|

市场调查报告书

商品编码

1851807

先进积体电路基板:市场占有率分析、产业趋势、统计数据和成长预测(2025-2030 年)Advanced IC Substrates - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

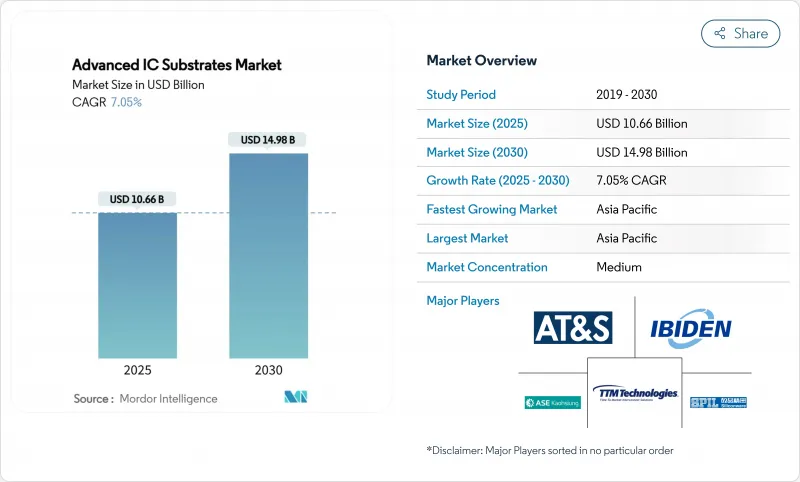

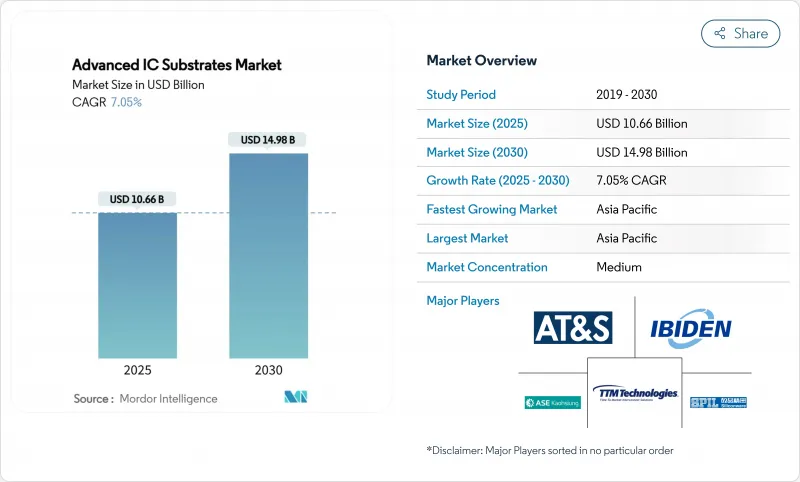

预计到 2025 年,先进 IC基板市场规模将达到 106.6 亿美元,到 2030 年将达到 149.8 亿美元,年复合成长率为 7.05%。

市场需求已从传统运算转向以人工智慧为中心的工作负载,这些工作负载需要更高的层数、更精细的线宽和更严格的翘曲控制。亚太地区的基板供应商受益于此转变,因为他们已经拥有大规模的ABF生产能力,并且与代工厂的封装生产线有着紧密的联繫。一家大型云端服务供应商将长期采购协议的期限提前至2025年,以确保CoWoS和FC-BGA的供应安全,这进一步增强了基板製造商的定价权。同时,玻璃芯技术的创新日趋成熟,为计划在本十年后半期商业化的超高密度封装提供了ABF以外的战略选择。

全球先进积体电路基板市场趋势与洞察

AI/HPC加速器对ABF基板的需求快速成长

2025年生成式人工智慧伺服器的大规模部署导致味之素增材製造膜(ABF)供应紧张,ABF面板的前置作业时间超过35週,现货价格溢价高达25%,远超2024年的合约价格。台湾供应商优尼美光、金硕和南亚PCB在经历了长期的库存调整后,营收已恢復两位数成长,但仍以90%的运转率维持营运以满足需求。三星马达在2025年第二季提高了其用于人工智慧的ABF产量,并开始试生产玻璃芯。台积电已宣布计划将其CoWoS年产量翻番,这意味着基板需求将显着超过现有产能。综上所述,这些发展导致供应缺口扩大了20%, 基板製造商预计,这一缺口要等到2026年新生产线运作后才能弥补。

小型化和异质整合趋势

晶片组架构、无芯中介层和硅通孔技术重新定义了封装设计规则,推动基板线宽在製造过程中降至 10µm 以下。应用材料公司强调,与单晶片晶粒相比,封装内整合离散晶片组可实现更高的每瓦性能。拓普科技推出了一种无芯有机中介层,其热膨胀係数比传统的 ABF 解决方案低 45%,从而减轻了多晶粒堆迭中的机械应力。博通公司的 3.5D XDSiP 技术整合了超过 6000mm² 的硅片和 12 个 HBM 堆迭,显示市场对能够在有限空间内布线数千个高速讯号的基板的需求日益增长。台积电和日月光已投资建造尺寸达 310 x 310mm 的面板级封装生产线,以提高步进马达效率并降低每平方英吋成本。这些变化使先进 IC基板市场成为下一代运算密度的关键推动因素。

ABF基板物产能短缺及前置作业时间急剧增加

2024-2025 年先进 IC基板市场受限于 ABF 面板产能的持续短缺。 ABF 树脂的近乎独家供应商味之素承认,在新的树脂反应器于 2026 年运作之前,供需缺口将达到 20%。代工厂也证实了这项限制,台积电宣布只能满足 80% 的 CoWoS 需求。积水化学等竞争对手试图摆脱对其他积层製造流程的依赖,但高阶 AI 封装的认证週期减缓了其应用。日东纺持续面临低热膨胀係数 T 型玻璃芯材的短缺,导致产能扩张受阻,前置作业时间显着延长。基板製造商实施了线上计量以提高一次产量比率并扩大现有产能,但大多数客户在 2025 年之前仍需遵守配额计划。

细分市场分析

2024年,FC-BGA基板占据了先进IC基板市场45%的份额。 FC-BGA基板凭藉其在AI加速器和伺服器CPU中所需的成熟电气性能而占据主导地位。由于GPU製造商竞相确保产能,其利用率在2025年仍维持高位。然而,成长重心转向了用于汽车网域控制器和折迭式行动装置的软硬复合CSP生产线。软硬复合CSP的产量以8.1%的复合年增长率成长,吸引了能够平衡弯曲半径和可控电阻的新型层压板供应商。 FC-CSP继续为中阶行动处理器提供动力,但成本压力限制了平均售价的成长。有机BGA/LGA继续用于传统桌面平台,但其设计优势已被覆晶方案所取代。面板级FC基板(仍归类于「其他」)目前正由台积电和日月光进行试验和量产,使每个面板的可用面积增加了七倍,并创造了新的规模经济效益。

FC-BGA 仍然是 CoWoS 製造流程的主力军。设计人员要求 14-26 层,这迫使对套准精度抗蚀剂更高的要求。为了应对这项挑战,基板製造商采用了人工智慧光学检测技术,以便在迭层早期检测过孔到走线的偏差。随着汽车製造商将资讯娱乐系统升级到 15 吋曲面显示屏,需要 Z 轴方向的柔性,软硬复合CSP 也从中受益。此外,折迭式产品中摄影机整合度的提高也促进了刚挠性 CSP 的发展。这些动态共同支撑了软硬复合在 2030 年前的持续流行,而 FC-BGA 将在先进 IC基板市场保持其高价值地位。

预计到2024年,ABF将占据先进IC基板市场61%的份额。味之素专有的树脂配方赢得了客户在2.5D和3D堆迭领域的信赖,确保了稳定的介电性能和可钻孔性。供应商在2025年扩大了ABF混合车间,但产量成长落后于需求,增强了卖方的议价能力。玻璃基板在2024年的出货量占比不到2%,但预计复合年增长率将达到14.1%。玻璃基板在200mm x 200mm尺寸下具有±5µm的平整度,与ABF相比,能够实现更精细的重分布层和更高的I/O密度。英特尔退出内部研发,促使第三方玻璃供应商获得认可,并加速了生态系统的完善。

在汽车控制单元领域,BT树脂仍占有重要地位,因为基板温度通常高达150°C。陶瓷和低温共烧陶瓷(LTCC)晶片为承受持续热循环的功率元件提供动力,在ABF晶片产能过剩时,它们能够提供一定的收入缓衝。玻璃基板的认证在通孔形成均匀性方面面临挑战,但早期生产的良率在回流焊接过程中显示出良好的翘曲指标。 AMD已表示计划将2026年的CPU平台转向玻璃基板,并敦促基板製造商在量产爬坡推出确保产能。如果产量比率能够维持稳定,到2030年,玻璃基板的收入份额可望达到或超过5%。

先进 IC基板市场按基板类型(FC-BGA、FC-CSP、有机 BGA/LGA 等)、核心材料(ABF、BT、玻璃等)、封装技术(2D覆晶、2.5D 中介层等)、装置节点(≥28 奈米、16/14-10 奈米地区等)、终端用户(A.A)、终端用户、北美地区运输/北美地区、北美地区和亚地区运输公司。

区域分析

到2024年,亚太地区将占据先进积体电路基板市场69%的份额。台湾的优尼美光、金硕和南亚PCB预计将在2025年恢復两位数成长,因为人工智慧伺服器的需求将取代2023年库存调整对出货量造成的负面影响。日本在3.9兆日圆(约255亿美元)的补贴下重振经济,重新将九州打造成为以台积电熊本工厂为中心的封装中心。韩国宣布了一项4,710亿美元的综合丛集计划,旨在逻辑晶片厂附近建设ABF-CoWoS生产线,目标是到2030年将晶圆月产量提升至770万片。中国推出了区域奖励以扩大覆晶和SiP产能,但出口限制阻碍了工具的获取,并减缓了玻璃芯的普及。

在北美,根据《晶片封装和封装法案》(CHIPS Act)进行的在地化工作取得了进展。台积电位于亚利桑那州的园区已转型为六晶圆厂布局,并计划增设ABF生产线以降低风险。 Entegris公司获得了高达7500万美元的联邦资金,用于基板镀铜过程中使用的过滤介质。一家大型OSAT公司评估了扩大其美国业务以满足国防晶片封装需求的可能性,儘管该公司也对薪资上涨表示担忧。

欧洲的重点是汽车和功率装置。安森美半导体(OnSemi)位于捷克的碳化硅(SiC)工厂在欧洲建立了一条完整的逆变器基板供应链。德国和法国探索了一条联合ABF(先进基板製造)试点生产线,以支援英特尔和台积电的代工厂扩张。同时,越南、印度和马来西亚寻求组装补贴。安姆科(Amcor)在北宁省开设了一家价值16亿美元的工厂,印度核准了760亿卢比(约9.1亿美元)的OSAT合资企业,该合资企业由CG Power和瑞萨电子主导。这些倡议分散了先进积体电路基板市场的地理风险。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- AI/HPC加速器对ABF基板的需求激增

- 小型化和异质整合趋势

- 5G 的普及促进了高频射频封装的发展

- 汽车和电动车的电气化需要高度可靠的基板。

- 玻璃芯基板可解锁两倍以上的层数。

- 与基板工厂相关的晶片类补贴

- 市场限制

- ABF基板生产能力短缺和前置作业时间突然增加

- 高资本密集度和复杂流程

- 覆铜板价格波动

- 加强积垢膜化学物质排放的监管

- 价值链分析

- 监管环境

- 技术展望

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 定价分析

- 宏观经济因素的影响

第五章 市场规模与成长预测

- 基板类型

- FC-BGA

- FC-CSP

- 有机BGA/LGA

- 刚柔结合型和柔性CSP

- 其他的

- 依核心材料

- ABF

- BT

- 玻璃

- LTCC/HTCC

- 陶瓷製品

- 透过包装技术

- 2D覆晶

- 2.5D 中介层

- 3D-IC/SoIC

- 扇出WLP

- SiP/模组

- 按器件节点(nm)

- 28奈米或以上

- 16/14-10 nm

- 7-5 nm

- 4奈米或更小

- 按最终用途行业划分

- 行动和消费者

- 汽车与运输

- 资讯科技和通讯基础设施

- 资料中心/人工智慧和高效能运算

- 工业、医疗及其他

- 按地区

- 北美洲

- 美国

- 加拿大

- 南美洲

- 巴西

- 其他南美洲国家

- 欧洲

- 德国

- 法国

- 英国

- 义大利

- 西班牙

- 俄罗斯

- 其他欧洲地区

- 亚太地区

- 中国

- 日本

- 韩国

- 台湾

- 印度

- 亚太其他地区

- 中东和非洲

- 中东

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 土耳其

- 其他中东地区

- 非洲

- 南非

- 奈及利亚

- 其他非洲地区

- 北美洲

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- ASE Technology Holding Co., Ltd.

- AT&S Austria Technologie & Systemtechnik AG

- Siliconware Precision Industries Co., Ltd.

- TTM Technologies, Inc.

- Ibiden Co., Ltd.

- Kyocera Corporation

- Fujitsu Interconnect Technologies Ltd.

- JCET Group Co., Ltd.

- Panasonic Holdings Corporation

- Kinsus Interconnect Technology Corp.

- Unimicron Technology Corp.

- Nan Ya Printed Circuit Board Corp.

- Samsung Electro-Mechanics Co., Ltd.

- LG Innotek Co., Ltd.

- Simmtech Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Shennan Circuits Co., Ltd.

- Zhen Ding Technology Holding Ltd.

- Daeduck Electronics Co., Ltd.

- Meiko Electronics Co., Ltd.

- WUS Printed Circuit Co., Ltd.

- Zhejiang Kingdom Sci-Tech Co., Ltd.

- SKC Absolics Inc.

- Tripod Technology Corp.

- Toppan Inc.

第七章 市场机会与未来展望

The advanced IC substrates market size stood at USD 10.66 billion in 2025 and is forecast to climb to USD 14.98 billion by 2030, translating into a 7.05% CAGR.

Demand shifted decisively from traditional computing toward AI-centric workloads that require higher layer counts, finer linewidths, and tighter warpage control. Asia-Pacific-based substrate vendors benefited from this pivot because they already possessed high-volume ABF capacity and close relationships with foundry packaging lines. Major cloud service providers accelerated long-term purchase agreements in 2025 to secure guaranteed CoWoS and FC-BGA supply, further tilting pricing power to substrate producers. At the same time, glass-core innovation matured, creating a strategic alternative to ABF for ultra-high-density packages scheduled for commercial release in the latter half of the decade.

Global Advanced IC Substrates Market Trends and Insights

Surge in ABF-substrate demand for AI/HPC accelerators

Massive roll-outs of generative-AI servers in 2025 tightened supplies of Ajinomoto Build-up Film, pushing lead-times for ABF panels past 35 weeks and triggering spot-price premiums of up to 25% over 2024 contract levels. Taiwanese suppliers Unimicron, Kinsus, and Nan Ya PCB restored double-digit revenue growth after concluding a prolonged inventory correction, yet still operated at 90% utilization to keep pace with demand. Samsung Electro-Mechanics ramped AI-oriented ABF volume in Q2 2025 and started pilot glass-core runs, reflecting a dual-sourcing strategy aimed at mitigating single-material risk. TSMC disclosed plans to double annual CoWoS output, implying substrate demand well above existing capacity. Collectively, these moves widened a 20% supply gap that substrate makers do not expect to close until fresh lines come online in 2026.

Miniaturization and heterogeneous integration trend

Chiplet architectures, coreless interposers, and through-silicon vias redefined package design rules and pushed substrate line-widths below 10 µm in production settings. Applied Materials highlighted that on-package integration of discrete chiplets delivered superior performance per watt compared with monolithic die approaches. TOPPAN unveiled a coreless organic interposer with a 45% lower coefficient of thermal expansion than legacy ABF solutions, easing mechanical stress inside multi-die stacks. Broadcom's 3.5D XDSiP technology integrated more than 6,000 mm2 of silicon and 12 HBM stacks, underscoring the demand for substrates that can route thousands of high-speed signals in confined footprints. TSMC and ASE invested in panel-level packaging lines up to 310 X 310 mm to gain stepper efficiency and reduce cost per square inch. These shifts position the advanced IC substrates market as a pivotal enabler for next-generation compute density.

ABF-substrate capacity shortage and lead-time spikes

A persistent deficit in ABF panel output restricted upside for the advanced IC substrates market during 2024-2025. Ajinomoto, the near-monopoly supplier of ABF resin, acknowledged a 20% demand-supply gap that would remain until new resin reactors started in 2026. Foundries confirmed the constraint when TSMC said it could satisfy only 80% of CoWoS demand. Competitors such as Sekisui Chemical aimed to break dependence on alternate build-up chemistries, yet qualification cycles for high-end AI packages slowed adoption. Parallel shortages of T-Glass core material, prized for low expansion coefficients, delayed capacity expansions at Nittobo, compounding lead-time spikes. Substrate makers deployed inline metrology to raise first-pass yield and stretch existing capacity, but most customers still entered allocation programs through 2025.

Other drivers and restraints analyzed in the detailed report include:

- 5G build-out boosting high-frequency RF packaging

- Automotive-EV electrification needs high-reliability substrates

- High capital intensity and process complexity

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

FC-BGA substrates accounted for 45% of the advanced IC substrates market share in 2024. Their lead is derived from proven electrical performance required by AI accelerators and server CPUs. Utilization stayed high through 2025 as GPU makers rushed to secure capacity. Growth, however, shifted toward rigid-flex CSP lines that served automotive domain controllers and foldable mobile devices. Rigid-flex volume increased at an 8.1% CAGR, attracting new laminate suppliers able to balance bend radius with controlled impedance. FC-CSP continued to service mid-tier mobile processors, but its cost pressures limited ASP upside. Organic BGA/LGA remained relevant for legacy desktop platforms, yet ceded design wins to flip-chip options. Panel-level FC substrates, still counted under "Others," emerged in pilot volumes at TSMC and ASE, promising 7X usable area per panel and opening new economies of scale.

FC-BGA stayed the workhorse for CoWoS build-ups. Designers demanded 14-26 layer counts, forcing tighter registration tolerances. In response, substrate makers installed AI-enabled optical inspection to catch via-to-trace violations early in the stack. Rigid-flex CSP benefited when automakers migrated infotainment units to 15-inch curved displays that required Z-axis flexibility. Increased camera integration in foldables presented an additional pull. These dynamics support sustained penetration for rigid-flex through 2030 while FC-BGA continues to anchor high-value positions within the advanced IC substrates market.

ABF represented 61% of the advanced IC substrates market size in 2024. Ajinomoto's exclusive resin recipe established consistent dielectric performance and drillability that customers trusted for 2.5D and 3D stacks. Suppliers expanded ABF mixing rooms in 2025, but output gains lagged demand growth, reinforcing seller leverage. Glass substrates, though less than 2% of 2024 shipments, recorded a 14.1% forecast CAGR. Flatness within +-5 µm across 200 mm x 200 mm plates allowed finer redistribution layers and higher I/O density than ABF. Intel's exit from in-house development validated third-party glass suppliers and accelerated ecosystem readiness.

BT resin preserved relevance in automotive control units where 150 °C board temperatures were common. Ceramic and LTCC segments supplied power devices exposed to continuous thermal cycling and offered incremental revenue buffers when ABF lines were oversold. Qualification of glass cores faced hurdles in via formation uniformity, but early builds delivered promising warpage metrics at reflow. AMD signaled its intention to switch its 2026 CPU platforms to glass, encouraging substrate makers to lock capacity slots well ahead of volume ramps. If yields hold, glass could equal or surpass 5% revenue share by 2030.

Advanced IC Substrates Market is Segmented by Substrate Type (FC-BGA, FC-CSP, Organic BGA/LGA, and More), Core Material (ABF, BT, Glass, and More), Packaging Technology (2D Flip-Chip, 2. 5D Interposer, and More), Device Node (>=28 Nm, 16/14-10 Nm, and More), End-Use Industry (Mobile and Consumer, Automotive and Transportation, and More), and Geography (North America, South America, Europe, Asia-Pacific, and Middle East and Africa).

Geography Analysis

Asia-Pacific captured 69% of the advanced IC substrates market in 2024. Taiwan's Unimicron, Kinsus, and Nan Ya PCB returned double-digit growth in 2025 as AI server demand replaced the inventory correction that weighed on 2023 shipments. Japan's resurgence, backed by JPY 3.9 trillion (USD 25.5 billion) in subsidies, re-established Kyushu as a packaging hub anchored by TSMC's Kumamoto fab. South Korea announced a USD 471 billion integrated cluster plan designed to deliver 7.7 million wafer starts per month by 2030, embedding ABF-CoWoS lines adjacent to logic fabs. China deployed regional incentives to build flip-chip and SiP capacity, but export restrictions narrowed tooling access, slowing glass-core adoption.

North America's advanced localization efforts under the CHIPS Act. TSMC's Arizona campus moved to a six-fab vision with potential ABF lines colocated for risk mitigation. Entegris secured up to USD 75 million in federal support for filtration media used in substrate copper plating. OSAT giants evaluated U.S. expansion to satisfy defense-oriented chip packaging mandates, though wage inflation remained a concern.

Europe focused on automotive and power devices. OnSemi's Czech SiC facility created an end-to-end supply chain for inverter substrates inside the bloc. Germany and France considered joint ABF pilot lines to support foundry expansions by Intel and TSMC. Meanwhile, Vietnam, India, and Malaysia pursued assembly subsidies. Amkor opened a USD 1.6 billion plant in Bac Ninh, and India approved INR 7,600 crore (USD 910 million) for an OSAT venture led by CG Power and Renesas. These moves diversified geographic risk in the advanced IC substrates market.

- ASE Technology Holding Co., Ltd.

- AT&S Austria Technologie & Systemtechnik AG

- Siliconware Precision Industries Co., Ltd.

- TTM Technologies, Inc.

- Ibiden Co., Ltd.

- Kyocera Corporation

- Fujitsu Interconnect Technologies Ltd.

- JCET Group Co., Ltd.

- Panasonic Holdings Corporation

- Kinsus Interconnect Technology Corp.

- Unimicron Technology Corp.

- Nan Ya Printed Circuit Board Corp.

- Samsung Electro-Mechanics Co., Ltd.

- LG Innotek Co., Ltd.

- Simmtech Co., Ltd.

- Shinko Electric Industries Co., Ltd.

- Shennan Circuits Co., Ltd.

- Zhen Ding Technology Holding Ltd.

- Daeduck Electronics Co., Ltd.

- Meiko Electronics Co., Ltd.

- WUS Printed Circuit Co., Ltd.

- Zhejiang Kingdom Sci-Tech Co., Ltd.

- SKC Absolics Inc.

- Tripod Technology Corp.

- Toppan Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surge in ABF-substrate demand for AI/HPC accelerators

- 4.2.2 Miniaturisation and heterogeneous integration trend

- 4.2.3 5G build-out boosting high-frequency RF packaging

- 4.2.4 Automotive-EV electrification needs high-reliability substrates

- 4.2.5 Glass-core substrates unlock >2X layer counts

- 4.2.6 CHIPS-style subsidies tied to substrate fabs

- 4.3 Market Restraints

- 4.3.1 ABF-substrate capacity shortage and lead-time spikes

- 4.3.2 High capital intensity and process complexity

- 4.3.3 Copper-clad-laminate price volatility

- 4.3.4 Tighter chemical-emission rules for build-up films

- 4.4 Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Pricing Analysis

- 4.9 Impact of Macroeconomic Factors

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Substrate Type

- 5.1.1 FC-BGA

- 5.1.2 FC-CSP

- 5.1.3 Organic BGA/LGA

- 5.1.4 Rigid-Flex and Flex CSP

- 5.1.5 Others

- 5.2 By Core Material

- 5.2.1 ABF

- 5.2.2 BT

- 5.2.3 Glass

- 5.2.4 LTCC / HTCC

- 5.2.5 Ceramic

- 5.3 By Packaging Technology

- 5.3.1 2D Flip-Chip

- 5.3.2 2.5D Interposer

- 5.3.3 3D-IC / SoIC

- 5.3.4 Fan-Out WLP

- 5.3.5 SiP / Module

- 5.4 By Device Node (nm)

- 5.4.1 >=28 nm

- 5.4.2 16/14-10 nm

- 5.4.3 7-5 nm

- 5.4.4 4 nm and below

- 5.5 By End-Use Industry

- 5.5.1 Mobile and Consumer

- 5.5.2 Automotive and Transportation

- 5.5.3 IT and Telecom Infrastructure

- 5.5.4 Data-centre / AI and HPC

- 5.5.5 Industrial, Medical and Others

- 5.6 By Geography

- 5.6.1 North America

- 5.6.1.1 United States

- 5.6.1.2 Canada

- 5.6.2 South America

- 5.6.2.1 Brazil

- 5.6.2.2 Rest of South America

- 5.6.3 Europe

- 5.6.3.1 Germany

- 5.6.3.2 France

- 5.6.3.3 United Kingdom

- 5.6.3.4 Italy

- 5.6.3.5 Spain

- 5.6.3.6 Russia

- 5.6.3.7 Rest of Europe

- 5.6.4 Asia-Pacific

- 5.6.4.1 China

- 5.6.4.2 Japan

- 5.6.4.3 South Korea

- 5.6.4.4 Taiwan

- 5.6.4.5 India

- 5.6.4.6 Rest of Asia-Pacific

- 5.6.5 Middle East and Africa

- 5.6.5.1 Middle East

- 5.6.5.1.1 Saudi Arabia

- 5.6.5.1.2 United Arab Emirates

- 5.6.5.1.3 Turkey

- 5.6.5.1.4 Rest of Middle East

- 5.6.5.2 Africa

- 5.6.5.2.1 South Africa

- 5.6.5.2.2 Nigeria

- 5.6.5.2.3 Rest of Africa

- 5.6.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ASE Technology Holding Co., Ltd.

- 6.4.2 AT&S Austria Technologie & Systemtechnik AG

- 6.4.3 Siliconware Precision Industries Co., Ltd.

- 6.4.4 TTM Technologies, Inc.

- 6.4.5 Ibiden Co., Ltd.

- 6.4.6 Kyocera Corporation

- 6.4.7 Fujitsu Interconnect Technologies Ltd.

- 6.4.8 JCET Group Co., Ltd.

- 6.4.9 Panasonic Holdings Corporation

- 6.4.10 Kinsus Interconnect Technology Corp.

- 6.4.11 Unimicron Technology Corp.

- 6.4.12 Nan Ya Printed Circuit Board Corp.

- 6.4.13 Samsung Electro-Mechanics Co., Ltd.

- 6.4.14 LG Innotek Co., Ltd.

- 6.4.15 Simmtech Co., Ltd.

- 6.4.16 Shinko Electric Industries Co., Ltd.

- 6.4.17 Shennan Circuits Co., Ltd.

- 6.4.18 Zhen Ding Technology Holding Ltd.

- 6.4.19 Daeduck Electronics Co., Ltd.

- 6.4.20 Meiko Electronics Co., Ltd.

- 6.4.21 WUS Printed Circuit Co., Ltd.

- 6.4.22 Zhejiang Kingdom Sci-Tech Co., Ltd.

- 6.4.23 SKC Absolics Inc.

- 6.4.24 Tripod Technology Corp.

- 6.4.25 Toppan Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment