchored by Brazil's PIX instant-payment network. Large unbanked populations and mobile-first behavior create fertile ground for wallet providers, digital lenders, and micro-insurance schemes. Regulatory openness to sandbox testing attracts international capital, and domestic champions scale regionally by offering low-cost remittances and credit scoring tied to utility-bill histories. As the infrastructure matures, the region exports talent and product frameworks to other emerging markets.

Middle East and Africa present heterogeneous opportunity sets. Gulf Cooperation Council states issue digital-bank licenses, host government-backed fintech accelerators, and invest sovereign wealth in AI-centric finance ventures. Africa's mobile-money rails remain the world leading in transaction volume, and remittance corridors integrate with diaspora wallets abroad. Regional fintech themes include Sharia-compliant embedded finance, low-fee cross-border transfers, and agricultural-input lending facilitated via satellite agronomy data.

List of Companies Covered in this Report:

- PayPal Holdings Inc.

- Ant Group Co. Ltd.

- Stripe Inc.

- Block Inc. (Square, Cash App)

- Adyen N.V.

- Coinbase Global Inc.

- Robinhood Markets Inc.

- Revolut Ltd.

- Klarna Bank AB

- N26 GmbH

- SoFi Technologies Inc.

- Nubank (Nu Holdings)

- Wise plc

- Afterpay Ltd.

- FIS Global

- Fiserv Inc.

- Intuit Inc.

- M-PESA (Vodafone / Safaricom)

- Paytm Digital Payments Ltd.

- Razorpay Software Pvt Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Real-time Payments Mandates (FedNow, SEPA Instant Credit Transfer) Accelerating Fintech Adoption

- 4.2.2 Open-Banking & API Standardization (PSD2, Brazil Open Finance) Broadening Data Access

- 4.2.3 CBDC Pilots in China & India Driving Fintech Infrastructure Upgrades

- 4.2.4 Rise of Embedded-Finance Among Asian E-commerce Platforms

- 4.2.5 SME Credit Gap in MENA & South America Fueling Digital Lending Platforms

- 4.2.6 ESG-Linked Fintech Solutions Attracting Green-Investment Funds in Europe

- 4.3 Market Restraints

- 4.3.1 Regulatory Clamp-down on BNPL Models

- 4.3.2 Sophisticated Fraud & Deepfake?based Identity Risks

- 4.3.3 Cloud-Concentration Risk Creating Single Points-of-Failure

- 4.3.4 Funding Winter & Valuation Corrections Curbing Scale-ups

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Investment & Funding Trend Analysis

5 Market Size & Growth Forecasts (Value)

- 5.1 By Service Proposition

- 5.1.1 Digital Payments

- 5.1.2 Digital Lending and Financing

- 5.1.3 Digital Investments

- 5.1.4 Insurtech

- 5.1.5 Neobanking

- 5.2 By End-User

- 5.2.1 Retail

- 5.2.2 Businesses

- 5.3 By User Interface

- 5.3.1 Mobile Applications

- 5.3.2 Web / Browser

- 5.3.3 POS / IoT Devices

- 5.4 By Region

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.1.3 Mexico

- 5.4.2 South America

- 5.4.2.1 Brazil

- 5.4.2.2 Argentina

- 5.4.2.3 Chile

- 5.4.2.4 Colombia

- 5.4.2.5 Rest of South America

- 5.4.3 Europe

- 5.4.3.1 United Kingdom

- 5.4.3.2 Germany

- 5.4.3.3 France

- 5.4.3.4 Spain

- 5.4.3.5 Italy

- 5.4.3.6 Benelux (Belgium, Netherlands, and Luxembourg)

- 5.4.3.7 Nordics (Sweden, Norway, Denmark, Finland, and Iceland)

- 5.4.3.8 Rest of Europe

- 5.4.4 Asia-Pacific

- 5.4.4.1 China

- 5.4.4.2 India

- 5.4.4.3 Japan

- 5.4.4.4 South Korea

- 5.4.4.5 Australia

- 5.4.4.6 South-East Asia (Singapore, Indonesia, Malaysia, Thailand, Vietnam, and Philippines)

- 5.4.4.7 Rest of Asia-Pacific

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 South Africa

- 5.4.5.4 Nigeria

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market Level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for Key Companies, Products & Services, and Recent Developments)

- 6.4.1 PayPal Holdings Inc.

- 6.4.2 Ant Group Co. Ltd.

- 6.4.3 Stripe Inc.

- 6.4.4 Block Inc. (Square, Cash App)

- 6.4.5 Adyen N.V.

- 6.4.6 Coinbase Global Inc.

- 6.4.7 Robinhood Markets Inc.

- 6.4.8 Revolut Ltd.

- 6.4.9 Klarna Bank AB

- 6.4.10 N26 GmbH

- 6.4.11 SoFi Technologies Inc.

- 6.4.12 Nubank (Nu Holdings)

- 6.4.13 Wise plc

- 6.4.14 Afterpay Ltd.

- 6.4.15 FIS Global

- 6.4.16 Fiserv Inc.

- 6.4.17 Intuit Inc.

- 6.4.18 M-PESA (Vodafone / Safaricom)

- 6.4.19 Paytm Digital Payments Ltd.

- 6.4.20 Razorpay Software Pvt Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment