|

市场调查报告书

商品编码

1907297

义大利太阳能市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Italy Solar Energy - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

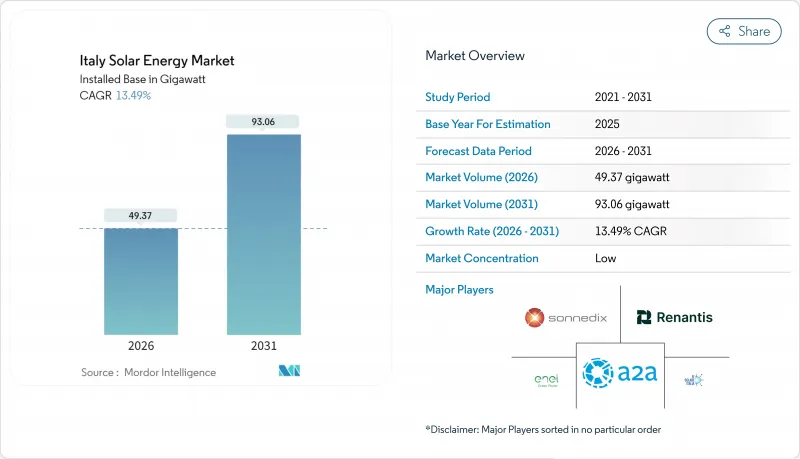

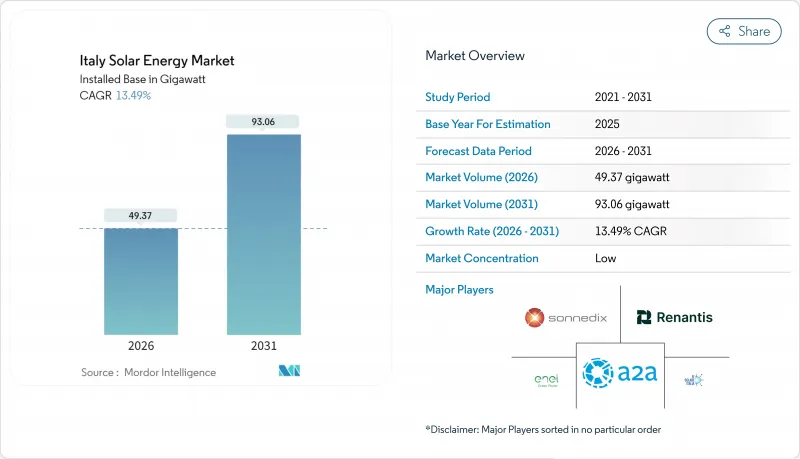

2025 年义大利太阳能市场装置容量为 43.5 吉瓦,预计到 2031 年将达到 93.06 吉瓦,高于 2026 年的 49.37 吉瓦。

预计在预测期(2026-2031 年)内,复合年增长率将达到 13.49%。

电力平准化成本(LCOE)的下降、欧盟的「再生能源指令」(REPowerEU)以及义大利的「2030年电力产业发展规划」(PNIEC 2030)目标,共同为开发商提供了长期发展前景。即使补贴逐步取消,充裕的资本流入也维持了发展动能。在阳光最充足的南部各州,大型太阳能计划目前全天的发电量均超过燃气发电,平均LCOE低于0.040欧元/千瓦时。光是2024年,就签署了价值28亿欧元的企业购电协议(PPA),这显示主要製造商将固定价格的太阳能合约视为对冲大宗商品价格波动风险的有效手段。在家庭层面,「超级奖励计画」(Super Bonus scheme)正在刺激住宅需求,但该计画即将结束,因此在2025年之前儘早安装太阳能係统势在必行。

义大利太阳能市场趋势及分析

降低太阳能发电的平准化电成本

2024年,义大利太阳能光电发电的平均电波成本(LCOE)将降至0.045欧元/度电时,首次在不享有补贴的情况下与传统发电成本持平。主流晶体硅组件的效率已达22.5%,标准化的安装系统进一步降低了系统总成本。在义大利南部地区,公共产业计划的度电成本已降至0.040欧元/千瓦时,燃气发电厂的地位也随之下降。义大利本土逆变器製造商Fimer推出了一款效率高达99.2%的组串式逆变器,有效降低了转换损耗,这将进一步巩固到2027年的成本持续下降趋势。

欧盟的 REPowerEU 和 PNIEC 2030 目标

布鲁塞尔将义大利2030年的太阳能装置义务提高到85吉瓦,几乎是先前国家太阳能规划目标的两倍,并引入了季度合规性审查机制以维持政治承诺。罗马拨款69亿欧元用于国家太阳能区域发展计画(PNRR),其中60%指定用于南部地区的太阳能扩张。区域「绿色走廊」已将50兆瓦以上项目的审批週期从24个月缩短至约8个月。此外,新建面积超过1000平方公尺的商业建筑现在必须安装屋顶太阳能係统,从而创造了稳定的市场需求。

饱和的电网和冗长的审批程序

北方电网积压了23吉瓦的计划,导致併网时间延迟长达两年,热点地区的併网费用也飙升至每兆瓦8万欧元。 Terna公司180亿欧元的扩建计画仍在进行中。开发商必须经过14项核准程序,光是环境影响评估一项就可能需要长达12个月的时间。针对10兆瓦以下电厂的简化审核流程可以缓解压力,但对占新增装置容量绝大部分的大型电厂却收效甚微。

细分市场分析

到2025年,太阳能光电发电将占新增装置容量的99.97%,这主要得益于成熟的供应链和便利的屋顶安装方式。聚光太阳热能发电(CSP)目前的装置容量仅0.02吉瓦,但其复合年增长率高达104.7%。六小时熔盐储热系统可满足晚间用电高峰需求。西西里岛的太阳辐射量高(年均超过2000千瓦时/平方公尺),这使得聚光灯太阳能发电能够提供与天然气发电厂竞争的固定电价,欧盟的分类标准也认可其电网稳定能力。义大利国家电力公司(Enel Green Power)的混合式聚光太阳能-光伏发电模式,将白天的太阳能发电与日落后的储热输出相结合,有望彻底改变可再生能源作为核心能源的利用方式。

义大利聚光太阳能发电(CSP)市场规模仍然小规模,但绿色债券提供的优惠融资条件正在降低资本成本。独立发电商(IPP)已获得25年的上网电价补贴(FIT),该补贴涵盖电力供应和类似「容量保证」的运转率支付,从而提高了风险调整后的收益。要求50兆瓦以上计划提供电网支援服务的政策实际上鼓励了储热技术的发展,引导开发商转向可调功率的聚光太阳能发电。因此,中期成长更取决于组件供应商能否快速大规模生产专用接收器和储热盐,而较少依赖技术风险。

义大利太阳能市场报告按技术(光伏和聚光型太阳热能发电)、併网类型(併网和离网)以及最终用户(大型公用事业公司、商业/工业用户和住宅)进行细分。市场规模和预测以装置容量(吉瓦)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 太阳能发电量下降趋势与平准化能源成本 (LCOE) 相关

- 欧盟的 REPowerEU 和 PNIEC 2030 目标

- 义大利工业企业间电力购买协议(PPA)数量迅速成长

- 住宅「超级奖金」和税额扣抵计划

- 透过农光互补提高土地的双重用途价值

- 将用户侧储能成本与太阳能发电成本进行比较

- 市场限制

- 饱和的电网和冗长的审批程序

- 逐步减少超级奖金优惠待遇

- 对农地地面太阳能发电的限制

- 当地居民反对及景观保护条例

- 供应链分析

- 监理展望

- 技术展望

- 波特五力模型

- 新进入者的威胁

- 供应商的议价能力

- 买方的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- PESTEL 分析

第五章 市场规模与成长预测

- 透过技术

- 光伏(PV)

- 聚光型太阳热能发电(CSP)

- 按网格类型

- 併网

- 离网

- 最终用户

- 实用规模

- 商业和工业(C&I)

- 住宅

- 按成分(定性分析)

- 太阳能模组/面板

- 逆变器(组串式、集中式、微型)

- 安装和追踪系统

- 系统周边设备和电气设备

- 储能和混合整合

第六章 竞争情势

- 市场集中度

- 策略性倡议(併购、伙伴关係、购电协议)

- 市场占有率分析(主要企业的市场排名和份额)

- 公司简介

- Enel Green Power SpA

- EF Solare Italia SpA

- Sonnedix Power Holdings Ltd

- Renantis SpA(ex-Falck Renewables)

- A2A SpA

- Acea SpA

- Gruppo STG Srl

- Peimar Srl

- SunPower Corporation

- SunEdison Inc.

- Canadian Solar Inc.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- SMA Solar Technology AG

- Fimer SpA

- TerniEnergia SpA

- Sorgenia SpA

- Saras SpA(Sardeolica)

- NextEnergy Capital Group

- Engie Italia SpA

第七章 市场机会与未来展望

The Italy Solar Energy Market size in terms of installed base was valued at 43.5 gigawatt in 2025 and estimated to grow from 49.37 gigawatt in 2026 to reach 93.06 gigawatt by 2031, at a CAGR of 13.49% during the forecast period (2026-2031).

Lowered levelized cost of electricity, the European Union's REPowerEU mandate, and Italy's PNIEC 2030 target combine to provide developers with long-range visibility, while abundant capital inflows sustain momentum even as subsidies taper. Utility-scale projects now achieve an average LCOE of below EUR 0.040/kWh in sunny southern provinces, outperforming gas-fired generation at every hour of the day. Corporate power-purchase agreements (PPAs) worth EUR 2.8 billion were signed in 2024 alone, indicating that large manufacturers view fixed-price solar contracts as a hedge against commodity volatility. At the household level, the Superbonus incentive is spurring residential demand, although its upcoming phase-down creates urgency that may prompt front-loading of installations into 2025.

Italy Solar Energy Market Trends and Insights

Declining LCOE of PV Electricity

Italy's average solar LCOE fell to EUR 0.045/kWh in 2024, marking the first instance of subsidy-free parity with conventional generation. Module efficiencies reached 22.5% for mainstream crystalline panels, and standardized racking further trimmed balance-of-system expenses. Southern utility projects now deliver LCOE as low as EUR 0.040/kWh, pushing gas peakers into residual duty. Domestic inverter maker Fimer introduced 99.2% efficiency string models that reduce conversion losses, locking in cost reductions that are likely to deepen through 2027.

EU REPowerEU & PNIEC 2030 Targets

Brussels raised Italy's 2030 solar obligation to 85 GW, nearly doubling the earlier PNIEC figure and incorporating quarterly compliance reviews that maintain political focus. Rome earmarked EUR 6.9 billion in PNRR funds, with 60% dedicated to southern solar build-out. Regional "green corridors" have reduced permit cycles for sites exceeding 50 MW from 24 months to approximately 8 months, while new commercial buildings over 1,000 m2 are required to install rooftop systems, creating an assured demand pipeline.

Grid Saturation & Lengthy Permitting

Northern grids face 23 GW of queued projects, which delays connections by up to two years and increases interconnection fees to EUR 80,000/MW in hotspots. Terna's EUR 18 billion expansion plan is still ramping. Developers must navigate 14 approvals; environmental impact assessments alone can take up to 12 months. Fast-track rules for sub-10 MW plants ease pressure but do little for the large farms that dominate new capacity.

Other drivers and restraints analyzed in the detailed report include:

- Corporate-PPA Boom Among Italian Industrials

- Residential "Superbonus" & Tax-Credit Schemes

- Phase-down of Superbonus Incentives

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

PV installations accounted for 99.97% of total additions in 2025, driven by mature supply chains and the ease of rooftop siting. Concentrated solar power, though scarcely 0.02 GW today, is accelerating at a 104.7% CAGR and could supply evening peaks with six-hour molten-salt storage. Sicily's high direct normal irradiance, exceeding 2,000 kWh/m2/year, enables CSP to dispatch at fixed tariffs that rival those of gas units, and the EU taxonomy favors its grid-firming traits. Enel Green Power's hybrid CSP-PV blueprint pairs up-front PV yields with stored thermal output after dusk, a template that could reshape baseload renewables.

The Italy solar energy market size for CSP remains modest, yet favorable debt terms under green bonds lower capital cost. Independent power producers secure 25-year feed-in contracts that cover both electricity and "capacity-like" availability payments, improving risk-adjusted returns. A policy requiring >=50 MW projects to demonstrate grid-support services implicitly rewards thermal storage, nudging developers toward CSPs' dispatchable profile. Medium-term growth thus hinges less on technology risk than on how quickly component suppliers can scale specialized receivers and salts.

The Italy Solar Energy Market Report is Segmented by Technology (Solar Photovoltaic and Concentrated Solar Power), Grid Type (On-Grid and Off-Grid), and End-User (Utility-Scale, Commercial and Industrial, and Residential). The Market Sizes and Forecasts are Provided in Terms of Installed Capacity (GW).

List of Companies Covered in this Report:

- Enel Green Power S.p.A.

- EF Solare Italia S.p.A.

- Sonnedix Power Holdings Ltd

- Renantis S.p.A. (ex-Falck Renewables)

- A2A S.p.A.

- Acea S.p.A.

- Gruppo STG S.r.l.

- Peimar S.r.l.

- SunPower Corporation

- SunEdison Inc.

- Canadian Solar Inc.

- JinkoSolar Holding Co., Ltd.

- Trina Solar Co., Ltd.

- SMA Solar Technology AG

- Fimer S.p.A.

- TerniEnergia S.p.A.

- Sorgenia S.p.A.

- Saras S.p.A. (Sardeolica)

- NextEnergy Capital Group

- Engie Italia S.p.A.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Declining LCOE of PV Electricity

- 4.2.2 EU REPowerEU & PNIEC 2030 Targets

- 4.2.3 Corporate-PPA Boom Among Italian Industrials

- 4.2.4 Residential "Superbonus" & Tax-credit Schemes

- 4.2.5 Agrivoltaics Enhancing Dual-Use Land Value

- 4.2.6 Behind-the-Meter Storage Cost Parity with PV

- 4.3 Market Restraints

- 4.3.1 Grid Saturation & Lengthy Permitting

- 4.3.2 Phase-down of Superbonus Incentives

- 4.3.3 Restrictions on Ground-mount PV on Farmland

- 4.3.4 Local Opposition & Landscape-Protection Rules

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Outlook

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 PESTLE Analysis

5 Market Size & Growth Forecast

- 5.1 By Technology

- 5.1.1 Solar Photovoltaic (PV)

- 5.1.2 Concentrated Solar Power (CSP)

- 5.2 By Grid Type

- 5.2.1 On-Grid

- 5.2.2 Off-Grid

- 5.3 By End-User

- 5.3.1 Utility-Scale

- 5.3.2 Commercial and Industrial (C&I)

- 5.3.3 Residential

- 5.4 By Component (Qualitative Analysis)

- 5.4.1 Solar Modules/Panels

- 5.4.2 Inverters (String, Central, Micro)

- 5.4.3 Mounting and Tracking Systems

- 5.4.4 Balance-of-System and Electricals

- 5.4.5 Energy Storage and Hybrid Integration

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves (M&A, Partnerships, PPAs)

- 6.3 Market Share Analysis (Market Rank/Share for key companies)

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Products & Services, and Recent Developments)

- 6.4.1 Enel Green Power S.p.A.

- 6.4.2 EF Solare Italia S.p.A.

- 6.4.3 Sonnedix Power Holdings Ltd

- 6.4.4 Renantis S.p.A. (ex-Falck Renewables)

- 6.4.5 A2A S.p.A.

- 6.4.6 Acea S.p.A.

- 6.4.7 Gruppo STG S.r.l.

- 6.4.8 Peimar S.r.l.

- 6.4.9 SunPower Corporation

- 6.4.10 SunEdison Inc.

- 6.4.11 Canadian Solar Inc.

- 6.4.12 JinkoSolar Holding Co., Ltd.

- 6.4.13 Trina Solar Co., Ltd.

- 6.4.14 SMA Solar Technology AG

- 6.4.15 Fimer S.p.A.

- 6.4.16 TerniEnergia S.p.A.

- 6.4.17 Sorgenia S.p.A.

- 6.4.18 Saras S.p.A. (Sardeolica)

- 6.4.19 NextEnergy Capital Group

- 6.4.20 Engie Italia S.p.A.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment