|

市场调查报告书

商品编码

1906216

中东建筑化学品市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031年)Middle East Construction Chemicals - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

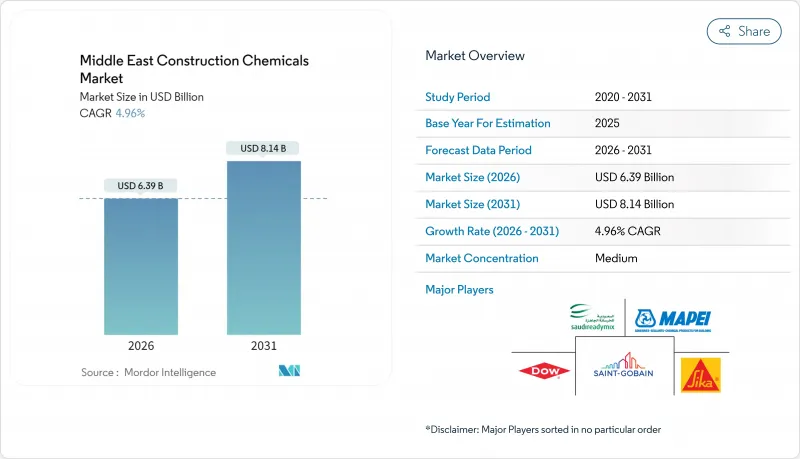

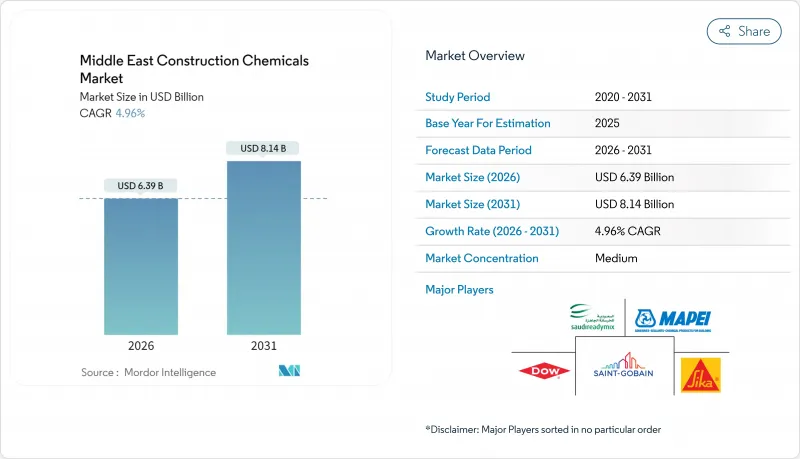

预计到 2026 年,中东建筑化学品市场规模将达到 63.9 亿美元,从 2025 年的 60.9 亿美元成长到 2031 年的 81.4 亿美元,2026 年至 2031 年的复合年增长率为 4.96%。

这一成长的驱动力来自主权财富基金与国家愿景规划相符的支出、摆脱石油依赖的趋势,以及重视高性能、低排放配方的技术法规。沙乌地阿拉伯的计划、阿联酋机场和资料中心的激增,以及卡达的液化天然气基础设施,都推动了对混凝土外加剂、防水系统和耐腐蚀涂料的需求。能够履行长期框架合约、保证多阶段性能并证明低VOC排放的供应商可以获得溢价,而全球领先企业之间日益加剧的整合则推动了规模经济。随着计划开发商要求端到端的供应保障、在地采购以及符合绿色建筑法规的可靠证明,进入门槛也不断提高。

中东建筑化学品市场趋势与洞察

国家愿景计画下的基础建设支出加速

在「愿景策略」下,前所未有的公共部门投资巩固了一系列机场、铁路走廊、工业区和新城计划,这些项目将持续多年。光是沙乌地阿拉伯就已向NEOM新城、红海以及世界各地的其他项目投入超过1.1兆美元,这笔资金流入推动建筑化学品消费量几乎翻了一番。开发商正在洽谈长达五年的供应合同,以降低基准重迭风险,从而在实际混凝土浇筑前推动了散装外加剂需求的激增。同时,包括阿联酋耗资350亿美元的阿勒马克图姆国际机场扩建项目在内的其他雄心勃勃的项目,加剧了海湾合作委员会(GCC)成员国之间的竞争,并保持了单价稳定。这些因素共同导致区域订单积压时间延长、工厂运转率稳定,以及供应商对本地生产的投资不断增加。

强制性绿建筑评级系统

阿布达比的「Estidama Pearl」和卡达的「GSAS」等法规已将低挥发性有机化合物(VOC)和低碳含量标准纳入计划核准,使环保配方成为必备条件,而非小众的额外选择。阿联酋2024年气候法要求企业揭露温室气体排放指标,并鼓励承包商向化学品供应商索取环境产品声明(EPD)。为此,跨国公司正在引入水性技术,在维持既定时间和抗压强度基准值的前提下,将溶剂含量降低至100克/公升以下。率先采用这些技术的企业将获得优先供应商地位,并受益于总体规划社群的规范锁定。

对溶剂型产品实施更严格的VOC排放限制

地方政府采纳了美国环保署 (EPA) 修订后的气雾剂涂料标准,要求製造商重新配製或召回挥发性有机化合物 (VOC) 含量超过 100 克/公升的传统材料。缺乏研发能力的小型供应商面临摊销沉没成本的困境,不得不转向利润较低的商品线。大型公司则利用水性分散系统和粉末系统来维持产品的机械性能,并利用监管变化扩大商店空间。施工人员在调整施工量和适应气候条件方面面临挑战,但违规处罚远大于合规成本。

细分市场分析

2025年,混凝土外加剂在中东建设化学品市场占有35.07%的份额。这是因为大型计划对混凝土性能的要求高于传统混合料。即使在50°C的高温环境下,仍能保持良好可加工性的、抗压强度达到80 MPa的专用混合料仍是采购标准。主要供应商正在进行奈米二氧化硅添加剂和二氧化碳养护促进剂的示范试验,以规避碳课税法规对水泥厂的风险。

从高密度聚苯乙烯(HDPE)地工止水膜到聚氨酯液态涂覆膜,防水系统将以 5.32% 的复合年增长率 (CAGR) 成长,直到 2031 年。绿建筑法规鼓励采用气密建筑围护结构,并将每英吋的水分传递率控制在 0.1% 以下,这推动了防水系统的发展。此外,人口密集的城市中心也推动了市场需求,因为地下结构越来越多,地下水盐度升高会加速地下结构的劣化。供应商意识到这一趋势,目前提供的保固期与 30 年的设计寿命相匹配,这使他们在与开发商的生命週期成本谈判中占据优势。

中东建设化学品报告按产品类型(混凝土外加剂、表面处理剂、修补剂和翻新剂、防护涂料、工业地板材料、防水剂、黏合剂和密封剂等)、最终用户产业(基础设施和公共空间、商业、工业、住宅)和地区(沙乌地阿拉伯、阿联酋、卡达、科威特、埃及和中东其他地区)进行细分。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 根据国家愿景计画加快基础建设投资

- 强制性绿建筑评级体系(例如,Estidama、GSAS)

- 越来越多的超大型计划需要使用专用的高性能外加剂

- 资料中心建设的快速扩张推动了对防静电地板材料的需求。

- 海水淡化厂的快速成长推动了对防腐蚀腐蚀涂料的需求。

- 市场限制

- 对溶剂型产品实施更严格的VOC排放法规

- 关键原料(环氧树脂、聚羧酸盐)供应链的波动性

- 由于技术纯熟劳工短缺,现场施工能力有限。

- 价值链分析

- 波特五力分析

- 供应商的议价能力

- 买方的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争程度

第五章 市场规模与成长预测

- 依产品类型

- 混凝土外加剂

- 表面处理

- 维修和维修

- 保护涂层

- 工业地板材料

- 防水的

- 黏合剂

- 密封剂

- 水泥浆和锚固件

- 水泥研磨助剂

- 按最终用户行业划分

- 基础设施和公共空间

- 商业的

- 产业

- 住宅

- 按国家/地区

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 卡达

- 科威特

- 埃及

- 其他中东国家

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率(%)/排名分析

- 公司简介

- Ahlia Chemicals Company

- Akzo Nobel NV

- Caparol Paints

- Dow

- GulfBitumen

- HB Fuller Company

- Henkel AG & Co. KGaA

- Jotun A/S

- LATICRETE International, Inc.

- Mapei SpA

- Pidilite Industries Ltd

- Saint-Gobain

- Saudi Readymix

- Saveto Group

- Sika AG

- The Sherwin-Williams Company

第七章 市场机会与未来展望

The Middle East Construction Chemicals Market market size in 2026 is estimated at USD 6.39 billion, growing from 2025 value of USD 6.09 billion with 2031 projections showing USD 8.14 billion, growing at 4.96% CAGR over 2026-2031.

The expansion stems from sovereign wealth fund spending tied to national Vision programs, a pivot away from oil dependence, and technical regulations that reward high-performance, low-emission formulations. Saudi Arabia's giga-projects, the UAE's airport and data-center surge, and Qatar's LNG infrastructure together form a demand backbone that favors concrete admixtures, waterproofing systems, and corrosion-resistant coatings. Suppliers that can align with long-term framework agreements, guarantee multi-phase performance, and document low-VOC footprints capture price premiums, while consolidation among global leaders amplifies scale advantages. Competitive barriers also rise as project developers insist on full-cycle supply security, local content, and proven compliance with green-building mandates.

Middle East Construction Chemicals Market Trends and Insights

Accelerated Infrastructure Spending under National Vision Programs

Unprecedented public-sector funding under Vision strategies has locked in multi-year pipelines for airports, rail corridors, industrial zones, and new-city projects. Saudi Arabia alone channels more than USD 1.1 trillion into schemes such as NEOM and Red Sea Global, a capital flow that effectively doubles historical construction-chemicals consumption baselines. Developers negotiate supply commitments of up to five years to de-risk phase-overlap, causing bulk admixture demand to spike in advance of actual concrete pours. Parallel ambitions in the UAE, including the USD 35 billion Al Maktoum International Airport expansion, sharpen inter-GCC competition and keep unit prices firm. The combined effect lengthens regional order books, stabilizes plant-utilization rates, and anchors supplier investment in local production.

Mandated Adoption of Green Building Rating Systems

Regulations such as Abu Dhabi's Estidama Pearl and Qatar's GSAS embed low-VOC, low-embodied-carbon thresholds into project approvals, making eco-compliant formulations a ticket-to-play rather than a niche premium. The UAE climate law of 2024 forces enterprises to disclose greenhouse-gas metrics, compelling contractors to request environmental product declarations from chemical vendors. In response, multinationals deploy water-borne technologies that maintain set-time and compressive-strength thresholds while cutting solvent levels below 100 g/L. Early adopters secure preferred-supplier status and enjoy specification lock-ins that span entire master-planned communities.

Tightening VOC-Emission Caps on Solvent-Borne Products

Regional authorities adopt U.S. EPA aerosol-coating amendments as reference, obliging manufacturers to reformulate or withdraw legacy materials above 100 g/L VOC. Smaller suppliers lacking research and development depth face sunk-cost write-offs and retreat to commodity lines with lower margins. Large players leverage aqueous dispersion and powder-based systems to retain mechanical performance, using the regulatory shift to gain shelf space. Contractors grapple with application-rate adjustments and climate-cure challenges, but specification penalties for non-compliance outweigh adaptation costs.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Giga-Projects Requiring Specialty, High-Performance Admixtures

- Desalination-Plant Boom Driving Demand for Anti-Corrosion Coatings

- Supply-Chain Volatility for Key Raw Materials

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Concrete admixtures commanded 35.07% of the Middle East construction chemicals market share in 2025 as giga-projects elevated performance requirements beyond conventional mixes. Proprietary blends that lengthen workability in 50 °C heat while meeting 80 MPa compressive strengths remain the procurement benchmark. Tier-one vendors trial nano-silica infusions and CO2-curing accelerators, hedging against potential carbon-levy regulations on cement plants.

Waterproofing systems, ranging from HDPE geomembranes to polyurethane liquid-applied membranes, chart the fastest 5.32% CAGR through 2031. Here, green-building mandates that promote tight building envelopes and moisture-migration ratings under 0.1 perm-in. drive specification. Demand also flows from rising below-grade structures in dense urban cores, where groundwater salinity accelerates deterioration. Suppliers capitalizing on this trajectory now bundle warranties that match 30-year design lives, giving them leverage in lifecycle-cost discussions with developers.

The Middle East Construction Chemicals Report is Segmented by Product Type (Concrete Admixtures, Surface Treatments, Repair and Rehabilitation, Protective Coatings, Industrial Flooring, Waterproofing, Adhesives, Sealants, and More), End-User Industry (Infrastructure and Public Spaces, Commercial, Industrial, and Residential), and Geography (Saudi Arabia, United Arab Emirates, Qatar, Kuwait, Egypt, and Rest of Middle East).

List of Companies Covered in this Report:

- Ahlia Chemicals Company

- Akzo Nobel N.V.

- Caparol Paints

- Dow

- GulfBitumen

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Jotun A/S

- LATICRETE International, Inc.

- Mapei S.p.A.

- Pidilite Industries Ltd

- Saint-Gobain

- Saudi Readymix

- Saveto Group

- Sika AG

- The Sherwin-Williams Company

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerated Infrastructure Spending Under National Vision Programs

- 4.2.2 Mandated Adoption of Green Building Rating Systems (e.g., Estidama, GSAS)

- 4.2.3 Rise of Giga-Projects Requiring Specialty, High-Performance Admixtures

- 4.2.4 Rapid Expansion of Data-Center Construction Needs Antistatic Flooring

- 4.2.5 Desalination-Plant Boom Driving Demand for Anti-Corrosion Coatings

- 4.3 Market Restraints

- 4.3.1 Tightening VOC-Emission Caps on Solvent-Borne Products

- 4.3.2 Supply-Chain Volatility for Key Raw Materials (Epoxy Resins, Polycarboxylates)

- 4.3.3 Skilled-Labor Shortages Limiting Correct On-Site Application

- 4.4 Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitutes

- 4.5.5 Degree of Competition

5 Market Size and Growth Forecasts (Value)

- 5.1 By Product Type

- 5.1.1 Concrete Admixtures

- 5.1.2 Surface Treatments

- 5.1.3 Repair and Rehabilitation

- 5.1.4 Protective Coatings

- 5.1.5 Industrial Flooring

- 5.1.6 Waterproofing

- 5.1.7 Adhesives

- 5.1.8 Sealants

- 5.1.9 Grouts and Anchors

- 5.1.10 Cement Grinding Aids

- 5.2 By End-user Industry

- 5.2.1 Infrastructure and Public Spaces

- 5.2.2 Commercial

- 5.2.3 Industrial

- 5.2.4 Residential

- 5.3 By Country

- 5.3.1 Saudi Arabia

- 5.3.2 United Arab Emirates

- 5.3.3 Qatar

- 5.3.4 Kuwait

- 5.3.5 Egypt

- 5.3.6 Rest of Middle-East

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share (%)/Ranking Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Ahlia Chemicals Company

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Caparol Paints

- 6.4.4 Dow

- 6.4.5 GulfBitumen

- 6.4.6 H.B. Fuller Company

- 6.4.7 Henkel AG & Co. KGaA

- 6.4.8 Jotun A/S

- 6.4.9 LATICRETE International, Inc.

- 6.4.10 Mapei S.p.A.

- 6.4.11 Pidilite Industries Ltd

- 6.4.12 Saint-Gobain

- 6.4.13 Saudi Readymix

- 6.4.14 Saveto Group

- 6.4.15 Sika AG

- 6.4.16 The Sherwin-Williams Company

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment