|

市场调查报告书

商品编码

1910843

德国资料中心市场:市场占有率分析、产业趋势与统计、成长预测(2026-2031)Germany Data Center - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

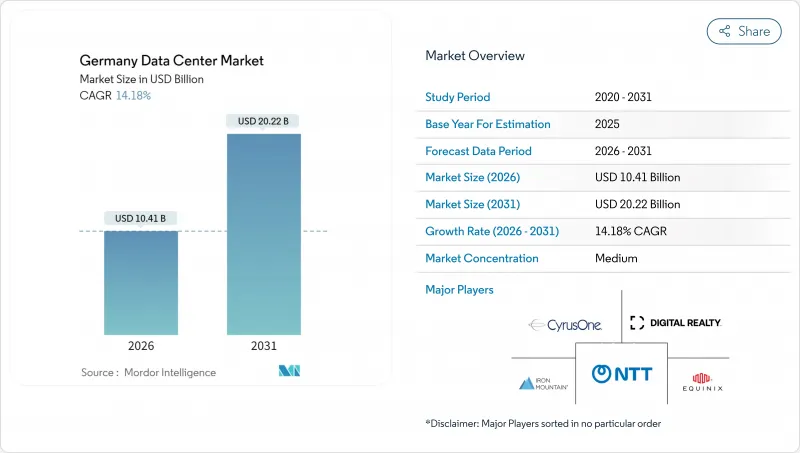

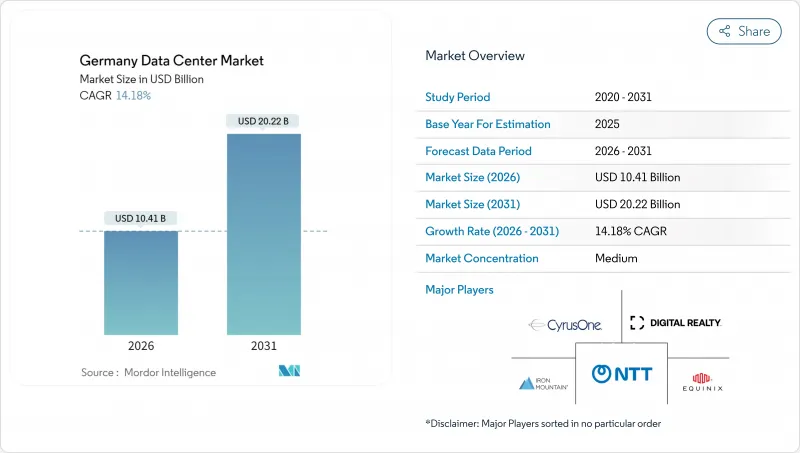

德国资料中心市场预计到 2026 年将达到 104.1 亿美元,高于 2025 年的 91.2 亿美元。

预计到 2031 年将达到 202.2 亿美元,2026 年至 2031 年的复合年增长率为 14.18%。

就IT负载容量而言,市场预计将从2025年的3,440兆瓦成长到2030年的6,230兆瓦,在预测期(2025-2030年)内复合年增长率(CAGR)为12.60%。市场占有率和估计值均以兆瓦为单位计算和报告。成长的主要驱动力是人工智慧(AI)工作负载的快速成长、超大规模资料中心业者营运商持续的资本支出以及鼓励建造现代化高密度设施的监管要求。该市场在欧洲已位居第二,在法兰克福,超大规模资料中心业者营运商的预租承诺吸收速度超过了新增供给能力的吸收速度。此外,5G赋能的边缘配置正使主要都会区以外的需求多元化。机架密度的提升和液冷技术的应用正在缩小云端环境和本地环境之间的效能差距,促使企业摆脱传统的伺服器机房。最后,政府对自主人工智慧基础设施和废热再利用的激励措施正在创造新的收入来源,并加强对新计画的投资决策。

德国资料中心市场趋势与洞察

人工智慧、云端运算和5G推动工作负载快速成长

基于GPU的推理和训练的扩展正推动机架密度达到30-100kW,与传统企业环境相比实现了五倍的飞跃。微软斥资32亿欧元,计画在2026年将国内人工智慧容量翻一番,凸显了这种规模的变革;而德国电信的目标是到2030年部署1万个边缘节点,以支援5G低延迟应用场景。目前,法兰克福超大规模资料中心的平均运转率超过85%,造成了供应紧张,迫使新进业者选择备用场地。由于风冷系统已无法应对高密度GPU丛集的热负荷,液冷技术的应用正在加速。这些技术现实共同推动了电力和占地面积的需求,直接为德国资料中心市场中那些严格遵守能源效率标准的营运商创造了更多商机。

法兰克福超大规模资料中心业者扩张计划

亚马逊网路服务(AWS)计划在2040年投资94.4亿美元,这将是德国有史以来规模最大的私营部门基础设施投资,巩固了法兰克福作为德国领先人工智慧中心的地位。如此规模的投资吸引了重视云端连接接近性的企业租户,但也推高了地价,加剧了电网瓶颈。开发商目前正在模拟分阶段建设,利用中间柴油发电机作为过渡方案,等待最终高压供电线路的建成。儘管存在集中风险,但由于主要租户通常会签订10至15年的电力合同,因此近期收益前景正在改善。

法兰克福都会区电网连接限制

由于区域变电站接近饱和,联邦网路管理局目前采用候补名单系统分配新的大容量馈线。开发商表示,50兆瓦及以上的併网工程面临18至24个月的延误,迫使他们分阶段运作或将工程迁至邻近的莱茵兰地区。一项耗资7.5亿欧元的电网强化计画有望缓解这一压力,但预计要到2033年才能全面生效。因此,一些计划提前购买电池储能设备,以便在启动运作自主满足关键负载需求,这增加了资本预算,也使资金筹措更加复杂。

细分市场分析

截至2025年,大型机房在德国资料中心市场占据33.62%的份额,主要得益于超大规模资料中心业者资料中心的规模经济效应。同时,边缘站点虽然规模较小,但随着5G的普及加速本地处理,其复合年增长率(CAGR)仍维持在12.97%。儘管目前边缘资料中心在德国资料中心市场的份额仍然小规模,但像德国电信这样的业者计划在2030年部署1万个节点,这条蓝图可能会增加区域接入点(PoP)的数量。边缘节点通常安装在维修的电信交换机房中,从而降低土地成本并缩短审批流程。即使在微型站点中,液冷系统维修也正成为常态,因为人工智慧推理处理需要类似于核心园区的高密度机架。

容量在 5 至 25 兆瓦之间的中型资料中心,对于那些已超出其本地部署环境容量但尚未准备好迁移到超大规模资料中心的公司而言,是一个理想的过渡方案。法兰克福正在建造多个容量超过 100 兆瓦的大型资料中心园区,但由于电网压力,这些园区不得不分阶段投入运作。因此,德国资料中心市场呈现出大规模集中式资料中心与不断扩展的边缘资料中心并存的趋势,在不牺牲云间互联性的前提下,将运算资源更靠近使用者。

到2025年,三级资料中心将占德国资料中心装置容量的59.25%,反映出企业对可控价格下并行维护性的重视。四级资料中心容量是德国资料中心市场成长最快的细分市场,复合年增长率达13.62%。这主要归功于银行、金融和保险(BFSI)以及人工智慧训练,这些行业在长时间模型运行週期中无法容忍停机。法兰克福的金融公司通常需要可用性超过99.995%的高弹性设计。虽然边缘资料中心目前主要采用二级资料中心等级的设计,但它们越来越多地采用N+1液冷迴路,从而有效地提升了弹性等级。

当工作负载需要极高的正常运作时,超大规模资料中心业者资金筹措Tier 4 级资料中心;而对于 Tier 3 级资料中心,自动扩展的消费级云端执行个体即可满足需求。目前,德国所有新建设资料中心都必须通过 EN 50600-3 标准认证。展望未来,混合架构将融合 Tier 4 级核心资料中心和高弹性边缘资料中心,根据工作负载的关键性,为德国资料中心市场带来多层拓扑结构。

德国资料中心市场报告按资料中心规模(大型、超大型、中型、巨型、小规模)、等级(Tier 1-2、Tier 3、Tier 4)、资料中心类型(超大规模/自建、企业/边缘、託管)、最终用户(银行、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、媒体和娱乐、金融服务和保险 (BFSI)、IT 和 ITES、电子商务、政府、电信製造业、市场预测以 IT 负载容量(兆瓦,MW)为单位。

其他福利:

- Excel格式的市场预测(ME)表

- 3个月的分析师支持

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 市场驱动因素

- 人工智慧、云端运算和 5G 推动工作负载爆炸性成长

- 法兰克福超大规模资料中心业者扩张计划

- 透过 DE-CIX 实现强大的光纤和海底光缆连接

- 企业数位转型和GDPR推动了对託管服务的需求。

- 政府支持的人工智慧超级工厂计划促进新建设

- 透过强制利用废热创造二次收入来源

- 市场限制

- 法兰克福都会区电网连接受限和电力短缺

- 与其他欧盟国家相比,电力成本较高

- EnEfG 合规成本涉及可再生能源采购义务和 PUE 限制

- 高密度液体冷却操作领域技术纯熟劳工短缺

- 市场展望

- IT负载能力

- 高架楼层面积

- 託管收入

- 预装机架

- 机架空间利用率

- 海底电缆

- 主要行业趋势

- 智慧型手机用户数量

- 每部智慧型手机的数据流量

- 行动资料通讯速度

- 宽频资料通讯速度

- 光纤连接网路

- 法律规范

- 价值炼和通路分析

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模及成长预测(兆瓦)

- 按资料中心规模

- 大规模

- 巨大的

- 中号

- 百万

- 小规模

- 依层级类型

- 一级和二级

- 三级

- 第四级

- 依资料中心类型

- 超大规模/内部建设

- 企业/边缘运算

- 搭配

- 未使用的

- 运作中

- 零售共址

- 批发託管

- 最终用户

- BFSI

- 资讯科技/资讯科技服务

- 电子商务

- 政府机构

- 製造业

- 媒体与娱乐

- 沟通

- 其他最终用户

- 透过热点

- 法兰克福

- 汉堡

- 德国其他地区

第六章 竞争情势

- 市场集中度

- 策略趋势

- 市占率分析

- 公司简介

- Equinix, Inc.

- NTT Corporation

- Digital Realty Trust Inc.

- Vantage Data Centers, LLC

- Leaseweb Global BV

- CloudHQ, LLC

- Goodman Group

- noris network AG

- euNetworks Group Limited

- Global Switch Holdings Limited

- Telehouse International Corporation of Europe Ltd.

- AtlasEdge Data Centres Ltd.

- ITENOS GmbH

- STACK Infrastructure, Inc.

- GlobalConnect A/S

- maincubes one Services GmbH

- CyrusOne Inc.

- Iron Mountain Inc.

- EdgeConneX, Inc.

- Data4 Group

第七章 市场机会与未来展望

Germany Data Center market size in 2026 is estimated at USD 10.41 billion, growing from 2025 value of USD 9.12 billion with 2031 projections showing USD 20.22 billion, growing at 14.18% CAGR over 2026-2031.

In terms of IT load capacity, the market is expected to grow from 3.44 thousand megawatts in 2025 to 6.23 thousand megawatts by 2030, at a CAGR of 12.60% during the forecast period (2025-2030). The market segment shares and estimates are calculated and reported in terms of MW. Growth is driven by the surge in artificial intelligence (AI) workloads, sustained hyperscaler capital expenditures, and regulatory requirements that favor modern, high-density facilities. The market already ranks as Europe's second-largest hub; hyperscaler pre-leasing in Frankfurt is absorbing new capacity faster than it can be delivered, while 5G-enabled edge deployments diversify demand beyond the main metro. Rising rack densities and the adoption of liquid cooling are narrowing the performance gap between cloud and on-premise environments, encouraging enterprises to abandon legacy server rooms. Finally, government incentives for sovereign AI infrastructure and waste-heat reuse create incremental revenue streams that strengthen the investment case for new projects.

Germany Data Center Market Trends and Insights

AI, Cloud and 5G-Driven Workload Surge

Ramp-up of GPU-powered inference and training is pushing rack densities to 30-100 kW, a five-fold leap from traditional enterprise footprints. Microsoft's EUR 3.2 billion program to double national AI capacity by 2026 highlights the scale shift, while Deutsche Telekom targets 10,000 edge nodes by 2030 to support 5G low-latency use cases. Average hyperscale utilization in Frankfurt now exceeds 85%, tightening available supply and pushing new entrants toward secondary sites. Liquid-cooling adoption is gaining momentum as air systems can no longer evacuate the thermal load of dense GPU clusters. These technical realities collectively amplify power and floor-space demand, directly lifting revenue opportunities for operators adhering to the Germany data center market's stringent efficiency codes.

Hyperscaler Expansion Commitments to Frankfurt

Amazon Web Services' USD 9.44 billion pledge through 2040 represents the largest single private-sector infrastructure investment in Germany to date, cementing Frankfurt as the country's AI nucleus. Such scale attracts enterprise tenants who value latency adjacency to cloud on-ramps, but the same clustering inflates land prices and exacerbates grid bottlenecks. Operators now model multi-phase builds with interim diesel-generator bridging while waiting for final high-voltage feeds. Although risk is concentrated, near-term revenue visibility improves because anchor tenants typically lock in 10- to 15-year power contracts.

Grid Connection Constraints in Frankfurt Metro

Bundesnetzagentur now allocates new high-capacity feeds via a queueing mechanism as local substations approach saturation. Developers report 18-24-month delays for >=50 MW connections, forcing staged commissioning or relocation to nearby Rhineland plots. A EUR 750 million reinforcement program will ease pressure, but full impact is unlikely before 2033. Consequently, some projects pre-purchase battery storage to self-sustain critical loads during ramp-up, inflating capital budgets and complicating financing.

Other drivers and restraints analyzed in the detailed report include:

- Strong Fiber and Submarine Connectivity via DE-CIX

- Corporate Digital Transformation and GDPR-Driven Colocation Demand

- High Electricity Costs Relative to EU Peers

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Large halls retained 33.62% of the Germany data center market share in 2025 thanks to hyperscaler economies of scale. Yet edge sites, while smaller, are on track for 12.97% CAGR as 5G adoption accelerates localized processing. The Germany data center market size allocated to edge remains modest today, but operators such as Deutsche Telekom plan 10,000 nodes by 2030, a roadmap that will multiply regional PoP counts. Edge units frequently occupy refurbished telecom exchanges, lowering land costs and shortening permitting cycles. Liquid-cooling retrofits are becoming standard even at micro sites because AI inferences require high-density racks similar to core campuses.

Medium facilities often 5-25 MW provide a bridging option for enterprises that outgrow on-premise rooms but are not yet ready for hyperscale footprints. In Frankfurt, mega campuses exceeding 100 MW continue to break ground, though grid scarcity forces phased energization. The Germany data center market thus combines massive centralized developments with a proliferating edge rim, bringing compute closer to users without sacrificing cloud interconnectivity.

Tier 3 halls comprised 59.25% of installed power in 2025, reflecting enterprises' preference for concurrent maintainability at a manageable price point. The Germany data center market size allocated to Tier 4 grows the fastest, 13.62% CAGR, because BFSI and AI training cannot tolerate downtime during long model-run cycles. Financial firms in Frankfurt routinely specify fault-tolerant designs delivering >=99.995% availability. Edge locations tend toward Tier 2 equivalents but increasingly add N+1 liquid-cooling loops, effectively moving up the resilience ladder.

Hyperscalers finance Tier 4 builds where workloads justify premium uptime, while auto-scaling consumer cloud instances remain content with Tier 3. Certification to the EN 50600-3 standard is now a baseline across all new German builds. Over time, hybrid architectures will mesh Tier 4 cores with resilient edge outposts, giving the Germany data center market a multi-tier topology aligned to workload criticality.

The Germany Data Center Market Report is Segmented by Data Center Size (Large, Massive, Medium, Mega, and Small), Tier Type (Tier 1 and 2, Tier 3, and Tier 4), Data Center Type (Hyperscale/Self-built, Enterprise/Edge, and Colocation), End User (BFSI, IT and ITES, E-Commerce, Government, Manufacturing, Media and Entertainment, Telecom, and More), and Hotspot. The Market Forecasts are Provided in Terms of IT Load Capacity (MW).

List of Companies Covered in this Report:

- Equinix, Inc.

- NTT Corporation

- Digital Realty Trust Inc.

- Vantage Data Centers, LLC

- Leaseweb Global B.V.

- CloudHQ, LLC

- Goodman Group

- noris network AG

- euNetworks Group Limited

- Global Switch Holdings Limited

- Telehouse International Corporation of Europe Ltd.

- AtlasEdge Data Centres Ltd.

- ITENOS GmbH

- STACK Infrastructure, Inc.

- GlobalConnect A/S

- maincubes one Services GmbH

- CyrusOne Inc.

- Iron Mountain Inc.

- EdgeConneX, Inc.

- Data4 Group

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 AI, Cloud and 5G-Driven Workload Surge

- 4.2.2 Hyperscaler Expansion Commitments to Frankfurt

- 4.2.3 Strong Fiber and Submarine Cable Connectivity via DE-CIX

- 4.2.4 Corporate Digital Transformation and GDPR-Driven Colocation Demand

- 4.2.5 Government-Backed AI Gigafactory Initiatives Incentivizing New Build

- 4.2.6 Waste Heat Utilization Mandates Creating Secondary Revenue Streams

- 4.3 Market Restraints

- 4.3.1 Grid Connection Constraints and Power Scarcity in Frankfurt Metro

- 4.3.2 High Electricity Costs Relative to Other EU Peers

- 4.3.3 EnEfG Compliance Costs for Mandatory Renewable Sourcing and PUE Limits

- 4.3.4 Skilled Labor Shortage in High-Density Liquid Cooling Operations

- 4.4 Market Outlook

- 4.4.1 IT Load Capacity

- 4.4.2 Raised Floor Space

- 4.4.3 Colocation Revenue

- 4.4.4 Installed Racks

- 4.4.5 Rack Space Utilization

- 4.4.6 Submarine Cable

- 4.5 Key Industry Trends

- 4.5.1 Smartphone Users

- 4.5.2 Data Traffic Per Smartphone

- 4.5.3 Mobile Data Speed

- 4.5.4 Broadband Data Speed

- 4.5.5 Fiber Connectivity Network

- 4.5.6 Regulatory Framework

- 4.6 Value Chain and Distribution Channel Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (MEGAWATT)

- 5.1 By Data Center Size

- 5.1.1 Large

- 5.1.2 Massive

- 5.1.3 Medium

- 5.1.4 Mega

- 5.1.5 Small

- 5.2 By Tier Type

- 5.2.1 Tier 1 and 2

- 5.2.2 Tier 3

- 5.2.3 Tier 4

- 5.3 By Data Center Type

- 5.3.1 Hyperscale / Self-built

- 5.3.2 Enterprise / Edge

- 5.3.3 Colocation

- 5.3.3.1 Non-Utilized

- 5.3.3.2 Utilized

- 5.3.3.2.1 Retail Colocation

- 5.3.3.2.2 Wholesale Colocation

- 5.4 By End User

- 5.4.1 BFSI

- 5.4.2 IT and ITES

- 5.4.3 E-Commerce

- 5.4.4 Government

- 5.4.5 Manufacturing

- 5.4.6 Media and Entertainment

- 5.4.7 Telecom

- 5.4.8 Other End Users

- 5.5 By Hotspot

- 5.5.1 Frankfurt

- 5.5.2 Hamburg

- 5.5.3 Rest of Germany

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Equinix, Inc.

- 6.4.2 NTT Corporation

- 6.4.3 Digital Realty Trust Inc.

- 6.4.4 Vantage Data Centers, LLC

- 6.4.5 Leaseweb Global B.V.

- 6.4.6 CloudHQ, LLC

- 6.4.7 Goodman Group

- 6.4.8 noris network AG

- 6.4.9 euNetworks Group Limited

- 6.4.10 Global Switch Holdings Limited

- 6.4.11 Telehouse International Corporation of Europe Ltd.

- 6.4.12 AtlasEdge Data Centres Ltd.

- 6.4.13 ITENOS GmbH

- 6.4.14 STACK Infrastructure, Inc.

- 6.4.15 GlobalConnect A/S

- 6.4.16 maincubes one Services GmbH

- 6.4.17 CyrusOne Inc.

- 6.4.18 Iron Mountain Inc.

- 6.4.19 EdgeConneX, Inc.

- 6.4.20 Data4 Group

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment