|

市场调查报告书

商品编码

1910840

印度资料中心市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)India Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

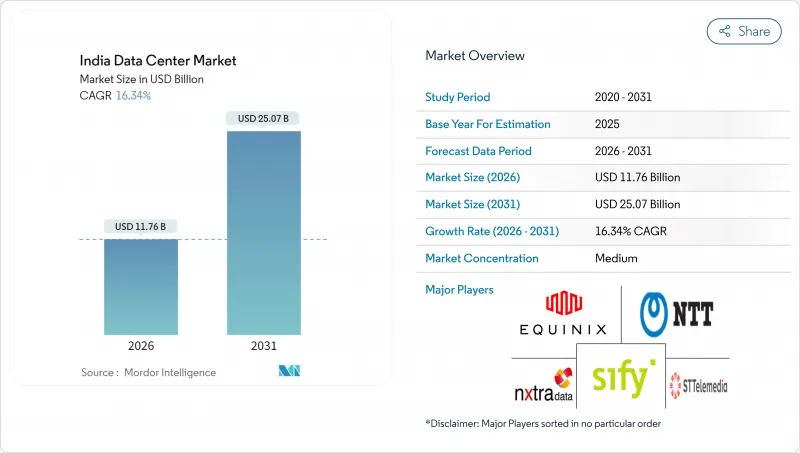

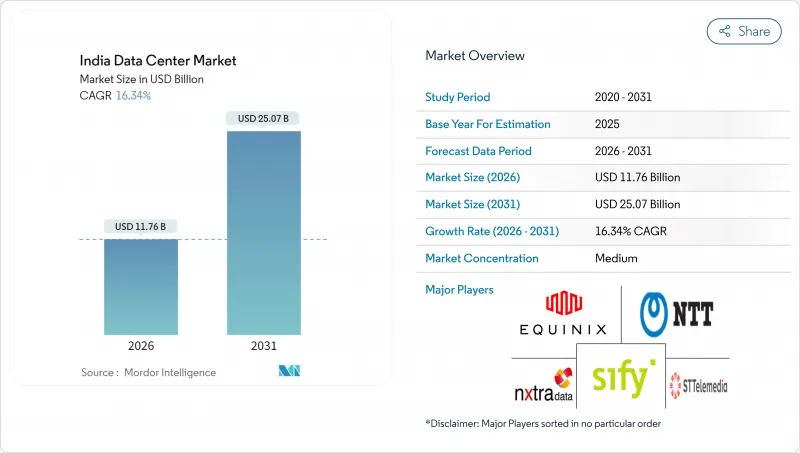

据估计,印度资料中心市场在 2026 年的价值将达到 117.6 亿美元,高于 2025 年的 101.1 亿美元,预计到 2031 年将达到 250.7 亿美元。

预计2026年至2031年年复合成长率(CAGR)为16.34%。

就IT负载容量而言,预计市场将从2025年的4,480兆瓦成长到2030年的12,470兆瓦,在预测期(2025-2030年)内以22.72%的复合年增长率成长。市场占有率和估计值均以兆瓦为单位计算和报告。这一快速成长归因于六大因素:印度数位计画推动了超大规模云端投资;爆炸性成长的OTT流量推动边缘节点向区域城市转移;强制性数据本地化法规;购电协议(PPA)降低了可再生能源采购风险;海底电缆容量使国际频宽提升了四倍四倍;以及蓬勃发展的AI工作负载将机架密度推高至50千瓦以上。云端服务供应商正计划建造一系列价值数十亿美元的园区,而国内营运商则专注于GPU赋能的设计并扩大可再生能源容量。孟买和清奈国际连接的加强正在降低跨境流量延迟,并提升印度资料中心市场作为亚太地区互联枢纽的吸引力。同时,印度储备银行(RBI)和电子资讯科技部(MeitY)的资料在地化强制令正在银行、金融服务和保险(BFSI)以及公共部门使用者中催生出不可或缺的需求,为长期运转率奠定了基础。在此背景下,在可再生能源、高密度製冷技术和沿海所拥有土地拥有优势的营运商正在获得战略优势。

印度资料中心市场趋势与洞察

印度数位计画后,超大规模云端部署呈现爆炸性成长。

信实工业宣布在贾姆讷格尔投资300亿美元建设一座3GW的AI园区,这是印度迄今最大的单笔资料中心投资。亚马逊云端服务(AWS)、微软和谷歌已承诺在孟买、清奈和海得拉巴週边投资超过150亿美元用于新增容量,并受益于基础设施激励措施和一站式审批流程。印度人工智慧使命拨款1037.1亿卢比(约12.5亿美元)用于部署1万个GPU,凸显了政策的持续支持。这些措施正在重塑资料中心的设计,使其朝着50-120kW机架、液冷和现场可再生能源的方向发展,从而推动从通用託管模式向专用超大规模园区进行竞争性转型。

国内OTT影片流量的快速成长推动了对边缘节点的需求。

OTT订阅用户持续以两位数的速度成长,将对延迟高度敏感的快取扩展到浦那、斋浦尔和科钦等二线城市。到2024年,阿萨姆邦、比哈尔邦和北方邦东部的农村宽频覆盖率将超过都市区,凸显了分散式基础设施的必要性。 5-20兆瓦的边缘站点有助于服务供应商实现低于50毫秒的延迟,降低回程传输成本,并改善使用者体验。专注于紧凑型面积的区域运营商正在抓住这一转变,并利用全球CDN运营商部署区域接入点(PoP)以提供本地化高清内容的倡议。

州际电力价格差异削弱了成本竞争力

工业用电价格从安得拉邦的每千瓦时4.50卢比到马哈拉斯特拉邦的每千瓦时8.00卢比不等,相差40%至50%,而且在20年的资产使用寿命内,这种差异还会进一步扩大。人工智慧机架的耗电量是传统伺服器的15至20倍,因此对这种价格差异的感受最为强烈。目前正在就开放式电力采购政策进行讨论,预计这将缓解这种价格差异,但具体时间尚不确定。这促使营运商寻求自建太阳能-风能混合发电设施以及跨邦可再生能源购电协议,例如Google与古吉拉突邦30吉瓦卡夫达计划的合作。

细分市场分析

大型资料中心将占2025年收入的22.08%,巩固其作为超大规模租户基础设施的地位。共用基础设施和50至200兆瓦的规模提供了营运优势和交叉连接深度。同时,中型资料中心将实现19.22%的复合年增长率,这主要得益于二线城市边缘节点的部署,旨在降低OTT(Over-The-Top)延迟并支援物联网应用。这种分散式网路使服务供应商能够将运算资源部署在更靠近终端用户的位置,从而补充而非取代大型园区。随着人工智慧模型的成熟,市场需求正在出现两极化,一方是千兆瓦级的大型园区,另一方则是许多中型资料中心。

营运商正在调整其扩张计划,以平衡土地成本、电网接入和延迟目标。大型资料中心开发商倾向于选择沿海地区和电力资源丰富的内陆走廊,这些地区拥有多条海底光缆和可再生能源丛集,能够提供长期稳定的网路弹性。中型资料中心建造者则寻求拥有强大光纤骨干网路的现有设施(棕地),并优先考虑在 12 至 18 个月内运作。对于竞相满足使用者体验阈值的OTT 和游戏平台而言,这个时间节点至关重要。永续性要求也在影响规模决策,因为诸如节水冷却和现场太阳能发电等组件使得以 20-50 兆瓦为增量进行扩张更加可预测。这些因素强化了一种双层建设策略:在枢纽位置利用印度资料中心市场的规模优势,同时向消费区域辐射小规模的节点。

三级资料中心是基础级资料中心,透过 N+1 冗余实现 99.982% 的运转率,从而平衡资本投资,预计到 2025 年将保持 49.05% 的市场份额。同时,四级资料中心正以 20.25% 的复合年增长率快速成长,以满足银行、金融和保险 (BFSI)、医疗保健和即时交易平台对 99.995%运转率的要求。能够采用 2N 电源配置实现可维护性和容错性的营运商正在赢得高价值工作负载。一级/二级资料中心将继续用于开发和测试环境以及对成本敏感的应用场景,但随着其重要性的提升,其市场份额预计将逐渐下降。

监管机构和保险公司正日益将服务等级协定 (SLA) 与 Tier 4 标准接轨,迫使企业将关键任务系统升级到更高等级。模组化设计允许企业逐步投资,并从一开始就获得 Tier 4 认证,从而降低资本成本。同时,混合云端架构师正在推广在备用站点采用标准化的 Tier 3 架构,简化灾害復原计划,而无需承担完整的 Tier 4 成本。最终形成了一种分级正常运转率结构,其中卓越的弹性与实用的冗余级别并存,使能够提供清晰服务级别差异化的运营商能够在印度数据中心市场获得市场份额。

印度资料中心市场报告按资料中心规模(大型、超大型、中型、巨型、小规模)、层级(Tier 1 & 2、Tier 3、Tier 4)、资料中心类型(超大规模/自建、企业/边缘、託管)、最终用户(银行、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、娱乐、电信製造业)以及热点等。市场预测以 IT 负载容量(兆瓦)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 印度数位时代后,超大规模云端采用率爆炸性成长。

- 国内OTT影片流量的快速成长推动了对边缘节点的需求。

- 根据印度储备银行(RBI)和资讯科技部(MeitY)的政策,资料在地化是强制性要求。

- 公司专属使用的混合太阳能和风能发电的购电协议(数量挂钩协议)

- 扩大海底电缆登陆站将提升国际频宽供应

- 日益繁重的AI/ML工作负载需要高密度GPU机架。

- 市场限制

- 各州之间电力价格差异导致成本竞争力下降

- 高需求海岸枢纽土地征用延误

- 城市中心柴油紧急发电机的审批程序延误

- 专业资料中心建设劳动力短缺

- 市场展望

- IT负载能力

- 高架地板面积

- 託管收入

- 预装机架

- 机架空间利用率

- 海底电缆

- 主要行业趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动资料通讯速度

- 宽频资料通讯速度

- 光纤连接网路

- 法律规范

- 价值炼和通路分析

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(兆瓦)

- 按资料中心规模

- 大规模

- 巨大的

- 中号

- 百万

- 小规模

- 依层级类型

- 一级/二级

- 三级

- 第四级

- 依资料中心类型

- 超大规模/内部建设

- 企业/边缘运算

- 搭配

- 未使用的

- 目前正在使用

- 零售共址

- 批发託管

- 最终用户

- BFSI

- 资讯科技/资讯科技服务

- 电子商务

- 政府机构

- 製造业

- 媒体与娱乐

- 沟通

- 其他最终用户

- 透过热点

- 班加罗尔

- 清奈

- 海得拉巴

- 孟买

- 新德里

- 其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- NTT Ltd

- CtrlS Datacenters Ltd

- AdaniConneX Private Limited

- STT Telemedia Global Data Centres India Private Limited

- Amazon Web Services Inc

- Princeton Digital Group Limited

- Sify Technologies Limited

- Colt Data Centre Services Holdings Limited

- Nxtra Data Limited

- SAP SE

- Yotta Infrastructure Solutions LLP

- RackBank Datacenters Private Limited

- MilesWeb Internet Services Pvt Ltd

- Pi DATACENTERS Pvt Ltd

- Reliance Communications Limited

- Equinix Inc

- Digital Realty Trust Inc

- Web Werks India Pvt Ltd

- Tata Communications Limited

- Bridge Data Centres India Private Limited

第七章 市场机会与未来展望

India Data Center Market size in 2026 is estimated at USD 11.76 billion, growing from 2025 value of USD 10.11 billion with 2031 projections showing USD 25.07 billion, growing at 16.34% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 4.48 thousand megawatt in 2025 to 12.47 thousand megawatt by 2030, at a CAGR of 22.72% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. This sharp expansion stems from six forces: hyperscale cloud investments unlocked by Digital India incentives, explosive OTT traffic that pulls edge nodes into tier-2 cities, mandatory data localization rules, power purchase agreements that derisk renewable sourcing, submarine cable capacity that quadruples international bandwidth, and surging AI workloads that push rack densities above 50 kW. Cloud providers have lined up multi-billion-USD campuses, while domestic operators are pivoting to GPU-ready designs and renewable capacity additions. International connectivity upgrades at Mumbai and Chennai reduce latency for cross-border traffic, enhancing the attractiveness of the India data center market to Asia-Pacific interconnection hubs. Simultaneously, RBI and MeitY localization mandates create non-discretionary demand from BFSI and public-sector users, anchoring long-term utilization. Against this backdrop, operators with renewable power, high-density cooling, and coastal land banks are securing strategic advantages.

India Data Center Market Trends and Insights

Explosive Growth in Hyperscale Cloud Deployments Post-Digital India Incentives

Reliance Industries unveiled a USD 30 billion, 3 GW AI campus in Jamnagar, marking the largest single data center investment in India. AWS, Microsoft, and Google have together pledged more than USD 15 billion for new capacity around Mumbai, Chennai, and Hyderabad, facilitated by infrastructure status benefits and single-window clearances. The India AI Mission earmarked INR 10,371 crore (USD 1.25 billion) for 10,000 GPUs, validating sustained policy support. These moves are reshaping facility design toward 50-120 kW racks, liquid cooling, and on-site renewables, shifting competition from generic colocation toward purpose-built hyperscale campuses.

Escalating Domestic OTT Video Traffic Driving Edge Node Demand

OTT subscriptions keep rising in double digits, driving latency-sensitive caches into tier-2 cities such as Pune, Jaipur and Kochi. Rural broadband lines in Assam, Bihar and Uttar Pradesh East surpassed urban connections in 2024, underlining the need for distributed infrastructure. Edge sites of 5-20 MW help providers meet sub-50 ms latency, trim backhaul costs and improve user experience. Regional operators specializing in compact footprints are capitalizing on this shift as global CDNs deploy regional PoPs to localize high-definition content.

Inter-State Power Tariff Differentials Eroding Cost Competitiveness

Industrial tariffs vary from INR 4.50 in Andhra Pradesh to INR 8.00 in Maharashtra, a 40-50% spread that magnifies over a 20-year asset life. AI racks that draw 15-20 times the power of legacy servers feel this disparity most keenly. Pending policy talks on open-access procurement could ease the gap, yet timelines remain undefined. Operators therefore pursue captive solar-wind hybrids and multi-state renewable PPAs, illustrated by Google's tie-up with the 30 GW Khavda project in Gujarat.

Other drivers and restraints analyzed in the detailed report include:

- Mandated Data Localization Under RBI and MeitY Policies

- Rising AI-ML Workload Intensity Requiring GPU-Dense Racks

- Land Acquisition Delays in Coastal High-Demand Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large facilities represented 22.08% of 2025 revenue, cementing their role as anchor hubs for hyperscale tenants. Shared infrastructure and 50-200 MW scale deliver operating leverage and cross-connect depth. Medium sites, however, will clock a 19.22% CAGR, propelled by edge-node rollouts in tier-2 cities that lower OTT latency and support IoT applications. This distributed mesh allows providers to place compute closer to end users, complementing megacampuses rather than replacing them. As AI models mature, demand is bifurcating between a few giga-watt campuses and numerous mid-sized outposts.

Operators are calibrating expansion plans to balance land costs, grid access, and latency targets. Large-campus developers favor coastal or power-rich inland corridors where multiple subsea cables or renewable clusters offer long-term resilience. Medium-site builders seek brownfield buildings with robust fiber backbones that can be brought online within 12-18 months, a timeline crucial for OTT and gaming platforms racing to meet user-experience thresholds. Sustainability mandates also influence sizing decisions because water-efficient cooling and on-site solar form factors scale more predictably in 20-50 MW blocks. These variables reinforce a two-tier build strategy that anchors the India data center market size at hub locations while radiating smaller nodes into consumption zones.

Tier 3 remains the baseline, retaining a 49.05% 2025 share thanks to N+1 redundancy, which balances capex and achieves 99.982% availability. Yet Tier 4 is accelerating at 20.25% CAGR as BFSI, healthcare, and real-time trading platforms demand 99.995% uptime. Operators that can deliver concurrently maintainable, fault-tolerant layouts with 2N power trains are capturing high-value workloads. Tier 1 and Tier 2 rooms persist for development and testing, as well as cost-sensitive use cases, but face gradual erosion as criticality increases.

Regulators and insurers are increasingly aligning service-level agreements with Tier 4 benchmarks, nudging enterprises to migrate their mission-critical stacks upward. Capital costs are mitigated by modular designs that allow operators to phase in investment while achieving Tier 4 credentials from day one. In parallel, hybrid-cloud architects push for standardized Tier 3 footprints at secondary sites to simplify disaster-recovery blueprints without incurring the full expense of a Tier 4 footprint. The net result is a stratified uptime landscape where premium fault tolerance coexists with pragmatic redundancy tiers, collectively broadening the India data center market share for operators that offer clear service-level differentiation.

The India Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- NTT Ltd

- CtrlS Datacenters Ltd

- AdaniConneX Private Limited

- STT Telemedia Global Data Centres India Private Limited

- Amazon Web Services Inc

- Princeton Digital Group Limited

- Sify Technologies Limited

- Colt Data Centre Services Holdings Limited

- Nxtra Data Limited

- SAP SE

- Yotta Infrastructure Solutions LLP

- RackBank Datacenters Private Limited

- MilesWeb Internet Services Pvt Ltd

- Pi DATACENTERS Pvt Ltd

- Reliance Communications Limited

- Equinix Inc

- Digital Realty Trust Inc

- Web Werks India Pvt Ltd

- Tata Communications Limited

- Bridge Data Centres India Private Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Explosive growth in hyperscale cloud deployments post-Digital India incentives

- 4.2.2 Escalating domestic OTT video traffic driving edge node demand

- 4.2.3 Mandated data localisation under RBI and MeitY policies

- 4.2.4 Availability-linked power-purchase agreements for captive solar-wind hybrid energy

- 4.2.5 Submarine cable landing expansions boosting international bandwidth supply

- 4.2.6 Rising AI-ML workload intensity requiring GPU-dense racks

- 4.3 Market Restraints

- 4.3.1 Inter-state power tariff differentials eroding cost competitiveness

- 4.3.2 Land acquisition delays in coastal high-demand hubs

- 4.3.3 Slow clearances for diesel-based backup generators in urban cores

- 4.3.4 Shortage of specialised data center construction labour

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Bengaluru

- 5.5.2 Chennai

- 5.5.3 Hyderabad

- 5.5.4 Mumbai

- 5.5.5 Delhi-NCR

- 5.5.6 Rest of India

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 NTT Ltd

- 6.4.2 CtrlS Datacenters Ltd

- 6.4.3 AdaniConneX Private Limited

- 6.4.4 STT Telemedia Global Data Centres India Private Limited

- 6.4.5 Amazon Web Services Inc

- 6.4.6 Princeton Digital Group Limited

- 6.4.7 Sify Technologies Limited

- 6.4.8 Colt Data Centre Services Holdings Limited

- 6.4.9 Nxtra Data Limited

- 6.4.10 SAP SE

- 6.4.11 Yotta Infrastructure Solutions LLP

- 6.4.12 RackBank Datacenters Private Limited

- 6.4.13 MilesWeb Internet Services Pvt Ltd

- 6.4.14 Pi DATACENTERS Pvt Ltd

- 6.4.15 Reliance Communications Limited

- 6.4.16 Equinix Inc

- 6.4.17 Digital Realty Trust Inc

- 6.4.18 Web Werks India Pvt Ltd

- 6.4.19 Tata Communications Limited

- 6.4.20 Bridge Data Centres India Private Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and unmet-need assessment