|

市场调查报告书

商品编码

1910910

义大利快递、速递、小包裹:市场占有率分析、产业趋势、统计数据、成长预测(2026-2031 年)Italy Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

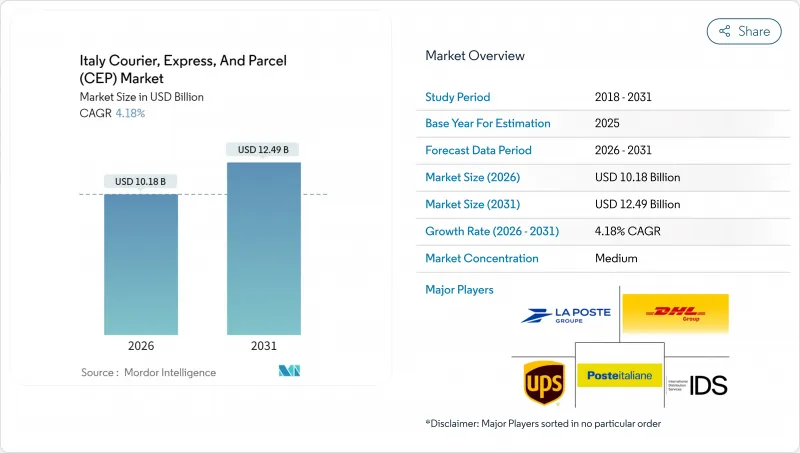

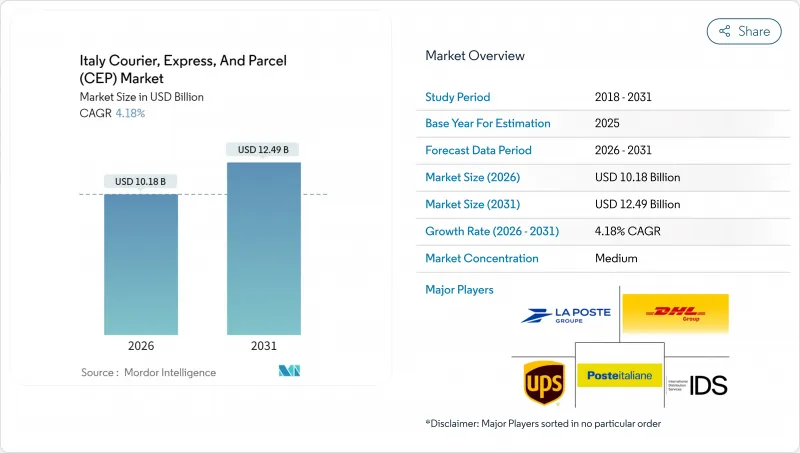

预计义大利快递、速递和小包裹(CEP) 市场将从 2025 年的 97.7 亿美元成长到 2026 年的 101.8 亿美元,到 2031 年将达到 124.9 亿美元,2026 年至 2031 年的复合年增长率为 4.18%。

义大利是欧洲重要的物流枢纽。电子商务支出持续成长,预计到2024年将达到588亿欧元(约648.9亿美元),同时,製造业出口商对小包裹的需求也同步復苏。米兰和罗马等都市区的高密度交通网络为高端快递服务提供了有力支撑。同时,国内道路通行费的上涨和司机短缺正促使营运商实现营运自动化以降低成本。跨境电子商务、药品出口以及简化的游客购物增值税退税流程推动了国际物流的成长,其成长率超过了国内运输。随着义大利邮政、DHL、UPS、联邦快递和GLS等公司投资于自动化分类、异地收件网路和低排放车辆,市场竞争日益激烈。欧盟即将实施的「Fit for 55」法规也加速了车队更新和基础设施电气化。

义大利快递、速递、小包裹(CEP) 市场趋势与分析

从2024年起,中小企业出口的强劲復苏将提升B2B小包裹密度。

2025年3月,中小型厂商的出口量年增5.8%,其业务活动主要集中在连接Lombardia与欧洲主要市场的A4和A1高速公路沿线。出口路线的集中化使得快递业者能够提高停靠效率,并增加每条路线上的高价值货物递送数量。机械、纺织品和特色食品製造商越来越依赖隔日的CEP快递服务,以满足客户紧迫的交货期限,同时减少库存积压。米兰和贝加莫週边的北部物流枢纽正在吸引对自动化分类中心的投资,因为高吞吐量地区能够支撑更高的资本投入。随着出口商选择清关有保障且收件时间较长的高级产品,国际快递的利润率正在上升,而国内回程传输运输则降低了搬迁成本。

杂货连锁店扩大微型仓配中心规模,促进了都市区的当日送达服务。

2024年,食品零售商加快了微型仓配中心的部署。 Esselunga投资580万欧元(约640万美元)兴建小型配送设施,能够在两小时内完成拣货和出货。这些面积不到1万平方英尺的配送中心缩短了「最后一公里」的配送距离,从而刺激了当日达配送需求的激增,并方便了重量低于5公斤、可装入轻型电动货车的小包裹运输。 MD与Eberly等公司的多城市合作,创造了可预测的晚间高峰需求,使承运商能够部署专用的城市配送路线,并在严格的配送时间段内运作。当日达的食品小包裹需支付更高的费用,以弥补高密度配送点带来的较高人事费用。随着零售商试用自动拣货臂和温控週转箱,科技应用推动了门市系统与CEP配送引擎之间资料整合的需求。

人口老化加剧了司机短缺问题。

义大利卡车驾驶人中,仅2.2%的人年龄在25岁以下,而近一半的人年龄超过55岁——这一比例远高于欧洲平均。根据义大利运输联合会(Conftrasport)估计,目前仍有2万个驾驶人驾驶人空缺,约4,000欧元(4,414.56美元)的培训费用阻碍了新人的加入。米兰週边的物流公司提供的月薪为3392欧元(3,743.55美元),但他们仍难以招募到足够的司机。运力限制推高了分包商的费用,迫使中央出口运输网络(CEP)重新竞标干线运输合同,并延长了运输时间。政府已提案一些政策应对措施,例如加快非欧盟司机的许可证审批流程和共同资助许可证发放项目,但这些措施的实施进展缓慢。为了提高每位司机的货运量,卡车运输公司正在尝试使用双层拖车和人工智慧路线规划工具,但这些努力并不能完全弥补劳动力短缺的情况。

细分市场分析

至2025年,电子商务将占货运总量的34.60%,其所建立的服务标准将逐步影响其他产业。高退货率增加了逆向物流的复杂性,促使承运商实施基于规则的自动化流程,将退货直接分类至再製造中心。时尚品牌正在米兰和都灵试行当日试穿服务,虽然这增加了小包裹处理时间,但也提高了每位顾客的总收入。

2026年至2031年,随着义大利人口老化导致药品分销量增加,以及生物製药製剂低温运输运输的要求日益严格,医疗小包裹复合成长率将达到4.33%。运输公司正在对其货车进行改造,加装符合GDP标准的冷却装置,并安装即时温度探头,以便向控制中心发送警报。製药公司倾向选择与医院药局排班同步的专属配送时段,以确保在安全区域内享有优先通行权。

到2025年,国内配送将占义大利宅配市场份额的66.10%,这主要得益于本地采购和全国性电子商务的蓬勃发展,从而形成稳定的日均货量基础。密集的住宅配送中心使承运商能够最大限度地提高停靠效率,而对邮递区号的熟悉感也降低了地址更正成本。跨境小包裹虽然目前数量较少,但预计从2026年到2031年将以4.31%的复合年增长率增长,因为时尚、医药和工业零部件等行业为了获得竞争优势,优先考虑限时送达服务。一站式进口系统简化了海关手续,减少了行政摩擦,促进了跨境包裹的成长。

国际出口成长主要集中在米兰、都灵和波隆那机场附近,出口商可以利用保税设施加快清关速度。旅游相关的C2C小包裹可享有免税配额,业者则销售固定费率的包装盒以满足纪念品需求。国内网路仍能维持规模经济,使物流整合商能够在国内需求低迷时期将车辆调配至国际干线。协调国内和欧洲的货物分类时间对于在不增加枢纽人工成本的情况下维持隔日截稿承诺仍然至关重要。

其他福利:

- Excel格式的市场预测(ME)表

- 分析师支持(3个月)

目录

第一章 引言

- 研究假设和市场定义

- 调查范围

第二章调查方法

第三章执行摘要

第四章 市场情势

- 市场概览

- 人口统计数据

- 按经济活动分類的GDP分配

- 按经济活动分類的GDP成长

- 通货膨胀

- 经济表现及概览

- 电子商务产业的趋势

- 製造业趋势

- 运输和仓储业的GDP

- 出口趋势

- 进口趋势

- 燃油价格

- 物流绩效

- 基础设施

- 法律规范

- 价值炼和通路分析

- 市场驱动因素

- 义大利中小企业出口的强劲復苏将带动2024年及以后B2B小包裹密度的增加。

- 连锁超市扩大微型仓配中心规模,并增加都市区的当日送达服务。

- 欧盟「Fit for 55」法规加快了促进车辆电气化的措施

- 计划于2026年试运行米兰和贝加莫机场之间的无人机走廊。

- 由于面向游客的数位增值税退税平台的普及,C2C交易和退款流量增加。

- 邮政银行整合使农村地区能够实现最后一公里货到付款服务

- 市场限制

- 米兰马尔彭萨机场货运时刻短缺

- 人口老化加剧了司机短缺问题。

- 2025年至2027年,A4和A14走廊的道路通行费将逐步增加。

- 南部地区小包裹窃盗率居高不下。

- 市场创新

- 波特五力分析

- 新进入者的威胁

- 买方的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场规模与成长预测

- 目的地

- 国内的

- 国际的

- 配送速度

- 快递

- 非快递

- 模型

- B2B

- B2C

- C2C

- 运输重量

- 重型货物运输

- 轻型和重型货物运输

- 中型重型货物运输

- 交通工具

- 航空邮件

- 陆上

- 其他的

- 终端用户产业

- 电子商务

- 金融服务(BFSI)

- 卫生保健

- 製造业

- 一级产业

- 批发零售(线下)

- 其他的

第六章 竞争情势

- 市场集中度

- 关键策略倡议

- 市占率分析

- 公司简介

- Asendia

- DHL Group

- FedEx

- GEODIS

- International Distributions Services(including GLS)

- La Poste Group(including BRT)

- Poste Italiane

- Sailpost SpA

- Speedy SRL

- United Parcel Service(UPS)

第七章 市场机会与未来展望

The Italy courier express parcel market is expected to grow from USD 9.77 billion in 2025 to USD 10.18 billion in 2026 and is forecast to reach USD 12.49 billion by 2031 at 4.18% CAGR over 2026-2031.

Italy holds a pivotal logistics role inside Europe because e-commerce spending hit EUR 58.8 billion (USD 64.89 billion) in 2024 and keeps expanding, while small-package demand from manufacturing exporters recovers in parallel. Route-dense urban areas such as Milan and Rome underpin high stop densities that support premium express services, even as national road toll hikes and driver shortages push operators toward cost-saving automation. International flows expand faster than domestic shipments, powered by cross-border e-commerce, pharmaceutical exports and simplified digital VAT refund processing for tourist purchases. Competitive intensity rises as Poste Italiane, DHL, UPS, FedEx and GLS invest in sortation automation, out-of-home collection networks and low-emission fleets, while impending EU Fit-for-55 rules accelerate fleet renewal and infrastructure electrification.

Italy Courier, Express, And Parcel (CEP) Market Trends and Insights

Strong Rebound of Italy's SME Exports Post-2024 Creates Higher B2B Parcel Density

Small and medium manufacturers lifted export volumes by 5.8% year on year in March 2025, concentrating activity along the A4 and A1 corridors that link Lombardy with key European markets. Dense export lanes generate superior stop economies for express carriers, allowing trucks to complete more premium deliveries per route. Machinery, textiles and specialty food producers increasingly rely on next-day CEP options so they can postpone inventory and still honor tight customer schedules. Northern logistics hubs around Milan and Bergamo attract investment in automated sort centers because carriers can justify higher capex where volumes cluster. International express margins rise as exporters pick premium products that guarantee customs clearance and late pickup windows, while domestic backhauls reduce repositioning costs.

Expansion of Micro-Fulfillment Centers by Grocery Chains Boosts Urban Same-Day Volumes

Grocery retailers accelerated micro-fulfillment roll-outs in 2024, with Esselunga spending EUR 5.8 million (USD 6.40 million) on compact facilities that can pick and dispatch orders inside two hours. These sub-10,000 ft2 nodes shorten last-mile distances, create same-day demand spikes, and favor parcels under five kilograms that fit light electric vans. Partnerships such as MD's alliance with Everli cover multiple cities and add predictable evening peak traffic, enabling carriers to deploy dedicated urban rounds that operate on strict delivery windows. Same-day grocery parcels carry premium surcharges which absorb the higher labor costs linked to dense stop frequency. Technology adoption rises as retailers test automated picking arms and temperature-segmented totes, raising requirements for data integration between store systems and CEP routing engines.

Driver Shortage Aggravated by Demographic Ageing

Only 2.2% of Italian truck drivers are under 25, while nearly one-half surpass 55, a gap wider than the European mean. Conftrasporto estimates 20,000 vacant driving jobs, and training costs near EUR 4,000 (USD 4,414.56) deter entrants. Logistics employers around Milan advertise monthly pay of EUR 3,392 (USD 3,743.55) but still struggle to fill shifts. Capacity tightness inflates subcontracting rates, forcing CEP networks to rebid linehaul contracts or lengthen transit windows. Policy responses include proposals to fast-track non-EU driver permits and co-fund license programs, yet uptake remains slow. Carriers trial double-deck trailers and AI routing tools to lift parcels per driver, but these gains do not fully offset workforce attrition.

Other drivers and restraints analyzed in the detailed report include:

- EU Fit-for-55 Regulation Accelerates Fleet Electrification Incentives

- Drone Corridor Pilot Between Milan and Bergamo Airports Slated for 2026

- 2025-27 Road-Toll Step-Ups on A4 And A14 Corridors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

E-commerce commanded 34.60% share of 2025 volumes and sets service benchmarks that spill into other verticals. High return rates create extra reverse-logistics complexity, prompting carriers to deploy rules-based automation that sorts returns directly to refurbishment centers. Fashion brands pilot same-day try-at-home programs in Milan and Turin, extending parcel touches but lifting overall revenue per customer.

Healthcare parcels expand at a 4.33% CAGR between 2026-2031 because Italy's aging population increases medication throughput and biologic therapies demand strict cold-chain compliance. Carriers retrofit vans with GDP-validated chillers and install real-time temperature probes that send alerts to control towers. Pharmaceutical firms favor dedicated delivery windows that synchronize with hospital pharmacy schedules, ensuring priority access inside security zones.

Domestic deliveries accounted for 66.10% of the Italy courier express parcel market in 2025 because local sourcing and nationwide e-commerce anchor predictable daily volumes. Dense residential delivery points allow carriers to maximize stop efficiency, and familiarity with postal codes reduces address correction costs. Cross-border parcels, while smaller in count, expand at a 4.31% CAGR between 2026-2031 as fashion, pharmaceuticals, and industrial components rely on time-definite services for competitive differentiation. Customs simplification under the Import One-Stop Shop scheme lowers administrative frictions and supports growth.

International outbound growth is clustered around Milan, Turin and Bologna airports where exporters can access bonded facilities that speed clearance. Tourism-linked C2C parcels leverage duty-free thresholds, and operators market flat-rate boxes to capture souvenir traffic. The domestic network still underpins scale advantages, letting integrators redirect vehicles to international linehauls during off-peak domestic cycles. Alignment of domestic and European sortation windows will remain critical for maintaining overnight cut-off commitments without inflating hub staffing costs.

The Italy Courier, Express, and Parcel (CEP) Market Report is Segmented by End User Industry (E-Commerce and More), Destination (Domestic and More), Speed of Delivery (Express and Non-Express), Shipment Weight (Heavy Weight Shipments and More), Mode of Transport (Air, Road, and Others), and Model (Business-To-Business, Business-To-Consumer, and Consumer-To-Consumer). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Asendia

- DHL Group

- FedEx

- GEODIS

- International Distributions Services (including GLS)

- La Poste Group (including BRT)

- Poste Italiane

- Sailpost SpA

- Speedy SRL

- United Parcel Service (UPS)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Logistics Performance

- 4.12 Infrastructure

- 4.13 Regulatory Framework

- 4.14 Value Chain and Distribution Channel Analysis

- 4.15 Market Drivers

- 4.15.1 Strong Rebound of Italy's SME Exports Post-2024, Creating Higher B2B Parcel Density

- 4.15.2 Expansion of Micro-Fulfilment Centres by Grocery Chains, Boosting Urban Same-Day Volumes

- 4.15.3 EU Fit-for-55 Regulation Accelerating Fleet Electrification Incentives

- 4.15.4 Drone Corridor Pilot Between Milan-bergamo Airports Slated for 2026

- 4.15.5 Digital VAT Refund Platforms for Tourists Increasing C2C and Return Flows

- 4.15.6 Postal Bank Integration Unlocking Last-Mile Cash-on-delivery for Rural Areas

- 4.16 Market Restraints

- 4.16.1 Airport Slot Scarcity for Freighters at Milano-Malpensa

- 4.16.2 Driver Shortage Aggravated by Demographic Ageing

- 4.16.3 2025-27 Road-Toll Step-Ups on A4 and A14 Corridors

- 4.16.4 High Parcel Theft Rates in Southern Regions

- 4.17 Technology Innovations in the Market

- 4.18 Porter's Five Forces Analysis

- 4.18.1 Threat of New Entrants

- 4.18.2 Bargaining Power of Buyers

- 4.18.3 Bargaining Power of Suppliers

- 4.18.4 Threat of Substitutes

- 4.18.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 Destination

- 5.1.1 Domestic

- 5.1.2 International

- 5.2 Speed of Delivery

- 5.2.1 Express

- 5.2.2 Non-Express

- 5.3 Model

- 5.3.1 Business-to-Business (B2B)

- 5.3.2 Business-to-Consumer (B2C)

- 5.3.3 Consumer-to-Consumer (C2C)

- 5.4 Shipment Weight

- 5.4.1 Heavy Weight Shipments

- 5.4.2 Light Weight Shipments

- 5.4.3 Medium Weight Shipments

- 5.5 Mode of Transport

- 5.5.1 Air

- 5.5.2 Road

- 5.5.3 Others

- 5.6 End User Industry

- 5.6.1 E-Commerce

- 5.6.2 Financial Services (BFSI)

- 5.6.3 Healthcare

- 5.6.4 Manufacturing

- 5.6.5 Primary Industry

- 5.6.6 Wholesale and Retail Trade (Offline)

- 5.6.7 Others

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Asendia

- 6.4.2 DHL Group

- 6.4.3 FedEx

- 6.4.4 GEODIS

- 6.4.5 International Distributions Services (including GLS)

- 6.4.6 La Poste Group (including BRT)

- 6.4.7 Poste Italiane

- 6.4.8 Sailpost SpA

- 6.4.9 Speedy SRL

- 6.4.10 United Parcel Service (UPS)

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment